Legislation

The main law governing taxation issues in Russia is the Tax Code. It sets out general rules that all regional laws must comply with. Transport tax is a regional tax and is regulated by their regulatory framework.

According to Russian legislation, transport tax is a mandatory fee paid by vehicle owners. This is enshrined in Art. 357 Tax Code of the Russian Federation.

Regional taxes are sent to the local budget and are subject to local laws. But all these laws should not contradict the Tax Code.

Thus, most of the tax benefits are established by regional legislative acts. This rule is enshrined in Art. 356 Tax Code of the Russian Federation.

In order to determine whether pensioners are entitled to benefits, it is necessary to refer to the law that applies in the territory where the car is registered.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Today, each subject of the Federation has its own legislative acts and they can differ significantly on the issue of providing benefits to different unprotected categories of citizens.

Who doesn't pay?

There are certain categories of pensioners who may be exempt from paying this type of tax.

Such pensioners include pensioners who are heroes of the Soviet Union, the Russian Federation, pensioners who are owners of awards and orders of Glory. This category of citizens may include:

- exempt from paying tax for only one vehicle;

- pensioners who are veterans and disabled people of the Great Patriotic War . Non-payment of tax also implies only one vehicle;

- pensioners who are veterans and disabled combatants are also not paid for one car;

- pensioners who have 1st and 2nd disability groups . Tax may not be paid on one registered vehicle;

- if pensioners were prisoners of concentration camps and other places of forced order under the age of majority, then they have the right not to pay tax contributions for one vehicle that is registered.

What are the transport tax benefits for pensioners?

Tax for individuals persons are calculated using a simple formula:

TN = tax rate * vehicle power.

That is, the tax rate is multiplied by the number of horsepower in the car engine.

This product will be accrued for payment by the pensioner if he has not declared that he has a benefit. In order to determine what benefits a citizen has, you need to know your law.

It is also important to note that the federal cities of Moscow and St. Petersburg have their own laws that differ significantly from the laws of the Moscow and Leningrad regions.

Thus, benefits can be expressed as a percentage of the tax amount, as well as in complete exemption from tax on a certain type of transport. In order to find out what benefits are provided in different regions, let’s turn to local laws.

In addition to listing benefits, local legislative acts specify tax rates, which also vary significantly across Russian regions:

| Region | Is there a benefit for an ordinary pensioner? | Pensioner category giving the right to benefits | What a benefit | Normative base |

| Moscow | There are no benefits for ordinary pensioners. Receiving benefits is possible only under certain circumstances | Heroes of the USSR and the Russian Federation Combat veterans Disabled people I-II groups | Completely released for 1 tr. means | Law Moscow from 9.07. 2008 N 33 About transport tax |

| Availability of a car up to 70 hp | Completely released | |||

| Saint Petersburg | Eat. For 1 vehicle domestic production, power up to 150 hp (including boat, motor boat) | Heroes of the USSR, Russian Federation Full cavalry. Order of Glory, Order of Labor Glory | Completely for 1 vehicle with power up to 200 hp | Law of St. Petersburg On transport tax |

| Veterans, Disabled people of WWII, Disabled people of I-II group Disabled people with restrictions on work activities II-III st. Chernobyl victims | Completely for 1 vehicle, up to 150 hp. or over 15 years old | |||

| Leningrad region | Eat. Owners of a car with a power of up to 100 hp pay 80% of the rate | Heroes of the USSR, Russian Federation Disabled WWII Veterans Chernobyl victims | Completely for 1 vehicle with a power of no more than 150 hp. | Linen. Region Regional Law on Transport Tax |

| Gr-not with 1 car father. production with a capacity of 80 hp and with a year of manufacture up to 1990. | Fully | |||

| Moscow region | No | Heroes of the USSR, Russian Federation Chernobyl victims WWII participants Disabled people I-II gr. Disabled since childhood | Fully exempt for 1 vehicle | Law of the Moscow Region dated 16.11. 2002 N 129/2002-OZ refers to the Law of the Moscow Region of November 24, 2004 N 151/2004-OZ On preferential taxation in the Moscow region |

| Disabled III group Veterans | 50% for 1 tr. means | |||

| Stavropol region | There are pensioners with a car with a power of up to 100 hp. Pay 50% | Heroes of the USSR, Russian Federation Chernobyl survivors Participants of the Second World War Combat veterans | Completely released | Law of the Stavropol Territory from 27.11. 2002 N 52-kz About Transport Tax |

| Voronezh region | No | Heroes of the USSR, Russian Federation Full holders of the Order of Glory | Completely for 1 vehicle | Law of the Voronezh region from 11.06. 2003 N 28-OZ On the provision of tax benefits for the payment of TN |

| WWII veterans, Combat veterans, concentration camp prisoners Chernobyl victims | Completely for 1 vehicle with power up to 120 hp | |||

| Ryazan Oblast | There are old-age pensioners and pensioners of the Armed Forces and the Ministry of Internal Affairs completely for a car up to 150 hp. | Heroes of the USSR, Russian Federation Chernobyl survivors Participants of the Second World War Combat veterans | Fully | Law of the Ryazan Region from 22.11. 2002 N 76-OZ About TN in the Ryazan region Refers to the Law of the Ryazan region. dated April 15, 1998 On tax benefits |

| Vologda Region | There are Fully citizens with 1 vehicle with a power of up to 150 hp | Heroes of the USSR and the Russian Federation, awarded 3 Orders of Glory | Fully | Law of the Vologda region from 15.11. 2002 N 842-OZ About transport tax |

| Completely for 1 cargo vehicle with a power of up to 85 hp and a weight of up to 1100 kg | Disabled people | For a car with power up to 150 hp | ||

| Completely regarding the motorboat | ||||

| If there are several grounds for benefits, the pensioner himself chooses for which object the benefit will be provided |

Analyzing the table above, it can be noted that in most regions of Russia, in order to receive a transport tax benefit, it is not enough to simply reach retirement age.

In some cases, additional categories are required to receive benefits (disability, participation in the Second World War, etc.).

When purchasing a car, a pensioner should study regional legislation well, since in some areas, when providing benefits, the power of the car, expressed in horsepower (hp), matters.

Do pensioners pay?

Pensioners pay transport tax with full rights ; it is regulated through the tax code of our country.

In general, there are no rules that would allow people who have reached retirement age not to pay transport taxes, but in different regions of the country some types of benefits are possible for these citizens regarding these payments for motor vehicles.

Thus, each region of our homeland has its own benefits and discounts that are provided for pensioners (not only for transport taxes). These taxes, their amount, payment terms, etc. may be regulated by a specific region. Therefore, in order to prepare all the necessary documents to receive transport tax benefits, you need to find out from special authorities what is needed for this and how to do it.

If a person has reached retirement age, this does not mean that he has certain benefits; they begin to operate only by notification.

Thus, in order to achieve benefits, you need to take care of how to claim your rights . And only after submitting the necessary package of documents to government agencies and after writing the necessary application, you will have the rights to use some benefits.

How to apply

It is important to understand the fact that benefits are accrued only after the application of the beneficiary. That is, if a citizen himself has not applied for the benefit entitled to him by law, then it will not be taken into account in calculating the tax.

You can find out whether a pensioner has the right to a benefit by reading the local law on transport tax or by contacting the tax office. There you can also clarify the list of documents required to apply for the benefit.

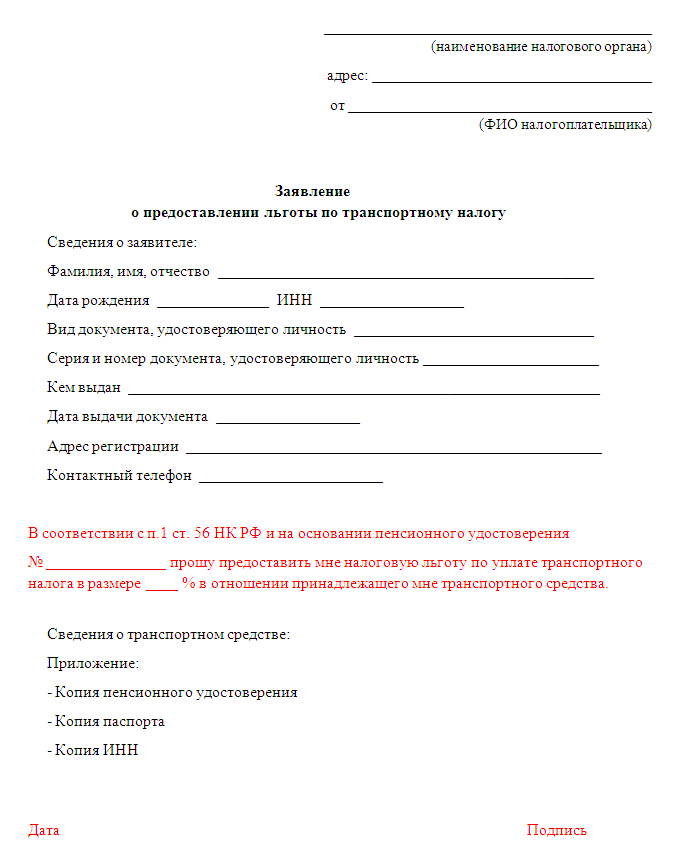

To fill out the application, you must go to the tax office and take a special form:

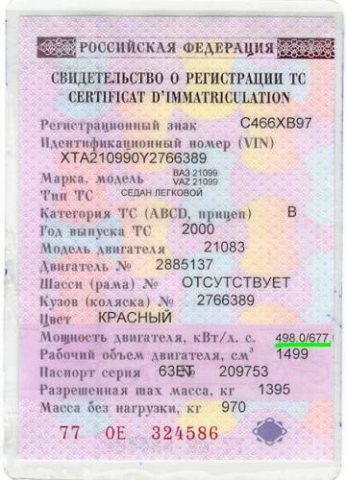

There is an important rule that must be followed. The application indicates the license plate number of the vehicle and its power. After consideration of this application, the benefit will be accrued specifically for this car.

It will be taken into account as long as the car is in the possession of this pensioner. That is, it is enough to write an application for the benefit once.

If a pensioner sold the car that was declared when applying for the benefit and bought a new one, then he will have to apply for the benefit again. Otherwise, the tax on the new car will be calculated without taking into account the benefit.

Rules for filling out an application

The application for exemption from paying the fiscal fee has a strict and approved form.

The general rules for filling it out are:

- entering current, factual information;

- use of black ink (when handwritten);

- inadmissibility of corrections and blots;

The application is submitted with a set of documents identifying the citizen, as well as confirming the right to receive the corresponding benefit.

This is important to know: Temporary disability benefit: what it is, who is entitled to receive it, the amount of benefits in 2020, the duration of payments

Documentation

It is worth preparing for a visit to the tax office in advance and making copies of all necessary documents. Often the Federal Tax Service office does not have photocopying equipment and you will have to look for where you can make a copy. To avoid this, it is better to take care of this in advance.

To apply for benefits, a pensioner will need:

- passport;

- TIN;

- SNILS;

- pensioner's ID;

- Vehicle title;

- vehicle registration certificate.

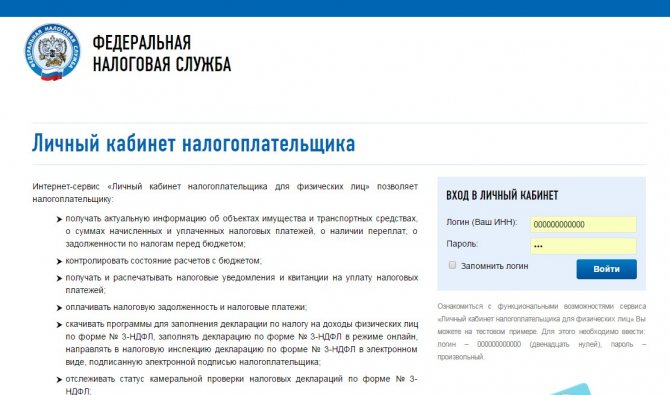

Copies of documents are attached to the application and submitted along with it. Sometimes employees do not ask for originals, but it is better to have them with you to avoid any discrepancies. To inform taxpayers on the Internet, there is a very convenient system launched by the FMS. This is the taxpayer's personal account. To connect to it, you need to know your Taxpayer Identification Number (TIN) and obtain a password from the inspector. The password is issued only to the taxpayer upon presentation of his passport.

Thus, except for a specific taxpayer, no one will be able to access his personal account and find out information about taxable objects.

Any citizen who has the right to benefits must take advantage of them. But often, taking advantage of citizens’ legal illiteracy, benefits are not awarded. Pensioners need to keep abreast of changes in legislation if they want to save their budget.

![Alfa-Bank Credit cards [CPS] RU](https://7daystodie.ru/wp-content/uploads/alfa-bank-kreditnye-karty-cps-ru-330x140.jpg)