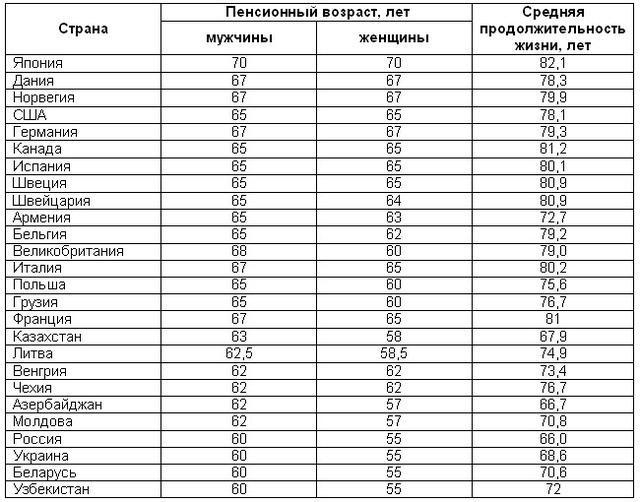

The retirement age is different in different countries of the world. Also, each state has its own rules for retirement. Do not forget that funds paid to a person are calculated according to different principles. Each country has its own rules in this regard. What distinguishes pension systems in the world from Russian accrual of funds in old age? What features should you pay attention to? At what age do they go on a well-deserved rest in a particular area? It is quite difficult to answer, because every year various changes occur in the world regarding pensioners. The table will help you find at least approximate answers about what the average retirement age is in different countries of the world. Where do older people get the best support?

Three systems

At the moment, there are only a few systems in the world that allow you to easily determine the amount of payments due upon retirement. There are 3 such points in total. Each system has its own characteristics and nuances. They will have to be taken into account.

The retirement age in different countries and its size are different everywhere. But in general, funds can be accrued using the following methods:

- according to an individual savings plan;

- distribution system based on taxes (pension);

- distributive based on total tax revenues.

But the age at which one is allowed to retire, as a rule, varies. Much depends on the situation in a particular country, as well as on the average life expectancy of people.

Minimum and maximum retirement age

The maximum retirement age of 67 years is set in countries with a high standard of living, such as Germany, Norway, USA, France and Israel (men).

In many European Union countries, the retirement age is set at 65 years, while the governments of most countries of the Old World are moving towards raising the retirement age. High age thresholds are set primarily by countries with low birth rates.

The minimum retirement age is set in countries located in the post-Soviet space, 50 years for women and 60 years for men. The CIS countries also preserve it. Russia is currently in a transition period; according to the new law, women and men will retire at the ages of 60 and 65, respectively.

In 2020, a decision was made to raise the retirement age in Russia; 2020 was marked by the country’s entry into the reform of a gradual raising of the retirement age.

The countries of the Old World have the highest age threshold for retirement in the world; citizens of economically developed countries retire the latest, as evidenced by the table below:

| A country | Men/women |

| Czech | 61/58 |

| Portugal | 65/65 |

| Greece | 67/67 |

| Spain | 65/65 |

| Finland | 65/65 |

| Luxembourg | 60/60 |

| Austria | 65/60 |

| Denmark | 67/67 |

| Slovenia | 63/61 |

In most European countries, it is not customary to make gender distinctions; men and women have equal rights and responsibilities and go on vacation at the same age.

Men and women

With all this, the retirement age in different countries of the world differs between men and women. As practice shows, there are very few countries where both the “weak” half of the population and the “strong” achieve the opportunity to retire at the same time.

All this is connected with the fact that women are a priori considered weaker and less resilient. And this despite the fact that the fair half of society lives on average longer than men. Plus, many people’s work experience includes the period of caring for newborns.

Men almost always get the right to a well-deserved rest later. They are considered the main money earners, they are stronger and more resilient. But at the same time, as statistics show, it is often the male half of society that has a shorter life expectancy.

Retirement age in France

The retirement age in France is 62.5 years for both men and women, with an average life expectancy of 82 years. After the retirement age was raised from 65 to 62.5, a wave of rallies took place across the country, but this did not change the government’s decision.

But for representatives of some professions, for example, miners, it is possible to go on vacation earlier. Railway employees can exercise the same right; people who have become disabled due to injury at work; former concentration camp prisoners; those who began working before adulthood. This also includes some employees in the arts sector.

Modern tendencies

Each state tries to leave the pension system in a stable state. But in modern conditions, doing this is very problematic. In 2015-2016, the retirement age in different countries of the world began to rise. Or states began to actively discuss these changes. The global crisis is making itself felt - if we exclude pensioners, there is practically no one to work. The available funds in the treasury of each country are not enough for all expenses. Therefore, in order to replenish it, it is necessary to force the population to work longer.

This means that retirement in different countries of the world (the table will be presented) is not a constant value. It is recommended to constantly learn about these features. Perhaps pension reforms have taken place in one state or another!

Also, in some countries they are talking not only about increasing the retirement age, but also about equalizing this indicator among men and women. In any case, there will be no drastic changes anywhere now - such a step will lead to a general revolt. The population is not ready to abruptly postpone their legal vacation. Therefore, almost all countries began to slowly but surely raise the retirement age. So as to cause minimal damage to the population.

Middle East, Asia

In Israel, in 2004, the retirement age was increased for men from 65 to 67 years, for women - from 60 to 62 years. By 2020, it was planned to raise the retirement age for women to 64 years (by 2030 - to 67 years), but the authorities are still delaying making this decision.

In China, the pension system covers only a small part of the population, these are government employees and people employed in industry. Men retire at 60 years old, women at 50-55 years old (those engaged in manual labor at 50 years old, those working in the administrative sphere at 55 years old). To receive a pension you must have 15 years of work experience. In 2012, it was proposed to begin gradually increasing the retirement age in order to bring it to a common level of 65 years by 2045, but the reform was postponed.

In India, only government employees are included in the social benefits program. The retirement age is 60-65 years (each state has its own pension legislation). The size of the benefit and the retirement age of the rest depend on the employer.

In Japan, until 2000, pensions began at age 60. Since 2001, this age threshold has gradually increased and in 2013 reached 65 years (for men and women). For those who continue to work after 65 years of age, the pension increases annually.

Features of pension systems

At the same time, we should not forget about the formation of pension savings. It has already been said that countries use different principles for calculating money “for old age”. The most popular technique is to combine several types. What features and principles of pension formation are hidden in each of the 3 existing pension systems?

Individual savings is when a citizen works and transfers part of his earnings to the Pension Fund. Or the employer does it for the subordinate. Next, a pension in old age will be formed from these savings.

Distribution based on pension taxes - current employees do not save their money. They transfer part of their earnings to pay pensions to current retirees. Accordingly, such employees will receive their “old age savings” at the expense of working citizens after retirement.

Distribution based on general taxes - funds are paid from funds that went to the tax fund.

Popular pension systems in the world and their features

Pension systems in different countries differ from each other and are built on different principles, since significant differences in the ratio of the number of workers to the number of pensioners, tax policy, the state of the economy, the labor market, and life expectancy do not allow pension policy to be brought to a common denominator.

States adjust the time for citizens to retire in accordance with changes occurring in the domestic labor market and in social policy.

The pension system of each state is based on at least one of three social protection institutions:

- state social security;

- compulsory social insurance;

- personal pension insurance.

As a rule, the pension system of a single state is built on a mixture of two, or even all three, of these institutions, one of which necessarily dominates.

The English pension model includes receiving a basic pension in combination with labor social insurance payment.

The German system is based on the principle of solidarity, workers pay contributions to a pension fund, which pays benefits to pensioners, in turn, those currently working will receive their pension from the same fund, from the contributions of those who will work after them.

In addition, German enterprises pay industrial pensions to workers, and workers make independent contributions to non-state pension funds and receive personal pension income.

In Japan, the pension payment consists of a basic pension, to which all residents are entitled, and professional accruals, which employees receive in addition to the basic one.

Promises of countries

The retirement age is set differently in different countries. Somewhere it is more, somewhere it is less. What promises do some states make in this regard? Among the main statements are:

- Ukraine, which promises to raise the retirement age for women to 60 years. These changes should happen by 2021.

- Kazakhstan wants to equalize the retirement age for men and women in 2020. Now they plan to do it at 63 years old.

- In Britain and Poland, a well-deserved rest will be allowed only from the age of 67.

- In the United States, it is planned to sharply increase the retirement age - from 65 to 69 years.

- France is going to increase the possibility of retirement to 62 years.

These are the main changes that want to be implemented in the world. In fact, as experts say, there is still no ideal pension system and optimal retirement age.

Retirement age in France

Until 2020, the retirement age in France was 60 years old. In 2020, the age limit was increased by two years, and is now 62 years for the French, without division by gender. The increase in the age limit will not stop there. It is planned that by 2023 the age limit will reach 67 years.

For persons whose work history began before the age of 18, persons who became disabled due to an accident at work, the retirement age in France will remain the same - 60 years.

The longest work

What kind of retirement is possible in different countries of the world? Who works the most? Or rather, longer than everyone else? The thing is that if you do not take into account the countries’ plans to raise the retirement age, then at the moment the residents of Albania are waiting for a well-deserved rest later than everyone else.

Here, men retire at 69.5 years old, and women at 64.5. Citizens in Denmark are also required to work longer than everyone else. Here, for everyone, there is a restriction on taking a well-deserved rest. Both men and women living in Denmark go on holiday at age 67.

Germany should be included in this list. The retirement age in different countries of the world is usually different for the male and female half of society. But the Germans have the same rules as Denmark - everyone is equal when it comes to retirement. In addition, it is allowed to do this only after 67.

The stumbling block is retirement age

In 2020, the European Commission officially stated that Europe is on the verge of an unprecedented demographic challenge that requires immediate pension reforms. If now for every pensioner in the European Union there are four people of working age, then by 2060 the proportion will change to one to two.

The German Institute for Economic Research in Berlin (DIW) is already actively advocating for raising the retirement age in the country to 70 years. From 2030 in Denmark, the retirement age will increase by one year every five years, depending on average life expectancy, and by 2035 it could reach 69 years. In Norway, where men already retire at 67 and women at 64, it is planned to equalize the rights of everyone by 2030 and make a single retirement age of 67 years.

Ten years ago in France, the retirement age was raised from 60 to 62 years and the length of service was set at no less than 42 years. At the same time, the age at which length of service does not affect the size of the pension increased from 65 to 67 years. In 2020, President Emmanuel Macron tried to introduce a single pension regime to replace the existing 42, eliminating benefits for several professions from 2025. This sparked protests and strikes throughout the country. At the same time, we must admit: the official retirement age in France is one of the lowest among rich countries.

Happily ever after: how to live to be a hundred years old

The material was published in the Vesti newspaper dated March 12, No. 043. You can purchase the full issue of the Vesti newspaper at press distribution outlets or subscribe online.

Below everyone

Who works the least in the world? It has already been said that the pension system is constantly undergoing changes in each state. But at the same time, in some places the age for retirement is the lowest.

Among such countries at the moment is Belarus. In it, men receive a pension from the age of 60, and women from the age of 55. Russia and Ukraine are also located here. In Turkey, men retire in the same way as in the previously listed countries, but women must work until the age of 56. In France, everyone receives a pension at 60.

These countries are unsurpassed leaders in retirement. But this does not mean at all that the standard of living of pensioners for those who may not have worked before is better or worse. It all depends on the rules that apply to the formation of pension savings.

Pension reform: The President declared war on those who oppose

In his New Year's speech Putin said Russia's future depended on the "efforts and contributions of each of us" as he attempted to unite a fractured society. It’s wonderful, of course, but against the backdrop of growing social injustice and pension reform, this message from the president sounded boring and formal, essentially for show.

Billionaires from the Russian Federation (both “Yeltsin’s” and “Putin’s”), who pump out billions for the vanity fair, did not care about our country. There is no doubt that the majority of Russian members of the Forbes list did not even listen to GDP, enjoying the beautiful views from the windows of their palaces and yachts.

And the common people have no idea what efforts the respected Vladimir Vladimirovich was talking about when you live, at best, from paycheck to paycheck. Of course, the president didn’t even remember about the pension reform, which affected everyone, about raising the retirement age. But he could have said: “Dear elderly Russians! If you're turning 55/60 next year, rejoice that you'll be receiving your pension just a year later. Not like the losers who hit 50/55. They have to work for 10 years until retirement, although there is no normal work.”

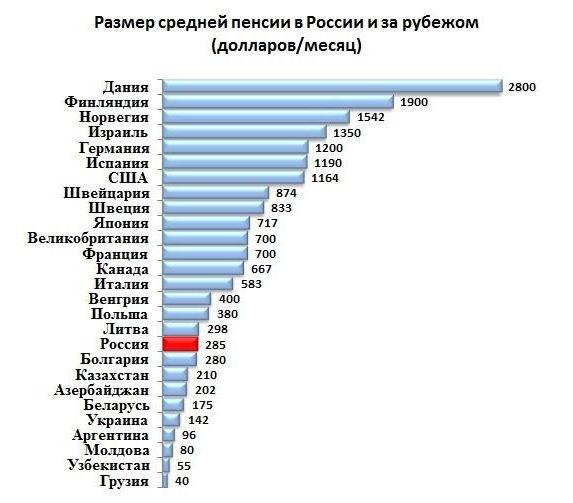

Leaders in pensions

The retirement age in different countries is now clear (the table will be given below). But does this somehow affect the funds received? Not really. Basically everything depends on the welfare of the country. The level of pensions is different everywhere. Many generally try to save money for old age so as not to depend on the state.

Currently, citizens in France receive fairly high pension payments. If we convert the pension into rubles, then in this state a person is entitled to 42-43 thousand rubles. Next, you can include Germany in the list of the “richest” pensioners - 32-33 thousand. In Japan, pensioners receive an average of 27,500 in rubles, in the USA a little less - 24-25 thousand.

Retirement age

By introducing new pension rules in the country, the French authorities intended to further push back the limit on retirement in old age - to 67 years by 2023. However, there was a strong protest from the population, and already in 2020 it was announced that the current retirement age would be “frozen” at 62 years old, but not lowered to the original level.

At the same time, for some categories the age of termination of work remained unchanged. The following may apply for support from the state at the age of 60 and a little earlier:

- those who worked in difficult conditions: shift work at night, extreme temperatures, pressure, vibration and noise at work;

- disabled people;

- employees with a long career who began working at 16 years of age or earlier.

For a working Frenchman, it is important not only when to retire in France, but also the minimum required length of service during which a person was considered insured. It is these periods that give the right to full old-age benefits if a person has reached 62 years of age.

Pension legislation provides that the following length of service is considered full:

- minimum 162 quarters - for those born before 1951;

- 172 quarters or more - for those born after 1973 (depending on the year of birth).

Missing quarters can be “purchased” by paying additional fees for these periods. But you can add no more than 12 blocks.

When the length of service is still not enough to assign a full old-age pension in France, a kind of fine of 1.25% is applied to the calculated indicator for each missing quarter. The size of the reduction in payments cannot exceed 25%.

In practice, this is expressed in a reduction in the coefficient from 50% of the average salary to 37.5%: for people born after 1952, it is equal to 0.625%.

Lowest pensions

Retirement age in different countries (the table is presented), as can already be seen, does not have a significant impact on payments. Which countries are least supportive of people retiring?

At the moment, the lowest pensions are in China. Here a person is entitled to about 9,500 rubles per month. In Latvia - 9,300. Also among the countries that transfer the least amount of money to their citizens in the form of pensions is Russia. According to some data, the average person receives 8-9 thousand rubles per month. Not everyone has such low payments, but the average statistical indicators still remain at the lowest level.

Retirement age in the world

The average retirement age worldwide is 65 years . However, each country has developed individual retirement age indicators.

When setting the retirement age, authorities always take into account the quality and average life expectancy.

As for Russian parameters , women apply for an old-age pension at 55 years old, and men at 60 years old. At the same time, there is a category of beneficiaries who have the right to apply for a pension 10 years earlier, for example, residents of the Far North, employees of a hot shop, underground work, and so on.

Below is a table showing the periods for registering pension payments in different countries of the world:

| Country name | Retirement age for men | Woman's retirement age |

| Japan | 70 | 70 |

| Denmark | 67 | 67 |

| Norway | 67 | 67 |

| Austria | 65 | 65 |

| Belgium | 65 | 62 |

| Great Britain | 65 | 60 |

| Germany | 67 | 67 |

| Greece | 65 | 60 |

| Georgia | 65 | 60 |

| Spain | 65 | 65 |

| Italy | 65 | 60 |

| Canada | 65 | 65 |

| Poland | 65 | 60 |

| USA | 65 | 65 |

| France | 65 | 60 |

| Netherlands | 51 | 51 |

| Kazakhstan | 63 | 58 |

| Lithuania | 62,5 | 58,5 |

| Moldova | 62 | 57 |

| Ukraine | 60 | 55 |

| Belarus | 60 | 55 |

| Uzbekistan | 60 | 55 |

Despite this information, the retirement age in different countries is gradually increasing due to the economic situation.

Thus, the following countries plan to raise the age of pensioners:

- Ukraine – women under 60 years of age.

- Kazakhstan – women 63 years old.

- Great Britain and Poland – 67 years.

- USA - 69 years old.

- Hungary – from 62 to 65 years.

- Bulgaria – 65 years.

- Denmark – 68 years old.

- Spain – 67 years.

- Ireland - from 66 to 68 years.

Features of the Russian pension system

Retirement in different countries of the world, as has already become clear, is constantly changing. Moreover, recently many people want to significantly increase it. The Russian pension system requires special attention. She often tolerates some innovations. Therefore, the population does not know how to behave. The majority do not rely on the state and try to save money for their old age on their own.

The thing is that a point system for calculating pensions has recently been in effect on the territory of the Russian Federation. To receive money in old age, you need to have 7 years of work experience and 30 so-called pension points. Depending on how many of these “points” a citizen has in his account, his pension will be formed.

They also want to raise the retirement age in the Russian Federation, and significantly. It is planned to increase the existing restrictions every 6 months for six months. And to bring the retirement age of women to 60 years, and for men to 63. They want to implement the idea by 2020-2021. Many people speak negatively about these changes. After all, some pensioners, taking into account the average life expectancy in the country, will never see their savings. Or they won’t receive them for too long. That is why Russia has proposed gradually raising the retirement age.

The Russian Federation also has a funded pension system. In 2020, the funded portions of payments will be “frozen” until 2020. This measure is necessary - to get out of the crisis.

Pension systems: where are the best?

There are several types of pension systems in the world, which differ in the principle of accumulation and in the share of participation in the state pension. Depending on the participation of the state, there are three types of pensions: state, private and mixed type. They are also divided according to the principle of accumulation into distribution (solidarity) and accumulation.

The distribution system uses pension taxes, which form future payments through contributions from currently working citizens. And in the savings system, an account is opened for each employee, from which a pension will be paid in the future. According to a World Bank study, more than 85 countries have a pay-as-you-go pension system, which is controlled by the country's authorities. The retirement age may vary depending on life expectancy in a particular country, as well as the general economic situation.

But the quality of pension systems in different countries varies greatly. Since 2009, an annual study has been conducted that produces the Melbourne Mercer Global Pension Index (MMGPI), which compares pension systems and evaluates each on the basis of its adequacy, sustainability and integrity.

In 2020, the study ranked 37 countries, home to more than 63% of the world's population. As a result, the pension systems of the Netherlands and Denmark , which have been occupying leading positions for several years.

The Netherlands (retirement age 65) uses a flat-rate state pension and an occupational pension based on employment contracts, which most workers have. And the pension of a Danish pensioner (retirement age is 66.8 years) consists of two parts, each of which is calculated according to its own rules: the state basic pension, paid to everyone living in the country, depends on the number of years lived in Denmark after the age of 15. Plus there is a labor pension paid by the Pension Fund to all workers, linked to wages and length of service.

There's a place for old people here. How do the world care for pensioners?

Table

Now it’s clear what the retirement age is in different countries. The table below will clearly show the difference between some states.

| A country | Retirement age for women | Retirement for men |

| Austria | 60 | 65 |

| Armenia | 63 | 63 |

| Belgium | 65 | 65 |

| Germany | 67 | 67 |

| Georgia | 60 | 65 |

| Ukraine | 55 | 60 |

| Russia | 55 | 60 |

| Japan | 70 | 70 |

This list can be continued indefinitely. The main thing is that they plan to raise the retirement age. Nobody knows exactly how much it will be in a few years in a given area. The retirement age in different countries of the world is not constant. You need to constantly monitor the changes that have come into force.

Retirement conditions in France for men and women

Pension reform in the country is relatively complete, even based on the age at which local residents retire in France. Both women and men, regardless of their length of service, have the right to retire at age 67 and receive a stable minimum pension for the rest of their lives. But there are also categories of the population that have social support from the state and have the right to retire at an earlier age:

- In 2020 and in the future, regardless of the pension reform taking place in the country and the gradual increase in the retirement age, such categories of the French population as disabled people, participants in military operations and prisoners during the war in concentration camps will retire at age 60.

- The retirement age will also remain at the same level for those citizens who began their official working career before the age of 18 - they become pensioners by the age of 60.

- A decrease in the retirement age is also typical for the population with difficult working conditions. Depending on the nature of work and length of service, the retirement age ranges from 60 to 62 years for women and men.

The retirement age in France is the same for men and women, which is unusual for residents of Russia. In 2020, the retirement age for citizens with at least 42 years of work experience is 62 years. Among other highly developed European countries, France has a very high level of overall work experience. In a number of other countries in Europe, you must work for at least 30 years.

Who works the most?

Determining the most productive and hard-working people is not easy, since it requires taking into account a lot of factors, some of which cannot be assessed and measured. But, knowing what the retirement age is in different countries of the world, and focusing on the table, it will be possible to establish that the strictest requirements are established in the USA.

At the same time, we must not forget the cultural characteristics and traditions of individual peoples. Thus, in Japan, the lives of working people are negatively affected by numerous overtime hours, reaching up to 10 hours a week and forcing people to “live at work.” This situation leads to stress, nervous breakdowns, exhaustion and even suicide, but it is impossible to change the situation, since it is difficult to cope with established traditions.

Retirement age in different countries of the world in 2020

Speaking about the retirement age in the world, it is worth understanding that different countries have, in principle, different attitudes towards pensions themselves.

In most countries of the world, the retirement age for men and women is different. Women usually retire earlier than men, although there are states where the retirement age is the same for both sexes. Such equality exists in the USA, Japan and the most developed countries of Europe.

However, if we take into account that women everywhere live longer than men, they spend more years in retirement, even where the retirement age for them is equal to that of men.

Raising the retirement age in the world is indeed a frequently observed trend. The retirement age is being raised both in developing and relatively poor countries (for example, Belarus) and in the most affluent ones (for example, in Germany).

In all cases, the general reason for raising the retirement age in the countries of the world where it occurs is similar. The state needs to balance the economy and cope with the payment of pensions in principle.

Another thing is that in developed countries there are prerequisites for this in the form of already high and even increasing life expectancy. Let's take Germany as an example. In this country, the retirement age for men and women is gradually being raised to 67 years. This means that even after the reform, men will live on average about 12 years in retirement, women – 16.5 years.

Life expectancy differs quite greatly from one state to another. The retirement age in different countries of the world does not in itself give an idea of how long older citizens of a particular state live in retirement. Therefore, we have prepared two tables that take into account not only retirement age, but also life expectancy in 44 countries.

These tables are based on data on the retirement age in each country in 2020 (where there is a gradual increase in the retirement age, we take into account the current retirement age), as well as life expectancy in the same countries according to WHO. Based on these data, it was calculated how many years the average resident of each country spends in retirement. The tables are given separately for men and women.

Retirement age in different countries of the world: table and pension amount

Having decided on the features of the systems used, it remains to move on to the most pressing issue for modern Russia, related to the age of going on a long-awaited vacation in most foreign countries.

| A country | Age male/female | Average pension (in dollars) | Life expectancy (World Bank statistics) |

| Russia | 60/55 (the increase law has not yet been adopted) | 150 | 71 |

| Kazakhstan | 63/58 | 44 | 72 |

| Belarus | 61/56 (reformed) | 158 | 73 |

| Uzbekistan | 60/55 | 42 | 68 |

| Germany | 65/65 | 1200 | 81 |

| France | 62,5/62,5 | 1200 | 82 |

| Italy | 66,5/66,5 | 680 | 83 |

| Great Britain | 65/60 | 800 | 81 |

| USA | 67/67 | 700 | 79 |

| Israel | 67/62 | 1500 | 82 |

| China | 60/55 | 160 | 76 |

| India | From 60 to 65 (for civil servants) | 5 | 68 |

| Japan | 65/65 | 2000 | 83 |