One-time payments to those born before 1966: payment amount and receipt procedure

In recent years, the pension system has changed. In 2012, a funded pension was provided for Russian citizens for the first time, and from 2020, pension provision can be provided through insurance contributions of a citizen or his employer. lump sum payments to pensioners born before 1966 aroused increased interest among citizens Explanations from the Pension Fund and analysis of legislation will help you understand these nuances.

What is a funded pension?

To understand what resources form a lump sum payment to pensioners from the funded part of the pension (hereinafter referred to as NPP), you need to understand the principles by which contributions to the Pension Fund of the Russian Federation are divided. If a person is officially employed, then the employer is obliged to make monthly pension contributions at a rate of 22% of the employees’ earnings. They are divided as follows: 6% goes to the formation of fixed additional payments to pension benefits (at the so-called solidary tariff), the remaining contributions of 16% go to accounts intended for insurance and savings subsidies.

You can choose between contributions that go into savings and contributions that form insurance subsidies. If the Russian chose the first option, then 6% of the amounts contributed by the employer go to the funded part of the pension. The remaining 10% is intended for insurance subsidies. Since 2020, due to the economic crisis, the state has introduced a moratorium on savings contributions. The resumption of these contributions is not predicted until 2020. To stabilize the economic situation, all funds transferred by the employer are transferred to the insurance part of the pension.

A Russian can create savings by choosing between state and non-state pension funds (hereinafter referred to as NPFs). Upon reaching a certain age or when other circumstances specified by law arise, a lump sum payment of pension savings becomes available. Contributions can be paid on a voluntary basis, individually, having agreed with the employer an additional percentage of accrued wages deducted to the Pension Fund of the Russian Federation or Non-State Pension Fund.

What is a one-time benefit?

A one-time benefit is receiving part of your pension savings not in periodic payments, but in one go.

Federal Law No. 166 provides for annual indexation of pensions, that is, its recalculation taking into account the inflation of the current year. If problems arise with indexation, the state can return the unpaid interest in cash with a deferment, providing a one-time compensation.

Example: in November 2020, the President of the Russian Federation approved the corresponding regulatory act, which made it possible to return the withheld part of the amount for beneficiaries as one-time financial assistance.

This procedure is not reflected in further regular social payments.

Types of lump sum payments to pensioners born in 1957-1966

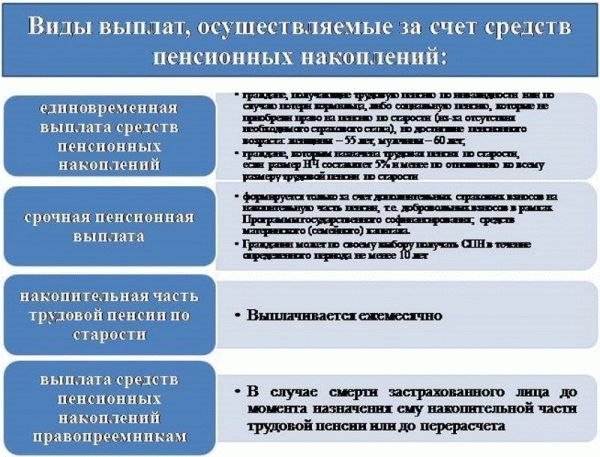

Federal Law No. 360 of November 30, 2011 provides for the following types of social payments:

- Urgent - performed every month for a set period;

- Savings - paid monthly as compensation for loss of ability to work after the amount in a special account where the money was transferred by the employee or his employer;

- For legal successors - the funds are received by the relatives of the deceased insured citizen, as well as other persons who can legally inherit the unpaid portion of the money;

- Lifetime - a citizen regularly receives government assistance for the rest of his life;

Payment to pensioners born in 1953-1966 is made at a time from the following sources:

- Security in case of loss of a breadwinner;

- Fixed subsidies - from an annually indexed base payment, the size of which is affected by length of service, place of residence, age, presence of supported family members and disability;

- From old age insurance benefits - consists of insurance contributions stored in the Pension Fund of Russia. The amount of contributions directly depends on the official salary;

- Disability benefits;

- For final calculations of wages and vacation pay upon the worker’s retirement;

- Funds received from the co-financing program;

- From accumulative savings, which consist of social contributions (subject to their investment in 2002-2004).

What is the essence of one-time benefits?

Pension savings refers to the amount that is located in the account of someone who has retired. These funds can be generated only on the condition that the person takes part in the compulsory insurance system organized by the Pension Fund. It is also possible to open an account in a non-state fund.

The savings include:

- insurance amount, which was transferred by the organization where the person worked. Contributions are made every month while the person is working. The accumulative part of the security is formed from these funds;

- transfers made by persons under the co-financing program. Provides that each employee has the right to make contributions to increase his future benefits;

- family capital funds;

- income received as a result of investing specified items.

A one-time benefit is paid when the transferred money is used.

Pension savings funds are intended for persons born before 1967. The main condition is participation in the pension insurance system. In addition, there must be evidence of work activity after 2001.

Also entitled to savings are:

- co-financing program participants;

- women who used family capital to accumulate benefits.

Other categories of recipients cannot count on these amounts upon retirement.

A one-time payment to pensioners in 2020 is calculated in addition to monthly income.

Types of benefits:

- urgent payments;

- one-time deductions;

- transfers due to a person upon reaching a certain age category;

- funds intended for the legal successors of the deceased person.

Each monetary amount is assigned based on an application.

One-time payments to pensioners in 2020 provide that the person receives part of the insurance contributions. The allowance is credited to the account in a single payment. It is permissible to issue an increase if the condition is met that the account has accumulated less than 5% of the total pension amount.

Only those citizens for whom the enterprise transferred insurance contributions to the Pension Fund can receive funds.

Recipients of a one-time benefit include:

- persons who have received benefits related to the presence of disability;

- citizens to whom a pension is transferred due to the loss of a breadwinner.

A one-time supplement to the pension is provided from the funds of the Pension Fund or a non-state fund, depending on where the pensioner transferred his funds.

Before receiving benefits, you will need to fill out an application. The document is submitted to the PFR or NPF branch.

Attached to the application:

- an act by which the identity of a citizen is verified;

- SNILS;

- a certificate reflecting the length of insurance coverage and the amount of benefits. You can obtain this document by contacting the Pension Fund;

- bank card details.

A decision on the submitted application is made within a month. If the answer is positive, then the citizen is provided with a one-time payment. The transfer to the account is made no later than 2 months after the decision is made.

When a negative answer is issued, employees of the authorized body send the person a copy of the issued act.

Federal Law No. 385 of 2020 “On one-time cash payment to citizens receiving a pension” provides that the supplement is currently 5,000 rubles. This amount is established for all categories of recipients.

For employees of the Ministry of Internal Affairs who have retired, these benefits are also provided. A person has the right to rely on funds if, before the beginning of March 2005, he became registered as needy.

Who is eligible for one-time compensation?

Art. 4 of the Law “On Funded Pension” and the rules of the compulsory insurance system list a number of persons who have the right to one-time payments from the Pension Fund:

- A one-time payment is provided for pensioners born before 1966 (women since 1957, and men since 1953);

- Those for whom the difference between the insurance and funded pension is 5%;

- Individuals who participated in the state co-financing program;

- Persons who have pension insurance, which is reflected in a special individual personal account;

- People who worked in the period 2002-2004;

- Persons who transferred funds from family capital for a future pension;

- Foreigners who meet all the above requirements and reside in Russia on a permanent basis.

Important: these benefits cannot be obtained until retirement age.

When paying a one-time benefit, pensioners born in 1957-1966. do not give the right to choose the option of forming future security, while such an opportunity is provided for younger fellow citizens. But it is precisely this category of persons that meets the requirements for simultaneous compensation. From 2002 to 2005, employers of such citizens were required to make payments for a funded pension.

Who is entitled to a lump sum payment?

A one-time payment is a cash payment of all the funds accumulated by a pensioner and investment income in one amount, without breaking it down over a certain period.

Such a payment is due and is paid not to everyone, but to types of citizens who fall under the following parameters:

- Citizens of the Russian Federation;

- Persons who have pension savings in their account;

- People who were insured in accordance with the Federal Law: 167-FZ of December 15, 2001.

In addition, until the receipt of an old-age pension, only the following can receive a lump sum insurance payment:

- Persons upon recognition of disability of groups 1, 2, 3;

- In case of loss of a breadwinner.

Procedure for receiving refunds

After the described circumstances arise, the person acquires the right to one-time compensation, for which he needs to contact the pension fund; such an application can be submitted indefinitely.

One-time payments from savings to pensioners born before 1966 are issued in the following order:

- Preparation of necessary documents;

- Registration of an application with the Pension Fund of Russia, Non-State Pension Fund, multifunctional center or through the State Services portal;

- Receive a certificate from an official;

After receiving the documents, the administration of the authority issues a receipt confirming the acceptance of the application. The relevant authorities review the information in one day and make a decision on the issue within a month. It will take about two months to implement the solution.

You can receive funds through the pension fund cash desk, by mail or to your personal account.

How to receive a lump sum payment from the Pension Fund

A lump sum payment to pensioners from the funded part of the pension can be issued in several ways. The state takes into account that not all citizens can, due to health reasons, personally visit a branch of the Pension Fund of the Russian Federation, traveling by public transport to the organization’s office. The following methods are available for submitting an application for a one-time subsidy:

- personal appeal to the NPF or Pension Fund of the Russian Federation by a pensioner with an application for payment;

- registration of the required documentation at the MFC, when the organization provides such a service;

- submitting an application via the Internet to save time, using the portal of the public services system, completing the registration procedure on the website;

- using the services of a third party, a relative, with the execution of a power of attorney from a notary confirming the right to submit an application, and the availability of documents identifying the person authorized by the pensioner to take such actions.

Application for return of the funded part of the pension

The legislation provides for certain requirements when filling out an application form for a one-time payment of savings. The document must contain the following information:

- full name of the branch of the Pension Fund of the Russian Federation where the citizen applies;

- surname, name, patronymic of the applicant;

- date, place of birth as indicated in the passport;

- presence of Russian citizenship;

- a note about the applicant's gender;

- address at the place of permanent registration;

- series, passport number, by whom, when issued;

- SNILS;

- a valid telephone number at which the applicant can be contacted to notify him of the decision made on one-time deductions;

- a certificate stating that the applicant has been assigned one or another type of pension;

- an acceptable method of receiving funds, details of the debit account where the one-time donation is supposed to be transferred;

- date of preparation of the application with the signature of the applicant;

- information about a third party, if receipt of payment is made through a notarized power of attorney.

If savings were formed in a non-state management company, then receiving a one-time benefit is also regulated by legislative regulations. A unified version of the application has been established, which is mandatory for all NPFs to comply with. A citizen will have to fill out an application on the website of a non-state management company or ask for a petition form during a personal visit to the organization’s office.

- Inhalations for dry cough

- How to take echinacea tincture to improve immunity - reviews. Echinacea for boosting immunity

- How to brew fireweed tea

Package of necessary documents

The legislation regulates the list of documentation required from a citizen applying for the portion of pension savings due to him. If a one-time subsidy is drawn up by a relative of a pensioner who, for objective reasons, cannot visit the MFC or a branch of the Pension Fund of the Russian Federation, then it is allowed to present to the organization’s employees copies of the following documents instead of the originals, provided they are certified by a notary. The applicant is required to provide employees of the Pension Fund of the Russian Federation with the following list of official papers:

- an application drawn up in the prescribed form, filled out correctly, without dashes, blots, or corrections;

- passport of the applicant or the person making the payment by proxy;

- information that the applicant has the right to a state, social or insurance pension;

- a certificate of the amount of pension benefits received;

- details of the bank account where the additional payment is supposed to be transferred;

- information about the duration of employment if the applicant receives social security due to the loss of a breadwinner or other grounds provided for by law;

- other documents at the request of employees of the Pension Fund of the Russian Federation, MFC.

Timeframe for making a decision

After a citizen submits the entire package of official papers for verification to the MFC or Pension Fund of the Russian Federation, an employee of the organization must issue a receipt and confirm receipt of the documentation. The verification of the compliance of the declared data with the actual information about the applicant begins. It can last up to 30 days, after which a decision is made in writing. The applicant will be notified that the Pension Fund has made a positive or negative decision on the application by calling an employee of the organization to the phone number specified in the application.

If the received answer does not suit the pensioner, then you can appeal it in court. Sometimes the application is returned for revision. Cancellation of a request occurs for the following reasons:

- a carelessly, incorrectly completed application that cannot be read, with blots or corrections;

- the documentation package attached to the application lacks official papers;

- differences were found between the information provided and the actual data.

Required documents

One-time payments to pensioners born before 1966 are drawn up according to the following documents:

- Direct statement;

- Passport or other identification document;

- Labor and pension book;

- SNILS;

- Certificate on the amount of pension savings;

- Confirmation of receipt of assistance from the state for disability;

If you are unable to submit an application yourself, you can provide a package of documents through a proxy, who must have a notarized power of attorney and your passport.

The law allows you to bring copies of documents certified by a notary.

The application must contain the following information:

- FULL NAME;

- Residence address;

- Passport details;

- Insurance number of an individual personal account;

- List of submitted papers:

- Contact numbers, email, etc;

- Date and place of birth;

- Date and signature;

- Savings account number and preferred method of receiving money;

If false information is provided in the documentation or there are no grounds for calculating benefits, the application may be refused, the applicant is warned about this by returning the documents to him within 5 days from the date of the decision to refuse.

One-time payment to pensioners: how to apply and where to receive it

A one-time payment to pensioners does not apply to all citizens who have reached retirement age, as Russians often assume. It only affects men and women who were born between 1953 for men and 1957 for women until the end of 1966. In addition to the age limit, a number of additional conditions are taken into account.

Brobank will tell you what kind of lump sum payment to pensioners is approved by law, what to do to get it and where to go with the documents.

One-time payments to seniors

A lump sum payment to pensioners is a payment from pension savings that is not permanent, but one-time.

Over the past decade, the system for calculating payments to older people has changed significantly. In 2012, a funded pension appeared. And in 2020, payments began to be calculated based on the amount of insurance premiums. They are paid by the employer for each employee. After this, the number of pension points accumulated is calculated and the final payment amount is assigned.

But the legislation of the Russian Federation provides for annual indexation of pension payments.

Thus, the pension is periodically recalculated taking into account the inflation rate that was recorded in the previous year or that was projected for the current year.

But problems often arose with indexation; unpaid interest was given to elderly people as a one-time compensation. It did not in any way affect the pensioner’s receipt of his next pension in the following months.

What types of payments are prescribed?

According to Federal Law No. 360, several types of payments are established:

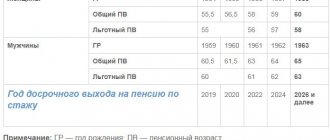

| Payment type | Characteristic |

| Urgent | Monthly payments that are issued over a certain period |

| Cumulative | Monthly compensation if a citizen loses his or her ability to work. Payments are assigned from a special account where the employer or the citizen himself transferred the money |

| To assignees | Money is given to relatives or other persons who, by law, can receive money unpaid to the pensioner |

| Lifetime | These types of payments are given on a regular basis; a citizen can receive them as long as he is alive |

One-time payments to pensioners who were born before 1966 are made in several areas:

- Security in case of loss of a breadwinner.

- From old age insurance payments. These payments consist of insurance contributions to the Pension Fund. The amount contributed directly depends on the employee’s income.

- Money from the co-financing program.

- Disability benefits.

- From the funded part of the pension. These are the amounts of social contributions that were made in 2002-2004.

- When calculating wages and vacation pay at the time of a citizen’s retirement.

- Fixed subsidies. They are calculated from the annual indexed base compensation.

The amount of basic compensation is influenced by the length of service, the age of the citizen, the presence of dependents, address of residence and disability.

Who is the money given to?

Not all pensioners can receive a one-time subsidy. Federal Law No. 360, Article 4, lists the conditions under which citizens apply to receive one-time payments:

- Citizens who were born before 1966. At the same time, a minimum threshold has been established: for women - starting from 1957, and for men - from 1953.

- The discrepancy between the insurance and funded parts of the pension must be less than or equal to 5%. If the difference is greater, then payments are not assigned.

- Citizens who were officially employed between 2002 and 2004.

- Persons participating in the co-financing program.

- Citizens who took out pension insurance. This must be noted in the individual personal account.

- Citizens who provide themselves with a pension from personal funds.

- Foreigners who meet the above requirements and reside in the Russian Federation on a permanent basis.

At the same time, money can be issued only to those persons who have reached retirement age.

The peculiarity of receiving compensation is that citizens who were born before 1966 cannot independently determine the method of forming pension provision. But those who were born since the beginning of 1967 have this opportunity.

Pensioners born before 1966 can receive state assistance, since from 2002 to 2005, employers paid contributions to the funded part of the pension for all their employees.

Documents for receiving state aid

One of the main documents for processing a one-time payment to pensioners is an application. Be sure to include the following information in its text:

- FULL NAME;

- the address where you live;

- passport information;

- contact information: phone number, email address;

- personal account insurance number;

- savings account number and method of receiving funds - in cash, to a bank account or card;

- date and place of birth;

- list of documents attached to the application;

- date and signature.

In addition to the application, please provide:

- Citizenship of the Russian Federation or another document that confirms your identity.

- SNILS.

- Work book and pension certificate.

- Certificate about the amount of pension savings.

- Confirmation that assistance from the state for disability has been assigned.

If you cannot personally apply for payments, another citizen may represent your interests. In this case, he must have a notarized power of attorney. You do not need to bring original documents; the law allows for the possibility of providing notarized photocopies.

If erroneous information is accidentally provided, or based on the results of an audit, Pension Fund employees reveal that the applicant cannot receive a one-time benefit, he will be notified of this. Information will be received within 5 days from the moment the decision to refuse was made.

How and where to get compensation

If a citizen meets the requirements for receiving a one-time benefit for pensioners, he can submit an application with documents to the Pension Fund. The procedure for processing one-time compensation from a pensioner’s savings consists of three stages:

- Preparation and collection of documents.

- Registration of an application to the organization.

- Receiving a certificate from an official.

Payments can be made in several ways:

- in the branches of the Pension Fund and Non-State Pension Fund;

- in the department of the multifunctional center;

- through the government services portal.

You can receive financial compensation:

- At the Pension Fund cash desk.

- To a personal bank account or card.

- At the post office.

When employees accept documents from a citizen, they must issue a receipt confirming receipt of the application. One day is given to review the package of documents. There is 1 month to make a decision. If approved, payment is given within 2 months.

It is impossible to determine the exact amount of lump sum payments to pensioners. The amount depends on the amount of money in your personal account. The range of amounts varies from 5 to 15 thousand. On average, the amount of state assistance is 7-8 thousand rubles.

Moreover, they increase it slightly; the inflation percentage sometimes remains higher than the increase percentage. Those applicants for a one-time payment who have already used their right and received money have the right to apply again no earlier than after 5 years.

Thank you very much