Why do pensioners need a birth certificate for an adult child?

To apply for a pension, a citizen needs to prepare a package of documents. The list of securities directly depends on the type of security assigned. The birth metric of an adult child is not included in the mandatory list, but there may be a separate requirement from Pension Fund employees in this regard.

- To increase income due to the size of a fixed payment. Its meaning varies depending on the category of applicant. If a citizen has custody of minor children or dependents under the age of 23, subject to their full-time education, a supplement to the FV is due. For a single person - 1/3 of the basic amount of a fixed payment, for two - 2/3, for three - the amount of the basic financial contribution is paid to the parent in double the amount.

- To increase the number of pension points when taking into account “non-insurance periods” in the case of an old-age insurance pension. When caring for a child up to 1.5 years of age, 1.8 points are awarded for 1 year, for 2 - 3.6 points, for 3 - 5.4.

- For early calculation of pension if the child has been disabled since childhood.

- For early retirement, if the woman is a mother of many children (before January 1, 2020 - five children; from January 2020 - three or more);

- For early assignment of pension payments if a woman lives in the Far North and has given birth to two or more children.

To increase the number of pension points when taking into account non-insurance periods in the case of an old-age insurance pension.

Why do you need to provide your children’s birth certificates to the Pension Fund when applying for a pension?

A child’s birth certificate is a document that certifies a person’s identity until they receive a passport at age 14. When a teenager receives this document, parents assume that the certificate will no longer be useful and hide it in a distant drawer.

The document is required to show close family contacts between children and parents, enter information about the child, or prove the episode of the birth of the baby. This paper must be presented in different places, including the Pension Fund. Why do children’s birth certificates need to be shown when applying for a pension? This and much more will be discussed in our article.

certificate of income for the last 5 years;

Why do you need a birth certificate for children when applying for a pension?

If we look at the list of documents required to receive a pension, we will find there only the papers listed below

- a general passport, which will act as an identity document;

- a certificate of average earnings for recent years or of income received for 5 consecutive years;

- work book confirming work experience.

Individual entrepreneurs will also need to present a certificate of registration to receive an old-age pension.

As you can see, the list is quite short. But recently you can see complaints on the Internet that Pension Fund employees require birth certificates of adult children when applying for a pension. Is such a requirement legal, and for what purposes is this document even needed? Let's try to understand this issue.

But recently you can see complaints on the Internet that Pension Fund employees require birth certificates of adult children when applying for a pension.

Why do you need a birth certificate for children when applying for a pension?

When applying for a pension, we present to the social security service for verification, among others:

- passport;

- SNILS;

- work book;

- certificates – archival, from the employment service; on wages for the period of work determined by the law on calculating pensions;

- other documents that can certify family status and field of activity (military, business, etc.).

In the Federal Law on Pensions (Article 18, Part. How to do without the original birth certificate when applying for a pension?

How to get a second certificate?

And you can always have it certified by a notary. Employees will definitely check your passport to determine family ties.

The following persons have the right to receive a duplicate birth certificate:

- A citizen who has reached 18 years of age.

- Relatives of a deceased person.

- Parents or guardians of the child.

- Authorized representatives of government bodies.

- Guardians of a citizen declared incompetent.

If the required registry office is located in the city of permanent residence of the citizen who needs a duplicate, then you need to go there in person. Share These amounts will be paid until the migrants receive Russian citizenship, but not longer than 6 months.

Question to the expert: “Why does the Pension Fund need a birth certificate for children when applying for a pension and is it necessary at all?!” When applying for a pension, we present to the social security service for verification, among others:

- passport;

- work book;

- certificates – archival, from the employment service; on wages for the period of work determined by the law on calculating pensions;

- other documents that can certify family status and field of activity (military, business, etc.).

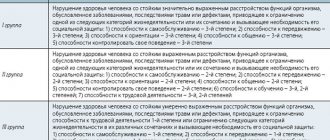

The Federal Law on Pensions (Article 18, Part 3, Law No. 173) talks about the obligation of those applying to submit the required documents to the social security officer. The birth certificate of a pensioner candidate may be needed, for example, if it is spelled incorrectly in any document first name, patronymic or last name, possible typo, incorrect (uncertified) correction. The social security service may request documents:

- about disabled family members;

- about the presence of dependents;

- about changing the surname, name, patronymic;

- on establishing disability.

A future pensioner may have children under 14 years of age. The documents confirming their age will be the CoP or adoption document.

What documents are needed when applying for a pension?

The list of documents required for assignment or recalculation of a pension differs depending on the type of security. In addition to the application drawn up in the prescribed form, as a rule, the following is submitted:

- passport for all adult citizens of Russia (over 14 years old);

- residence permit (for stateless persons and foreigners);

- SNILS;

- documents confirming the existence of insurance experience (for example, a work book, extracts from orders);

- certificate of average monthly salary for 60 consecutive months until 01/01/2001;

- extract from the medical and social examination report (for disabled people);

- documents on the death of the breadwinner (for the loss of the sole breadwinner);

- confirmation of relationship with the deceased breadwinner (for the loss of a breadwinner);

- documentary evidence of belonging to the small peoples of the North (social peoples of the North).

- Transport tax benefit for pensioners - terms of provision, registration procedure and package of documents

- Individual pension capital - formation procedure

- Survivor's pension for wife - conditions for assigning social or insurance

I never dreamed of SNILS

The RG correspondent tried to understand several situations related to the preparation of documents in the Pension Fund and most often causing confusion among people.

Pension from infancy

– Have you issued a certificate of compulsory pension insurance for your daughter? I already did it for Christine. They say that now all children must have SNILS in order to receive free medicines and maternity capital.

At first it seemed to me that my colleague had simply mixed something up. Why does a baby need an individual personal account insurance number (SNILS) if deductions for it are made from current earnings, and what is 6-month-old Christina’s earnings?! Maybe just have this green plastic card for your collection. But it was difficult to suspect the girl’s mother of stupidity - before the birth of the child, she worked as an accountant and was accustomed to treating all kinds of documents with respect.

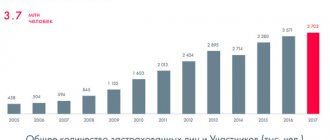

For clarification, the RG correspondent turned to the branch of the Pension Fund in the Sverdlovsk region. There we were assured that to issue a certificate for receiving maternity (family) capital, only the mother’s SNILS is required. A certificate of compulsory pension insurance is required for a child when he is on disability and has the right to a monthly cash payment (disability pension). Such children are included in the federal register, and the certificate allows the recipient of the money to be identified.

In addition, according to the law, with the help of SNILS, children under the age of 3 years (low-income children up to 6 years old), as well as those with a certain range of diseases, can receive free medicines within the framework of the national project “Healthcare”. According to the head of the department for organizing drug supply and pharmaceutical activities of the Ministry of Health of the Sverdlovsk Region, Irina Burmantova, the list of preferential drugs was approved by the regional government decree No. 1832 dated December 17, 2009. Its text can be found on the ministry’s website, as well as on information boards in pharmacies operating according to the regional program to provide social support measures to certain categories of citizens at the expense of the budget. The same document lists the categories of diseases that give the right to receive free medicines.

The RG correspondent studied these lists. If you do not take into account such serious diseases as cerebral palsy, diabetes or cystic fibrosis, children under three years of age can apply for only four positions: hopantenic acid, piracetam, azithromycin, amoxicillin, as well as drugs based on bifidobacteria and lactobacilli (bifidobacterium infantis, lactobacilli acidophilus, enterococcus fecinum). But even this meager list will hardly be possible to use - for example, I have never heard from the local pediatrician about free medications, although the same bifiform is often prescribed to infants for digestive problems. So it’s up to you, dear readers, to decide whether SNILS is really necessary for your baby.

Family capital

Here are a few more misconceptions associated with receiving documents from the Pension Fund. One of them concerns refusals to issue a state certificate for maternity capital. Questions are constantly asked on parenting websites: why do officials require the presentation of a marriage and divorce certificate from the father of the first child, if the mother is married to the father of the second child, and the presence of her children is confirmed by birth certificates? More than once, those who got married worry that they may be refused due to “moral unreliability” and wonder why they need to present a divorce certificate - is maternity capital only entitled to married mothers? Finally, some mothers are interested in whether they are entitled to a “gift” from the state at all if the eldest child is already 18 years old?

– The age of the first children at the time of the birth of the second (third) or at the time of applying for a certificate for receiving maternity capital does not matter. Yes, from the point of view of civil law, an adult offspring is capable and is an independent subject of law, but from the point of view of family law, he will always be considered a child in relation to his parents, explains Alena Kuznetsova, head of the social payments department of the PFR branch in the Sverdlovsk region.

As for copies of marriage and divorce certificates, they are asked only in cases where it is difficult to establish family relationships. There are situations when a woman, when getting married, leaves her last name, and the child is registered with her husband’s last name, there are children from different marriages with different last names, single women give birth and then get married and change their last name, and finally, it may occur to a mother to change her name. only the last name, but also the first and patronymic.

You need a birth certificate to apply for a pension

Why do you need a birth certificate for children when applying for a pension?

- Compulsory military service.

- Living with spouses of officers or contract soldiers in regions of the country where there were no employment opportunities. This period cannot exceed five years.

- Care for disabled people of group I, which is carried out by able-bodied persons.

- Removal from work duties due to unfounded criminal prosecution (the period is counted only if there are documents confirming rehabilitation).

- Caring for an elderly person over 80 years of age.

- Service in the army, internal affairs bodies and other law enforcement agencies without acquiring for any reason the right to a pension according to length of service or disability.

- Documented care for a disabled child.

- Residence outside Russia of spouses of diplomats and other officials.

- Care by one of the spouses for children until they reach the age of 1.5 years (the period cannot exceed 6 years).

The only situation in which the need to present a child’s birth certificate is determined by current legislation is when applying for a pension for the child himself in connection with the loss of a breadwinner. This document will be used as an identification document for the future recipient of payments from the state.

Living with spouses of officers or contract soldiers in regions of the country where there were no employment opportunities.

Why do you need a birth certificate for children when applying for a pension?

- passport;

- SNILS;

- work book;

- certificates – archival, from the employment service; on wages for the period of work determined by the law on calculating pensions;

- other documents that can certify family status and field of activity (military, business, etc.).

A birth certificate (CoB) of a candidate for pensioner may be needed, for example, if the name, patronymic or surname is incorrectly spelled in any document, a possible typo, or an incorrect (uncertified) correction.

Why do pensioners need a birth certificate for an adult child?

List of documents for two children

Now let’s look at how bonuses affect the size of pensions for mothers who have two or more children.

Logically, it is clear that women with two or more children will be awarded more points. Accordingly, the increase in pension will be higher than for a woman with one child. It is important to know that points are awarded for a maximum of four children.

- To calculate the increase in pension if there are two children, various factors will be taken into account: place and length of work, the size of the official salary, the birth of a child or several children. From this we can conclude that even if each female pensioner has the same number of children, the additional payment to her pension will not be the same.

Attention! If your pension was issued on preferential terms, you should not recalculate! Those who apply for early pensions and are not yet close to retirement age are not recommended to request an additional payment to their pension. Because based on the results of recalculation and replacement of working time with “non-insurance”, which includes 1.5 years when you took care of children, the preferential period will be lost and you will lose your right to a pension before the deadline.

- But such a recalculation is very beneficial for those women who, at the time of the birth of their children and until they were one and a half years old, were unemployed or receiving education. They will be given a new period that didn’t even exist before, and they will receive additional pension bonuses (points) for it.

You can find out in what situations a pension recalculation is needed and how to do it in our article.

For anyone interested in where bonus points come from, we suggest you read the information below:

- Points are generated through your employer's insurance premiums. They are mandatory. For the current year, such contributions amount to 22% of the employee’s wage fund, of which 6% goes towards a fixed payment, the remaining 16% goes towards pension points, which are displayed on an individual personal account.

Points are awarded taking into account “non-insurance” periods of time. For example, for a man this is the period when he undergoes military service, and for a woman it is caring for a newborn child until he reaches the age of one and a half years.

Useful information: when recalculating and accruing the amount of the pension, the points on the individual personal account of each pensioner are taken into account for the entire period of his working activity and for those periods that are designated as non-insurance. These points are multiplied by the value of 1 coefficient, which is set by the government. As a result, you can calculate your future pension. From April 1 of this year, 1 pension point is valued at 78.58 rubles.

Sometimes the payment amount may be reduced. The reasons for this decision may be related to:

- When wages already taken into account when calculating a pension are excluded from the calculations. The reason is that in the process of recalculating the pension, the period of work is changed, replacing it with a “non-insurance” period. As a result, such an “addition” to your pension may not be in your favor.

- If the pensioner’s period of work has been shortened as a result of recalculations.

There are several ways to apply for additional payment to the pension for children:

- You can directly contact the pension fund yourself. To avoid wasting time in queues, register for the queue in advance. A similar service is available on the pension fund website. However, registration in this case is not required.

- You can also contact MFC centers. Now there are quite a lot of them, and as a rule, they are much less crowded, especially on weekends.

- The most convenient way to carry out this procedure is right at home via the Internet on the government services portal. To do this, you need to be registered on this site and have a personal account.

Attention! Five days after submitting the electronic application, you need to bring all the necessary documents to the pension fund. If this is not done, your electronic document will become invalid and the operation will have to be repeated again.

- And the last method, although not the most convenient, is to do everything via registered mail. In this case, you will need to make copies of all documents and have them certified by a notary to complete the necessary actions.

Good luck and patience to you!

You can find out more information about who is entitled to this bonus from this video: