Contributions to the pension fund for individual entrepreneurs for themselves (the founder) have undergone some changes this year and no longer depend on the minimum wage. Now a market participant acting as an individual entrepreneur must make fixed payments to the Pension Fund and additionally pay a 1% fee on the amount of income that exceeds 300 thousand rubles. At first glance, it seems that the novelty only aggravates the already difficult situation of entrepreneurs, however, according to analysts, the innovation will have a beneficial effect on the businessman’s budget over time, since the indexation of the fee will be less than the minimum wage on which the contribution was previously based. Payments to the Pension Fund of the Russian Federation made for employees hired by individual entrepreneurs remain unchanged.

What are insurance premiums?

From the moment of entering information about a newly registered individual entrepreneur, the authorized tax authority is obliged to notify extra-budgetary funds, which include the Pension Fund of the Russian Federation, about this.

According to the letter of the law, each market participant carrying out economic activities in the form of an individual entrepreneur is required to make mandatory contributions to the pension fund according to the following list:

- From payments and remunerations of employees under an employment contract;

- From payments and remuneration of employees under a civil contract;

- Insurance premiums for yourself as the only employee (founder of the individual entrepreneur).

Also, the founder of an individual entrepreneur is obliged to report and pay the fee for compulsory health insurance.

Contributions related to temporary disability or maternity are paid at the personal discretion of the entrepreneur, since they are not mandatory according to regulatory regulations. However, their payment will allow you to receive deductions from the corresponding extra-budgetary fund (FSS) upon the occurrence of sick leave or another event specified by law.

Pension contributions for individual entrepreneurs: features

When conducting business, it is important to take into account the following features:

- After registering as an individual entrepreneur, a letter from the Pension Fund of the Russian Federation must be sent to the legal address of the founder, indicating that information about him will be entered into the database of the extra-budgetary fund;

- If, after a period of one month, the individual entrepreneur has not received a notification from the Pension Fund, then he must appear independently to enter the relevant information;

- The founder of an individual entrepreneur must generate information for the Pension Fund for each reporting period, regardless of whether he is conducting business activities or not;

- Even if business activity brings losses to its owner, he retains the obligation to pay contributions to extra-budgetary funds;

- Despite the targeted nature of the payments, they should be paid to the Federal Tax Service, which registered the individual entrepreneur (this rule is considered new from the current year);

- In some cases, the founder of an individual entrepreneur with employees may apply reduced rates for pension contributions (the rule does not apply to contributions “for oneself”);

- Since from this year an individual entrepreneur must make an additional pension fee on the amount of revenue that exceeds 300 thousand rubles, when generating a payment order at a rate of 1% it is safer to use the new KBK;

- Mandatory payments to extra-budgetary funds remain until an entry is made in the Unified State Register of Entrepreneurs about the exclusion of the individual entrepreneur from it, therefore the founder must notify the Pension Fund of the Russian Federation as soon as possible about the termination of activities in order to avoid charges;

- If the founder of an individual entrepreneur is a pensioner, then he remains obligated to make contributions to the Pension Fund, even if he:

- Receives an old-age pension;

- Employed in another organization that makes the above deductions in his favor.

Deadlines for payment of FP IP

The rules of law establish the requirement to pay fixed payments within a fixed time frame. The first amount of the fixed payment of the individual entrepreneur must be sent to himself before the end of the current year, that is, before December 31. At the same time, the entrepreneur decides when exactly and in what part to pay contributions.

He can divide this amount into monthly or quarterly shares, or pay the fees with a single payment document at once. The basic rule is that payment must be made before the end of the year.

On some preferential regimes, it allows you to take into account the amounts of transferred insurance premiums towards taxes due:

- For UTII - if an individual entrepreneur makes payments for compulsory insurance during the reporting quarter, he has the right to take such payments into account when calculating the single tax. For example, UTII for the 1st quarter can be reduced if the contribution was paid within the period from January to March inclusive.

- Under the simplified tax system, insurance premiums can be used to determine the advance tax payment, and at the end of the year in the total tax amount.

This is interesting: How to understand which clinic you belong to

Timely payment of fixed payments for individual entrepreneurs without involving persons under special regimes sometimes allows one to reduce taxes to zero based on the results of its activities.

Changes for 2020

Since the beginning of 2020, a number of amendments have been made to the calculation of the contribution by the founder of an individual entrepreneur for himself, which affected the following points:

- The amount of contributions to the Pension Fund does not depend on the minimum wage;

- The State Duma has established the amount of pension payments for individual entrepreneurs for the next three years:

- 2018 – 26 thousand 545 rubles;

- 2019 – 29 thousand 354 rubles;

- 2020 – 32 thousand 448 rubles;

- If an entrepreneur’s income exceeds the limit of 300 thousand rubles, then he needs to make additional deductions (equivalent to 1% of the difference);

- There are frameworks that set the maximum amount of the annual pension contribution (it should not exceed more than 8 times the current fixed amount, in other words, the limit is 212 thousand 360 rubles).

The above changes essentially reflect the following consequences:

- The deadlines and reporting forms have not changed;

- In order to reduce the amount of contributions, the legislator slightly changes the principle of establishing fixed rates for contributions;

- Contributions that were previously accepted by the extra-budgetary fund itself (PFR, MHIF, Social Insurance Fund) are now authorized to be accepted by the tax authority at the place of registration of the individual entrepreneur;

- Changes were made to the budget classification codes (which should be given special attention when filling out reports).

Payment of social contributions

If we talk about how to pay the Pension Fund for individual entrepreneurs, then first you need to decide on the procedure for calculations and payment of social payments. The general deadlines set by the state are:

- for fixed deductions (PFR+FFOMS) – until December 31 of the reporting year;

- for contributions that exceed the limit - until April 1 of the following reporting year.

This is interesting: What does it mean to dispose of a taxpayer’s personal account?

You can learn how an individual entrepreneur can pay for a pension fund from Law No. 212-FZ of July 24, 2009. The same regulatory act sets rates, determines the procedure for distributing the savings and insurance parts, as well as personalized reporting forms and deadlines for filing. A fixed contribution to the Pension Fund must be made in a single payment, and the division into the insurance and savings part will be carried out by the fund itself.

Important! The tax amount can be reduced by the amount of insurance payments under the simplified taxation system (income 6%). In this case, it is more profitable to pay the contribution in installments, this will reduce advance payments for the single tax.

- It is worth noting that contributions to the Pension Fund and the health insurance fund are paid in separate payments. There are a number of services on the Internet where you can generate payment document forms for paying insurance premiums.

- In addition, you can generate receipts and keep records of insurance payments in your personal account on the Pension Fund website. There is also detailed information on how individual entrepreneurs should pay the pension fund, what budget classification codes to indicate in the payment slip and other information. To register on the fund’s portal, you must select the region in which the entrepreneur is registered, enter your last name, first name and mobile phone number.

- You can pay the Pension Fund contribution for individual entrepreneurs either in cash at a bank branch or from the individual entrepreneur’s account without extra fees and interest. A similar payment mechanism applies to health insurance. The payment details for medical contributions are similar to the details for payments to the Pension Fund, since they are also administered and distributed by the Pension Fund.

The difference between the two payments is only in the amount, purpose of payment and KBK code. You can find out the details for cash payment and filling out a payment order yourself on the Pension Fund website.

Contributions to the Pension Fund for individual entrepreneurs with employees

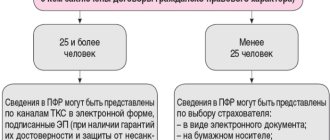

When calculating the amount of pension contributions expected to be paid by an individual entrepreneur for each employee he hires, the legislator does not make exceptions based on the organizational and legal form. That is, an individual entrepreneur (like a legal entity) determines their size based on:

- The volume of income received;

- Rates in force at the time of calculation.

Payments to the Pension Fund and other extra-budgetary funds are as follows:

- 22% - for compulsory pension insurance;

- 2.9% - for voluntary contributions related to temporary disability or maternity;

- 5.1% - health insurance premiums.

How to fill out receipts for mandatory insurance premiums for individual entrepreneurs in 2020?

Good afternoon, dear individual entrepreneurs!

In this case, our individual entrepreneur must pay the state for 2018:

- Contributions to the Pension Fund “for yourself” (for pension insurance): 26,545 rubles

- Contributions to the FFOMS “for yourself” (for health insurance): 5,840 rubles

- Total for 2020 = 32,385 rubles

- Also, don’t forget about 1% of the amount exceeding 300,000 rubles of annual income (but more on that below)

A little hint. To understand where these amounts came from, I advise you to read the full article on individual entrepreneur contributions “for yourself” for 2018: https://dmitry-robionek.ru/calendar/pro-vznosy-ip-2018.html

But back to the article... Our individual entrepreneur wants to pay quarterly in order to evenly distribute the load throughout 2020.

This is interesting: The second pension of a military pensioner after 60 years

This means that he pays the following amounts every quarter:

- Contributions to the Pension Fund: 26545: 4 = 6636.25 rubles

- Contributions to the FFOMS: 5840: 4 = 1460 rubles

That is, our individual entrepreneur prints two receipts for payment of insurance premiums every quarter and goes with them to Sberbank to pay in cash. Moreover, the deadlines for quarterly payments are as follows:

- For the first quarter of 2020: from January 1 to March 31

- For the second quarter of 2020: from April 1 to June 30

- For the third quarter of 2020: from July 1 to September 30

- For the fourth quarter of 2020: from October 1 to December 31

In our example, we will consider exactly the case when an individual entrepreneur pays quarterly. Almost all accounting programs and online services offer these terms for payment of contributions. Thus, the burden of mandatory insurance contributions for individual entrepreneurs is distributed more evenly.

And an individual entrepreneur using the simplified tax system of 6% can still make deductions from advances under the simplified tax system. Please note that if you have an individual entrepreneur account with a bank, it is strongly recommended that you pay contributions (and taxes) only from it. The fact is that banks, starting from July 2020, control this moment. And if you have a bank account for an individual entrepreneur, then be sure to pay all taxes and contributions only from the individual entrepreneur’s account, and not in cash

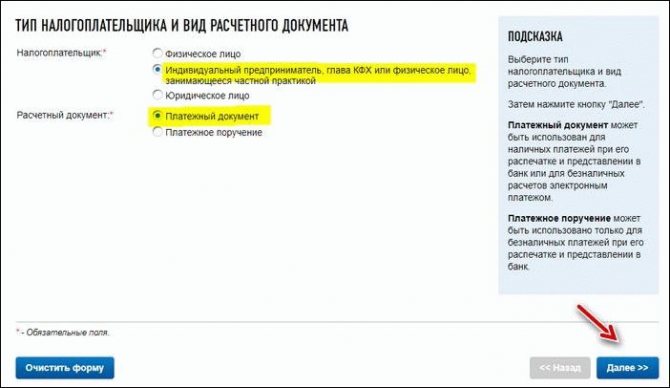

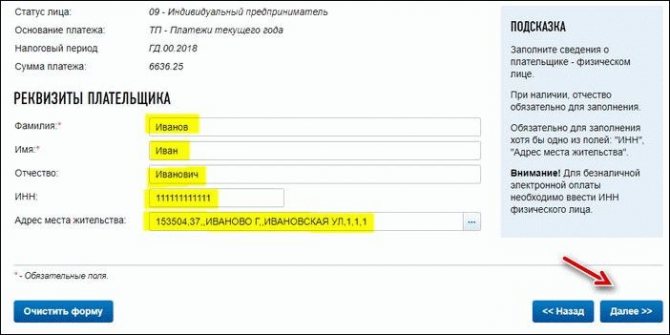

Since we pay as individual entrepreneurs, we check the boxes as follows:

Click the “Next” button

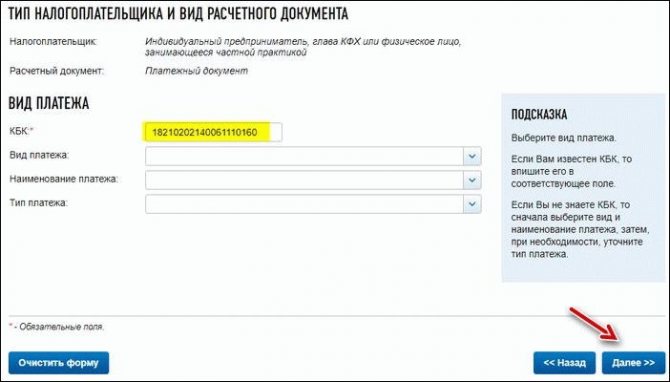

And we immediately indicate the required KBK

- If we pay a mandatory contribution to pension insurance “for ourselves,” then we enter the BCC for 2020: 18210202140061110160

- If we pay a mandatory contribution to health insurance “for ourselves,” then we enter another BCC for 2020: 18210202103081013160

Important: enter KBK WITHOUT SPACES!

That is, when you issue these two receipts for pension and health insurance, you will do this procedure twice, but at this step you will indicate different BCCs and different payment amounts, which are indicated above and highlighted in yellow.

Let me remind you once again about the payment amounts for the full year 2020:

- Contributions to the Pension Fund “for oneself” (for pension insurance): 26,545 rubles

- Contributions to the FFOMS “for yourself” (for health insurance): 5840 rubles

If you do it quarterly, the amounts will be as follows:

- Contributions to the Pension Fund: 26545: 4 = 6636.25 rubles

- Contributions to the FFOMS: 5840: 4 = 1460 rubles

It is clear that if the individual entrepreneur has worked for less than a full year, then you will have to recalculate the contributions yourself, taking into account the date of opening (or closure of the individual entrepreneur). Instead of paying fees for a full year.

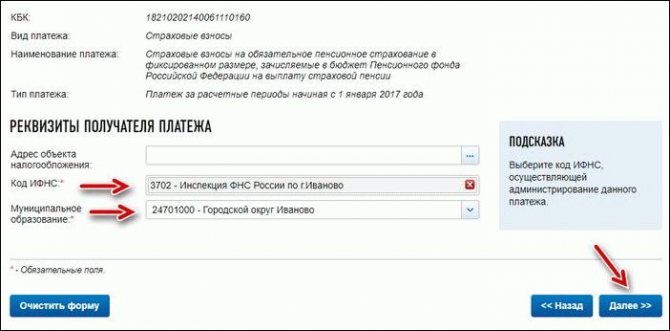

And again click on the “Next” button. In the “IFTS Code” field, enter the tax office code. Let our individual entrepreneur live in the mountains. Ivanovo, and its tax office code is 3702 (see screenshot below).

Of course, you will enter your tax office code.

If you don’t know the code of your tax office, then pay attention to the hint on the right (see the picture above).

Click the “Next” button

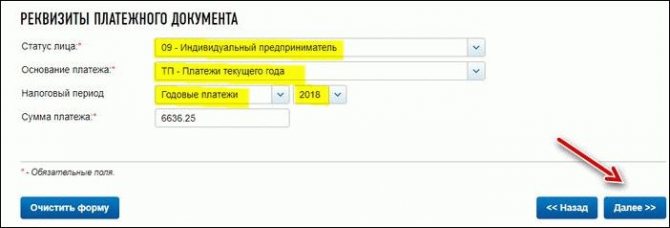

We select the status of the person who issued the payment as “09” - taxpayer (payer of fees) - individual entrepreneur.

- TP – current year payments

- And indicate the tax period: GY-annual payments 2018

- Enter the payment amount (of course, you may have a different amount)

Next, enter your information. Namely:

Please note that you need to pay fees on your own behalf. Click the “Next” button and check everything again...

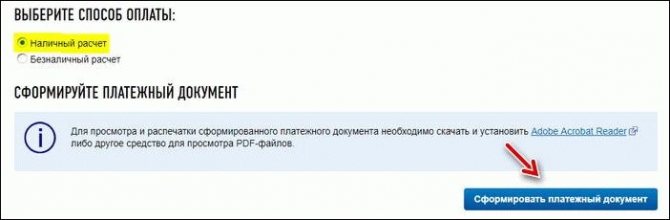

After making sure that the data is entered correctly, click on the “Pay” button. If you want to pay in cash, using a receipt, then select “Cash payment” and click on the “Generate payment document” button

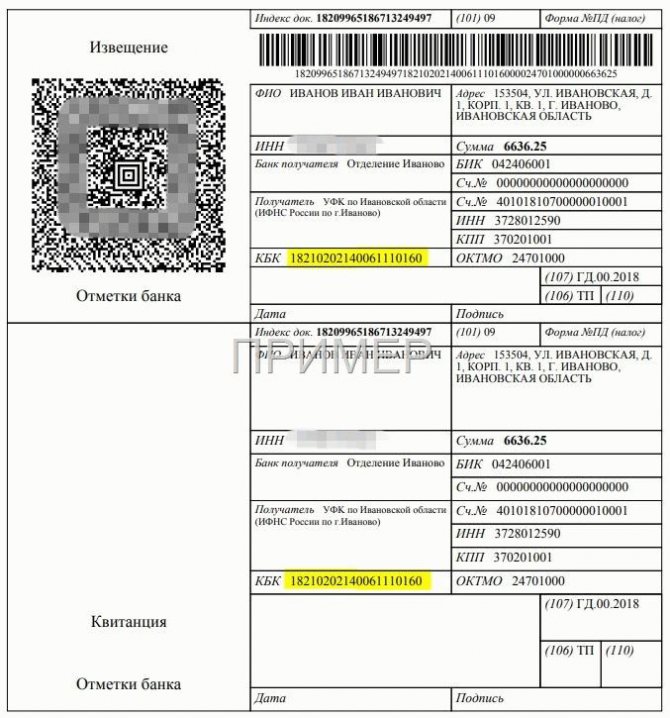

That's it, the receipt is ready

- Since we entered KBK 18210202140061110160, we received a receipt for payment of mandatory contributions to the pension insurance of individual entrepreneurs.

- In order to issue a receipt for payment of the mandatory contribution for health insurance, we repeat all the steps, but at the stage of entering the BCC, we indicate a different BCC: 18210202103081013160

Example of a receipt for a quarterly payment for compulsory pension insurance:

Contributions to the Pension Fund by the founder for himself

A businessman operating as an individual entrepreneur and having no staff must make deductions only for himself.

Within the framework of legal requirements, individual entrepreneurs must make the following payments “for themselves”:

- For compulsory pension insurance (about 26 thousand rubles);

- Additional fee equal to 1% (calculated on income that exceeded the limit of 300 thousand rubles);

- For compulsory health insurance.

Individual entrepreneurs without employees have the right to make payments:

- One payment for the whole year;

- For each quarter (dividing the payment into 4 parts).

Calculation of pension contributions for individual entrepreneurs

The calculation of the additional pension contribution, which involves withholding 1%, directly depends on income, which can be determined after determining the taxation system used.

The volume of collection is determined by one of the following algorithms:

- General taxation system:

- The income allowed by Article 210 of the Tax Code of the Russian Federation is accepted for calculation;

- It is possible to reduce the tax base by the amount of professional deductions;

- The formula looks like this: (income - 300 thousand rubles) * 1%

- "Simplified":

- In practice, the algorithm for determining income is implemented according to Article 346.15;

- Disputes may arise regarding the issue of calculation, since the generally accepted methodology diverges from judicial practice;

- The formula looks like this: (income-expenses-300 thousand rubles)*1%

- UTII:

- Imputed income is taken into account for calculation;

- Additionally, coefficients K1 and K2 are used;

- Unified agricultural tax:

- When calculating, it is necessary to focus on the income from which the single tax levy provided for this system is actually withheld;

- Expenses are not taken into account when determining the size of the pension contribution;

- Patent system:

- The income for the coming year, calculated for the future, is taken into account (it can be determined according to Articles 346.47, 346.51 of the Tax Code of the Russian Federation);

- A proportional reduction in the probable annual income is acceptable in case the entrepreneur declares liquidation without having completed the entire term of the patent;

- Combined modes:

- It is necessary to determine the income for each of the modes used;

- The resulting amount will become the basis for withholding 1% of the contribution.

Since special court decisions have been made regarding the simplified and general tax system, individual entrepreneurs using them have the right to claim a refund of overpaid amounts.

How to use the calculator

Indicate the year for which we are calculating contributions.

If you registered as an individual entrepreneur or deregistered during the year, indicate the date of commencement of activity (this is the next day after registration in the Unified State Register of Entrepreneurs) and its end (this is the day before the date of registration of termination of activity). In the “Income” field, enter the amount of annual income. If you work on a simplified basis, this is income without expenses. On the imputation or patent - indicate the imputed annual income or the amount of income under the patent. On OSNO, indicate the amount of income reduced by the tax deduction. If you work in several modes, summarize the income for each of them.

Once you have entered your details, you will see the due amount at the bottom of the calculator.

The amount of contributions consists of a fixed part - these are contributions for pension and health insurance - and 1% of income over 300 thousand rubles per year (they are paid for pension insurance). In 2020, the amount of contributions should not exceed 212,360 rubles. There is no need to transfer more than this amount. Here we talk in detail about the independent calculation of contributions to the simplified tax system in 2020.

| Year | Amount, rub. |

| 2018 | 32,385.00 (1% of income from amounts over RUB 300,000) |

| 2017 | 27,990.00 (1% of income from amounts over RUB 300,000) |

| 2016 | 23,153.33 (1% of income from amounts over RUB 300,000) |

| 2015 | 22,261.38 (1% of income from amounts over RUB 300,000) |

| 2014 | 20,727.53 (1% of income from amounts over RUB 300,000) |

| 2013 | 35 664,66 |

| 2012 | 17 208,25 |

| 2011 | 16 159,56 |

| 2010 | 12 002,76 |

| 2009 | 7 274,4 |

| 2008 | 3 864 |

In order to make the calculation, you need to enter the amount of wages for the month, as well as the amount received cumulatively for the employee since the beginning of the year. It is necessary for calculating taxes on funds, and it is also a condition for applying deductions for an employee.

For 2020, the maximum value of the total salary for applying deductions is 280 thousand rubles. Also, reduced interest rates have been established for the Pension Fund of the Russian Federation, when exceeding 711 thousand rubles, and in the Social Insurance Fund - 670 thousand rubles. In 2020, these figures have increased and will amount to: for the Pension Fund of Russia 796 thousand. rub., and for the Social Insurance Fund - 718 thousand rubles, the amount of the maximum salary for applying deductions in 2020 is 350 thousand rubles.

Next, you need to enter information about standard deductions. If any of them does not depend on the maximum salary of 350 thousand rubles, then put it in “deductions without restrictions.”

In order to calculate the total taxes paid by the employer and employee, you have two options:

- You can enter the amount of wages before taxes are calculated on it, all amounts will be calculated automatically, including the amount of wages that will be due to the employee after taxes are paid.

- You can enter the amount of salary that the employee receives “in hand”, after which the calculator will calculate all taxes in reverse order and show the amount of salary that needs to be calculated based on the amount received “in hand”. At the same time, do not forget to take into account deductions if they are provided to him. The calculation will also be adjusted to these amounts automatically.

Initial data

Useful information on payroll

Compensation for unused vacation. Responsibility of the employer in case of salary delays.

Instructions for using the individual entrepreneur insurance premium calculator

- By default, calculations are made for the selected whole year. If you registered an individual entrepreneur this year, or you closed it, then select a more specific start and end date for the period.

- If your income for the selected period was no more than 300,000 rubles, then you can leave the “Income for this period” field empty. The entered amount will not affect the final result.

- Click "CALCULATE". You can save the result with all the calculation details to a doc file.

As soon as an individual entrepreneur has received registration in this capacity, he has obligations to the state for taxes and fees. Regardless of the taxation system he adheres to and the financial success of his business, individual entrepreneurs must annually pay contributions to insurance funds.

To calculate the amount of amounts required to be paid, you can use an online calculator, which will make this process quick and transparent.

Although contributions are fixed, the amount payable changes annually. Until 2020, it depended entirely on the minimum wage set by the state. The object and basis for calculations do not matter.

To calculate the amount of fixed contributions using the calculator, you need to know the following basic initial indicators:

- the minimum wage value established for the reporting year at the legislative level (necessary for calculation only until 2018);

- tariffs for contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund (constant values, required for calculation only until 2020);

- fixed amounts in the Pension Fund and the Federal Compulsory Medical Insurance Fund (for 2018-2020);

- the number of billing months for which it is planned to transfer the contribution (12 in the case of annual payment);

- income for the selected period (in rubles).

The first three indicators do not need to be entered; they are fixed in the calculator. You need to enter the start date of the reporting period and its end, the calculator will take into account the estimated time independently.

Svzn = Rfix / 12 x Nmonth, where:

- Svzn – amount of insurance premium payable;

- Rfix – a fixed amount of a specific insurance contribution (to the Pension Fund of the Russian Federation or to the Federal Compulsory Compulsory Medical Insurance Fund);

- Nmonth – the number of months for which the contribution is paid (after all, the business may not have been started from the beginning of the year or only part of the payment needs to be calculated).

READ MORE: Insurance disputes regarding compulsory motor liability insurance in Moscow and the regions

Свзн = minimum wage x Рtar x Nmonth, where:

- Svzn – amount of insurance premium payable;

- OSAGO VSK

- Minimum wage – the minimum wage value adopted by the state for the reporting year;

- Rtar – the rate of a specific insurance premium (in the Pension Fund of the Russian Federation - 26% or in the Federal Compulsory Medical Insurance Fund - 5.1%);

- Nmonth – the number of months for which the contribution is paid.

If you need to calculate an additional contribution amount for an individual entrepreneur with more than 300 thousand annual income, then the Pension Fund should receive an additional 1% on the amount exceeding the limit.

In what cases is an individual entrepreneur exempt from pension contributions?

As a general rule, even without employees, an individual entrepreneur will report quarterly to the Pension Fund and make the appropriate payments for himself, as the only employee of the organization, however, there are exceptional cases that allow a tax entity to refrain from these fees, including the following circumstances:

- The entrepreneur was called up to serve in the armed forces of the Russian Federation;

- The founder of an individual entrepreneur is on parental leave for up to 1.5 years (but in total no more than 6 years for all pupils);

- The individual entrepreneur provides care for:

- A person with the first disability group;

- A person who has reached 80 years of age;

- A disabled child;

- The entrepreneur, together with his spouse, who is a diplomatic or consular employee, resides permanently abroad in trade or other consulates of the Russian Federation;

- The entrepreneur lives together with his military spouse in areas where the second was sent under the terms of the contract, and the first is not able to work;

- Suspension of the activities of a lawyer's office (during the entire period of such suspension).