Northern military pension: accrual conditions

Receiving a northern military pension is only possible if you serve in the Far North. This is one of the privileges awarded to a person who has given a debt to his homeland. Similar benefits are provided to military personnel who were deployed for military service in the Arctic Circle and were exposed to many hardships and hardships.

Principles for calculating military pensions

The closer you get to the Arctic Circle and the more you move beyond it, it is accompanied by worsening weather conditions and a change in climatic zone. Based on these conditions, the northern military pension is a kind of compensation that becomes available after completing a period of service in the extreme points of the North or in another territory close to this description.

In general terms, benefits presuppose the presence of certain parallel factors that determine the advantage of military personnel who served in the North.

They consist in reducing the duration of military service and the possibility of going on vacation earlier. But unfortunately, such a positive point is not available to every military man, since a reduction in service is possible in the presence of three components, which include the following points:

- person's age;

- insurance experience;

- life time.

Each of the above indicators has clearly defined information specified and approved in legislative acts.

For example, the period of military service for all levels of military personnel in the Far North region is 15 years, and in places that are equivalent to it, it is at least 20 years.

The insurance period is also not equal and has completely different standards depending on the gender of the serviceman. Women must have 20 years of experience, and men at least 25 years.

Another criterion for long-term retirement is the person’s age. It also has different indicators and involves overcoming the mark of 50 years for women, and 55 years for men.

Only the presence of all of the above factors and their compliance with the approved standards is a good basis for contacting the relevant authorities for a positive decision in calculating benefits, which is called a military pension in the Far North.

If one of the factors does not meet the requirements, this eliminates the possibility of accruing and receiving pension payments, bonuses and other benefits that are due upon reaching the required period of service.

Receiving a second pension for military pensioners

However, since 2002, a new mechanism for the formation of pensions has been in force, under which the insurance and funded part of pensions is formed. In 2007, the Constitutional Court of the Russian Federation declared unconstitutional a provision of the law that did not allow a pensioner who worked after retirement to receive the funded part of a pension. Therefore, from 01/01/2007 (or from the moment you reach 60 years old, if this happened later), you have the right to claim the funded part of the pension that was formed during your working life after retirement.

I receive a long service pension - a military pension. I have experience that is not included in the military pension - from 04/01/1976 to 10/24/1976 - Ukraine (before conscription into the army) from 12/26/1978 to 10/20/1989 - work in Ust-Nera - Yakutia ( region of the Far North) continuously and from 01/01/2009 to 01/24/2013 in the Bratsk region (an area equivalent to the regions of the Far North. From what time am I entitled to receive a second pension for military personnel if I live in the Bratsk region? Year of birth: 1958 Thank you!

What conditions must be met for receiving a military northern pension?

The first thing you need to remember is that the size of the northern pension for military personnel is strictly an individual value. Its size is calculated from the duration of military service in a certain point in the Far North. For the calculation, the entire period of a person’s stay in difficult northern conditions is taken into account, but the maximum amount of this benefit cannot be more than three pensions approved in accordance with current legislation.

When a military pensioner changes residence or moves to other regions to places more favorable for living, the northern pension is recalculated. In addition, the amount of the pension depends on the actual place of residence and service, and is also recalculated in the event of a change of region. At the same time, the value of the length of service required for a pension remains unchanged.

However, it is necessary to take into account 3 factors, failure to comply with which will lead to the impossibility of calculating the northern pension:

- minimum insurance period;

- required service life in the Far North or equivalent areas;

- required retirement age.

Compliance with these criteria significantly increases the chances of receiving a northern military pension; in addition, it is possible to receive, in addition to the military one, a regular labor pension, which is called the northern military pension.

As already mentioned, in the North, military pensions are awarded after 20 years of service; if this period is extended, then accrual is made annually in an additional amount of 3% starting from 21 years of service.

Cold surcharge

— Many pensioners are worried that when moving from the “northern” regions they will lose the increased pension amount, so they do not transfer their pension files. Are such fears justified?

— Indeed, residents of the northern regions have a number of advantages in pension provision. Firstly, this is an increase in the fixed payment by the regional coefficient for the entire period of residence in the northern region. Secondly, citizens with long northern experience are entitled to an increased fixed payment. If a citizen has worked for at least 15 years in the regions of the Far North, then the fixed payment increases by 50%, and if for at least 20 years in areas equated to the regions of the Far North, then by 30%. It is worth noting that not the entire pension increases, but only the fixed payment.

Moreover, if a citizen has worked for a long time in the North and lives in the northern region, then only one increase, the most advantageous in size, is established, either at the expense of the regional coefficient, or for the accumulated northern experience.

FOR EXAMPLE. The city of Amursk belongs to an area equated to the regions of the Far North; for people who have worked here for 20 calendar years and live in Amursk, where the regional coefficient is set at 1.2, the fixed payment to the insurance pension increases by 30% for the northern work experience. It should be noted that for such citizens the size of the fixed payment will not be revised even if they leave the northern territory. Pensioners living in Okhotsk receive a fixed payment, increased by a regional coefficient of 1.6. For such citizens, when they move to another, non-northern region, the size of their pension is revised.

Necessary documents for calculating pension

Pensions for military personnel in the northern regions require a fixed bonus, which provides for a given coefficient that is taken into account when calculating and calculating pensions.

It depends on the area of residence and the more severe the climatic conditions, the higher the established coefficient, and the milder climate reduces the indicator accordingly.

Proper registration of a northern pension for military personnel involves providing the necessary list of documents that will confirm all the parameters necessary for payment of the pension. They must be prepared and certified, and some of them require a special request to be sent, after which they are issued.

Such documents include:

- passport of a citizen of the Russian Federation;

- a corresponding application, according to the sample for the issuance of a military pension;

- document on family composition;

- work book confirming the required length of service;

- military ID;

- a document certifying that you have completed work experience in the Northern regions;

- availability of a document certifying registration from the place of residence;

- information about disabled wards.

Design features

Payment of pension funds for former military personnel is carried out at the expense of the federal budget. In this regard, unlike civilians, military personnel do not apply for pensions to the Pension Fund.

To begin the process of applying for pension payments, a serviceman needs to collect the following documents:

- passport;

- military ID;

- papers confirming information about residence in the northern regions;

- papers confirming information about service in unfavorable climatic conditions.

In addition, depending on the circumstances, the military will need to provide documents confirming the presence of dependents, certificates of family composition, and so on.

To apply for a survivor's pension, family members of a deceased military officer must provide similar documents, only instead of a citizen's passport, a death certificate is presented.

A complete package of documents is sent to the relevant departments of the Ministry of Defense (as a rule, these are the pension departments of military commissariats at the place of residence).

Military personnel who performed their duties in the difficult climatic conditions of the Russian north can count on additional benefits. The most significant of them are to reduce the period of service for granting a pension, as well as the establishment of regional increasing coefficients for monetary allowance.

How is military pension calculated?

There are several criteria based on which the total amount of security is formed. In addition to salary, the amount of payments is influenced by the length of service, awards, and merits of the military man. A person is accrued two types of pension payments.

These include:

- the main one - for length of service in a military organization, or service, in the Russian Guard, the Ministry of Internal Affairs;

- civil - it is received by all people who have reached retirement age.

Features of the second pension for military pensioners

- Russian Post (at the box office or at home);

- at a bank branch (either at the cash desk or by transfer to a card using the specified details);

- with the help of an organization that delivers pensions, at the cash desk or at home (PFR employees have a list of companies in a particular region, and it is given to the pensioner when choosing this method).

- application for a request to pay a second pension;

- certificate of registration in the OPS;

- death certificate of a citizen;

- evidence that the deceased received a pension for long service;

- documents that confirm a close relationship with the deceased;

- certificate of income for the last 5 years, including benefits and benefits.

Formulas for calculating pensions for the military

Calculations vary depending on whether military or mixed experience is taken into account. Based on this, one of 2 formulas is used. The first option for calculating pension benefits for military personnel

If a person just served and left after reaching the 20-year mark, then the formula for calculating the due payments will be as follows:

P = (A*50% + A*3%*B)*C , where

- P – military pension;

- A – monetary support for a serviceman (this indicator depends on medals, rank, awards, participation in hostilities, position);

- B – the number of years that are counted after the 20 minimum;

- C – reduction factor.

As can be seen from the formula, the longer an officer serves, the higher the pension will be.

Let's look at an example. Ivanov A.S. served for 25 years. The salary was 37,000. The pension is calculated as follows:

P=(37000*50% + 37000*3%*5)*4%= (18500+5550)*0.04=24040-961.6=23078.4.

- 50% - this is the figure by which the military’s salary increases;

- 3% is accrued upon reaching a minimum length of service of 20 years;

- 5 – number of years worked after reaching 20;

- 4% - reduced coefficient.

The second method of calculating payments to the military

The second formula is applied for mixed length of service. It looks like this:

P = (A*50% + A*1%*B)*C , where:

- P – pension payment;

- A – salary;

- B – number of years counted after 20 minimum;

- C – coefficient value.

The percentage of the salary has been reduced - instead of three percent it is equal to one. Example: Major A.S. Terentyev has a total work experience of 27 years, while he has served for 14 years, the salary was 29,000. The officer has the right to count on the following pension: P = (29,000 * 50% + 29,000 * 1%) * 4% = 14,500 +290=14790*4%=14790-591.6=14,198.4

- 50% is calculated from the salary;

- 1% - accrued for mixed years of service;

- 4% is the coefficient by which the collateral is reduced.

In this example, his salary increases by 50% and 1%, since the type of payment is mixed. Then the total value is reduced by 4% (coefficient).

LABOR CONSULTANT

The pension, or rather its size, should directly depend on how hard a person worked before reaching retirement age. Due to the special climatic conditions, residents of the North are given additional allowances, as well as certain privileges, including a reduction in the retirement age, because life expectancy in the North is also several years shorter than in other regions of our country.

Ten years of work in Karelia must be equal to 90 months of work in Chukotka. Adding up the indicators, we get a total length of service equal to 108 months. This number of years is not enough to receive maximum payments, however, even this length of service gives the employee the right to retire a little earlier - at the age of 57. If the employee continues his work for another 6 years, he will receive a full right to claim northern additional payments.

07 Feb 2020 juristsib 415

Share this post

- Related Posts

- Young Family Program 2020 Conditions of the Saratov Region

- Income tax benefits in 2020 for disabled children

- Application for Russian citizenship of the new sample 2020 form

- Disabled since childhood, group 2, pension amount indefinitely 2020

Payments to military disabled people

The category of disability directly affects the total amount of benefits.

To calculate how much the pension is for military pensioners, you need to take into account the group :

- 85%, if the military man is disabled 1st and 2nd degree, and received the group after an injury;

- 50% for group 3;

- 75% when a military man becomes disabled due to illness.

In 2020, the reduction factor was 72.23%. This year, from October 1, it will increase by 2% and will be equal to 73.68% .

Minimum amount of military pension

According to Federal Law No. 4468-1 of 1993 “On pension provision for persons who served in military service,” the minimum pension of a military personnel is established as a percentage of the basic provision for positions.

In 2020, the lowest allowance for military pensioners will be:

- 100% of the basic social pension equal to RUB 5,334.19;

- 150-300% if the pension is issued for disability;

- 150-200% when accruing to a family upon loss of a breadwinner.

It will not be possible to calculate more accurate figures and say what the sergeant major’s military pension will be, since the standards do not provide for a specific amount of the basic accrual.

How much do pensioners earn in the country?

Deputy Defense Minister Tatyana Shevtsova said how much a military pensioner earns in Russia.

The average pension for officers is:

- the lieutenant colonel's allowance in 2020 was 88,700 rubles. in 2020 90,000 rubles;

- the lieutenant and platoon commander received - 66,100;

- Afghan minimum is 9500 in 2020.

To find out how much a retired colonel’s pension is, you can use an online service that will calculate the amount.

Changes in 2020

Inflation is growing every year, along with the depreciation of the ruble, prices are rising. This is especially evident in essential products. The state helps pensioners who find it difficult to provide for themselves.

Events held in 2020:

- all allowances increased by about 1000 rubles;

- indexation on January 1, 2020 was 6.6%;

- supplement for all pensioners, except those who are still working;

- the increase in support is carried out in two stages - first, payments and salaries for military personnel will be increased by 4.3%;

- at the second stage, the overall result will be increased by another 2%.

As a result, the total additional payment to officers in 2020 will be at least 6.3% .

Compared to 2020, this year’s bonus will be given to pensioners no earlier than October 1. Government authorities explain this by a lack of money. The bonus will be guaranteed - the law on the state budget for 2019-2021 has already been formed. The federal budget was adopted by the State Duma and signed by the President.

Calculate military pension online

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Quidem laboriosam, soluta adipisci incidunt consequatur quos ea aut facere at possimus beatae dolorem doloribus minus? Accusantium dolorum quo sunt cupiditate beatae.

Monetary allowance

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Libero, eaque praesentium ratione dignissimos aspernatur maiores accusamus aliquid accusantium voluptatum quo culpa doloribus dolorem, magni eveniet sit. Ullam esse fuga aliquam!

For those who have work experience, the period of work officially confirmed in civilian positions must be at least 9 years. If a serviceman reaches the required insurance pension age, in order to receive a military pension benefit, he must serve in the force for at least 12.5 years.

For 2020, the length of service for assigning a pension to the listed categories in the event of their dismissal is 20. Law enforcement officers who continue to serve beyond the minimum length of service receive monetary compensation equal to 25% of their pension pay.

How does retirement work?

A paradoxical situation may arise in which former military personnel of the countries participating in this Agreement, having military service of 20 to 25 years, when moving to permanent residence in the Russian Federation, will have the right to a pension for long service, and citizens of the Russian Federation with the same length of service - No.

First of all, military personnel who retire in 2020 will receive two good news: the growth of the reduction coefficient is frozen, and this year, as in the previous year, it is 72.23%. From January 1, 2020, there was an increase in salaries, from which the pension amount will be calculated. The tariff size of payments for positions held by privates and sergeants increased by 400-720 rubles, and for the official salary of officers - by 800-1800 rubles.

In 2020, the formula for calculating a military pension remained the same: ((OD + OZ + NVL) x 50% + (OD + OZ + NVL) x 3%)) x PC = RVP, where OD is the official salary, OZ is the salary in accordance with military rank, NVL - bonus for length of service (every year, over 20 years), PC - reduction factor. However, from January 1, 2020, salaries were changed both by military rank and position. Consequently, compared to 2020, the pension amount will be larger and the calculation of the military personnel’s pension in 2020 must be done again. The long service pension for military personnel is calculated using our calculating machine above.

Additional payments to military personnel

In addition to the required payments for length of service, officers can expect to receive other amounts, so the size of the military pension will be increased. Pensioners are entitled to additional payments in the form of a fixed amount (4,900 rubles) subject to service in certain organizations.

The allowance is provided if the citizen was employed in:

- Sun;

- Russian Guard;

- Drug Enforcement Administration;

- ATS;

- Fire Department;

- criminal-executive department.

Conditions for calculating the northern pension for military personnel

The northern pension is issued to military personnel subject to their service in the Far North. It is one of the varieties of those privileges that arise before a person who has given his duty to the Motherland. Military service is associated with many hardships and hardships. Joining the armed forces is the borderline between your past life and a completely new stage in it. The vastness of our country implies the possibility of sending a soldier to any corner of it, from the southern borders to the harsh trials of the Far North. It is the deployment of military personnel beyond the Arctic Circle and their corresponding service in such conditions that provide them with the opportunity to receive certain benefits.

Northern pension for military personnel and principles for calculating it

It's no secret that approaching the Arctic Circle and moving beyond it is characterized by a change in climatic zone and a significant deterioration in weather conditions. Based on these factors, the northern military pension is a set of certain privileges that become available after the expiration of the established term of service in the Far North or in areas equivalent to them.

In general, such benefits imply the presence of two parallel vectors that provide certain advantages for people who served in the North. The first of them is a reduction in service life and the possibility of an early retirement. However, such a privilege is not available to everyone, since its provision is based on three basic principles that must be taken into account. They look like this:

- life time;

- insurance experience;

- person's age.

Each of these parameters has its own very clear indicators specified in legislative acts. Thus, the service life in the Far North for all categories of military personnel is 15 years or more, in places equated to the CS, this term has an indicator of 20 years. At the same time, the insurance period has completely different standards, depending on the gender of the person serving. Men must have it for at least 25 years, and women - 20 years. The last criterion is the age of the serviceman. It also has certain characteristics based on gender differences, and implies that men reach the age of 55 years, and women - 50 years.

Only full compliance with all the necessary conditions is helpful for applying for and receiving benefits, which is called a military pension in the Far North. Failure to meet at least one of the above requirements makes it impossible to accrue and receive a pension, as well as bonuses due when overcoming the service limits.

Pension in the northern regions

All the conditions and examples listed below also apply to the fixed basic amount of the labor pension valid before January 1, 2020 and after January 1, 2020.

Permanent residence in the Far North and equivalent areas. Work for at least 25 and 20 years, respectively, as reindeer herders, fishermen, and commercial hunters

We recommend reading: maternity capital to buy out a share

The law provides for the possibility of assigning a pension with a reduction in the retirement age in proportion to the length of service.

Conditions for granting a northern pension and factors requiring compliance

The northern pension for military personnel, in particular its size, is strictly individual. Its calculation is made based on the calendar periods of service in a particular region of the Far North. In this case, all periods of a person’s stay in the given conditions are taken into account. However, the maximum amount of such a benefit cannot exceed three minimum pension payments determined by current legislation.

A change of place of residence of a military pensioner and his move to regions with a milder climate lead to a recalculation of the northern pension.

This provokes a new calculation procedure and, accordingly, a change in the size of the payments themselves. This principle is also embodied in the opposite situation, that is, when moving to the Far North from warmer regions of the country. In addition, the size of the pension is directly dependent on the actual place of service and residence of the serviceman, and is also subject to recalculation when he changes region. The length of service required for a pension remains absolutely unchanged.

At the same time, there are certain conditions that require full compliance, since failure to meet the specified requirements makes it impossible to accrue and receive a northern pension. These include the following factors:

- Established retirement age.

- Required length of service in the territories of the Far North or in areas equivalent to them.

- Having a minimum insurance period.

Compliance with all the above criteria makes it possible to calculate benefits and receive them. However, military personnel have the opportunity to receive, in addition to a military pension, an ordinary labor pension. In such a situation, the so-called northern allowance for military personnel is formed, which is calculated on top of the labor pension and is a certain amount, the formation of which depends on the conditions of service and the place of service. Military pensions in the North are awarded when a person exceeds the limit of service, which corresponds to 20 years. In such conditions, he is charged an additional amount of 3% of the payment every subsequent year over a 20-year service life.

Good day to all! ARCH IMPORTANT!!!. When appealing the decisions of the Pension Fund to refuse to grant an early old-age insurance pension, in a statement of claim to the court it is necessary to refer to the following legal acts (from the times of the USSR) -

In accordance with Part 8 of Art. 13 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, when calculating the insurance period for the purpose of determining the right to an insurance pension, periods of work and (or) other activities that took place before the entry into force of this Federal Law and were counted when assigning a pension in accordance with the legislation in force during the period of work (activity), may be included in the specified length of service using the rules for calculating the relevant length of service provided for by the specified legislation (including taking into account the preferential procedure for calculating length of service), at the choice of the insured faces.

In accordance with clause 2 of the Instruction on the procedure for providing benefits to persons working in regions of the Far North and in areas equated to regions of the Far North, approved by the Resolution of the State Committee for Labor of the USSR, the Presidium of the All-Union Central Council of Trade Unions dated December 16, 1967 No. 530/P-28, valid until 31 December 1991 (hereinafter referred to as the Instructions), the benefits provided for in Art. 1, 2, 3 and 4 of the Decree of the Presidium of the Supreme Soviet of the USSR of February 10, 1960 “On the streamlining of benefits for persons working in the regions of the Far North and in areas equated to regions of the Far North” (hereinafter referred to as the Decree of February 10, 1960), taking into account the changes and additions made by Decree of the Presidium of the Supreme Soviet of the USSR dated September 26, 1967 No. 1908-VII (hereinafter referred to as the Decree of September 26, 1967 ), are provided regardless of the existence of a written fixed-term employment contract.

According to paragraphs. “a” clause 43 of the Instructions , the total length of service giving the right to receive a pension is calculated for the period of work in the regions of the Far North and in areas equated to regions of the Far North, in relation to old-age and disability pensions in the following order - for the period from On March 1, 1960, one year of work is counted as one year and six months of work for persons indicated incl. in paragraph 2 of these Instructions .

Subparagraph “b” of Article 1 of the Decree of the PVS of September 26, 1967 established: to pay all workers and employees of state, cooperative and public enterprises, institutions and organizations an increase in their monthly earnings (excluding the regional coefficient and remuneration for length of service) in the regions of the Extreme North at the rate of 10 percent after the first six months of work, with an increase of 10 percent for each subsequent six months of work, and upon reaching a sixty percent increase - 10 percent for each subsequent year of work.

Article 2 of the Decree of the PVS of February 10, 1960 established : to provide additional leave in addition to the annual leave established by current legislation in the Far North for a duration of 18 working days.

From the specified norms of legislation in force until December 31, 1991, it follows that

that all workers who worked in the Far North had the right to additional leave, as well as an increase in earnings. Consequently, the plaintiff also had the right to these benefits.

The defendant did not provide evidence that during the specified disputed period the plaintiff did not have the right to receive these benefits; the defendant does not refer to the existence of such circumstances.

Thus, according to paragraph 2 and paragraphs. “a” paragraph 43 of the Instructions, the plaintiff’s work experience, giving the right to receive an old-age pension, for the period before December 31, 1991 should have been calculated as a year for one year and six months.

Taking into account Part 8 of Art. 13 of Federal Law No. 400-FZ of December 28, 2013 “On Insurance Pensions”, the same procedure for calculating the plaintiff’s insurance experience should be applied when determining whether the plaintiff has the right to receive an old-age insurance pension at the present time.

Calculation of the northern pension and list of required documents

The northern pension for military personnel implies a fixed supplement to the main part of the pension of people serving in the Far North. Based on this, there is a certain coefficient that is taken into account when calculating and calculating the pension. It depends on the area of residence, and its values are indicated in the relevant legislative acts. At the same time, the presence of the most severe climatic conditions and further advancement beyond the Arctic Circle contributes to an increase in the given indicators. While a milder climate and service in areas equivalent to the conditions of the Far North significantly reduce its values. Therefore, people who served in the most difficult conditions can count on a significant increase in their pension and its fixed rate.

Second pension for military personnel after 60 years in 2020

Dear Yuri! I am also a military pensioner and I am 60 years old. 35 years of military service. Total experience 45 years. But we, military pensioners, are deprived of the right to early retirement on a civil pension on the basis of Art. 13 clause 4 400-FZ. The Supreme Commander-in-Chief promised all veterans, but apparently forgot about us!

Amount of the second pension for military pensioners

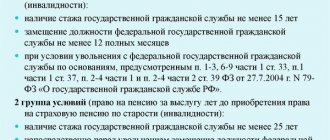

For military pensioners, the conditions for retirement are the same as for all other citizens. Conditions for retirement for citizens who have work experience in areas equivalent to the KS are fixed in clause 6, part 1, article 32 of Law No. 400-FZ.

If all of the above conditions are not met in 2020, then military personnel cannot yet obtain insurance payments through the Pension Fund. It is also worth noting that in 2020 the standards will be even higher: age 56.5 and 61.5 years, 11 years of insurance experience and an IPC of at least 18.6 points.

The procedure for calculating the second civil pension for military pensioners will not change - the amount of payment will still depend on the number of points accumulated during their working career. In 2020, a planned increase in the amount of pension benefits took place - the amount of the increase depended on the status of the pensioner:

Increasing the retirement age for military personnel from January 1, 2020

With the implementation of the pension reform in 2020, the conditions for receiving a second pension for military pensioners - those dismissed from the military or other equivalent service (Ministry of Emergency Situations, Ministry of Internal Affairs, National Guard, Federal Penitentiary Service and others) will change. This change will consist of raising the retirement age to 65 for men and 60 for women, but in 2020 the intermediate provisions of the new law will still be in effect, so these standards will be lower - 55.5 and 60.5 for women and men .

Important! The provisions of Federal Law No. 400 “On Insurance Pensions” stipulate that payments are calculated from the day the application is received by employees of the Pension Fund. That is, if the application is granted, a recalculation will be carried out with the accrual of pensions for all days starting from the date of submission of the application.

Military personnel, despite accumulating a special pension, can also qualify for a second benefit if their civilian work involves performing work duties in the Far North. And the conditions for former military personnel will be the same as for civilian workers who have worked in the region from the very beginning.

We recommend reading: Certificate form for a driver's license 2020

Mandatory documents

All categories of official employees can apply for additional unpaid leave. The main thing is to write a handwritten statement. Thus, the law establishes a category of employees to whom the employer cannot refuse to provide additional vacation days. These include:

We hasten to reassure you - you won’t have to “chase” for the minimum experience. If, for example, a military pensioner turned 60 years old in 2020, and he only accumulated 8 years of civil service (with the requirement of 9 years), then next year (2020) he will not be required to have 10 years of service in order to receive a civil pension. For him, the required length of service will be fixed at 9 years – i.e. at the time of the occurrence of the insured event for him. Thus, in 2020, having worked the missing year, he will be able to safely apply for a second pension to the Pension Fund.

Northern military pension

The northern pension for military personnel has always been higher. There is an explanation for this, since the size of the pension allowance for northern military personnel depends on regional coefficients established in the regions that are located near the Arctic Circle and in the Far North (hereinafter referred to as KS).

Due to the harsh climatic conditions in these areas, coefficients have been established that apply when calculating wages, pensions, and all additional payments.

The coefficient was introduced during the Soviet Union and is valid to this day.

Northern pension when moving to another region in 2020

When calculating the labor pension, they take into account how many years of experience a citizen has. But it is not the grace period that is taken into account, but the calendar period. The maximum amount of accruals cannot be greater than the sum of the three minimum ones. This value may vary depending on the ratio set in a particular area. For 2020-2020, the basic amount of payments for citizens with work experience in the Far North who receive an old-age pension is 5865 rubles (if there is 1 dependent - 7820 rubles). And for persons who have a minimum work experience in territories equated to a given locality, a basic northern pension is assigned in the amount of 5083 rubles, if there is 1 dependent - 6777 rubles. The average labor pension in the Far North, according to data for 2020, is 13,710 rubles.

For citizens living in the Far North, as well as in nearby regions, preferential conditions for retirement are established by law. The same rights are enjoyed by people who have northern experience, but by the time they retire they live in another region. After a person has completed 7.5 years of service, each subsequent year of work will bring his retirement four months closer.

On the calculation of pension payments for northern military personnel

The new law on the formation of the insurance part takes into account the effect of regional coefficients in relation to future pensioners. When calculating pension payments, all accumulated pension points are calculated taking them into account. Find out how to count them in this article.

Recent changes in the law have identified categories of citizens who acquire the right to receive a pension at the CS:

- Citizens who are registered and work at enterprises in the northern regions of the Russian Federation.

- Employees of the authorities for control of the circulation of psychotropic drugs.

- Employees of criminal enforcement agencies.

- Law enforcement officers.

- Fire service employees.

- Military.

Citizens living in these regions have a preferential retirement period with a simultaneous increase in the insurance portion. Reserve military personnel who have northern service experience, but have already left the region, have the right to enjoy the rights of northerners.

One year of normal experience is correlated with 9 months of work in a CS environment.

By law, an employee must have 15 years of service behind him upon retirement:

Second pension for military pensioners

A second pension through the Pension Fund of Russia can be assigned to a military pensioner if the following conditions are simultaneously met: age, length of service, points, long-service pension. Reaching the generally established age - 60 years for men, 55 years for women. Certain categories of military pensioners are assigned an old-age insurance pension before reaching the generally established retirement age, subject to the conditions for early assignment. For example, in the case of working in the North, working in difficult conditions, etc. The presence of a minimum insurance period that is not taken into account when assigning a pension through the law enforcement agencies (in other words, length of service in civilian life). In 2020 it is 8 years and will increase by 1 year annually to 15 years in 2024. Availability of a minimum amount of individual pension coefficients (points) - for 2017 it is set at 11.4 and will increase annually to 30 in 2025. Availability of an established pension for long service or disability through the law enforcement agency. When calculating the insurance and general work experience of military pensioners, it does not include periods of service preceding the assignment of a disability pension, or periods of service, work and other activities taken into account when determining the amount of a long-service pension in accordance with the Law of the Russian Federation of February 12, 1993 No. 4468-I “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families. Insurance for military pensioners The old-age pension is assigned without taking into account the fixed payment. The insurance pension is indexed annually by the state. If a military pensioner, after the assignment of the second pension, continues to work in civilian institutions, then the amount of his old-age insurance pension is subject to recalculation without application on August 1 annually.

We recommend reading: At what age must energy drinks be sold?

In the Khanty-Mansiysk Autonomous Okrug - Ugra, more than 1,720 military pensioners receive old-age insurance pensions. Every month, citizens of this category contact the client service of the Pension Fund with applications for the assignment of an insurance pension to them. Pension Fund specialists provide explanations on the conditions for assigning a civil pension.

Conditions for receiving a northern pension in 2016

To receive a pension in the CC areas, according to the new legislation, the following conditions must be met:

- Actual residence and work at enterprises in the northern regions of the Russian Federation.

- Minimum work experience in a CS environment.

- Retirement age established by law.

- Minimum insurance period. In 2020 it was 9 years.

Military personnel transferred to the reserve, upon completion of service, have the right to receive pension benefits according to the standards provided for by the new legislation, taking into account the northern coefficient.

Military pensioners have the opportunity to earn a second pension in the civil service after discharge. To do this, they need to register with the pension fund, obtain an insurance certificate and begin accumulating pension points by getting a job at a civilian enterprise. Read a detailed article on how to earn a second pension for a military personnel here.

Civil pension for military pensioners

Experience. Availability of the required insurance experience, which is not taken into account when assigning a pension through the law enforcement agency. In 2019 it is 10 years and will increase by 1 year annually until 15 years in 2024.

It is clear that a military pensioner must be registered in the compulsory pension insurance system (have SNILS). Information about civil service, accrued and paid insurance premiums, wages, as well as periods of work in civil organizations are reflected in the individual personal account in the Pension Fund and will determine the right to an insurance pension and possible payment from pension savings. SNILS can be obtained in person at the Pension Fund Client Service or through an employer when applying for a job.

On the peculiarities of calculating northern pensions for military personnel

The calculation of pension payments for all citizens who worked in the North is carried out taking into account the northern coefficient, which has a significant impact on its size. For military personnel retiring due to age, calculations are made using special mechanisms, but the use of regional coefficients is also used when calculating military pensions.

The calculation is carried out based on the legislative framework, which provides for resignation for the following reasons:

- For years of service , the calculation is based on 15 years of service at the CS, 50% of the monthly monetary allowance, as well as 3% for each year of service in excess of the required one.

- Based on length of service, taking into account civilian experience, 50% of the salary and 1% for an additional year of service.

- For disability:

- Wound – 85% of average earnings.

- Illness – 75% of average earnings.

Relatives in connection with the loss of a breadwinner receive 40% in the event of his death during hostilities and 30% in all other cases.