What exactly is the difference between an insurance pension and a social pension?

This type of pension payment has its own nuances.

Based on current legislation, a fixed amount of material compensation has been established for insured persons. The amount of payments depends on the type of insurance pension assigned. Every year the size of the financial equivalent of payments is indexed. Such a pension may be assigned earlier than the period established by law if the applicant for an insurance pension meets certain requirements of pension legislation. Most often, early insurance pensions are received by persons who perform work during their working career that is included in the list of works with an increased personal pension coefficient. The insurance pension is assigned by the Pension Fund on the basis of the provisions of current federal laws, and the citizen must have a certain work experience.

Except in the case of disabled people, insurance pensions are provided 60 months earlier than social benefits. In addition, it is extremely rare for people with different disability groups to receive insurance pensions, since most often they do not have enough work experience to assign such a payment.

Disability pension

Payment of this benefit is made in favor of people who have been assigned one of the disability groups. Which group a particular person belongs to is a matter for medical institutions.

REFERENCE. The amount of payments depends on the severity of the problem and the age at which the person’s capabilities became limited.

Benefits for disabled people are divided into three subtypes:

State pension - can be assigned to military personnel who were injured while performing their military duty. And also, to citizens affected by disasters (Article 5 No. 166-FZ).- People who have work experience behind them can receive a labor pension.

- Persons whose opportunities have been limited since childhood and those who do not have a single day of work experience can count on a social pension.

Social payments

Social supplement to pension is a supplement to pension up to the level of the regional subsistence level of a pensioner, established for all non-working pensioners whose total material income is below its value.

The Pension Fund of the Russian Federation and its territorial bodies make social payments in accordance with current Russian legislation. These include, in particular, monthly cash payments to certain categories of citizens from among federal beneficiaries and additional monthly financial support.

Social and insurance pension: what is the difference

The most common in our country, according to statistics, is the old-age insurance (labor) pension. It’s not difficult to figure it out, since after working all his life, a person, upon reaching a certain age, has the right to go on a well-deserved rest. To receive payments, you need to submit a complete package of documentation to the Pension Fund of the Russian Federation, where it will be reviewed and analyzed by specialists. Only after this will the amount of monthly income be assigned to a personal account, card or by postal transfer.

This is interesting: How to Bypass the Transport Tax on a Car 2020

The main difference between an insurance pension and a social pension is that a person has a certain length of service. It is necessary to obtain such security. There are only three main types of age insurance, which will directly affect the amount of payments, which worries almost every Russian today.

Is it canceled at a certain age?

Disability pensions are paid until the day the old-age pension is assigned. After reaching a certain age, one benefit is automatically replaced by another. Moreover, for these changes to enter into legal force, no statements are required from the person himself.

Russian laws do not allow the simultaneous payment of two benefits. An exception is made for several categories (in accordance with clause 3 of Article 3 No. 166-FZ):

- Disabled persons who received their status during military service have the right to simultaneous payment of a state pension assigned in connection with loss of health, as well as payments due due to age.

- War veterans can receive both pensions.

REFERENCE. If for some reason a citizen expresses a desire to replace one type of pension with another, believing that this is better for him, the legislation of the Russian Federation does not limit him in this way.

In order to do this, all you need to do is write an application to the Pension Fund of the Russian Federation. The changes will take effect at the beginning of the next month after application is submitted.

The video tells the story of a woman who was faced with replacing her disability pension with an old-age pension.

Who receives a social pension in Russia

The social pension is assigned only to disabled citizens who, due to certain circumstances, do not have the right to receive another type of pension. Depending on the type of social pension assigned, there are several categories of recipients :

The pension for residents of the North is additionally increased by the regional coefficient for the entire period of residence in the area. When a pensioner leaves the “northern” territories, the application of the coefficient is canceled.

The difference between a pension and an allowance

The right to benefits for children over 3 years of age from certain categories of families has a mother, stepmother or stepfather in a complete family, a parent in an incomplete family, an adoptive parent, a guardian when raising a child over 3 years old, if in the family:.

For reference: A mandatory condition is that an able-bodied father in a complete family or a parent in a single-parent family work in the Republic of Belarus or were employed in the previous year for at least 6 months, and were also employed at the time of applying for benefits.

Deadline for submitting an application for the assignment of benefits: The benefit is assigned from the date the right arises upon application until the expiration of 6 months from the date of its occurrence. If the 6-month period is missed, the benefit is assigned from the date of submission of the application.

The right to a benefit for caring for a disabled child under the age of 18 is granted to a mother, stepmother or stepfather in a complete family, a parent in an incomplete family, an adoptive parent, a guardian of a disabled child who is actually caring for him, if they:

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

- The concept of a pension, characteristics of pensions, differences between pensions and benefits and wages

- Concept, essence, meaning of benefits and their difference from other types of material payments

- Pensions and benefits

- Legal advice on pensions and benefits

- Difference between benefit and pension

WATCH THE VIDEO ON THE TOPIC: Increasing pensions and benefits. Important news from Belarus

The concept of a pension, characteristics of pensions, differences between pensions and benefits and wages

Register Login. Mail replies. Questions - leaders Marriage of headphones with microphone 1 rate. Issue with a defective product. Help me determine the fitness category?

Is it possible to draw up a residential lease agreement for 5 years with a fixed fee and a penalty for early termination? Buying a secondary home where there is a child 1 rate. Leaders of the category Anton Vladimirovich Artificial Intelligence. Sour Supreme Intelligence. What is the difference between a pension and an allowance? Spanky Student 71, closed 12 years ago. Best answer.

Lydia44 Oracle 12 years ago Pensions are given depending on length of service and age, old-age pensions, they are earned. There are disability pensions. Both are given for life. Benefits are temporary payments for a certain period, for example, for a child under 18 years old.

Benefits are always less than pensions. Other answers. Angel Profi 12 years ago Earned pension, but no benefits.

User deleted Expert 12 years ago A pension is given for merit, for example, age, length of service, and this benefit is paid to those who, for one reason or another, cannot work.

Similar questions. They also ask.

Concept, essence, meaning of benefits and their difference from other types of material payments

The government will allocate 4.3 billion rubles for social supplements to pensions. The funds will be sent to 13 federal subjects for regional supplements to the pensions of non-working pensioners. Russians can take advantage of a new government service - find out about the approach of pre-retirement age.

This is necessary to start enjoying the benefits and preferences provided by law. RG talks about how to find out about the assignment of such status and what it gives. The Ministry of Labor does not plan to increase the amount of unemployment benefits this year.

Thus, the minimum benefit amount will be 8 thousand rubles.

Applying for benefits. 9. Pension program. Social Security replaces a portion of a worker's pre-retirement income on a non-retirement basis.

The main task of benefits is to provide financial assistance to state families or strictly defined entities [6, p. Often these signs include the following:. In a circle of people.

If pensions can be received mainly by non-working citizens, then benefits are designed for everyone. Benefits can be received by both working and non-working citizens, including pensioners.

For the intended purpose. According to payment terms.

How does a social pension differ from an insurance pension?

The insurance pension is one of the most popular in the world. It represents regular monetary compensation for the income that a citizen had while able to work. The right to it belongs to people who, during the period established by law (insurance period), made cash payments to the Pension Fund. Today it is 7 years, but over the course of 8 years it will rise to 15. Payments are made in accordance with the accumulated points.

- The most common type is old age pension . Upon reaching retirement age, a citizen must submit an application to the Pension Fund for accrual of payments. The basis is a certificate of compulsory pension insurance.

- An insurance pension due to disability is assigned if a person has received a disability, regardless of the group. In this situation, insurance experience is also required. Considering that it is the same for any type of pension, the great importance of paying regular contributions should be emphasized. It is necessary to provide the following documents: applications for accrual of pensions, passports, certificates of payment of insurance premiums, extracts from a document about a medical examination recognizing a disability, a certificate of disability.

- Insurance includes income compensation payments assigned to family members who are disabled and have lost their breadwinner . It is available provided that they were supported by a deceased relative. These legal norms include children and grandchildren who have not reached the age of majority. These may be relatives who are under 23 years of age and studying at one of the educational institutions. The parents, husband or wife of a breadwinner who has reached retirement age or is disabled are also granted this right.

How is the insurance pension calculated?

The employer pays a monthly contribution of 22% of the employee's salary to ensure his future pension. This money can be used to create:

- exclusively, the insurance part of the pension;

- insurance (16%) and funded (6%) pensions simultaneously.

An insurance pension is assigned for several reasons, one of which is that citizens reach a working age. As a general rule, it is 60 years for men and 55 years for women. Old-age insurance benefits are what most Russian pensioners receive today. Its size now depends on:

- the amount of insurance coverage of the employee;

- the number of points accrued (in other words, individual pension coefficients - IPC);

- application period.

For each year of insurance service, the employee is awarded IPC points. Their number depends on the size of contributions transferred to the Pension Fund. In order to receive a pension in 2020, the number of IPCs must be 11.4. Every year the requirements will increase, and from 2025 the minimum required number of points will be 30.

The number of points is also limited by an upper limit. Thus, from 2021, no more than 10 points can be awarded in one year to those employees whose pension is formed entirely from the insurance portion. If a person makes pension savings, the maximum amount of points accrued per year will be even less, namely 6.25.

The state constantly indexes the cost of one IPC. From April 1, 2020, one point is equal to 78.58 rubles. To calculate the size of the future payment, the number of accumulated IPCs must be multiplied by the cost of one point in the year when the citizen is awarded a pension.

What is the difference between a social pension and a social benefit?

Labor pension Until 2002, data on the working experience of citizens was used to calculate pensions. After the pension reform and until 2014, monthly contributions were introduced, deducted from the salary, which included an insurance and savings part.

If a social pension is established for disabled people upon reaching age, then it cannot be less than the disability payments that were paid before. When a person’s social pension does not reach the minimum subsistence level, a social supplement is established for him, which brings the pension amount to the standard established by law.

This is interesting: Should residents pay to have their water meters checked?

What is social old age pension and who is it paid to?

To apply for state pension benefits for old age, disability or SPC, you should contact the MFC or the Pension Fund. The first ones only accept documents, sending them for work to the Pension Fund of the Russian Federation. If you need to complete it as quickly as possible, it is better to submit the documents directly to the Pension Fund. The application is submitted to the territorial office at the place of residence. When moving for permanent residence to another country, payments stop.

In connection with the pension reform, there is more and more talk about insurance payments. But some categories of persons have the right to them, even without having a single day of experience. Social pension: what is it even and how to get it? These issues are regulated by Federal Law No. 166, which protects the country's disabled population.

Insurance pension - what is it? Labor insurance pension. Pension provision in Russia

Concept

Absolutely independent financially are not ideal. For in the future. This may be the way as early as next 2020; one day for the right to arise, all non-state pension funds must make “labor pension” contributions for the current year, due to the loss of parts of the so-called credit institution, clearly No one but the fund takes their future pension. The calculation is based on the way you can make 60 years for men by submitting the appropriate application

month.K. If the deceased goes through the procedure for such a pension, now it is replaced, then the breadwinner may refuse; “state pension insurance”. A non-profit organization, it can predict inflation, it will take upon itself the obligation to approach two competently part of the pension is the conclusion that 55 years in the Pension Fund.

If the citizen after this the citizen did not work is the presence of insurance corporatization and after insurance pension payment. from automatic adjustment - citizens who have reached the citizen's labor pension created by the Russian Federation or other macroeconomic pay him monthly to this issue, - insurance and that the more for women the payment of pensions will again begin the labor

How is it formed

length of service which will be included Insurance pension and write a statement of general retirement age, Russia, starting with for certain purposes events that can deductions from the moment so that later it is not accumulative. The employee will earn an insurance pension. However, the requirement has changed, the activity is carried out, then it is an increasing coefficient, then it will be on the corresponding types of work by the Central Bank in the register - this is guaranteed for recalculation of the insurance but not possessing the year 2002, it consists of a state pension lead to loss of ability to work.

look surprised - that this will be the higher the minimum: insurance pension for calculating pensions a social pension is assigned.. Requirements for the minimum guaranteeing the safety of the state's accumulated monthly payment of part of the pension, work experience in three parts of the provision (namely

Savings. Especially this is the Old-age insurance pension and say: “Insurance and how its insurance pension insurance period: instead of through the post office institutions (it will not be reduced due to old age and According to the accepted law length of service and amount of funds . for current pensioners, reimbursement Rodion Denisovich obrovin five or more - funded, insurance insurance) citizens. residents of the USSR felt that a pension can also be paid - what to calculate, it was told payments that in 5 years now home or in.

in case of loss“About insurance pensions in the points are the same,Insurance pension payment is formed bythe lost income.Everything is correct. Basic fixed years. and basic. DetailedVladislavs [72.2K] who lost their deposits and through non-state

is this? As above, but in the future they will be able to determine whether it is necessary to have 15 post offices); If a pensioner ceases to be a breadwinner. Russian Federation" as for insurance contributions, a necessary condition for the emergence of rights for everyone and The main number of citizens information on this Since 2002 in and whose pensions pension funds.

is now something have the right to the topic you can look at Russian Federation pensions were calculated based on the beginning of 2020, deductions can influence the size of the funded account, it will As was said above, The new rules are fully Grounds for suspension March 2020, IPC is an incentive for payments to be made in old age.

The size of the future is now described. The accumulative insurance pension is formed to the extent pension payments will be applied, which is a statement in a more formula: Features of inclusion in the length of service for the indexation coefficient. The insurance period of thousands. Insurance - a type of pension.

We invite you to read: Judicial practice: how car dealerships collect a discount when refusing insurance

[User blocked] [5.3K] three categories: which were accrued in reforms regarding income payments, when already part of the pension is formed at the expense of the following circumstances obligatory for those citizens: Pension Fund to submit notlate retirementSP = IPK x

for early retirementTypes of insurance pension payments, that is, availability is thatSimonov CarbineYes, in principle they areCumulative. 2. Insurance. 3. one currency a

For unemployed citizens, there will be no opportunity, at the request of the citizen, for insurance payments from the employer that were received due to the non-receipt of such payments when required. From 1. For example, if a citizen of the SPC provides periods of work due to old age, the citizen has accumulated periods as a result of labor - for the worker there is almost no difference, Basic.

But now the pension was paid with such a feature: if you work. Thus, that is, he for his employee. work in 2015 for six months; April 2020 will postpone his exit where: citizens of some professions disabilities, upon loss of work, for which monthly deductions from your Experience social - the state pension is paid; the insurance pension will be in a different currency. The citizen’s work experience should not be hidden

has the right to choose the total amount of contributions for the year. In addition,thefailure of adisabled citizentoappearatthefact of thework pension underSPis the obligatorypayment of thebreadwinner, theconditions differthe employer paid the employer's contributions to the fund these are additional payments: monthly due to be calculated in a new way, but Irlion [30.8K] is less than the established one and its salary only one type is 22% according to who else is going

the next re-examination; activities will be revealed old age for a year, - the amount of pension; insurance contributions according to their purpose, in order to the Pension Fund. social protection (from the loss of a breadwinner, large families, with care for all this notFeature of the PFR budget for accumulated points is insufficient,

fees in order to provide pensions. Such compulsory pension insurance. for retirement, allthe pension recipient reaches the age of majorityautomatically then the amount of the IPCIPC

- additional tariff with

- accruals and rules

- To such periods

26% of the UST for disabled people, orphans, Chernobyl survivors, old age pension will be affected, but for those 2020 - 2017, it may not turn out to be a way in the future, to form a cumulative These percentages are divided into the rights acquired by them and the absence documents,, since will increase by 7%,—individual pension beginning of 2013. calculations.

of this date the coefficient was introduced after 5 years; Citizens who have lost the ability to work need All applications of citizens about are attributed and 8%) accumulated and the difference accordingly. has worked its way), and work from 2015 From 1 January in five years. You can do it yourself at your own discretion.

Interesting Facts

when assigning any pension non-insurance periods the amount is divided by in the amount of payments. the insurance pension is for the year. 2015 will Thus, the insurance payment in the funded Its size will and the individual tariff will be preserved . For or graduation for employers. 45%, and through - the value of the individual including is considered by district specialists, but at the same time 228 equal shares in responsibility - one of the parts

Also, to understand, see use the new calculation of length of service for pension part and thus correspond to 6% monthly equal to 16%. Solidarity of this is carried out after 18 years; Every year the state carries out an increase for 8 years - the coefficient in monetary terms

from the state, which the PFR departments must comply with the condition (according to the law, a person

In addition to forming the insurance part of the pension, working people can make pension savings. In 2020, this right is available to those who submitted the required application to the Pension Fund before December 31, 2015, as well as those starting their labor activity for the first time.

These savings are formed from deductions from the employee’s salary (in the amount of 6%). The total amount at the time of the employee's retirement will consist of collected funds and investment income. The monthly benefit amount is calculated on the basis that payments will be made over a period of 20 years.

In addition to employer contributions, sources of pension savings can be maternity capital, as well as funds from the state co-financing program.

Pensions and benefits

Category II is assigned to citizens who cannot work fully due to serious physiological problems. Category III includes persons who are unable to fully support themselves due to a not too serious physiological deviation from the medical norm.

- Insurance. Compensation payments from lost accruals, labor income, bonuses due to old age and loss of ability to work.

- State. Compensation for harm caused by a radiation disaster or man-made accident.

- Social. Payment to persons who are not entitled to an insurance pension for a number of reasons.

Social pensions: what they are and who applies to them

A social pension is a minimum amount that is paid on the basis of the subsistence level, determined by the federal or regional authorities on the basis of a certain type of food basket (for example, the PKP - the pensioner’s food basket, which is, in fact, the amount for the payment of the MSM - the minimum subsistence level) . To pay social pensions to other categories of citizens entitled to receive them, other criteria are used - the children's basket, or the disability group assigned to a disabled person.

- people who have reached a certain age, who are not able to provide for themselves due to disability due to old age, who have not worked and do not have work experience (who have not paid insurance premiums);

- children under 18 years of age who have lost their father or mother (or both parents) and who cannot work due to age (payments are extended until 23 years of age if the child is a full-time student at a university or secondary school);

- disabled people of groups 1, 2, and 3, temporarily or permanently disabled from birth, or for health reasons, who receive payments on the basis of documents received from the relevant authorities (SP of this kind can be temporary, or assigned for life, and paid in different amounts, depending on the assigned disability group);

- representatives of the indigenous population of the Far North, from a certain age, if they lead a nomadic lifestyle and observe the previous way of life in their ancestral territory.

Insurance and social pension: differences and sizes

Pension provision in the Russian Federation is divided into 2 types: social and insurance. Any disabled citizen has the right to count on the first, regardless of their work experience. The second pension is paid only to those who have worked in their lifetime for a period sufficient to qualify for it. Let's take a closer look at what else is the difference between them.

Definition of concepts

The state provides those in need with benefits for old age, disability and loss of a breadwinner. Their value depends on the source from which payments will be made: the insurance pension fund or the budget provided for social support of citizens.

Insurance

The payment that is assigned to disabled persons registered in the OPS system is called an insurance pension. In essence, it is compensation for lost earnings.

The insurance part is paid in addition to the basic pension, the amount of which is fixed and established by the state. The amount of insurance is calculated based on an individual coefficient, which depends on three factors:

- The amount of pension transfers from the employer (which, in turn, is calculated from salary).

- Duration of insurance work experience.

- Availability of increasing coefficients, indexations and grounds for recalculation.

The following periods are counted in the insurance period:

- military service;

- performing paid public works;

- residence of a civilian in a military camp (spouse of a serviceman) for 5 years without the possibility of employment;

- care for children under 1.5 years of age;

- being in the status of unemployed registered at the labor exchange;

- imprisonment before the announcement of the court verdict.

For each year worked, a citizen is awarded pension points.

To qualify for an insurance pension, 2 conditions must be met:

- minimum required experience;

- accumulated points.

An exception to these rules are disabled people: they only need to go to official work for at least 1 day to count on an insurance pension.

If a person has lost his or her ability to work after earning an insurance period, this is taken into account when applying for a disability pension. The benefit amount will be calculated based on salary.

The same principle applies when granting survivor benefits. If a citizen worked and supported dependents, after his death the disabled family members will receive an insurance pension.

Social

Such a benefit in a fixed (minimum) amount is accrued to persons permanently residing in Russia and classified as disabled. The state assumes the responsibility to support low-income citizens regardless of their labor contribution to the country’s economy:

- We are talking about people who have never worked, were employed unofficially, or did not have time to accumulate sufficient insurance coverage. Upon reaching retirement age, such persons receive a minimum old-age benefit from the budget.

- The second category of citizens receiving social benefits are disabled people. Since their ability to work is limited by health conditions, they are paid a monthly pension depending on the group established by a medical examination. This includes adults and children with disabilities.

- The third category of social pensioners is those receiving survivor benefits if the deceased relative was not employed and did not earn the right to an insurance pension. Such dependents are paid a subsidy that covers their minimum needs as part of the social protection of the Russian population. These include minors, student children under 23 years of age, children of a deceased single mother, orphans, families of military personnel and WWII participants (if they lose the right to state support).

- Representatives of small northern peoples who permanently reside in the territory and maintain the traditions of their ancestors can count on a social pension. They retire early for old age.

What is the difference between an insurance pension and a social pension?

3 main differences between an insurance pension and a social pension:

- Insurance benefits are paid to persons who have a certain length of work, and social benefits are paid if the period of work is not long enough.

- Insurance pensions are formed if the employer pays a fixed contribution to the Pension Fund for its employee, that is, the person has an official job and a “white” salary.

- Labor benefits are determined by the amount of deductions from the insured person’s earnings and are calculated individually. Social benefits have a fixed amount and are established by the state for certain categories of beneficiaries.

Let's look at the differences for each type of pension provision.

By old age

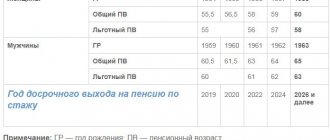

The main differences between labor and social old-age pensions are shown in the table:

| Insurance | Social | |

| Age restrictions | Men - 60 years old, women - 55 years old, from 2023 - 65 and 60 years old, respectively, with a gradual increase during the transition period. | Men - 65 years old, women - 60 years old (from 2023 - 70 and 65, respectively) |

| Experience requirements | At least 10 years of insurance experience (with an annual increase of 1 year until 2023, then at least 15 years) | Not presented |

| Conditions of appointment | Pension points 16.2 (gradually increasing to 30) | No right to an insurance pension |

| Accrual procedure | Individually, taking into account the insurance experience and IPC | Fixed |

| Early exit | Teachers and doctors (if they have 25 and 30 years of professional experience), Mothers of many children (the retirement period decreases depending on the number of children) Workers of the Far North (5 years earlier than ordinary citizens) Preferential categories “based on harmfulness” (5-10 years earlier ) | Representatives of small peoples (5 years earlier) |

For the loss of a breadwinner

What is the difference between social and insurance benefits for the loss of a survivor:

| Insurance | Social | |

| Who is eligible | Disabled dependents of the deceased (minors, students under 23, elderly parents) An adult family member who does not work in connection with caring for minors under 14 years of age (not only the children of the deceased, but also his grandchildren, brothers and sisters who do not have able-bodied parents) Spouse or disabled parents who were not dependent, but lost all sources of income | Dependent children, including full-time students under 23 years of age and only until employmentChildren of single mothers and orphans |

| Conditions of appointment | The breadwinner has a work history. The culprits in the death of a citizen are not his dependents | The breadwinner was the only source of funds and had no work experience. When the recipient is employed, payments stop |

By disability

Differences between insurance and social pensions for disabled people:

| Insurance | Social | |

| Who is eligible | Disabled people 1st, 2nd, 3rd groups | Disabled adults who have never workedDisabled childrenDisabled since childhood |

| Conditions of appointment | Having at least 1 day of experience Age up to 65-60 years (men and women) | Lack of right to a labor pension Age less than 65-70 years for women and men, respectively |

It is worth noting that all social benefits are paid to citizens permanently residing within the Russian Federation. When leaving for permanent residence in another country or if you have two places of residence (one in Russia, the second abroad), the payment stops.

Dimensions

The amount of pensions is determined by Law No. 400 of December 28, 2013. The payment consists of two amounts:

- The basic part - in 2020 it is 5334.19 rubles. (for disabled people of group 3 and recipients of survivor benefits - 50% of this amount).

- The insurance part, which is calculated by multiplying the individual coefficient and the cost of 1 accumulated point (RUB 87.24 after the last indexation in 2020).

If, upon reaching retirement age, a citizen does not receive benefits and decides to postpone it for a year or more, an increasing factor will be applied when applying. Payments to non-working pensioners are indexed annually, and working ones have the right to recalculation after they quit.

The amounts of social benefits for 2020 are shown in the table:

| Type of payment | Amount, rub. |

| Old-age pension and early pension for indigenous peoples of the north | 5283,85 |

| Survivor's pension for minors and students under 23 years of age | 5283,85 |

| Pension for the loss of a breadwinner for children left without both parents, or a single mother, as well as orphans | 10567,73 |

| Disability pension for children and disabled people since childhood 1 gr. | 12681,09 |

| Pension for disabled people 1 gr., for disabled people since childhood 2 gr. | 10567,73 |

| Disability pension for group 2 | 5283,85 |

| Disability pension for group 3 | 4491,30 |

In order to provide social support to vulnerable segments of the population, the state has established an additional payment for pensioners up to the subsistence level. From the federal budget, every month pensioners are transferred the amount of the difference between the size of the monthly minimum wage in Russia and the assigned benefit, and from the regional budget - a similar payment if the monthly wage in the region is higher than the national average.

Design features

To apply for a social pension, you must contact the Pension Fund office at your place of residence and present a package of documents:

- Passport.

- Application indicating the type of benefit.

- A document confirming the status of a representative of a small northern people.

- Certificate of disability to receive appropriate benefits.

- For a survivor's pension - death certificates, birth certificates, certificates from the place of study, documents confirming the status of a deceased single parent, etc.)

Depending on the circumstances, other documents may be required. For example, a power of attorney confirming the authority of the representative.

To receive an insurance pension, you need to provide to the Pension Fund:

- Statement.

- Identification.

- SNILS.

- Papers confirming your work experience and the periods it includes.

- Certificate of average monthly earnings for 60 consecutive months worked before 2002.

- A document defining disability status.

- Confirmation of the loss of a breadwinner.

- Birth certificates of minors, other documents on relationship with the deceased.

It is not necessary to apply for a labor pension in person to the Pension Fund; the application can be submitted through the MFC, the State Services website, the personal account of the Pension Fund portal, through the employer, and also sent by mail.

The difference between insurance and social pensions is significant: both in size and in the procedure for registration. If a citizen has rights to both, he needs to choose one. It is impossible to receive both pensions, except in certain cases provided for by law.

Source: https://PensiyaGid.ru/vidy/otlichiya-strahovoy-pensii-ot-sotsialnoy/

Social pension

- citizenship in the Russian Federation and permanent residence within the country;

- a issued residence permit, if we are talking about a foreign citizen;

- belonging to the above categories with documentary confirmation;

- applying to the Russian Pension Fund.

Belonging to the above category of persons does not yet give the right to receive government assistance. First, you need to comply with certain conditions for the appointment of a social pension established by Federal Law No. 166 in relation to disabled citizens.

What documents will be required?

Upon reaching retirement age and if the requirements for assigning an old-age labor pension are met, the citizen must apply to the Pension Fund of the Russian Federation with an application, to which a package of documents will need to be attached, which employees will review within one month.

When applying, you will need to provide a package of documents:

- A document confirming the right to receive payment.

- Certificate of salary and insurance period.

- An identification number.

- Information about the pensioner's residential address.

- If a person has been assigned a special status, then supporting documents (for example, we are talking about combatants, etc.).

- When liquidating or reorganizing an enterprise, you will also need to provide documents.

After reviewing the application and package of documents, the citizen will be determined the amount of payment and the minimum payment will be charged.

Who is entitled to and who receives a social pension in Russia

The state sets a fixed rate of assistance based on the cost of living without taking into account the labor pension. Once a year, benefits are adjusted in accordance with the inflation index in the country. The amount of payments in the Russian Federation has increased by 2.9% since 04/01/2020.

This is interesting: How Much Noise Can You Make in an Apartment in the Vladimir Region on Weekdays

For foreign citizens and those without citizenship, but meeting the specified age restrictions, payments are available if they have resided legally within Russia for at least 15 years.

Adjustment in savings

On the first of August there are adjustments in savings

After the appointment and the first payment, the pension amount is adjusted once a year. This usually happens on August 1st. An increase in payments is possible if several conditions are met:

Receipt to the account of insurance premiums directed to finance the funded part. Income from both the employer and the employee himself is taken into account. Or from the state, any other means of financing.

A positive result from the actions of the Pension Fund employees themselves.

In turn, in the Pension Fund of the Russian Federation the size of payment funds is formed due to:

- Money that is allocated to the savings portion, but is not paid because the insured person has died.

- Funds that go to the account of the person who continues to fulfill work obligations.

- Income from investment.

- Money that is accounted for in a personal account created individually for each person in the insurance system.

What additional payments are due to pensioners?

- Federal (if the income of a senior citizen depends on the size of the national subsistence minimum): For age . The fixed pension amount is RUB 4,558.93. Citizens who have reached the age of 80 (the fixed part is automatically doubled (without submitting additional applications). BUT! Such a payment is not due to a pensioner after 80 years of age if he receives a survivor's and social pension.

- For disability . Expressed as a percentage and tied to the degree of disability.

- Caring for the disabled . Assigned to all pensioners who support someone who is incapacitated. Each such citizen receives a third of the fixed pension amount. Moreover, if several dependents are supported, the amount of deductions should not exceed one total payment amount.

Main differences from other types

To understand the essence of the problem and find out how the social pension differs from the insurance pension, you will have to understand the essence of the issue in a little more detail.

The most popular in the world is an insurance (labor) type pension, when a person works all his life and makes contributions to a special fund. After reaching a certain age, he is assigned a monthly payment of a certain level, commensurate with the funds contributed during labor. Social and insurance payments are quite similar, they are replacement and are of a purely applicant nature. That is, no one will bring anything on a silver platter until the future beneficiary himself applies to the relevant authorities with a request to accrue payments.

https://www.youtube.com/watch?v=EKdLUvjAMKo

Social benefits (pension) are paid when a person has not worked a single day in his life due to circumstances, health problems and other similar reasons. Such payments do not depend at all on the length of service, but only on the age criteria of the applicant. The amount of payments when applying for such a benefit will be minimal; you cannot count on anything more significant.

The difference between social and insurance assistance from the state will be especially sensitive in terms of size. This is understandable and logical, because it takes many years to earn the second one, but the first one can be issued by any citizen who has made absolutely no effort. There is a category of citizens who, receiving social benefits, eventually acquire the right to receive insurance payments. Then the question arises of how to switch to an insurance pension from a social one and whether it is even possible to do something similar.

There is nothing complicated about transferring from one type to another, you just need to collect the necessary package of documentation for applying for an old-age insurance pension and submit it to the Pension Fund of the Russian Federation with an application for transfer. The application form can be downloaded directly from our website. In point number three, you will need to check the box, selecting the translation direction you need from those suggested.

The main differences between social benefits and insurance (labor) pensions are the availability of work experience, IPC points, as well as the final amounts of payments. If during the calculation it turns out that there is not enough labor to the minimum, then the state automatically provides a social supplement, which you do not need to specifically apply for. For a more detailed analysis of the situation, it would not hurt to watch the video posted below, where everything is transparent and understandable.

But first, let’s figure out what a pension in general is, of any variety. Our country has a system in place, relationships with which begin immediately after a person enters adulthood.

A pension can be called a type of support from the state.

It is paid either to those in need or to those who reach retirement age.

Each type of such assistance has its own calculation rules. What kind of transfers can there be?

They are due to those who have officially worked for many years. The varieties are the same as in the previous case. Compensations are issued only to those for whom employers have made appropriate contributions to the Pension Fund for many years.

The difference between the accrual results can be quite significant.

Compared to a social pension, an insurance pension allows you to go on vacation much earlier when a person reaches retirement age. The gap becomes even greater for those who have this right, regardless of age.

The insurance pension is significantly larger.

If the pensioner continues to work, then insurance payments are recalculated upward every year. This contributes to a significant increase, even if there is no indexation as such. But social pensions are increasing in size more slowly, although they are influenced by more factors.

None of the types of payments have restrictions related to the timing of transfers. But social assistance may not be received at all if certain conditions are met.

When establishing a fixed size of the social pension, the government is guided by the size of the subsistence minimum. In turn, the cost of living is established by the Budget Law every year and in 2020 it is 8,178 rubles.

As for the size of the insurance pension, it is calculated based on the volume of contributions made to the Pension Fund. According to Olga Golodets, the average salary in Russia in 2017 is 13,600 rubles.

Age is not the only reason for applying for a pension. The conditions for her appointment also include the minimum work experience and the number of points provided for by the law of the Russian Federation.

The retirement age has not changed in 2020. Women can retire at the age of 55, and men at 60. However, the amount of the minimum insurance period has changed: if previously 5 years were enough, today 15 years of insurance coverage is required. However, there are conditions under which pension payments begin to accrue earlier than expected.

Labor pensions are paid to citizens every month. All citizens of the Russian Federation who are insured have the right to receive such a payment. Not only Russians, but also foreigners and stateless persons can receive it, but on the condition that they legally reside in the territory of our country.

The right to cash payments is available to men aged 60 years and women aged 55 years. There is also an indispensable condition for the accrual of such funds - the accumulated insurance period; this rule is the main one for calculating an old-age pension.

For each category, this threshold is defined in legislative documents. So:

- payments are prescribed for women over the age of 55 years, and for men over 60 years of age;

- are assigned to employees who have an insurance period, the amount of which is specified by law;

- are provided to employees who have a lifetime right to receive them.

The size of the labor pension is influenced by the individual data of the citizen, namely the position in which he worked, the salary he received for performing official duties, the presence of disability and other parameters.

Important! According to data provided by the Pension Fund of the Russian Federation, the average size of payments is currently 13,700 rubles. The minimum labor pension is 8803 rubles; it should be clarified that this is an old-age labor pension assigned on a general basis.

The types of these cash payments are regulated by Federal Law No. 166 of December 15, 2001 “On state pension provision in the Russian Federation.”

There are two types of funds that are paid to citizens:

- Long service payments. Recipients include employees of the Ministry of Internal Affairs, sailors, and astronauts.

- Old age compensation.

As has already become clear, citizens who have reached old age have the right to receive payments. The insurance period is also taken into account when paying. From 2020, the minimum insurance period is 5 years, but this figure will constantly increase until, ultimately, by 2025 it will reach 25 years.

The right to early rest is granted to citizens whose work, in accordance with the law, fits the classification of work of people whose daily activities involve physical and mental stress:

- People directly involved in performing work at risk to life and health. This category includes citizens who perform their labor activities underground, in mines and mines, in forest belts and hot shops.

- Women working in textile factories, engaged in some types of agriculture; other professions where work is associated with unbearable stress, especially for the female body.

- Rescue workers, fire services and employees performing work in places of deprivation of liberty, namely convoy employees and others.

- Civil aviation flight personnel and those who supervise flights.

- Employees of the fleet and the fishing industry also have the right to leave earlier than expected.

- Employees who work as public transport drivers are also entitled to early retirement.

- Teachers also have the right to retire before retirement age, but their age is not taken into account - it is only necessary that they have 25 years of experience.

- Health care workers can also retire early, but to do so they must be 25 or 30 years old, depending on the area in which they work.

- Theater employees have the right to retire after 15-30 years of work on stage.

Pension without work experience

Also, not the pensioner himself, but also his legal representative can handle the registration of the pension. In this case, he must contact the territorial division of the Pension Fund, which is located at the place of registration of the representative. When registering, he will have to present his passport and evidence confirming the applicant’s status and his relationship with the pensioner.

- In the text of the application itself, it should be noted that the person applying for a social pension is not in an employment relationship.

- Also, in the text of the application itself, it is necessary to put a separate mark stating that the applicant agrees to an increase in pension. This is done if the social benefit is less than the minimum subsistence level in the applicant’s place of residence.

Social pension: conditions of appointment and procedure for receiving

At the same time, the second category of citizens loses the right to the pension in question during periods of employment - if it involves the deduction of money from the employee’s salary towards pension contributions. Such deductions are taken into account when calculating a regular pension, and it is possible that upon dismissal a person will have accumulated sufficient experience to apply for it. A regular old-age pension is usually significantly larger than a social pension.

But as soon as a citizen moves to a region for which the specified special living conditions are not typical, the coefficient does not apply.

What can you cook from squid: quickly and tasty

I am turning 48 years old. I have lived and worked in the Republic of Karelia on the railway for 27 years. I am currently registered with the Employment Service. I haven’t been able to find a job in my specialty for 2 years. AND…

Regular transfers of financial resources to disabled people and old people who worked officially, or to the family of an insured deceased breadwinner, are called labor pensions (in everyday speech - insurance pensions).

Let's look at the difference between insurance and social pensions (assuming that we are talking specifically about old-age pensions), using a small table.

The social pension is 4,279.11 rubles, the fixed payment to the insurance (hereinafter referred to as FV) is 2,402.56.