Payment terms

There are some conditions that allow you to receive pension savings.

A person must be officially employed, and the funded part of the pension can only be received if the employer has made mandatory contributions to the pension fund. The employer is obliged to make payments to the Pension Fund to the account of men born in 1953 to 1966 and women born in 1957 to 1966. Payments were to be made from 2002 to 2004. If the employee was born in 1967 or later, then the employer is obliged to make payments until the employee resigns or retires.

Also, a condition for receiving the funded part of the pension is making voluntary transfers to the Pension Fund of the Russian Federation. These transfers are made thanks to the co-financing program.

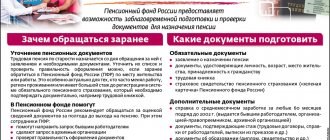

It should be noted that in order to receive the funded part, it must be completed. To do this, you need to submit the following documents to the PFRF:

- Identification;

- Statement;

- SNILS.

Pension Fund or Non-State Pension Fund: which is better?

When faced with a choice of how to use the funded part of their pension, citizens of the Russian Federation need to decide which direction is their priority.

If you refuse to transfer pension savings to a non-state pension fund or management company, the amount of social contributions depends entirely on the state of the country’s economy and the size of its budget. The state guarantees annual indexation of insurance payments taking into account rising inflation and adjustment factors. The funded pension, the procedure for its formation and payment in this case are not taken into account.

The level of coefficients that adjust the final amount of insurance contributions will be significantly lower for the state than for private companies, since their indexation is related to the state of the company in the insurance market. That is, Russian citizens have a choice: remain in the Pension Fund and are guaranteed to receive insurance payments upon reaching a certain age, or transfer savings contributions to a private company, where they will be additionally indexed.

If the company's activities over the last year have been successful, the amount of trade payments for the funded pension may be higher than the insurance part offered by the state. However, there is a risk of lost profit: if the NPF or management company conducted a loss-making campaign, no additional payment to the funded pension will be made.

What is the funded part of pension provision?

It also includes funds from maternity capital, which, by decision of the mother, was directed to the formation of her funded pension.

These amounts should be increased through investments by the fund manager, and subsequently increase the size of the pension. It is formed only upon receipt of funds by the Pension Fund.

Currently, pension insurance transferred by the employer is 22%, of which for certain categories of citizens the funded part is 6%. But currently, until 2020, all 22% of deductions go to the insurance portion.

A citizen can independently form the funded part of his pension by transferring certain amounts of money to it.

There is also a pension co-financing program, that is, the employee contributes 1,000 rubles to his pension each month, and the state also added 1,000 rubles to this amount.

Who is entitled to low frequency

The legislation determines that the funded part appears:

- For persons born in 1967 and later.

- Persons who are participants in the pension co-financing program.

- Mothers who received the right to use maternity capital and used it to form their pension.

Persons born before 1967 can also have a funded part of their pension, provided that they independently (or the employer does it for them) additionally transfer to the funded part of their pension on a voluntary basis.

How is a funded pension formed?

About twenty years ago, the pension was divided into two parts - insurance and funded. If earlier deductions from salaries went towards monthly payments to pensioners, then after 2002 part of the funds began to accumulate in the personal pension accounts of working citizens. From each salary, our employer contributes 16% to the insurance part of the pension (it is from this money that payments are made to current pensioners) and 6% to the funded one. Contributions to the funded pension remain in the individual pension account. It will be paid “in old age” along with an insurance pension, which will be paid for by working citizens.

The funded pension appeared not so long ago, in 2002. And in 2014, a moratorium was declared on its replenishment through employer contributions: now they are used to pay the insurance pension. The moratorium will be in effect until 2021 inclusive.

To check how much you have already managed to accumulate, you can request information on the state of your individual personal account () on the State Services portal.

Terms of payment in 2020

Due to the economic crisis in 2020, a decision was made to freeze the funded part, which was extended in 2020 until 2020.

However, pensioners can receive this part of the pension subject to the following rules:

- A person has a disability group and is retiring.

- The person is the recipient of a survivor's pension.

- The established amount of pension upon retirement for a pensioner is less than the established minimum subsistence level.

Conditions for assigning a funded pension

In accordance with Federal Law No. 424 “On funded pensions”, persons insured in the compulsory pension insurance system who have previously chosen a funded pension are entitled to this type of security. In connection with this choice, a certain amount of savings was formed in their account. As a rule, these are citizens born in 1967 and later.

- For persons born in 1966 and earlier, insurance premiums are used only for the formation of insurance coverage . But men born between 1953 and 1966 and women born between 1957 and 1966. have savings in their personal accounts, since from 2002 to 2005 employers paid insurance contributions for a funded pension.

- There is also a program of state co-financing of pension savings. Under this program, citizens can form a funded pension through voluntary contributions .

- Women can use maternity capital for their future pension.

Citizens who have reached retirement age without taking into account the increase carried out since 2020 have the right to payment of this security. In our country, the retirement age for a funded pension for women is 55 years, for men - 60 years. Just like the old-age insurance pension, the funded pension can be assigned ahead of schedule in accordance with Art. 30 and art. 32 Federal Law No. 400 “On insurance pensions”.

Classification of payments of the funded part:

There are the following types of payments of the funded part.

One-time

But this payment is not available to all categories of retired persons. The main condition for receiving it is reaching retirement age. Currently it is 60.5 years for men and 55.5 years for women.

Also, to receive the full amount on a one-time basis, it is required that the applicant:

- There were no pension points required to receive a pension.

- A person who was a recipient of survivor benefits or has a disability group established.

- The size of the funded part is less than 5% of the insurance pension.

- If the owner of the savings portion has died, then these funds can be received at a time by his heirs, who must enter into the inheritance within 6 months from the date of death.

If a pensioner works, then this type of payment is not available to him. Thus, there is no legal way for a working citizen to receive a funded pension all at once.

Urgent

With this type, the pensioner can receive his pension in installments over a certain period, which is set by him. However, according to the law, this period cannot be less than 10 years.

Statistics show that pensioners choose this particular payment option, since the amount of the monthly supplement to the pension in the form of part of the funded part is greater than in the unlimited option.

Indefinite

A pensioner may apply to receive an indefinite supplement to his pension in the form of a funded payment.

In this situation, the total amount of funds accumulated in the pension account is divided by the coefficient established by the state. The latter is revised annually and in 2020 it is 252 months.

Rules for drawing up an application to a non-state pension fund

In order to return the funded part of the labor pension to pensioners, it is necessary to fill out an application to the Pension Fund.

Or a non-state fund in which this part of the pension contributions was placed. Each organization provides its own application form, which must be completed.

Most often it contains the following details:

- Personal data Full name;

- SNILS number and NPF account number;

- Registration and actual residence address;

- Contact Information;

- Passport information;

- Please schedule a payment indicating information about current pension payments;

- Information about the method of receiving payment.

Required documents

The list of documents that a pensioner must provide to receive a funded pension may vary depending on the non-state fund.

But most often organizations require the following forms:

- Passport to confirm the applicant’s identity;

- Passport and notarized power of attorney to confirm the identity and powers of the applicant’s authorized representative;

- SNILS card;

- Certificate of receipt or right to receive an old-age insurance pension indicating the date of occurrence of such right (when registering a payment in a non-state fund).

The pensioner must contact the organization that generated the funded pension. This can be a non-state fund (most often documents are submitted there by personal appearance), or a Pension Fund (documents can be submitted there by personal appearance or through the MFC).

Terms of consideration

Most often, an application for a funded pension is considered within 30 days from the date of submission of the application. After this, either the procedure for establishing the payment will be carried out, or a reasoned refusal will be provided regarding the impossibility of assigning a funded pension.

Be sure to read it! Do illegitimate children have the right to inheritance?