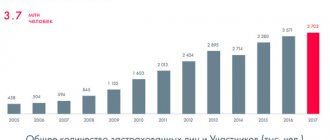

About 60% of Russians have chosen non-state pension funds (NPFs) to form a funded pension within the framework of the compulsory pension insurance system. This could be done until 2016, after which all contributions began to be transferred to the formation of only the insurance pension.

Article on the topic Pension savings. How not to lose income when changing NPFs

If you have written an application for the formation of a funded pension at a non-state pension fund, but have forgotten or do not know where your pension is formed, then you can find out about it in one of the following ways.

How to find out your pension fund using SNILS: Government services and other methods

Among the methods described above, you can choose the most convenient for yourself, all of them are available and free. The services of the State Services portal are the most popular; the advantages of this choice are obvious: you don’t have to go or travel anywhere, it’s enough to have the Internet at home and be a registered user.

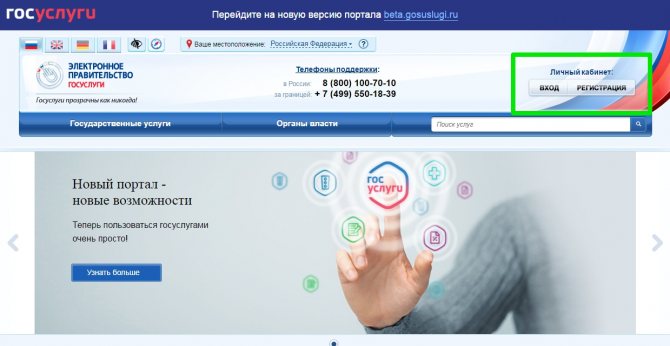

- Follow the “Register” link on the “State Services” website.

- Enter personal data: last name, first name, phone number or email address.

- Before you click the “Register” button, you must read the terms of use and privacy policy of the portal.

- To confirm your phone number or email address, enter the code sent by the system.

- Specify a unique password to log in, then you need to duplicate it.

- Enter the requested personal data. You will need a passport and SNILS certificate.

Find out through personal contact

You can request information about your affiliation with one of the Funds from the state Pension Fund, one of its partner banks, or at work from your accountant.

To the Pension Fund

The most logical solution is to go to the Pension Fund at your place of registration. You will seek a simple consultation, and the government agency does not have the right to refuse you this service. If you are not tied to a regular Fund, the specialist will immediately notice this in the database and will be able to tell you which organization is saving your savings for retirement instead.

You can’t just come to the Pension Fund; you will need the following documents:

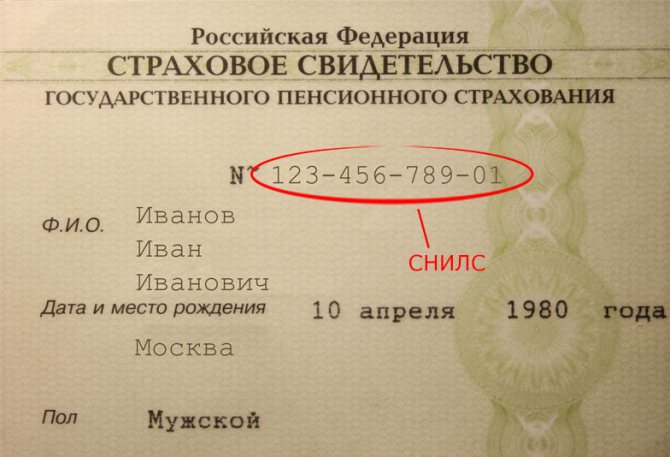

- Your SNILS (you must have it, like all citizens of the country). It is recommended to bring the entire Pension Insurance Certificate card, and not just dictate the number to the specialist (the Pension Fund may not accept such information).

- Your passport with registration to confirm your identity and possible affiliation with this particular local Pension Fund.

You can verify your identity at a state fund only with a passport; no other document is suitable. Also, if you decide not to obtain information yourself, but to hand over your documents to a relative for this purpose, be prepared to receive a refusal to issue information. Such data can only be requested from the Pension Fund in person and in extreme cases with a power of attorney, but this is not encouraged and can cause more headaches.

Information is not provided immediately - checking in the database takes up to 10 days (only workers are counted). If you decide to receive information by regular mail and write this in your application, the period may be extended due to the work of the Russian Post.

In the bank

The state Pension Fund has partners through which the Fund transfers funds to pensioners. The list usually contains 5-6 banks and it remains unchanged over the years.

The most important partner is, of course, Sberbank of Russia. Next come Gazprom Bank, VTB and UralSib. In addition, the Bank of Moscow also represents the interests of the Pension Fund in the capital.

When you contact one of these credit institutions, you will be able to receive a statement about the status of your personal pension account, and most importantly, where exactly it is located.

The application must be accompanied by the same documents:

A bank employee has the right to make a photocopy of these documents to be attached to the application. The timing for providing information varies and can range from 1-10 days. Sometimes it is possible to obtain information immediately if the technical equipment of the partner bank allows it.

At work

Information about what deductions from your salary go where is also stored by the accountant of the organization where you work. The option that the accounting department refuses to provide this information is not and cannot be. By law, you are responsible for your pension savings, and you have the right to be informed about it.

Read more: Government support for small businesses in Poland

The employer himself cannot redirect your contributions to another fund - you must sign an agreement with this new fund to do this. It’s another matter if at some point you were obliged to do this, and you forgot that this happened.

Important! If your employer forced you to transfer your savings to a non-state pension fund, he violated your right to freely dispose of your future pension. This action is punishable under the Criminal Code of the Russian Federation.

To obtain information, it is enough to inform the accounting department that you need this information - usually there is an employee there who is responsible for writing off funds from your salary for a pension in a non-state pension fund or Pension Fund. There is no need to provide documents, but just in case, take your SNILS and passport.

How to find out your pension savings using SNILS

Securing your future pension worries every working person. It is not easy for people to sort out their pension savings, especially in modern conditions, when the pension system has been undergoing serious reforms over the past few years. The principles by which savings are calculated have already been changed several times:

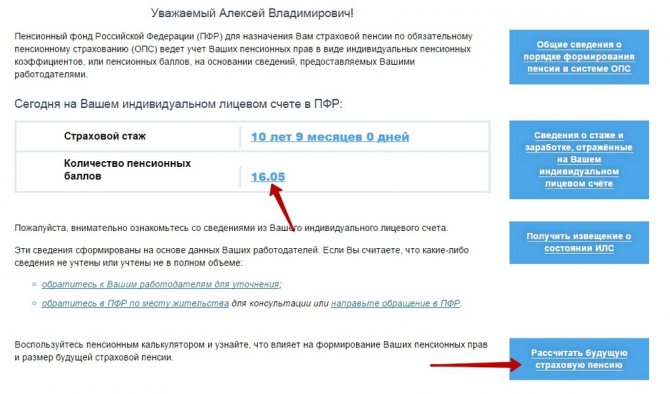

If you prefer to use a direct search for information by contacting the “original source,” you can use the official website of the Pension Fund of Russia. Since January 2020, it has a new section “Personal Account of the Insured Person”. With its help, you can clarify how much IPC (individual pension coefficients) a citizen has accumulated, as well as what length of service he currently has.

SNILS will help

A small green plastic card called SNILS will help you, and it will do it in two ways. In more detail it looks like this:

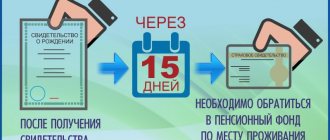

- In order to find out exactly which NPF manages your pension contributions, you need to write an application and take it to the territorial pension fund. You need to have your passport and SNILS with you. In this case, the requested information will be provided to you within 10 days in person or will be sent by mail, for which you will also need to write a statement;

- find the bank that cooperates with the Pension Fund. Then you can come to any branch of such a bank. By contacting the employees and presenting the same set of identification documents, you will receive knowledge in its purest form.

How to find out employer contributions to the Pension Fund

Next, you need to select the item Ministry of Health and Social Development . Then we find a button labeled Pension Fund that needs to be pressed. Now you can choose what information you want to see. This also applies to contributions to the Pension Fund.

Most citizens are interested in the question “how to find out the employer’s contributions to the pension fund?” The most convenient and easiest way to find out the necessary information is to contact the chief accountant of your enterprise. He must have all the necessary information.

Personally through the Pension Fund or MFC

Since information about the status of an individual account is always stored in the Pension Fund, you can first contact this organization - at your place of residence or at any branch around the country (the response time may increase). You must take the originals with you:

- passports;

- SNILS.

The applicant can apply personally or his legal representative:

- parent for a minor;

- guardian or trustee for a minor and/or incompetent person.

On the spot, the citizen fills out an application in the prescribed form. The employee accepts the application for work. However, the information will be available, as a rule, not immediately, but several days (no more than 10 days) from the moment of application. It can be sent by mail if the applicant has indicated the appropriate feedback method.

Expert opinion

Salomatov Sergey

Real estate expert

Similarly, the applicant can apply to any branch of the MFC - a single center for the provision of services to citizens. In this case, there will be no need to wait in line, since you can choose the most convenient time before visiting the office.

All about how to find out your length of service in the Pension Fund via the Internet

- contact the department of the Multifunctional Center;

- use the services of the Russian Post;

- provide documents to the Rostelecom service center and in other ways provided for by the regulatory legal act of the Government of July 10, 2013 No. 584 and other laws of the Russian Federation.

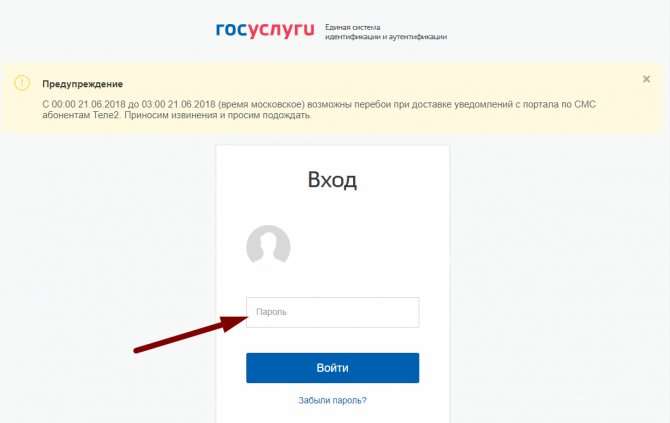

- Log in to your Personal Account on the State Services website;

- If a citizen has not yet registered, when entering the section a window will appear with empty fields that are required to be filled out. After the work has been done, the system will provide access to your Personal Account;

- By clicking on the “Services” link and opening the “Authorities” category, a list of government agencies will appear on the screen, among which will be the Pension Fund;

- The window that opens provides access to a number of services that can be completed online. To find out your work experience in the pension fund via the Internet, you need to click on the tab “Notice about the status of your personal account in the Pension Fund of Russia”;

- After clicking on the appropriate link, the system will provide information on how you can familiarize yourself with a citizen’s pension rights. By following these instructions, you can get information within a few minutes.

More to read: Where to get an extract from the house register in Moscow

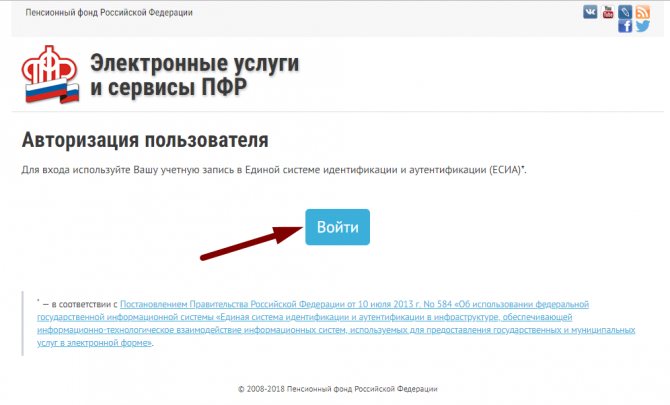

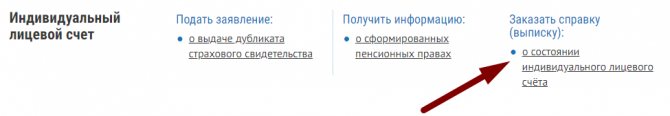

Online through the Pension Fund website

You can also check information online in your personal Pension Fund account. You can enter it using the data from the State Services portal. To do this, go to the main page and click “Login”.

Then they enter the password from the State Services website and get to their page.

Then you need to find the section related to your personal account information and click on “Order a certificate.” This is an account statement - a document similar to what can be ordered in paper form at any branch of the Pension Fund or MFC.

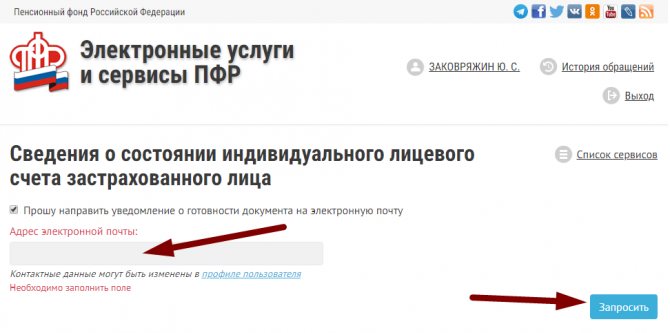

You can receive an extract in electronic form directly in your personal account, and you can also duplicate the document by email by entering its address in the specified field. Then click “Request”.

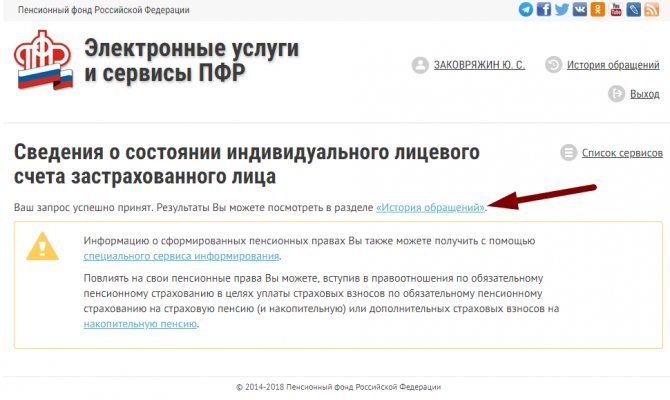

The system immediately accepts the user’s request and indicates that the answer can be seen in the “Request History” section, where you can follow the link.

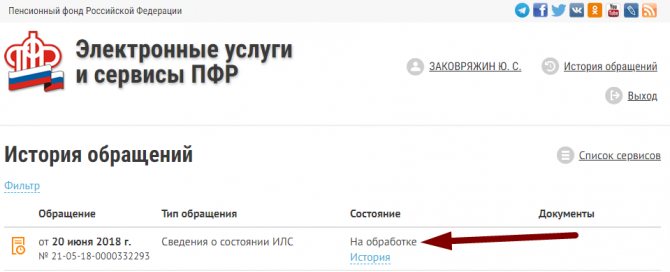

Next, you need to wait for some time - for a certain period, the status of the request will remain “Under Processing”.

Then in your personal account (or by mail) you can download a document with the data of interest.

Where and how to find out the amount of the funded part of the pension? Step-by-step recommendations, necessary documents

Many are confused and cannot understand what is the difference between them and what is a pension that can be accumulated. Each citizen of the Russian Federation has a personal personal account in the Pension Fund, on which funds are accumulated. Let's figure out exactly how they are enrolled there.

As you know, the first mentions of this began to appear in 2002, after the pension reform. Nevertheless, over the course of 13 long years there have been significant changes in legislation to improve the funded system. And in 2020, not only the concept of “funded pension” took root, but also the procedure for calculating it was developed.

Pension in the Russian Federation

In the Russian Federation, a pension is formed by two components - insurance and funded. The insurance pension depends on the amount of contributions paid during working life. Contributions are converted into points, and the amount of the insurance part of the pension depends on them. The size of the insurance pension is also affected by length of service. In addition, this type of pension is indexed annually taking into account inflation.

The funded pension consists of 6% of mandatory contributions, as well as extraordinary contributions from a person, part of maternity capital. In this way, savings are formed and collected in the individual account of the future pensioner. It is these savings that their owner can dispose of at will - leave the savings in the Pension Fund or transfer them to a non-state pension fund.

To receive additional income from pension savings, many citizens transferred them to non-state pension funds. NPFs, in turn, invest the savings of future retirees in financial projects, resulting in investment profit. As a rule, it is more profitable to store savings in non-state pension funds than in the Pension Fund of Russia

Most often, citizens are puzzled by the issue of funded pensions before going on their well-deserved retirement. Here it turns out that not everyone knows where their pension savings are. In the process of collecting documents for applying for a pension, a problem arises - how to find out which pension fund I am a member of, how to clarify the amount of savings or withdraw them. This can be done in several simple ways.

Reference! Every year, until December 31, citizens have the right to write an application to transfer the funded part of their pension to another NPF. In this case, one should take into account the possible risk of losing part of the investment profit.

How to view your pension contributions to the Pension Fund via the Internet

Individual entrepreneurs also make the same transfers for each employee. For employees working in harmful and dangerous working conditions, there is an additional insurance premium rate (Federal Law No. 212, Article 58.3). The highest tariff is adopted for hazardous working conditions, it is 4%.

The larger the amount of transfers, the higher the pension will be. Since not all employers treat this type of deductions in good faith , it is better to keep the situation under control and be able to defend your rights to receive a future pension. How to view and find out pension contributions to the pension fund?

Personal visit to the Pension Fund of Russia using SNILS number and passport

You must show up at the State Fund branch at your place of registration with your passport and SNILS number. In order not to waste time, it is best to make an appointment in advance through government services.

Arriving on the appointed day, the employee uses the SNILS number to request an application for the issuance of the document. After 10 days, the visitor will again have to appear on the threshold of the Pension Fund.

The employee provides information about transfers for the entire length of service. The document will also contain the name of the organization in which the savings are stored. The service is provided free of charge.

How to check SNILS online using the pension fund database

Let's start with the fact that SNILS is the number contained on the “green card” issued upon registration in the Russian Pension Fund system. This number is unique and is assigned to a citizen’s individual personal account in the pension system once and for life. Is it possible to check SNILS using the pension fund database online?

The position of the Russian Pension Fund itself on this issue is clear: no! Information about SNILS is classified as confidential information, since this insurance number is also an individual account number. It contains information about the citizen, his length of service, earnings and contributions made by the policyholder (the organization where the citizen works) for him to the pension insurance system. Confidential information is closed from third parties, is not available on the Internet and is protected by law. Therefore, the SNILS check against the pension fund database is carried out personally by the citizen directly at the territorial body of the Pension Fund upon presentation of a passport.

Also read: Category B license for tractor driver

Selecting a method for providing information

If for some reason you do not know which NPF you are a member of, you can find out without any problems. Each of the above methods has its pros and cons. For example, not all Russians feel confident as Internet users.

This primarily concerns older citizens. It may be difficult for them to register on the relevant portal and obtain the required information.

As for obtaining data through an employer, this is a suitable option for people engaged in working activities.

If a person has already reached the retirement threshold and retired, he will have to go to his last place of work to visit the accounting department.

Important

You must have your passport, INN and SNILS with you.

- Identity confirmation using an electronic signature, which can be obtained from an accredited certification center.

- Identity confirmation using UEC (universal electronic card).

After completing the registration procedure, you will be able to use your “Personal Account”. There you can order information about the pension fund in which your pension savings are placed.

- Use the online service.

There are various sites on the Internet that provide the necessary information upon request. Usually, to receive data, you need to go through authorization by sending an SMS message to a short number.

The cost of the service is set by the site owners. Did you fall for it? Remember that you should never trust your personal data to unverified sites , much less send SMS to short numbers, since there is a high risk of becoming a victim of a scammer. Use only the government services website.

Have you not yet decided which NPF to transfer the funded portion of your pension to? Read our instructions on how to choose a non-state pension fund - we tried to make it as informative as possible.

Find out which non-state pension fund the funds were transferred to

Analyzing the available information, we can identify the following ways to find out which non-state PF you are a member of:

- Contacting the territorial department of the pension fund;

- Contacting the accounting department at the place of primary employment;

- Contacting a credit institution that has a cooperation agreement with the Pension Fund;

- Submitting a request on the unified portal of public services;

- Making a request on the online service.

Control over pension savings today means stability tomorrow.

How to find out which NPF I am a member of

Since 2013, every citizen of the Russian Federation independently controls their pension savings, and, accordingly, where their funded part of their pension is located. Of course, because now it turns out that everyone is largely responsible for the formation of their future pension. There was even a public service announcement in which a woman refuses to work after learning that her salary will be given to her in an envelope. Namely, contributions to the Pension Fund are made from wages.

- Send a request through the State Services portal. If you do not have access to your personal account on the e-government portal, you need to register. If you have access to your personal account, then in 2-3 minutes you will find out the information you are interested in. This same method is the easiest if you are wondering how to find out your contributions to the pension fund. In order to check deductions via the Internet, you need to select in your personal account. Information about which fund you are a member of will also be there. If you do not yet have a personal account at State Services, then verification of your identity may take up to 5 days.

- Contact the accounting department of the organization where you work. Employees are often required to sign an agreement with a certain non-state pension fund, to which the accounting department will transfer a certain percentage of insurance premiums in the future.

- Contact the UPFR at your place of residence (stay). Don’t forget to take your passport and SNILS; using them, the Pension Fund specialist will not only tell you who manages the funds of your individual personal information system, but will also answer questions and, if necessary, accept an application for transfer from your fund to another.

- Contact the credit institution with which the Pension Fund cooperates. Currently they are: Sberbank of Russia, Uralsib Bank, Gazprombank, VTB 24 CJSC, Bank of Moscow.

Internet to help

Although this item is one of the last in this list of options, nevertheless, in practice, it is most often addressed first. This is not surprising.

At our level of technological development, few people have the desire to go somewhere if the issue can be resolved with a few clicks of a computer mouse. And when it comes to ways to resolve the issue with PF, they usually settle on the following options.

Help from the government services portal

The unified portal of public services is a quite useful and convenient resource that helps solve many problems. By the way, with its help you can find out your PF.

To do this you need:

- Register on the portal itself in the appropriate section (the process itself will take only a few minutes).

- Wait for a registered letter with an activation code (unfortunately, it can take up to three weeks).

- If time is pressing, then this code can be obtained in person at a Rostelecom branch.

- After activating your account (for this you will need not only the received code, but also SNILS), you will be able to log into your “Personal Account of the Insured Person” on the Public Services portal.

- While in the “Personal Account” of the resource, you need to select the departments “Pension savings” and “Get a service”.

- After complete completion of the registration process, it is in the “Personal Account” that you can request information about the Pension Fund in which your accumulated funds are located.

In addition, the “Personal Account” on the government services portal opens up other opportunities for you:

- you can find out your work experience;

- the number of accumulated pension points;

- use an online calculator and calculate your future pension;

- receive a statement of the status of your pension account intended for paper media;

- You can also send an appeal to the Pension Fund;

- submit an application for a pension and resolve the issue of receiving it;

- make an appointment at the Pension Fund;

- manage maternity capital funds.

Other services

Of course, the government services portal is not the only help when searching for your pension fund. The Internet is overloaded with resources that offer a variety of services: from checking the reality of the existence of SNILS to determining your PF.

However, you should not place much trust in such services.

As already mentioned, the above personal information is quite important and you should think twice before sharing it with others.

Moreover, the state has taken care of the possibility of obtaining the data you are interested in through secure channels and, in addition, in the most comfortable way for you.

How to find out your pension fund: PFR or NPF

This is the traditional way to contact a government agency. If you want to receive information from the Pension Fund of the Russian Federation about the placement of your pension savings, you will need to contact the employee of the territorial office of the Pension Fund of the Russian Federation at the place of your residence permit (registration), who is responsible for this issue and submit an application.

Each enterprise has an employee in the accounting department who deals with matters related to tax deductions to extra-budgetary funds, including contributions to the Pension Fund of the Russian Federation, for the employees of this enterprise. This same accounting employee will easily provide you with all the information you are interested in regarding the pension fund in which you are a member and in which your funded pension is formed.

26 Jun 2020 stopurist 579

Share this post

- Related Posts

- How to restore a lost driver's license in Russia

- Application for removal of encumbrance on an apartment arrest

- Program for reference 3 personal income tax official website of the tax office of the Russian Federation

- Sample application form for employment sample

In partner banks of the Pension Fund of the Russian Federation

You can also find out about your pension savings by contacting one of the partner banks of the Russian Pension Fund for compulsory pension insurance.

There are 4 of them so far:

Question answer

Is there a difference between NPFs?

- Gazprombank;

- Sberbank;

- "UralSib";

- "VTB Bank of Moscow".

To obtain information, you will need to present a passport and a certificate of compulsory state pension insurance (SNILS).

How to write an application to the Pension Fund to determine which pension fund I am a member of correctly?

If you work, then the accounting department can provide you with this information, and there is no need to write an application. But if you decide to contact the territorial branch of the Pension Fund of Russia, then in order to get information from their melon databases, you need an application. Confirmation of the fact of the need to belong to a specific Non-State Pension Fund will be the presence of a SNILS with the corresponding number.

There is no special form for this application. You can compose it in free form. It is enough to write the words “please inform me of the non-state pension fund.” Of course, you need to indicate your full name. Since there can be many identical names, to find out the exact data, please indicate your SNILS number. All that remains is to sign.

Find out online

Important! On the Internet, information about your Fund is stored only by the portals of State Services and the Pension Fund of the Russian Federation. Third-party verification services, which may or may not require money but promise “true information,” work to obtain your passport information (and sometimes funds) for their own purposes. Be careful!

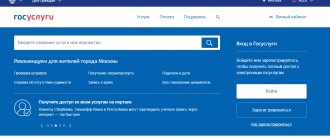

On the State Services portal

The website https://www.gosuslugi.ru collects all current data about you in your personal account for more convenient information. In your State Services profile there is a whole section dedicated to savings that should go towards retirement. It is there that you can see the name of the Fund in which the money is stored.

To do this you must:

- Go to the website.

- Log in to your profile with your username and password - if you don’t have them yet, you will need to register, the button is located under the login form.

- Go to the pensions section.

- There you will have access to information about contributions and the Fund to which they go.

In LC PFR

On the official website of the Pension Fund of the Russian Federation, the same personal account system as on the State Services has been running for more than four years, only information there is collected specifically about the pension and relevant deductions for it.

LC is available not only to already pensioners, but also to those who are not yet pensioners - to all citizens of the country who are insured in the system (have SNILS). This is a great tool to keep your employer honest and monitor the current state of your pension.

The office is located at the link - https://es.pfrf.ru.

To access it, you need to use the ESIA record - this is a link for logging in from the same State Services, so you don’t have to register twice.

What to do:

- Go to the page - link above.

- Click "Login".

- The system will redirect you to the State Services login site.

- You can log in using SNILS or using your mobile/email and password.

- Once you have entered your details, click “Login”.

- You will be redirected back to your FIU profile page.

Information about which pension fund your money is in will be displayed on the first page. In some cases, you will have to look for it in the section on contributions to the Fund. If there are no contributions for the Pension Fund, then either your employer does not pay, or the money goes to a non-governmental organization.

Since the beginning of 2013, every citizen of the Russian Federation controls their pension savings and where they are located independently. This is due to the fact that in 2012 the Pension Fund sent letters to the population, which displayed information about the status of the ILS (individual personal account), as well as which pension fund you are a member of: state or non-state.

If, for some reason, you do not have this data, you have a question: “How can I find out which pension fund I am in? What pension fund am I a member of..." Dont be upset. Today, finding out the pension fund in which you are a member, be it the Pension Fund of Russia (Pension Fund of Russia) or the NPF (Non-State Pension Fund), as well as data on pension savings, does not represent much effort. Previously, in order to obtain this information, you had to go to the relevant authorities, stand in line, and fill out a lot of necessary application forms. Now all you need is a laptop, tablet or smartphone and Internet access. But let's look at all the options for obtaining this information.

The first way: in a pension fund.

The first method is traditional. If you want to receive information from the Pension Fund about the placement of your pension savings, you will need to contact an employee of the territorial department of the pension fund at your place of residence (registration), who is competent in this matter. You must have with you a document certifying your identity (citizen’s passport or a document replacing it) and SNILS (individual personal account insurance number), which is included in the certificate of compulsory state pension insurance.

Read more: How is the insurance period for sick leave calculated?

After completing the procedure described above, you will be able to receive the data you need no earlier than ten working days. In order to receive notification by mail, you will need to write an application.

Second method: on the State Services portal.

To use the public services service, you must register on the portal //www.gosuslugi.ru

(if you are registered in the system, immediately go to your personal account). Buttons for logging into your personal account and registering are located in the upper right corner.

Below is the main page of the portal

I won’t describe how to register in the system, since there is nothing complicated about it. Everything is visually clear. If you are registered in the system, then within a few minutes you will find out all the information that interests you. What does this require? By entering the login and password for your personal account and, accordingly, logging into it, you need to find the “Check pension savings” section. This section contains all the information on your pension calculations and which fund you are directly a member of. In general, there are a lot of useful things on this resource. Almost any information can be obtained without leaving your computer. In my opinion, this is the simplest, easiest and very convenient way. But this is only if you have a personal account. Otherwise, obtaining this information by registering on the portal may take from five to ten days.

Third way: in the organization where you work.

To use this method, you must contact the accounting department of the organization where you work. Each enterprise has an employee who deals with matters related to pension contributions to the Pension Fund for the employees of this enterprise. This same accounting employee will easily provide you with all the information you are interested in regarding the pension fund to which you are a member.

Fourth method: in banks - employees of the Pension Fund of Russia.

If the above methods do not suit you, then you can obtain the necessary information by contacting one of the following banks that cooperate with the Pension Fund:

To obtain the necessary information, you will need to present your citizen’s passport and SNILS to the bank employee dealing with these issues. Next, after filling out and signing the required application, you will be able to receive data from the NPF to which you are a member.

And the last fifth method: you don’t need to use it.

Today on the Internet there are various online services that provide any information for a fee. In most cases these are scammers. All the information that we discussed in this article is provided free of charge and only personally to everyone upon presentation of identification documents. Don't forget about this so as not to be deceived!

If for some reason you are not satisfied with the pension fund in which you are a member, then you can change one NPF to another once a year, or return back to the Pension Fund. To do this, you will need to submit applications of the appropriate form no later than December 31 of the current year.

And in conclusion to everything that has been written, I would like to invite you to watch a video in which they compare funds: state or non-state, and what are their differences.

That's all. I hope you got answers to your questions. Bye!

In 2012, the Russian Pension Fund sent out so-called “chain letters” to the population for the last time, from which citizens received information about the status of their ILS. From these notices you could find out which fund you belong to: state or non-state. Now the curious person will have to find out for himself where his pension savings are, fortunately, there are several options:

- in a pension fund;

- on the state portal;

- at the employer;

- in banks - “partners” of the Pension Fund.

If the insured person’s ILS funds are in a fund that does not suit him, then they can be transferred to another once a year, but no later than December 31. Transfer from the Pension Fund to a non-state pension fund is carried out by submitting an application to one of the institutions:

- in non-state pension funds - only in case of conclusion/termination of an agreement;

- in UPFR (management);

- at the MFC.

Read more: Power of attorney to conduct a civil case in court