A woman who has received maternity capital can use its funds to form her funded pension. This direction of disposal of the certificate will allow increasing the future old-age pension. The following payments are made from pension savings:

- lump sum payment of invested funds and income from investment;

- immediate pension payment;

- lifetime funded pension.

To direct maternity capital to form a funded pension for the mother (adoptive mother), you must contact the Pension Fund of Russia (PFR) and provide the required documents. An application for an order may be submitted from the moment the second (subsequent) child is three years old . If desired, the owner of the certificate can transfer funds to a non-state pension fund (NPF). If a woman dies, in some cases her husband and children may inherit her pension savings formed from maternal (family) capital (MSC).

According to Part 2 of Art. 12 of Federal Law No. 256-FZ of December 29, 2006 on additional measures of state support for families with children, a mother who decides to use maternity capital to form her pension savings has the right to refuse this direction in favor of any other provided by law. She can do this at any time before her actual retirement .

How to transfer maternity capital to mother's pension?

Maternity capital funds can be used to form a mother's funded pension 3 years after the birth or adoption of a child, with the birth of which the right to receive a certificate arose. To do this, you need to contact the Pension Fund with an application and the required documents; this can be done in one of the following ways :

- when visiting a territorial branch of the Pension Fund of Russia (in person or through a representative);

- by sending an application and certified copies of documents by mail;

- through your personal account on the Pension Fund website or the State Services portal.

When submitting an application via the Internet, you will need to deliver documents to the Pension Fund within the next 5 days .

Maternity capital funds can be used to form a mother’s funded pension, either partially or fully.

In Art. 2 of Federal Law No. 360-FZ of November 30, 2011 “On the procedure for financing payments from pension savings” defines options for obtaining these funds:

- urgent pension payment (its duration is determined by the pensioner independently, but cannot be less than 10 years );

- funded lifetime pension (assigned taking into account pension savings and the expected period of payments - in 2020 it is 21 years );

- lump sum payment (provided that the funded pension is 5 percent or less of the insurance pension, taking into account the amount of the fixed payment established on the day of appointment);

- payment to legal successors (made in the event of the death of the insured person).

Application and documents

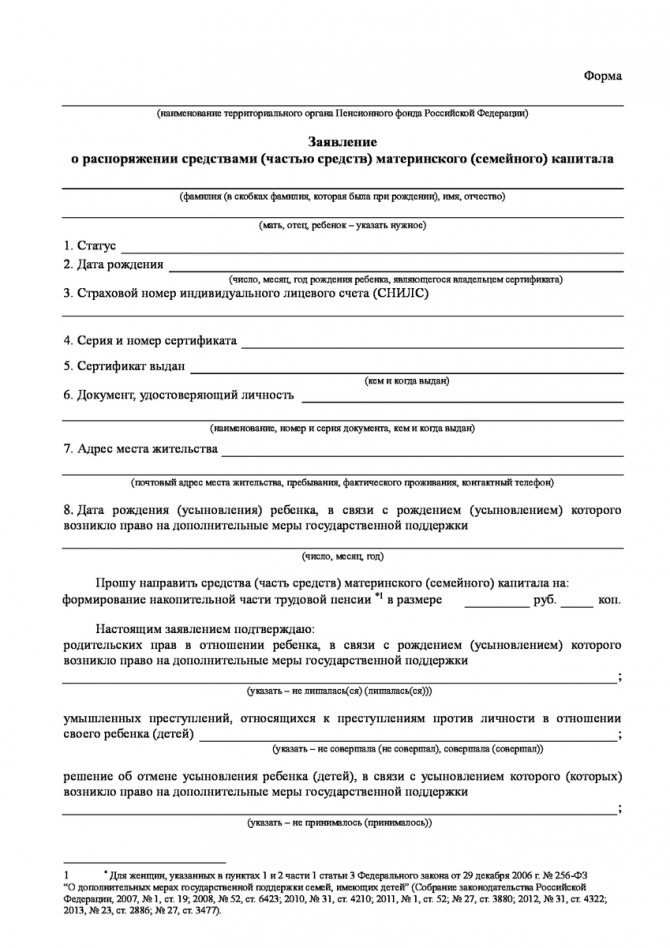

The application for the order must include the following information :

- number and series of the certificate, date of issue;

- date of birth, SNILS number and residential address of the recipient of the certificate, as well as information about the identity document;

- date of birth of the second (subsequent) child;

- direction of use of funds;

- transfer size;

- about the absence of restrictions on parental rights.

Along with the application, you must provide the following documents :

- a document proving the identity of the certificate holder and his place of residence;

- in case of applying through a representative - documents proving his identity, place of residence and powers.

The Pension Fund will make a decision on the application within a month from the date of registration of the application.

How to use maternity capital for your mother's retirement

Only the mother can direct the funds provided by the issued certificate to the funded part of her pension. She has the right to do this only when the child for whose birth a certificate was issued reaches the age of three years.

Neither the father nor the children have the opportunity to use benefits in this direction if the mother loses the right to receive funds under this program. Only a woman with a certificate can use the entire amount of savings or only part of it.

Investing the program funds in this way will help significantly increase the amount of your old-age pension, and this is the only way to cash out the capital.

USEFUL INFORMATION: Why banks refuse loans

Application and documents for application

In order to increase the funded part of the pension at the expense of maternity capital, you need to send an application to the pension fund, which should indicate:

- information about the certificate holder;

- information about the child for whose birth the certificate was received;

- information about the direction in which the desire to spend the funds provided by the program arose;

- the amount that is going to be used for this investment;

- information that there was no court decision on deprivation of parental rights.

statements on the disposal of maternity capital funds

You can submit such an application by visiting the pension fund in person, using your personal account on the pension fund’s website, or using postal services.

The application must be supplemented with the following documents:

- A copy of the certificate.

- Certificate of compulsory pension insurance issued to the certificate holder.

- Certificate holder's passport.

The application is considered for 30 calendar days, then the applicant is informed of the result of the consideration. In case of refusal, the reasons for making such a decision are stated.

Is it possible to transfer funds to a non-state pension fund?

You can also direct the accumulation of funds provided for by the program to a non-state pension fund. The choice of fund depends on the wishes of the owner of the capital.

To transfer funds to a non-state pension fund you should:

- Apply to the pension fund at your place of residence about the decision to use capital in the selected fund.

- Draw up an agreement with a non-state pension fund.

If you use funds in this way, you can significantly increase savings through the investment activities of the fund. You can obtain information about the organization’s income level on the Internet. Also, at present, without losing the income from investments, you can redirect funds to another direction provided for by the program.

When transferring funds to a non-state pension fund, you must remember the risks of such an event:

- refusal of the state guarantee to support the safety of cash savings;

- the risk of losing part of the funds from unprofitable investments.

Savings payment options

There are the following ways to receive cash savings that were aimed at forming the funded part of the pension:

- Perpetual - payments are made monthly throughout life and are calculated based on the expected period.

- Term pension payment - the pensioner himself determines the duration of payments for a period of at least 10 years. This method differs in that it is possible to inherit the unpaid portion of the funds.

- Lump sum - provides for the probability of receiving all funds at once, if their amount is less than 5% of the amount of the assigned pension benefit.

How much will your pension increase using maternity capital funds?

The result of directing maternity capital funds to form the funded part of the mother’s pension will be known only after the woman actually retires. To know the approximate profit of an investment, it is necessary to carry out a calculation .

Example

For example, a woman born in 1992 decided to use MSC funds to form her future pension in 2020. The amount of maternity capital was not indexed after 2020; in 2019, the size of the certificate is 453,026 rubles . A woman will be able to retire when she reaches 60 years of age, that is, in 2052. Accordingly, for 33 years , the funds allocated for the formation of a funded pension will be increased at the expense of the selected pension fund.

For example, the manager’s return for the year is 5.75%. Thus, the amount of pension savings will be:

453,026 x (1 + 5.75%)33 = 2,866,656 rubles

Depending on the type of payment, the increase in the mother’s pension will be:

- unlimited term (21 years) - 2,866,656/252 months = 11,375.62 rubles ;

- fixed-term (10 years) - 2,866,656/120 months = 23,888.8 rubles .

Since the profitability of management companies can change every year, the obtained values are approximate.

Is it possible to transfer maternity capital to a non-state pension fund?

Family capital funds can be directed to the formation of pension savings not only in the state, but also in the non-state pension fund . To do this, the recipient of the certificate must conclude an agreement on compulsory pension insurance (OPI) with the NPF. This can be done at the office of the selected NPF; you must have with you:

- Identification document (passport).

- SNILS.

After the agreement with the NPF is concluded, you need to submit an application for disposal to the Pension Fund along with a standard list of documents and an additional application for transfer to the NPF .

When managing the funds of the MSK certificate, its recipient can change the insurer without losing investment income, in contrast to managing pension savings in the form of insurance contributions paid by the employer and their own investments in the event of an early transfer to the pension fund.

Citizens of the Russian Federation have the right to change their pension fund in one of two ways:

- urgent transfer (transfer of pension funds is carried out after 5 years from the date of application);

- early transfer (funds are transferred the following year after submitting the application).

What happens to maternity capital allocated for retirement if a person dies?

Legal successors have the right to receive the balance of maternity capital and income from their investment only in the event of the death of the insured person during the period after the assignment of an urgent pension payment to him (see more details on the website of NPF Sberbank). The circle of legal successors is limited to the following persons:

- father (adoptive parent) of the second or subsequent child;

- minor children (child), upon whose birth the right to maternity capital arose, or adult children if they are studying full-time and have not yet reached the age of 23 years.

If pension savings were formed in a non-state pension fund, the legal successor must contact the NPF before the expiration of 6 months from the date of death of the certificate owner. If the deadline is missed, it can be restored in court.

When applying for payment of pension savings, you must provide an application and the following documents (certified copies):

- passport (copy of all pages of the document) or birth certificate (if the legal successor is a child);

- documents confirming family relations with the recipient of maternal capital;

- death certificates;

- SNILS of the certificate owner or another document containing the insurance number of an individual personal account.

How to transfer maternity capital to your mother’s pension: where to apply and what documents are needed for this

Reading time: 6 minute(s) Every woman who gives birth to two children is entitled to an additional subsidy from the state. How to use maternity capital for your mother’s retirement? To transfer savings, you need to submit an order to the territorial department of the Pension Fund in person or through a multifunctional center. In some cases, the father of the children or the children themselves receive the right to manage money. Before filing an appeal, you need to know the features of this direction of capital, as well as the opportunities provided by law to cancel a previously submitted order.

Conditions for receiving maternity capital and program details

Federal Law No. 432-FZ dated December 28, 2017 extended the validity of the maternity capital program until December 31, 2021.

The conditions for receiving maternity capital are specified in Art. 3 of Law No. 256-FZ of December 29, 2006:

- a parent of a child who applies to the Pension Fund or the MFC to receive a certificate for maternal capital must have Russian citizenship;

- applicants for maternity capital can be women who gave birth or adopted a second, third or subsequent child, if the child was born later than January 1, 2007 and the woman has not previously applied to the Pension Fund for a certificate.

In exceptional cases specified in Art. 3 5 of Law No. 256-FZ, the right to dispose of money on maternity capital passes to the father or the child himself:

- The right to dispose of the certificate passes to the child's father if the mother is declared dead, if she has lost parental rights, as well as in the legally established process of canceling the adoption.

- If the right to dispose of funds passed to the child’s father, but the child’s father died, lost parental rights, and the process of cancellation of adoption was carried out in relation to him, the right of disposal passes to the child after receiving full legal capacity.

The amount of capital in 2020 is 466,617 rubles.

Where to go and what documents need to be prepared?

The child’s mother or father has the right to apply for a certificate of maternal capital at any time convenient for them. There are four ways to send such a request:

- at a personal reception at the Pension Fund at the place of residence or stay;

- through the citizen’s personal account on the Pension Fund website;

- through a multifunctional center;

- by mail.

The following documents must be attached to the application:

- applicant's passport;

- birth certificates of children (adoption);

- confirmation of Russian citizenship of the second child;

- for a proxy: passport, confirmation of representation.

If the father receives a certificate, additional information related to the child’s mother is provided:

- mother's death certificate, court decision depriving the mother of parental rights;

- court verdict finding the mother guilty of a crime against the person of the child.

When transferring rights to maternal capital to a child, additional forms are provided:

- death certificate of parents or decision of authorized bodies to deprive the mother and father of parental rights;

- court verdict finding parents guilty of a crime against their child.

The form to fill out to receive capital can be downloaded from the Pension Fund website.

Sample application for transfer

According to Art. 13 Appendix 1 to the order of the Ministry of Labor and Social Protection No. 606n dated 08/02/2017, the order must contain:

- name of the Pension Fund branch to which the application is sent;

- Full name of the applicant;

- status of the recipient of funds (mother, father, child);

- passport;

- information about the applicant’s place of residence or place of stay;

- date of birth, date of adoption of the child, according to which the right to dispose of maternity capital arose;

- information about the applicant’s representative: passport, power of attorney;

- an indication of the choice of disposal of money, for example, the formation of an additional pension;

- information about restrictions on the disposal of maternity capital, if any (for example, in connection with the deprivation of parental rights of the mother);

- bank details of the recipient of funds;

- applications.

The order must also include a note indicating familiarization with Order of the Ministry of Labor and Social Protection No. 100n dated 03/11/2016 as amended by Order of the Ministry of Labor and Social Protection No. 609n dated 03/03/2017 in case of sending funds for an additional pension.

Below is a sample of such a request.

The application form can be downloaded from the link: https://yadi.sk/i/Os4ZjeDr3SYqqM

Transfer of maternity capital to the funded part of the mother's pension

In accordance with Art. 12 of Law No. 256-FZ, you can use maternity capital for the mother’s pension, that is, transfer savings to a management company or to a non-state pension fund (NPF). In accordance with paragraph 4 of Art. 33.3 of Law No. 167-FZ of December 15, 2001 and Art. 6.1 of Law No. 351-FZ of December 4, 2013, until 2020, contributions to the accumulated pension are taken into account as an insurance pension with appropriate indexation.

In what form can savings payments be made?

In accordance with Art. 2 of Federal Law No. 360-FZ of November 30, 2011, maternity capital can be paid in the following order:

- Like an immediate pension payment. The amount of charges is determined by the formula:

SP=PN/T, where SP is the amount to be issued, PN is pension savings, T is the number of months of pension issuance, which cannot be less than 120.

- In the form of a one-time subsidy. It is assigned when the amount of the accumulated additional pension does not exceed 5% of the amount of the insurance pension and the coefficients that increase it.

- Like a funded lifetime pension. When assigning such a pension, all amounts in the individual personal account with the Pension Fund are taken into account, but length of service is not taken into account.

Impact on the size of future pension

The legislation allows you to calculate the addition in current prices to the future insurance pension.

In 2020, the cost of the pension coefficient is 93 rubles. The period of parental leave cannot exceed one and a half years. For the first child, 1.8 points are awarded per year of maternity leave, for the second - 3.6 points, for the third and fourth - 5.4 points each. Thus, the increase in the insurance pension at current prices will be:

- 1.8 x 1.5 x 93 = 251.1 rub. for the first child;

- (1.8 + 3.6) x 1.5 x 93 = 753.3 rub. for two children;

- (1.8 + 3.6 + 5.4) x 1.5 x 93 = 1506.6 rubles. for three children;

- (1.8 + 3.6 + 5.4 + 5.4) x 1.5 x 93 = 2259.9 rub. for four children.

When calculating the additional savings pension, it is necessary to take into account the assumption that there is no moratorium on the savings (accumulated) pension, which is valid until 2020. According to feedback from federal agencies, freezing pensions is a necessary measure to cover the budget deficit. With an average salary of 33,300 rubles. with an annual indexation of 3%, taking into account only maternity capital with an annual return of 4% per annum, the amount of the additional pension in the absence of a moratorium could be as follows:

- 12061 rub. for a woman born in 1990;

- 9222 rub. for a woman born in 1985;

- 6887 rub. for a woman born in 1980;

- 4969 rub. for a woman born in 1975

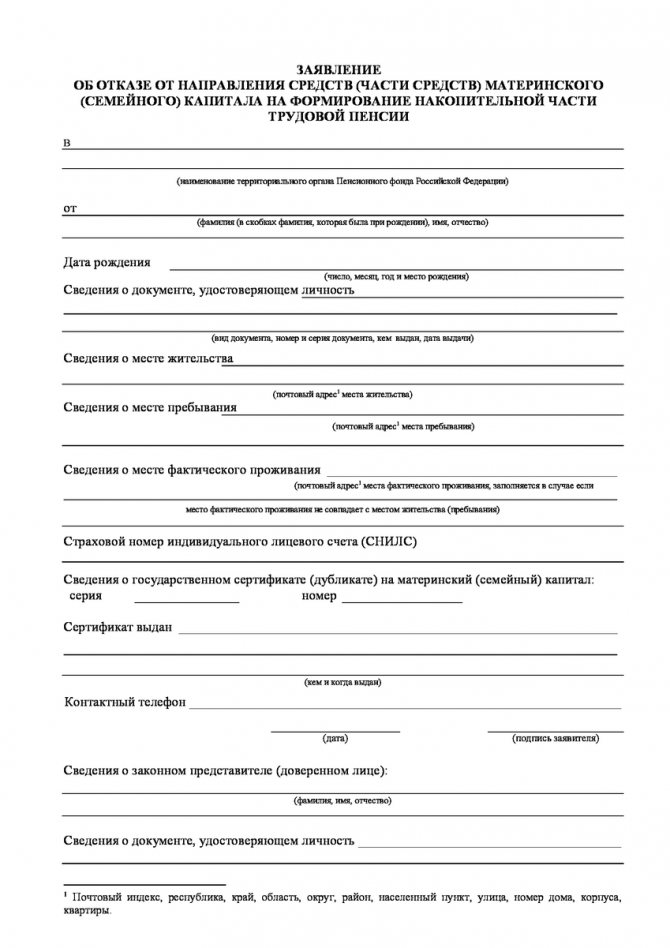

Registration of refusal to send MSC for the formation of the funded part of the mother’s pension

According to Art. 12 of Law No. 256-FZ, before the appointment of an old-age pension, the owner of maternal capital can apply to the Pension Fund to refuse an additional pension and transfer capital in one of the following directions:

- to improve living conditions;

- for the education of a child or children;

- for the purchase of goods and services for a disabled child (expense item introduced by Law No. 348-FZ of November 28, 2015).

In general, such an order can be made at any time after the child for whom the capital was received reaches three years of age.

An appeal may be submitted earlier than the established date when sending funds for a down payment on a mortgage, for the purchase of goods and services for a disabled child, or for preschool education.

In accordance with the Rules for refusing to transfer maternity capital for an additional part of a pension, approved by Order of the Ministry of Labor No. 100n dated March 11, 2016, an application for a new use of savings can be transferred in the following ways:

- through the territorial branch of the Pension Fund at the place of residence;

- through the MFC;

- through your personal account on the Pension Fund website.

Sample application for refusal

The appeal must contain the following details:

- Full name, date of birth of the applicant;

- passport data;

- information about place of residence, stay, actual residence;

- SNILS number;

- information about the issued certificate (series and number, date of issue).

The order must also indicate the amount of funds allocated for other needs and attach a copy of the passport to it.

Sample:

The corresponding form can be downloaded on the Pension Fund website or via the link: https://yadi.sk/i/BQAIgXWM3SZ9d8.

Is it possible to receive maternity capital after the death of a mother?

Article 3 of Law No. 256-FZ outlines cases where adoptive parents receive maternity capital after the death of the mother: if two or more children born after January 1, 2007 are adopted by a woman and a man, the woman receives maternity capital. If the only adoptive parent of the children is a man, the certificate is issued to the man.

Maternal capital is not paid to the adoptive parent if the children are his stepsons or stepdaughters.

Children left without parental care manage maternity capital independently after receiving full legal capacity (after coming of age).

A woman can receive maternity capital in the form of a pension only if additional savings exceed 5% of the total insurance pension. Otherwise, you should rely only on a one-time benefit. If the mother does not work, that is, does not have an insurance pension, she is still entitled to a one-time subsidy or a fixed-term accumulated pension. The owner of the capital has the right to submit a request to cancel the transfer of money to a pension after the child turns 3 years old or earlier than the established date, if it is necessary to spend the capital on pre-school education or on the rehabilitation of a disabled child.

Did this article help you? We would be grateful for your rating:

1 4