What is valorization?

This concept is used when talking about increasing the price of things or any services.

If we are talking about pensions, then we mean recalculating the value of the monetary rights of pensioners acquired by them before the pension reform. In other words, valorization implies an increase in citizens’ pensions. This process should be distinguished from indexing and recalculation. Let's understand the concepts:

- Valorization is an increase in pensions that applies to absolutely all citizens.

- Pension indexation is an allowance for retired persons.

- Recalculation is making changes in accruals for certain reasons.

It is clear from the definitions that these processes have almost nothing in common and are only different mechanisms for increasing pension payments.

Why is it needed?

After the collapse of the USSR, the pension system was radically changed. At the same time, during the reform carried out in 2002, citizens, the bulk of whose work experience fell on the Soviet period, lost a significant part of their pension. This was due to the fact that after appropriate amendments were made to the legislation, the final amount of the pension began to be decisively influenced not by the total length of service, but by the amount of insurance contributions paid by the employer for the worker, as well as the amount of his salary. Taking these factors into account, pension capital is formed - the total amount on the basis of which the amount of payments due to the pensioner is calculated.

Since before the reform, as well as during the Soviet period, no deductions were made, to determine the estimated pension capital of citizens, the bulk of whose work occurred during this time, the length of service was transferred to pension capital on the basis of special formulas established by Article 30 of the Federal Law “On Labor Pensions.” The calculation of capital required determining the estimated size of the labor pension. To do this, the pensioner had two formulas to choose from:

- formula based on length of service;

- a formula based on the average salary of a pensioner.

However, such a transfer turned out to be biased and violated the interests of citizens, significantly reducing their pensions. The coefficients used in the formulas made the pension capital small. Valorization partially eliminates this violation by revaluing the amount of pension rights acquired before 2002, and, in essence, increasing the estimated pension capital.

What are the rules?

Valorization is carried out in relation to all pensioners who have work experience acquired before the Federal Law “On Labor Pensions” came into force. To do this, you do not need to visit the Pension Fund branch and write a statement about the procedure there - the department’s employees will do everything themselves.

“Non-insurance” periods and recalculation of pensions for Soviet service

In Art. 12 of Law No. 400-FZ lists the periods that are counted towards the insurance period despite the fact that they are not related to work activity. We are talking about “socially significant” activities, or about periods when a person could not work due to circumstances beyond his control:

- Military or equivalent service.

- The period of care for each child up to the age of 1.5 years (but not more than 6 years in total).

- The period of care for a disabled person of group 1, a disabled child or a person over 80 years old.

- The period of residence of spouses of military personnel or diplomats together with their spouses at the place of service (work), but not more than five years.

- The period of suspension from work of persons unjustifiably brought to criminal liability.

| Child | First | Second | Third | Fourth |

| Points for each year of care up to age 1.5 years | 1,8 | 3,6 | 5,4 | 5,4 |

The law does not provide for calculations for a larger number of children, because In total, no more than 6 years of child care can be used to earn points.

It is the accounting of “non-insurance” periods that can make it possible for pensioners to receive additional payment for Soviet service. Next, we will consider who can count on recalculation of pensions for Soviet work experience.

Why was there a need for valorization?

Until 2002, the calculation of the amount of pension capital was based on the following indicators:

- At the choice of the citizen, the amount of wages for any 5 years.

- Full work experience.

In 2002, it was decided to include employer contributions in this list. The system operated in this form until 2014, when innovations appeared in it in the form of IPC - accumulated points during operation.

An analysis of the savings system showed that until 2002 there were no insurance contributions, and therefore the pensions of older citizens suffered greatly in size.

In order to equalize the rights of pensioners who received pensions in Soviet times with those currently in effect, the Russian government adopted a resolution to increase the amount of payments.

Corresponding changes were made to the Federal Law on Pensions to carry out mass valorization, which began to be carried out on 01/01/10, and the capital of future and current pensioners began to grow.

A significant increase was felt by those who had a long work history before 2002. For citizens who retired in the period 2010-2014, valorization went unnoticed, since the increase was automatically included in the amount of payments when accrued.

In 2020 Significant changes were made to the legislation, many innovations appeared, but not a word was said about valorization. The law no longer applies, but the provision by which the amount of the insurance portion is determined remains in force.

All pensioners, starting from 2020, who were officially employed and had some length of service before 2002, retained their right to increase their pension capital.

Other options for additional payments to Russian pensions

Using a slightly similar algorithm, indexing occurs based on the length of service coefficient. This rule only works for those who managed to accumulate significant official experience before 2002. Slightly different limits apply for both sexes:

- men are required to reach 25 years;

- women need to save for 20 years.

The collected period is valued at 0.55. But if someone manages to collect several years in addition to the standards, then each of them will provide for an increase in the coefficient by 0.01. It follows from this that the winner is the one who has managed to accumulate the maximum possible experience, having started working at a very young age.

The issue of lifetime supplements is taken into account separately. This rule has been in effect in the Russian Federation for a long time and implies the use of the opportunities of the so-called northern experience.

If a citizen managed to work for 15 years during his working activity in the territory of the Far North. In this situation, a person can count on 50% of the fixed-type payment.

According to the latest data, this amount equates to almost 2.8 thousand rubles.

On the meaning of the concepts of indexation, valorization, recalculation

All three concepts operate in parallel in the pension legislation system, because they have completely different meanings. Their only similarity is that they are used to increase pension benefits. Their differences lie in the accrual mechanism and their legal basis.

- Indexing is the procedure for changing the index of a value. In this way, the decrease in the purchasing power of pensioners is compensated for by the inflation rate. The indexation percentage is set by the government and brings the size of the pension to the level of the consumer basket. As a result of its implementation, payments to pensioners should, at a minimum, reach the level of the consumer basket. For some categories of pensioners, indexation is carried out in the form of an increase in monetary remuneration - for astronauts and civil servants.

- Valorization - an increase in the size of the pension, which was lowered in Soviet times, is carried out for citizens with any length of service until 2002. The increase is carried out without the presence of citizens. The amount of the bonus depends on the length of service earned before 1991 and the regional coefficient, if any.

- Recalculation is carried out if circumstances have changed that influenced the amount of the pension. It is necessary to provide documents that confirm the changes. For example, recalculation regularly occurs for working pensioners, since as their length of service increases, the number of employer contributions to the insurance part of their pension increases.

Valorization

The size of the increase in pension depends on the length of service earned before 1991. The point of valorization is to equalize the pensions of people who worked in the USSR. Affects citizens employed before the start of the pension reform in 2002. The process occurs automatically; citizen participation is not required.

Indexing

Indexation is carried out automatically for pensioners to increase purchasing power during inflation. Indexation depends on price increases ; the government independently determines the coefficient. Pensions of federal civil servants and astronauts are indexed as monetary remuneration increases.

Recalculation

If circumstances affecting pension payments change, recalculation occurs. If the pension authority has all the documents confirming the citizen’s rights to a pension, the recalculation will occur automatically . According to Article No. 142 of the Federal Law, recalculation occurs on August 1. Additional paperwork is required if:

- the pensioner has reached 80 years of age;

- a higher disability group has been established;

- the number of dependents has increased;

- The pension authority mistakenly did not take into account the pensioner’s length of service.

Are studies and child care taken into account in the work experience during valorization?

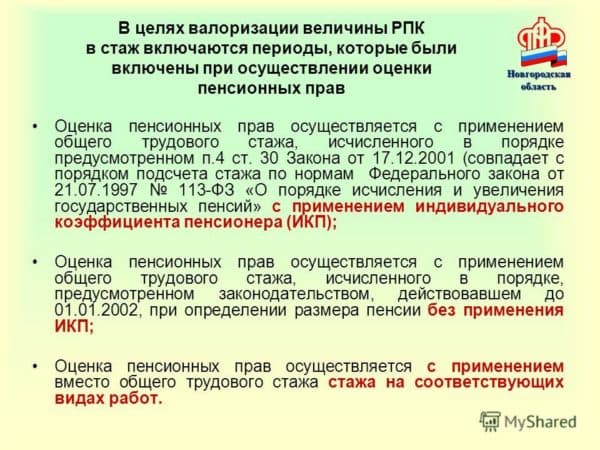

For the category of citizens under consideration (for recipients of pensions under special Lists 1 and 2), there are 2 different options for the procedure for assessing their existing pension rights, namely:

- calculation is made from the total length of service (labor);

- Special experience is taken as a basis.

When indexing, the valuation option can be replaced with a more profitable one. Ultimately, the calculation of the insurance component (initial) itself will change.

To complete the process, you do not need to submit any applications or documents; it is performed automatically for each pensioner individually, as well as for those who plan to retire soon.

The personal presence of a pensioner at the Pension Fund is required only if the Fund does not have the necessary documents to carry out the recalculation. In this case, the pensioner must present all documents about his work experience.

Basic rules and valorization rights

The main rule of valorization is automatic recalculation based on the citizen’s official work experience before 2002 The pension authority has information on the amount of pension contributions as of January 1, 2020.

Rules for valorization of pensions

If a citizen worked unofficially, but can confirm this with other documents, he must send them to the pension authority for review.

Citizens officially employed in the Far North receive an increased valorization coefficient. It ranges from 1.4 to 1.9%, varies from region to region and leads to higher pension payments.

Revaluation of the pensions of “Chernobyl victims”

Only entities receiving pensions in accordance with the previously mentioned Federal Law will be subject to valorization. Military pensions are regulated by a different law. However, if a serviceman was also engaged in labor activity, so to speak, in civilian life for more than 5 years and thereby acquired the right to a 2nd pension (the insurance component of a labor pension), then valorization is guaranteed to him.

As has been said many times before, all labor pensions, without exception, are subject to valorization. Persons who took part in the process of eliminating the negative consequences of the Chernobyl disaster receive, in addition to the labor pension, a state pension. This category of citizens also has length of service up to 01/01/2002, which is subject to reassessment.

Finally, it is worth recalling once again that the valorization of labor pensions is the indexation of pension capital accumulated by Russian citizens in Soviet and post-Soviet times.

Basic terms of valorization

Calculating valorization is not difficult if you understand the basic terms:

- The work experience coefficient means the period of official employment until 2002. If the work experience is 25 years, the coefficient is 0.55. For 1 year, 1% is accrued, but not more than 75%. Interest rates are reduced if the work experience is less than 25 years.

- Conversion - recalculation of length of service into cash equivalent for citizens working before 2002.

- Pension rights - data on wages and insurance accruals that determine the insurance part of payments.

- Estimated capital is the amount of pension contributions for 2002. All officially employed citizens who have received a pension certificate have an estimated capital. When a citizen begins to receive a pension, the capital becomes the insurance part of the payments.

Calculation of pensions taking into account valorization

What pension is indexed?

And citizens who are already receiving it, and pensioners in the future. Those for whom it had already been issued before the law on the valorization of pensions came into force were immediately indexed in the same year (2010).

The remaining citizens who reached the established retirement age (retired) in the period from 2010 to 2014 did not actually feel the revaluation, since it was carried out at the same time as the procedure for registering their cash benefits for old age or disability.

More on the topic Indexation of pensions in 2020 for non-working pensioners and will there be an increase for working people: how much will it be increased and when?

How is accrual carried out?

Standard pension valorization is a procedure that takes into account all existing work experience accumulated by the pensioner before 2002.

When implementing the valorization procedure, a number of factors are taken into account:

- the total amount of available pension “capital” before the reform period;

- total length of service up to the established period;

- “Soviet” work experience until 1991;

- total amount of points awarded until 2002.

In this case, a special revaluation system is used, in which the total estimated capital, which was accumulated in detail before January 1, 2002, is established - it increases by every 10% + 1% for each full year of operation before January 1, 1991. This system provides for an individual accrual system for each pensioner.

For citizens who are entitled to a pension, pension valorization will be a mandatory procedure - there will be no need to write an additional application for a detailed recalculation. The entire system of recalculations is carried out automatically - the personal presence of the pensioner is not required, a visit to the pension fund will be required only if the citizen has questions about recording certain data on work experience.

Valorization of pensions in 2020 provides for an increase in pension contributions, which varies from 700 to 1,700 rubles. — the amount of accruals will depend on the established retirement dates. A higher premium is provided for those citizens who have a longer work experience.

What factors are taken into account in the process?

In a situation where the pension capital was established without taking into account the time spent on training due to the fact that this was considered the most profitable option for converting this type of rights - according to Federal Law No. 173, taking into account the total length of service, the time period in question will not be included in the calculation of valorization. If there was another Federal Law (340), then the years of study will be taken into account when revaluing.

As mentioned earlier, recalculation is made relative to the insurance period. As for studying at a party school, in the case where it took place separately from a specific production and, moreover, did not act as an insurance period, this period will not be included in the calculation (subject to the calculation of the pension according to the option that assumes the presence of an individual coefficient).

And if it is beneficial for the subject to calculate the pension using a different option (according to Federal Law No. 340), then all periods will already be taken into account, including studying both at the party school and at other universities, as well as non-insurance periods. However, there is a limitation - the maximum pension amount. In this regard, this time period may be included in the calculation of valorization (most often this is not very profitable). That is why PFR specialists always check the feasibility of the calculation option for the payment in question.

More on the topic Tinkoff terms for installment cards

The situation is similar with the childcare period. During the course of valorization, the relevant bodies of the Pension Fund checked the possibility of the subject’s transition to a more beneficial pension provision for it. For example, in a number of cases it was more expedient to calculate pension capital based on the total length of service, rather than on special service, because the revaluation amount was higher.

It is important to note that experience gained in previously existing Soviet republics will also be included. Based on the Agreement of the CIS countries (1992), its member state assigns a pension strictly according to the norms of existing legislation to a person who arrived from the above countries for permanent residence. In our country, these pensioners are assessed for the rights in question received before 01/01/2002, and the time they worked in other countries is counted as length of service when calculating the Russian pension.

Until 2002, there was a pension system in the Russian Federation that calculated old-age benefits based on the following indicators:

- wages for any officially worked 5 years (the citizen had the right to set the period at his own discretion);

- total length of service.

The innovations introduced in 2002 assumed that insurance contributions from the employer would be added to the above points, through which personal pension capital would be formed. Upon reaching retirement age, funds from this capital are added monthly to the benefit received.

Since pensioners who retired earlier did not have such an account, the size of their pensions differed significantly from payments to citizens who retired later. In this regard, a bill on mass valorization was adopted, equalizing the rights of older citizens.

Until 2002, only two factors were taken into account when calculating a pension: the average salary for a certain period of employment and the total duration of work. Now the amount of payments depends on actual insurance deductions. Therefore, in order for all pensioners to have equal rights, a decision was made to increase pensions.

The following factors are taken into account:

- Experience until 1991 (years of work in the Soviet Union)

- Experience until 2002

- PC size before 2002

- Sum of points after 2002.

After the 2002 reform, insurance premiums and additional points appeared in pension calculations, and it was also noticed that the accruals for older citizens were losing in size. Due to the increase in the number of payment points, payments to younger pensioners increased slightly, but noticeably - from 700 to 1,700 rubles.

Transfer “The Principle of Law”. Broadcast 05/02/2010.

Noticed a mistake? Select it and press Ctrl Enter to let us know.

Jul 2, 2019Content Manager

You can ask any question below

About the rules of valorization

The calculation of pension capital is carried out by Pension Fund employees, but every citizen can do this independently and roughly imagine whether it is possible to hope for anything at all in terms of increasing payments.

All data on the estimated capital of citizens as of 01/01/02. are in the PF database.

Everyone who worked in the USSR has a certain number of years of experience before 2002. From 01/01/10. this capital is multiplied by 10% one-time, then another 1% for each full year after 1991.

The national average increase in capital in pension accounts was 1,430 rubles. per month.

In each case, it is individual and depends on the age and time of retirement:

Retirement (year)Additional payment (RUB)

| 2002 | 1008 |

| 2004 | 872 |

| 2004 | 872 |

| 2005 | 938 |

| 2006 | 846 |

| 2007 | 903 |

| 2008 | 755 |

| 2009 | 743 |

| 2010 | 498 |

| Age | Additional payment (in rubles) |

| up to 50 | 210 |

| 50-60 | 739 |

| 61-70 | 1314 |

| 71-80 | 1649 |

| 81-90 | 1733 |

Increased pensions are subject to all indexations carried out throughout the year. To recalculate the amount of pension provision, you must submit an application from the Pension Fund.

If new circumstances have arisen, new documentary evidence has appeared about the existing experience for previous years, which were not taken into account at the time when assigning pension payments. In other cases, valorization is performed automatically.

Concepts used in recalculation:

- Conversion - transformation, transfer of pension rights into capital for those who were employed before 2002.

- The work experience coefficient is the entire time period of work until 2002. It is calculated from 0.55 with 25 years of experience, to 0.75 with more work experience. For 1 additional year of work, 1% is added, but not more than 75% in total. If the experience is less than 25 years, then the percentage decreases proportionally.

Example of pension calculation

To better understand the principle of calculation, we can take a real problem as an example:

Ivan Ivanovich, who had a total work experience of 42 years as of January 1, 2002, including 40 years of experience before 1991. Ivan Ivanovich’s salary exceeds the average salary in the country for the same period by 1.2. How much will the pension of this citizen increase?

Calculation:

- Year of birth: 1931

- Year of first pension assignment: 1991

- Work experience – 42 years, including 40 years of employment in the Soviet Union

- Experience after 2002 – did not work

- The ratio of a man’s average earnings to the national average salary is 1.2

- Insurance pension at the end of 2002 – 3655.37 rubles

- The basic pension on the same day is 2562 rubles.

- Insurance pension at the beginning of 2010: 5483.06 + 2562 = 8045.06 rubles.

- Experience coefficient on the first day of 2002: 0.55 + 0.17 = 0.72

- Estimated pension amount: 0.72 × 1.2 × 1671 = 1443.74 rubles

- PC on the first day of 2002: (1443.74 - 450) × 144 + 143098.56 rubles

- The citizen’s pension will increase by (143098.56 × 0.5 × 3.6784): 144 = 1827.69 rubles

When valorizing, the Pension Fund takes into account the following conditions:

- Year of birth of the citizen.

- Insurance period:

- until 01.01.02.

- until 01/01/91.

- after 01/01/02.

- The ratio of wages in different periods.

- Year of granting the old-age pension.

- Average salary in the country after 01/01/02.

The formula for valorization is:

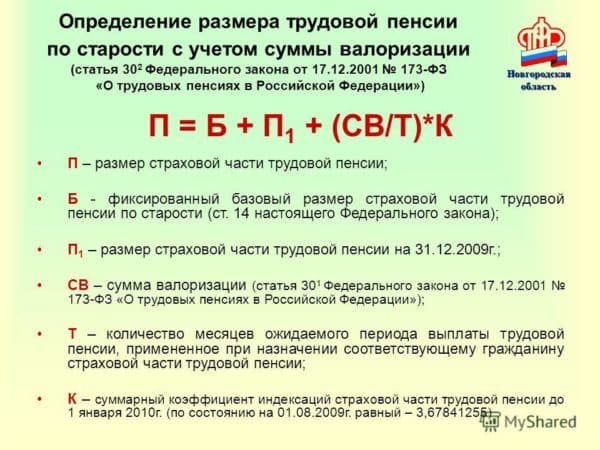

PC = (RP - warhead) x T

- PC – pension capital.

- RP – pension amount.

- BC - the basic part of the pension as of 01/01/02. (450 rubles)

- T – period of payment of old-age pension benefits.

Thus, the increase in pension capital is calculated by substituting individual values into the generally accepted formula, where only the size of the basic part of the pension payment as of 01/01/02 is the same for everyone.

Pension capital

In order to fully understand the issue of pension supplements for Soviet service, it is necessary to understand what pension capital is and how it is taken into account when calculating the supplement.

Expert opinion

Davydov Alexander Yurievich

Civil law consultant with 20 years of practice. Author of numerous articles on legal topics

First of all, pension capital is discussed in Article 30 of Federal Law No. 173. This law presupposes a certain formula for calculating pension capital. How does she look? What does it consist of?

- Coefficient for experience;

- Salary ratio;

- Payment period;

This is important to know: 353 Federal Law “On Consumer Credit and Loans” as amended in 2020

PC = ((SK X ZR / ZP X SZP) – 450 rub.) X T

- PC – pension capital

- SC - coefficient for length of service

- ZR – Average monthly salary

- ZP – Average salary in Russia for the same period of time.

- SWP is the average monthly salary, which is approved by the Government of the Russian Federation. Amounts to 1671 rubles as of January 1, 2002.

- 450 rubles is the basic part of the old-age labor pension established by the Russian Federation on January 1, 2002.

- T is the expected payment period for the old-age labor pension. As a rule, it is equal to the same period that will be applied for the actual payment of the labor pension.

It is worth noting that you will not be able to independently calculate the amount of your bonus for Soviet experience. For example, a pair of pensioners who have similar work experience during the Soviet period, but their salaries were different, will receive a different bonus for Soviet experience.

To more accurately calculate the increase in pension for work in the USSR, you must contact the nearest branch of the Pension Fund of the Russian Federation, where they will raise the pension case and carry out all the necessary recalculations.

Is there an additional payment to the pension for Soviet service? “You are entitled to an increase in your pension!” “The additional payment will amount to tens of thousands of rubles!” “The Pension Fund is silent about this.” Having seen similar headlines on the Internet, many pensioners click on the link. And they are surprised to read that the Pension Fund, it turns out, greatly underpays them.

Is it possible to independently calculate the number of pension accruals?

Currently, there is an automatic system for calculating all existing pension payments, but it is possible to make all the calculations yourself. To do this, it is necessary to fully calculate the established amount of the total pension capital existing before 2002. Next, it is important to correctly calculate the total amount of all pension savings before 1991. The total amount of capital is multiplied by the percentage value obtained as a result of the system calculation. With automatic calculation, all funds received are calculated taking into account the valorization system.

Features of the pension system of valorization

The valorization procedure differs significantly from indexation and existing recalculations of pension accruals. The main difference lies in the recalculation system - for example, indexation is designed to compensate for the general decrease in purchasing power as a result of inflation, and the valorization procedure implies significant changes in “pension rights”.

Valorization of pension rights is the existing monetary revaluation of pension accruals for citizens whose total work experience falls on the period before 2002. All pension capital acquired before this year is indexed by 10%, with an additional 1% added for each year of existing service until 1991.

The longer the “Soviet” service, the greater the percentage of accruals will be made towards retirement. In 2020, an accrual is provided that does not exceed the amount of 1,700 rubles. The valorization of pensions is intended to protect the rights of pensioners who have accumulated work experience before the pension reform.

Shortcomings of the pension calculation system in 2002 and ways to correct them

Due to the changes that occurred in the above-mentioned period of time, citizens who worked and received work experience before December 31, 2001, actually did not have the required insurance premiums. In addition, it became obvious that even if the pension capital formed before 2002 was established in accordance with the old rules, the pension of the older generation would suffer significantly in quantity.

Amendments were made to Article 28 of the Federal Law. They began to be implemented on 01/01/2010. New articles also appeared, in particular 30.1 – 30.3.

The scheme of the changes made turned out to be quite simple: the pension capital that a citizen received before 01/01/2002 increases by 10% and another 1% for each year worked for the period before 01/01/1991, and in order for the pension to be valorized , it doesn’t matter how many years you worked before 2002. The only limitation is that you must work for at least 12 months.

It has already become clear how to calculate the valorization of a pension; now it is necessary to deal with the issue of capital, which is subject to revaluation.

Conclusion

Thus, valorization is a mechanism for increasing pension savings for certain categories of citizens. It applies to citizens who have work experience before the beginning of 2002. This measure allows citizens to compensate for their losses in the amount of pension accruals that are associated with the 2002 reform, when there was a transition to an insurance pension model.

Sources

- https://posobie.help/pensiya/valorizatsiya-pensii.html

- https://npfrate.ru/pensia/valorizaciya.html

- https://opensii.info/novosti/valorizaciya/

- https://www.Consultant.ru/document/cons_doc_LAW_34443/e92c4aa357ea33c6be733ead20eb720aeba4ce1b/

- https://StrPls.ru/pensionnoe/obyazatelnoe/valorizaciya-pensii.html

- https://zen.yandex.ru/media/id/5a5eff9b8c8be3bc496540f8/5b49b0d73ff35400a714d116

- https://zakonguru.com/trudovoe/oplata/pensija/valorizatsiya.html