Legal basis

A set of laws that will clarify all the required payments for the third child:

- No. 81-FZ of May 19, 1995 (in particular Chapter II) on guaranteed benefits;

- No. 256-FZ of December 29, 2006 on family capital;

- Decree of the President of the Russian Federation No. 606 of May 7, 2012 on supporting large families in the regions.

These are the main documents that guarantee the receipt of funds. In addition, there are regional laws and individual articles discussed below.

It is also worth noting that in addition to the federal payments that families throughout the Russian Federation receive, there is also assistance allocated from the budgets of the constituent entities of the Russian Federation at the place of residence of the family.

One-time benefits for the birth of 3 children

The payments listed below are due for any child - for the first, third, fifth and next.

Maternity benefit

The table below shows the categories of women who can count on financial assistance and the procedure for calculating benefits.

| Officially employed | Full-time students | Employees in the military under contract, in the fire service, the Ministry of Internal Affairs, the National Guard, at customs, in the Federal Penitentiary Service | Unemployed (officially registered with the Employment Center) due to the liquidation of an organization, termination of the activities of an individual entrepreneur, loss of the status of a notary or lawyer |

| Average daily earnings* number of days of maternity sick leave | Scholarship amount/30.4*number of days of maternity sick leave | Maternity benefits are paid in the amount of cash allowance at the time of going on maternity leave | 679.89 rubles per month, or 2719 rubles for 140 days of maternity leave |

Those who have adopted a third child under 3 months can also receive money. The size of the payment depends on the above category.

“Maternity benefits” are withdrawn in one amount for the period - 70 days before childbirth and 70 days after for easy childbirth (Article 7 No. 81-FZ).

In the case of difficult or multiple births, the mother in labor is issued a sick leave certificate in the maternity hospital, which increases the number of days of sick leave and, accordingly, the amount of payments.

ATTENTION! Only the mother of a newborn can be the recipient of maternity benefits. They will not be issued to other persons.

If a woman goes on leave under the BiR while receiving a monthly allowance for up to 1.5 years for the previous child, she is entitled to only one of these payments (Article 13 No. 81-FZ).

Benefit for early registration during pregnancy

To receive the amount, you must register with the antenatal clinic before 12 weeks, take the appropriate certificate and take it to the place where maternity benefits are calculated.

It applies to all categories of women, except the unemployed, and the amount is the same for everyone - 655.49 rubles in January 2020, then 680.39 rubles until the end of the year.

The benefit is paid together with maternity benefits. Read more about this here.

One-time benefit for the birth of a baby

Every woman is entitled to receive it, and this benefit can be awarded to both the father and the adult raising the baby instead of the parents.

In this case, other relatives must provide certificates that they did not receive this payment.

For 2020, the amount of financial support is equal to 17,479.73 rubles in January and 18,143.95 rubles from February 1, 2020.

If there are multiple births, then the money is addressed to each child. But if a baby is stillborn, there is no right to benefits.

The employed receive money at their place of employment, the unemployed from the social security authorities at their place of residence.

Read more about how to apply here.

Payment for the birth of a child to the wife of a conscript

In addition to all the listed payments, the conscript's spouse has the right to another lump sum in the amount of 27,680.97 rubles in January 2020 and after indexation of the benefit from February 1, 2020 - 28,732.85 rubles.

Here are the conditions:

- the spouse was sent to serve by the draft commission (the marriage is officially registered);

- pregnancy for a period of at least 180 days.

REFERENCE! Spouses of military school cadets and contract employees do not receive this payment.

Mother of three children benefits

If the organization is nevertheless liquidated, its successor will be obliged to provide a job for a single mother with a child under 14 years of age. And if the child is already an adult and is undergoing military service upon conscription, then his single mother is given the priority right to remain at work in the event of a reduction in staff.

It can be used by those mothers whose collective agreements guarantee the provision of additional annual leave without pay. In this case, if your child is not yet 14 years old, you can take the required number of days (no more than two weeks) at a time convenient for you. You can add them to your main paid leave, or you can use them separately. If you are a single mother of a disabled child, you are provided with an additional four paid days off per month.

We recommend reading: How to Find out the Owner of a House by Address

Monthly benefits

The situation here is the same as with one-time payments. Standard, regulated by law, payments are due to everyone, regardless of the order of birth of the child.

Child care allowance up to 1.5 years old

Any Russian citizen can become its recipient if he has obligations to raise and support the child. These can be not only biological parents, but also grandparents, other relatives, and guardians.

The benefit amount depends on the following factors:

- the recipient is working. 40% of his average income for the last 2 years is taken. The minimum in 2020 is RUB 4,852.00, the maximum is RUB 27,984.66;

- serves or is dismissed during the period of “maternity leave”. 40% of the average allowance (earnings) for the last year is taken;

- unemployed and full-time students - 6,554.89 rubles.

REFERENCE! The order of children goes along the mother's side, i.e. the third child must be from the mother (previous children on the father's side are not taken into account).

If the parent already receives such benefits for a previous child, then the amounts are summed up. The total result for the payment of two benefits cannot be higher than 100% of the full earnings indicated when calculating the benefit (Article 15 No. 81-FZ).

Working parents receive payments at their place of work, while unemployed parents register with the social security authorities at their place of residence. See more details here.

Payments for a child of a military personnel

These funds are paid in parallel with those listed above and do not cancel them.

The recipient can be a citizen raising a child.

The main condition is that the child’s father must serve as a conscript at this time.

In 2020, RUB 11,863.27 is accrued monthly per child.

They apply for benefits at the social security authorities at their place of residence.

Compensation from the employer for a child under 3 years of age

Based on Government Decree No. 1206 of November 3, 1994, you can write an application for compensation to your employer/dean’s office:

- working until the child is three years old;

- full-time students during academic leave.

The amount of compensation is 50 rubles.

Benefit for up to 3 years in regions with low birth rates

In regions with a low birth rate (currently 62 constituent entities of the Russian Federation), upon the birth of a third child, families are paid an allowance in the amount of the child's subsistence minimum, taking into account regional coefficients. The national average benefit is about 10,000 rubles per month.

Basic criteria for receiving benefits:

- Money is paid only to low-income families.

- Children and parents must permanently reside and be registered in the region

- The program applies only to children born/adopted after January 1, 2020.

Social security authorities are responsible for processing payments. The specific list of documents for benefits and its amount can be clarified there. As a standard, applicants will be required to :

- Application for benefits

- Identity document

- Birth certificates for all children.

- Certificate of family composition.

- Certificate of income for the last three months.

- Account details for transferring funds.

The list of regions in which benefits are paid can be found here.

What benefits are available to a family with three children?

- the right to receive a free plot of land

- additional benefit for the third child, which is paid monthly (the amount is set individually in each region and corresponds to the minimum subsistence level in this area)

- benefits when paying transport tax

- the possibility of employing young parents after the birth of their third child in a job where there is a flexible schedule or the opportunity to work part-time

- if necessary, a free opportunity to retrain young parents and further employ them.

- documents that are proof of identity of both parents (passports)

- documents that serve as birth certificates for all children in the family

- certificate indicating family composition

- If children are being raised in a single-parent family, it is necessary to provide a document confirming the annulment of the marriage between the parents.

We recommend reading: How to register ownership of an apartment

Maternal capital

Funds from the family capital can be received for the 3rd child, if the certificate was not issued for the second (Clause 1, Article 3 No. 256-FZ).

In 2020, the amount of maternity capital will be indexed to RUB 466,617.00. (draft law on the federal budget for 2020).

It is disappointing that the so-called monthly “presidential” payments allocated from maternity capital for the second child are not available for the third.

Those. You can receive a certificate, but you cannot withdraw money in cash as a benefit.

The law under which these benefits are paid, No. 418-FZ dated December 28, 2017, applies to the mother’s first two children.

In other cases proposed by law, the certificate works (purchase of housing, payment of education, etc.).

An application for payment of maternity capital must be submitted to the Pension Fund at the place of residence.

Work and pension benefits

In fact, whether the status of having many children has been formalized or not does not matter.

The only thing that matters is having a large number of children.

Working parents should know that if there are two or more children under 14 years of age, the employer is obliged to provide two weeks of leave at his own expense once a year. The parent has the right to choose when to go on such leave independently.

You cannot fire a person from work if the following conditions apply simultaneously:

- The employee is the sole breadwinner for a child under three years of age.

- There are three or more children in the family.

- The second parent does not work or does not exist at all.

Of course, there are exceptional situations. For example, liquidation of an organization, violation of duties, etc.

Every mother should know that, based on Law No. 400 “On Insurance Pensions” dated December 28, 2013, the period of caring for a child up to one and a half years is included in the length of service for calculating a pension. Additionally, there is a maximum number of years.

It is six years. It turns out that this benefit can be obtained for the first four children.

Parents of three or more children can register with the employment center and receive training for a new specialty.

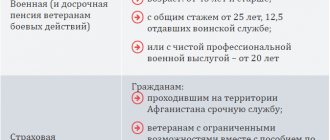

In accordance with the law “On Insurance Pensions in the Russian Federation,” mothers of many children can apply for a preferential pension and retire at age fifty in the following cases:

- Those who have given birth to five or more children. In addition, they must raise them until they are at least eight years old. And also have fifteen years of insurance experience.

- It is allowed to assign a preferential pension to women who have given birth to two children. But those who have worked in the Far North for at least twelve years, or 17, in areas equivalent to the north. The total experience must be at least twenty years.

You can find out what documents are needed to receive a preferential pension from the video:

Noticed a mistake? Select it and press Ctrl+Enter to let us know.

Privileges

At the legislative level, benefits for large families are enshrined in Decree of the President of the Russian Federation No. 431 of 05/05/1992. A family with three or more children must confirm its status of having many children.

As a rule, for this purpose, a certificate for a large family is issued by the social security authorities at the place of residence.

A specific list of benefits should be obtained from the social welfare department at your place of residence.

There you can also clarify the procedure for submitting them and the necessary documents.

The state offers options:

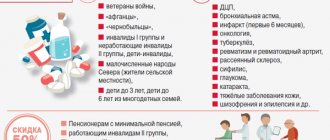

- 30% discount on some housing and communal services;

- Children under 6 years old receive free medications with a doctor's prescription;

- free travel for schoolchildren on municipal transport within the city and outside it;

- priority enrollment in kindergartens;

- free meals in educational canteens;

- once a month free admission to some cultural events;

- benefits for housing construction;

- tax preferences and more.

Benefits for mothers of many children - what they are entitled to

As a rule, families where a large number of minors are constantly experiencing financial shortages and need additional help, therefore, the state has developed certain types of programs and projects that make it possible to provide assistance specifically to mothers with many children. Let's look at some types of benefits that such categories of citizens are entitled to and highlight the most important points.

- Payment for housing and communal services is made on a preferential basis in the form of a 30% discount on each type of service. For some regions this figure may be increased.

- A child can be admitted to kindergarten out of turn, however, there are families who can also apply for admission to a preschool institution out of turn - these are families with one parent or those without a means of subsistence.

- The mother can apply for a compensation payment that will cover the cost of purchasing solid fuel for premises where there is no centralized heating system. Last year, the state provided funds to reimburse the cost of coal and firewood.

- Mothers with many children have the right to ride public transport for free and receive a discount on travel on intercity routes. The discount is up to 50% of the ticket price.

- You can receive free medicines for children under 6 years of age, provided they are prescribed by a doctor.

- A citizen has the right to receive free medical care and receive vouchers for a trip to a sanatorium or resort for health improvement.

- Mothers of many children have the right to attend cultural events - museums, exhibitions, zoos once a month free of charge.

- Children are entitled to free school and sports uniforms, and in some regions compensation payments are provided.

- Children can eat free at school twice a day, as well as teenagers studying at universities but who have not yet turned 18 years old.

- Funding for children is: for the 1st child under 1.5 years old - 2,718 rubles and for the 2nd and other children - 5,436 rubles.

- Cash payments are due in connection with caring for a child 1.5-3 years old. The amount is equal to one minimum for accommodation, and for the 2nd and other children it is double the amount.

We recommend reading: Certificate of a Mother of Many Children

Obtaining a land plot

The “Land Code of the Russian Federation No. 136-FZ dated October 25, 2001” works here. In paragraph 6 of Art. 39.5 states that large families have the right to receive land free of charge if they are on the list of those in need of improved housing conditions.

The law provides for the option of replacing a land plot with finished housing, but this depends on the capabilities of the regional authorities.

Each region has its own rules and conditions for obtaining it and should be looked for in local legislative documents.

Three children in a family: benefits and subsidies

It's no secret that raising a child in our time is quite difficult.

Children require not only physical labor, but also financial investment.

Every person who has at least one baby will agree with this statement.

And if you think about large families, it is difficult to wrap your head around how much money is needed to raise them.

They require constant: food, clothing, health, diapers, toys and education.

All this is very expensive in our difficult times. In order to help large families, the state has introduced a number of subsidies and benefits.

This includes not only compensation and benefits, but also various material support programs. It should be understood that if there are three children in a family, benefits are provided in any case. Let's take a closer look at what families with a large number of children can expect.

Mortgage at a reduced rate

The program was developed as a tool for targeted support for families with two or more children (RF Government Decree No. 1711 of December 30, 2017).

The bottom line is that banks provide mortgage loans at 6% per annum, which is significantly less than the national average rate (12-13% per annum). The difference in the interest rate on the bank loan is paid by the state.

Briefly about the conditions:

- in the family from January 1, 2018 to December 31, 2022, a second, third, etc. little citizen appeared;

- the loan agreement can be issued in the name of the mother or father;

- credit or additional the refinancing agreement was drawn up from 01/01/2018 to 03/01/2023;

- issued for the purchase of living space on the primary market, or for participation in shared construction only from legal entities;

- the family must make an initial mortgage payment from their own funds in the amount of at least 20% of the cost of housing;

- banks have the right to issue no more than 6 million rubles. under a loan agreement throughout the Russian Federation, and for Moscow, Moscow Region, St. Petersburg and Leningrad Region - no more than 12 million rubles.

IMPORTANT! For Russians living in the Far East, in whose family another child was born from 01/01/2019 to 12/31/2022, the loan is issued at 2%.

The benefit is valid for the entire loan repayment period.

The maximum loan term is 35 years.

Banks participating in the program and the amount of subsidies for each of them are distributed by order of the Ministry of Finance of the Russian Federation No. 88 dated February 19, 2018.

Partial list of credit institutions:

- PJSC "Sberbank";

- PJSC VTB Bank;

- JSC Gazprombank;

- PJSC Promsvyazbank and others.

Write-off 450,000 on mortgage

Since September 2020, Law No. 157-FZ of July 3, 2019 on state support for large families came into force. Rules for it were developed by Decree of the Government of the Russian Federation No. 1170 of September 7, 2019.

Now families who have taken out a loan can submit applications to the bank to write off part of the principal debt in the amount of up to 450,000 rubles.

Conditions of treatment:

- mother or father are citizens of the Russian Federation;

- issued to families where a third or subsequent baby was born from 01/01/2019 to 12/31/2022;

- one-time payment;

- The loan was issued until July 1, 2023 for the purchase of any housing or for shared construction.

The application for subsidy payment is submitted to the bank that provided the loan, along with a package of documents.

List of required papers:

- documents confirming the identity and citizenship of the borrower/co-borrower;

- documents confirming the identity and citizenship of the borrower’s children;

- documents confirming family ties in relation to children (birth certificate, etc.);

- documents confirming the issuance of a mortgage loan to the borrower;

- documents confirming the purchase of residential premises or registration of a land plot for individual housing construction.

Next, the bank itself is involved in processing the subsidy. 450,000 is written off from the main loan debt. If the principal amount is less than the specified amount, the remainder of the subsidy can be used to pay off interest on the loan.

IMPORTANT! Money is not issued in cash. The bank writes off the debt from the borrower's mortgage loan account in the amount of 450,000 rubles.

The above rules allow 7 working days for consideration of the application and transfer of the subsidy.

The bank is obliged to notify the borrower of the debt write-off within 3 business days from the date of the write-off.

Benefits for the birth of a third child for all residents of the Russian Federation in 2020

So, using the example of one of the regions, we looked at what large families with three or more children can claim. Now let's find out what benefits for such categories exist at the federal level.

If a family has at least three minor children, then its members can count on purchasing their own home with a mortgage on attractive terms. Thus, the interest rate when taking out a mortgage for an apartment will be less than five percent per year, and there will be no need to pay a down payment.

This type of lending will be partially repaid from the federal budget. And in order to register it with Sberbank, you must provide the following package of documents:

- income certificates of both parents;

- work books;

- birth certificates of all children;

- copies of passports of both parents;

- a special certificate issued to large families.

This is important to know: When does the law stop paying child support in Russia?

Regional benefits and benefits

Local authorities can provide:

- one-time and monthly benefits;

- services;

- natural help.

Monthly assistance, as a rule, is provided to the poor and is paid until the child reaches 1.5 or 3 years of age.

In Moscow and Moscow Region, families with a third child are entitled to payments in 2020 (Moscow Region Law No. 1/2006-OZ dated January 12, 2006):

- lump sum at birth - 60,000 rubles;

- lump sum for the birth of triplets - 300,000 per family;

- regional maternity capital - 100,000 rubles.

In St. Petersburg and the Leningrad Region, payments for the third child in 2020 are due (regional law No. 130-OZ of December 20, 2018 on the budget):

- lump sum at birth - 30,000 rubles;

- monthly - 10,027 rubles;

- maternity capital - 122,054 rubles.

Each region is obliged to monitor the demographic situation on its territory and provide financial support to families with children. The accrual and amount of assistance directly depend on the financial capabilities of the region’s budget. All information should be found on the administration website or from the social security authorities.

What rights does a working mother of many children have?

According to the law, all mothers are recognized as having many children if they are raising at least three children, none of whom have reached adulthood.

A flexible schedule is not the only opportunity that an officially employed mother of many children has access to. Citizens of these categories can count on early leave and pension. Labor benefits for families with many children are also presented in other categories.

There are several common schemes for using vacation rights:

- Independent use based on application.

- Division by parts.

- Joining the next paid vacations.

The main thing is that a collective or individual agreement is concluded, which describes the rules for granting such leaves.

Another benefit is early retirement. To obtain this right, it is important to meet certain conditions:

- At least five children in care.

- At least five children over 8 years old by the time the pension is issued.

- Work experience – minimum 15 years.

To receive rights and benefits, an employee must comply with safety precautions and labor discipline. Violation of any rules of the Labor Code may lead to denial of certain benefits.

Benefits for mothers of many children at work under the Labor Code of the Russian Federation in 2020

Among the benefits available to such citizens:

- Involvement in night and overtime work only with written consent.

- Establishing a part-time working day if an application is sent with a corresponding request.

- There is no probationary period for those who support and raise a child under 1.5 years old.

The same rules apply to fathers with many children. They can count on additional vacations at any time. They cannot be assigned a business trip without additional consent. The main thing is to come to a compromise with the other party, and not refuse to communicate, then you can agree on a convenient work schedule.

Other employment benefits

Citizens with many children can count on certain privileges in relation to work. The following benefits are usually available:

- Choice of various forms of employment, including flexible schedules and part-time work.

- A mother of many children has the right to choose a workplace at her own discretion.

- Retraining and raising the level of qualifications are carried out out of turn.

These benefits will remain in effect until the legal acts establishing them are repealed. According to the Labor Code, adjustments are applied, but the basis remains the same.

For certain categories of the population, Labor Law provides additional protection when required. The rights of parents with many children are similar to the privileges of ordinary citizens raising minors. Additional holidays and early retirement are the only exceptions. An employer’s refusal without a good reason is considered illegal and a reason for going to court.