Retirement in Spain is a period in which people can do their favorite things without thinking about the need for survival, which is extremely rare. It was during this period that the Spaniards feel free and protected. They begin a comfortable life, during which they can afford travel, development and pleasant leisure. Many residents of the country receive additional education, some take care of their families, and some simply have an interesting time visiting exhibitions, theaters, cinemas and other cultural events. And those who wish can continue working, which will not affect their pension provision. How many pensioners are there in Spain? There are many of them, especially considering the fact that life during this period is at a high level in all areas. Therefore, the citizens of the country allow themselves to forget about the difficulties and simply enjoy every day of life.

Types of pensions in Spain:

- Old age pension. It is calculated based on length of service and age. The higher the length of service, the greater the payments. Every month, citizens who are officially employed pay tax on wages;

- Disability pension. Accrued to children who are born with disabilities, as well as people who have received an injury during their life that led to disability;

- For the loss of a breadwinner.

The country has a private and social pension. A private pension is available to those who make monthly contributions to the fund of a set amount. After retirement, the funds are returned. A social pension is assigned to people living in the country, but who do not have the required work experience.

Rules and retirement age in Spain

Accruals are regulated at the legislative level, but even if there is no experience, citizens are still paid benefits for a normal life in the country. At what age do people retire in Spain? The retirement age in Spain for women and the retirement age in Spain for men are the same. In this case, the work experience must be continuous for at least 2 years. To receive maximum payments, a person must have more than 37 years of experience.

Situations when the retirement age is reduced:

- If monthly deductions from wages were made for 38.5 years, then withdrawal is possible at age 65;

- In the case of work activity in the period before January 1, 1967. In such a situation, exit is possible at 60 years old;

- People who have worked for 30 years and lost their job can retire at age 61, but 7% will be withheld from the accrual amount;

- When calculating a special pension, the age is reduced to 64 years.

More to read:

What is the retirement age in France for women and men?

What is the average pension in Italy?

Spanish state pension

Having reached the retirement threshold, a Spanish citizen can be sure of the following:

- Receiving free medical care and free medicines;

- In a good monetary amount of your pension;

- The fact is that he will be able to lead an active lifestyle in the future.

The required pension in Spain includes clubs, excursions and other leisure activities, which the authorities organize for pensioners free of charge.

The Spanish pension can be obtained based on length of service or old age. In order for a legalized resident to qualify for pension payments, he must work in Spain for at least a year.

The country also provides private pension insurance. You can personally save money in a deposit account, or entrust it to an insurance company. The employer contributes the amounts to the state fund. When calculating the pension, earnings over the last 15 years are taken into account. These years are considered to be the peak of a person's career.

Of these 15 years, the salary for the last 2 years of work is indexed. The average income for the remaining 13 years is also calculated.

The pension is usually between 60% and 100% after all calculations. The minimum old-age pension in Spain is just over 600 euros. The maximum crosses the mark of 2500 euros.

More than 9 million pensioners live in Spain. Every year their number is growing steadily.

Spaniards can also retire early.

Retirement age in Spain

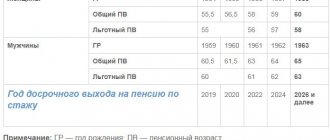

The average life expectancy of a person born in Spain is over 80 years. Men and women in this country retire at the same retirement age. In 2020, the retirement age for Spaniards was 67 years old, which caused a wave of protest from the population. Since quite recently, old-age pensions began at 65 years old.

Among the EU countries, only Greece has a higher rate of pension payments; Spain is in second place there, which, however, has already led to the creation of a pension fund deficit, as well as to an increase in the retirement age. The situation is also worsened by the high percentage of unemployment in the country. Spaniards receive a pension twice a year. It falls in June and December, since pension payments are quite significant, pensioners in Spain can afford to travel a lot, and also often provide financial assistance to their grandchildren.

Is there early retirement in the country?

Possible if a person has at least 30 years of work experience within the country. If a person quit during this time and did not work for more than six months, then 7% is withheld from the pension. You can leave before the age of 65 if you have worked for more than 38.5 years and contributed to the insurance fund during this time.

Who has this opportunity?

- Working in difficult and dangerous conditions;

- Marine employees;

- Mining industry workers;

- Miners;

- Railway employees;

- Agricultural workers;

- Employees of oil and gas platforms.

Is there life in retirement?

vivaspain

Jul 29, 2020 · 6 min read

Some Spanish statistics

The 2013 pension reform in Spain set the retirement age at 65. In 2020, the retirement age rose to 65 years and 6 months.

By 2027, the retirement age is planned to be increased to 67 years. However, it will also be possible to exit at 65 if the required number of years have been worked.

According to official data from the Ministry of Employment and Social Affairs. provision in 2020, the average real retirement age is 64.1 years.

51% of Spaniards retire at the legal age, 44% retire earlier and only 5% continue to work after 65.

In Spain there are also categories of citizens who retire earlier:

Sailors, railway workers, agricultural workers

Miners who work in closed mines retire at 40. In open at 45

Firefighters -59 years old with 35 years of experience

Police officers -59 years old.

The minimum pension in 2020 in Spain is 636 euros, and the maximum is 2580 e per month! This is with 36 years of experience.

Since 2013, if a Spanish pensioner is able and willing to continue working, it is possible to apply for partial retirement. In this case, he will not work full time and receive 50% of the pension plus his salary. board

In Spain there is also a funded pension program. Banks offer money management or you can choose a pension fund yourself. Pension savings are inherited, and they can also be used ahead of time in the event of force majeure. But compared to other economically developed countries, this option is not very popular in Spain.

So, are Spanish pensioners living well?

According to WHO data for 2020, Spain is in 4th place in terms of life expectancy.

Men live 80 years, women 85. That is, in Spain the question is not “living until retirement”, but rather living the remaining years well. And according to my observations, the Spaniards cope with this task quite well! Naturally, not without the help of the state!

Spaniards are very socially active. And it seems to me that pensioners are even more likely than young people.

Old age in Spain is not something scary or shameful. It is also called the third age. This is the time when you can continue to enjoy life: meet friends in a cafe, walk in the park, go to the pool and cinema, devote more time to hobbies, spend time with your grandchildren. In the pool, I regularly observed groups of pensioners replacing each other in water aerobics classes. This is an ordinary municipal swimming pool and quite ordinary pensioners, with arthritis, varicose veins and other age-related problems. For them, these classes are primarily communication, and physical education comes second.

In parks and boulevards you can see groups of old women or old men walking and chatting animatedly. Some with Nordic walking poles, and some bent over with a stick - the main thing is movement and communication.

Petanque is very popular in Catalonia and is played mainly by pensioners. In every district of Barcelona there is a petanque club, and sometimes more than one. Near the Arc de Triomphe you can watch how excitedly old people throw balls.

And in every district there are centros de día centers for older people, where they come during the day to chat and play cards and dominoes. Something like a day camp or after-school group. There are specialized day centers for people with dementia and Alzheimer's disease, where they are supervised by specially trained staff.

And yes, old people in Spain are treated, and not sent home to die as a spent resource!

Registration of a pension and its features

After reaching retirement age, you must write an application and take it to the Institute for Social Security of Citizens. When calculating the amount of accruals, the average income of a citizen that was received over the last 15 years is taken as a basis:

- Actual amount for the last 2 years of work experience;

- Indexed amount for the last 15 years of service.

The final indicator is multiplied by the age coefficient. That is, when calculating, both the length of service and the person’s age are taken into account. Most retirees receive about 70% of their last salary received.

If a person is entitled to several payments, for example, has reached retirement age and has a disability, then he will have to choose one option. To do this, you can consult with a specialist to choose more favorable conditions for yourself.

Types and size of pensions

There are three types of pension in Spain:

- usual, depending on the length of work experience. It is paid from the state social insurance fund.

- special, designed to support those persons who do not have or have insufficient pension experience.

- private pensions paid by commercial pension funds.

The average pension in Spain is not very high compared to pensions paid in other EU countries, but it is quite decent. So, for example, the minimum size of a regular pension is 636 euros, and the maximum is 2567. As for the average size of the pension, in 2020 it was 908 euros.

On average, the pension payment is 80% of the former salary. Even in France this figure is 80%. Only Greece has achieved great success, where the percentage of pension payments from wages is 95%.

Typically, pension payments are made monthly, with another additional pension also paid twice a year, namely in June and December. If we talk about the formula for calculating the amount of the pension, then in Spain it depends on the amount of income from which the pension was paid to the Social Security Fund, as well as on the length of service. Usually, when calculating, the average earnings for the last 15 years are taken.

If we talk about the most wealthy, retired representatives of certain professions, then they include:

- specialists in the field of it.

- business owners.

- bankers and economists.

Men pensioners in Spain receive a larger pension than women, while the size of payments also varies by region. So, for example, in the Basque Country it is 1114 euros, and in Madrid – 1064. The poorest can be considered pensioners in Galicia with their income of 759 euros.

It is also worth noting that the amount of pension payments directly depends on the length of service. So, for example, if a person has worked for more than fifteen years, he can count on half his salary. Further, its size increases depending on the length of service and the amount of interest. As for disabled people and people in need of constant assistance, they can count on an amount of fifty percent of the minimum pension.

What is the monthly pension in Spain?

The minimum pension in Spain in 2020 is 636 euros. In this case, the maximum payment amount reaches 2567 euros. But what is the average pension in Spain in 2020? It is equal to 908 euros.

The amount of payments is calculated individually, taking into account length of service, salary and working conditions. The longer a person worked, the higher the benefits will be upon retirement. If the experience is more than 25 years, the payment will increase by 2% of the amount.

Amount of pension payments in Spain

The size of pensions for citizens differs depending on who the person worked and how much he earned. Working conditions also play an important role.

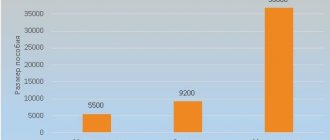

The payment amount is as follows:

- The minimum amount is 636 euros.

- The average payout in 2020 is 908 euros.

- The maximum payout is 2567 euros.

The more a person has worked officially, the higher the amount of security will be . If a person has worked for a quarter of a century, the pension amount will be greater by 2% of the amount established by law. For length of service over 25 and up to 37 years, payments are 2.75% more. Working for 37 years is paid 4% more than the amount that everyone else is entitled to.

What surcharges exist?

Citizens are entitled not only to pensions due to old age.

They are also entitled to other payments:

- If there are physical defects and the status of disabled person is assigned, then the person receives a benefit in the amount of 948 euros. This helps him meet his needs and continue treatment.

- Additional payments to disabled pensioners. In addition to the basic old-age pension, they receive an additional 316 euros every month.

- Benefit in case of loss of a breadwinner. Its size is 648 euros.

These types of cash assistance are intended to improve the living conditions of socially disadvantaged segments of the population and free up jobs for the younger generation.

Differences in pensions in different regions of Spain

How much a person will receive directly depends on what the salary of his position was. The amount of payments is also influenced by the fact in which region the person lives and works.

| Region | Pension amount in euros |

| Navarre | 1047,91 |

| Asturias | 1077,69 |

| Madrid | 1080,00 |

| Basque Country | 1133,00 |

| Extremadura | 761,00 |

| Galicia | 771,34 |

| Murcia | 803,52 |

| Andalusia | 821,40 |

| Valencia | 841,70 |

| Canary Islands | 842,71 |

| Castile-La Mancha | 843,43 |

| Balearic Islands | 844,04 |

| Rioja | 887,31 |

| Castile and Leon | 897,96 |

| Catalonia | 948,15 |

| Cantabria | 958,53 |

| Aragon | 958,92 |

What do former unemployed people get in retirement?

If a person is a citizen of the country, but he has not been able to accumulate the required length of service, the state does not leave him in the lurch and assigns payments. These categories of the population require government assistance. Its sizes range from 458-1375 euros per month . People whose income does not reach the established minimum can count on this type of pension. Benefits are paid for 10 years.

Russian pensioners in Spain

Since 1996, residents of the Russian Federation who are officially employed in Spain can apply for a Spanish pension. The following requirements are put forward to citizens:

- Total work experience of at least 15 years;

- Work experience in Spain for at least 1 year.

Subject to these simple conditions, Russian residents have the right to apply for a pension in the amount of 650 euros monthly. It is worth noting that if the work experience is longer, then pension payments will also be higher. You can calculate your pension in rubles using the current euro exchange rate. Emigration to Spain for pensioners is very attractive, since the conditions are loyal and the payments are much higher than in Russia.

Therefore, many people who are approaching retirement seek to leave Russia for more advanced and successful countries, where they can calmly spend the rest of their lives without thinking about how to pay for food and utilities. It’s not for nothing that in Russia pensioners not only don’t think about traveling, but are afraid to live, because the level is very low in all areas of support.

There are three options for obtaining a residence permit in Spain for retirees:

- Purchase of real estate with further registration of a residence permit

- Purchasing luxury expensive real estate and obtaining a residence permit under an Investor Visa

- Family reunion

If you are going to move to Spain by purchasing a home, then it is enough to have your own home in Spain, have a permanent source of income, as well as medical insurance. There is also the option of obtaining a Spanish residence permit, subject to a long-term rental agreement. But remember, this housing must comply with all living standards in Spain. That is, a family consisting of several people cannot live in one apartment.

An important issue is obtaining health insurance in Spain. People who have reached the age of 70 are reluctant to take out insurance here. And if you are 75 or older, be prepared to be denied health insurance. But there are always options, don’t despair. Contact several institutions, somewhere they will definitely make concessions for you.

The second option for obtaining a residence permit for retirees in Spain is the purchase of expensive real estate. If you have the funds, then it will not be difficult for you to make a purchase of 500,000 euros or more. Either put money on deposit (from 1 million or more), or purchase securities in one of the companies in Spain in the amount of 1 million euros. Thus, you become the owner of the so-called Golden Investor Visa and can apply for a residence permit.

And another option is a residence permit for pensioners through family reunification. If your children already have a residence permit, then you as parents have the right to also apply for a residence permit in Spain. To do this, you must also provide a certificate of income. But your children should already take care of this. It is important to prove that the parents have been supporting the children for a year or more, and you must also fully justify the need for the parents to live in Spain.

Residence permit in Spain for retirees - Cost of living

According to International Living Magazine, retirees in Spain can enjoy an excellent standard of living by spending around US$2,100 per month per person. This is due, among other things, to the absence of certain cost items.

For example, Spain has a reduced heating requirement relative to more northern countries and regions, so utility costs in winter are lower, for example, than in the UK or Scandinavia. If your goal is a residence permit in Spain for retired travelers, remember that traveling within the country is much cheaper compared to other EU countries, including the cost of train and bus tickets, as well as gasoline costs.

Food and drinks are inexpensive in the country. There are many places in Spain where a glass of wine or a small glass of beer costs just one euro, and restaurant menus throughout Spain include hearty and inexpensive dishes. The cost of a lunch, including two or even three courses, is on average only 10 euros.

Residence permit in Spain for retirees - Taxation

Although Spain has a reputation for being tax-heavy, there are ways to get around high taxes with the advice of a good lawyer or tax professional.

All Russians, Ukrainians and Belarusians wishing to obtain a residence permit in Spain for pensioners should be considered to be tax residents of Spain if they fulfill the following conditions: if they spend more than 183 days in the country during a calendar year or if their families, main professional activities or the majority of assets are located in Spain.

As tax residents of Spain, each is responsible for paying tax on personal income from worldwide sources. At the same time, Spanish tax non-residents are responsible for paying income tax on income derived from Spanish sources.

Residence permit in Spain for retirees - Healthcare

Every person, whether an EU citizen or a non-EU citizen, has the right to emergency medical care in Spain.

For those wishing to apply for a residence permit in Spain for pensioners: in order to enjoy all the benefits of the Spanish healthcare system legally, foreign pensioners need to register at their city hall (padrón) at their place of residence.

This will bring many additional valuable benefits, including tax breaks and deductions, preferential use of utilities and even free access to social and recreational infrastructure such as sports centers and libraries.

Russian, Ukrainian, Belarusian and Kazakh pensioners who are not eligible for free public health care can obtain private health insurance or pay full price for any medical services and treatment they receive.

If your goal is a residence permit in Spain for retirees, remember that there is one very simple way to gain access to all the resources of the Spanish public health care system. This scheme is called "specialio especial".

Participation requires that a resident of the country register with their local town hall (padrón) for a year, after which such resident will be able to participate in the government's health insurance scheme. To do this, you need to be prepared to make a monthly payment of at least 60 euros.

Medical tourism is actively developing in Spain, which is also popular among retirees. For example, Marbella is quickly becoming famous in Europe and around the world for its quality medical care in private medical centers. The region's health tourism industry is expected to grow by at least 40% next year.

Residence permit in Spain for retirees - Buying and owning real estate in Spain

As mentioned above, to use the health care system and other resources of the socio-economic infrastructure of the host country, as well as to stay on Spanish territory legally all year round, resident status is required. That is, you need a residence permit in Spain for pensioners.

A residence permit in Spain can be obtained not just by purchasing real estate, but by investing in an asset that is growing in value - comfortable housing on the sea coast to enjoy a well-deserved vacation.

Over the past few years, getting a mortgage to buy Spanish property has become easier. The intensity of construction is increasing, as is the market turnover. This means that if you buy Spanish real estate in order to obtain a residence permit in Spain for retirees right now, you can count on its price to rise at least in the short and medium term.

Retirement housing prices on the Costa del Sol and Costa Blanca have still not fully recovered from the steep fall (over 50% in many areas) during the 2008 economic crisis. So now you can buy a high-quality cottage or villa at a decent discount. This is also true for Valencia, among other things.

Across the country, home prices are on the rise. However, when purchasing property in Spain, retirees should pay attention to some local markets, such as the Balearic Islands, Mallorca, Marbella and the Costa del Sol. There is already a shortage of luxury apartments and villas there due to high demand - even despite rising prices.

All Russians, Ukrainians and Belarusians wishing to obtain a residence permit in Spain for retirees, as well as other foreign buyers of real estate on Spanish territory, are recommended to use the services of local specialists: realtors and lawyers. They will check the asset for possible problems and speed up the implementation of the transaction. By trusting a good law firm or real estate agency, foreign buyers can avoid any mistakes along the way.

Be sure to read it! Reporting to the Pension Fund, what documents must be submitted to the pension fund in 2020

Residence permit in Spain for pensioners - Transfer of pensions to Spain

Russian and Ukrainian pensioners who decide to live in Spain and receive a state pension in their home countries can choose to receive their pension from their bank branch in Spain (if there is one) or transfer it to their bank account in Spain.

However, those wishing to apply for a residence permit in Spain for pensioners should exercise caution, since their pension will be paid in rubles / hryvnias, and not euros, so you should be aware of fluctuations in exchange rates.

Before leaving your home country, be sure to contact your state pension fund to clarify all the procedures and formalities for transferring your pension to Spain. For non-EU countries, everything will depend on whether there is an appropriate agreement between your country of origin and Spain. Fortunately, Spanish officials have already concluded such agreements with their Russian and Ukrainian colleagues. Details in the table below.

| Jurisdiction | Date of conclusion of the agreement with Spain | Notes |

| Russia | April 11, 1994 | The distribution of expenses for the payment of pensions is provided depending on the amount of pension rights acquired by citizens in the countries. In this case, Russia is responsible only for the experience acquired on its territory. |

| Ukraine | March 27, 1998 | The calculation of pensions is regulated by the agreement between Spain and Ukraine “On Social Security of Citizens” |

Residence permit in Spain for retirees – Moving and immigration to Spain

There are many options and schemes for moving to this country that allow you to minimize the amount of time spent and expenses.

For the information of all those wishing to apply for a residence permit in Spain for pensioners: many town halls have their own Department of Foreigners, where immigrant pensioners can receive information about local social groups that meet regularly. For example, you can sign up for Spanish language classes there. Learning at least the basics of Spanish is important for the integration process and beyond.

Taking other classes, such as ballroom dancing, or salsa dancing classes, or cooking classes, or learning to play golf or tennis, or sailing, can open up a whole new world.

All Russians, Ukrainians and Belarusians who want to obtain a residence permit in Spain for pensioners should suffer the fate that in many Spanish cities, cycling clubs and walking groups, theater groups and book clubs have been created for people of retirement age. You can join them to make new friends and enjoy retirement life in Spain.

It is not surprising that more and more foreigners are finding happiness in Spain after retiring. They can buy inexpensive houses by the sea, taste a variety of foods and dishes, and enjoy the mild weather.

Plus, you're guaranteed to find other friendly retirees to befriend in any part of the country. The Spanish government and local residents are making it easier for immigrants to move and live in Spain.

What benefits are there for pensioners?

For the most part, pensioners in Spain live comfortably and rarely experience financial difficulties. Many of them devote most of their time to travel. There are a lot of different benefits for people in the country:

- Free medical care. It includes not only an examination by a doctor, laboratory tests, but also favorable conditions for the purchase of medications;

- Discounts on public transport travel are more than half the cost;

- Discounts on visiting cinemas;

- Possibility of free entry to state museums;

- Discounts for education. Oddly enough, pensioners in Spain often engage in self-education in old age. The cost is affordable for everyone;

- Possibility of profitable visits to sports complexes;

- Promotions for purchases. Many trading companies offer pensioners social cards, with which they can purchase food and other goods at special prices excluding VAT.

We recommend these articles:

What is the retirement age in America?

What is the minimum pension in Norway?

But of course, not everything is rosy in the Kingdom of Spain!

Before the economic crisis, the Spanish pension system was considered one of the best among economically developed countries. But skeptics believe that in its current form it is not viable.

According to forecasts, by 2050 there will be 75 pensioners per 100 people of working age in Spain.

Increasing life expectancy and low birth rates and, as a result, an aging nation.

The main part of the pension fund is formed from payments from employers and the working population. The conclusions are obvious.

And this problem faces not only Spain, but also most economically developed countries.

Despite all the problems, Spain remains one of the most attractive countries for retirees.

Russian citizens can also count, under certain conditions, on receiving a pension in Spain.

But that is another story!

Subscribe to the channel!

Receiving a widow's pension

This issue is especially relevant not only in Spain, but also in other countries. The fact is that the average age of a woman who is left alone is 73.4 years. Men live less than women on average by several years, so women often have to apply for benefits.

A widow's pension is necessary for a normal life for a single person, because all utility bills will have to be paid independently, which is not always easy. Therefore, the state helps such people who find themselves in a difficult financial situation.

“Golden Visa” – residence permit for investors

Another way for a pensioner to obtain a residence permit in Spain is to invest in:

- real estate – 500,000 €;

- shares and deposits - €1,000,000;

- government loan bonds - €2,000,000;

- opening your own company – €1,000,000.

Most often, real estate is used as an investment object. First of all, it's cheaper. Secondly, there are fewer risks. Thirdly, by receiving a residence permit under this program, a pensioner immediately resolves the issue of housing.

Conditions for obtaining a Golden visa when purchasing luxury real estate

If you are interested in a Golden Visa when purchasing real estate, please consider the following:

- it is not necessary to buy one object at a price of 500 thousand euros - there can be several objects (the main thing is that their total cost is not less than the specified amount);

- 500 thousand euros is the price threshold for one person, that is, when purchasing an object at this price, you register it for one owner (if you register it for spouses, then each will have 250 thousand investments);

- housing must be free of encumbrances - that is, credit funds cannot be used when purchasing it.

The following requirements are put forward to the buyer:

- must be over 18 years of age (suitable for pensioners);

- stay in the kingdom legally;

- must be “entry” to other EU countries;

- obtain medical insurance;

- confirm your financial solvency of bank accounts.

It is worth noting that at the beginning the investor receives only a visa for a year, and after that he can receive a residence permit for a period of 2 years with the right to extend. After 10 years, a pensioner who purchased real estate worth more than €500,000 can obtain citizenship.

A significant advantage of the Golden visa is that its holder can bring with him all family members - spouses, including common-law spouses, minor children, financially dependent parents and children over 18 years of age.