According to statistics, about 12 million people live in Russia who officially receive benefits for the disabled. This category includes people who retired early due to health conditions. You can find out how the value of insurance pensions has changed in 2020, and what rate will be considered the average, in our new material. We will tell you how a disability pension is calculated and paid, who is entitled to an additional bonus and what its size depends on.

What is a disability insurance pension?

Disability pension is a benefit assigned to disabled people of groups 1, 2 or 3 who have at least one day of insurance coverage. The conditions for assigning a disability insurance pension, its concept and definition are regulated by Federal Law No. 400. Its value consists of the basic labor part and a fixed payment established by the state. The basic part is calculated based on the number of points of the individual pension coefficient or IPC. IPC points are accumulated throughout the entire period of official employment. Their cost changes every year taking into account the indexation of insurance benefits for disabled people.

Important! Until 2020, according to Federal Law No. 173, the concept of “labor payments” existed. It was appointed taking into account the citizen’s working experience. Now the benefit is divided into two parts: funded and insurance, they can be received at a time.

In addition to the insurance part, there is a social benefit intended for citizens who have never officially worked. Its structure and calculation formula will depend on the living wage adopted in a particular area. Social benefits are fixed and paid in one installment. The amount of insurance-type payments depends on the disability group and can exceed social disability by approximately 4,000-5,000 rubles. The difference between the two types of benefits is the presence of labor deductions for the insurance payment.

What is the size of disability pensions for groups 1, 2 and 3

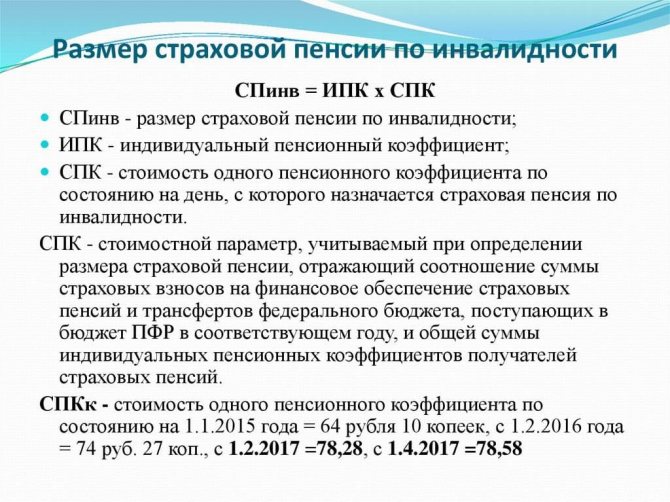

In order to find out how much money the state will pay for a certain disability group, a simple formula is used. It practically does not change regardless of the type:

We recommend reading: A car was arrested and seized, but it was registered to the former owner

Amount of disability payments in 2020

- If there are no dependents, then the amount is 10,668.32 rubles.

- If there is one dependent, the amount is increased to 12,446.38 rubles.

- Two dependents require assistance in the form of 14,224.45 rubles.

- If three disabled individuals are supported, then the assistance will amount to 16,002.57 rubles.

- the amount of insurance premiums received to the citizen’s individual personal account (separately before January 1, 2020 and separately after January 1, 2020);

- the number of months of the expected period of payment of the old-age pension (this indicator is 228 months);

- the cost of a pension point as of January 1, 2020

, which is 64 rubles 10 kopecks; - the standard duration of the insurance period of a disabled person;

- non-insurance periods (military service on conscription, child care, care for a disabled person of group I, a disabled child, a citizen over 80 years old).

In this article we will talk about how you can calculate the amount of a disability insurance pension. Citizens recognized as disabled are entitled to this pension, regardless of the cause of disability and the length of the insurance period. At the same time, the right to a disability insurance pension does not depend on when the disability occurred - during the period of work, before entering work or after termination of work.

How to calculate a disability pension in 2020

Cost of one pension point C

. In essence, this is the price of one pension point. Every year, from February 1, the value of the pension point increases by no less than the consumer price growth index for the past year, and from April 1, it is established (specified) by the law on the Pension Fund budget for the next year and planning period. Relatively recently, the annual February and April indexation of the fixed payment has been suspended until January 1, 2025.

To correctly determine the benefit amount, you can use an online calculator. It is posted on many portals dedicated to the pension system. For calculations, special formulas are used, each type has its own. In addition, the amount of payments depends on the disability group and the presence of dependents in the care of the disabled person.

When are disabled people entitled to benefits?

Payment of an official disability insurance pension is due to disabled people of one of three groups who have documented their incapacity for work. To receive benefits, a citizen is required to undergo the procedure of medical social examination or MSE. After this, he will be assigned a group based on his diagnosis and given a supporting document. A citizen who previously worked or is currently working has the right to receive an insurance pension; if he has not worked a single day, he is assigned a social benefit.

Article on the topic: What is an insurance pension, the conditions for its appointment and how to apply for benefits

There are three groups of disability, depending on the disability and type of illness:

- First. Assigned to completely incapacitated citizens who depend on the help of guardians, relatives or third parties.

- Second. Designed for citizens who can take care of themselves, but have health limitations. Due to partial legal capacity, it is difficult for them to find suitable work.

- Third. Designed for working disabled people with partial health limitations. Because of them, the range of professions available to a group 3 disabled person is greatly narrowed.

Group 3 disability benefits in 2020 may increase if the citizen has dependents. This type of supplement is also available to disabled people of the second group. Children under the age of 18 and close incapacitated relatives are recognized as dependents, for whom a monthly cash payment is established. Its amount depends on the category of disability and the number of dependent persons of the citizen. According to the law, disabled people of the first group do not have the right to support dependents, since they themselves are completely disabled.

How much will the pension of group 2 disabled people be added in 2020?

In 2020, pensions increased again, thanks to an increase in all social benefits. benefits. The necessity of increasing social standards is associated with ruble inflation and the active increase in prices for goods and services. However, you should not count on a large-scale increase. The changes will not exceed 2.9 percent, but this is enough to cover inflationary growth.

Additional payments to pensions

For example, for disabled people of the second group, treatment in sanatoriums, completely free travel on public transport, and so on are expected. However, it is worth remembering that a person who has such rights can refuse these services. If he decides to do this, then he should contact the social authorities. protection. And in return for these benefits, he will receive a regular increase in his pension.

- The disability insurance pension is calculated by summing the base amount in accordance with the degree of disability with the amount of personal accumulated pension funds, divided by the duration of probable survival (standards set at 240 months). The calculation is influenced by regional coefficients, the presence of dependents (child care), living in the far north and length of service. 20 years of service entitles you to receive a pension at a higher rate.

- The social pension is not calculated - it is established by the state and is subject to changes only on the basis of relevant acts;

- The state pension is calculated from the size of the social pension (that is, ultimately also fixed), multiplied by a value from 100% to 300%. The coefficient is influenced by the disability group and the basis for receiving a state pension.

Attention! If you have any questions, you can consult with a lawyer for free by phone in Moscow, St. Petersburg, and all over Russia. Calls are accepted 24 hours a day. Call and solve your problem right now. It's fast and convenient!

Amount and calculation of disability pensions

- A disability insurance pension is available to persons who have any officially confirmed work experience for which insurance premiums have been paid. A special feature is the calculation of pensions based on the pension savings of a disabled person. In some cases, the pension experience may be so short that the assignment of a labor pension is impractical. Then it is possible to choose an alternative - a minimum social pension.

- The social disability pension in 2020 is available to all Russian citizens. The absence of other criteria makes this type of pension the only one available to disabled children, disabled people with no experience, as well as persons who received disability upon reaching 18 years of age (former disabled children).

- The state pension is awarded to persons subject to special government regulations, presidential decrees and federal laws. This type of pension is received by the smallest number of people, in particular war veterans, blockade survivors and liquidators of the Chernobyl accident.

We recommend reading: Sample payment order for fines on income for 2020

For working disabled people, increased vacation time is provided up to 60 days and a shortened workweek of 40 hours. Dismissal of a disabled worker at the initiative of the employer is legal if the employee has been undergoing treatment or recovery for more than 4 months. At the same time, the employee retains the right to paid sick leave and severance pay.

- RUB 10,668.38 in the absence of persons who are dependent on the recipient of payments;

- +1778.06 rub. to this amount if there is 1 disabled family member;

- +3556.12 rub. if there are 2;

- +5334.12 rub. if there are 3 or more.

Disability benefit for group 3

The fixed part, taking into account regional coefficients, is paid regardless of the place of residence of the person at the time of payment. Thus, in order to receive an increased insurance payment for work in the Northern regions and equivalent regions, it is not at all necessary to live there.

A citizen living in the central region of Russia received group 3 and has 1 dependent. The basic payment for disability group 3 in 2020 was 2,491 rubles. 45 kopecks With an additional payment for dependents, he will receive 4152.42 rubles.

Rules and procedure for issuing benefits

The establishment and receipt of a disability insurance pension is regulated by Federal Law No. 400, Article 9. Only citizens of certain categories can apply to the Pension Fund for benefits. This includes disabled people who have lost the ability to work due to illness or injury, as well as people who have not reached old age retirement age. The procedure for assigning an insurance pension requires having at least one day of work experience. As proof, you must provide a document from the Social Insurance Fund.

Working disabled people have the right to an insurance pension, but in this case indexation will be frozen for them. The recalculation and calculation of the disability insurance pension for this category of persons is carried out every year on August 1. The new amount is calculated taking into account the number of new IPCs that appeared during the period of work. If a beneficiary has earned 100 IPC over the entire length of service and has added 3 IPC to the total during the year, only the last indicator is taken into account in the calculation.

Calculation of Disability Pension 2 Groups in 2020 Calculator

The value of the individual pension coefficient in 2020 is 81.49 rubles, it increases in August of each year, for which inflation rates are used, leading to indexation. To calculate the fixed part, there is a simple formula: the number of points is multiplied by the cost of each, and a fixed payment is added to the result.

How to calculate a disability pension

In 2020, thanks to changes in legislation, the funded pension no longer applies to the labor pension, and is a separate type of benefits paid in old age. The size of the savings portion depends on how long the funds have been deducted and in what amount they were contributed to the savings organization.

A citizen living in the central region of Russia received group 3 and has 1 dependent. The basic payment for disability group 3 in 2020 was 2,491 rubles. 45 kopecks With an additional payment for dependents, he will receive 4152.42 rubles.

At the request of the applicant, NSO can be presented as preferential services, or paid in the form of a cash increase. To transfer the benefit into cash equivalent, the pensioner submits a one-time application for waiver of benefits before October 1 of the current year.

State

If disability is established, an extract from the medical and social examination report is redirected to the Pension Fund. Bureau employees are required to convey the conclusion to fund employees within 2 working days from the date of registration of the applicant’s disability.

In those social authorities protection, you can find out if you are included in the list of persons who are entitled to such payments. This bonus is paid immediately along with the pension itself by this body. For example, if the Pension Fund is engaged in paying the basic pension, then it is obliged to pay EDV.

We recommend reading: Veteran of Labor in Mari El 2020

Citizens with disabilities have the right to additional social security from the government. Accordingly, new types of allowances and social benefits are regularly designed at the federal and regional levels. help. Therefore, a pension is not the only type of assistance that can be used.

EDV for disabled people of group 2

In 2020, pensions increased again, thanks to an increase in all social benefits. benefits. The necessity of increasing social standards is associated with ruble inflation and the active increase in prices for goods and services. However, you should not count on a large-scale increase. The changes will not exceed 2.9 percent, but this is enough to cover inflationary growth.

If a citizen received disabled status as a child, then the amount increases to 9919.73 rubles . If a citizen has work experience, he has the opportunity to receive appropriate payments. This type of benefit is calculated using a formula that takes into account the amount of output and the value of the fixed component.

Requirements for appointment

Before applying for an official disability insurance pension, you need to receive groups 1,2 or 3. After passing the ITU, it is necessary to obtain a doctor’s opinion on obtaining the status of a disabled person, which will be sent to the Pension Fund. This procedure is not enough, since the procedure for applying for benefits is of a declarative nature. A disabled person will need to independently contact the Pension Fund at his place of residence and write an application. This can be done at any time after the group is assigned.

Where to apply for registration

If there are grounds for receiving benefits, you need to contact the Pension Fund with an application and a package of necessary documents. Employees will consider the application within 10 working days. During this period, the accuracy of the papers is checked and the benefit that will be assigned to the citizen is calculated. The procedure for determining the size of the disability insurance pension is regulated by Federal Law No. 400 and is carried out taking into account current legislation.

Related article: Features of the survivor's insurance pension in 2020

Pension protection for disabled people: federal laws

The features of the labor pension assigned to disabled people, the conditions for receiving it, the norms for calculating payments and other aspects are regulated by several regulatory documents.

The main one is Federal Law No. 166 “On state pension provision in the Russian Federation” dated December 15, 2001. It defines the features of all types of pensions, the conditions for assigning each of them, and addresses many other issues.

The labor (or insurance) disability pension is discussed in more detail in Federal Law No. 173 of December 17, 2001 “On labor pensions in the Russian Federation.”

Important! Many articles of this regulatory act have lost force since January 1, 2020; however, it is in accordance with Federal Law 173 that the size of pension payments is still calculated.

The main aspects, with the exception of the procedure for calculating pensions, are specified in Federal Law No. 400 “On Insurance Pensions” dated December 28, 2013.

And, of course, we must not forget about the decrees of the Government of the Russian Federation, which indicate the minimum amount of payments for the current year.

Required documents

To find out the terms of appointment and the amount of the pension, a citizen must prepare an application and a complete set of documentation. The official application form can be downloaded on the Pension Fund website, or contact specialists at the Pension Fund who will provide it (a sample can also be downloaded here). Documents are submitted in person, or through a representative with a power of attorney to the Pension Fund of Russia or the MFC at the place of registration.

The standard list of documents should include the following papers:

- application in the form, according to the order of the Ministry of Labor dated January 19, 2016;

- passport for citizens of the Russian Federation or residence permit for foreigners;

- SNILS;

- a document confirming the insurance period, for example, a certificate from the employer;

- an extract from the ITU report confirming the assignment of a disability group according to the diagnosis.

A citizen must necessarily confirm his insurance experience so that Pension Fund employees can accurately calculate and determine the amount of the insurance portion of the benefit. In addition to a certificate from the employer, additional documents may be required for this purpose. The request for such papers must be justified. Despite the absence of missing documents, the date for filing the application and applying for benefits remains the same.

Payment amount

Benefits are calculated using the formula for calculating the disability insurance pension or using a special calculator. The amount of payments will depend on the length of work experience, the amount of salary and the number of contributions made to the Social Insurance Fund. The pension consists of two amounts and includes a basic and a fixed rate. The amount of the base rate will depend on the level of disability and the number of dependents the disabled person has. The general and social rates depend on the specific region and the coefficients that apply to each region.

Important! Indexation of insurance benefits occurs after an increase in the cost of the IPC. In 2020 it was no more than 7%. The amounts of fixed payments are reviewed every year, with the exception of old-age benefits.

The minimum rate is calculated according to the citizen’s region of residence. Its size is determined taking into account the cost of living of people of retirement age living in a particular area. If the benefit and payment are less than the PMP, a social subsidy is added to it. To issue a subsidy, you must submit a separate application to the Pension Fund. Benefit amounts as of 2020 will depend on the disability group. Disabled people of the first category receive a maximum pension equal to 10,668.38 rubles, the second and third - 5,334.19 and 2,667.09 rubles, respectively.

You can find out how to calculate benefits using a special formula: SPinv=IPKxSPK. SPinv means insurance pension, IPC - individual coefficient and SPK - the rate for one pension coefficient on the day the pension is calculated. As an example, we can cite a disabled person of group 3 who receives an allowance for dependents:

Article on the topic: What is an insurance pension, the conditions for its appointment and how to apply for benefits

Citizen Petrov S.A. He is 53 years old, has a 3rd group disability and supports two minor grandchildren. The number of his IPC is 110. According to the formula: 110x87.24, he will receive an allowance of 9596.4 rubles and an allowance for dependents of 3556 rubles. His pension will be 13,152.4 rubles.

Pension calculator

These results of calculating the insurance pension are purely conditional and should not be perceived by you as the real amount of your future pension. To make the results easier to understand, all calculations are performed under constant conditions of 2020. For calculation purposes, it is assumed that the entire period of formation of your future pension rights took place in 2020 and you were “assigned” an insurance pension in 2020, taking into account the life plans you personally indicated, and also on the condition that you will “receive” all the years of your working life the salary you specified.

This is interesting: What benefits do disabled pensioners have in the Novgorod region when paying tax on small vessels and outboard motors

The actual amount of the insurance pension is calculated by the Pension Fund of the Russian Federation when applying for its appointment, taking into account all the generated pension rights and benefits provided for by pension legislation on the date of assignment of the pension. For example, for disabled people of group I, citizens who have reached the age of 80, citizens who worked or lived in the Far North and equivalent areas, citizens who have worked for at least 30 calendar years in agriculture, who do not carry out work and (or) other working activity and living in rural areas, the insurance pension will be assigned in an increased amount due to the increased size of the fixed payment.

Appointment and payment terms

The timing of each disability insurance pension is established by law. The benefit is assigned from the day the person is recognized as disabled, if the citizen submitted an application no later than 12 months after this date. Otherwise, benefits will be accrued from the date of application. The duration of payments is determined depending on the length of service and the IPC. If the length of service is more than 15 years and the IPC is not less than 30, the pension will be paid until the age of 70 and 65, respectively.

After this, the citizen is assigned an old-age labor payment. In order to consistently receive disability benefits before this period, you will need to confirm your disability before reaching retirement age. In the absence of insurance experience or IPC, benefits will also be paid until the age of 65 and 70, after which the citizen will be assigned an official social payment. Disability benefits of any group are always issued for the period regulated by Federal Law No. 400.

Features of termination and suspension of payments

Payments may be suspended if a citizen’s ITU certificate has expired and he was unable to obtain an updated document. Also, disability benefits will not be paid after reaching retirement age and in the event of going back to work or registering as an individual entrepreneur. A working citizen is required to report employment to the Pension Fund. All payments will stop after the first day of the month following the reporting month. If the ITU certificate was not renewed for valid reasons, payments will be extended starting from the day the pause began. To do this, you will need to obtain confirmation from members of the medical commission.

Every citizen can use PSO according to the law and apply for disability benefits. The pension will be assigned in accordance with his insurance experience and number of points, as well as taking into account current legislation.

Video files

How is a disability pension calculated: types of payments and allowances

The content lists the restrictions that give the right to this status and are not subject to re-examination. He also lists a number of diseases for which, after certain periods of time, the medical examination must be repeated. Without this, the disability group may be lowered or the citizen will completely lose this social status.

Grounds for recognizing citizens as disabled

Reference . This does not mean, however, that disabled people do not receive social security until retirement. It is awarded to them by the state in the form of benefits, but, accordingly, does not apply to pensions - these are the so-called social benefits.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant: