Insured citizens of the Russian Federation who form pension savings have the right to choose each year the method of their formation, as well as the management company itself. The latter can be either the state Pension Fund of Russia (PFR) or NPF - a non-state pension fund.

Some citizens are so-called “silent”, that is, they have never submitted relevant applications. In this case, they automatically form their pension savings through the state pension fund (PFR). The investment of pension savings will be handled by the state-owned management company Vnesheconombank, since the Pension Fund of the Russian Federation has entered into a trust management agreement with it for pension savings. In the article we will look in detail at how to choose a non-state pension fund or pension savings management company and the procedure for cooperation with them.

Choosing a non-state pension fund: what you need to know

Before we begin to analyze and select a suitable non-state pension fund, let’s understand how the funded part of the pension is formed and what it consists of.

Pension savings may include:

- Part of insurance premiums.

- Funds co-financed by the state, which the citizen independently paid.

- Maternity capital funds aimed at forming a future pension.

- Profit received from the investment of all contributions.

We figured out the composition. Next, we will consider the issue of distribution of funds depending on the type of pension fund.

Important! In order to understand the issue of where to store pension savings, it is recommended to compare state and non-state pension funds (PFR and NPF). You should also analyze the distribution of contributions in these funds, since the Pension Fund of the Russian Federation has a stable, but not very dynamic level of profitability, and the Non-State Pension Fund has a risk of loss from an unsuccessful investment.

There are several criteria for choosing the optimal non-state fund, statistical data and ratings. And if a citizen has found a fund that offers a higher income, then he has the right to transfer his pension savings at any time, but in order not to lose income, experts advise doing this no more than once every five years.

Profitability of web uk extended for 2020

“The results for the State Management Company portfolios in terms of income are more than a third higher than comparable indicators for the first 9 months of 2020.

The significant growth in income is due to favorable market conditions and the choice of instruments that are optimal in terms of risk/return, first of all, we mean bonds of Russian companies and government securities,” said VEB Deputy Chairman and Board Member Sergei Lykov, whose words are quoted in the message.

At the end of August, VEB unveiled plans for possible participation in another pension segment. “At one time we discussed with the Central Bank how to create a player in the non-state pension system, a non-state fund that both the government and the Central Bank, employing organizations and citizens can trust.

We plan to acquire a blocking stake in NPF Blagosostoyanie. The target time frame is one to two months. We have to explore new opportunities for working with major employers who are interested in creating pension programs for their employees,” VEB Chairman Igor Shuvalov said then.

At the same time, the State Management Company will not be reformatted and will continue to work with savings.

How to find out pension savings in web uk extended

To independently choose VEB Management Company as the manager of your pension savings and investment program, you need to submit an application to the territorial division of the Pension Fund of Russia.

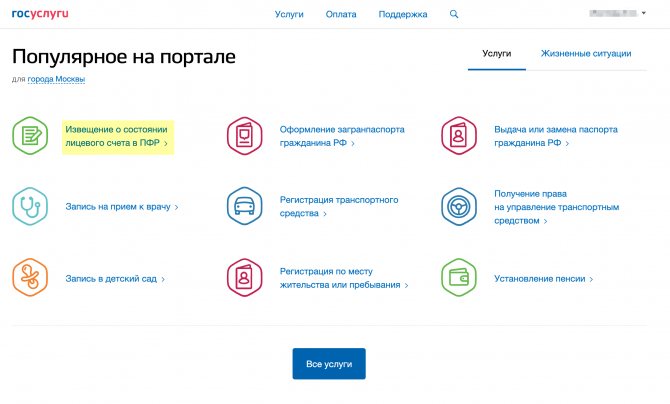

You can also submit an application by mail, through the MFC or the Unified Government Services Portal if you have a verified account.

The funds of all applicants before December 31 of this year will be transferred to the Development Bank from March next.

The money of future pensioners is kept separately from other assets of the Development Bank. Each investment object is selected by the Trust Management Committee based on the degree of probable risk and return. All transactions and operations are checked by the Internal Control Service for compliance with legal requirements.

NPF web uk extended personal account

An old-age pension is a monthly cash payment to people who have reached legal retirement age and are no longer working. In the Russian Federation, the pension system operates through contributions from citizens to special state and private funds.

Those who do this consciously trust the state management company more. This money is completely virtual. Therefore, the savings part must be left. It is necessary to diversify the sources of receiving pensions.

The more ways you can save, the more secure your future. This is the law. An insurance pension reduces the risks of a funded pension under possible negative financial market conditions.

The more money is invested, the more income the state receives.

How to get the accumulative part of the web uk extended

The state financial system in its definition must, as is known, fulfill the tasks of creating conditions for the effective operation of the financial sector of the economy.

This occurs in the form of ensuring the stability of the national currency, access of the population and business to credit resources, asset management infrastructure, as well as the possibility of fair distribution of national wealth, both in the form of financial assets and material ones.

In many ways, this also applies to such areas of ensuring the well-being of citizens as pensions or social insurance.

The overall significance of this one of the most important institutions of any country is the creation of conditions for compensation for citizens who have worked all their lives in the form of guaranteed pensions at the level of the average normal level of consumption of material goods, health care services, etc.

The Russian Pension Fund and the Russian Ministry of Finance equally control the activities of both the state company and private management companies. In both the first and second cases, funds are stored in the accounts of the state depository company. The main difference lies in the principles of the investment strategy of the management company - the investment declaration.

Vek uk extended what is it

For example, you can transfer your pension savings to Vnesheconombank or another non-state pension fund at your discretion. Savings in it are formed from income from investments. At the same time, it is useful to know that Russian legislation provides for the purpose of protecting funds by investing only in those assets that can be called low-risk.

We recommend reading: Subsidies 2020 for Large Families in Tatarstan

This can play a cruel joke if brokers are careless. Highly depends on the economic situation within the country. A prolonged systemic crisis can lead to disastrous consequences. Usually, a comparative description gives a clear idea and answer to the question - which is better?

Web UK Government Securities Yield 2020

Explosions at an ammunition warehouse in the Krasnoyarsk Territory began on the afternoon of August 5. Deputy Defense Minister Dmitry Bulgakov blamed the cause of the fire on human factors.

A state of emergency was introduced in the Achinsky, Nazarovsky districts and the city of Achinsk, which has already been cancelled.

According to the Ministry of Emergency Situations, more than 16 people were evacuated from settlements located within a radius of 15 km from the incident site. He faces from three to eight years in prison.

The beaten man himself denied this version in a conversation with an employee of the office of the Commissioner for Human Rights in St. Petersburg, Alexander Shishlov.

He also submitted a statement to the Ombudsman asking for help, according to a message on the Ombudsman's website.

Law enforcement officers detained a new defendant in the case of mass riots in the center of Moscow on July 27, TASS reports, citing a source.

Starting next year, the funded part of the “silent people’s” pension will be invested in VEB’s expanded portfolio

The branch of the Pension Fund for the Tomsk Region draws the attention of residents of the region: in order to leave their money - the accumulative part of the future pension - in a conservative portfolio, a citizen must write an application to the Pension Fund at their place of residence by September 30. The money of those who do not write an application before this time will automatically fall into VEB’s expanded portfolio.

The State Administrator (VEB), according to the law that came into force on August 1, will be able to invest the funds of future pensioners - the funded part of the pension - in a larger number of financial instruments starting next year.

This money will be divided into two portfolios: conservative and expanded. Funds from the first will be invested, as before, only in government securities. Money from the second part will be invested in a wider range of financial instruments.

VEB will be able to invest them not only in government securities, but also in bonds of large Russian companies, mortgage-backed securities, as well as in ruble deposits in banks.

In addition, the state management company can transfer part of the money into foreign currency and securities of international financial organizations.

In old age

If your savings part is managed by a private management company, I would also recommend switching to VEB’s government securities portfolio to hedge against a recession. If you are already in a non-state pension fund, then you need to wait five years for the transition so as not to lose investment income.

As 2008 showed, during periods of instability, the most conservative strategy proves to be the undisputed leader in the market. The same thing happened at the end of 2020, which was recognized as the worst year for investors in a century, as more than 90% of asset classes showed losses.

As a result, last year the leader in profitability of managing the funded part of a pension was VEB’s government securities portfolio (almost 7% per annum, while almost all private management companies and non-state pension funds made less than 5.5-6% per annum).

VEB's expanded portfolio showed results at the level of management companies and non-state pension funds (slightly above 4%).

We recommend reading: Rosgosstrakh Auto insurance Osago Online 2020

Maternity capital for mother's pension

- to your local branch in person or through a representative;

- through the MFC;

- by mail, in which case it is not the original documents that are sent, but their notarized copies; the signature on the application must also be certified;

- through State Services or the personal account of the Pension Fund.

To use the certificate funds for your mother’s pension, you must contact the Pension Fund (PFR) with an application and a passport. If a woman sends her savings portion to non-state pension funds (NPFs), she will also need an application for transfer to the NPF.

Pension savings management: top 8 best companies

If at the beginning of the year 40 portfolios participated in the rating, by the end of the first quarter their number had decreased to 38; in the second and third quarters, one company terminated the trust management agreement with the Pension Fund of Russia, but in the last quarter of the past year their number sharply decreased to 21 (due to that PFR contracts with a number of companies were not renewed).

The first group (high level of quality of pension savings management by the Pension Fund) included 8 companies with 8 management strategies, the second group (average level of quality of pension savings management) included 11 companies with 11 portfolios, respectively, the third group (low level of quality of pension savings management) included 4 companies with 5 management strategies.

Khvorykh Irina Alexandrovna

We would like to inform you that on March 29, 2020, from 18:30 to 00:00 (Astana time), technical work is planned to be carried out in the WEB-SFM subsystem. In this regard, the system will not be available during the specified period.

Source: https://nl-consalting.ru/oformlenie-razvoda/dohodnost-veb-uk-rashirennyj-za-2019-god

How is a funded pension formed?

According to the compulsory pension insurance system, today the insurance premium rate is 22% of the insured citizen’s salary. The joint tariff (it is not recorded on the consumer’s personal account) is considered to be 6%. The remaining 16% goes to the formation of pension capital. After this, the distribution of the tariff occurs depending on which pension option the insured citizen has chosen:

- 6% goes to the funded pension, and 10% to the formation of the insurance pension.

- All 16% goes towards the formation of an insurance pension.

You need to understand that the formation of a funded pension occurs not only from the 6% that his employer contributes every month for an employee. Savings also come from funds that are independently and voluntarily contributed by a citizen who takes part in the pension co-financing program, as well as from maternity capital and the investment of funds that are in a personal account.

So, the total amount of the funded pension is formed from the sources listed above.

What is trust management of a funded pension in a management company?

The issues of managing pension savings must be approached very seriously. Currently, there are many pension funds and management companies on the market that offer their financial services to citizens.

Many future pensioners are not yet ready to invest their funds in non-state funds, so the issue of trust management of the funded part of the pension in a management company is urgent for them.

Formation order

Insurance contributions to the Pension Fund amount to 22% of the employee’s official salary, and it is this amount that the employer is obliged to transfer to the country’s budget.

- 16% These insurance contributions are reflected on the personal account of the insured and directly affect the size of his future pension:

- if a citizen does not participate in the formation of a funded pension, all 16% goes to the insurance account;

- when investing pension savings in a non-state pension fund or management company, 6% of contributions are transferred to their account, and 10% remains with the state to form the insurance pension of the insured.

- The remaining 6% (out of 22%) goes to pay the fixed part of the pension to current pensioners.

In addition to mandatory pension payments that the employer is required to make, the funded part of the pension can be increased through the following income:

Indexation of pension savings invested in a non-state pension fund or management company occurs through the investment of these funds in assets with stable returns (securities, shares). The list of these assets is subject to strict control by the state.

Insurers of pension savings in the Russian Federation can be state or non-state pension funds:

- The specificity of the state fund is such that a citizen has the right to choose the company that will manage his financial resources.

- NPF clients do not have such a choice, since the fund resolves all issues regarding invested savings independently.

The choice of fund also affects future pension transfers. If the savings are held by the management company, then the Pension Fund will handle all pension payments. The money invested in the NPF will be paid to the pensioner from the accounts of the non-state fund.

The legislation of our country does not prohibit changing NPFs or management companies. The transition can be made at any time at the request of the insured person, but in order to preserve investment income, this should be done no more than once every 5 years.

In order to transfer your savings from the Pension Fund to the NPF, you must follow the following procedure:

- Sign an agreement with the selected fund.

- Submit to the Pension Fund an application in the prescribed form for the transfer of pension funds to a non-state pension fund.

- To change the fund for the next year, all necessary documentation must be completed no later than December 31 of the current year.

Transfer of funds to the management company

Unlike non-state pension funds, the state fund works more openly and gives its clients the opportunity to choose the company that will manage their savings. This can be either a state-owned company or any private company that has concluded a corresponding agreement with the Pension Fund of Russia.

Trust management is the management of various financial assets based on the voluntary instructions of their owner. According to Federal Law 75 of 05/07/1998, only management companies are vested with such powers in our country, and state funds cannot independently manage pension savings.

Citizens born in 1967 could invest their funded pension in a non-state pension fund or management company until 2020 inclusive. For those who still haven’t made a choice, the funds were transferred to the management of the State Management Company “Vnesheconombank”.

A trust agreement can be concluded with a management company for a maximum period of 15 years and must contain the following information:

- investment declaration;

- financial identifier approved by the Bank of Russia (determines management efficiency).

Based on this, the fund’s responsibilities include the mandatory transfer of data on the conclusion of an agreement with the management company to the Bank of Russia within three days from the date of signing.

How to transfer pension contributions to the management company

Regardless of whether a citizen himself chose a management company or a non-state pension fund, or automatically fell into the management of the State Management Company "Vnesheconombank", he always retains the right to change the management company at any time. To transfer savings to another management company, the insured person must contact the Pension Fund with a written application. This procedure can be carried out in the following way:

- personal visit to the Pension Fund;

- through an authorized representative;

- through the post office;

- using the State Services website or the Pension Fund (in this case, the application must be sealed with an enhanced electronic signature).

Changing the management company does not affect investment income, since the fund itself, in which the savings are located, remains the same, so the management company can be changed every year. The transfer of funds to another management company occurs before April 1 , provided that the corresponding agreement was concluded no later than December 31 of the previous year.

What to look for when choosing a company

The selection of management companies for concluding trust management agreements with the Pension Fund of the Russian Federation is carried out by the Federal Service for Financial Markets. Competitions are held once a year according to the following parameters:

- The amount of authorized capital.

- Return on investment for past periods.

- The total available amount of savings.

- Degree of reliability according to leading rating agencies.

- Duration of operation on the market.

Before choosing a management company, you need to compare all indicators, including the results of rating agencies . It is a mistake to rely in your choice only on the company’s profitability level, since this is often associated with great risks.

It is recommended to study the work of the management company over several years , and it is worth paying close attention not only to its profitability and the size of the client base, but also to the reputation of the management company. To do this, you can study reviews from customers who have already used the services of this company.

Application Form

To fill out the application, you must use the prescribed form. You can get it at any branch of the Pension Fund or download the document below.

statements on the choice of management company.

The application form was officially approved by Resolution of the Pension Fund Board No. 850p dated September 9, 2016 and includes the following information:

- full name of the Pension Fund branch to which the application is submitted;

- details of the applicant (authorized person):

- FULL NAME;

- Date of Birth;

- SNILS;

- passport data;

- name of the selected management company;

- consent to the formation of a funded pension, or refusal of it in favor of an insurance pension;

- a note about the chosen method of obtaining the result (by hand or by e-mail);

- date and signature.

The application must be filled out only in black or blue pen, without allowing any corrections or abbreviations. If the document was filled out electronically and printed, the full name, signature and date must still be completed in writing.

What to choose - the Pension Fund or a non-state pension fund?

When pension reform took place in the country, each citizen had to choose where exactly parts of their pension savings would be stored:

- PFR – Pension Fund of Russia.

- NPF is a non-state pension fund.

In order to correctly choose the institution that is suitable for your case, you should understand exactly how the funded pension system is built from the inside.

When a pension fund is selected, the citizen’s pension savings will be transferred to a management company, which will invest them to further increase them. A company can be either private or public.

When pension savings are transferred to a non-state pension fund, the fund, at its discretion, sends them for trust management to the management company that it has chosen after analyzing the results of its investment activities.

Important! You need to understand that the insured citizen has the right to manage only pension savings. The fixed payment and insurance pension remain in the Pension Fund of the Russian Federation and are not subject to transfer to a non-state pension fund.

If we analyze the positive and negative aspects of these two funds and talk about their ratios as percentages, it is worth noting that the state carries out indexation of the insurance pension once a year, and this procedure is guaranteed to all citizens. In turn, funded pension funds are multiplied by income received from investing in the financial market. But it may also happen that investing can be unprofitable.

One way or another, it should be noted that the funds stored in the Pension Fund are growing at a slow pace, but are still increasing. And in a non-state pension fund, the level of profitability is inextricably intertwined with how competently and successfully the fund invested.

It is important that insurance of pension savings has been introduced since 2014, and even if events follow a negative scenario and the non-state pension fund goes bankrupt, the accumulated pension savings will not be lost. But in any case, a citizen has the right at any time to refuse to form a funded pension and transfer all savings back to the Pension Fund.

State management company – Vnesheconombank

Unlike an insurance pension, which can only be formed by the Pension Fund of Russia, savings provision to both the Pension Fund (represented by management companies) and non-state funds.

The funded pension itself is the formation of pension savings , which are accounted for in the account of the insured persons and consist of:

Having made a choice in favor of the Pension Fund of Russia (as an insurer), a citizen must choose a management company that will invest funds in the financial market. You can entrust savings to a state company (Vnesheconombank) or any other private company with which the Pension Fund has an agreement.

Where can I form a funded pension?

Unlike the insurance payment, which is taken into account in pension points (IPK) and only on the personal account of the Pension Fund of the Russian Federation, the funded pension is formed in monetary terms in the account of the insurer, which the citizen has the right to choose himself:

- state (PFR);

- non-state (NPF).

Both state and non-state foundations cannot manage funds. For this purpose, there are management companies (MCs) . The NPF independently, without taking into account the opinions of the insured persons, selects the management company with which it enters into an agreement. The Russian Pension Fund reserves the right for citizens to choose their own management company. It could be:

- GUK (state management company);

- CHUK (private management companies).

Both State Management Companies and private management companies are legal entities that have the appropriate license to manage funds in the financial market. There are many of them, but not all of them can carry out this activity.

According to the legislation of the Russian Federation, an insured person can transfer his savings to the management only of those management companies that are annually selected based on the results of competitions held by the Federal Service for Financial Markets, and with which the Pension Fund of the Russian Federation has concluded a trust management agreement.

Activities of Vnesheconombank in relation to pension savings

The state management company from 2003 to this day is the Bank for Development and Foreign Economic Affairs - Vnesheconombank . The main task of a state company, like any other management company, is to invest pension savings, which are transferred to it by the Russian Pension Fund.

Despite the fact that Vnesheconombank is a state management company, it cannot guarantee a pension increase. The income of the State Management Company (like any management company) is the result of investing savings, and there can be both profit and loss. In the event of a loss, a citizen will be able to receive only the amount that was contributed by him and his employer.

In accordance with Article 26 of Federal Law No. 111-FZ of July 24, 2002, it is allowed to place funds only in low-risk assets (government securities of the Russian Federation, shares and bonds of Russian issuers, etc.).

The funds of savings are under the management of the State Management Company:

- citizens who consciously entrusted the formation of their pension to the State Administration of Ukraine;

- “silent people” (those who have pension savings, but have never entered into an agreement with anyone).

Vnesheconombank is a 100% state corporation , that is, it does not have membership of a non-profit organization.

How to place the funded part of your pension at Vnesheconombank

Since when choosing the State Institution “Vnesheconombank” the insurer is the Pension Fund of Russia, you only need to submit the corresponding application to the territorial branch of the Pension Fund of the Russian Federation. This can be done either in person or by post (in this case, copies of documents must be notarized). In addition to the application to the pension fund, you must submit :

It is also allowed to submit documents through an official representative (authorized person). In this case, you will additionally need a document certifying the identity of the authorized person and a corresponding document that confirms the right of the representative to act on behalf of the insured person (for example, a power of attorney).

Both those who are just planning to create a future funded pension and those who have already accumulated a certain amount in other companies can entrust their savings to Vnesheconombank. In the second case, the legislation of the Russian Federation allows at least a year to transfer savings under the management of the State Management Company.

This can also be done by insured persons who have chosen a non-state pension fund as their insurer. However, in this case, the insurer will be changed, that is, the citizen will transfer his funds from the NPF to the Pension Fund . And this can lead to loss of investment income. Therefore, it is necessary to switch from a non-state fund to a state fund no earlier than after five years.

When choosing the state management company Vnesheconombank, a citizen must also choose one of two investment portfolios .

Selecting an investment portfolio and placing funds

The investment portfolio represents assets that were formed at the expense of funds transferred to the Pension Fund of the management company under one agreement. These funds are separated from other assets, and the portfolio is formed in accordance with the investment declaration.

two investment portfolios for investing savings :

- Basic portfolio of government securities (GS);

- Expanded investment portfolio.

The government securities portfolio consists of government securities of the Russian Federation and bonds of domestic companies, as well as funds in rubles and foreign currency guaranteed by the Russian Federation.

The expanded investment portfolio also includes mortgage-backed securities and bonds of international financial organizations.

Remedies of the “silent”

were automatically transferred to the expanded GUK portfolio.

The management company separates investment portfolios, which are formed from pension savings, from other property (including its own), and opens separate accounts for each (with the Bank of Russia, credit institutions, etc.).

Funded pension trust management agreement

The agreement on trust management of savings is concluded between the Pension Fund of Russia and the state management company. In accordance with this agreement, the Pension Fund transfers savings funds to the State Management Company for management .

After signing this agreement, the management company receives the opportunity, on its own behalf, to enter into relevant transactions on the securities market, which must be carried out in the interests of the Pension Fund of the Russian Federation.

In essence, the State Management Company offers special services for asset management (funds and securities). For these services, the company receives a remuneration - a part of the profit or a certain percentage of the value of these assets.

Profitability of VEB pension savings

The return on investment of savings funds is calculated in accordance with Order of the Ministry of Finance of the Russian Federation No. 107n dated August 22, 2005 and is a relative indicator of the growth of funds. There are four profitability indicators:

- year to date;

- for the previous 12 months;

- for the previous 3 years;

- average (for the entire period of validity of the trust management agreement).

Information on the profitability of savings of the state management company is not classified and is publicly available on the official website of Vnesheconombank.

Which is better: a state or private management company?

The Russian Pension Fund and the Russian Ministry of Finance equally control the activities of both the state company and private management companies. In both the first and second cases, funds are stored in the accounts of the state depository company.

The main difference lies in the principles of the investment strategy of the management company - the investment declaration. In this regard, a private management company can use more financial instruments for investment. This may bring in more income, but it also carries more risk. In addition to what is permitted by the State Criminal Code, private companies can also invest in:

- shares of index investment funds;

- shares of domestic companies that place funds in government securities of foreign countries;

- shares and bonds of foreign companies.

Both public and private management companies are interested in maximum income from investment, since their remuneration depends on this. The higher the investment income, the greater the company's remuneration.

It is also worth noting that the financial difficulties of the management company (GUK or PMU) do not affect savings funds, since they are stored separately from the funds of the management company and are not used to pay off the company’s obligations.

Online consultant answers to user questions

or

Source: https://pensiology.ru/ops/budushhim-pensioneram/formirovanie-nakopitelnoj-pensii/doveritelnoe-upravlenie/guk/

What are the main criteria when choosing a non-state pension fund?

If we turn to clause 6 of Article 13 of the Law dated 05/07/1998 No. 75-FZ “On Non-State Pension Funds”, it states that a citizen has the legal right to transfer his own pension savings from one non-state pension fund to another, and to carry out this procedure no more than once a year.

It is for this reason that the issue of choosing a fund must be taken very seriously and thoughtfully.

Important! After the final choice of a non-state pension fund has been made, the citizen must, by the end of the current year, write a corresponding application for transfer from the Russian Pension Fund to a non-state pension fund (or another non-state pension fund) and take it personally to the local department of the Pension Fund. The application can also be submitted by mail, but it must be certified by a notary.

There are several criteria that allow you to choose the best option among a huge variety of other non-state pension funds:

- Fund's return level. On the fund’s website and according to the report of the Bank of Russia, everyone can assess the success of investing in a non-state pension fund.

- Age of the fund and its founders. It is clear that the older the fund, the more reliable it is, since over the many years of its activity it has accumulated impressive experience and reputation. Each of us has faced a financial crisis in the country, and if the fund managed to successfully overcome the problems that arose, then we can safely choose it. If the founders of the fund are a large industrial organization, then they deserve the greatest trust from citizens.

- Open and accessible information on the official website of the fund. If you look at Article 35.1 of the Law dated 05/07/1998 No. 75-FZ “On Non-State Pension Funds”, it states that basic information about the fund should be posted on the fund’s website:

- License number.

- Name of company.

- Location information.

- Information about investment results.

- Information about financial statements.

- Information about how many depositors and insured persons the fund has.

- Information about the number of participants.

- NPF reputation and place in the independent NPF rating. The position in the rating that a fund occupies shows the degree of reliability of this organization, since rating agencies evaluate only successful market participants. In addition, the rating agency makes a forecast about the development of non-state pension funds.

- Convenient service. As a rule, NPFs do everything possible for the convenience of their clients. They have access to a hotline at any time, by calling which they can quickly obtain all the necessary information from a specialist. For convenience, a personal account has been created on the website, using which a citizen can track how his pension savings are moving.

Which pension fund management company to choose

If it is not there, then the reliability of the organization is in doubt. About the rating of management companies It is recommended to choose an organization for placing pension capital by comparing performance indicators. At the same time, people often put their profitability first. Experts consider this approach to be erroneous:

- High returns are usually associated with high risks. Consequently, the investor may be left without profit.

- A large income received in a certain period does not guarantee the same performance in the future.

Recommended: study indicators over several years. Dynamics provide a more accurate description of the company's performance. In addition, it is advisable to rely on other performance indicators of the management company. An important characteristic of a financial organization is its reputation. It is taken into account by both investors and investment funds.

Important

This is done by:

- sending a request to the Pension Fund;

- obtaining the corresponding service on the government services portal.

The legislation establishes the rules for the interaction of citizens with trust organizations that have an agreement with the Pension Fund:

- You can place your funds in only one management company;

- changing the Criminal Code is allowed no more than once a year;

- at any time a person can terminate the contract for the formation of savings.

Attention: if you refuse to transfer contributions to capital, the money already placed in the management company will continue to work. You can pick them up after registering your insurance pension. The essence of the activities of the management company The basis for the formation of the management company and the organization of its work are the provisions of Law No. 156-FZ of November 29, 2001.

To make an informed choice, you need to analyze 5 company indicators. 1. The volume of own funds (property intended to support statutory activities).

2. Profitability indicator for managing pension savings funds for previous years. 3. The total volume of pension savings of citizens under management. 4.

Which is better: NPF or UK?

What is the difference between Non-State Pension Funds and Management Companies Details Created 11/08/2013 09:55 Good afternoon, dear readers of finstok.ru.

In previous articles, when we talked about the pension contributions system and the pension reform currently being carried out, we said that the management of the funded part of the pension can be entrusted to non-state pension funds (NPF) or a management company (MC).

With a competent approach to managing your pension savings, these structures can not only protect your savings portion from inflation, but additionally increase it. However, in previous articles we ignored a rather important issue - what is the difference between a Management Company and a Non-State Pension Fund.

Pension savings management

Instead of a conclusion: comparison of NPF or management company The most pressing issue for people who want to build capital for retirement is the choice between non-state pension fund and management company. When thinking about which form of cooperation is better, you should keep in mind:

- The work of the Criminal Code is controlled by the state through the Pension Fund.

Therefore, deposits have a serious guarantee:- a person has the opportunity to take part in choosing a specific organization for managing money;

in addition, they are paid after the pension is assigned, together with the insurance part, through the Pension Fund.

- NPFs independently select investment companies. Citizens are not allowed to participate in this process. You will also have to receive your accumulated funds from NPF accounts (not guaranteed by the state).

Attention: the order of NPF interactions with people does not in any way affect its profitability.

It may well turn out to be higher than that of the Criminal Code.

Managing the funded part of your pension via uk

Attention

To do this, they need to entrust the management of the funded part of the pension to one of the organizations providing similar services:

- management company (MC)

- non-state pension fund (NPF).

Methods of forming pension savings Money for future payments in old age or in other insurance cases is formed on the personal accounts of the participant in the pension insurance system. Trust management of pension savings funds is carried out by:

- In general, the Pension Fund of Russia (PFR).

- When choosing a savings tariff - management company or non-state pension fund.

For each worker, the employer contributes to the solidarity budget of the Pension Fund an amount equal to 22% of his earnings (from his own money).

Investing pension savings: NPF or MC?

In contrast, pension capital always retains its ruble equivalent. This means that the trust organization takes it into account in national currency, without converting it into other forms.

In addition, funds are deposited into a specially allocated part of the system participant’s personal account. This section of the future disability support budget includes the following funds:

- 6% of the contribution transferred by the employer;

- voluntary payments of a person;

- income from investment activities of the management company.

Important: the insured person has the opportunity to check the status of his personal account at any time.

Management of funded pension in uk

In this case, this contribution is distributed as follows:

- 6% goes immediately to make current payments to the insured persons who have received the legal right to them;

- 16% is taken into account on the personal account of the system participant.

Attention: when choosing a savings tariff, only 6% (of the personal 16%) is transferred to a trust organization. These funds form the basis for future savings payments. In addition, workers have the right to independently replenish their own savings fund for old age by:

- voluntary contributions;

- participation in the state co-financing program;

- investing maternity capital into a pension (available only for women).

When choosing to form pension savings in the Pension Fund, citizens must submit a corresponding application to the local branch of the Pension Fund.

Which pension fund management company to choose

- receives remuneration from profits:

- in a fixed amount;

- in percentage terms.

Definition: trust management is the provision of asset management services:

- in cash;

- securities.

Download for viewing and printing: Federal Law of 02/07/2017 N 11-FZ “On Amendments to the Federal Law “On the Accounts Chamber of the Russian Federation” How to choose a reliable and profitable management company Experts recommend focusing on the following characteristics of organizations providing the relevant services:

- profitability (according to publicly available reports);

- period of work in the markets;

- the amount of assets, including those received from the pension capital of citizens.

Important: all information necessary for research must be contained on the company’s official website.

Well, let's fix it! Management company A management company is a commercial organization in the form of a legal entity that carries out trust management of the property of individuals or legal entities transferred to it. Trust management is carried out on the basis of an agreement.

If it is not entirely clear from the definition what this term means, let’s conduct the following thought experiment: You are a billionaire, you have earned an unreal amount of money, and you have decided in the future to simply enjoy life, traveling around the world.

The earned capital can be placed on bank deposits - but again the question arises, which bank to choose so that it is reliable enough and, at the same time, brings the necessary profitability. You can, of course, choose several banks to diversify your assets. On the other hand, part of the capital can be invested in real estate and receive income in the form of rent.

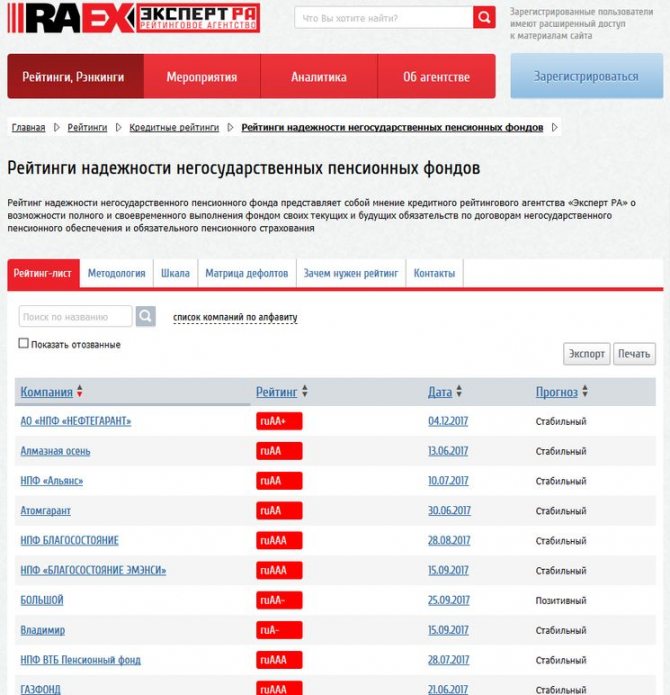

Ratings of reliability of non-state pension funds and their profitability

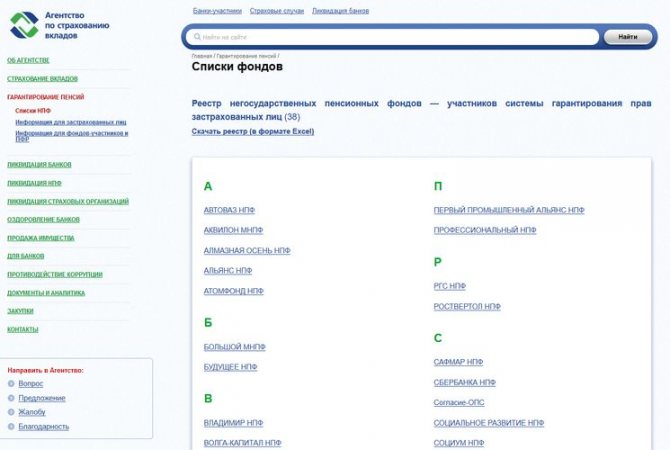

So that anyone can get acquainted with information about the reliability of non-state pension funds and determine the level of profitability, special ratings have been developed that classify funds from the most reliable to the bankrupt fund, and from profitable to unprofitable.

So, the rating agency "Expert RA" has developed a fund class system that assesses the reliability of the fund, where:

- A++ represents the most stable and reliable funds in crisis conditions.

- A+ are stable non-state funds that have gained credibility.

- A – funds that have been tested over the years and are reliable organizations.

- B++ - the level of reliability is average, but there are no negative reviews.

- B+ are funds of dubious reliability.

- B – the fund has no guarantees. This is a low level of reliability.

- C++ and C+ - such funds have a high probability that the license will be revoked.

- C – the fund has a negative reputation, reviews about it are negative.

- D – funds that are bankrupt.

- E – the fund is in the process of liquidation or its license has been revoked.

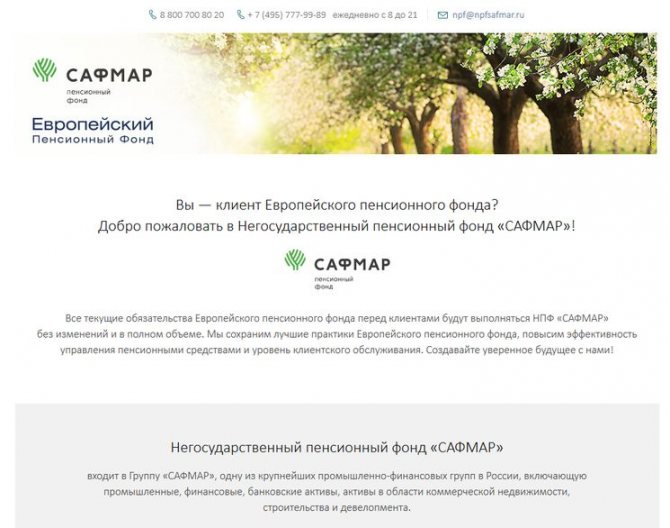

If we talk about statistics on the profitability of non-state pension funds, then according to information from the Central Bank, today we can note the five best funds:

- Sberbank.

- Confidence.

- European Pension Fund.

- Stalfond.

- Lukoil-Garant.

Who is the best NPF in 2020 based on performance results?

Based on official rating data, in 2020 the best non-state pension fund can be noted as European Pension Fund JSC (EPF).

Since 1994, this fund has been effectively operating and taking part in the system of guaranteeing the rights of insured persons. The foundation has a license.

Important! JSC European Pension Fund leads the rating in terms of profitability, which is 14.37% and has the maximum level of reliability, according to the assessment of the Expert RA agency. That is, the SPF class is A++.

In addition, JSC European Pension Fund is a member of the National Association of Non-State Pension Funds, which is an autonomous organization of Non-State Pension Funds in Russia. She is also a member of the Association of European Businesses. If we talk about trust in this fund, it should be noted that over 20,000 accounts were opened by participants under the non-state pension program. An important fact that strengthens confidence is that the fund’s pension savings amount to 183 billion rubles!

How to go

Pension savings will be transferred to the management company the next year after submitting the application.

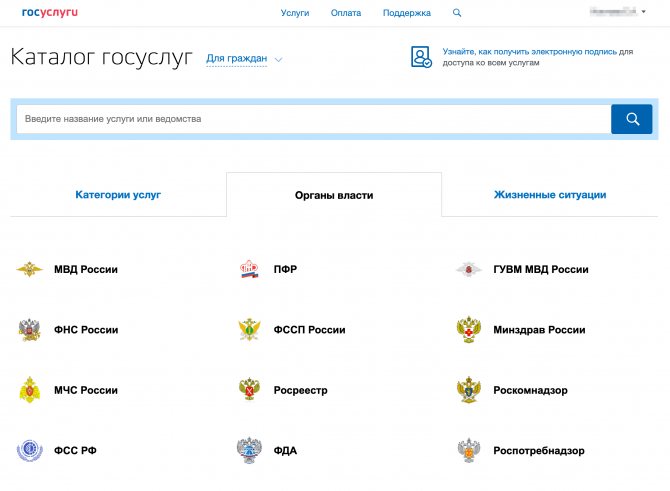

You can submit an application in person to the Pension Fund, through the MFC or through government services after full registration on the website. Application forms are available on the Pension Fund website, at the MFC or in your personal account on the State Services website. When working with your personal account, an electronic signature will be required.

If you transfer pension savings through government services, go to your personal account, follow the link “and select “PFR”

If you are transferring from a non-state pension fund, the procedure is similar, but the form will be called “Transition from a non-state pension fund to the Pension Fund”. Indicate your NPF, in the “Where” column - Pension Fund, and below, in the “Name of the investment portfolio” column, enter the name of the management company and its portfolio, if it offers a choice. In this case, the early transition checkbox becomes an important element.

Those who transferred to a non-state pension fund in 2012-2014 or 2016-2019 and submit an application to transfer a funded pension in 2020 make an early transition. If the agreement came into force in 2012-2014, five years have already passed and a new five-year period has begun, if in 2016-2019, the first five years have not yet passed.

Another option is to check the “Urgent transition” box. Then you will be transferred to the year when an urgent transfer is possible.

There is no need to conclude an agreement with the management company, since the insurer is the Pension Fund of Russia. SNILS is an analogue of an agreement between you, and you do not need to sign additional papers. You also do not need to contact the management company itself, because the account is maintained by the Pension Fund.

You can find out which NPF or which management company you are in by checking your account statement through the Gosuslugi website or on the Pension Fund website. There you will also find the number of the outgoing document on the transfer of savings.

More on the topic Russian Pension Fund hotline Khimki phone 8-800

To receive an extract through the state → “Get

Is it possible to change the non-state pension fund?

If the insured citizen has expressed a desire, then the generated pension savings can be transferred from one non-state pension fund to another. H

To start this procedure, you will need to visit the local Pension Fund department to write a corresponding application, attaching a package of necessary documents to it. At the legislative level, a period is established during which documents and applications are subject to consideration. And if a positive decision is made that the transition will take place, then the participants in the procedure will be notified.

Important! We must not forget that a transfer to another selected fund can be carried out only once every five years, and if this rule is not followed, income from the investment activities of the fund may be lost.

The new fund, which the citizen has chosen, will receive pension savings only five years after the Pension Fund of Russia makes a positive decision. The funds accumulated by the citizen will be transferred along with the income received from the investment activities of the previous fund. The citizen will retain the right to transfer funds next year before the appointed date.

How to fix the situation?

Correcting the situation in this generally noble idea of the Pension Fund is as follows:

- The state must loudly announce to its citizens that their money in the Pension Fund still belongs to them and without any conditions.

- Any citizen can at any time find out the amount that he has personally accumulated (the state has accumulated for him - and there is nothing reprehensible in this, let’s not forget about our lack of organization in life and the state’s assistance to us in this matter).

- Any citizen has the opportunity to refuse to participate in the formation of his pension and take all accumulated funds for himself. The reason, yes, any: from the confidence that this will be enough for him until hour “X”, to the reluctance to leave something behind, and over 60 he no longer sees himself or does not want to see himself.

- The state, respecting the opinion of its citizens (A CORNER MESSAGE TO WHICH NEEDS TO BE CONSTANTLY PAYED ATTENTION) and caring about their future, can only constantly remind them of the need to think, not to let things take their course, they say, we'll see. The state needs to constantly pursue targeted lifestyles. You shouldn’t be afraid that everyone around you is so stupid that they will definitely do everything wrong (and we’ll just add - as the official wants).

More on the topic Free pension lawyer on pension issues