People working on the railway can take advantage of a preferential pension, which allows them to receive payments from the state before the national retirement age. To do this, the number of actual years worked by the specialist at Russian Railways is taken into account.

In another way, such a pension is called payment for length of service, but it is assigned only to persons working in special positions. Additionally, railway workers are provided with other types of benefits and concessions from the state. This is due to specific working conditions.

In the article we will discuss the most important issues: what is the pension for Russian Railways, from what age, what benefits are entitled to former employees.

Are railway employees entitled to a preferential pension?

Railway employees can count on a preferential pension for long service , but it is offered only in some specialties. For this purpose, special lists of professions established by law are taken into account.

A preferential pension in the Russian Federation is offered to men after reaching 55 years of age, and to women at 50 years of age. In 2020, such conditions remained unchanged, although in 2020 a pension reform was adopted, according to which the general retirement age is increased by 5 years.

The registration process involves submitting a written application to the Pension Fund branch. You will have to prove the optimal length of experience and work in the desired position.

Railway workers' pensions in Russia

The pension reform carried out in the Russian Federation influenced different segments of the population.

An analysis of the provisions of Law N 350-FZ, adopted in early October, showed that the retirement of railway workers was not subject to age “increases”.

Raising the retirement age affected those who are not eligible for early retirement. As a result, railway workers receiving benefits received an advantage over others within 10 years.

Early retirement pension for railway workers

RJSC OJSC has an extensive system of employees. Many of them have access to earlier (compared to others) retirement due to the specific nature of their work.

Ensuring safe transportation and traffic on the railway, maintaining locomotives in good condition is a complex and responsible job. It involves round-the-clock activity, both day and night.

Therefore, such persons receive a social privilege from the state - early old age pension.

Specifics of pension provision for railway workers:

- the pre-retirement age has been reduced by 5 years;

- Payment is made until the end of life.

Not all railway employees are beneficiaries. Early Russian Railways pension is available to those who fall under the provisions of Article 30 of Law N 400-FZ.

Basic conditions for establishing an early retirement pension

Pensions for railway workers are granted earlier than usual, subject to:

- performing work on an ongoing basis as part of a locomotive crew or work on the safe transportation of goods and passengers in the metro and railway transport;

- reaching the minimum age “threshold”;

- accumulation of total length of service (GSS), accompanied by payment of contributions to the Pension Fund of the Russian Federation;

- availability of special experience (special experience) within the framework of the specified work.

The reform did not affect the criteria for sending railway workers to a preferential pension. The indicators remained unchanged, still varying depending on gender (Article 30 of Law No. 400-FZ):

| Criterion | Men (years) | Women (years) |

| Age | 55 | 50 |

| OSS | 25 | 20 |

| Special experience | 12,5 | 10 |

An additional condition is that the individual coefficient (pension) should not be lower than 30.

For comparison: since 2020, well-deserved rest is available to men from 65 years old and women from 60 years old, provided that there are 15 years of OSS, IPK - 30 (Article 8 of Law N 400-FZ).

Preferential professions

The law does not provide benefits to all retired railway workers. Article 30 of Law No. 400-FZ, defining the right to a “young” pension, in the fifth subparagraph of paragraph 1 refers to the register of professions approved by Government Decree No. 272 of April 24, 1992.

It mentions:

- foremen, attendants, foremen and fitters working in heavy railway traffic;

- employees of stations with a large volume and area (attendants and dispatchers);

- dispatchers and conductors;

- mechanics and speed controllers;

- electricians and electromechanics.

This list applies to all areas of railway traffic. Payments do not depend on the area of ownership of the enterprise servicing the railway lines. Railway workers in the private and public sectors are equal when assigning pensions. The main thing is confirmation of the conditions of OSS and special experience, achievement of the initial retirement age (55 and 50 years).

For workers who are not directly employed in locomotive crews, who do not transport cargo and who do not provide security, preferential vacation leave is available with reference to the same Article 30 of Law N 400-FZ. Its first paragraph (subparagraphs 1 and 2) refers to two more lists of professions adopted on January 26, 1991 by Resolution of the Council of Ministers of the USSR No. 10.

List No. 1 contains specialties in which work is carried out in hazardous conditions. According to it, a “young” pension is offered to workers of the metro and railway transport:

- bandages;

- pourers of alloys containing lead and tin;

- punchers and blowers of channels (pipes);

- repairmen working on rolling stock, tanks and their valves (provided that the tanks are used for ethyl liquid).

List No. 2 is tied to difficult working conditions (due to which it is considered difficult) and is more extensive. There are not only workers here, but also specialists and managers. Relaxation of pension conditions is received by:

- operators and boilermakers;

- stokers and washers;

- masters of washing stations (trains, points).

Regular night shifts in the metro will allow you to become pensioners ahead of schedule:

- foremen and drainage workers;

- trolley drivers and machinists;

- assemblers, fitters and service technicians;

- operators and tunnel workers;

- locksmiths and carpenters;

- electricians and electricians;

- engineers and craftsmen;

- inspectors and technicians;

- electromechanics.

For metro employees, preferential rest time according to list No. 2 is available specifically during night work.

Formation of pension amounts for railway employees

In Russia, pensions for railway workers can be of both a state and corporate nature. A railway employee can choose his insurance scheme by age:

- pay contributions to the Pension Fund of the Russian Federation (like employees of other professions - 22%);

- deposit insurance amounts into a non-state pension fund.

The corporate insurance system allows the formation of a non-state pension fund reserve, from which payments are made. Contributions to such a fund are made according to a double scheme. The funded part of the pension is replenished by deductions from the railway worker’s salary. The rest of the payments will be compensated by Russian Railways.

The size of the non-state pension depends on:

- salary received;

- length of participation in the non-state pension fund;

- chosen accumulation scheme.

When becoming a member of a non-state pension fund, a railway employee chooses from several options:

- purely insurance (low premiums, no possibility of inheritance);

- savings and insurance (from the moment established in the agreement, funds can be inherited);

- insurance-savings (inheritance is available from the moment the pension is approved);

- savings (after the death of a railway worker, it is transferred to his heirs).

Retirement from Russian Railways triggers the right to receive accumulated contributions from the NPF reserve fund.

Social benefits for Russian Railways employees

Early retirement is offered to railway workers as a benefit for working in non-standard, physically difficult and dangerous conditions. This is where government insurance comes from. The corporate system allows you to achieve two goals:

- cover the costs of a resource such as health;

- stock up on money for a normal “retirement” life.

By analyzing his right to early retirement, an employee can calculate his total length of service (from entries in the work book) and view periods of work in the desired profession. Look at your passport and make sure you have reached the required age.

The main difficulties arise when proving the existence of special experience. Railway workers are advised to carefully analyze their documents, check entries in the work book, and certificates received from the employer. A competent approach to collecting documents is half the solution to the problem.

You may also like

Source: https://zavtrapensiya.ru/pensioneram/otdelnym-kategoriyam-grazhdan/pensiya-zheleznodorozhnikov

List of specialties

To receive an early pension, it is necessary to work in certain specialties that are related to the organization of the safe movement of trains by rail. Additionally, such a privilege is assigned to persons working in a locomotive crew.

The following specialists can apply for a preferential payment:

- locomotive drivers and their assistants;

- train conductors;

- dispatchers;

- stokers;

- duty officers working at Russian Railways stations;

- track linemen foreman;

- mechanics;

- persons inspecting the train before departure;

- other employees who are involved in ensuring the safety of railway transport.

For women, the length of service for preferential payments from the state is 10 years. During this period, you need to work for Russian Railways in order to count on early retirement. For men, the duration increases to 12.5 years.

The total length of service worked by a Russian Railways employee must exceed 20 years, and for men the period increases to 25 years.

Attention! For Russians who worked for a company for at least 6 years and 3 months before 1992, they can count on reducing the retirement age by 2 years for women and 2.5 for men.

Is there a preferential pension for a tower crane operator?

Is there a preferential pension for crane operators, operator of tower and gantry cranes? Is it true that a preferential pension for crane operators (men) does not apply?

Vladimir, hello! Yes, unfortunately, the right to early retirement, according to Art. 27 of the Federal Law “On Labor Pensions”, only women have if they have worked as tractor drivers in agriculture, other sectors of the economy, as well as as drivers of construction, road and loading and unloading machines for at least fifteen years and have insurance (general work experience of at least twenty years.

Loading and unloading machines include: cranes (gantry, portal, tower), loaders, excavators and other machines performing loading and unloading operations.

Men are deprived of such benefits.

Olga Valerievna thank you very much for the comprehensive answer to my question

Age of retirement

Persons who are not entitled to benefits because they work in ordinary professions go on vacation under general conditions. Therefore, for them, the retirement age is 60 years for the female half of workers, and for men this value is increased to 65 years.

For beneficiaries, even after the adoption of the pension reform, the rules for issuing a long-service pension were not changed. Therefore, as before, they can apply at 50 (women) or 55 (men). If a specialist has worked less than 10 or 12.5 years, but more than half, then the pensioner’s age is reduced by 2 years for women and 2.5 for men.

Refusal to receive early pension for crane operator

HELLO. My name is Tatyana. Tell me how and where to apply for early retirement by profession as an overhead crane operator at a tank repair plant. I live in the Krasnodar region. I have 31 years of work experience and 16 years of continuous professional experience. When I applied to the pension fund, they asked me from work to provide an extract of my work experience, but at work they refused me and sent me back to the pension fund. Motivating by the fact that I do not have harmful working conditions and I don’t know how to prove to them that I have continuous experience as a crane operator and not because of harmfulness. What do i do?

Formation of payment

Like other persons, the pension is formed by taking into account the size of the salary. The more money the employer transferred for his employee to the Pension Fund, the higher the citizen’s pension will be. Anyone can pay a fee on their own to increase future payments. Therefore, the amount of contributions, accumulated points and length of service are taken into account.

The following factors influence the payment of a railway worker:

- average earnings;

- the region in which the citizen worked;

- total work experience.

Reference! Russian Railways employees can choose a corporate pension, but it is usually less than the state pension.

Allowances for the duration of continuous work in healthcare institutions

Personal finance » Pensioners » Pension benefits Medical workers working in positions and institutions (the list of which is established by law) have the right to early retirement. The calculation of the length of preferential pension for doctors mainly depends on length of service: in cities - 30 years, in rural areas - 25 years. A year of work is equivalent to 1 year of experience, but the exception is work in rural areas (1.3 years), as well as performance of official duties in certain departments and professions (1.5 years). Advertising “Pension” loan at the Ural Bank ReviewFrom 15 minutes Registration From 15 minutes Loan term Up to 7 years Rate (per annum) From 17% Maximum amount 600 thousand rubles.

Other types of preferences

Russian Railways employees can count not only on a pension, which is assigned 10 years earlier than other citizens of the Russian Federation, but also on other types of benefits. Such relaxations are due to the specific conditions under which specialists have to work. Typically, benefits are specified in a collective agreement that citizens sign during employment.

The number and types of concessions depend on the length of service, the presence of injuries or occupational diseases, as well as other merits.

The following types of preferences are offered as standard:

- with over 20 years of experience, free tickets are issued for long-distance trains, as well as for commuter trains, and in compartments, and you can also issue them not only for yourself, but also for one minor child;

- a railway worker may refuse a free reserved seat ticket for an adult child between 18 and 24 years of age who is studying full-time at a university;

- a Russian Railways pensioner who has been awarded the “Honorary Railway Worker” award is offered free travel in a train compartment for a distance of up to 200 km;

- a former employee who holds the title of Hero of the USSR, the Russian Federation or Socialist Labor, and is also a holder of the Order of Glory or Labor Glory, receives a monthly payment of 7.5 thousand rubles;

- if a pensioner was fired before 2008 and does not receive a non-state pension, then he is offered special financial assistance, and the amount of payment depends on the decision of the management of the organization in which the citizen worked;

- receiving medical care in special medical institutions of Russian Railways;

- if expensive treatment is required due to an occupational disease or injury received during work, then it is fully compensated by Russian Railways;

- if paid medical care is needed that is not related to work, then expenses will still be fully or partially compensated if you have at least 20 years of experience;

- employees in need receive free household fuel;

- free installation or repair of dentures in Russian Railways medical institutions;

- Russian Railways provides compensation of up to 6.9 thousand rubles for the funeral of a pensioner;

- free issuance of vouchers for sanatorium treatment to non-working pensioners;

- appointment of monthly payments for WWII veterans by May 9.

Additionally, targeted assistance is offered, which is assigned to railway workers who have distinguished themselves during their work. It is intended to encourage and motivate, and bonuses are also given if the employee has any personal problems.

Does the profession of crane operator belong to list 2?

Hello, please tell me whether the profession of crane operator (crane operator) belongs to the second list, and is it true that you can retire at 45-50 years old, no matter what region you live in?

Lawyers' answers (1)

The retirement age is established by the Federal Law “On Insurance Pensions”.

The law applies throughout Russia; its effect does not depend on a specific region.

The name of the profession “crane operator (crane operator)” appears in both List No. 1 and List No. 2, depending on the nature of the work, production, etc.

Accordingly, the nature of your production will depend on which list the nature of your production belongs to will determine at what age you will have the right to receive a pension: from 45 or from 50 years.

It also won’t hurt if you get a certificate from your employer in advance confirming your working conditions, the nomenclature of your position, etc.

Subsequently, it may be needed by the Pension Fund or the court (if you have to prove your right through the court - unfortunately, the Pension Fund very often refuses to grant preferential pensions).

The concept of a corporate pension through the NPF “Blagosostoyanie”

NPF “Blagosostoyanie” is a non-governmental institution specially created to form pensions for Russian Railways employees. If a specialist becomes a participant in the program, he can receive a high non-state pension. Now there are more than 500 thousand railway workers in this fund. Some are already receiving payments from the fund's reserves.

To form a future pension, some part of the salary deductions is sent to a non-state pension fund, and the specialist independently chooses the savings accrual scheme. If low premiums are chosen, then an insurance payment is formed, and the savings and insurance payment is inherited, but subject to certain limits. The savings account is transferred to the heirs at any time after the death of the railway worker.

A corporate pension is issued only after reaching retirement age. The process of disbursing funds depends on the rules of the corporate system. To participate in the program, you must make contributions for at least 5 years.

What additional pension does Russian Railways pay?

Russian Railways employees are paid an additional pension upon reaching retirement age and having more than 5 years of specialized experience. The amount of payments is indexed annually, and additional payments are provided for special merits.

All corporate schemes are based on the parity principle: contributions are deducted from salaries, and the company doubles them. Payments can be made for life, in fixed payments or in stages.

The average railway pension in 2020 was 8,900 rubles.

JSC "Russian Railways" has been implementing corporate pension provision for employees together with the NPF "BLAGOSOSTOYANIE" since 1999, acting as a guarantor in terms of financing. More than 595,000 railroad employees are registered in the system, and 308,000 former railroad workers receive pension payments.

Conditions for receiving a Russian Railways pension

The conditions for assigning a Russian Railways corporate pension, requirements for participants in the non-state system, the amount of contributions and payments are established:

All structural units are subject to the norms of these documents without the right to make amendments.

Rice. 1. Any employee can become a participant in the program of the NGO “BLAGOSOSTOYANIE”, regardless of position and salary

Payments are assigned to employees with more than 5 years of experience, subject to:

- reaching the retirement age established by Federal Law No. 400 “on insurance pensions”;

- registration of early railway pension;

- establishing a non-working disability group.

If a system participant with 5 years of experience leaves Russian Railways before reaching retirement age, he retains the right to receive a corporate pension, provided that he remains a participant in the NPO system, that is, does not leave the NPF.

In the absence of the required length of service, an applicant for additional non-state support can continue to make personal contributions, which will make it possible to increase output. The amount of contributions in this case cannot be less than twice the amount of financial assistance that is paid to Russian Railways pensioners with 30 years of service.

Taking into account the negative attitude of employees towards the ongoing reform, which provides for raising the generally accepted age for retirement, the company’s management decided to maintain the age criteria for paying a corporate pension for those who:

- entered the NGO system before January 1, 2020;

- agreed to be transferred upon reaching pre-retirement age to a lower paid position.

Railway workers who meet these criteria can receive both wages and a non-state pension.

Corporate pension plans

When entering the system, a participant can choose any scheme or its variant.

Rice. 2. Investors’ money is invested by the fund in profitable projects

As of 2020, valid:

- 4 options for pension plan No. 2:

- Insurance option – without the right to transfer rights to the beneficiary.

- Savings - with the right to inherit funds.

- Savings and insurance – inheritance is possible before the date of assignment of non-state payments.

- Insurance-savings – provides for the transfer of money to the beneficiary after the appointment of additional security.

- Pension scheme No. 6 – life savings and insurance.

The amount of contributions determined as a percentage of salary depends on the type of pension scheme chosen. Once a year, a participant can change the pension plan.

The system operates on parity principles - shared participation of the employee and the employer is provided. Regardless of plan type, contributions are withheld from your paycheck. The company co-finances the program, that is, it doubles the contributions. In addition to the mandatory payment from wages, an employee can send part or all of the funds from the compensated social package to an individual account.

Payment period

The monthly payment depends on the selected payment option:

- Lifetime provision is the most popular type, since the pensioner will receive payments from the railway throughout his life.

- Fixed-term pension – the participant independently determines the period during which he will receive payments.

- Staged payments - the “step by step” scheme provides for the payment of 160% of the estimated lifetime security in the first stage, and in the second - determined from the balance of funds in the account. This type of payment is possible when choosing a term scheme exceeding 10 years for men and 14 years for women.

Rice. 3. Stepped payment scheme

Within 4 months from the date of assignment of payments, the participant has the right to change the period for receiving money, for which an application is sent to the fund.

Russian Railways corporate pension amount

The amount of payments is calculated based on the chosen scheme, taking into account:

- personal funds in the account;

- finances transferred by the enterprise;

- investment income;

- the presence of special awards that give the right to additional payment;

- return on future periods at a rate of 4%.

By decision of the Board of Directors, corporate payments for certain categories of Russian Railways pensioners may increase:

- In 2020, payments were indexed to pensioners over 70 years old, disabled people, and WWII veterans.

- In 2020, payments to pensioners who were 70–79 years old at the beginning of 2014 were increased by 15%.

- In 2020, for disabled people of group 1, who began receiving pensions in 2017, payments were indexed by 70%.

Rice. 4. Pension payments may increase for special services to Russian Railways

In addition to annual indexation, an increase in non-state support for special achievements in the industry is provided. Participants with awards are provided with an additional payment:

- 10% – “For impeccable work in railway transport for 30 years”;

- 15% – “For impeccable work in railway transport for 40 years.”

- 20% – “Honorary Railway Worker of JSC Russian Railways”, “Honorary Railway Worker”.

- 40% – twice “Honorary Railway Worker of JSC Russian Railways” or “Honorary Railway Worker” from the Ministry of Transport of Russia while working in the company.

According to the reports of the NPF "BLAGOSOSTOYANIE", payments to retired railway workers increase annually.

Table 1. Average amount of non-state pension provision

| Year | Average corporate pension size, rub. |

| 2008 | 2 736 |

| 2009 | 3 499 |

| 2010 | 4 029 |

| 2011 | 4 760 |

| 2012 | 5 104 |

| 2013 | 5 400 |

| 2014 | 6 000 |

| 2015 | 7 900 |

| 2016 | 8 700 |

| 2017 | 8 900 |

Source: website of the “BLAGOSOSTOYANIE” foundation

Chart 1. Dynamics of average payments under the non-state pension program of Russian Railways. Source: website of the “BLAGOSOSTOYANIE” foundation

It should be taken into account that at the payment stage, personal income tax is withheld from part of the funds transferred by the employer. At the same time, personal finances transferred to the formation of a corporate pension are not subject to taxation. In addition, a participant in the system has the right to a tax deduction.

The procedure for registering a corporate pension for Russian Railways

Participation in the Russian Railways NPO system is based on the principle of voluntary entry. Therefore, those wishing to receive a corporate pension are required to:

- join the agreement and become a depositor by submitting documents to the NPF “BLAGOSOSTOYANIE”;

- submit an application to the HR department to deduct contributions from wages.

Contributions are withheld from salary in the amount established by the pension plan. The additional payment provided for by the co-financing program is transferred to the participant’s individual account automatically.

If desired, a railway worker can independently top up his individual account.

To control the status of your account, you can use the “Personal Account” service, access to which is provided when contacting a branch of the fund or the HR department of the enterprise.

In addition, NGO participants are provided with a connection to SMS notifications, which allows them to receive all important information regarding the fulfillment of obligations under the contract.

Experts from NPF “BLAGOSOSTOYANIE” explain in a video what a railway corporate pension is:

Source: https://yakapitalist.ru/finansy/korporativnaya-pensiya-v-rzhd/

Pensions for drivers and employees of Russian Railways

In 1956, some categories of railway workers received the right to retire without waiting for retirement age. To do this, they need to work in this industry for a certain number of years.

In 2020, pensions for Russian Railways employees are paid by the Pension Fund of Russia. In addition, railway employees have the right to participate in the corporate pension program implemented by a non-state pension fund.

Pensions for railway workers

Citizens who work for JSC Russian Railways can count on old-age pensions on a general basis. However, some categories of such workers have the right to take early retirement based on their length of service.

Destination Features

Those railway employees who meet the following requirements can take a well-deserved retirement based on length of service:

- The minimum age for early retirement is 50 years for women and 55 years for men;

- The total experience must be at least 20 years for women and 25 years for men;

- To receive a long-service pension, Russian Railways employees must work as employees of locomotive crews, transportation organizers or persons ensuring traffic safety on railway transport: women - 10 years, men - 12 years 6 months.

After the appointment of payments to railway workers for years of service, they occur for life.

Early retirement for railway workers

The possibility of early assignment of pension provision is provided for citizens whose positions and professions are included in the List of Professions (List No. 1 and 2). This list was approved in 1956 and has remained virtually unchanged. In 2020, this list includes the following professions in the field of railway support:

- Drivers and assistants;

- Dispatcher;

- Conductors;

- Heads of repair teams;

- Train station attendants;

- Inspectors;

- Stokers;

- Masters;

- Locksmiths;

- Mechanics;

- Compilers;

- Workers ensuring the safety of locomotives.

Important: special length of service includes only periods of employment during a full working year. Periods of absenteeism, unpaid leave, downtime, and completion of advanced training courses are not taken into account.

In the absence of the required special experience, a Russian Railways employee may also be granted benefits ahead of schedule. According to the Explanations of the Pension Fund, men who worked on the railway for 6 years and 3 months before 1992, or women who have at least 5 years of experience during the designated period, are entitled to receive a long-service pension.

Important: the right to early payments in this case appears not at 50 and 55 years (women and men, respectively), but at 52 years for women and at 57 years 6 months for men. Download for viewing and printing:

List No. 1

List No. 2

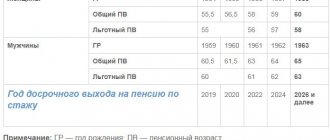

Will early retirement for railway workers continue in 2020?

On January 1, 2020, Federal Law No. 350-FZ came into force, which launched the pension reform developed by the Government of the Russian Federation. It involves a gradual increase in the retirement age. For the first 2 years, the increase will be for 6 months, then for 12. In 2028, men will become eligible to receive pension payments at age 65, and women at age 60.

The adopted Law preserves the right of certain categories of citizens to early assignment of pension benefits. These categories include persons whose professions are included in List No. 1 and 2. According to this provision, employees of Russian Railways who had the right to early retirement still have this opportunity.

Note: in 2020, railway employees can retire early (women at 50 years old, men at 55 years old) if the conditions for assigning such content are met. Download for viewing and printing:

Federal Law of the Russian Federation dated October 3, 2018 No. 350 “On amendments to certain legislative acts of the Russian Federation on the appointment and payment of pensions”

Corporate pension for railway workers through NPF “Blagosostoyaniye”

The employer JSC Russian Railways strives to provide its employees with an additional source of income after retirement. The Russian Railways corporate pension system helps achieve these goals. Any employee of the company can become a participant in this program, regardless of how long they have worked for the company.

The corporate pension system of Russian Railways is built on the principle of shared participation of the employer and employee in the formation of a funded pension. Contributions are sent to the NPF Blagosostoyanie, which invests pension contributions in various sectors of the Russian economy and annually accrues interest on the amount of savings of the insured person.

The formation of an employee’s funded pension occurs through his/her independent contributions from wages and constant transfers from the employer’s funds. A participant in the Russian Railways corporate pension program can choose the best option for forming a funded pension:

| Scheme | Distinctive features |

| Insurance | Minimum contributions, impossibility of inheriting insurance funds |

| Savings and insurance | Inheritance can be carried out strictly on the designated date (not earlier and not later) |

| Insurance and savings | You can inherit only after a funded pension has been assigned |

| Savings | Accumulated funds can be inherited at any time |

| Scheme 6 | Only immediate family members can inherit funds at any time |

A corporate pension was assigned to a Russian Railways employee after retirement (based on age or length of service). However, in connection with the new pension reform, which started on January 1, 2020, the board of Russian Railways decided to increase social protection for railway workers.

The age of employees receiving the right to receive corporate benefits remained at the same level: men - 60 years old and women - 60 years old. Employees are also given the right to choose: start receiving a funded pension at the “previous” age, or continue working until the general retirement age (60 years for women and 65 for men) and increase the amount of insurance savings.

A project is under consideration that implies the possibility of assigning a corporate pension when an employee moves to a lower-paid position. If this innovation is approved, a list of such positions will be additionally determined.

Formation of pension amounts for railway employees

The amount of the state pension is calculated based on:

- Average employee salary;

- The region in which he worked;

- The total duration of the insurance period.

The amount of corporate payments is calculated based on the total amount of savings generated through:

- Personal contributions of the insured person;

- Employer transfers;

- Investment interest accrued by non-state pension funds.

Also, when calculating the amount of payments, the period of receiving the payment chosen by the insured person is taken into account: for life or for a certain period.

The amount of monthly savings payments is constantly increasing. If in 2008 the average size of such a pension was 2,700 rubles, then in 2020 it was equal to 9,000 rubles.

The pension reform retained the opportunity for railway workers to retire early.

Also, JSC Russian Railways, in care of its employees, launched a corporate pension program that allows them to create a funded pension and thereby increase the amount of benefits after retirement.

Watch the video about Russian Railways pensions August 19, 2020, 09:00 January 7, 2020 02:05 Retirement age Link to current article

Source: https://pensionniy-vozrast.ru/pensii-rzhd.html

Salaries of Russian Railways employees in 2020

The salary level also depends on the qualifications of the employee. The company has requirements that determine monthly payments. Their list is fixed by internal orders of the management of Russian Railways. For example, to receive the maximum possible salary you need:

From region

“The first increase awaits workers from March 1, 2020; wages will increase by at least 2%. Proposals on the exact amount of indexation will be formed by February 1,” the press service quotes the words of the head of the department for organization, remuneration and motivation of labor of Russian Railways, Vladimir Nikitin.

- 1st class - assigned after a 2nd class driver has worked for 4 years in his profession (only a 1st class driver can transport passengers on long-distance trains);

- 2nd class - assigned to employees who worked as drivers for 2 years, being a 3rd class employee (2nd class drivers can drive commuter and passenger trains);

- 3rd class - this class will be assigned to drivers who have worked for 2 years as an assistant driver (the capabilities of a 3rd class driver are not great - driving a subway electric train, shunting locomotive, intercity electric train).

The work of a driver involves spending many hours in conditions of unstable lighting (you constantly have to navigate the light markings, flashes of lighting fixtures are observed) and high noise. When driving a vehicle, the driver is under stress, and the situation is worsened by being underground - an artificial microclimate has been created here. Many workers develop claustrophobia due to being in cramped offices and traveling through tunnels.

Expert opinion on the question of what benefits are established for machinists in Russia

Despite the fact that the duration of a driver’s shift should not exceed 6 hours, in fact today an employee has to work 8 or more hours daily. Moreover, the metro is always open, which means that you will have to go to work on weekends and holidays.

Will I receive loyalty to the Russian Railways company for three years of service? Will I be paid? If out of these three years I have already been on maternity leave 1.7 The above is not regulated by federal legislation, it cannot be determined by it.

It is a mistake to think that in any case you can limit yourself to one sentence. If new vacancies suitable for health reasons appear within a two-month period, the employer is obliged to offer them to the dismissed employee.

What benefits are provided upon dismissal due to staff reduction?

- professional staff;

- large volumes of transportation;

- positive business reputation among Russian and foreign companies.

- many years of experience in international relations;

- the presence of scientific, technical and construction capacities that allow the development of new projects on the territory of the Russian Federation and abroad;

- Citizens will have to work an additional 6 to 18 months. The duration of work depends on the individual’s date of birth. The number of points required to receive pension payments will increase along with the length of service.

- After working the required additional time, the citizen visits the Pension Fund (PFR) with an application, work book, and a certificate of average monthly earnings. The payment to the old-age pensioner will be assigned 10 days after submitting the documents.

- Raising the retirement age. It will be gradually increased for women up to 60 years old, and for men up to 65 years old.

- Increasing the retirement age of citizens who worked and live in the Far North and equivalent territories by 5 years.

- Increasing the individual pension coefficient (IPC) for going on vacation to 30.

- A gradual increase in the minimum work experience to 15 years.

We recommend reading: Travel on the Suburban Train for Labor Veterans Cost

By year of birth

Russians will be able to receive pension payments after they reach a certain age. The first 2 years of the reform include men born in 1959 and 1960, women born in 1964 and 1965. Pension payments will be assigned to them if they meet the following requirements:

Various types of pension calculators are very common on the Internet, which is explained by the increased interest of citizens in the issues of calculating pensions. However, it should be remembered that there is no calculator that could even approximately reliably calculate the size of your future pension payments. This is due to many reasons, the main one of which is the extreme opacity of the system for calculating pension savings practiced by the Pension Fund.

Retirement table by year from 2020

Thus, over the next 5 years for men and 8 years for women there will be a so-called “transition period”, during which the period of working capacity will gradually increase in increments of “1 year per year”, and starting from 2023 and 2026 for them the values stipulated by the bill will be established - 63 and 65 years.

Women born between 1964 and 1970 and men born between 1959 and 1962 will be subject to the transitional provisions provided for by the new law. This means that they will be given an intermediate age rather than a final age (63 and 65).

Case No. 2-1301/2015 ~ M-815/2015

Case No. 2-1301/15

DECISION IN THE NAME OF THE RUSSIAN FEDERATION

July 3, 2020

Zheleznodorozhny District Court of Rostov-on-Don, consisting of:

Judge V.A. Gubacheva,

under secretary Oganesyan A.S.,

having considered in open court on the premises of the court a civil case based on the claim of V.V. Makarenko. to the State Administration of the Pension Fund in the Zheleznodorozhny district of Rostov-on-Don on the recognition as illegal of the refusal to grant an early labor pension, the obligation to include excluded periods in the special work experience, the obligation to assign an early retirement pension in old age,

installed:

Makarenko V.V. filed the above-mentioned claim against the Main Directorate of the UPFR in the Zheleznodorozhny district of Rostov-on-Don to declare illegal the refusal to grant an early labor pension, the obligation to include excluded periods in special work experience, and to assign an early labor pension. The plaintiff bases his claims on the fact that he worked in jobs that gave him the right to receive an early old-age pension due to special working conditions. Special experience is more than 12 years 6 months, in connection with which DD.MM.YYYY filed a corresponding application with the defendant. According to the minutes of the meeting of the commission to consider the implementation of pension rights of citizens dated DD.MM.YYYY No., he was denied an early retirement pension due to the lack of the required special experience. The following periods of his work were not included in the special length of service: 10/04/1978. — 04/30/1979 00-06-27 Study at the Rostov Technical School of Locomotive Drivers with a break from production; 03/11/1985 — 06/11/1985 00-03-00 Study at the Kaluga Technical School of Locomotive Drivers at the VPR-1200 driver course; 06/17/1985 - November 10, 1986 01-04-24 Driver of the VPRS-500 machine on the Batayskaya route of the North Caucasus Railway, because the profession is not covered by Lists 1 and 2; 06/01/1987 — 09/25/1988 01-03-25 Trolleybus driver at the Oktyabrsky tram and trolleybus depot in Rostov-on-Don, because work on regular city passenger routes is not documented; 08/16/1989 — 05/28/1992 02-09-13 Track machine operator of the VPR-1200 commissioning crew because profession not covered by Lists 1 and 2; 05/29/1992 — 08/31/1992 00-03-03 Assistant driver of the trolley, because the profession is not covered by Lists 1 and 2; 09/01/1992 - November 25, 1992 00-02-25 Track machine driver of the 3rd Rostov distance of the North Caucasus Railways track service because the profession is not covered by Lists 1 and 2; November 24, 1993 — 05.09.1995 01-09-12 Trolleybus driver at the Oktyabrsky tram and trolleybus depot in Rostov-on-Don, because work on regular city passenger routes is not documented; 02/19/1997 — 04/17/1997 00-01-29 Track machine adjuster, because the profession is not covered by Lists 1 and 2; 04/18/1997 — 02.11.1997 00-06-15 Driver of the VPR track machine of the Rostov route of the North Caucasus Railway, because the profession is not covered by Lists 1 and 2; 05/03/2001 — November 19, 2002 01-06-18 Driver of the VPR track machine of the Rostov route of the North Caucasus Railway, because the profession is not covered by Lists 1 and 2; November 22, 2001 — 09/30/2003 00-10-09 Driver ADE-1 of the flaw-detecting motor carriage of the Motorized track distance for the repair and operation of track machines PChM-Novocherkassk SKZD, since the insured presented Lists of jobs, names of professions, positions and indicators with special working conditions, work in which gives the right to early labor pension in accordance with articles 27, 28 of the Law of December 17, 2001. for 2002-2003, in which there is no profession “driver of ADE-1 No. flaw detection motor carriage” (Letter of the UPFR in Novocherkassk dated DD.MM.YYYY. No.); 01.10.2003 - 15.06.2009 05-08-15 Driver of the flaw detection motor carriage ADE-1 of the Krasnodar distance of the SKZD track, since the insured did not confirm the fact of working with special conditions (letter from the branch of Russian Railways OJSC, structural division of the North Caucasus Directorate of Infrastructure Krasnodar travel distance from DD.MM.YYYY No.), due to the fact that information about the length of service for these employers is presented without the benefit component code. Believing that the refusal to grant an early retirement pension was not based on the law, the plaintiff filed this claim in court.

The plaintiff asks the court, taking into account the clarification of the claim, to declare the decision of the commission of the State Administration of the Pension Fund in the Zheleznodorozhny District of Rostov-on-Don dated DD.MM.YYYY No. illegal in terms of the refusal to assign him an early retirement pension in old age;

oblige the State Pension Fund Administration in the Zheleznodorozhny district of Rostov-on-Don to include in the special work experience that gives the right to early assignment of a labor pension the periods of work: 10/04/1978. — 04/30/1979 00-06-27 Study at the Rostov Technical School of Locomotive Drivers; November 22, 2001 — 09/30/2003 00-10-09 Driver ADE-1 of the defect-detecting motorized railcar for the repair and operation of track machines PChM-Novocherkassk SKZD; from 01.10.2003 - 15.06.2009 Driver of the flaw detection motor carriage ADE-1 on the Krasnodar route of the North Caucasus Railway;

oblige the State Pension Fund Administration in the Zheleznodorozhny district of Rostov-on-Don to assign him an early retirement pension, due to special working conditions from DD.MM.YYYY;

The plaintiff appeared at the court hearing and supported the claims.

The representative of the defendant, acting on the basis of a power of attorney, Sakharchuk T.V. appeared at the court hearing and did not admit the claims.

Representative of a third party of JSC Russian Railways, a branch of the structural unit S-K of the Infrastructure Directorate, acting on the basis of a power of attorney from Dudnikov A.S. appeared at the court hearing and supported the claims.

The court, after hearing the parties and examining the case materials, found the following.

Article 39 of the Constitution of the Russian Federation guarantees everyone social security by age, in case of illness, disability, loss of a breadwinner, for raising children and in other cases provided for by law.

In accordance with Article 3 of the Federal Law of December 17, 2001 N 173-FZ On Labor Pensions in the Russian Federation (hereinafter referred to as the Federal Law of December 17, 2001 N 173-FZ), citizens of the Russian Federation insured in accordance with the Federal Law have the right to a labor pension On compulsory pension insurance in the Russian Federation, subject to their compliance with the conditions provided for by the specified Federal Law.

In accordance with subparagraph 5 of paragraph 1 of Article 27 of Federal Law N 173-FZ, an old-age labor pension is assigned to men upon reaching the age of 55 years, and to women upon reaching the age of 50 years, if they have worked respectively for at least 12 years and 6 months and at least 10 years as working locomotive crews and workers of certain categories directly organizing transportation and ensuring traffic safety on railway transport and the subway, as well as as truck drivers directly in the technological process in mines, open-pit mines, mines or ore quarries for coal export , shale, ore, rock and have an insurance experience of at least 25 and at least 20 years, respectively.

When calculating special work experience, it should be taken into account whether the plaintiff worked in the profession (held a position) indicated in the List of professions of working locomotive crews, as well as professions and positions of employees of certain categories directly organizing transportation and ensuring traffic safety on railway transport and the metro, approved by Decree of the Government of the Russian Federation of April 24, 1992 N 272, and whether the work he performed was associated with the adverse effects of various types of factors indicated in this List (for example, employment on sections of main railways with heavy train traffic for track fitters , foremen) (clause 21. Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 11, 2012 N 30

On the practice of courts considering cases related to the implementation of citizens’ rights to labor pensions).

From the case materials, it appears that the plaintiff Makarenko V.V., born DD.MM.YYYY, DD.MM.YYYY, applied to the UPFR at <address> with an application for the assignment of an old-age labor pension in accordance with subsection. 5 p. 1 art. 27 Federal Law dated DD.MM.YYYY N 173-FZ.

By the decision of the UPFR in the Zheleznodorozhny district of Rostov-on-Don dated DD.MM.YYYY No. Makarenko V.V. the granting of an early retirement pension in old age was refused due to the failure of the policyholder to confirm the fact of working under special working conditions. The following periods of work were excluded from the plaintiff’s special work experience:

04.10.1978 — 04/30/1979 00-06-27 Study at the Rostov Technical School of Locomotive Drivers; November 22, 2001 — 09/30/2003 00-10-09 Driver ADE-1 of the defect-detecting motorized railcar for the repair and operation of track machines PChM-Novocherkassk SKZD; from 01.10.2003 - 15.06.2009 Driver of the flaw detection motor carriage ADE-1 on the Krasnodar route of the North Caucasus Railway;

The plaintiff's special experience was 5 years 3 months. ld.18

According to paragraph 2 of Art. 27 of the Federal Law of December 17, 2001 N 173-FZ, lists of relevant works, industries, professions, positions, specialties and institutions, taking into account which the labor pension provided for in paragraph 1 of this article is assigned, the rules for calculating periods of work and assigning labor pensions, if necessary, are approved Government of the Russian Federation.

Based on sub. g p. 1 of the Decree of the Government of the Russian Federation of July 18, 2002 N 537 On the Lists of production, work, professions and positions, taking into account which an old-age labor pension is assigned early in accordance with Art. 27 of the Federal Law of December 17, 2001 N 173-FZ, when assigning an old-age labor pension early to workers employed as locomotive crew workers, and to workers of certain categories who directly organize transportation and ensure traffic safety on railway transport and the metro, the List of worker professions is applied locomotive crews, as well as professions and positions of employees of certain categories who directly organize transportation and ensure traffic safety on railway transport and the metro, approved by Decree of the Government of the Russian Federation of April 24, 1992 N 272 (hereinafter referred to as the List).

This List provides for the positions of driver and assistant driver of railcars and motor locomotives; the positions of driver and assistant driver of handcars are not provided for in the List.

In list No. 2 of industries, workshops, professions and positions with difficult working conditions, work in which gives the right to a state pension on preferential terms and in preferential amounts, approved by Resolution of the Council of Ministers of the USSR on August 22, 1956 N 1173, the positions of locomotive drivers and their assistants were named, diesel locomotives, electric locomotives, diesel trains, motor locomotives.

Having assessed the evidence presented and the arguments of both parties, the court comes to the conclusion that Makarenko V.V. During the disputed periods, he worked as a driver of the ADE-1 flaw-detecting motor carriage of the Machined Track Distance for the repair and operation of track machines PChM-Novocherkassk SKZD, full time, which gives him the right to early pension provision.

These circumstances are confirmed by entries in the work book, a clarifying certificate issued by the employer, a certificate clarifying the special nature of the work, and an archival certificate.

Taking into account the above, the court comes to the conclusion that during the disputed periods, with the exception of leave without pay during the period from DD.MM.YYYY to DD.MM.YYYY, the court established that the plaintiff worked as a driver motor carriages and a motor locomotive, which gives him the right to early pension provision, since on the specified date, taking into account the periods counted by the court, Makarenko V.V. more than 12 years and 6 months of special experience are required.

Regarding the argument of the defendant’s representative about the lack of evidence of the plaintiff’s permanent employment in special conditions, the court considers it necessary to note the following.

By virtue of clause 4 of the Rules for calculating periods of work, approved by Decree of the Government of the Russian Federation of July 11, 2002 N 516, the length of service that gives the right to early assignment of an old-age pension includes periods of work performed continuously for a full working day, unless otherwise provided for by the Rules or other regulatory legal acts, subject to payment of insurance contributions to the Pension Fund of the Russian Federation for these periods.

According to the clarification of the Ministry of Labor of Russia dated May 22, 1996 N 5, full-time work means performing work under working conditions provided for by the Lists of relevant types of work, at least 80% of the working time.

Clause 3 of Art. 13 of the Federal Law of December 17, 2001 N 173-FZ On Labor Pensions in the Russian Federation (as amended by the Federal Law of July 24, 2009 N 213-FZ) provides that in some cases it is allowed to establish work experience based on the testimony of two or more witnesses in case of loss documents and for other reasons (due to their careless storage, intentional destruction and similar reasons) not through the fault of the employee. The nature of the work is not confirmed by witness testimony.

Thus, this legal norm establishes a limitation on the admissibility of means of proof when determining the nature of the work. In this case, the nature of the work refers to the peculiarities of the conditions for the implementation of the labor function.

The full employment of the plaintiff is confirmed by certificate No. 81/OK-15 dated June 30, 2015, issued by the Branch of Russian Railways S-K Directorate of Infrastructure of the Krasnodar Track Distance, in which there is no indication of the plaintiff’s diversion from the main activity during the disputed period, with the exception of unpaid leave wages from DD.MM.YYYY to DD.MM.YYYY, as well as statements of calculation and payment of wages, a workplace certification card for the working conditions of a railcar driver for a general assessment of the hazards and dangers of factors in the working environment and the labor process, certified according to class of hazardous working conditions.

The plaintiff's full-time employment was also confirmed by witnesses AAE and OSI, who worked with the plaintiff during the disputed period.

During the trial, the defendant did not present evidence to refute these conclusions. Meanwhile, in accordance with Art. 12 of the Code of Civil Procedure of the Russian Federation, justice in civil cases is carried out on the basis of adversarialism and equality of the parties and in accordance with Art. 56 of the Code of Civil Procedure of the Russian Federation, each party must prove the circumstances to which it refers as the basis for its claims and objections, unless otherwise provided by federal law.

Based on the documents presented in the case file, the court also considers it established that the plaintiff was sent on October 4, 1978. to 04/30/1979 to study at the Rostov Technical School of Locomotive Drivers while maintaining his job and average earnings, in connection with which the disputed period must be included in the length of service required to assign a preferential pension.

Based on the foregoing, the court comes to the conclusion that the claim is satisfied.

Guided by Article 194-198 of the Code of Civil Procedure of the Russian Federation, the court

decided :

To recognize the decision of the commission of the State Administration of the Pension Fund in the Zheleznodorozhny district of Rostov-on-Don dated 08/14/20142 No. as illegal in terms of refusal to include in the special length of service the periods of work of Makarenko VV: from 10/04/1978. — 04/30/1979 — study at the Rostov Technical School of Locomotive Drivers; November 22, 2001 — 09/30/2003 - driver of the ADE-1 defect-detecting motorized railcar for the repair and operation of track machines PChM-Novocherkassk SKZD; 01.10.2003 - 15.06.2009 — driver of the flaw detection motor carriage ADE-1 on the Krasnodar route of the North Caucasus Railway.

To oblige the State Administration of the Pension Fund in the Zheleznodorozhny district of Rostov-on-Don to include Makarenko VV in the special work experience period of work: from 10/04/1978. — 04/30/1979 — study at the Rostov Technical School of Locomotive Drivers; November 22, 2001 — 09/30/2003 - driver of the ADE-1 defect-detecting motorized railcar for the repair and operation of track machines PChM-Novocherkassk SKZD; 01.10.2003 - 15.06.2009 - driver of the flaw detection motor carriage ADE-1 of the Krasnodar distance of the North Caucasus Railway, with the exception of unpaid leave in the period from DD.MM.YYYY to DD.MM.YYYY

Oblige the State Administration of the Pension Fund in the Zheleznodorozhny district of Rostov-on-Don to assign Makarenko VV an early retirement pension in old age from October 31, 2011.

The decision can be appealed to the Rostov Regional Court through the Zheleznodorozhny Court within a month from the date the decision was made in final form.

Judge:

The decision was made in final form on July 8, 2015.

Basic conditions for establishing an early retirement pension

Pensions for railway workers are granted earlier than usual, subject to:

- performing work on an ongoing basis as part of a locomotive crew or work on the safe transportation of goods and passengers in the metro and railway transport;

- reaching the minimum age “threshold”;

- accumulation of total length of service (GSS), accompanied by payment of contributions to the Pension Fund of the Russian Federation;

- availability of special experience (special experience) within the framework of the specified work.

The reform did not affect the criteria for sending railway workers to a preferential pension. The indicators remained unchanged, still varying depending on gender (Article 30 of Law No. 400-FZ):

| Criterion | Men (years) | Women (years) |

| Age | 55 | 50 |

| OSS | 25 | 20 |

| Special experience | 12,5 | 10 |

An additional condition is that the individual coefficient (pension) should not be lower than 30.

For comparison: since 2020, well-deserved rest is available to men from 65 years old and women from 60 years old, provided that there are 15 years of OSS, IPK - 30 (Article 8 of Law N 400-FZ).