Additional payment for Soviet experience for pensioners in 2020

Continuing the topic, it is necessary to say about the size of the bonus for Soviet experience in 2020. How much is it?

If a pensioner has work experience earned before 2002, then the pensioner receives an accrual of 10% of the pension capital.

At the same time, for each full year worked, the pension fund adds 1%. Here we should once again focus on such an important point that the calculation of the percentage of the bonus for Soviet experience comes from the entire pension capital. The size of the pension is not taken into account here.

Let's now take a closer look at the size of the bonus you can receive for work in Soviet times (period), that is, for Soviet experience. Let's take three pensioners as an example.

Increase in pension for Soviet service from 1971 to 1990

The pension supplement for Soviet service was organized back in 2010. This is a measure of government support for all pensioners who not only remember Soviet times, but also gave their strength and labor to that era.

The supplement to the pension for Soviet service has a number of conditions. Some people end up getting a bonus, while others don’t. To understand what you are entitled to, you must carefully study the information described below so that you can competently submit documents to a specialist at the Pension Fund at your place of residence.

To make everything as clear as possible, you need to show it with an example. So, the additional payment for Soviet experience goes as a supplement to the pension for work experience immediately before 2002. That is, for work activity before 2002.

Thus, the bonus for Soviet experience will be given to everyone who worked at least one day before January 1, 2002.

It is also necessary to take into account the important point that the bonus for Soviet experience is only due in relation to:

- Insurance old age pensions;

- Disability pensions;

- Survivor's pensions;

There is no pension supplement for Soviet service in relation to:

- Social pensions;

- State pensions;

As a rule, few people know about this, but the calculation of the bonus for Soviet experience is carried out by the Pension Fund of Russia (PFR) without a declaration. That is, automatically. That is, a pensioner may receive this bonus and not even know about it.

Pension capital

In order to fully understand the issue of pension supplements for Soviet service, it is necessary to understand what pension capital is and how it is taken into account when calculating the supplement.

Expert opinion

Davydov Alexander Yurievich

Civil law consultant with 20 years of practice. Author of numerous articles on legal topics

First of all, pension capital is discussed in Article 30 of Federal Law No. 173. This law presupposes a certain formula for calculating pension capital. How does she look? What does it consist of?

- Coefficient for experience;

- Salary ratio;

- Payment period;

This is important to know: 353 Federal Law “On Consumer Credit and Loans” as amended in 2020

PC = ((SK X ZR / ZP X SZP) – 450 rub.) X T

- PC – pension capital

- SC - coefficient for length of service

- ZR – Average monthly salary

- ZP – Average salary in Russia for the same period of time.

- SWP is the average monthly salary, which is approved by the Government of the Russian Federation. Amounts to 1671 rubles as of January 1, 2002.

- 450 rubles is the basic part of the old-age labor pension established by the Russian Federation on January 1, 2002.

- T is the expected payment period for the old-age labor pension. As a rule, it is equal to the same period that will be applied for the actual payment of the labor pension.

It is worth noting that you will not be able to independently calculate the amount of your bonus for Soviet experience. For example, a pair of pensioners who have similar work experience during the Soviet period, but their salaries were different, will receive a different bonus for Soviet experience.

To more accurately calculate the increase in pension for work in the USSR, you must contact the nearest branch of the Pension Fund of the Russian Federation, where they will raise the pension case and carry out all the necessary recalculations.

Is there an additional payment to the pension for Soviet service? “You are entitled to an increase in your pension!” “The additional payment will amount to tens of thousands of rubles!” “The Pension Fund is silent about this.” Having seen similar headlines on the Internet, many pensioners click on the link. And they are surprised to read that the Pension Fund, it turns out, greatly underpays them.

Which earnings to choose for calculating your pension?

It is approximately possible to calculate whether the Soviet salary will be beneficial for calculating pension benefits. First, you need to visit the territorial office of the Pension Fund of the Russian Federation and find out the value of the coefficient. If for the period from 2001 to 2002 it already has a maximum value, there is no point in turning to Soviet earnings for a pensioner.

- How to earn a big pension

- Calculation of pensions for those born in 1965 - new rules for calculating the amount of payment

- Calculation of pensions for those born in 1968 - points, coefficients and calculation examples

Provided that the value is not entirely profitable, since it does not reach the limiting value, it is important to present a certificate of salary for the Soviet era.

Based on data on average wages in the USSR, it is possible to determine what minimum one needed to receive at that time and choose the optimal, more profitable 60-month period in terms of earnings. To do this, you need to multiply the amount of earnings by 1.2 (northerners use the corresponding indicator established for them):

- 1980 - 209 rubles;

- 1981 – 214 rubles;

- 1982 – 221 rubles;

- 1983 – 226 rubles;

- 1984 – 232 rubles;

- 1985 – 240 rubles;

- 1986 – 248 rubles;

- 1987 – 258 rubles;

- 1988 – 280 rubles;

- 1989 – 315 rubles;

- 1990 – 364 rub.

If the limit coefficient does not reach the maximum

The Constitutional Court of the Russian Federation ruled that the rights of citizens who earned a pension during Soviet times cannot deteriorate regardless of changes in legislation. For this reason, a person has the right to demand a recalculation of pension benefits for work during the Soviet era.

The Soviet salary must be officially confirmed to calculate the pension. It is better to prepare in advance and provide information to the Pension Fund before the appointment of the insurance pension, so as not to have to recalculate it later.

To obtain a certificate of earnings, a citizen needs to contact the enterprise where he previously worked.

If the organization is liquidated, the application is written to the archives. You can find out the exact address and departmental affiliation of the archival organization directly from the Pension Fund of Russia. You can also obtain a certificate by contacting the Multifunctional Center (MFC) or filling out a special application on the Rosarkhiv website. Services are provided free of charge.

What do “pension lawyers” promise?

Since the end of 2020, Pension Fund employees in the regions have been massively receiving applications from citizens demanding recalculation of pensions. In most cases, we are talking about including the period of Soviet service in the calculation. Which was allegedly not taken into account by the Pension Fund when assigning a pension.

Statements of similar content are drawn up by commercial organizations providing legal services. As a result of consideration of applications, almost all applicants were refused. Let's figure out what's the catch here.

After 2002, a transition to a fundamentally new system took place.

The pension began to be based on insurance contributions transferred by the employer to the individual personal account of the employee. Thus

- the higher the salary and the transferred insurance premiums,

- the greater the future pension.

For pensioners of the older generation, after the pension reform of 2002, a pension capital is established based on their length of service and earnings.

This is a calculated value, taking into account which the insurance part of their pension is determined (Article 30 of the Law).

In order to ensure an increase in the pensions of Soviet-era citizens, the state decided in 2010 to reassess the monetary value of the pension rights they acquired before the launch of the pension reform.

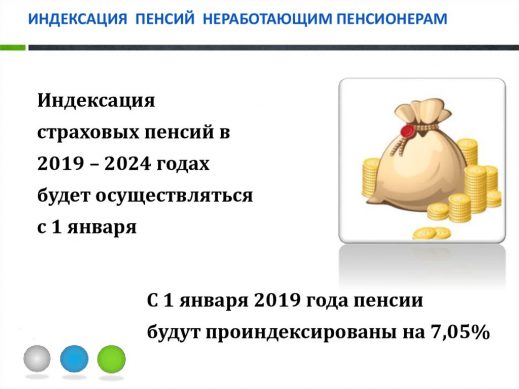

The procedure for indexing insurance pensions

After a person retires, the Russian Pension Fund recalculates the payments due to him, taking into account the missing indices during his work. The final indexed pension is restored 3 months after the fact of dismissal.

A long period is determined by law for confirming and verifying data on the fact of work on special forms from policyholders, followed by a decision to make payments to the Pension Fund of the Russian Federation.

Below is a step-by-step example of dismissal and subsequent indexation for a working pensioner as of May 5, 2020:

- The policyholder sends information monthly via special form in the Pension Fund of the Russian Federation. No later than the 15th day of the month following the reporting period, provides information about each person working for him. In the situation under consideration, the citizen is formally considered to be working in the month of May, despite the fact that his dismissal occurred at the beginning of this month. Despite this fact, the employer is obliged to provide information about work for this worker by June 15. A citizen will be considered unemployed for the Pension Fund of the Russian Federation from June 2019;

- The second stage is the adoption by the Pension Fund of the Russian Federation of a decision on the payment of indexed amounts, which is made already in the next month, in relation to the previous one. We are talking about July, during which the fund must actually calculate the payment amount, taking into account the increase;

The finally calculated pension is paid to the person starting from the month following the month in which the corresponding decision arose.

It is important to know: a citizen will begin to receive his full pension only 3 months after his dismissal. If after this the person gets a job again, the size of his pension will not decrease.

Reasons for non-indexation of pensions after dismissal

The reason for the lack of an increase in the size of the pension after the expiration of the period determined by the legislator for making a decision on indexation is the delay by the employer in sending reports confirming the fact that the person has fulfilled his job duties. In this situation, the legislator is entirely on the side of the individual.

If such a case arises, as well as the provision by the employer of distorted information, which in turn affects the increase in the size of the pension, the latter is subject to revision by the Pension Fund of the Russian Federation and for the past. The foregoing means that a person has a legal right to receive the additional payment due to him and for the elapsed time from the moment the right arose.

The opposite situation is also possible, in which, due to incorrect provision by the employer of the relevant information, an excessive accrual occurs on the part of the Pension Fund, since the latter believes that the person is not working at this time. And in this case, the law is completely on the side of the physical person. persons, since all responsibility falls entirely on the shoulders of the employer. The identified error is eliminated (corrected) starting the next month after its discovery.

In this case, the responsibility for reimbursement of overpaid pension amounts lies entirely with the policyholder, and he will also be subject to penalties in the amount of five hundred rubles in relation to each of the insured citizens.

Recalculation in August 2020 what pensioners can expect

In August next year, the next recalculation of pensions is planned for older people engaged in official work activities.

The considered addition to the insurance pension will be based on points not taken into account in 2020, which in turn are accumulated on the citizen’s individual personal account from financial resources sent by the policyholder.

It is important to know: this recalculation is carried out without a statement, and therefore it is not necessary to send a written application to the Pension Fund of the Russian Federation!

In cases where this recalculation is not made at the specified time, you must call the fund’s hotline and ask a question about your actual right to receive an additional payment. If it is available, the insurance pension is paid in full, taking into account the final recalculation.

Additional payment 1000 rubles

Pensions for older people are indexed annually. This also applies to payments to pensioners who are on vacation and not working. Two years ago, the indexation in question was abolished. At the same time, the government of the country justified this action by the need to take measures aimed at stabilizing the economic situation in the country.

From 2020, it is planned to increase pensions for older workers after dismissal by 1000 rubles. This procedure will be carried out through indexing.

Already today, it is planned to accrue funds to elderly and unemployed citizens for past labor services to their homeland, as well as for certain chronic diseases. At the same time, the budget of the Pension Fund of the Russian Federation will be adjusted taking into account the upcoming reform in the coming year.

Innovations for working pensioners in 2020

The main issue of interest to working pensioners is directly related to the indexation of payments. Persons who regularly receive only a pension can hope to transfer the specified amount according to the official inflation rate. People who decide to continue working after legal retirement will not be affected by the above rule.

Last year, the country's government decided to abolish indexation for working pensioners, explaining that they receive additional money in the form of wages for their work. However, a significant number of representatives of the social sector believe that such a decision is discriminatory, since older citizens often continue to work not because of a good life, but because of an urgent need for money. Despite the above circumstances, the current government promises to make additional payments of lost funds to working pensioners as soon as they give up work.

The pension reform is associated with the desire of the authorities to reduce the expenditure side of the state budget. This limitation will allow for significant financial savings for the Russian treasury.

How recalculation is done

The amount of valorization is calculated individually for each citizen. Its essence is as follows. All citizens who worked before 2002 automatically received a 10% increase in their pension capital, regardless of their retirement date.

The increase is set the same for everyone. In order to remove from citizens the need to confirm their experience with documents during the unstable 90s.

Expert opinion

Davydov Alexander Yurievich

Civil law consultant with 20 years of practice. Author of numerous articles on legal topics

Important ! The increase is not calculated to the total amount of the pension, but only to its part - the estimated pension capital until 2002.

Those who earned work experience before the collapse of the USSR also received an additional 1% for each full year of work experience earned before 1991. There are no restrictions on the number of years worked. All length of service is taken into account, including in excess of the maximum indicators established in Soviet times

- 45 years for men

- 40 years for women.

This is important to know: Pregnancy certificate: what it looks like in 2020

For example, a man born in 1949 worked for 25 years until 1991. He retired in 2009 and no longer worked. As a result of valorization, his pension capital increased

- by 10% for work experience before 2002

- by 25% during operation until 1991,

- in total - by 35%.

Valorization does not only apply to those who were pensioners in 2010. Pension capital is recalculated for all citizens who

- have work experience up to 2002

- and retired after 2010.

Thus, it turns out that Soviet experience is “worth” more than what was earned after the collapse of the USSR.

Important ! Since 2020, insurance pensions, rather than labor pensions, will be paid.

The provisions on valorization remain in force when issuing insurance pensions in relation to length of service acquired before 2002.

New procedure for calculating and forming pensions in 2020

On January 1, 2020, Law 400-FZ “On Insurance Pensions” and a new procedure for calculating and forming pensions came into force in Russia. Two types of it are being introduced – insurance and savings. The concept of retirement experience and “labor pension” will generally disappear from our everyday life.

An old-age insurance pension will be assigned to citizens subject to three conditions:

- Firstly, this means reaching the age of 60 for women and 65 for men (that is, the retirement age will not increase).

- The second is a certain insurance period (minimum period of payment of insurance premiums). In 2020 it will be six years. Further, the increase in length of service requirements will occur gradually: one year every ten years, so in 2024 it will be 15 years.

- The third condition is the presence of an individual pension coefficient (IPC) of a certain level. In 2020, the minimum IPC value will be 6.6 points, and by 2025 it will be increased to 30 points.

Pension rights in the new system are formed not in rubles, but in individual pension coefficients (points). The accumulated points will be converted into rubles when a pension is assigned. The maximum number of points you can earn in a year is 10.

At the time of retirement, points for each year are added up and multiplied by their value. The cost of the point will be set by the state, and it will grow annually at a level not lower than inflation in the previous year. In 2014, one point is equal to 64 rubles. 10 kopecks

The procedure for assigning and paying out the funded part does not change: the profitability of pension savings depends solely on the results of their investment.

The current pension legislation does not provide for additional payment to the pension for length of service. All length of service earned by the time of retirement is taken into account in the initial calculation of its size.

The calculation of the pension will be affected by the size of the salary, the length of the insurance period, as well as the age of applying for a pension (the later a citizen applies for a pension, the higher it will be indexed).

Even if a pension has already been assigned, citizens have the right to refuse it in order to receive an increased payment with bonus coefficients in a year or several years.

So, for example, when applying for a pension 5 years after reaching retirement age, the fixed payment towards the pension will increase by 36%, and the insurance pension itself will increase by 45%. If after 10 years, then the fixed payment will increase by 2.11 times, and the pension – by 2.32 times.

Today, the size of the old-age labor pension primarily depends on the volume of insurance contributions that employers pay for the employee during their working life to the compulsory pension insurance system. At the same time, the length of insurance (work) experience has virtually no effect on the size of the pension.

Therefore, it turns out unfair: those who worked a lot receive less than those who worked less but paid more insurance premiums. Those. Equalization when calculating pensions leads to the fact that pension payments to citizens with little insurance (work) experience are made in approximately the same amount as to citizens with a long work experience.

Since 2020, according to the pension reform, three types of insurance pensions have been established: old age, disability, and loss of a breadwinner.

It has been established that rights to an insurance pension will be taken into account in pension coefficients (points) based on the level of wages (insurance contributions paid from them), length of service and retirement age.

More on the topic Pension payments were indexed on February 1, 2020

The conditions for the emergence of the right to an old-age insurance pension are reaching the age of 60 years for men, 55 years for women, having an insurance period (i.e., a minimum period of payment of insurance contributions) of at least 15 years, having an individual pension coefficient (points) at least 30.

In 2025, the minimum total length of service for receiving an old-age pension will be used in pension calculations, reaching 15 years. From 6 years in 2020, it will gradually increase over 10 years - 1 year per year. Those whose total length of service by 2025 will be less than 15 years have the right to apply to the Pension Fund for a social pension (women at 60 years old, men at 65 years old). In addition, a social supplement to the pension will be made up to the subsistence level of the pensioner in the region of his residence.

From January 1, 2020, the minimum value of the individual pension coefficient at which the right to assign an insurance pension arises is set at 6.6, followed by an annual increase of 2.4 until it reaches 30 in 2025.

The full insurance pension will be formed according to the new rules for citizens who will begin working in 2020.

For future pensioners who have insurance coverage until 2020, all generated pension rights are recorded, preserved and guaranteed to be fulfilled. In 2014, they will be converted into individual pension coefficients - a new tool for accounting for a citizen’s pension rights.

Annual PC =

* If a citizen refuses to form pension savings in the compulsory pension insurance system, then the employer will pay insurance premiums for him to form his insurance pension at a rate of 16%. If a citizen chooses a 6% tariff for the formation of a funded pension, then insurance premiums will be sent to the formation of his insurance pension at a 10% rate.

** The rate at which employers pay insurance contributions to the compulsory health insurance system is 22% of the employee’s wage fund (the maximum level of the contributionable salary is determined annually by federal law). 6% of the tariff of insurance contributions from the compulsory pension insurance system goes to finance a fixed payment, and 16% is an individual tariff, the paid contributions for which, at your choice, can either be completely directed towards the formation of pension rights in an insurance pension, or 6% can be directed towards the formation of pension savings of a citizen, and 10% - for the formation of pension rights in an insurance pension.

Note: maximum PC value (7.39 in 2020, 10 in 2021)

From 2021, with an annual increase in the level of contributory wages to 2.3 of the average Russian salary, the maximum value of the annual PC will reach 10 from 7.39 in 2020. The maximum annual coefficient is accrued to a citizen if his salary, from which insurance premiums are paid, is not lower than the maximum salary from which employers, by law, pay insurance contributions to the mandatory pension insurance system, and the citizen has refused to form pension savings.

When calculating the annual PC, only the official salary before deduction of income tax (13%) is taken into account.

Note: The cost of the pension coefficient is determined annually by the Government of the Russian Federation.

The new rules for calculating pensions include such socially significant periods of a person’s life as military service, caring for a child, a disabled child, or a citizen over 80 years of age. For these so-called “non-insurance periods”, special annual coefficients are assigned if the citizen did not work during these periods.

Thus, during the period of conscription military service, pension coefficients are calculated based on a conditional salary of 1 minimum wage: 1.8 pension coefficients for each year of conscription military service.

Periods of child care (up to 1.5 years for each child) are also counted towards the length of service, and for each child the following is accrued:

- 1.8 pension coefficient per year of leave - for the first child,

- 3.6 pension coefficient per year of leave - for the second child,

- 5.4 pension coefficient per year of leave - for the third child and fourth child.

A funded pension is a monthly payment of pension savings formed from insurance contributions from your employers and income from their investment. Today, employers pay insurance contributions to the mandatory pension system at a rate of 22% of the employee’s wage fund. Of this, 6% of the tariff can go to the formation of pension savings, and 16% - to the formation of an insurance pension, or maybe - at the choice of the citizen - all 22% can go to the formation of an insurance pension.

If a citizen was born in 1967 or older, then his pension according to the old-age pension formula will not contain pension savings, because his employers contribute the entire amount of insurance contributions only to the insurance pension.

If a citizen was born in 1967 and later, until December 31, 2020, he will additionally be given the opportunity to choose a pension option: 1) refuse to form a funded pension and direct all insurance contributions to the formation of an insurance pension (the rate of insurance contributions for the funded part is 0 %));2) continue to form a funded pension, maintaining, as today, the insurance premium rate of 6%.

When choosing a pension option, according to the pension reform, you need to remember that by deciding to form a funded pension, you reduce your pension rights to form an insurance pension, and vice versa. Which option is more profitable - you decide for yourself. When making a decision on your choice, it is worth remembering that the insurance pension is guaranteed to be increased by the state through annual indexation at a level not lower than inflation.

While a funded pension is pension savings that are transferred from the Pension Fund to the management of a non-state pension fund or management company and are invested by them in the financial market. The funded pension is not indexed by the state. The profitability of pension savings depends solely on the results of their investment, that is, there may be losses. In case of losses, only the payment of the amount of paid insurance contributions to the funded part of the pension is guaranteed.

| Year | Requirements for insurance experience | Minimum amount of individual pension points to qualify for an insurance pension | Maximum annual score | |

| When choosing a funded pension tariff 0% | When choosing a funded pension tariff 6% | |||

| 2015 | 6 | 6,6 | 7,39 | 4,62 |

| 2016 | 7 | 9 | 7,83 | 4,89 |

| 2017 | 8 | 11,4 | 8,26 | 5,16 |

| 2018 | 9 | 13,8 | 8,70 | 5,43 |

| 2019 | 10 | 16,2 | 9,13 | 5,71 |

| 2020 | 11 | 18,6 | 9,57 | 5,98 |

| 2021 | 12 | 21 | 10 | 6,25 |

| 2022 | 13 | 23,4 | 10 | 6,25 |

| 2023 | 14 | 25,8 | 10 | 6,25 |

| 2024 | 15 | 28,2 | 10 | 6,25 |

| 2025 | 15 | 30 | 10 | 6,25 |

Do I need to submit an application to the Pension Fund?

Monetary revaluation of pension rights in connection with valorization was carried out as of January 1, 2010 on a non-declaration basis. Pension Fund employees automatically recalculate taking into account all documents available in the pension file.

For everyone who retired before January 1, 2010, recalculation has already been made in 2010. To those who

- applied for a pension after this date

- or will only be issued in the future,

valorization of pension capital is carried out when establishing the size of the pension.

Thus, there is no need to contact the Pension Fund with an application. The only exceptions are those pensioners who have additional documents on their length of service that were not previously taken into account when assigning a pension.

How are pension points awarded for work during Soviet times?

Today, the size of the insurance pension payment depends on:

- the individual part, which includes the length of work experience, the number of points earned, and so on;

- a fixed payment, which is the amount of money accrued established by law.

According to the requirements of Federal Law No. 400, to calculate the insurance payment, the length of the citizen’s work experience, the number of individual coefficients earned by him, as well as the cost of one IPC on the date of assignment of the pension are taken.

It would seem that there is nothing complicated, everything is extremely clear. However, what about people who worked half or most of their lives during the Soviet era? To answer this question, you should refer to the provisions of Federal Law No. 173.

There are many legal portals and duplicate sites of the Pension Fund on the Internet. They

- publish false information about pensions and social benefits

- and provide dubious services.

Fraudsters operate according to a similar scheme. Online chats offer free assistance from a “pension lawyer”

- in receiving allegedly under-accrued pensions

- and offset of unaccounted experience.

Immediately after the start of communication, for convenience, they are asked to provide the contact number to which the call is received. In a telephone conversation, services for drawing up applications to the Pension Fund are offered.

Which you already need to pay, usually several thousand rubles. As a result, the pensioner, after sending documents drawn up by “lawyers”, receives a refusal from the Pension Fund with reference to the fact that

- the recalculations due for valorization have already been made,

- and the experience was taken into account in 2010

- or upon retirement.

Important! There is no point in complaining about such “lawyers”, since they have done the work of drawing up the application. And they are not responsible for the results.

When you go to the desired section, the phone number will be displayed, as well as links to

- online reception,

- official groups on social networks.

In this case, you can be sure that you are communicating with real Pension Fund specialists.

Not all immigrants from the USSR know who is entitled to an additional payment to their pension for Soviet service in 2020, and how much they can count on when making a recalculation based on this parameter. To clarify such an important issue, consultants from the Pension Fund have put together all the main options for bonuses that citizens of the Russian Federation can rely on for their accumulated experience.

Conclusion

Whether there will be an increase in pensions for Soviet service depends on its duration, the level of wages and the presence of “non-insurance” periods. First of all, mothers with many children and those who had a low salary in Soviet times can count on a profitable recalculation. In order to obtain the most complete information on their situation, it is best for a pensioner to contact the Pension Fund branch at their place of residence.

Read also

30.06.2018 26.12.2018 24.12.2018 29.08.2018 17.08.2018 20.07.2018

Who is entitled to an increase in benefits for Soviet experience?

Due to the fact that domestic legislation regarding pension provision for citizens changes regularly, it can be difficult for ordinary people to navigate the constant innovations. But, regardless of what scenarios the government comes up with, the basic basis for calculating pension benefits remains the amount of wages and accumulated work experience.

The current pension legislation offers several ways to increase the amount of payments based on the collected officially worked years. But one of the most popular among those who are already on a well-deserved rest is recalculation based on the Soviet experience earned.

To receive such an addition to the main amount, you need to fit into certain limits.

The requirement is to earn the required length of service before the new legislation came into force in 2002. If a citizen successfully fits into such a framework, he can apply for valorization, which automatically means the opportunity to add as much as 10% to his pension capital.

When accumulating length of service up to 1991, the pensioner is additionally charged 1% for each year.

It turns out that those individuals who managed to accumulate an impressive number of working years during the heyday of the USSR can now count on the opportunity to significantly increase their own level of income through an increased pension.

This is important to know: The process of converting residential premises into non-residential premises, nuances, timing and cost

Are pension points accrued for Soviet service?

The system of calculation and payment of pensions existing in the Russian Federation is characterized by multiple changes. The latest of these is the introduction of a point system, or so-called individual coefficients (IPC). On the one hand, they simplify the process of calculating pensions, and on the other, they complicate it.

Attention! When retiring, the process of assigning a pension is currently complicated by the fact that it is necessary to provide evidence of work experience in writing. Such documents must include information not only about the duration of work, but also about the nature of the work that was performed, the amount of wages that were paid to the employee, and a number of other indicators.

In those days, all information was entered on paper, which tended not only to deteriorate, but also to get lost, so the transfer of existing pension rights of the Soviet and post-Soviet periods into individual coefficients is accompanied by many nuances.

Calculating the IPC for each pensioner requires dividing the working time of Soviet-era persons into the following periods:

- before 1991;

- until 2002;

- after 2002.

Other options for additional payments to Russian pensions

Using a slightly similar algorithm, indexing occurs based on the length of service coefficient. This rule only works for those who managed to accumulate significant official experience before 2002. Slightly different limits apply for both sexes:

- men are required to reach 25 years;

- women need to save for 20 years.

The collected period is valued at 0.55. But if someone manages to collect several years in addition to the standards, then each of them will provide for an increase in the coefficient by 0.01. It follows from this that the winner is the one who has managed to accumulate the maximum possible experience, having started working at a very young age.

The issue of lifetime supplements is taken into account separately. This rule has been in effect in the Russian Federation for a long time and implies the use of the opportunities of the so-called northern experience.

If a citizen managed to work for 15 years during his working activity in the territory of the Far North. In this situation, a person can count on 50% of the fixed-type payment.

According to the latest data, this amount equates to almost 2.8 thousand rubles.

How the calculation is done: step-by-step instructions

To convert work experience during the Soviet period into an individual pension coefficient, the following indicators are taken into account:

- duration of work in the period up to 2002;

- Duration of work until 1991:

- the average monthly salary for a certain period of time before 2002.

Taking into account the specified data, the calculation of the IPC for the Soviet period is carried out as follows.

Step 1. The number of IPCs is calculated taking into account the following data:

- as for women, if the duration of work is less than 20 years, a coefficient of 0.55 is applied, if the work experience is more than 20 years, then the coefficient of 0.55 is multiplied by 0.1 (for each additional year of work above the norm provided by law);

- As for men, if the duration of work is less than 25 years, the same coefficient is applied - 0.55; if the work experience is more than 25 years, then 0.55 is multiplied by 0.1 for each additional year of work above the norm provided by law.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

However, ultimately the coefficient may not exceed 0.75. If it is higher, then 0.75 is taken as the basis.

Step 2.

The ratio of the average monthly salary of a pensioner for a certain period of Soviet times and the level of average monthly salary for the same period in the Russian Federation is calculated.

The calculation is carried out according to the formula:

A=B/C, where:

- A – coefficient of average monthly earnings; B – the amount of remuneration received by a citizen for work; C is an indicator of the average monthly salary in the Russian Federation for a certain time period.

In this case, the maximum value of this ratio should not exceed 1.2. This requirement does not apply to residents living in the Far North and equivalent areas.

The benefits of longevity that open up opportunities in 2020

To receive a lifetime supplement, it is absolutely not necessary to work in the Far North. An identical principle is used to calculate those who worked on an official basis in regions that are equated to the Far North. Such workers are entitled to a 30% bonus if their output represents 20 years in total.

The “northern” surcharge remains with the pensioner even if, after completing his working career, he decides to move to another region.

Expert opinion

Davydov Alexander Yurievich

Civil law consultant with 20 years of practice. Author of numerous articles on legal topics

To be eligible to receive such a privilege, you must have a total work experience, which for women is 20 years and for men – 25.

Some regions have their own bonuses for a number of their pensioners. There is no exact information here, since each region has its own requirements and nuances, because similar incentives are not even offered throughout the state.

As an example, consultants cite St. Petersburg. Here, length of service is taken into account, subject to 20 years of official experience.

Let us remind you that it was previously reported how much the salary in the Russian Guard will be raised from October 1, 2020.

The majority of modern pensioners are people whose work experience began to be calculated back in the Soviet period. Therefore, many pensioners are wondering whether the pension for Soviet work experience will be recalculated in 2020.

Pension Fund of the Russian Federation increasing pensions for Soviet service in 2020

The duration of official employment affects the possibility of receiving a bonus in the following cases:

- the citizen continues to work after entering a well-deserved retirement;

- deferred retirement (for each year an increasing coefficient is applied to the fixed payment and the insurance part);

- there is unaccounted experience due to the lack of supporting documents;

- The number of years worked allows you to receive the title “Veteran of Labor”.

It is important to distinguish between the concepts of labor and insurance experience. The first is applied when assessing the pension rights of an applicant who was listed as employed before January 1, 2002. The length of work experience affects the calculated amount of the pension, which is subsequently converted into pension points using a special formula.

After January 1, 2002, the amount of the pension is affected by the amount of insurance contributions paid by the employer.

It occurs on an individual basis, so the future amount of accruals depends solely on your past work experience.

There is also no need to carry it out, that is, you do not need to write any statements. It will be done automatically for everyone. For a clear example, let’s look at what all these terms mean:

- Valorization is an automatic increase in pension payments that applies to absolutely all pensioners.

- Recalculation is the operation of making changes in the calculation of payments for certain reasons.

- Indexation is the assignment of an increase to pension payments for certain retired citizens.

It should be noted that terms such as valorization, indexation and recalculation have completely different meanings and have nothing in common in their work.

Important! However, one thing

To calculate this, let’s take the average size of the old-age insurance pension. The official website of the Pension Fund reports that this year the average amount is 14,151 rubles. Translated into points, this is 112,506 pension points.

We multiply them by 87.24 (this is the new value of the point) and add a fixed payment of 5334. The resulting amount is 15,149. The increase amounted to almost a thousand rubles. For all subsequent years, the increase in the pension after the January indexation will also be within one thousand rubles.

Therefore, the increase will only be 775, and not a thousand rubles.

The President of Russia, when introducing amendments to the law on pensions, paid special attention to this. Pensioners should be aware that in Russia there is a constant revaluation of the value of pension rights that were earned by pensioners before the reform of pensions in 2002.

After this reform, pensioners began to be awarded points.

There are a large number of pensioners in Russia who have extensive work experience. For some pensioners it is half a century. These are people who gave most of their lives for the good and prosperity of the country.

It is for this category of people that, as part of the reform of the pension system, increased payments and additional benefits are provided.

https://www.youtube.com/watch?v=33u9GScMnK4

One of these benefits is retiring 2 years earlier.

And of course, their interest is understandable whether the length of service for this period will be taken into account when calculating pensions, in the context of reforming the pension system at the beginning of 2020.

There are a large number of pensioners in Russia who have extensive work experience.

For some pensioners it is half a century.

The pension for Soviet service is also calculated on the basis of information about wages. But not only the time when a person worked and received wages, but also the so-called.

We are talking about “socially significant” activities, or periods when a person could not work due to circumstances beyond his control: Military or equivalent service. The period of caring for each child up to the age of 1.5 years (but not more than 6 years in total ).

The period of care for a disabled person of group 1, a disabled child or a person over 80 years old. The period of residence of spouses of military personnel or diplomats

The Ministry of Finance explains this by the fact that the incomes of working pensioners are already growing at a rapid pace due to rising wages (in particular, in 2020, the Government equalized the minimum wage with the subsistence level for the first time).

The reform of the pension system, which the Government plans to implement in the coming years, is aimed at ensuring sustainable growth of pensions above the inflation rate, as well as bringing its value to 40% of a citizen’s salary.

The Government is solving all these problems with the goal of creating a sustainable (self-sufficient) pension system that will exist without the need to attract additional funds from the federal budget to cover the deficit of the Russian Pension Fund (PFR). The following changes are expected in 2020:

rubles - as a result of indexation from January 1, 2020, pensions will increase on average by about a thousand rubles. However, it should be remembered that the increase in pension is individual for each pensioner, and its amount will depend on the size of the pension.

The procedure for indexing insurance pensions for working pensioners has remained unchanged: they will not receive indexation of their insurance pension and fixed payment to their insurance pension.

For information, we inform you that for subsequent years the Law* establishes the cost of one pension coefficient: - in 2020 - 93 rubles.

However, existing payments are not being made, because those who worked during Soviet times are already receiving accrued funds. The increase in pensions in the Russian Federation took place in 2010, when the authorities had the necessary funds for this process.

Valorization in the financial sector is the legal revaluation of securities or payments upward.

At that time, a different system for calculating pensions was in effect, in which Soviet experience was not taken into account, and only that which had been worked since 1991 was taken into account. At the time, it seemed more rational to the authorities. In 2010, for each year of Soviet service, 10% 1% was added to existing payments.

Soviet period compensation

When calculating the amount of the pension, compensation that the pensioner received while working before 1991 is not taken into account. However, the modern pension system provides additional payments for the time a woman spends caring for a child of up to 1.5 years.

For one child she is entitled to an additional 1.8 points (that is, for two - 3.6 points), and if there are three at once - 5.4 points. To prove your right to recalculate and receive additional points, it is enough to provide your children’s birth certificates to the pension fund (PFR).

Non-insurance periods and additional pension points

You can confirm non-insurance periods and recalculate due to additional pension points. In most cases, in practice, such periods are used as the period of caring for a disabled person (an elderly person or a person with disabilities of groups 1 and 2) and the time of caring for a child up to one and a half years old.

When the named periods were not taken into account when assigning pension benefits, or they were taken into account, but the smallest wage coefficient was used, then you can request recalculation not according to the coefficient, but according to pension points.

Proving time spent caring for a person with a disability is easy. To do this, you need an application from the disabled person himself (if the caregiver and ward lived in the same territory) or you need to draw up an examination report with the participation of a Pension Fund employee.

If a citizen has grounds for recalculating pension benefits, then the increase in the pension amount occurs from the 1st day of the month following the application to the Pension Fund.