How pensions are organized in Europe

The governments of many developing countries of the European Union are interested in ensuring that pensioners receive payments that are sufficient to meet all needs.

The main focus of many pension-related reforms in European countries is raising the retirement age.

There is a rational grain in this, because many older Europeans, regardless of their age, work, which means they have a stable source of livelihood.

Reference! Many employers prefer to employ people of retirement age rather than young workers, because older people, as a rule, have extensive experience and all the skills and knowledge necessary for effective work.

The standard of living of older people is affected by the following:

- minimum established amount of pensions;

- indexing pension provision taking into account inflation in the state;

- benefits for pensioners;

- retirement age. It depends on the average life expectancy, as well as on the consumer basket.

Average payout level

The pension system is best developed in the following countries:

- Danish . Denmark is considered a “Mecca” for old people. Citizens of other European countries want to work in Denmark in order to receive payments in the future, the average amount of which is 2.8 thousand dollars monthly.

- Finnish. The average payment in Finland is $1.9 thousand. The amount of pension benefits depends on the length of service and salary.

- Norwegian . The highest retirement age is set here (67 years). However, the amount of payments compensates for such a “shortcoming”. The standard of living in the Norwegian state is quite high, even taking into account the high taxes paid by workers and businessmen.

- Czech. Here you can receive a pension from the age of 58. The average payout is 1 thousand dollars.

- Germanic . About 25 percent of Germans receive pension benefits, the average amount of which is 850 euros. In addition, every pensioner can count on support from the state, which includes the opportunity not to pay for utilities.

- French . Here pensions depend entirely on length of service and salary. The French become pensioners at the age of 60.

Danish pension for foreigners

A foreigner can also count on a pension in Denmark. To do this, he will need to legally live in the country for at least 10 years (five of them immediately before retirement) and work. This can easily be achieved by those who have mastered a sought-after specialty (in the field of medicine, IT and science) or have decided to open and develop a business in the country and have considerable capital for this.

And here you don’t have to worry about losing your job. Firstly, the country is experiencing a fairly high staff shortage, and secondly, unemployment benefits in Denmark allow you to lead a decent life and not rush to look for a suitable vacancy. The payout is almost equal to the amount of lost earnings, averaging $2,600.

You can find out about unemployment benefits in different countries of the world by following the link.

In general, the system of benefits and social benefits not only for pensioners, but for all citizens in the country is well developed. For example, single mothers and mothers on maternity leave receive decent payments, and they also have subsidies for housing costs. And this is in addition to the benefit for a child under 16 years of age.

But payments for loss of ability to work are compensated until the person can provide for himself. If this moment does not come, then he may be assigned a social pension. The latter is comparable to the corresponding old-age benefits.

Social Security for Retirees in the USA

The average pension in the United States of America is 1.2 thousand dollars. You can become a pensioner at the age of 62. At the same time, you can retire later, up to 67 years of age. The later a person stops working, the more money he will receive in the future. The average life expectancy in America is 78 years.

Reference! In total, 15.3 percent is withheld from a citizen’s salary for social needs. 50 percent of this amount is paid by the citizen himself, 50 percent by the employer.

In addition, America has many programs that allow citizens to save for their own life in old age. For example, there are special savings accounts that are exempt from taxation.

In which European countries do pensioners live poorly?

The ranking of such countries includes the following:

- Russia. The average payout is $242.

- Bulgaria - $251.

- Romania - $446.

- Lithuania - $408.

- Estonia - $656.

- Latvia - $327.

Recent pension reforms in Russia have made little difference to the lives of older people. Many of them do not have enough money to cover the minimum costs of food and housing and communal services.

Today, Russia ranks 18th in the world among countries that pay social benefits to older people.

Russian pensioners do not have the chance to travel around the world, like, for example, their German or Czech “colleagues”.

Pensioners in many European countries have been saving certain amounts for many years, which they then spend on travel. This is a common practice in developed and developing countries.

Pension in Australia

The state pays single elderly people approximately $0.5 thousand monthly. Families of 2 people receive 0.9 thousand dollars for two. The average salary in the state is 4.5 thousand dollars. Like other social benefits, pension benefits are indexed every year due to price increases.

Not all citizens receive the above amounts. If an Australian has a home worth more than $160,000, the pension benefit is reduced. For all other types of property there is a limit of 280 thousand dollars. A citizen may be completely left without pension payments if he is the owner of expensive property.

People who have large incomes tend not to go beyond the legal limit. Of course, what is important to them is not so much the pension itself as the benefits for pensioners.

How does this happen?

To begin with, the Danish pension system consists of two main elements: the state pension plus payments from the pension fund.

State pension

is a classic type of social benefits. That is, a person who has earned a lot all his life and has accumulated substantial savings in the bank receives a minimum amount. And if he earned little and saved nothing, then more.

While a state pension helps avoid poverty, a pension from a pension fund

is calculated using a formula more familiar to us: it is proportional to income during working life.

If a person does not have pension savings, he receives a so-called basic pension and a supplement. If he lives alone, this amount is about 18,000 Danish kroner (approximately $2,800)

. It’s interesting that you have to pay some taxes from this amount, but there will still be enough money for a decent, well-fed life.

Supply in China and Japan

A distinctive feature of the Chinese state’s pension system is that agricultural workers do not receive any financial support.

Only managers, civil servants and factory employees are entitled to receive a pension in China . Males begin to receive payments at 60 years old, females at 50. Women who worked as managers become pensioners at 55 years old.

In general, despite the significant economic recovery that the state has shown over the past 30 years, most issues regarding pensions remain unresolved. The average pension payment in the Chinese state is only $80. This situation is due to the large number of old people in China; this nation is recognized as aging.

During his working life, a citizen transfers 11 percent of his own salary to the state. In this case, 4 percent are deducted automatically, and the remaining 7 percent is contributed by the hiring company.

To acquire the opportunity to obtain a basic pension, you must work in a state-owned company for more than 15 years.

In Japan, things are completely different. The average pension payment in Japan is approximately $700. This makes it possible for older Japanese people not to lack money and live a comfortable life. This amount is enough for food, for making utility bills, and for vacation.

Reference! You can become a pensioner in Japan at age 65. In addition, you can start receiving a pension earlier, from the age of 60. However, in this case, the amount of payments will be reduced by 25 percent. On the contrary, if you become a pensioner at age 70, the amount of payments will increase by 25 percent.

According to statistics, Japan has the highest life expectancy. The number of Japanese people who are over 100 years old is more than 60 thousand people. The average life expectancy in Japan is 84 years.

Experts believe that healthy eating helps Japanese people live long. They eat a lot of rice, soy, and fish. Also, when becoming a pensioner, a Japanese citizen does not stop living actively. You can meet pensioners from Japan in any part of the world.

Germany

The level of development of the state depends, among other things, on the attitude towards pensioners. As an example, consider the German pension system. A state with one of the most powerful economies in the world provides its citizens who have reached retirement age with all the conditions for a decent life.

The pension threshold established in the country is the same for men and women and is equal to 67 years. Despite this, citizens of the country can retire without waiting for this age: this is possible in the case when the pensioner pays from personal savings a certain amount necessary to compensate for the funds not received by the pension fund (about 0.3% of the existing savings for each unearned month).

It would be logical to assume that everything is in order with the size of the pension in Germany. On average, women in Germany receive 630 euros, and men - 1080. The average pension is 770 euros.

It should be said that, despite the reunification of the two Germanys, which occurred after the fall of the Berlin Wall, the difference in the development of the east and west of the country still exists to this day.

Working at one of the German enterprises, a citizen of the country contributes about 20% of his earnings to the Pension Fund during his work experience. In this case, half of the contribution amount is collected directly from the employee, the second half is paid by the employer.

Every German has the opportunity to resort to the services of one of the insurance companies in order to independently determine the amount of pension payments and accumulate a pension amount.

To count on an insurance pension, a German citizen must work at one of the country's enterprises for at least 5 years. If certain conditions are met, a pension in Germany can also be accrued to foreigners.

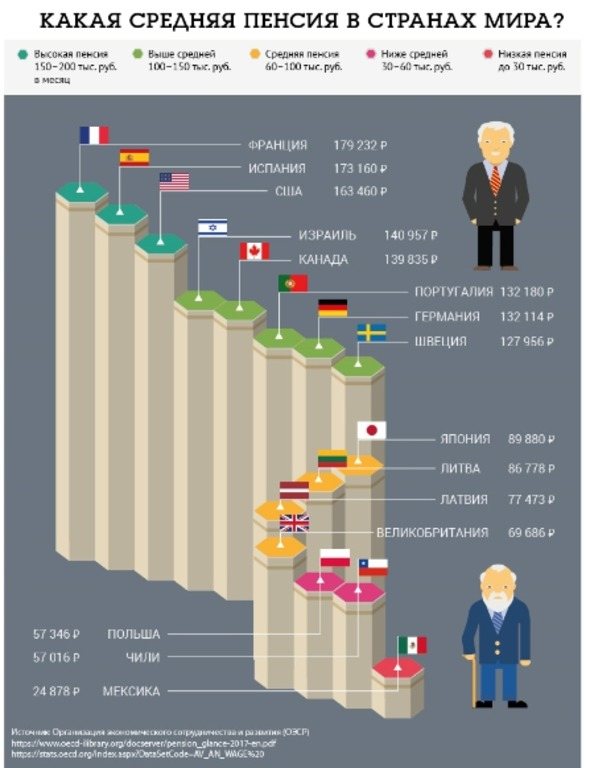

Comparative table of pensions in countries around the world

Here are the figures for the size of pensions in the Russian Federation and European countries as of 2020:

| A country | Average pension, dollars |

| Russia | 285 |

| Germany | 1200 |

| Spain | 1190 |

| Sweden | 833 |

| Italy | 583 |

| Hungary | 400 |

It becomes clear that in European countries pensions are much higher than in Russia. Even in Hungary, older people receive more than in the Russian Federation, to say nothing of countries such as Germany and Spain. However, it must be taken into account that prices in European countries, as well as tax contributions, are quite high, especially when compared with the Russian Federation.

Upcoming reforms

According to analysts, the Russian pension system will not be able to exist in its current state for longer than 5-10 years. This is explained by the need to raise the retirement age, which is an extremely unpopular measure. In this regard, the government is constantly trying to popularize this decision, but so far no success has been achieved.

An obvious drawback of such a solution is the discrepancy between the level and life expectancy and the conditions implied by the reforms being implemented.

Who gets paid and how much in retirement in Germany, watch the video.

In countries around the world, the most dramatic increase in the pension threshold is observed in the United States, where citizens will be able to receive payments only after reaching the age of 69. Kazakhstan plans to level the requirements for both men and women, setting this indicator at around 63 years.

Russia

The average pension in Russia is $150. However, you can receive it from the age of 65. And no one knows what will happen in 5 or 10 years. It is possible that the retirement age will rise to 70 years.

Therefore, if you want a truly dignified old age, then you need to put money aside for a deposit now. In our country, counting on government help is an unaffordable luxury. Therefore, you need to take care of yourself from a young age. We have already talked about the most profitable deposits; you can choose and arrange the most suitable one in the “Deposits” section.