Labor legislation provides thirteen grounds for dismissal of an employee at the initiative of the employer. One of these types is the reduction of personnel or positions at the enterprise. People of pre-retirement age are in this case the most vulnerable category. However, employment legislation provides for the right to apply for a pension early, without waiting until a certain age is reached.

Dear readers! The articles contain solutions to common problems. Our lawyers will help you find the answer to your personal question

free of charge To solve your problem, call: You can also get a free consultation online.

Early retirement due to layoffs

Early pension in case of staff reduction or liquidation of an enterprise can be issued after an appropriate proposal from the employment center. Article 32 of the Law on Employment in the Russian Federation No. 1032-1 establishes not only the algorithm for the action of the employee himself, but also guidelines for the employment center, including the timing of assigning such status.

It should be noted that in 2014 laws on the insurance part of the pension and its funded share were introduced. Thanks to these innovations, it became clear how calculations are made and according to what criteria.

So, if a person applying for early retirement (before the age of 60 and 55) falls under redundancy, then it is necessary:

- submit documents through the employment center to establish unemployed status;

- obtain a certificate stating that it is impossible to find a suitable vacant position (criteria of professional suitability, presence of diseases, etc. may be taken into account here);

- if the above criterion is met, receive a written proposal for the preparation of documents for early pension provision;

- submit proposal approval;

- make sure that the insurance period at the time of submitting documents for a pension is sufficient (nominally in 2020, this period of continuous work activity cannot be less than nine years. Subsequently, it will be added one year at a time until 2024);

- contact the pension fund to calculate the coefficient (the threshold for 2020 is 13.8 points, by analogy it should be increased to 30 in the same time interval).

Latest news and changes

It is established by law that the right to receive early pension payments is possible only in the event of complete absence of work, as well as the inability to obtain additional qualifications. But the law also stipulates that an unemployed person can be involved in public labor.

Read about the new individual pension capital system here.

Read the article about how to properly resign due to retirement.

If the employment service refuses to grant early retirement benefits, a citizen may go to court . But in most cases, judicial authorities make negative decisions in these cases, since such payments are not guaranteed measures of social support from the state.

Changing the retirement age in Russia will directly affect the conditions for calculating early pensions. The government has repeatedly raised the issue of not only equalizing the retirement age for men and women, but also gradually increasing it. Starting in 2020, the retirement age for civil servants has already been raised to 65 years .

Thus, the deadline for obtaining the right to early payments will also shift every year.

Video: Consultation with a specialist

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Reduction of an employee of pre-retirement age

The reduction of a pre-retirement employee is carried out in compliance with the standard procedure. The law stipulates that the worker must be warned 2 months before the expected date of dismissal. After a refusal to assign a pension ahead of schedule has been made, you can count on an extension of the period for paying unemployment benefits.

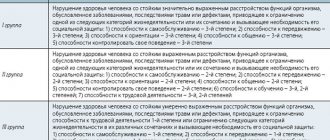

An important criterion is the remaining time until the standard assignment of a pension. A year before retirement or even a couple of years before women reach 55 years of age, and men reach 60 years of age, you can safely expect the Central Bank to offer early retirement. If you were reduced before these years, then you should not apply for a reduction in the period. We can only talk about length of service, which when working in the Far North, for example, is calculated differently, which means that the onset of pensions is early (if you compare other regions in the Russian Federation). To accumulate points, a connection is established not only with length of service, but also with the place of work, as well as with the working conditions in a reduced position. For example, in accordance with the requirements of Order of the Ministry of Health and Social Development 302n, additional guarantees and compensation are provided (including when establishing a harmful class of working conditions).

What the law says

An employer (company, individual entrepreneur) has the right to terminate an employment contract in cases of reduction in headcount or staff (clause 2, part 1, article 81 of the Labor Code of the Russian Federation). But everyone must be notified about the upcoming dismissal and signed at least 2 months before the farewell date (Part 2 of Article 180 of the Labor Code of the Russian Federation).

At the same time, when reducing the number or staff, the employer is obliged to offer the employee another available job (vacant position) in accordance with Part 3 of Art. 81 of the Labor Code of the Russian Federation (Part 1 of Article 180 of the Labor Code of the Russian Federation).

According to Art. 179 of the Labor Code of the Russian Federation, in case of layoffs, employees with higher labor productivity and qualifications have a preferential right to remain at work.

With equal labor productivity and qualifications, preference is given to:

- family - in the presence of 2 or more dependents (disabled family members who are fully supported by the employee or receive assistance from him, which serves as their permanent and main source of livelihood);

- persons in whose family there are no other independent workers;

- employees who received a work injury or occupational disease while working for this employer;

- disabled people of WWII and combat;

- employees who improve their skills in the direction of the employer without interruption from work.

By the way, a collective agreement may provide for other categories of workers with a preferential right to remain at work with equal labor productivity and qualifications.

According to Part 1 of Art. 178 of the Labor Code of the Russian Federation, upon termination of an employment contract due to a reduction in the number or staff of employees of the organization - paragraph 2 of part one of Article 81 of the Labor Code of the Russian Federation - to the dismissed person:

- pay severance pay in the amount of average monthly earnings;

- retain their average monthly earnings for the period of employment, but not more than 2 months from the date of dismissal (including severance pay).

This is important to know: Survivor's pension and self-employment

In exceptional cases, the average monthly salary is retained for the dismissed person for the 3rd month from the date of dismissal - by decision of the employment service, provided that within 2 weeks after dismissal the employee (Part 2 of Article 178 of the Labor Code of the Russian Federation):

1. Contacted this authority.

2. He was not employed by him.

- or compulsory work for up to 360 hours.

Source: Rostrud review of current issues from workers and employers for January 2020.

If you find an error, please select a piece of text and press Ctrl+Enter.

Who cannot be fired due to staff reduction: Labor Code of the Russian Federation

The amount of severance pay may be disputed. In this situation, the organization pays the employee the undisputed portion of the amount. The remaining portion is paid based on an agreement between the employee and management or by court decision.

We recommend reading: State Payments Upon the Birth of a Second Child in 2020

In addition to the list of those who cannot be fired due to staff reduction, the Labor Code also has such a concept as “preemptive right”. According to Article 179 of the Labor Code, this right gives employees of organizations the advantage of maintaining their jobs in case of staff reduction, depending on the quality of their work duties or social reasons. These workers are the last to be laid off.

Reduction of a woman having a child over 3 years of age

There are also nuances when transferring a woman during a reorganization at an enterprise. Based on Article 72.1 of the Labor Code of the Russian Federation, it is possible to transfer an employee to another place of work due to production needs with his consent, which implies initiative on the part of the employer. But if necessary, a woman can also become the initiator.

We recommend reading: Power outages in 2020 Commercial Real Estate Timing

The duration of maternity leave is until the child reaches the age of 3 years. However, not all women are ready to be on maternity leave for 3 years, and many go to work earlier than the period specified by law. This right is granted by the Labor Code, according to which a woman has the right to go to work at any time.

Algorithm of actions for reduction

After dismissal as a result of a reduction or termination of the employer's employment, a person must register with the labor exchange within a period not exceeding two weeks. If during the first three months he is not found a job in his specialty, then the former employer will pay the laid-off employee severance pay .

Then, if it is impossible to find a job for a person, he may be offered to continue to be listed on the stock exchange and receive monthly cash payments for two years, the amount of which is stipulated by the state. Or retire early.

In order to become a pensioner ahead of time, you must prepare the following documents:

- A certificate from the labor exchange indicating that the person is unemployed.

- Statement.

- Passport.

- Work book.

- Military ID.

- SNILS.

- Documents that contain information about the amounts of cash deductions, as well as the time when they were made. These papers are requested from the Pension Fund, warning of their purpose. Here they are pre-certified.

- A certificate from the organization in which the citizen worked. The document must contain information about the average earnings received by a redundant employee for five consecutive years. The certificate must be signed by the director and chief accountant, and the organization’s seal must be affixed to it.

This is not a complete list and may change depending on the situation. Therefore, you should first contact the Pension Fund at your place of residence and clarify what documents need to be provided to apply for a pension. Having collected a package of documents, they are delivered to the Pension Fund and await a decision. Unfortunately, it is not always positive.

Amount of early pension

Early payment of a pension is calculated according to the same principles as the payment of an insurance pension. The formula for calculations is as follows:

DP=LPK*SPK + BV,

Where:

- DP – amount of early retirement benefit;

- LPK – personal pension point;

- SPK is the price for one pension point per year of applying for a pension;

- BV – basic payment.

In 2020, the basic payment is 4805.11 rubles, and the price of one point is 78.28 rubles. These two values are set at the state level taking into account inflation for the previous year.

The basic payment is set at an increased amount for certain social groups of the population: disabled people of group 1, persons providing for dependents living or working in the North of the country.

In a situation where the calculated DP amount is less than the minimum for a pensioner’s living expenses, an additional payment is assigned up to the specified minimum amount.

Pensioner and layoff

Determination of the Leningrad Regional Court dated January 17, 2013 N 33-100/2013 “Conclusion and justification of the court: The refusal to pay is lawful. The worker's demands were denied. The decision of the trial court was overturned and a new decision was made. The presence of a pension does not deprive pensioners of the right to receive average earnings for the third month of unemployment, but their greater social security requires significant circumstances that could be considered exceptional within the meaning of the provisions of Part 2 of Art. 178 Labor Code of the Russian Federation. The fact of registration with the employment service body and the non-employment of the employee by this body cannot be considered as exceptional circumstances. The provisions of Part 2 of Art. 178 of the Labor Code of the Russian Federation, these circumstances are classified as mandatory conditions under which the employee retains his average earnings for the third month from the date of dismissal. The employee did not provide evidence that she had exceptional circumstances in connection with which she could claim to retain her average earnings for the third month from the date of dismissal (lack of means of subsistence, serious illness requiring expensive treatment, etc.).”

We recommend reading: Documents for Certification of a Doe Educator for Compliance with the Position Occupied

No, if the Central Protection Commission had demanded an answer from the employee as to why it didn’t suit him there, it would have made more sense. And the problems will be solved as soon as (alas, unlikely) a law on parasitism appears

Dismissal of a working pensioner: rights of those retiring

In difficult economic situations, many managers are forced to make a decision to sharply reduce the number of employees at the enterprise. In most cases, the first to be hit are workers of retirement age. At the same time, management is guided by the consideration that they receive a pension and are socially protected, unlike other employees.

Work upon dismissal of a pensioner must be in the organization within three days if he wrote the following wording in the application: “I ask you to dismiss me of my own free will as a working pensioner.”

IF YOU ARE REDUCED

Good afternoon, I am an employee of the Ministry of Emergency Situations of Russia. On April 7, 2020 (although according to the law it should have been handed over exactly two months in advance, i.e. April 1 of this year), I was given a notification against signature that my position was being reduced from May 30, 2020, despite the fact that I I’m studying at the correspondence faculty at the academy at the Ministry of Emergency Situations of Russia, so far no positions have been offered, although this is being done at the very last moment. Do they have the right to lay me off if I’m studying at the correspondence faculty and what to do in this situation to prove that I’m right.

I was familiarized with the order of reorganization against signature. My department is not included in the new structure. I have not yet been notified of the reduction in staff against signature. I am an old-age pensioner. Can I register with the stock exchange as unemployed 2 months after the order for layoffs while maintaining the provided payments? ?

We recommend reading: Benefits for 3 RKbenka in 2020 in the Leningrad Region

Can a woman approaching retirement age be fired due to staff reduction?

The Reception Room on the Altaiskaya Pravda information portal received an appeal from a reader who is facing layoffs at the age of almost 54 years. “I was born on January 6, 1965. What year should I retire? On November 9, 2018, I was given an order to reduce my position. Is this legal? According to the law, what age is considered pre-retirement and protected by law? — Nadezhda wrote.

We recommend reading: Bondronat is included in the List of Drugs for Group 1 Disabled People

The generally established retirement age for the appointment of old-age insurance pensions from January 1, 2020 is 65 years for men and 60 years for women. The change in retirement age will be gradual, during the transition period until 2023, with an annual increase in age of 1 year. During the transition period, men born in 1959-1963 and women born in 1964-1968 will retire.

It’s like you were killed mentally.”

These same women encouraged the management to make a decision on the person they were looking for more quickly. They called me and offered to fill out documents. If it weren’t for them, I wouldn’t have stayed there: the work is unfamiliar, it’s hard to figure things out on my own. You learn everything new, ask again several times. On my first working day I wanted to pick up my documents. The flow of people is unbearable. But you get used to everything.

Many of them come looking as if they are owed everything. And they are waiting for the same reaction - for everyone to cave in to them. They publicly ask to call the administration, raise their voices, and attract attention. The administration knows this type of people: and it’s easier for them to just play along. They are visible immediately, even audible over the phone.

We recommend reading: What Documents Are Required to Apply for Russian Citizenship by Marriage 2019