A new scam has appeared in Russia. Messages with approximately the following content are circulating on social networks: “By order of the government of the Russian Federation, every citizen of Russia is entitled to compensation of 10 thousand rubles.” Users are asked to go to the website of the supposed Social Benefits Agency (names may vary) and just enter the SNILS number (individual personal account insurance number) there. To make it even more convincing, the advertisements are accompanied by a screenshot of a news release from a federal TV channel, where the presenter talks about SNILS. And also reviews from compatriots who allegedly received a five-figure payment.

Question and answer What is SNILS and why is it needed?

Natalya came across such an advertisement - the woman saw an announcement about compensation for “every citizen of the Russian Federation” in her Instagram news feed.

“I opened the comments, and there were a lot of reviews from happy people who supposedly had already received payments. The amounts are impressive - 500, 100 thousand rubles. Of course, that’s what I wanted too. I followed the link, but stopped in time,” Natalya told the Vesti-Kuzbass correspondent. It turns out that after clicking on the link and entering SNILS, a section opens with payments supposedly due to the citizen. At the bottom there is a big bright “get money” button. But if you click on it, you won’t receive compensation. First, you need to pay yourself - the fee is required to access insurance company databases. The asking price is 100-200 rubles, not very much, especially if you think that very soon you will receive “compensation” for several thousand. Citizens transfer money, but do not receive any access to the databases of insurance companies, much less payments from the state. The amount of losses is insignificant, so few people turn to law enforcement agencies, and attackers continue to profit from gullible compatriots.

Fraud with social payments using the SNILS number is reported by branches of the Russian Pension Fund (PFR). “The Pension Fund stores not money in an individual personal account, but information about generated pension rights. You can obtain confidential information in person at the client services of the Pension Fund, at the MFC, at State Services or through your personal account on the PFR website,” says the message from the PFR office in the Murmansk region.

Take care of your SNILS and passport. What documents should not be shown to scammers Read more

Payments according to SNILS

At the beginning of November, several sites became popular offering to find out the amount of funds and receive payments according to SNILS , allegedly credited to the account in the form of “insurance payments” from private funds. Anyone with a pension insurance card can check and receive money.

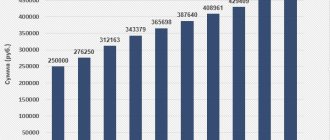

At the same time, the amounts are said to be quite large - several hundred thousand rubles . To transfer the required payments, it is proposed to pay only a small commission.

However, with each subsequent transfer the scammer sends increasingly large bills for his services, but the victim, of course, will not receive any transfers.

This scheme is fraudulent ! There are no ways to receive payments under SNILS. Note that SNILS is a plastic card intended for registering a citizen in the pension insurance system.

It does not act like a bank card or account; no money comes into it .

All individuals, companies, websites or any other sources that lure out personal data of citizens, and even more so take a commission for their services, are scammers.

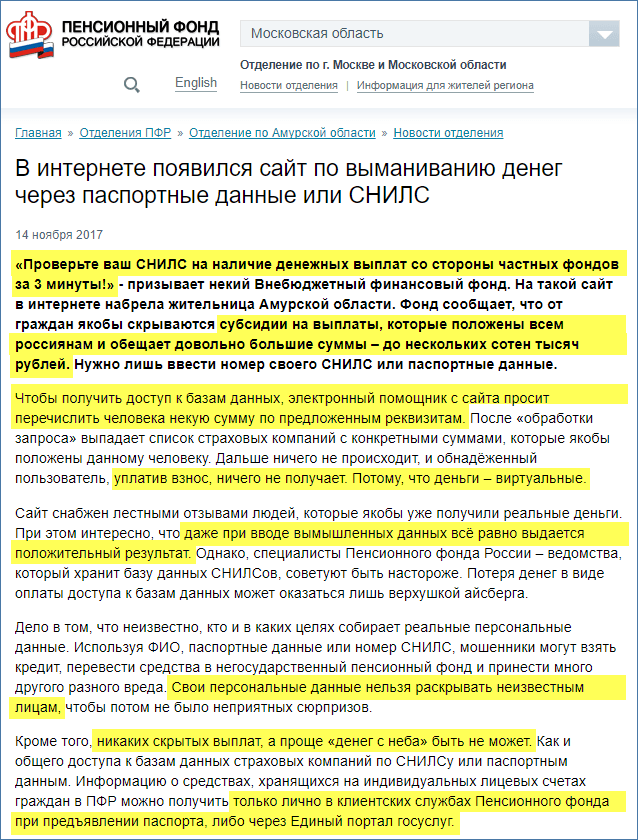

On November 14, the Russian Pension Fund published a warning to citizens about a new type of fraud. The Pension Fund of the Russian Federation warns : “There are no hidden payments, and it cannot be simpler than “money from heaven.”

As well as general access to insurance company databases using SNILS or passport data.

Information about funds stored in individual personal accounts of citizens with the Pension Fund of the Russian Federation can only be obtained in person at the client services of the Pension Fund upon presentation of a passport, or through the Unified Portal of State Services.”

Attention! If you have any questions, you can consult with a lawyer for free by phone in Moscow, St. Petersburg, and all over Russia. Calls are accepted 24 hours a day. Call and solve your problem right now. It's fast and convenient!

Control of all transfers for pension insurance is carried out only by the Pension Fund of Russia or the selected NPF.

How to check payments according to SNILS

There are already quite a lot of fraudulent sites offering. They are blocked, but their clones immediately appear. To check payments according to SNILS, you need to enter his number or passport data, and, as the description on the main page states, even a citizen of another country can receive payments using a foreign document.

It’s easy to get to scammers’ pages; it can be by clicking on a link in a contextual advertisement or sent by email. The operation scheme of similar sites is similar :

- Two methods are offered: checking payments using SNILS or passport number.

- The entered data can be absolutely anything: real or fictitious. The system will still begin searching for allegedly accrued funds.

- Available payments under SNILS are numbers generated randomly, but they are quite large to be attractive. For non-existent passport numbers and SNILS 000-000 entered by us, more than 100,000 rubles are due. Moreover, the insurance companies on the list are partly existing, partly fictitious or have already ceased their activities.

- Next, it is proposed to pay for access to databases for withdrawing money. The size of the commission compared to the possible payment is insignificant - only 235 rubles if checked by passport number and 195 rubles if checked by SNILS.

- Payment is made on the E-pay service by bank card, electronic wallets or from a telephone account.

- After paying the commission, you do not receive anything, and additional payments for an even larger amount are sent to your email, for example:

- 530 or 550 rubles for “personal data verification”;

- 350 or 450 rubles - for a “security pin code”;

- 1250 or 1350 rubles - for an “encrypted security key”;

- 1500 or 1600 rubles - for “operator remuneration”

There are quite a lot of names of funds and websites offering services on how to check payments according to SNILS:

- interregional public development fund.

- social fund for public support.

- extra-budgetary financial development fund.

They all have the same appearance and functionality, by which you can recognize scammers.

If you entered your real data, most likely there is no need to worry. This scheme is more like a money scam, but may have the purpose of collecting personal data.

Unfortunately, you will not be able to erase them from the database.

In this case, we recommend that you monitor your credit history and, if you find loans that you did not take out, file a fraud report.

If you transferred funds to the scammers' account, you must contact the bank and the police with a fraud report , also attach an electronic receipt for payment for services.

Are there payments under SNILS?

What payments are due under SNILS? You can only receive a pension using it . no other payments under SNILS . Moreover, you should not trust third-party sites. To find out the status of your personal pension account, you can only contact the Pension Fund in the following ways:

- Apply in person or order a personal account statement by phone. To do this, you will need your personal data: SNILS and passport.

- register on the official website of government services - gosuslugi.ru . Use your credentials to log into your PFR personal account on the website es.pfrf.ru. In the “Electronic Services” section you need to select the appropriate service. The site's capabilities allow you to monitor your employer's contributions to your future pension, as well as view the current amount of accumulated funds.

If pension savings are transferred to a non-state pension fund, then tracking is carried out by contacting a specific non-state pension fund to receive an extract from the personal account.

All insurance contributions begin to be transferred to the recipient only when a pension for old age, disability or family is issued in the event of death. It is impossible to receive insurance payments under SNILS ahead of schedule.

How to protect yourself from fraud

Every day, deception schemes become more and more inventive, which are quite difficult to recognize. Practical advice can be given in general:

- Be careful . Demand documents from people who approached you on the street or rang the doorbell. Call the hotline of the agency whose employees they claim to be and find out whether similar surveys or other events are conducted.

- Always check the information . If you come across a scam site, it would be a good idea to look for reviews about it on the Internet on other resources. If the scammers met in person, consult with relatives.

- Never transfer personal data and money to third parties until you are absolutely sure of the legality of their activities. It will be almost impossible to return them later.

Office of Compensation Provision - compensation and payments for unused public services

Since April 2020, a new fraudulent organization has been gaining popularity - the Compensation Security Administration.

The work scheme and goal of the organization is the same as it was, receiving illegal payments from citizens for providing access to compensation for unused government services.

The organization constantly changes names and registration addresses on the Internet. Examples of names:

- VKV - Office of Compensation Payments;

- UCF - Compensation Fund Management;

- UCO - Office of Compensation Provision.

Visitors arriving at such sites are misled by false news that is disguised as official media and TV channel websites.

Next, the user is redirected to “fake” forms, in which they ask you to enter your SNILS and passport data in order to access large sums that the state is “obliged” to pay you.

And then there is a standard fraudulent scheme - they ask for a nominal fee for access to the database, connection of SMS, password, and the like. After payment nothing happens.

It is important to remember that there are no payments for unused government services ! Please don't fall for the free cheese in the mousetrap. Do not enter your SNILS and passport data on resources that offer you payments from the state. This is all another deception!

Call right now and solve your problems - right now!

How to remove sweat stains from underarms on colored clothes

A new type of fraud is gaining threatening popularity on the Internet - insurance payments under SNILS from extra-budgetary funds (infamously known as the Social Fund for Public Support, the Interregional Public Development Fund, the Extra-Budgetary Financial Development Fund, etc. - all these organizations are fictitious, and as they “ recognition" more and more new names are constantly appearing). Citizens have already been warned about the danger of the new scam on the official website of the Pension Fund:

It should be noted that recently various divorce schemes on the topic “how to get money from the state” have been in great demand among the population. Citizens' distrust of the state apparatus and official social institutions creates fertile ground for attackers to spread rumors about various “hidden payments”, behind which often there is only deception in order to obtain money from gullible citizens (in other words, fraud or “money scam”).

A new scam tells citizens about supposedly government-provided subsidies for “insurance payments,” which are carried out through unknown “private funds.” In turn, these funds try not to advertise the receipt of non-existent government money “intended directly for payments to citizens,” and simply circulate it in commercial banks for the purpose of obtaining personal gain.

However, as the scammers report, any citizen can check on their website using their SNILS number or passport whether they are entitled to an insurance payment from the state, and if an accrual is detected they can be received in cash “at any time and in a convenient form” .

Here it is necessary to immediately warn the reader that no insurance payments under SNILS , which are not ordinary state pensions, are not provided for by law at all! In this situation, scammers simply manipulate the ignorance of citizens. Therefore, below we will provide some general information regarding what SNILS is and what payments are due under it. And if someone is not interested in this now, then you can go straight to the section about the essence of the new scam.

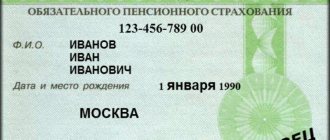

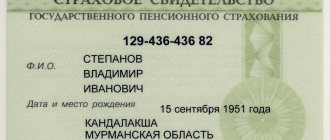

A citizen’s SNILS is the insurance number of his individual personal account in the compulsory pension insurance system. This number is indicated on the insurance certificate (green plastic card), which is issued by the Pension Fund of Russia (PFR) to citizens of all ages, including newborn children and children under 18 years of age.

This number is, first of all, necessary for the employer to use it to make contributions to the Pension Fund for compulsory pension insurance for its employees (this is 22% of wages before income tax).

Thus, according to common sense, in fact, “insurance payments under SNILS” are nothing more than:

- labor (insurance) pension - for old age, disability and loss of a breadwinner;

- funded pension , which can be formed for citizens younger than 1967 along with a regular pension in non-state pension funds (NPF) and which is due to be paid only upon reaching retirement age (or to the heirs of a deceased employee before his retirement).

No other “payments under SNILS” are provided for by law , that is, in fact, scammers are offering you to receive your future pension now (although for some reason they themselves write on their website that their offer is in no way connected with the Pension Fund, so supposedly there is no need to go and Asking the Pension Fund about these payments is a must!). This cannot happen by definition, because the budget does not provide money for this - now there is not enough money even for those who are already retired (for example, pensions have not been indexed for working pensioners for 2 years)! And in general, where does such generosity come from the state to distribute “money from heaven” to everyone, and for some reason, through some “private insurance funds”?

Why do scammers need SNILS?

In Moscow and the regions of Russia, the actions of scammers have been recorded, requiring citizens to present their SNILS number. This document confirms registration in the Pension Fund system.

Fraudsters pose as employees of the Pension Fund and find out the personal data of citizens. They approach citizens on the street and find out the necessary information. Another scheme is visiting citizens’ apartments.

Attention! If you have any questions, you can consult with a lawyer for free by phone in Moscow, St. Petersburg, and free calls throughout Russia. Calls are accepted 24 hours a day. It's fast and convenient!

The pretexts under which scammers try to find out the SNILS number are different:

- registration of a service that allows you to maintain the percentage of transfers to the Pension Fund;

- receiving attachments to SNILS confirming the authenticity of this document;

- conducting a census by the Pension Fund;

- participation in a social survey;

- When applying for a loan for goods in a store, a mandatory condition may be the transfer of funds to a non-state fund;

- promises to get a job, for which you need to fill out a form, indicate your passport details, and sign an application for transfer of a funded pension to a non-state fund.

When signing any documents at job search agencies or shops, there is often only the second page of the funds transfer agreement where you need to sign.

Typically, such scammers are young people aged 25-30, they present false documents about working at the Pension Fund of Russia, have a pleasant appearance and good manners. If a citizen refuses to show SNILS, then fictitious Pension Fund employees threaten to contact the police.

Payments according to SNILS in 2020

You can become a victim of fraud on the Internet. Recently, many websites have been created offering to receive payments using SNILS or passport . Fraudsters promise to transfer large sums accrued by private funds in exchange for a small commission for providing access to databases.

The general scheme of deception is as follows:

Attention! If you have any questions, you can consult with a lawyer for free by phone in Moscow, St. Petersburg, and free calls throughout Russia. Calls are accepted 24 hours a day. It's fast and convenient!

- A person goes to a website that offers a way to receive payments under SNILS.

- To search for accrued funds, you must enter your passport number or SNILS . At the same time, the system also skips non-existent numbers.

- Based on the results of the check, a large amount and the names of the insurance companies in which it was accrued are displayed. On average it reaches 150,000 rubles .

- To gain access to the databases you need to pay a fee of 195 or 235 rubles . It depends on what document was used to check.

- Subsequently, under various pretexts, new sums are extorted from the deceived person for Additional services:

- 530 or 550 rubles for personal identification;

- 350 or 450 rubles for a PIN code for protection;

- 1250 or 1350 rubles for a security key;

- 1500 or 1600 rubles to pay for consultant services.

- There are no payments under SNILS , so invoices for additional paid services will be issued constantly until the person realizes that he was deceived.

Site names are constantly changing, some of them are:

- interregional public development fund.

- social fund for public support.

- interregional development fund and others.

It is easy to understand that these are the same pages by their appearance - the design and layout are similar.

On November 14, the Russian Pension Fund published a warning: “There are no hidden payments, and it cannot be simpler than ‘money from heaven’. As well as general access to insurance company databases using SNILS or passport data.”

Thus, there are no ways to check and receive payments under SNILS in cash. Everyone who offers such services is a scammer.

What can scammers do if they know SNILS?

The insurance and savings part of the security is formed from the insurance contributions of citizens received by the Pension Fund. Control over savings is carried out by the Pension Fund or non-governmental organizations. A citizen has the right to choose who to entrust with the management of these funds.

What fraudsters can do, knowing the SNILS number, is to transfer funds from the Pension Fund (or NPF) to another non-state fund. After this operation is completed, the savings are at the disposal of the NPF, which is responsible for investing funds and paying citizens the savings provision.

The main reason why scammers need SNILS is their personal enrichment . In case of successful receipt of funds to the NPF, participants in this process receive a monetary reward from the NPF in the amount of 3,000 - 6,000 rubles.

Many citizens are interested in the question of whether scammers can use their SNILS number to obtain a credit loan . This document is not enough to apply for a loan, but if you provide passport data, this becomes possible.

In non-state funds, investing funds may become unprofitable. As a result, income from their use is lost and the amount of provision for citizens is reduced. The functioning of NPFs is regulated by the Deposit Insurance Agency. In case of unsuccessful investment, the nominal amount of savings must be returned.

How to protect yourself from fraud?

The following recommendations will help you avoid problems with pension savings:

- do not disclose your SNILS number to unauthorized persons;

- do not provide copies of documents to third parties;

- do not open the door to strangers offering work or services of the Pension Fund (PFR employees do not visit citizens at home);

- carefully read proposed agreements before signing them;

- do not use the services of dubious agencies and credit organizations.

The most effective way to protect your savings from fraudsters is to write an application to your fund. This is possible if the scammers know the SNILS number, but the transfer has not yet taken place. The document specifies the requirement to maintain the accumulated amount throughout the year . Then any attempt to transfer funds will be denied.

What to do if savings are transferred?

Transfer of savings is made upon submission of an application to the Pension Fund and an agreement concluded with a non-governmental organization. A citizen may sign such an agreement inadvertently or under the pretext of completing other documents.

What to do if scammers find out your SNILS number can be found out from the following algorithm:

- Contacting the Pension Fund at your place of residence or actual location. The department's specialists will provide information on pension rights and transfer of savings.

- Drawing up a complaint that Pension Fund employees will send to a non-governmental institution.

- Contacting the NPF to receive an application and agreement. A citizen can freely file a claim for unlawful transfer of funds.

- The NPF is obliged to inform the citizen on what basis the funds were transferred. The original contract with copies of supporting documents must be provided.

- Writing an application to transfer funds back to the Pension Fund or another selected fund. The application is sent in person or by mail to the Pension Fund branch. It is possible to send an application through the personal account of the insured person. The right to change the fund is granted once a year.

If you find out about the actions of scammers, you must:

- appeal to the Bank of Russia, which controls the work of non-state pension funds;

- writing a statement to the prosecutor's office;

- resolving the issue in court.

In case of illegal actions with savings, the responsible organizations are subject to a fine of up to 700,000 rubles . Officials are required to pay a fine in the amount of 10,000-30,000 rubles. In case of repeated violation, the penalty will be 50,000 rubles. or suspension from work.

An example of fraud with SNILS

Anna Yuryevna Semenova transferred her funded pension to Management Company “I” in 2004. Until 2020, she tracked her deductions, after which, due to child care, she did not check the status of the account.

In 2020 Semenova A.Yu. discovered that her savings ended up in NPF “B”. The funds transfer documents indicated a valid SNILS number, but a fictitious residential address. The information was obtained by fraudsters when the applicant was purchasing goods in installments.

Semenova A.Yu. filed a lawsuit to invalidate the document . The lawsuit also demands the return of funds to Management Company “I” 30 days after the court’s decision. Also, the plaintiff is asked to compensate for lost income, which in NFP “B” is 3%, while in the Criminal Code the profit is 11%.

Conclusion

- All actions on the part of citizens seeking to find out SNILS numbers are fraudulent.

- Most often, scammers introduce themselves as Pension Fund employees, approach you on the street or conduct door-to-door visits.

- The pretext for transferring the SNILS number may be the need to complete additional documents, conduct surveys, or get a job.

- If you have a SNILS number, fraudsters can transfer pension savings to a non-state pension fund.

- For their actions, fraudsters receive rewards from a non-state fund.

- To protect your savings, it is recommended to study all documents before signing them.

- If the fund where the savings were received is unprofitable, the profit from their investment is lost.

- If a transfer of funds has taken place, you need to contact the Pension Fund or directly the involved fund.

The most popular questions and answers regarding SNILS fraud

Question : How do I know if I have pension savings ? Can I somehow track them so as not to suffer from fraudulent schemes?

Answer : Information about pension savings is checked in your personal account on the Pension Fund website . Login is carried out after registration with a login and password. In the electronic services section you can order a certificate about the status of your personal account. Periodic checks of savings will also help to detect illegal transfers of funds in a timely manner.

Citizens born in 1966 and older have savings obtained through voluntary contributions or maternity capital funds. In the case of employment, contributions go only to pension insurance.

The following categories of citizens also have savings:

- men born 1953 to 1966;

- women born 1957 to 1966

For these categories, deductions were made from 2002 to 2004. Since 2005, a new legislative framework came into force, so these deductions stopped.

Until the end of 2020, citizens born in 1967 and later had the opportunity to choose a security option: form an insurance and savings part or only a savings part. At the moment, citizens born in 1967 and younger can choose the insurance method if their insurance premiums began to be received in 2014.

- Within Russia the call is free:

- Moscow and region:

- St. Petersburg and region:

Call right now - it's fast and free!

Payments via SNILS are fraud

Fraud using SNILS and compulsory medical insurance policies is gaining momentum in Russia. Violators are thinking up new ways to lure money from gullible citizens. But if you follow some security rules to prevent personal data from falling into the hands of violators, you can avoid financial losses.

Fraud schemes

In recent months, information has appeared in the media and on the pages of a number of Internet resources about scammers who fraudulently lure out SNILS data from citizens.

The methods these individuals resort to are different. They can come home, introducing themselves as Pension Fund employees, and organize pseudo-surveys on the street.

Fraudsters motivate the need to find out an identification number in different ways :

- Conducting official events within the framework of the Pension Fund.

- The main condition for providing a consumer loan in a store.

- Conducting a survey by a statistical center.

- Potential employment with the mandatory preliminary signing of documents on the transfer of pension savings from the Pension Fund.

To more successfully implement their plans, scammers resort to psychological tricks . To communicate with the insured persons, they use a young, representative person with a winning appearance and charisma. In some cases, blackmail and threats are used.

How to protect yourself?

If you adhere to the following simple recommendations, you can protect your pension savings as much as possible from outside attacks:

- Report SNILS only when necessary to official structures.

- Do not trust copies of personal documents to strangers.

- Do not negotiate with imaginary representatives of pension funds who come to citizens’ homes. You should be aware that Pension Fund employees do not have the duties and powers to visit citizens at home.

- Before signing any document, it is necessary to check the text, even if you absolutely trust the other party. As practice shows, most citizens independently signed documents on the transfer of savings, without even knowing it, because they just didn't read them.

- Try to avoid any contacts and transactions with unverified credit and financial structures.

But the most effective way of protection is a written application to the nearest branch of the Pension Fund of Russia, especially if there are suspicions that the identification number is known to attackers. The application will need to indicate a request to maintain savings for a year. In this case, no one except the Pension Fund will use the money during this period.

What to do if savings are transferred

Cash savings are transferred to a non-state pension fund only on the basis of a personal agreement with it and an application to the Pension Fund. Citizens often sign these documents due to their own carelessness.

What to do if scammers find out your SNILS number and transfer money? In this case, you will need to act with the involvement of regulatory structures according to the following scheme:

- Contact the nearest Pension Fund branch to find out information about your account and get expert advice on options for further action. They will also help you draw up an official complaint and send it to the fund to which the funds were redirected.

- Contact the NPF and demand to provide the original documents on the basis of which the transfer was made (application and agreement). Such documentation must be provided based on the personal request of the owner. The authorized officer should submit the claim of wrongful transfer and ensure that its acceptance is formally recorded.

- Submit an application to the Pension Fund for early transfer of funds back. It is better to do this before December 31st . Applications are checked until March 31 and if the decision is positive, money is transferred before this deadline.

In order to further protect yourself and other citizens, if you find out about the actions of scammers, you should involve law enforcement agencies and regulatory organizations:

- Contact the Bank of the Russian Federation with an application. It exercises control over the activities of non-state pension funds.

- File a complaint to the Prosecutor's Office. It can also be submitted on the official website.

- File a claim in court.

For such illegal actions, a fine can be imposed on both the organization itself and the responsible persons.

Insurance payments under SNILS from extra-budgetary funds

If you make a search query, you will find that in the Russian segment of the Internet there are many sites that offer to check payments according to SNILS. They operate according to the standard scheme:

- The citizen is asked to enter his passport details and SNILS number. After a short period of time, the program shows supposedly due payments.

- The applying citizen is offered to transfer a certain amount of money in order to gain access to the NPF database, and after fulfilling the condition, the scammers stop communicating.

Representatives of the Pension Fund were forced to make a statement that all such sites are fraudulent . All information regarding pension savings can be found only on State Services and on the official portal of the Pension Fund of Russia through your personal account.

At the same time, another scheme is operating on the Internet to illegally seize funds from citizens. All kinds of advertisements are sent to users, which contain a link to another resource.

After clicking on it, the user finds himself on a website designated as “Compensation Center for Unused Medical Services under the Compulsory Medical Insurance Policy .

Here, citizens are notified that if they make contributions to the Compulsory Medical Insurance Fund, but do not use the full range of possible services under the Compulsory Medical Insurance policy, they are supposedly entitled to monetary compensation for this. Then they ask for his details. No matter what data is entered, the program will provide information that the MHIF citizen owes a large amount of money.

To receive it, gullible citizens are offered to transfer

300 rubles .

After the operation, contact with such a user is stopped. Another fraudulent site related to health insurance is the so-called “Unified Compensation Center” .

All its visitors are convinced of the possibility of receiving monetary compensation for an insured event in the past for which compensation was not provided.

Then the scheme is standard: a citizen is asked for a certain amount for a service, he transfers it, and the scammers disappear.

Another structure that positions itself as an off-budget fund where you can receive compensation for pension savings is SNILS-fond.ru. To do this, you are asked to provide your passport details and identification number. Naturally, they don’t pay any money.

Main conclusions

- Fraudsters under the guise of an employee of the Pension Fund of Russia may come to you in person with a desire to find out your SNILS number.

- Knowing the insurance number, attackers will be able to transfer your pension savings to a non-state pension fund, for which they will receive a monetary reward.

- It will not be possible to take out a loan using the SNILS number alone without the personal presence of the owner.

- To protect yourself, you should not disclose your individual personal account insurance number to strangers.

- If you become a victim of criminals, you must immediately request contracts and signed documents for the processing of personal data at the NPF and submit an application to the court and prosecutor's office.

- Payments under SNILS do not exist, and sites offering such services are fraudulent.

Still have questions and your problem is not resolved? Ask them to qualified lawyers right now

Attention! If you have any questions, you can consult with a lawyer on social issues for free by phone: +7 in Moscow, St. Petersburg, +7 throughout Russia. Calls are accepted 24 hours a day. Call and solve your problem right now. It's fast and convenient!

Is it possible to get SNILS again after refusal?

The state guarantees the right of every citizen of the Russian Federation to receive SNILS. For this purpose, it is enough to contact the MFC, the employer or the local branch of the Pension Fund of the Russian Federation. Detailed instructions for registering an insurance number for an individual personal account are contained on the PFRF website at the link: https://www.pfrf.ru/knopki/zhizn/~450.

For a minor child, an application for restoration/registration of SNILS can be submitted by parents/legal representatives. If a minor attends an educational institution, a replacement can be made through its administration.

Currently, it is impossible to issue a new or replace a lost SNILS card through the State Services portal.

Payments according to SNILS

22.11.2019

Information has spread in Russia about a new type of fraud using SNILS and compulsory medical insurance. Criminals encroach on the savings of citizens, defrauding them of funds.

General information about payments

Since January 2020, information has appeared on the Internet revealing the possibility of receiving “insurance payments” from private funds to a SNILS account. Any cardholder could use this method.

To receive funds, a citizen had to pay a commission on the website. But the registration process did not end there: intermediary services were constantly becoming more expensive, but the money never arrived in the account.

This scheme is recognized as fraud, therefore its implementation is punishable by law.

According to regulations, receiving compensation under SNILS is not provided. The purpose of the document is to register a citizen in the pension system. SNILS does not perform other functions related to finance.

In November 2020, the Pension Fund made an official statement in which it explained to citizens the new fraud scheme. Employees announced that there are no hidden payments, and ordinary people do not have access to SNILS data. To obtain information, the owner must personally contact the Pension Fund branch, or fill out an application on the State Services portal.