It turns out that you made deductions, gave your funds for storage, but when needed, it turns out that they were missing. In fact, the corporation leaves its own clients in a hopeless situation. You cannot leave the fund in this state of affairs - in this case you will not receive any funds at all. As a result, there is only a loss from participation. You have to wait a long time for pension payments, sometimes even too long. Many clients generally believe that Lukoil-Garant is bankrupt. And he is simply unable to comply with the terms of the concluded agreements. At the moment, it allegedly exists at the expense of depositors. If you don't transfer money to the fund, it will close soon. And the license of NPF Lukoil-Garant will be revoked. This theory is voiced by many clients and even employees of the organization. This kind of behavior of the fund reduces all trust to a minimum. Moreover, it is repulsive.

Latest information on NPF Lukoil - Guarantor

Now we have to find out what a company called Lukoil-Garant actually is.

Reviews about this organization are increasingly being left by clients and employees of the corporation.

Can she be trusted? What does she even do? What features and services await citizens? Answering all this is not as difficult as it seems. A much more important question is whether Lukoil-Garant can be trusted? Many people try to understand this topic, but they cannot come to a consensus. After all, everywhere has its pros and cons. Therefore, it is worth paying attention to many aspects and nuances emphasized by investors.

Let's try to understand whether the organization called Lukoil-Garant is as good as the advertisement promises.

About activities First of all, what does this company do? After all, before using its services, you need to have a clear idea of what you are agreeing to.

NPF rating

Moreover, it provides opportunities to increase money. But in terms of changing passport data and customer information, outdated methods are used. This slows down the speed of customer service. The result is public dissatisfaction, and justified one at that.

Regardless of what city you live in, you will have to change your information with the help of the head office.

It is located, as you might guess, in Moscow. And this is where the problems begin. Either you personally contact the company, the same head office, or send all documents by mail with preliminary notarization. This results in unnecessary fuss and paperwork. But you can simply get advice by phone or by email. But you can’t make changes about yourself and your account in electronic format.

Payments to legal successors

In the NPO segment, Lukoil-Garant is among the TOP 10 participants with pension reserves of 20.9 billion rubles. The fund provides services to individuals and corporate clients, offering various programs for co-financing pensions in the field of mandatory pension insurance and non-profit pensions.

Special proposals have been implemented taking into account regional and municipal specific legislation.

With the help of Lukoil-guarantor you can:

- formulate future employee pensions;

- double voluntary contributions through co-financing “1000 for 1000”;

- independently determine the amount of non-state pension, including corporate pension;

- receive investment income.

A high level of reliability is ensured by a balanced investment policy with the placement of assets in profitable and reasonable financial instruments.

NPF "Lukoil-Garant": reviews of the fund, description

Lukoil-Garant receives feedback from clients as a non-state pension fund.

That is, this is the place where your pension will be stored. Or rather, its accumulative part.

In principle, there is nothing difficult to understand about this.

The thing is that in Russia citizens are now asked to independently take care of their savings “for old age.”

Moreover, there is a choice - either keep all the money in a state fund, or turn to a non-state fund. The second option promises to increase your money. Therefore, many people prefer this arrangement. Lukoil-Garant is a non-state pension fund that has existed in Russia for a long time.

But is it worth paying attention to it? Can you really trust this company? Or is it better to find another organization to preserve pension savings? Here Lukoil-Garant receives mixed reviews.

Lukoil Garant NPF license revoked

- Contact the NPF and the Central Bank.

- Submit a refund request.

- All deposits are insured.

- In the future, your pension savings will be reimbursed from the money available from the NPF, after the sale of the company’s property, or from a special fund.

- You will be able to apply for transfer to another institution.

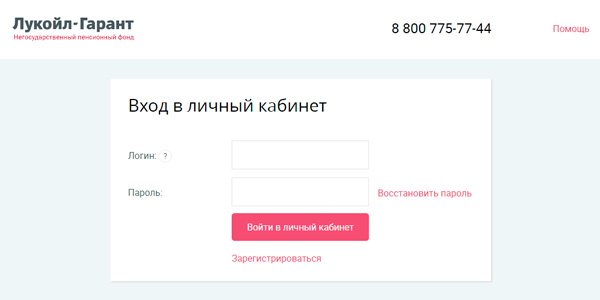

- Go to the official page of NPF "Lukoil-Garant".

- Fill in the empty fields of the proposed form with personal information such as:

- FULL NAME;

- date of birth of the depositor;

- passport information;

- actual mobile phone number;

- E-mail address.

- Enter the code combination received automatically on your phone/email.

- If difficulties arise, you can use the “Help” button, when clicked, a list of answers to frequently asked questions will be displayed in front of the resource user.

All about the current rating of NP Lukoil-Garant

Progress can be judged by the fact that back in 2020, to obtain a password for your personal account, you had to contact the office or send notarized copies of documents directly to the fund. Judging by the reviews of NPF Lukoil-Garant, this problem has been solved since 2016 and registration in your personal account can be done without leaving your home. Identified shortcomings There are, however, quite a lot of negative reviews about the work of NPF Lukoil-Garant. Some complaints are not directly related to the fund, but the imperfection of the organization's system should be recognized. There are comments about the unfair attraction of clients to non-state pension funds without their consent.

This happens when applying for a loan from a bank, when after some time a person finds himself a client of Lukoil-Garant.

The bank most often found in these types of reviews is Home Credit Bank.

About the non-state pension fund Lukoil-Garant in 2020

The Russian pension system is structured in such a way that one can count on the establishment of payments in a non-state format. Existing companies offer different conditions for storing pension funds.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

But it is worth understanding what the features of working with PF Lukoil Garant are. Profit from financial investments and proper storage of your own finances depends on this.

About the company (official website)

Non-state pension organizations appeared in 2020, when the state began a program to remove this type of security from budget funds. Citizens are given the right to receive funding through non-state points.

A person makes contributions to private pension funds, which receive profits from such investments. It is divided between the private owner himself and the pensioner.

The Lukoil Garant company has existed since 1994 as a joint-stock pension fund. Within its framework, there is both the opportunity to separately accumulate investments and transfer money from a state account to the Pension Fund.

Lukoil Garant offers not only individual security. This organization is developing programs of corporate importance, which reduces the burden on employees. Typically, such projects work in the oil and gas, chemical, and defense industries.

The main positive aspects of this institution are:

- reliability in accordance with state ratings;

- the activity is confirmed by existing work results;

- There are several financing options;

- investment policy is characterized by balanced positions;

- good service for working with the client base;

- use of information technology.

All your questions can be answered by studying the official website of lukoil garant ru.

Rating of this NPF

The state is engaged in providing the opportunity to assess the reliability of the structure. Based on the ratings, you can understand where and under what conditions it is worth investing.

Lukoil Garant has an NRA rating, which is established in accordance with the AAA procedure. This means that this structure has the highest degree of reliability. The company's funds are protected and distributed correctly.

You can also consider the rating of companies within the country. Thus, for 2020, this organization entered the Top 3 best NPFs in Russia. How many people store funds in this institution also speaks about reliability. For 2020, estimates indicate that 3.7 million people participate in the fund’s programs.

You can see the growth in the number of investors on the following graph:

Since 2020, the fund has become a participant in the guarantee system from the Deposit Insurance Agency. Lukoil Garant was one of the first to join this project and therefore all finances within the fund are also protected by state insurance.

As insurance when investing money, it is worth taking into account the presence of your own property. In case of bankruptcy, the state sells these objects and pays the debt to the shareholders.

This company has assets worth 283 billion rubles. This is a lot of capital, so the security of funds is appropriate.

The growth in property values since 2005 has been observed as follows:

Regarding own funds, the figures reach 7.8 billion. This data was obtained as of December 31, 2020.

Its profitability

In order to qualitatively analyze the profitability of an enterprise, it is worth understanding all aspects of the matter. This indicator is based on where the money is invested and how much the company has.

Own finances are enough to cover initial costs. But the level of pension savings at the end of 2020 is 249 billion rubles. Compared to 2020, there is a slight decline.

It should be taken into account that until 2020 the amounts included ROPS. Now this figure is not added to the pension amounts.

The diagram will make it clear how relevant the offers from Lukoil Garant are in 2020, based on savings within the company:

Regarding profitability, the official website offers two distribution systems. The first is responsible for accumulated profitability. Then the figures are 175.10%.

Growth is displayed by the following algorithm:

Annual statistics for 2020 have not been calculated. But you can compare points from previous periods:

The Central Bank provided reporting on this NPF. The state regulator included Lukoil-Garant in the list of those funds that showed the lowest profitability in 2020.

The company managed to make a profit of 260 billion rubles, which is 3.3%. In order to show operational efficiency, such an organization must have a percentage of 8.8.

The lowest in this ranking is NPF Gazfond, whose yield was 2.9%. But there is no need to worry about savings in this fund.

The drop in figures is explained by the fact that there was a collapse in the market. These indicators are responsible for the intermediate result of investments. By the end of 2020, the indicators may be completely different.

Has the license been revoked?

This non-state pension fund received a perpetual license from the government back in 2006. This means that there is no need to worry about the reliability and legality of all actions within the company.

As of 2020, Lukoil Garant's license is valid. Work continues as usual and there are no changes. The only thing is that the enterprise is currently being reorganized. This is due to the co-financing of NPF Electric Power Industry and RGS.

Completion of all processes is planned in the fourth quarter of 2020. This was confirmed by the Russian Pension Fund. All questions related to the transition to a new structure should be directed to the hotline. The telephone number is 8 (423) 2 498 716, valid for all regions of the country.

How to draw up an agreement

This procedure involves the transfer of funds for compulsory pension insurance from the Pension Fund of the Russian Federation to this structure. In this case, the procedure begins by contacting the fund office.

There you need to provide the following documents to enter information:

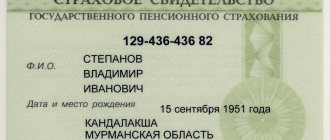

| Identification | Passport document provided |

| Insurance certificate | The one that stipulates the presence of clients in the compulsory pension insurance system. In Russia, this paper is SNILS |

Next, the OPS agreement is concluded, this must be done before the end of the year - the deadline is set for December 31.

At the same time, an application for transfer to the Pension Fund is submitted in one of the following ways:

| Personal appeal to the Pension Fund of Russia | Or sending a representative there |

| Multifunctional Center | If there is a MFC in the city |

| Russian Post | Only copies of papers are sent |

| Electronic application on the State Services portal | You must create and confirm an account |

Lukoil Garant provides an open access opportunity to review the agreement. The standard form is posted on the company's official website. A contract form is available. The organization also has another option - a non-state pension.

Funds are deposited into an open account and, upon reaching retirement age, are paid out in larger amounts, taking into account the company’s profits. A citizen has the right to choose one of the options, but the second method is financed by him personally, and not by the employer and the state.

How to find out your savings

The non-state pension fund Lukoil Garant provides a personal account. In it you can carry out a set of actions to check your savings.

When submitting an application for participation in the program, a person enters the authorization option:

- according to the passport - based on the number, series and date of issue;

- according to the insurance certificate number.

The first page looks like this:

The list of actions is written on the main page and it looks like this:

Replenishment methods

For compulsory pension insurance, automatic transfer of contributions is provided. The employer makes these payments based on a statement in the accounting department. Next, the details of the NPF are provided and payments are made in accordance with the law.

Reporting on such transactions must be submitted, as before, to state regulatory authorities. When using a non-state pension program, the citizen pays the contributions himself.

This can be done at branches of the organization or at bank branches. Find out where the company's office is located simply through a separate search for these purposes. There the locality is entered and the service is selected.

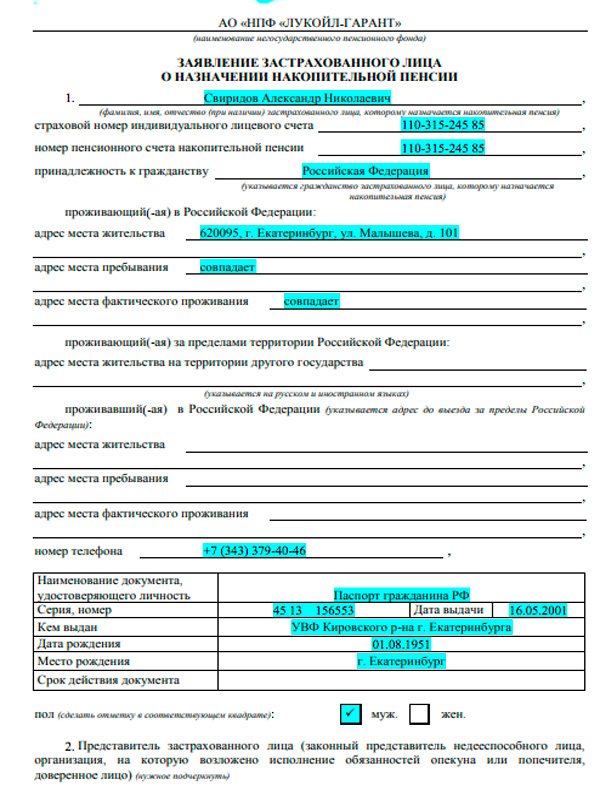

Applications for payment

Payments are assigned by submitting an application. This can be done either by visiting the branch in person or through the online service. An application form for an insured person to assign a funded pension to NPF Lukoil-Garant is available.

In the first case, the document looks like this:

To apply online, you must have an extended profile, which will be confirmed. At the time of application, the citizen must have reached retirement age.

Pension provision concerns all citizens of the country. For more efficient use of one's own contributions, it is allowed to transfer fees to non-governmental organizations.

They invest money and this makes it possible to receive not just their own deductions, but also profit.

When using the Lukoil Garant company, you should understand what features it has and whether it is safe to store funds.

Video: the pros and cons of this NPF

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- 8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

NPF "LUKOIL-GARANT": customer reviews

The national rating, compiled from reviews of NPF clients on blogs, places NPF Lukoil-Garant in 5th place.

Analytics show that the main issue that worries investors is the safety of their investments.

Return on investment came in second place, and share in the Russian market came in third. Summarizing the above and taking into account the difficult economic situation in the country, which has developed today due to forced government measures to freeze pension contributions until the end of 2020, it is recommended to conclude contracts only with NPFs admitted to participate in the insurance system.

Additionally, citizens can control the status of their accounts through the fund’s personal account.

The statistics provided do not include citizens who entered into agreements for OPS in 2013 and 2014.

When compiling ratings, agencies analyze financial indicators, and also assess the level of reputation of owners and partners, the structure of the client base (qualitative and quantitative) and the rationality of investments.

Some background information on NPF Lukoil-Garant In 2014, OJSC Lukoil-Garant was created during the reorganization by spinning off together with the transformation from the NO Lukoil-Garant, which has been active in the market since 1994. Almost all rights and responsibilities in the form of succession were transferred to the new organization, both in the field of public associations, and most of them in the field of non-governmental organizations. The fund ranks first in the Russian market of insurance of citizens and compulsory pension provision. At the same time, the return on investment is about 6.5%. It turns out that the organization is trying to keep its promises to increase the funded part of the pension.

Of course, whenever possible. And for this, NPF Lukoil-Garant OJSC earns positive reviews.

Do you need a safe and stable place to trust with your future retirement? Then Lukoil is the place for you.

Many people say so. In any case, if the profitability of the organization plays a big role for you, it is worth taking a closer look at this option. So far, it is difficult to find a higher rate from competitors. Data Sometimes clients change certain passport details. They, of course, have to be changed in the pension fund. It would seem that there is nothing difficult or special about this.

But at such moments, reviews of the Lukoil-Garant fund are not encouraging.

Why does this happen? Clients remain dissatisfied with the “Stone Age”. This is how they characterize the work of the fund.

Profitability

For some, giving back to the corporation is important. This is normal. After all, a funded pension is important to everyone in old age. Lukoil-Garant receives quite good reviews in terms of its profitability. Not great as we would like, but there are very few complaints here. At least, compared to other non-state pension funds.

The thing is that at the moment the yield is about 6.5% per year. This is more than some other pension funds can offer. Inflation, of course, “eats up” most of the profit, but so far Lukoil-Garant has every reason to rejoice at its success. The average return from most similar companies is 4-5%. So, although small, there is a difference. This attracts the attention of many customers.

It turns out that the organization is trying to keep its promises to increase the funded part of the pension. Of course, whenever possible. And for this, NPF Lukoil-Garant OJSC earns positive reviews. Do you need a safe and stable place to trust with your future retirement? Then Lukoil is the place for you. Many people say so. In any case, if the profitability of the organization plays a big role for you, it is worth taking a closer look at this option. So far, it is difficult to find a higher rate from competitors.

NPF Lukoil-Guarantor what's wrong with it

It turns out that by investing in this organization, you can remain in old age without a pension.

Or not receiving payments when needed. So it’s time to seriously think about whether you need to keep your money “for old age” in the non-state pension fund “Lukoil-Garant”. After all, there are more than enough pitfalls here! Ignoring What else is being paid attention to? Communication between employees and clients. This point, as already noted, outrages some. The point is that persistence and assertiveness at the very beginning later gives way to complete ignorance. Why? What's happening? The whole problem is that employees begin to ignore clients when Lukoil-Garant begins to have some problems. Give me a consultation? Easily.

Mikhail Obukhov | Banking Law | 03/04/2018 05:14 0 Comments

Payments

Another negative point is cash payments. The point is that they say that the license of Lukoil-Garant was allegedly revoked. That is, the organization lost the opportunity to make payments. Actually this is not true. But certain problems still arise with the issue of withdrawing funds. Why?

The whole problem is that when you try to obtain legal funds, you will most likely be told: “there is no money.” It turns out that you made deductions, gave your funds for storage, but when needed, it turns out that they were missing. In fact, the corporation leaves its own clients in a hopeless situation. You cannot leave the fund in this state of affairs - in this case you will not receive any funds at all. As a result, there is only a loss from participation.

You have to wait a long time for pension payments, sometimes even too long. Many clients generally believe that Lukoil-Garant is bankrupt. And he is simply unable to comply with the terms of the concluded agreements. At the moment, it allegedly exists at the expense of depositors. If you don't transfer money to the fund, it will close soon. And the license of NPF Lukoil-Garant will be revoked. This theory is voiced by many clients and even employees of the organization. This kind of behavior of the fund reduces all trust to a minimum. Moreover, it is repulsive. It turns out that by investing in this organization, you can remain in old age without a pension. Or not receiving payments when needed. So it’s time to seriously think about whether you need to keep your money “for old age” in the non-state pension fund “Lukoil-Garant”. After all, there are more than enough pitfalls here!