Home > Types of pensions > Insurance

- Collapse

- Expand

Article navigation

- The difference between an insurance pension and a labor pension

- Formation of an insurance pension

- Types of pensions and conditions for their assignment In old age

- By disability

- On the occasion of the loss of a breadwinner

- Individual pension coefficient

- Suspension and termination of payment

11 930

The pension system in our country is constantly being improved taking into account the requirements of modern realities. In Russia, several forms of pension provision have developed: state and non-state pensions, compulsory pension insurance. The latter assumes, according to the new law No. 400-FZ of December 28, 2013. “About insurance pensions”

, operating in our country since the beginning of 2020,

there are three types of insurance pension payments :

- by old age;

- on disability;

- for the loss of a breadwinner.

Under the new conditions, pension provision will be formed from three components : a fixed payment and two independent pensions (insurance and funded). Pension rights will now be taken into account in individual coefficients, or points.

It is important that all rights previously acquired by a citizen are recorded, taken into account in the new system and are not reduced .

How does an insurance pension differ from a labor pension?

The new legislation on pensions does not contain the concept of “labor pension”

, now it is replaced by an insurance pension payment.

An insurance pension is a state-guaranteed monthly payment to current pensioners that compensates them for lost income.

A necessary condition for the emergence of the right to an insurance pension is insurance experience , that is, the citizen has periods of work for which the employer paid contributions to the Pension Fund. Non-insurance periods may also be included in such periods of work , but the condition must be met - they were preceded or followed by periods of payment of insurance payments. Such periods are discussed in Art. 12 of the Law “On Insurance Pensions”

.

The main difference between a labor pension and an insurance pension is that previously the size of the payment depended primarily on the volume of insurance contributions transferred by the employer to the Pension Fund. When assigning an insurance pension, a significant factor will be the length of work experience .

The main differences between insurance and funded pension contributions

For most citizens of the Russian Federation there is no obvious difference between the two components of the pension component; the difference between the insurance and funded parts of the pension is as follows:

Basic pension part (insurance):

- this is a state guarantor of monthly payments, taking into account labor merit;

- does not depend on the funded component and the fund included in it (public or private);

- Payment of insurance premiums for the funded part of the labor pension is currently accrued to existing pensioners.

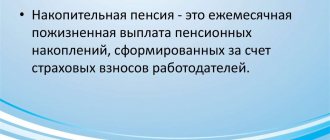

Storage part:

- subject to storage, accumulated in the personal account of the insured person. Data is not wasted on ongoing payments;

- the amount of funds depends on the fund and how it is invested;

- The choice of a management company or fund is made by the citizen at his own discretion;

- lack of guarantees and protection from risks by the state.

Citizens who want to try to have a higher pension know how to manage their capital - it is worth trying to get a high income in old age by investing the funded part of the pension in a non-state pension fund.

back to menu ↑

Formation of an insurance pension

This type of pension provision in the form of an insurance pension is established for all citizens in 1966 .

Persons born in 1967 are given the opportunity to choose to pay an insurance premium for an insurance pension or a funded .

- Having abandoned pension savings, a citizen forms only an insurance pension. Accordingly, the employer will transfer insurance payments for him to the Pension Fund in the amount of 22%, from which 16% goes to the insurance pension. These percentages are recorded on the personal account of the insured person and then recalculated (translated) into points.

- If you choose a funded pension, contributions to it will be 6%, the remaining interest will go to insurance pension payments.

In 2014-2020 the state took a kind of pause, redirecting all payments to insurance premiums . This step will reduce the PFR budget deficit for current payments to pensioners and increase the security of existing savings, because During this time, all NPFs will have to go through the corporatization procedure and will then be included by the Central Bank in the register, guaranteeing the safety of accumulated funds.

The insurance pension payment is formed from insurance contributions, guaranteed by the state and increased annually by an indexation factor.

Urgent pension provision

A special feature of this type of payment is the ability of legal successors to inherit the balance from the account of the insured person.

Submission of documents and review periods are identical to payments for life.

A small deviation related to the period of payments to the insured person, which he appoints independently, but not less than 10 years.

Persons fitting this category:

- Availability of maternity capital and transfer of funds for the formation of a funded pension;

- An insured citizen who transferred additional insurance contributions to the funded part of the pension. This is a state program for “co-financing” pension savings and insurance contributions for the funded part of the labor pension, at the expense of individual funds of the working population.

back to menu ↑

Types of insurance pensions and conditions for their assignment

Types of insurance pension payments for old age, disability, and loss of a breadwinner differ in the conditions for their assignment, the procedure for calculation and calculation rules.

All applications from citizens for the assignment of any pension are considered by specialists from the regional offices of the Pension Fund of the Russian Federation within 10 working days from the date of application or from the date of receipt of the missing documents if they were submitted within three months.

Old age insurance pension

The conditions for assigning an old-age pension payment are:

- age;

- having a minimum experience;

- having a minimum number of points.

Retirement age requirements are gradually increasing from 2020:

- for women up to 60 years old;

- for men - 65 years.

15 years by 2025 . In 2020, it was adopted equal to 11 with an annual increase to the required level.

at least 30 points by 2025 . If previously pension rights were expressed in rubles, now they are expressed in coefficients . Such conventional units depend on the level of wages and the number of insurance contributions paid from it to the Pension Fund. The minimum score was adopted in 2020 at 18.6 with a subsequent increase to the required level.

Citizens who, for one reason or another, have not acquired the right to an insurance pension are paid social pension benefits.

In addition to insurance payments for citizens of the established retirement age, there are early pensions assigned at an earlier age. The condition for the emergence of the right to such a pension is the presence of insurance experience in the relevant types of work . The minimum length of service and points requirements are the same as for a regular old-age pension.

A peculiarity of including periods of work for citizens of certain professions in the length of service for early retirement provision is the mandatory payment of insurance premiums at an additional rate from the beginning of 2013.

Disability insurance pension

Citizens who have lost their ability to work need comprehensive assistance, including from the state, which is taking measures to support and protect them . The basic concepts regarding support for people with disabilities are contained in the law No. 181-FZ of November 24, 1995 “On the social protection of people with disabilities in the Russian Federation”

.

To assign a disability pension, the following conditions :

- the onset of incapacity for work and the establishment of disability;

- availability of insurance experience.

With the introduction of the new law No. 400-FZ of December 28, 2013, disability pensions are assigned regardless of the cause of its occurrence . To confirm the fact of incapacity for work, the citizen is given an extract from the examination report issued by the medical and social examination bodies (MSE). With this document, a person can apply for a pension payment.

The length of service for which payments were transferred to the Pension Fund does not matter . It is important to have at least one such day. In the absence of one, a social pension .

Survivor's insurance pension

An insured event, namely the death of the breadwinner, is the basis for this type of pension. To establish payment for the loss of a breadwinner, the following conditions :

- the deceased has insurance experience;

- there is no unlawful act committed by a disabled family member and resulting in the death of the breadwinner.

The length of service during which the employer made contributions to the Pension Fund for the deceased breadwinner is necessary for the right to an insurance pension. Moreover, such experience can be equal to one day . If the deceased citizen did not work for a single day, then he will be assigned a social pension.

Survivor's insurance pension

An appropriate payment may be assigned in this case as well. In this case, the status of the applicant is taken into account. He must be dependent on the deceased, be disabled and be a relative. However, the right to insurance payment is lost if a crime was committed against the breadwinner, as a result of which the breadwinner died. In this case, it remains possible to assign only social benefits.

The assignment of the insurance part of the pension is carried out in a similar way if the citizen is declared missing. To do this, you need to go to court so that an appropriate decision can be made.

The peculiarity of this basis for payment is that it is assigned regardless of what period of service the deceased breadwinner had. However, in its complete absence, only social benefits are assigned.

Amount of insurance pensions

According to the adopted law “On insurance pensions in the Russian Federation”

The amount of insurance payment is calculated using the formula:

SP = IPK x SPK,

Where:

- SP

- pension amount; - IPC

- individual pension coefficient; - SPK

is the value of the individual coefficient in monetary terms on the day of payment.

This formula fully applies to the calculation of pension payments to those who begin their working career in 2020. For those who have little time left before retirement, the rights accumulated up to this point will also be converted into points, and then will be calculated in a new way.

Thus, the pension rights of citizens formed before 2020 will be converted into the sum of individual coefficients, and the coefficients for each year of service after 2020 will be added to this value.

The value of the individual pension coefficient (IPC)

As can be seen from the formula that determines the insurance payment, its main element is the IPC. This coefficient takes into account both periods of work that took place before the entry into force of the new law , and periods after . Thus, the expectations of citizens who formed their pension rights under the conditions of the previous legislation are taken into account.

The value of the IPC is determined by the formula:

IPK = (IPKs + IPKn) x KvSP,

Where:

- IPC

- individual coefficient for the day from which the payment is assigned; - IPKs

- individual coefficient for periods before January 1, 2015; - IPKn

- individual coefficient for periods of work after January 1, 2015; - KvSP

is an increasing coefficient for calculating old-age and survivor pensions.

The increase coefficient when calculating the IPC is an incentive for later retirement . For example, if a citizen postpones his old age pension for a year, the amount of the IPC will increase by 7%, after 5 years it will increase by 45%, and after 8 years - by 90%.

Fixed (basic) pension amount

The fixed payment under the new legislation is analogous to the basic size of the labor pension. This payment is established simultaneously with the assignment of a pension and is guaranteed by the state, paid in a fixed amount.

The amount of the basic (fixed) payment is annually indexed on February 1 by the consumer price growth index based on the results of the previous year.

An increased is established for certain categories of citizens , namely:

- those who have reached 80 years of age or are disabled people of group I;

- having dependent disabled family members;

- having 15-20 years of work in the Far North and equivalent areas with an insurance experience of 25 years for men and 20 years for women;

- children left without parents;

- living in the Far North;

- unemployed and living in rural areas, if they have 30 years of experience in agriculture.

An increasing coefficient is applied to the basic amount, as well as to the insurance pension payment, if the citizen decides to retire at a later date.

What pension is paid to working pensioners?

Since 2020, pensioners engaged in working activities are paid a pension without taking into account indexations . This rule applies to recipients of insurance pensions only.

Upon official termination of employment, the right to a planned increase will be restored and payments will be adjusted to the amount of all indexations that took place during the period of work. The insurance pension, taking into account indexation, will be assigned starting next month. In this case, there is no need to submit any application to the Pension Fund. From April 1, 2020, the fact of employment will be detected automatically , since simplified monthly reporting for employers was introduced from this date.

If a citizen then starts working again, his insurance pension will not be reduced .

Old age pension

Before the new pension reform was adopted, concerning the achievement of a certain retirement age, women retired at 55 years old, and men at 60. However, the reform brought new indicators. According to it, women will have to retire at sixty, and men at sixty-five. During the reform, the insurance part of the pension was also recalculated into pension points.

In addition, for this right to arise, there must be an insurance period of at least 15 years, as well as an individual pension coefficient (in short, IPC) equal to 30. Currently, these parameters are lower. They will rise gradually.

The following information is currently relevant:

- The retirement age has not been increased for all citizens. There are certain categories that are not affected by this order.

- The possibility of taking early leave also remains for various reasons, for example, length of service. This category of citizens often has a question about how to receive the insurance part of their pension if they continue to work.

- In 2020, to be able to retire, you need to have a minimum of 9 years of experience, and the number of IPCs is 13.8.

The pension reform will be completed by 2025, when the indicators will increase to their maximum level.

Indexation of pensions in 2020

Every year on February 1, the state increases all types of insurance pensions, taking into account rising prices and the average monthly salary in the country. However, for the period 2019-2024. indexation will take place from January 1 according to coefficients predetermined by law. For example, in 2020, insurance pensions were increased by 6.6%.

It is important to remember that the minimum pension payment cannot be lower than the subsistence level established in each specific region. If the pension provision is below this level, then the citizen has the right to establish a social supplement from the federal or regional budget.

Payment of labor pension

All types of insurance pensions are paid monthly for the current period . A pensioner can receive a pension payment personally or through a proxy. The pension established for the child is received by one of the parents or guardian. A fourteen-year-old child can receive a pension independently.

The method of delivery of pension payments is chosen by the citizen when writing an application for appointment . However, this method may be by submitting a corresponding application to the Pension Fund.

Payment of pension benefits is carried out :

- through post office institutions (at home or at the post office);

- through the bank.

Suspension and termination of payment

grounds for suspending pension payments:

- failure to receive such payments within six months;

- failure of a disabled citizen to appear for the next re-examination;

- the pension recipient has reached the age of majority and has no documents confirming his full-time studies, or has completed his studies after the age of 18;

- termination of the residence permit;

- receipt of documents on the departure of a pensioner for permanent residence in a foreign state, with which an agreement has been concluded on the obligations of this state to provide pensions to our citizens;

- receipt of documents on moving for permanent residence to a foreign country with which an international treaty has not been concluded, and the absence of an application to leave Russia.

The suspension or termination of payment of the pension amount is carried out from the 1st day following the month in which such circumstances occurred.

grounds for termination of pension payments:

- death of the pension recipient or recognition as missing;

- the expiration of six months from the date of suspension of payment;

- loss of the right to an assigned type of pension;

- failure by a foreign citizen or stateless person to provide a residence permit;

- refusal to receive insurance payment.

It should be remembered that a citizen is obliged to promptly notify the Pension Fund of the Russian Federation about circumstances entailing the suspension or termination of pension provision.

How is a pension formed?

Whether or not a taxpayer has a funded part of a pension directly depends on his status. By the end of 2020, persons born in 1967 and later must give orders about the fate of their future capital. They had two options:

- leave the money in the Pension Fund (then the state management company represented by VEB handles the savings);

- transfer money to any NPF.

Those who “kept silent”, i.e. If you didn’t choose either option, you lost the funded part of your pension altogether. Those who are just starting to work for the first time must decide on a management company within 5 years. If they do not make their choice, they will be considered “silent”.

The insurance and funded part of the pension - what is the difference?

Reviews

For those who want to increase their future pension, it is definitely worth highlighting the savings part. They will be able to invest in it using various instruments, for example, by personally directing insurance premiums to the savings part or transferring them to a highly profitable non-state pension fund. Other persons (including those born before 1967) will only be able to claim fixed and insurance coverage.

Thus, at the moment, the formula for the final pension amount looks like this:

F + N + IPC*B , where: F – fixed payment (6%);

N – accumulative part (6% for those who formed it, 0% for the rest); IPC – number of accumulated points; B – point value at the time of retirement. In 2020, the cost of a point is 87.24 rubles. Thus, having accumulated 50 points and taken a well-deserved retirement this year, you can receive an increase in your fixed pension in the amount of 4,362 rubles. Its final size will depend on the state of the savings in the savings account and on the procedure for disposing of them.

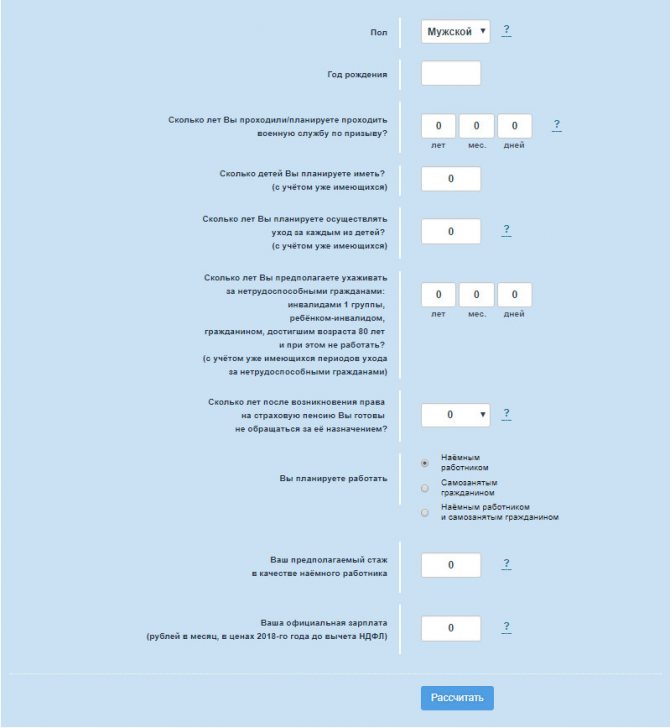

To preliminary calculate the amount of payments, including the funded and insurance part of the labor pension, you can use a special calculator located on the PFR website here: pfrf.ru/eservices/calc.

Calculate your pension yourself using a calculator, indicating the actual salary amount

For further calculations, it is better to contact the Pension Fund directly; the calculator does not take into account additional coefficients.

The final size of the pension, in addition to the indicated variables, is influenced by the type of work (for military personnel and government employees, the calculation is based on a different scheme), the presence of negative factors of work (in the conditions of the Far North, hazardous production, etc.), the number of dependents available, was carried out whether there was child care on maternity leave, whether the person worked after going on vacation after work, etc.

Comments (13)

Showing 13 of 13

- Valery 05/13/2016 at 18:49

There is a lot of talk now that young people can already influence the size of their future pension. My daughter is 36 years old. Please tell me what she can do to count on a decent pension in the future?answer

- Yulia 05/14/2016 at 18:00

In Russia, from the beginning of 2020, a new procedure for calculating pensions has been in force. Its size is influenced by several factors. First of all, this is the amount of the official salary - the higher it is, the higher the future pension payment. In addition, the length of experience has an impact. For each year of work, pension coefficients will be calculated. Accordingly, the pension amount will be greater for the one who accumulates more of these coefficients. An important feature with the adoption of the new law is the age of retirement. By postponing the pension date by a year or more, you can also increase the size of the future payment. In addition, if your daughter is a participant in the co-financing program, the state will increase the pension payment by doubling the voluntary contributions of citizens.

answer

Who came up with such a calculation of pensions that an ordinary person will never understand? Previously, the USSR had a very simple system and anyone could check the correctness of pension calculations. Everything was done on purpose, they confused everyone so that they wouldn’t figure it out, and whichever one they’ll charge, that’s what you’ll get.

answer

This is what it is designed for.

answer

An insurance pension is a state-guaranteed monthly payment to pensioners that compensates them for lost income. A pensioner on well-deserved retirement is assigned a pension consisting of a minimum wage and a fixed payment (as of April 1, 2020, it is 4805 rubles 11 kopecks). Until 2001, the employer in the USSR paid insurance payments to the pension fund. Russia is the legal successor of the USSR. When assigning a pension to those with work experience, the state established a basic payment. However, when indexing pensions in Orenburg, for some reason the fixed (basic) payment to a pensioner as of April 1, 2020 is not indexed (4805.11 rubles X 0.38%/100% = 18 rubles 26 kopecks). Each pensioner in Orenburg did not receive an additional pension in the amount of 18 rubles in April 2020. 26 kopecks Perhaps this situation is also in other regions. The legality of the correct indexation of the pension should be checked by lawyers. The state saves budget funds on the most vulnerable segments of the population - pensioners.

answer

Yulia 04/14/2017 at 09:14

Unfortunately, this is the case everywhere. When carrying out pre-indexation, the government only mentioned that the cost of one pension point would increase from 78.28 to 78.58 rubles, which is why the fixed payment was not increased.