In the Pension Sustainability Index of 54 countries, which has been published by the German financial holding Allianz for several years, Australia's pension system constantly ranks first, outperforming other countries, including Scandinavian countries, in terms of sustainability indicators.

How is the Australian pension system different and why is it considered the most sustainable?

“NO” TO PATERNALISM – “YES” TO PERSONAL RESPONSIBILITY

In Australia, the state has actually placed responsibility for their pension future in the hands of citizens, actually reducing dependency sentiment among the population.

Let's figure out how a pension works in the homeland of the crocodile Dundee?

Australia's pension market is $1.6 trillion. Australian dollars. This is more than in Germany, Canada and France. And this is not state money, but private pension savings. 4th largest savings market.

The system rests on 3 pillars: a time-tested state pension, which is provided by taxes, accumulative private pension funds, as well as the voluntary investment activity of citizens themselves, who can unite and create their own mini-fund.

Features of the Australian pension system

There are a number of certain purely Australian aspects of receiving a pension that you need to know if you are going to receive a pension in this country.

So, there is a rule in the Australian pension system that means that the more income a person has, the less his state pension will be.

It is important to know! In Australia, private pensions are also included in the income list.

Thus, a married couple can expect to receive a full pension if their joint income is less than 230 Australian dollars, and a single pensioner will receive full pension payments with an income of less than 130 Australian dollars.

Attention! A pensioner risks depriving himself of government benefits while having additional income.

That is why in Australia, people of retirement age try to regulate their income and keep it below the threshold set by the state.

If we talk about the most profitable type of accumulation of pension funds, then today private pension funds , which the state responsibly controls, are in demand. Payers will have access to the money upon reaching retirement age.

Pension in Australia - how much do they pay?

The average payment for a single citizen after retirement is $500 monthly. An elderly couple is entitled to an average amount of $900. The pension is subject to changes from year to year due to fluctuations in the economy and changes in the external political environment.

The size of payments is reduced when owning large private property, up to the deprivation of a pension. If, according to the authorities, a citizen owns real estate for a large amount, then he is able to live on personal savings and does not need support from the state.

For this reason, wealthy Australian citizens are trying to reduce their average income to the normal level, as they value special preferential opportunities for pensioners on the continent. In this case, after reaching retirement age, they receive minimum payments and retain benefits.

Be sure to read it! Corporate pension: what is it, where is it paid?

STATE PENSION

It is financed by the state budget and paid to an Australian citizen or a person from another country who has reached the age of 65 years.

To receive a pension from the state, citizens must reside in Australia for more than 10 years.

The length of service and place of work do not matter - pensions are paid even to those who have never worked in their lives.

The size of the payment depends on marital status, the number of dependent children, the amount of annual income and the availability of property.

The maximum amount is A$1,590 per month for a single pensioner and $1,200 for those who are married.

In addition, you must:

- have no more than 50 thousand Australian dollars in your personal bank account;

- have a land area of no more than 2 hectares.

- the value of all property must be less than 160 thousand Australian dollars.

Old age pension

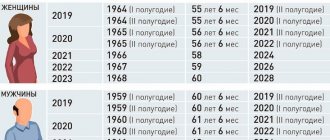

The retirement age in Australia is: - for women: 64 years - for men: 65 years. Not only age is considered a condition for paying a pension, but there are also additional conditions related to the financial difficulties of an Australian resident.

Retirement age in Australia

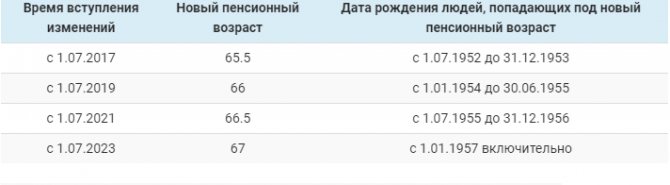

However, this idea was abandoned in 2017. Nevertheless, a law was passed according to which the age limit for retirement will be raised to 67 years by mid-2023. The provisions of this regulation apply only to people born after July 1952.

More detailed information is presented in the table:

But in Australia there are also opponents of such half-measures. They said that the decision to abandon retirement at age 70 would cost the state budget AUD 5 billion.

In the third quarter of 2020, life expectancy on the Green Continent is 84 years. According to forecasts, every fifth resident of the country will be over 65 years of age by 2045, which will lead to a manifold increase in the volume of pension payments.

PRIVATE OR ACCUMULATIVE PENSION (Superannuation)

It is formed independently through the employer’s contributions of 9% of the employee’s monthly official income to a private pension fund.

But provided that the employee works more than 30 hours a week.

We choose the pension fund ourselves, and this is not an easy task, because there are a huge number of them in Australia. Each fund sets its own conditions for the size of the entrance fee and commissions that are charged for servicing the pension account.

In a private pension fund, investors choose between 2 options: leave the transferred funds for safekeeping at a fixed interest rate or invest in shares of Australian or foreign companies and real estate.

Money from a private fund can be withdrawn after age 60, and if the investor has health problems or financial difficulties, then the pension can be withdrawn at age 55.

Savings in a private fund are not subject to income tax.

After 60 years, the saver decides what to do with the money - make a large property purchase or add it to the state pension.

Other types of pensions and benefits

In Australia you can get a pension that is not age related. Parents can count on state help. The government redistributes the amounts collected from taxes, trying to help everyone who is raising a child.

A woman who divorces and is left with small children in her arms will not vegetate in poverty. The state will support her financially, paying about $16,500 per year. Mom is also entitled to the benefits that pensioners have. A small child is considered to be one who has not yet reached the age of 8.

In addition to money and benefits, single parents have the opportunity to obtain public housing. Although you will have to pay rent, it is minimal. This is very often used by divorced women to reduce their expenses.

The pension received for children is also calculated individually depending on the income the mother has. The minimum amount for the year is $5,179, and the maximum is $47,330.

Not only single parents can count on state help when raising children. A pension is provided for children and married couples if they have a small income. Getting this help is not so easy: a number of conditions and requirements have been developed that applicants for receiving benefits must fulfill.

Citizens who are unemployed and do not receive pensions can count on unemployment benefits. Even those who have not yet lived in the country for 10 years can count on it. Often those who have just arrived in the country or people who are not yet entitled to an old-age pension apply for it.

“SELF PENSION FUND” (Self-managed Super Fund)

Australia has a unique opportunity - companies and citizens can open their own pension fund.

The state, by the way, encourages this initiative in every possible way and provides businessmen who have opened their own pension fund with a 2-fold reduction in taxes on the profits of their main business to 15%.

To open your own pension fund, you need:

- find 2-4 individuals under 75 years of age or legal entities;

- conclude a Trust Deed with a notary;

- contact the bank to open an account;

- register the fund with the Australian Business Register and the Australian Taxation Office

- Once a year, such funds provide a report to the Australian Taxation Office and an audit report that monitors investment activities.

Pension in Canada for immigrants: how much they get and how to apply

In quantitative terms, it is most convenient to compare pensions by estimating their average size: in Russia it is equal to 100 dollars; in Belarus – 75, in Ukraine – 52; in Georgia – 40. In Russia, Belarus, Kazakhstan and Ukraine, the pension system is similar, and much remains of the Soviet one. In Russia, the concept of “minimum pension” is not officially defined and is used only at the household level. And the size of the pension itself is set annually on the basis of the regional subsistence level of a pensioner (PMP). It is different for each region of the country, therefore the size of pensions is different. PMP, in fact, is the very minimum pension amount.

The Canadian pension system has the following levels:

- Old Age Security - old age pension for all citizens;

- The Canada Pension Plan - payments under pension insurance, which a working person must form independently;

- RRSP – personal savings, pensions from firms or companies where the employee works.

The Canadian government encourages its citizens to go beyond just paying mandatory fees. Investment funds offer numerous retirement plans for Canadian citizens. Payments made to them are not subject to additional tax.

WHAT'S THE POINT?

By 2030, 25% of the population in Australia will be old. Therefore, the state is trying to make the pension system as efficient and interesting as possible for citizens in order to increase the involvement of the population, switching from a passive role to an active one.

To achieve this, the government did 2 things. On the one hand, it has sharply reduced the size of the state pension and will continue to do so. This is a whip. Gingerbread is an opportunity to become more actively involved in investment activity in the stock markets in order to learn how to make wealth and capital on your own.

Retirement age and pension amount in Canada

The length of residence in the country, as well as the amount of income, are taken into account when determining the amount of pension payments. A 100% pension is awarded to Canadians who have lived in the country for 40 years and paid a percentage of their income to a special fund. In addition to this amount, additional benefits, insurance pension payments and other old-age bonuses are accrued.

Pension contributions are strictly mandatory for all employed persons. The percentage of income is fixed. Since 2003, its size has been 4.96%. The same figure is relevant for the employer. If the taxpayer belongs to the “self-employed” category, the rate for him is doubled. Pension contributions are levied on income falling within the interval between the fixed minimum and maximum.

Private pensions depend on the organization/firm and vary in their terms. For example, the federal government has a private pension for all employees. Deductions for this from your salary run parallel to deductions for the national pension and, if you worked for the government for 35 years, you can retire at 55 and receive 60% of your best salary.

Upon reaching age 65, Canadians also receive an old age pension (Old Age Security). There are no payroll deductions for OAS and no work experience is required to receive the age pension - you must be a legal Canadian resident, have resided in Canada for a certain period of time and have an annual income of less than $33,072/year.

Of course, it’s much better to live in a rich place, where medicine is more accessible and there is more comfort. The standard of living, social standards, and the nature of pension provision are of decisive importance.

This privilege makes it possible to earn a substantial pension, the size of which will exceed the old-age pension by 31%.

Russia needs a few more decades of quiet years to carry out the planned transformations, including bringing the pension system to fruition.

The retirement age in Canada for women is 65 years. Taking earned leave may be slightly delayed, but not longer than 4 years 11 months, provided that the person legally has permanent residence within the country.

It doesn’t matter whether you have just started your professional journey or are already approaching retirement, understanding the principles of building retirement income will help lay the foundation for planning for the future.

Author of most articles on the site. I am a graduate of Moscow State Law Academy, one of the most prestigious law schools in the country. I have extensive experience working directly with a pension fund.

Investing outside of a registered retirement savings plan provides the most flexibility. These include stocks, bonds, mutual funds, investment properties, and so on. For many, investing in retirement plans can make it difficult to purchase the investments listed.

Benefits for pensioners

In addition to regular cash payments, pensioners in Australia are entitled to various benefits. The main ones are the issuance of special cards that make it possible to buy medicines and essential goods at significantly reduced prices. Preferential travel on all types of public transport and tax benefits for working and retired citizens.

Seniors in Australia are offered large discounts throughout the country - in shops, cafes and restaurants, hotels and inns. The pensioner is also entitled to a free intercity ticket within the country once a year.

As for utilities, certain categories of pensioners are also provided with discounts - on electricity, telephone, etc. However, the size of the discount depends on the city. In various states of Australia, retired citizens are additionally provided with various allowances and surcharges.

Pension payments for expats

A pension in Canada for immigrants can also be paid subject to official residence in the country for at least 10 years, as well as the annual submission to the pension fund of a certificate about the status of the pension account opened in the previous country of residence. To accrue pension payments, a citizen must write a corresponding application and provide the necessary package of documents to the pension fund.

Canada has entered into an agreement with 49 countries on the mutual exchange of contributions to pension funds. Therefore, there should not be any difficulties in obtaining the necessary documentation.

Given that the average life expectancy of Canadians is 82 years, the country may soon consider legislation to increase the retirement age in order to preserve the funded part of the budget.