What types of benefits are established for pensioners in Moscow?

All types of benefits for pensioners can be divided into 2 groups:

Federal laws establish the following benefits for all pensioners and persons of pre-retirement age:

- additional leave at his own expense (if an old-age pensioner continues to work, the employer is obliged to provide him with additional unpaid leave of up to 14 days during the year);

- tax benefits;

- property tax deduction when purchasing a home;

- compensation for housing and communal services and contributions for major repairs;

- benefits for the purchase of medicines.

The laws of the city of Moscow establish the following benefits for all categories of pensioners registered on the territory of the city of Moscow:

- for payment of transport and land tax, property tax for individuals;

- on travel on public transport;

- on travel in suburban railway transport;

- compensation for using a landline telephone;

- to pay for garbage removal;

- home health care;

- receiving dental care, free production and repair of dentures (except for the costs of paying for the cost of precious metals and metal-ceramics);

- the right to social and material assistance;

- the right to sanatorium treatment (if there are medical indications).

Important (!) because This article (primarily) is intended for old-age pensioners; it does not SEPARATELY discuss benefits for such categories as:

- heroes of the USSR and Russia, full holders of the Order of Glory;

- heroes of Socialist Labor and Labor of Russia, full holders of the Order of Labor Glory;

- veterans of the Great Patriotic War, combat veterans and persons equivalent to them;

- disabled people of the Great Patriotic War, disabled combat veterans and persons equivalent to them;

- participants of the Great Patriotic War;

- persons awarded the badge “Resident of besieged Leningrad”;

- home front workers;

- disabled people;

- persons awarded the medal "For the Defense of Moscow".

Tax benefits for pensioners in Moscow

Tax benefits for pensioners in Moscow are described in detail on the thematic pages of this site:

- for payment of transport tax;

- for payment of land tax

- for payment of property tax for individuals;

- transfer of the balance of the tax deduction to previous years.

In addition to the above, we can only add that all payments to a pensioner (the pension itself, compensation, subsidies, other social and material payments) are not subject to personal income tax.

Additional payments to pension

Pensioners living in Moscow at their place of residence or place of stay may qualify for one of two main pension supplements:

- non-working pensioners can apply for a regional social supplement to their pension ;

- working pensioners who have lived in Moscow at their place of residence for 10 years or more receive a monthly compensation payment towards their pension .

Amount of additional payments to pension

For non-working pensioners:

The regional social supplement to the pension is set to the city social standard (in 2020 it is 17,500 rubles per month) if the non-working pensioner has been registered at his place of residence in Moscow for a total of at least 10 years.

If a non-working pensioner has been registered at his place of residence in the capital for less than 10 years or is registered at his place of stay, then the regional social supplement to the pension is set to the pensioner’s subsistence level in Moscow (in 2018 it is 11,816 rubles per month).

Any Moscow non-working pensioner can receive a regional social supplement to their pension.

For working pensioners:

The monthly compensation payment is set to the city social standard (in 2020 - 17,500 rubles per month). The payment can be established only for pensioners registered in Moscow at their place of residence for at least 10 years.

The following may apply for a monthly compensation payment towards their pension for working pensioners, regardless of place of work, position held and salary amount:

- disabled people and participants of the Great Patriotic War;

- disabled people of groups I and II;

- pensioners over 18 years of age who have been granted a survivor's pension or a disability pension of group III, combining work with full-time education, until completion of such education, but not more than until they reach 23 years of age;

- disabled people of group III working in organizations employing disabled people, and in organizations of the All-Russian Society of the Blind, the All-Russian Society of the Deaf and the All-Russian Society of the Disabled.

The following may apply for a monthly compensation payment towards their pension for working pensioners with an average monthly salary of no more than 20,000 rubles per month for the last six months:

- pensioners employed in individual positions in state and municipal social institutions providing services to the population (education, healthcare, social protection of the population, culture, physical culture and sports, and so on);

- other categories of pensioners.

Payment for housing and communal services

1. Subsidy for housing and communal services

If more than 10% of your family's income is spent on utility bills, you may qualify for a subsidy - the state will compensate for part of the costs of housing and utility services.

Citizens of Russia, Belarus or Kyrgyzstan who are permanently registered in Moscow, have no debts for utility bills and are:

- owners of housing (apartment, residential building or part thereof);

- members of a housing or housing construction cooperative;

- users of residential premises in state or municipal housing stock;

- tenants of housing under a rental agreement in a private housing stock.

Calculate your family's average total income. To do this, add up all sources of income (before taxes) for the last six calendar months and divide the resulting amount by six. The income of all family members living with you, their and your spouses, parents or adoptive parents of minor children, minor children, including adopted children, even if they live separately, is taken into account.

Compare the result to the maximum pre-tax income for your household to qualify for the subsidy. Maximum income for your family:

Tax benefits for major repairs

All Muscovites who have benefits for housing services receive social support for paying for major repairs: large families, labor veterans, disabled people and war veterans, rehabilitated people, etc. In addition to them, the following are entitled to social support:

- Muscovites living alone and not working, who own housing and have reached the age of 70 years - to compensate 50% of contributions for major repairs; those who have reached the age of 80 years - 100%;

- Muscovites who own housing, live in a family consisting only of non-working pensioners, and have reached the age of 70 years old - 50% of contributions for major repairs will be compensated; those who have reached the age of 80 years - 100%.

The benefit for paying for major repairs is issued once and only for one residential premises.

Compensation for telephone

Compensation for telephone payments is automatically assigned to those who live in Moscow at their place of residence, are a subscriber to a landline telephone of MGTS and receive a monthly city cash payment (USC) as a home front worker, a labor veteran or a rehabilitated person.

The amount of compensation in 2020 is 250 rubles per month.

If you receive an annual income tax, but are a subscriber to a landline telephone of another telecom operator, then you should submit an application for compensation for the telephone at any.

Separate compensation for telephone payments is issued if you live at your place of residence in Moscow, are a landline telephone subscriber and a pensioner in one of the following categories:

- non-working pensioners who have dependent children under 18 years of age;

- single pensioners (women over 55 years of age and men over 60 years of age), families consisting only of pensioners (women over 55 years of age and men over 60 years of age).

Exemption from payment for garbage removal

Along with some other preferential categories, single pensioners, families consisting only of pensioners - women over 55 years of age, men over 60 years of age are exempt from paying for garbage removal.

Free travel on public transport

Free travel on public transport and (or) free medicines can be obtained if you live in Moscow at your place of residence and belong to one of the following categories:

- home front workers, labor veterans (military service veterans), rehabilitated, receiving monthly city cash payments from the budget of the city of Moscow;

- family members of those rehabilitated who suffered as a result of repression;

- visually impaired people with disability groups I or II;

- persons awarded the medal “For the Defense of Moscow”;

- persons who worked continuously in Moscow during the defense of the city from July 22, 1941 to January 25, 1942;

- participants in the prevention of the 1962 Cuban Missile Crisis;

- single pensioners and families consisting of pensioners (women over 55 years of age and men over 60 years of age);

- families of pensioners with dependent children under 18 years of age;

- pensioners who do not belong to other preferential categories.

You can use benefits in the form of social services, that is, travel for free on city and (or) suburban transport and (or) receive medications, or choose monetary compensation instead of the right to free travel and receive free medications.

Persons entitled to discounted travel use the Muscovite social card for benefit recipients, students and pupils.

From August 1, 2020, social card holders entitled to free travel on public transport can travel for free on commuter trains (including fast commuter electric trains and commuter express trains).

Important(!) : despite the fact that travel is free, a ticket is also issued for it. To get a free train ticket for the first time, go to the ticket office of a suburban train station and present your social card - information about the free ride will be recorded on it. After this, free tickets can be issued both at the box office and at vending machines. For each trip, you need to issue one-time tickets in one or both directions (on the day of travel or earlier, but no more than 10 days before the train departure date), even if you are entitled to free travel.

Pensioners and other beneficiaries can travel for free to the final stops of routes that start from Moscow stations and pass through the capital, the Moscow region and some other regions. Now this list includes six regions adjacent to Moscow: Tver, Kaluga, Ryazan, Vladimir, Smolensk and Tula. Thus, for travel on the routes Moscow - Tver, Moscow - Ryazan, Moscow - Vladimir, Moscow - Gagarin (Smolensk region) and Moscow - Tula, beneficiaries can issue a free ticket. Free travel is provided to preferential categories of citizens when traveling between any stations within these routes.

Financial compensation

The monthly monetary compensation for free travel on city passenger transport in 2020 is 378 rubles.

Free medicines for pensioners in Moscow

The list of persons who can receive free medicines is the same as for persons who have the right to free travel on public transport.

The Russian government annually approves a list of preferential medications. It is called the list of drugs for medical use. For 2020, it was approved by Decree of the Government of Russia No. 2323-r dated October 23, 2020 (Appendix No. 2).

Pensioners receiving an old-age, disability or survivors pension in the minimum amount can receive all medications from the list with a 50% discount. In this case, you must be permanently or temporarily registered in Moscow.

You can get medicine for free or at a discount only with a doctor's prescription. The doctor will write a prescription if necessary for medical reasons.

You need to contact those medical organizations (city hospitals, clinics, dispensaries) where doctors have the right to write preferential prescriptions. You can clarify the list of such organizations by calling the hotline of the Moscow State Budgetary Institution of Healthcare “Center for Drug Supply of the Moscow City Health Department.”

Typically, a prescription is valid for 30 days from the date it was issued. If it was prescribed to a pensioner, a disabled person of the first group, a disabled child or someone suffering from a chronic disease that requires a long course of treatment - 90 days.

Financial compensation

The amount of monthly monetary compensation for free provision of medicines according to doctors’ prescriptions in 2020 is 1,108 rubles (for persons who do not receive EDV from the federal budget).

Voucher for sanatorium treatment

The right to free sanatorium and resort treatment can be granted to citizens of various preferential categories at both the federal and regional levels.

Moscow preferential categories of citizens include:

- unemployed labor veterans and military veterans, home front workers, rehabilitated persons, as well as persons who have been subjected to political repression and suffered as a result of political repression;

- citizens awarded the badge “Honorary Donor of Russia” or “Honorary Donor of the USSR”;

- non-working pensioners (women over 55 years old, men over 60 years old) who do not belong to preferential categories of citizens;

- citizens who suffered health damage as a result of terrorist attacks;

- spouses of those killed (deceased) as a result of terrorist acts;

- parents of those killed (deceased) as a result of terrorist attacks;

- children under the age of 18 killed (died) as a result of terrorist acts.

Vouchers for free sanatorium and resort treatment are issued on a first-come, first-served basis, but there are several categories of citizens who can receive vouchers first.

Benefits for certain categories of pensioners

Monthly city cash payment

In addition to the supplement to their pension, pensioners can receive an annual income tax. Old-age pensioners living at their place of residence in Moscow, who do not receive payments as federal beneficiaries and who belong to one of the following categories, can apply for a monthly city cash payment (USC):

- labor veterans and military service veterans;

- home front workers;

- rehabilitated persons who were subjected to political repression;

- persons who suffered as a result of political repression.

For 2020, the size of the cash capital is:

- for labor veterans and military service veterans - 1,000 rubles;

- for home front workers - 1,500 rubles;

- for rehabilitated persons who have been subjected to political repression - 2,000 rubles;

- persons who suffered as a result of political repression.

Benefits in Moscow for single and low-income pensioners

Single and low-income pensioners are entitled to the following benefits:

- discounts on utility bills and major repairs. Pensioners over 70 years of age are provided with 100% compensation;

- free production and installation of dentures, incl. from expensive materials;

- free medicines or discounts on the purchase of medicines;

- extraordinary medical care in hospitals, clinics, and at home;

- targeted household assistance for the purchase of food, necessary items and medicines;

- assistance from nurses in caring for elderly citizens deprived of the ability to self-care;

- free or discounted services of housekeepers for cleaning the apartment;

- benefits for funeral services.

A non-working pensioner living in Moscow and in a difficult life situation can receive a one-time financial payment and targeted clothing assistance (primarily we are talking about clothes and shoes).

Important (!) : targeted social assistance is provided to citizens and families with children in difficult life situations, in the form of cash, food, including hot meals, care products, sanitation and hygiene, clothing, shoes and other essentials (Article 19 of Moscow City Law No. 34 of July 9, 2008 “On social services for the population of the city of Moscow”).

Benefits in Moscow for labor veterans

Pensioners - labor veterans in Moscow (if they have confirmed data on work experience of more than 40 years) in 2020 have the following benefits:

- free travel on all types of public transport, with the exception of minibuses;

- compensation of up to 50% of utility bills;

- the right to unpaid two-week additional leave for employees;

- preferential dental services in state clinics;

- discounts on medicines, medical care services;

- regional additional payments to PM in Moscow;

- monetization of discounts if a person refuses privileges.

Benefits for military pensioners

For military pensioners living in Moscow, the following benefits are provided in 2020:

- free travel on city passenger transport (except taxis and minibuses) or monthly cash compensation in the amount of 378 rubles;

- free dental prosthetics (except for the cost of paying for the cost of precious metals and metal-ceramics);

- free travel by commuter rail or monthly cash compensation in the amount of 188 rubles;

- providing unemployed labor veterans with free vouchers for sanatorium and resort treatment if there are medical indications;

- reimbursement of travel expenses to the place of treatment and back using vouchers received through social security authorities;

- telephone network subscribers - monthly cash compensation for local telephone services in the amount of 250 rubles;

- 50% discount on payment for housing and communal services.

Preferential categories of pensioners

Pension conversions will not affect:

- Performing labor duties in unsafe (harmful) conditions:

- employees servicing locomotives and trains, as well as workers who create conditions for the safety of movement of railway transport and the subway;

- truck drivers working in mines;

- those who work in hot workshops underground;

- employed in textile production (women only);

- members of expeditions, geological exploration, topographical, geodetic, forest management, prospecting workers;

- employees of river and marine fleets, as well as the fishing industry;

- flight crews and engineers servicing civil aircraft;

- mine rescue and emergency personnel;

- those who extract natural resources in mining, build mines and mines;

- workers executing criminal sanctions in the form of imprisonment;

- employees working in timber rafting and logging;

- farmland tractor drivers, as well as drivers of road, construction and loading and unloading vehicles (women only);

- those who drive passenger vehicles.

- Persons whose pension, for health reasons or social reasons, is established earlier than the generally accepted time:

- mothers who gave birth to 5 or more children and raised them until the age of 8 years;

- those who received military injuries;

- the mother or father of a disabled person from infancy, who raised him until he was 8 years old;

- guardians of disabled people from childhood who raised them until they were 8 years old;

- visually impaired people of the 1st group;

- women who have the necessary insurance work experience in the extreme northern regions, who have given birth to 2 or more children;

- midgets and dwarfs;

- reindeer herders, hunters, fishermen, permanently living in regions belonging to the Far North.

- Victims of man-made or radiation tragedies, including at the Chernobyl nuclear power plant.

- Pilots of test and production parachute, aeronautical and aviation equipment.

Benefits in Moscow in connection with raising the retirement age in 2020

From January 1, 2020, Moscow City Law No. 19 dated September 26, 2018 “On additional measures to support residents of the city of Moscow in connection with changes in federal legislation in the field of pensions” in Moscow, persons of pre-retirement age retained existing benefits for women over 55 years of age and men who have reached 60 years of age, and new social support measures have been introduced for people over 50 years of age:

- free travel on public transport (except taxi);

- free travel on the Moscow Central Circle;

- free travel on public railway transport in suburban services;

- free production and repair of dentures (except for the costs of paying for the cost of precious metals and metal-ceramics);

- providing unemployed citizens with medical indications free vouchers for sanatorium-resort treatment and reimbursement of travel expenses to and from the place of treatment;

- free medical examination for persons over 50 years of age;

- targeted social assistance to residents of Moscow who have reached the age of 50 and are in difficult life situations;

- promoting employment for Moscow residents over 50 years of age.

Law on benefits for Muscovites of pre-retirement age from 01/01/2019 (Law No. 19 of 09/26/2018 “On additional measures to support residents of the city of Moscow in connection with changes in federal legislation in the field of pensions”)

This Law establishes the legal basis for providing additional support measures to certain categories of citizens residing in the city of Moscow (hereinafter referred to as residents of the city of Moscow), in order to maintain the level of their social security and adapt to new conditions of pension provision.

Article 1. Additional measures of social support for residents of Moscow who have reached the age of 55 years for women and 60 years for men

- Residents of the city of Moscow who have reached the age of 55 years for women and 60 years for men and who have the insurance experience necessary to assign an old-age insurance pension in accordance with federal legislation in the field of pensions are provided with the following additional measures of social support:

- Single and (or) living alone residents of the city of Moscow, specified in paragraph one of part 1 of this article, the authorized executive body of the city of Moscow, in the manner established by the regulatory legal act of the city of Moscow, provides assistance in organizing and implementing relocation during the renovation of the housing stock in the city Moscow.

- Residents of the city of Moscow, specified in paragraph one of part 1 of this article, who have been awarded the title “ Veteran of Labor ” or the title “ Veteran of Military Service ,” in addition to the additional measures of social support provided for in parts 1 and 2 of this article, are provided with the following additional measures of social support:

- If a resident of the city of Moscow has the right to provide the same measure of social support on several grounds in accordance with federal laws and other regulatory legal acts of the Russian Federation, this Law and other regulatory legal acts of the city of Moscow, the measure of social support is provided on one of the grounds according to the choice of a resident of the city of Moscow.

- The procedure and conditions for providing additional social support measures provided for in this article are established by the Moscow Government.

1) free travel on public transport in the city, including the metro (except taxis);

2) free travel on the Small Ring of the Moscow Railway (Moscow Central Ring);

3) free travel on public railway transport in suburban traffic outside the Small Ring of the Moscow Railway (Moscow Central Ring);

4) free production and repair of dentures (except for the costs of paying for the cost of precious metals and metal-ceramics);

5) providing, if there are medical indications, unemployed citizens with free vouchers for sanatorium-resort treatment through the social protection authorities and reimbursement of expenses for travel by rail to the place of treatment and back using the specified vouchers.

1) for payment of housing and utilities in the amount of 50 percent of the fee ;

2) monthly monetary compensation to telephone network subscribers to pay for local telephone services provided in the city of Moscow, in the amount established by the Moscow Government;

3) monthly city cash payment in the amount established by the Moscow Government, provided that the cash income of the specified person does not exceed one million eight hundred thousand rubles per year.

Article 2. Free medical examination program for residents of Moscow who have reached the age of 50

- In order to prevent diseases and ensure health protection for Moscow residents who have reached the age of 50, medical organizations participating in the implementation of the territorial program of compulsory health insurance for the city of Moscow are implementing a program of free medical examination for such residents of Moscow until they reach retirement age.

- The procedure and frequency of medical examination in accordance with the program specified in part 1 of this article, the composition of its activities are established by the Moscow Government.

Article 3. Targeted social assistance to residents of the city of Moscow who have reached the age of 50 and are in a difficult life situation

Residents of the city of Moscow who have reached the age of 50 and are in a difficult life situation have the right to receive targeted social assistance in the manner and under the conditions established by the Moscow Government.

Article 4. Promotion of employment for Moscow residents who have reached the age of 50

- In order to ensure employment for residents of the city of Moscow who have reached the age of 50, the authorized executive authorities of the city of Moscow organize the implementation of vocational training, advanced training and vocational training programs for such residents of the city of Moscow, and facilitate their acquisition of additional knowledge and entrepreneurial skills.

- To implement measures to ensure employment for Moscow residents who have reached the age of 50, by decision of the Moscow Government, a special center for retraining and employment of such Moscow residents is being created.

Article 5. Entry into force of this Law

This Law comes into force on January 1, 2020.

The article was written and posted on September 23, 2020. Added - 09/30/2018

ATTENTION!

Copying the article without providing a direct link is prohibited. Changes to the article are possible only with the permission of the author.

Will the pension reform affect people retiring early?

As legislators assure, the possibility of early retirement for the population and workers from the Far North and equivalent regions, as well as teachers, doctors and other “beneficiaries” will remain. But the retirement age for these categories of citizens will also increase due to its general growth.

Thus, employees from the regions of the extreme northern part of our country and similar territories can expect an increase in the age of access to state support by 5 and 8 years: the bill proposes a 60-year-old threshold for men and 58-year-old for women (the current standards are 55 and 50 years, respectively ). And in the same way, a gradual increase in standard years for applying for a pension will be applied to achieve new age limits.

The state believes that for residents of northern areas, the reduction in the retirement age was at one time due to extremely difficult living conditions in the 50s of the last century. But the measures taken to improve the demographic situation significantly influenced the life expectancy of northerners.

Medical workers, citizens of creative professions and teachers will also face an increase in retirement age standards. But the period of retirement will be calculated based on the period of completion of special service. According to the legislative norms in force in 2020, doctors and teachers receive the opportunity to retire prematurely if they have 25-30 years of experience. People in creative professions must have specialized experience from 15 to 30 years, depending on the category.

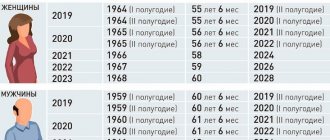

The change in the early retirement algorithm is presented in the table:

| Year in which special experience was obtained | Year in which the right to retire begins |

| 2019 | 2020 |

| 2020 | 2022 |

| 2021 | 2024 |

| 2022 | 2026 |

| 2023 | 2028 |

| 2024 | 2030 |

| 2025 | 2032 |

| 2026 and after | 2034 |

We looked at who will be affected by the pension reform, but some categories of citizens will not feel it. Who exactly - read on.