Features of assigning two pensions to civil servants in the Russian Federation in 2020

Civil servants, in accordance with the requirements of federal legislation, have the right to receive two types of pensions simultaneously. These include:

- disability or old age pension;

- state pension.

Registration of such payments is carried out on the basis of the requirements of federal laws No. 400 and No. 166. The following types of state support are allowed to be received at one time:

- state pension for long service and due to health conditions - for disability;

- insurance pension in connection with reaching the age limit for retirement, for 2020 for men it is 60 years old and for women - 55 years old, and a long-service pension.

It is possible for a citizen to apply for both types of pensions, both by simultaneously submitting documents for both types of state support, and gradually one, then the other.

Amounts of pensions for civil servants

The amount of pension payments assigned to civil servants is determined by Article 14 of regulatory act No. 166-FZ (dated December 15, 2001).

According to this law, if all established requirements are met, government employees are granted payments in the amount of 45% of their average monthly salary.

The benefit must be of this size taking into account the basic and insurance (for old age or disability) parts, as well as various increases that were established by the Federal Legislative Act “On Insurance Pensions”.

For each year of work after the minimum length of service has already been achieved, another 3% of the average monthly salary is added to the pension amount.

Calculation of length of service

When calculating civil service length of service, the duration of periods of labor or other actions that give a citizen pension rights is taken into account.

The total length of service in the civil service may include time spent working in state civil posts of federal significance or other positions, the list of which is determined by the President of the Russian Federation.

If the conditions for granting a pension include special requirements for the duration of total work experience, then it will consist of the stages of carrying out work or socially useful actions given in the law “On Insurance Pensions”.

Size calculation

The procedure for calculating the amount of state pension for length of service for civil servants is determined by Article 14 of Law No. 166-FZ.

According to this document, the following formula should be used to determine the amount of such benefits:

P = (SZ*0.45 – SP) + 0.03*SZ*St, where:

- P – amount of long-service pension;

- SZ – average monthly salary;

- SP – insurance share of old age (disability) payments together with the basic part;

- St – years worked in excess of the minimum required length of service.

The total amount of the long-service pension, the insurance part of the security and the fixed pension cannot be more than ¾ of the average salary of an employee specified in Article 21 of Law No. 166-FZ.

For clarity, the following example can be given:

Citizen Konovalova E.V. She was a civil servant and was assigned an insurance pension in the amount of 7,344 rubles. At the same time, she worked in her position for 27 years, and the average payment per month was 15,875 rubles.

Based on these data, the amount of the service pension is calculated as follows:

- St = 27 – 16 = 11 (years);

- SZ = 15875 (rubles);

- SP = 7344 (rubles);

- P = (0.45*15875 – 7344) + 0.03*15875*11 = 5038.5 (ruble).

IMPORTANT: if a pensioner reaches the age of 80, he will receive a special supplement to the amount already accrued.

Increasing the amount of payments

The amount of payments may increase due to indexation or recalculation of payments.

How does indexing work?

The long-service benefit can increase due to indexation, which is carried out:

- when the salaries of employees increase (similar to the index of increase in these salaries);

- when increasing other payments that are included in the maintenance of civil servants (in accordance with their increasing index);

- when the volume of old-age pension payments changes;

- with increasing length of civil service experience.

Old age insurance pensions are indexed on February 1 every year.

At the same time, losses resulting from inflation during the previous year are covered.

Recalculation

Civil servants are given the right to receive several types of benefits at once:

- old age;

- length of service;

- disability;

- loss of a breadwinner.

Moreover, the last two types of payments can be assigned while still performing public service. However, if long-service benefits are issued, their transfer stops.

Civil servants are provided with the simultaneous receipt of only two types of payments: length of service and partial old-age benefits.

Recalculation of a pension is carried out only if a citizen holding a specified position submits an application to switch to a different type of pension.

Who is eligible to receive insurance?

Civil servants who are recipients of a long service pension, upon reaching a specified age (in 2020 it is 56 years and 61 years for women and men, respectively), can apply to receive part of the old-age pension insurance.

This share is assigned taking into account the total number of pension points that have been accumulated for no less than a year from the date of registration of payments for years of service.

When calculating it, both the preferential and the total length of official work experience are taken into account.

The procedure for applying for two pensions in Russia in 2020

In practice, there are several ways to obtain financial support from the state for persons entitled to receive two pensions simultaneously. These include:

| Applying for each type of payment step by step. | This method is acceptable for citizens who have received the right based on length of service until they go on vacation due to reaching age. | It is necessary to apply for a pension for the first time on the basis of length of service if the total length of service in such positions is 23 years. After reaching retirement age, you should submit an application to the Pension Fund for the assignment of age-related security. |

| Simultaneous application for two types of pensions. | Such registration is possible upon reaching retirement age. | If the right to length of service coincides with reaching the retirement age, an application is submitted to receive payments simultaneously on two grounds. |

How will the reform take place and how will the pension be calculated?

Each region of the Russian Federation has the right to independently establish a list of benefits when assigning pensions to civil servants. These include:

- supplement to pension payments to civil servants;

- preservation of state guarantees;

- free medical care;

- providing vouchers to a health facility or monetizing those vouchers that were not used.

For example, the legislative act of Nizhny Novgorod dated June 24, 2003 number 48 defines a pension supplement for complete loss of ability to work. Samara Legislative Act No. 19 of March 13, 2001 established a monthly supplement equal to 45-75 percent of the pension.

Starting this year, the service life for obtaining a preferential exit will be 16.5 years, whereas previously it was 16 years.

The provisions of the new reform will affect categories of civil servants who are due to retire this year, as well as those employees whose retirement age was at the end of 2020. The latter were given the opportunity to remain in their jobs.

The reform came into full effect in 2020. 2020 is designated as a transition period. Thus, a gradual increase in the retirement age is provided for officials. According to the latest news, the retirement age of civil servants in Russia will finally increase to 65 years. It will be possible to continue serving until the age of 70, but no pension will be paid.

In many ways, the reason for such reforms is that, even after retiring, many officials continue to work, simultaneously receiving both a pension and a salary. In connection with this, the retirement age was increased.

On the other hand, the need for reforms is due to the imbalance between the working-age population and the population that, according to age indicators, should complete their working career. This situation could lead to the collapse of the pension system in the country.

Thus, the retirement ages established back in 1932: 55 for women and 60 for men are today undergoing forced changes. Thus, women are given the right to work until they are 60 years old, and men until they are 65 years old. In addition, you can continue working until you are 70 years old, but without accruing a pension. It is likely that the retirement age of civil servants will be changed in 2020.

The news describes the retirement age of civil servants as a step-by-step process.

- It will increase in stages - civil servants will receive an additional 6 months each year. In other words, for example, an employee must turn 60 years old in December, but the reform will add another 6 months to him, which he must work before retirement; next year another six months will be added. At the same time, the length of service will increase.

- Thus, special work experience will be increased from 15 to 20 years.

- In this case, the long-service pension will be calculated at 45% of the official’s salary. Also, the provisions of the new reform provide for an annual increase in the long-service pension by 3%, but in total it cannot exceed 75% of the official’s salary. The amount of his salary for the last year will be taken into account when calculating the amount of pension payments for length of service.

- This calculation does not include maternity leave, sick leave and leave without pay. Pensions of officials working in preferential regions will be increased by regional coefficients.

Among the positive changes, it can be noted that the child care period of one and a half years will be included in the insurance period, but in total no more than 4 years will be included.

Thus, raising the retirement age for civil servants is already a resolved issue at the legislative level, and the law itself has already entered into force.

Results of the reform

The increase in the retirement age affected only civil servants. For them, the retirement age has been increased to 65 years with a subsequent gradual increase.

The changes also affected special experience. So, if previously this period was set to 15 years, the reform increased this period to 20 years.

The changes also affected State Duma deputies. If previously it was enough to fulfill one’s duties for a year in order to receive 5% in addition to the future pension, then after the reform this period increased to 5 years. It should be taken into account that senators are elected for only four years. Also, if previously to receive 75%, it was enough to work for 3 years, but after the reform the period increased to 10 years.

Early retirement was previously provided only for officials working in the regions of the Far North. The ages were 50 and 55 years, respectively. After the introduction of the reform, these age limits will also be pushed back to 55 and 60 years, respectively. Those who have left the civil service will retire in accordance with the general procedure.

Found an error? Select it and press Ctrl Enter.

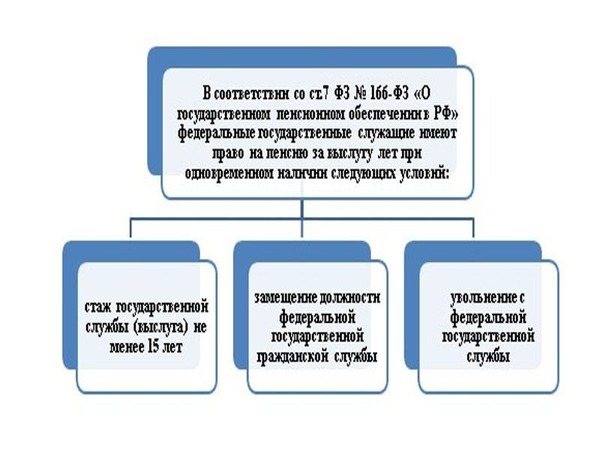

Civil servants have the right to receive 2 pensions at the same time:

- for length of service in accordance with Federal Law No. 166 “On State Pension Provision”;

- share of old-age insurance coverage in accordance with the Federal Law “On Insurance Pensions”.

Now only those who have worked not 15 years, but 20 years (increasing gradually) can receive the first pension.

The retirement age for them has also increased: for men it is now 65 years, and for women 63 years.

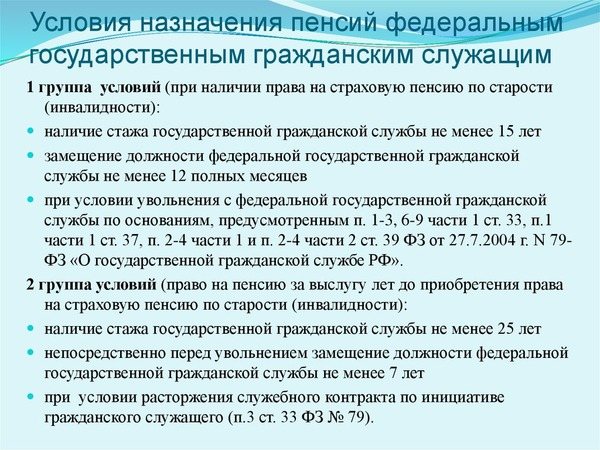

To receive the first type of pension, several conditions must be met:

- reaching above the stated age;

- continuous work experience of at least one year before retirement;

- dismissal only by agreement between the parties, for example, when changing the terms of the contract, liquidation or layoff.

A person can receive a pension at an earlier age, but then the work experience in the civil service must be at least 25 years, and a continuous period of 7 years. In the event of liquidation of a state body or reduction, it is possible to obtain security without working for a year.

Government officials have the right to count on insurance coverage after 15 years of employment, which includes length of service in the public service. It is paid only if you have the required number of points and reach the age limit.

The insurance payments include the following periods:

- all activities during which contributions to compulsory pension insurance were paid;

- civil service period;

- other terms specified in Article 12 of the Federal Law “On Insurance Pensions”.

The insurance payment is made based on the number of pension points, which are multiplied by the cost of one IPC. Government officials receive the amount without a fixed rate.

If a person continues to work after receiving support, then he is entitled to a recalculation, since he continues to pay contributions to the Russian Pension Fund.

In this case, the share of insurance coverage is subject to recalculation based on the points received, which were not previously taken into account when calculating the payment. Recalculation is carried out automatically annually in August without submitting a corresponding application.

The conditions for the appointment and size of pensions for federal civil servants and military personnel are somewhat different than for the rest of the country.

They are appointed in accordance with the federal laws “On pensions in the Russian Federation”, “On the state civil service of the Russian Federation”. Several factors influence the final result.

An additional social guarantee is pension provision for long service. It is accrued if the employee has served the minimum period approved by the government in the civil service.

The pension amount for civil servants includes:

- amount assigned based on length of service;

- and part of the insurance payment - subject to continued work after accumulated special experience.

Now, in order to qualify for additional pay for length of service, you must have 16.5 years of experience. The retirement age in 2020 is 56.5 years for women, 61.5 for men.

Regardless of what position you hold or perform work, if it is related to a government department, then in any case you are entitled to a certain type of benefit.

More on the topic What is a pensioner’s social card and how to apply for it?

However, there are certain professions that are entitled to slightly different benefits due to the fact that their type of activity involves hard work not only in the physical sense, but also in the psychological sense. It is also worth noting that there are certain areas of activity for which benefits are assigned on an individual basis and have types of benefits.

There are two types of these benefits, namely:

- Assignment of pension payments based on a certain amount of length of service.

- Assignment of pension payments upon reaching the established retirement age.

As for other types of civil servants who cannot be classified in the above category of persons, pension payments are assigned to them in the following order:

- Having professional work experience equal to at least 20 years of service in government agencies.

- Having a total work experience of 20 to 25 years. It doesn’t matter where exactly you carried out your work activity and in what structures, in any case it will be counted.

- Leaving the workplace due to reaching retirement age or personal desire.

As mentioned earlier in this article, in order to obtain the right to retire, it is important not only to reach the retirement age, which, as is already known, has increased, but also to have a minimum amount of work experience. Because if you do not have work experience in a certain field, namely, working all this time in the civil service, you will not be able to retire until you have gained it.

Methods for delivering double pensions to citizens in the Russian Federation in 2020

How the funds will reach the recipient must be indicated in the application for pension payment. The following variations are allowed:

- to a bank card/account – it is possible to open a special card of the Russian Mir system, money can be spent in non-cash form or cashed out through ATMs;

- Russian Post - the application indicates the residential address of the recipient of the funds;

- personally with home delivery - for this purpose, special organizations are appointed, whose specialists transfer funds personally to the pensioner at his place of residence.

The choice of delivery location is announced when making payments to the Pension Fund of the Russian Federation. It can be changed at any time by submitting an application in person or through the State Services website online.

Error 1: Choosing one of the grounds for receiving funds from the federal budget for pensions - disability, length of service or due to reaching the age for retirement.

Expert opinion

Davydov Alexander Yurievich

Civil law consultant with 20 years of practice. Author of numerous articles on legal topics

– According to the law, it is possible to receive both old-age (age) and disability or long-service pensions. The legislation does not establish restrictions on the appointment of both payments from the state.

Question 1 : I have the right to receive a long-service pension in connection with employment in the federal service for 16.5 years in 2020 and at the same time the age of 61 years for retirement on a general basis. Do I have the right to receive financial support on both grounds and what needs to be done to achieve this?

This is important to know: Sample letter of guarantee for the performance of work and provision of services under the contract

– You can submit, simultaneously with the onset of retirement age (material support from the state will be assigned automatically when a man turns 61 years old), an application for registration of material support based on length of service. According to the law, it is possible to receive funds on two grounds at once.

Petrova O.P. will retire by age in December 2020 - upon reaching 56 years of age.

She has been receiving financial support from the state for 5 years already in connection with receiving group 3 disability. She does not need to apply for two pensions at the same time, since on the first basis the funds are already being paid, and on the second basis, the transfer of funds from the state budget, taking into account previously received earnings, will be carried out automatically.

You do not need to choose one of the types of government support. It is permitted by law to pay funds on two grounds at once according to the state tariff simultaneously without restrictions.

According to Russian legal norms, individuals may have preferential pension benefits. For example, this is the case with pensions for civil servants. It is awarded for performing special tasks to solve state needs. And here there are special rights to retire.

Changes to long-service pensions for civil servants

Employees of government agencies begin to receive pension payments when they reach retirement age and complete their mandatory service. The conditions for granting pensions for civil servants are regulated by federal law.

Who falls under the category of civil servants

Civil servants include Russians who work in government agencies and receive money from budget funds for this. It should be noted that not every employee of a government agency is considered a civil servant.

These are only those who have been endowed with the functions of power, command, and management. The list of persons classified as civil servants is contained in the Federal Law dated June 27, 2004, number 79.

In order to apply for a long service pension, in addition to the application, you will need to prepare the following set of papers:

- passport (photocopy and original);

- a statement of the average monthly salary of a civil servant for the previous 12 months;

- an extract containing information about the position;

- photocopy of the work book;

- photocopy of the dismissal decree;

- photocopy of military ID;

- other documents confirming civil service for a certain period.

The application can be submitted by mail, during a personal visit to the Pension Fund/MFC. The petition can also be submitted by a representative of the pensioner.

Pension payments are provided monthly. A citizen has the right to choose a company that will deliver money. In this case, the pensioner’s representative can receive the money if there is a notarized power of attorney.

Money can be delivered to the recipient in one of the following ways:

- Russian Post. The money is delivered directly to the pensioner’s home. If a citizen does not receive a pension for 6 months, payments are suspended. To resume payments, you need to submit an application to the Russian Pension Fund.

- Banking organization. Money can be received at a bank teller. A pensioner can also make a card and withdraw funds through an ATM.

- A company that specializes in the delivery of cash payments. A pensioner can either come to the appropriate institution to collect the money themselves or have it delivered to their home.

Age benefits for retirement for civil servants

Each region of the Russian Federation has the right to independently establish a list of benefits when assigning pensions to civil servants. These include:

- supplement to pension payments to civil servants;

- preservation of state guarantees;

- free medical care;

- providing vouchers to a health facility or monetizing those vouchers that were not used.

For example, the legislative act of Nizhny Novgorod dated June 24, 2003 number 48 defines a pension supplement for complete loss of ability to work. Samara Legislative Act No. 19 of March 13, 2001 established a monthly supplement equal to 45-75 percent of the pension.

will be 16.5 years, whereas previously it was 16 years.

Calculation of long-service pensions for civil servants

When determining the size of the pension, only those payments for the last year that the Russian received in the civil service are taken into account.

If a pensioner was employed in another non-state organization for the previous 12 months, the money he received as salary will not be included in the calculation.

The average salary for 12 months is calculated by adding up all the money a person received during the year.

After this, the amount is divided by 12. The calculation includes:

- monthly salary received;

- monthly supplement received;

- material incentives;

- monthly/one-time bonus payments.

The calculation ignores periods when a citizen:

- is on unpaid leave;

- was on maternity leave;

- was temporarily disabled.

The amount obtained when calculating the average earnings for 12 months should not be more than 2.8 of the salary that is established for a certain position.

Also, the amount of pension provision is influenced by the length of service accumulated by a Russian. It calculates the percentage of average monthly earnings that will be provided to Russians in the form of pension payments. For 15 years of service, a citizen receives 45 percent of the average monthly salary. For each additional year, another 3 percent is added.

To calculate pension benefits, the salary is multiplied by a certain percentage. The result of the multiplication will be the bonus that will be provided to the person.

Calculation example

Sidorov L.P. worked as a federal civil servant. In April 2020, he was assigned an old-age pension insurance. The amount of this pension is 7197 rubles. Experience L.P. - 26 years. The average monthly salary of a citizen was 16,706 rubles.

The amount of the supplement is equal to 45 percent of the average monthly salary with at least 15.5 years of civil service experience and increases by 3 percent for every 12 months above the minimum, but not more than 75 percent. Above the norm L.P. worked 26 – 15 = 11 years. 0.45 (minimum coefficient) is multiplied by 16706. 7197 is subtracted from the product.

To the resulting difference is added the product 0.03 (coefficient for an additional year of service), 16706, 11. The result is 5833.68 rubles, which will be the amount of the state pension for long service.

A long-service pension is an insurance pension that must be earned through long-term work. Its size depends both on the number of years spent in civil service and on the average monthly salary.

Useful video

Will there be an increase for civil servants in 2020? Watch the video:

Pension provision for federal civil servants

Civil servant pensions are payments provided for long-term work, filling positions in the federal civil service. The parameters of pension benefits depend on the length of stay in the civil service.

Federal employees have the right to receive benefits established by 3 legal acts:

- Law “On State Pension Provision in the Russian Federation” No. 166-FZ of December 15, 2001.

- Law “On State Civil Service” No. 79-FZ of July 27, 2004.

- Law “On Insurance Pensions” No. 400-FZ dated December 28, 2013.

Download for viewing and printing:

Conditions for assigning pensions

The size of a civil servant's pension in 2020 is 45-75% of average monthly earnings. For exceeding the minimum length of service, an additional 3% is charged. But the total size should not exceed the mentioned 75%.

Federal employees can apply for double pay if they have completed length of service, reached retirement age, and have a number of pension points not lower than the established average.

Military personnel are entitled to monetary allowance. With 20 years of service, the pension allowance will be 50% of the salary. If the service lasted longer, then for each extra-term year an increase of 3% is due.

The accrual “ceiling” is 85% of the monthly allowance. Payments are calculated based on salary and benefits. All this adds up to one amount, of which half is taken. If you have more than 20 years of experience, the amount received increases by 3% for each year. A regional coefficient is added to the pay of those who have served at least 15 years in the Far North.

But a reduction factor also applies to everyone. In 2020 it is 0.7368. If a serviceman does not have the required length of service, he is deprived of the right to a military pension.

You can find out what kind of pension civil servants have in Russia and what the amount of payments is for each specific recipient, based on the provisions of the Federal Law “On State Pension Security in the Russian Federation”.

Ex-high-level officials receive up to 80 thousand rubles. with the minimum required experience. Years of service beyond the required amount increases the amount of payments.

Former prime ministers of the country receive a pension in the amount of 55-75% of the salary of the current head of the Cabinet of Ministers, namely 300-425 thousand rubles monthly. In addition to these amounts, ex-prime ministers have a labor salary of 19 thousand rubles. Other former officials have somewhat more modest pension payments.

Civil servants include Russians who work in government agencies and receive money from budget funds for this. It should be noted that not every employee of a government agency is considered a civil servant.

These are only those who have been endowed with the functions of power, command, and management. The list of persons classified as civil servants is contained in the Federal Law dated June 27, 2004, number 79.

In order to apply for a long service pension, in addition to the application, you will need to prepare the following set of papers:

- passport (photocopy and original);

- a statement of the average monthly salary of a civil servant for the previous 12 months;

- an extract containing information about the position;

- photocopy of the work book;

- photocopy of the dismissal decree;

- photocopy of military ID;

- other documents confirming civil service for a certain period.

The application can be submitted by mail, during a personal visit to the Pension Fund/MFC. The petition can also be submitted by a representative of the pensioner.

Pension payments are provided monthly. A citizen has the right to choose a company that will deliver money. In this case, the pensioner’s representative can receive the money if there is a notarized power of attorney.

Money can be delivered to the recipient in one of the following ways:

- Russian Post. The money is delivered directly to the pensioner’s home. If a citizen does not receive a pension for 6 months, payments are suspended. To resume payments, you need to submit an application to the Russian Pension Fund.

- Banking organization. Money can be received at a bank teller. A pensioner can also make a card and withdraw funds through an ATM.

- A company that specializes in the delivery of cash payments. A pensioner can either come to the appropriate institution to collect the money themselves or have it delivered to their home.

Reference! To select a delivery method or change it, you must submit an application to the institution of the Pension Fund of the Russian Federation that assigned the pension.

When determining the size of the pension, only those payments for the last year that the Russian received in the civil service are taken into account.

If a pensioner was employed in another non-state organization for the previous 12 months, the money he received as salary will not be included in the calculation.

The average salary for 12 months is calculated by adding up all the money a person received during the year.

After this, the amount is divided by 12. The calculation includes:

- monthly salary received;

- monthly supplement received;

- material incentives;

- monthly/one-time bonus payments.

The calculation ignores periods when a citizen:

- is on unpaid leave;

- was on maternity leave;

- was temporarily disabled.

The amount obtained when calculating the average earnings for 12 months should not be more than 2.8 of the salary that is established for a certain position.

Also, the amount of pension provision is influenced by the length of service accumulated by a Russian. It calculates the percentage of average monthly earnings that will be provided to Russians in the form of pension payments. For 15 years of service, a citizen receives 45 percent of the average monthly salary. For each additional year, another 3 percent is added.

Attention! The largest pension amount is determined by law. It cannot be more than 75 percent of the average monthly salary of a Russian.

To calculate pension benefits, the salary is multiplied by a certain percentage. The result of the multiplication will be the bonus that will be provided to the person.

Currently, the pension is calculated at 45% of average earnings if a person meets the criteria. For overtime in 3 years, another 3% of wages is added.

Important! The maximum amount cannot exceed 75% of the average income, even taking into account all benefits and allowances. Civil servants who are in difficult climatic conditions have the right to count on additional support.

When calculating payment in 2020, leave without pay, maternity leave, and various child care payments are not included. The amount of benefits calculated to be received during the period presented is also not taken into account in the final calculation. Money paid on the basis of sick leave is also not taken into account.

Indexation affected the pensions of prosecutors, judges and other civil servants. Since the pension provision of former employees did not grow, it was decided to index the pension annually - initially in 2020 by 4%, now also in 2020 by a similar figure. An increase of another 4% is planned in 2021. So far, the further initiative has received support from senior management.

More on the topic Changes in preferential pensions for teachers based on length of service

Judges' pensions will also be reviewed. It is planned to increase wages by 30%, but everything will depend on length of service.

Attention! Recalculation of pensions for civil servants is carried out on an annual basis in accordance with established rules.

Recalculation of longevity benefits is carried out annually if the employee continues to work. Accordingly, the calculation is based on the number of years of service.

According to current legal acts and decisions of the Government, pension insurance is also recalculated annually by increasing the fixed amount and increasing the consumer basket.

Indexation of the insurance pension is carried out annually, and benefits for age or disability also increase annually, but do not cover the category of officials. But a working pensioner will be able to count on an additional payment to the benefit based on the IPC received.

The insurance pension for civil servants is paid without taking into account the fixed payment; the general indexation procedure does not apply to this category of persons. And those who continued to work after receiving a pension have the right to receive an annual additional payment taking into account the individual coefficient.

The rule applies to all pensioners, including those who continue to work in a government agency or commercial organization.

Recalculation is carried out every year in early August after calculating individual points that have accumulated since the accrual of collateral on the calculation date.

Recalculation example

Based on length of service, the calculation is as follows. For example, state support for length of service for citizen P.P. Ivanov. assigned in the amount of 25,000 rubles. He worked the required period of time to receive a pension.

The recalculation of the pension in this case will look like this: 25,000 * 0.45 = 11,250 rubles.

Then he continued his activities to increase his income. He worked for another year. We get the following formula: 25000*0.45 3%*25000*1 year = 12000 rubles. This amount is payable after registration of the pension before the first period of recalculation, if the person continues to work in the civil service or in a commercial organization.

That is, from next year he will receive the presented amount..

Indexation for insurance payments. Ivanov P.P. issued two payments at once: for length of service and the insurance part. The pension based on individual points is 39. For 2020, the cost of the IPC is 93 rubles. Total: 39*93=3627 rubles.

As soon as Ivanov received his pension, he resigned from the government office (April) and moved to another job in a commercial organization. From the period of dismissal to the period of payment, the citizen accumulated points in the amount of 0.98. The additional payment will be 1.91 93 = 94.91 rubles. That is, in the next period he will already receive 3,721.91 rubles.

First, let's look at who is considered to be government employees and what specific professions can be included in their list. Federal state civil servants mean those employees of federal state civil institutions who, at the same time, receive monetary payments in connection with the performance of assigned duties and positions.

In other words, these are those citizens who occupy ordinary government positions and work exclusively in official positions.

Such employees include the following citizens:

- Law enforcement officers, for example, such as police officers.

- Military personnel, as well as those units that directly relate to them.

- Workers of the fire and tax services, as well as organizations whose responsibilities include maintaining law and order in the country.

- Employees of various regional institutions whose responsibilities directly include providing assistance and support to the local population.

Assignment of benefits to federal employees

People have the right to such security only under certain circumstances (death, disability due to health or due to old age).

Service pensions for civil servants are established in the presence of the following conditions:

- Civil service from 16.5 years (for 2020).

- Resignation for 1 of the following reasons:

- reduction in the number of civil servants or liquidation of government bodies;

- resignation from office due to the person’s resignation;

- reaching the maximum age limit for holding office;

- due to a physical condition that prevents continued service;

- independent dismissal due to departure for a well-deserved rest.

Rights to state support arise for citizens who have worked for at least 12 months immediately before the payment is issued.

Important! This does not apply to those dismissed from a government agency being liquidated or among those being laid off.

Age limits for civil servants in 2020

On May 23, 2016, the State Duma of Russia adopted a normative act increasing the age limit for civil servants to retire. The law came into force on January 1, 2017.

- 65 years for men.

- 63 years for women.

Raising the age limit applies only to working civil servants. Upon dismissal from a position, a citizen receives the right to an insurance pension (including early retirement), taking into account the previous age criteria.

The age limit for retirement will be increased in stages. From 2020, it increases annually by six months until the required level is reached. The maximum will be reached in 2034 for women, and for men already in 2028.

Requirements for old age pension:

| Woman's year of birth | Age | Released | Minimum IPC size (points) | Experience |

| 1963 | 56 | 2019 | 16,2 | 10 |

| 1964 1st half year | 56,5 | 2020 2nd half of the year | 18,6 | 11 |

| 1964 2nd half year | 56,5 | 2021 1st half of the year | 21 | 12 |

| 1965 | 57 | 2022 | 23,4 | 13 |

| 1966 | 58 | 2024 | 28,2 | 15 |

| 1967 | 59 | 2026 | 30 | 15 |

| 1968 | 60 | 2028 | 30 | 15 |

| 1969 | 61 | 2030 | 30 | 15 |

| 1970 | 62 | 2032 | 30 | 15 |

| 1971 | 63 | 2034 | 30 | 15 |

| Man's year of birth | Age | Released | Minimum IPC size (points) | Experience |

| 1958 | 61 | 2019 | 16,2 | 10 |

| 1959 1st half year | 61,5 | 2020 2nd half of the year | 18,6 | 11 |

| 1959 2nd half year | 61,5 | 2021 1st half of the year | 21 | 12 |

| 1960 | 62 | 2022 | 23,4 | 13 |

| 1961 | 63 | 2024 | 28,2 | 15 |

| 1962 | 64 | 2026 | 30 | 15 |

| 1963 | 65 | 2028 | 30 | 15 |

Civil servant Sergeeva I.V. Born 09/01/1963 reached the age of 55 years on September 1, 2020. She will have the right to an insurance pension only upon reaching the age of 56 years, that is, on September 1, 2019.

If Sergeeva decides to leave the civil service on September 1, 2020 or move to a job not related to the civil service, then the right to an old-age pension will remain with her as of August 1, 2018.

To acquire a service state pension, you must develop special experience.

| Year of assignment of long-service pension | Length of service required to assign a long-service pension in the relevant year |

| 2019 | 16 years 6 months |

| 2020 | 17 years |

| 2021 | 17 years 6 months |

| 2022 | 18 years |

| 2023 | 18 years 6 months |

| 2024 | 19 years |

| 2025 | 19 years 6 months |

| 2026 and beyond | 20 years |

This is important to know: Sample application to bailiffs for the adoption of a writ of execution

The government sees certain advantages in this step:

- maintaining qualified personnel, who are not easy to recruit due to the constant decline in the working-age population.

- significant savings in the budget.

Advice from lawyers:

1. I am a civil servant (10 years of civil service experience), I turned 55 in February 2019. Can I apply for and receive an old-age pension and continue working as a civil servant?

1.1. Hello! Civil servants, like other citizens, are entitled to an old-age pension. To obtain it you must: • reach a certain age; • accumulate the required number of pension points to calculate the individual pension coefficient; • have a certain insurance period. After a civil servant has been granted an old-age pension, he can continue to hold a civil service position.

After a civil servant has been granted an old-age pension, he can continue to hold a civil service position. However, unlike ordinary working pensioners, a civil servant will be fired upon reaching the age limit.

The age limit for civil service is 65 years.

The age for receiving an old-age pension depends on the year in which the civil servant turns 60 years old (for men) or 55 years old (for women). If this age comes: • in 2020, then you can receive an old-age pension from 61.5 years for men and 56.5 years for women; 2.

I will be 60 years and 6 months old on June 3, 2020. I want to apply for an old-age insurance pension, but I am a government employee. Can I resign from the government service, apply for a pension, and then re-enter the government service without losing my pension?

When? 2.1. This is exactly what everyone does, but the big catch is that many employers do not take back employees who quit, even if there are verbal agreements with them.

We recommend reading: What documents are needed to pass a technical inspection

This is how they get rid of boring ones, or simply free up thieves’ places. Everything is motivated very simply on the basis of the Federal Law on civil service in connection with reaching the age of civil service, because

fixed-term contracts for a period of 1 year are concluded by force of law at the initiative of the manager and no court will come to your defense if you voluntarily retire and they won’t take you back!

So the choice is yours! Good luck to you! 3. I am a civil servant, I will turn 54 years old in August, my total length of service is 34.5 years, I have been in the civil service for 27 years continuously, I have a 1-year benefit for Chernybyl, I want to retire on old age without having to work 1.5 years in the civil service. After retiring, can I get a job again, including in the civil service?

3.1. — Hello, dear site visitor, in my opinion, you do not have the right to early retirement. Then you can work anywhere if you are hired, but until you reach your retirement.

Good luck to you and all the best, with respect, lawyer Ligostaeva A.V. 4. Will I be granted an old-age pension?

I was born on October 15, 1964, and in October 2020 I am 55 years old. Civil servant since February 2004 (15 years in February).

Total experience in August 2020: 37 years.

4.1. Hello, In accordance with Article 8 of Federal Law No. 400 “On Insurance Pensions,” as a civil servant, you have the right to a pension at 56.5 years of age.

However, upon reaching 37 years of service, an old-age insurance pension may be assigned 24 months earlier than reaching the age specified in parts 1 and 1.1 of this article, but not earlier than reaching the ages of 60 and 55 years (men and women, respectively). That. in October 2020, you have the right to apply to the Pension Fund at your place of residence with an application for a pension. Based on the results of consideration of your application, the Pension Fund will make a decision, which, if you do not agree with it, you have the right to appeal.

5. I am a civil servant with 37 years of insurance experience. In September 2019 he will turn 55 years old.

Will I receive an old-age pension while continuing to work? 5.1. No, Federal Law of December 28, 2013 N 400-FZ (as amended)

dated December 27, 2018) “On insurance pensions” does not provide for the cancellation of receiving a pension when officially employed. In addition, according to the same law, if you continue to work, your pension will be indexed every year on August 1st.

6. Do I have the right to receive a civil servant’s pension and an old-age pension? A civil servant’s pension is assigned for length of service.

6.1. Hello, if after years of service you got another job and worked officially, then of course, when you reach retirement age, an old-age pension will be accrued. 7. On December 21, 1963, I turn 55 years old, I am a civil servant, a leading specialist in the prosecutor's office, work experience in school is 10 years, in the prosecutor's office for 20 years, total experience is 30 years. When should I retire?

7.1. What, your colleagues don’t know the answer to this question? However, this is not surprising. You will retire on a general basis. By the way, you should have been retired on December 21, 1963.

8. I turned 55 years old on March 30, 2020, I have been a civil servant since 1990, when I can retire on old age.

8.1. Good afternoon! THE FEDERAL LAW ON AMENDING SELECTED LEGISLATIVE ACTS OF THE RUSSIAN FEDERATION IN PART OF INCREASING THE PENSION AGE FOR SPECIFIC CATEGORIES OF CITIZENS increased the receipt of state insurance pensions. civil servants and municipal employees for 6 months.

The law came into force on January 1, 2020. It applies to you. From March 30, 2020, you will be entitled to receive the insurance part of your pension as a state pension.

employee. The experience required for this is 15 years 6 months, but you have it, and therefore you meet all the requirements. Contact the Pension Fund of the Russian Federation according to your territoriality with an application. 9. A person receives an old-age pension and as a civil servant.

At the same time it works. Can he receive a pension as a civil servant? 9.1. Good afternoon Ida, you can receive a pension as a civil servant if you do not work in the civil service. 10. I am a civil servant and turned 55 years old in 2020.

She left the civil service. I took out an old-age pension. Can I re-enter the civil service and receive a pension at the same time?

10.1. Yes, you can, you just won’t receive pension indexation at the beginning of the year.

There are no restrictions on this matter. 11. Based on what article or law can a federal civil servant receive a long-service and old-age pension at the same time?

And what is the difference from a municipal employee, except for the source of pension. 11.1. In fact - nothing. Federal Law of December 15, 2001 N 166-FZ (as amended on March 7, 2018)

“On state pension provision in the Russian Federation”

Article 7.

Conditions for assigning pensions to federal state civil servants 2. The long-service pension is established in addition to the old-age (disability) insurance pension assigned in accordance with the Federal Law “On Insurance Pensions” and is paid simultaneously with it. 12. I am a woman born in 1966, not a civil servant.

In what year can I retire for old age? 12.1. Upon reaching the age of 55, in accordance with the law on insurance pensions, you can, under certain conditions, two years earlier. Good luck to you and all the best. 13. My son works in the Federal Tax Service system.

Civilian, no shoulder straps. Does he have the right to early retirement in old age? If so, what should be the minimum length of service? Does he belong to civil servants?

If yes, what benefits will there be in this case? 13.1. If he is a civilian employee, then he has an insurance period, incl.

and “northern” experience. Therefore, the early right to an old-age insurance pension will arise at the age of 55 if you have a total insurance period of at least 25 years and work experience in the Far North region of at least 15 years or in an area equated to the regions of the Far North for at least 20 years.

Article 32 of Federal Law No. 400-FZ “On Insurance Pensions”. He is not a civil servant. 14. I am a civil servant, I am over 55 years old, can I receive an old-age pension and work as a civil servant?

14.1. For civil servants, the retirement age has been increased; in 2020, this age is 56 years. If you are currently a civil servant, you will not be granted an old-age pension until you turn 56. If YOU want to be granted a pension at age 55, then you must resign from the civil service.

In general, you can work in the civil service and receive an old-age pension at the same time.

15. I would like to know the calculation of the civil service pension, I have been retired since 2020, the old-age pension is 13467, I work, the average monthly salary for 2020 is 36000. rub. Please do the calculation, if I retire this year, how much will it be?

My experience in the civil service is 34 years.

I have been working in the tax office since 1990, and I also have 7 years of experience in the city financial department of the Administration. Is this included in the length of service of a civil servant? Thank you in advance. 15.1. Hello.

You can contact a lawyer, he will draw up legal requests to the state. authorities and other organizations, after which you will have all the necessary information. If necessary, you can contact the author of this message.

Lawyer Onypko O.O., office: M. Gorky St., no. 92, Rostov-on-Don, tel.: 89286077085 Share on social networks: vkontakte facebook classmates telegram whatsapp If you find it difficult to formulate a question, call a lawyer will help Free multi-channel phone Subscribe to notifications Mobile application We are on social media. networks

© 2000-2019 9111.ru *A response to a question within 5 minutes is guaranteed to the authors of VIP questions. Moscow Komsomolsky pr., 7 St. Petersburg emb.

R. Fontanki, 59 Ekaterinburg: Nizhny Novgorod: Rostov-on-Don: Kazan: Chelyabinsk:

Calculation of the term of civil service

The civil service period is the summed duration of labor and activity that is taken into account when employees become eligible for such payments and when calculating the parameters of benefits..

- in positions of the federal civil service;

- in positions determined by the President of the Russian Federation.

If a legal benefit requires work of some duration, it includes work and other socially useful activities that count towards the required insurance period.

How is a pension indexed?

The accrual of service state support, the recalculation of its parameters and the transition from the 1st formation to another are carried out in an application manner. This occurs regardless of the time after the emergence of powers and without time limits. The exception is disability social benefits.

Recalculation of the amounts of service-related state subsidies is carried out when:

- dynamics of parameters of disability/age payments;

- increasing the length of civil service experience;

- federal increase in wages for employees.

In other situations, there is a transition from the 1st subsidy type to another type of state pension provision.

Attention! Service-related government payments are indexed to the federal increase in wages of federal civil servants in the manner established by the Government of the Russian Federation.

Registration of service pension

Without time restrictions, people have the right to apply for registration of this type of payment after the corresponding powers arise.

- personally;

- through an authorized representative;

- by mail.

Download for viewing and printing:

In the latter case, the application period will be considered the day indicated on the postmark at the time it was sent by the applicant. If the application is submitted through the MFC, then the day of application will be considered the day the document was accepted by the MFC staff.

Advice! An application for pension payments can also be submitted to the human resources department at the place of work.

Payment deadlines

The legal period for consideration of a submitted application cannot exceed 10 days from the date of its submission along with a complete set of documentation. If some documents are missing, PF employees notify the applicant about this and provide additional time (up to 3 months) to transfer the remaining documents to the PF. If the applicant for social security meets this deadline, then the pension is assigned from the moment the application is submitted.

If there is not enough time, they may assign a pension based on the available documents or suspend the consideration period for another 3 months.

Registration for length of service

Starting from the moment the right to receive a long-service pension arises, a citizen can submit an application for the assignment of these payments.

You need to submit the document to the local branch of the Pension Fund or MFC.

You can make a request in several ways:

- personally;

- by mail, attaching notarized copies of all necessary documents (in this case, the date of application will be considered the date indicated on the postal stamp placed upon sending);

- through a legal representative.

Once the documents are received, the HR department takes over their processing.

No more than 10 days are allotted for review and verification of all papers from the date of provision of the full package of documentation.

If everything is in order, then the pension is assigned from the beginning of the month of application for it, but not earlier than the citizen has the right to it.

Documentation

To achieve the assignment of a pension based on years of service, you will need to provide a number of documents:

- passport (original and photocopy);

- a certificate containing information about the average monthly earnings of a civil servant during the pre-retirement year of work;

- a paper containing information about those places and stages of work that are taken into account when calculating preferential length of service;

- a certificate from the pension fund about the early assigned benefit based on age (disability) and its amount;

- work book (photocopy);

- order of dismissal from the last place of work (photocopy);

- military ID (photocopy, required if you have military service experience);

- other documentation that allows you to confirm the presence of stages that can be included in the special length of service of a civil servant.

To obtain the most accurate information regarding the list of required documents, it is advisable to first contact the Pension Fund branch where you plan to submit the application.

Statement

When submitting an application for a pension payment to civil servants, it must be addressed to the Chairman of the Board of the Pension Fund of Russia (PFR) and submitted along with other documents to the personnel department of the relevant government authority.

If the federal body was liquidated, then the paper is sent to the personnel department of the government agency that assumed the responsibilities of the reorganized government body.

The procedure for submitting such an application is set out in as much detail as possible in Resolution of the Ministry of Labor No. 44 of June 30, 2003.

How is the disability pension calculated? What should be the coefficient for calculating a pension? Find out here.

Pay

Payment of pension benefits to civil servants is carried out monthly. The pensioner himself decides which organization will deliver these payments:

- Post office. Receipt of funds can take place at the post office at your place of residence, or directly at home. If the recipient does not collect the pension within six months, then the transfer of payments is suspended and can be resumed by writing a special application.

- Banking organization. The money goes to the bank account previously registered by the citizen. You can withdraw them by visiting the bank's cash desk, or (if you have a payment card attached to your account) by using an ATM.

- Courier organizations specializing in the delivery of pensions and represented in special lists of the Pension Fund (the principle of interaction is the same as in the case of mail).

If necessary, the pension of civil servants can be paid to trustees, provided that they present a document confirming that they have in fact been granted the appropriate powers.

To approve any necessary delivery method or its replacement, it is enough to write a statement setting out this request. It must be sent to the Pension Fund branch where the citizen was assigned a pension.

Law on pensions for civil servants

In 2020, a draft law was introduced into the State Duma to increase the service life of civil servants from 55/60 to 63/65 years. These amendments were adopted and included in the law, which progressively increased the age of civil servants.

Expert opinion

Davydov Alexander Yurievich

Civil law consultant with 20 years of practice. Author of numerous articles on legal topics

It will gradually (with an increase of 6 months every year) increase the age of retiring civil servants, as well as the minimum length of service that civil servants must earn in their position.

The minimum length of service required in the civil service in 2020 will be 17 years. The following indicators reflect the period of increase in length of service:

- 15 years and 6 months. in 2020;

- 16 years in 2020;

- 16 years and 6 months. in 2020;

- 17 years in 2020;

- 17 years and 6 months. in 2021;

- 18 years in 2022;

- 18 years and 6 months. in 2023;

- 19 years in 2024;

- 19 years and 6 months. in 2025;

- 20 years in 2026

The list shows how the minimum retirement period for civil servants is gradually changing from fifteen to twenty years. In 2020, the minimum retirement period will be 17 years.

Civil servants – women (retirement) – 57 years old; male civil servants – 62 years old. By 2026, it is planned to increase the civil service experience (minimum) to 20 years, as provided by law.

The size of pensions for civil servants in Russia

The overall system of subsidy payments is influenced by the length of service of an employee of government departments. Today, calculations are carried out according to the previously adopted standard:

- To receive pension contributions in the amount of 45% of the average salary, a person must work according to the rule established in Article 166 14 of the Federal Law - 15 years . Insurance costs and possible additional factors will also be deducted here if the person has a disability.

- If such experience is more than 15 years , then the calculation will take into account overtime in the amount of 3% of the average salary of a civil servant.

What is included in the experience

- An employee's length of service must necessarily include months worked in departments and structures that have federal and regional status.

- If a citizen worked in various branches of government, but always had the status of a civil servant, such length of service will also be summed up according to the established rule for calculating pension benefits for citizens.

- Other places of work not classified as civil service will be calculated separately when calculating monthly pensions. As a result, the person will receive additional payments for each period worked, both through the state. employee and ordinary worker.

Benefit calculation formula

166 Federal law establishes a calculation formula by which future payments are calculated to pensioners who have worked in the public service. This formula looks like this:

(45% of average earnings - the amount of old-age insurance in the form of a fixed payment) + 3% of average earnings X length of service over 15 years.

The legislation also establishes that the total percentage of pension benefits cannot be more than 75 of the average earnings of a civil servant.

Earnings to determine the amount

Based on the general rule for calculating the amount of average earnings, it is necessary to indicate the following variables when calculating the amount:

- the full amount of income for 1 year;

- number of days worked in a calendar year.

The final amount must be divided by the total number of days actually worked, the result will be the average earnings for 1 year. When calculating length of service, the total amount of earnings for this period is taken and divided by the actual number of days worked.

How is it calculated in the Far North?

To calculate the northern length of service, civil servants will need a table of coefficients for the regions of the country. According to the established rules for calculating pension experience and future monthly subsidies, the final indicators are multiplied by the coefficient established in the employee’s specific region.

The size of the coefficient depends on how remote the region is and what weather and living conditions are present there. The more remote and colder the region, the higher the coefficient will be.

Indexing

The basic rule for indexing pension contributions of citizens in the public service is centralized budget management for the distribution of salaries to such employees.

The increase and growth of pension benefits depends on the amount of average wages that the employee received over the entire period of work experience. is also added here with an increase of 3% for each subsequent year.

Right to insurance benefits

400 Federal law controls in Article 19 the share of old-age insurance benefits for employees of public services.

The calculation uses individual pension coefficients, which make it possible to calculate the total amount of monthly payments due to citizens upon reaching retirement age (from 2020 this is 60.5 years for men and 55.5 for women) and having worked for more than 15 years .

How is the length of service of civil servants calculated?

The most accurate weather forecast for the whole summer by month

The length of service of civil servants is calculated by summing up all periods of work of a Russian in positions that are specified in the CP. All of them are summed up to achieve the minimum size of work in government agencies.

Based on the data obtained, the size of the pension of civil servants is calculated. The minimum length of service for civil servants from January 1, 2020 will be seventeen years.

This means that the total calculated length of service of a civil servant pensioner must be at least 17 years. Before the relevant law was issued, it was 15 years.

Expert opinion

Davydov Alexander Yurievich

Civil law consultant with 20 years of practice. Author of numerous articles on legal topics

The length of service has begun to increase progressively since 2020, and by 2020 it will already be 17 years. By 2026, it is planned that the minimum length of service for civil servants will be 20 years.

Conditions of appointment

The procedure for assigning pensions to civil servants based on length of service has changed several times. In 2020, Law No. 143 Federal Law was adopted, which regulates the consistent increase in the retirement age for civil servants. This means that the retirement period will gradually increase until the age prescribed by law is reached. For men this will be 65 years, and for women - 63 years. Every year the age required to receive a pension will increase by 6 months.

At the same time, the length of service required to receive a pension increases. This period will also increase gradually. Before the adoption of the law, the length of service for civil service employees was 15 years. In 2020, in accordance with the law, civil servants who have worked in relevant organizations for 15.5 years and have reached retirement age, which has also been increased by 6 months for men and women since 2020, have the opportunity to retire according to length of service.

What is included in accounting for average monthly earnings

The size of the pension of civil servants is calculated based on the data received by the Pension Fund for their last year of work in the public service. Based on data on his salary and contributions that the employer made to the Pension Fund. The calculation is made by dividing all income received during the year by 12.

This is important to know: Statement of claim for compensation for material damage and losses

Average monthly earnings consist of various payments that the employer made to the relevant employee. The list of payments that are included in the average monthly salary of an employee is as follows:

- monthly salary of a civil servant (MC);

- MO in accordance with class rank;

- monthly bonus to the Ministry of Defense for length of service;

- monthly bonus to the Ministry of Defense for special working conditions;

- monthly bonus to the Ministry of Defense for working with classified data;

- monthly bonus to MO;

- bonuses for working with particularly complex tasks;

- one-time payment when going on annual leave.

What is included in the length of service in the state civil service?

First, let's look at what the term experience means. It represents the full period of time during which a citizen held a certain position and performed his job duties.

Length of service plays the most important role when retiring, since it can affect its size and also when exactly a person can achieve the right to retire. Experience is divided into two types and can be general and special. But for most organizations, including government ones, it is calculated a little differently.

As for the special, in this case only that period of work activity is taken into account during which the person performed work exclusively in his professional field.

Now let's look at what is included in the length of service for civil servants upon retirement. This includes the following:

- Work experience, the duration of which must be at least 15 years;

- Well-deserved leave granted annually to recuperate;

- The period of time spent on sick leave.

Minimum length of service in civil service for granting a pension

As mentioned earlier in this article, in order to obtain the right to retire, it is important not only to reach the retirement age, which, as is already known, has increased, but also to have a minimum amount of work experience. Because if you do not have work experience in a certain field, namely, working all this time in the civil service, you will not be able to retire until you have gained it.

According to the latest changes made to the pension system for civil servants, the minimum length of service must be at least 15 years. And all this time you had to work in your professional field.

If the total amount of your experience is 15 years, but you did not work all this time in your field of activity, then this experience is not taken into account and is not complete.

It should also be noted that government employees are also entitled to additional benefits regarding their professional work experience. If the size is 15 years, then the additional payment is 45% of the previously received wages.

Payment of pensions for length of service to civil servants

This type of pension must be earned by working a certain number of years in the civil service. The size is determined by the length of service:

| Fifteen years of experience | Subsidy of 45 percent of the average monthly salary |

| With more than 15 years of experience | Each additional year worked adds 3 percent |

The total subsidy should not exceed 75 percent.

Possibility of receiving additional payment

Any employee working in the civil service can receive a bonus for length of service (doctors, military, teachers, federal and municipal civil servants). The amount of the bonus is calculated individually.

The basis for calculating the bonus is salary. The premium is calculated as a percentage and depends on a number of factors:

- Sphere of entertainment.

- Number of years worked.

- How long have you worked in a specific position?

- Previously received salary.

- Regional allowances.

- The industry where the work activity was carried out.

- Conditions listed in the labor and collective agreement.

- The amount of premium paid by your organization that is legal.

Who is eligible for payments?

If the employee has worked in the civil service for more than fifteen years, he receives an additional payment to his salary or insurance benefit.

Citizens who have worked:

- in unfavorable and difficult conditions;

- in the northern and equivalent regions;

- at a certain position.

Conditions for granting benefits:

Civil servants had to have fifteen years of work experience this year to receive the subsidy. If you have worked in the civil service for twenty-five years, then applying for a pension is possible without waiting for retirement age.

How to calculate correctly

The bonus is calculated as a percentage of the employee’s salary. The amount of the bonus (if any) is added to the calculated premium.

For rules for filling out a work book, see the article: rules for filling out a work book. Read about which jobs are more highly paid for men here.

The surcharge is subject to income tax. The size of the subsidy depends on the sphere of activity of citizens. For the military sector, the percentage of the allowance is:

| From 2 to 5 years | 10 percent |

| From 5 to 10 years | 15 percent |

| From 10 to 15 years | 20 per cent |

| From 15 to 20 years | 25 percent |

| From 20 to 25 years | 30 percent |

| From 25 and more | 40 percent |

For civil government employees:

| From 1 year to 5 years | 10 percent |

| From 5 to 10 years | 15 percent |

| From 10 to 15 years | 20 per cent |

| From 15 and more | 30 percent |

How is long-service pension calculated for civil servants? Let's look at an example. The employee has been retired since 2008.

The amount of his pension was 4,433.74 rubles. Experience - twenty-five years. Salary amount: RUB 3,287. The average monthly salary is 7,294.27 rubles.

Let's make the calculation:

| The pension amount will be 45 percent of the average monthly salary, with 15 years of experience | Every year, after reaching 15 years of work experience, the increase will be 3 percent. But no more than 75 percent |

| Let's calculate the experience coefficient | 45%+3%*10=75 percent |

| There will be a pension | 5,470.70 (75% of 7,294.27) RUR |

The long-service pension for federal civil servants is calculated using the formula:

P = (45% SZ – SP) + 3% SZ × St, where

| P | Long service pension |

| NW | Average monthly salary |

| JV | For disability (old age), the amount of insurance coverage |

| St | More than 15 years of experience |

Analysis of judicial practice

Imperfect pension legislation leads to legal disputes over the payment of preferential pensions. Let's consider a number of controversial situations.

Disputes due to non-inclusion of internship work in an employee’s length of service:

| Opinion of the Pension Fund | Based on Decree of the Government of the Russian Federation dated October 29, 2002 No. 781. Their opinion is that this work is not included in the list of positions specified in this resolution |

| Judicial authorities, considering this issue, have conflicting opinions | Some do not agree with the opinion of the Pension Fund, since by order of the Ministry of Health of Russia dated October 15, 1999 No. 377, the position of a doctor-intern refers to medical personnel. Others consider working as an intern a stage of education after college and do not consider it necessary to include this period in the work experience |

Disputes related to advanced training of health workers:

| Opinion of the Pension Fund | It is based on the fact that during this period no medical activities were carried out, therefore advanced training courses cannot be included in the length of service |

| Judicial authority | Takes the employee’s position on including this period in the employee’s length of service, since without advanced training the health worker will not be able to carry out medical activities |

Disputes related to the inclusion of parental leave in the work record:

| Pension authority | This period is not included in the length of service for calculating a preferential pension. |

| The court considers | What if the child's leave was taken before 10/06/1992, then this time is included in the length of service. If this period occurred later than 10/06/1992, then due to changes in legislation it is impossible to include it in the length of service |

| There are quite a lot of controversial situations | If they arise, it is necessary to involve an experienced lawyer to resolve the issue. |