Size

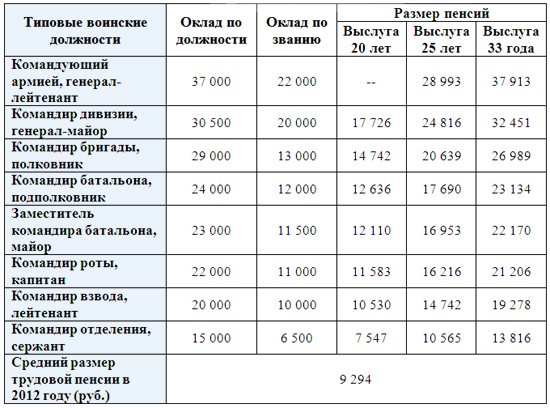

The amount is calculated on the basis of monetary allowance.

In accordance with the procedure determined by the Government of the Russian Federation, the official salary (salary for a military position or for a special rank) and a bonus for length of service (monthly bonus) are taken into account. Promotions associated with service under special conditions are not relevant. This allowance has been taken into account since 2012. Then 50% of the indicated amount was taken, but taking into account indexation, today the percentage has increased to 69.45%.

Retired colonel's pension

The amount of allowance depends not only on the rank, but also on the position. Interest is added to the amount for special conditions of service, complexity and tension, etc. Additional payments are provided for the availability of awards.

Accordingly, it is impossible to calculate an exact pension. On average, a position and title generates a salary of about 40-50 thousand rubles. Taking into account interest for years of service, the amount can increase by one and a half times or more.

Thus, 70% of the total allowance will be at least 50-60 thousand rubles. All this does not take into account significant premiums for education, risk during performance, etc.

What is the pension of a retired lieutenant colonel?

** The procedure for calculating length of service for assigning a monthly bonus for length of service to military personnel performing military service under a contract . approved by Decree of the Government of the Russian Federation of December 21, 2011 No. 1074.

Due to economic difficulties in the country, the average military pension leaves much to be desired. Therefore, today the main task of the Pension Fund of the Russian Federation is to maintain the existing salary and those benefits to which people who served their Fatherland are entitled. Every soldier before retirement is concerned with the question of how much money he will receive and how to calculate it. The topic of indexation of payments and tax breaks always remains relevant.

Decor

A person receives a pension after applying for appointment to the specialized pension authorities of the FSB.

Rules of circulation:

- The application is submitted along with the necessary documents.

- A person has the right not to provide papers that are at the disposal of government agencies or local self-government bodies. In this case, the necessary documents are simply requested and not required from the applicant.

- In accordance with Art. 52 of Law 4468-I, applications along with a package of documents are considered by these pension authorities within 10 days from the date of receipt of the application or the same period of time after the transfer of missing information or papers that were not received by the employee upon application.

Pensions, if all rules are observed, can be assigned from the day of dismissal, but not earlier than the day before which the salary was paid, with the exception of cases of assigning a pension at a later date.

Late application for a pension makes it possible to return the established amounts for no more than a year preceding the day of filing the application.

According to the law, the day of application for a pension is recognized as:

- the day the application is submitted to the competent authority along with all documents.

- date of sending the letter, if the documentation is sent by mail.

When not all documents are attached to the application, and the obligation to provide them lies with the applicant, then the person is explained which documents are missing.

If they are provided within three months, the date of application is considered the day of sending or submitting the application for a pension.

Conditions for military retirement

And then I would be a citizen of the Russian Federation and would be subject to the laws on pensions! Democratic JUSTICE IN ACTION!

My dad seems to be in his 30s. 25,000 was a long time ago, since then it has been increased decently. But he is also a researcher.

A military man submits documents for a long-service pension - and they are checked. The pension will be assigned within 10 days from the date of dismissal - but not earlier than the day before which the salary was paid upon dismissal. If you delay applying for a pension, it will be assigned retroactively from the day on which the right to it arose. You can receive payments up to 12 months before the date of application.

That is why the state took care in advance of benefits for all family members, and widows in particular, which continue to apply even after the death of the breadwinner.

Pensioner's ID

Pensioners are issued a special pension certificate from the Federal Security Service against signature. If personal receipt is not possible, the document is sent by registered mail with notification.

The certificate indicates:

- full name of the pensioner,

- his title

- type of pension received,

- day of appointment.

If we are talking about a dependent receiving an FSB survivor's pension, the title is not registered.

The document is signed by the head of the territorial body of the FSB and the pension division. Certification is carried out with the official seal of the territorial body. A color matte photograph of 3x4 cm, certified by a seal, is pasted inside.

Entries inside are made legibly, without corrections or erasures, only in black or blue pen; cleaning up errors is prohibited.

An incorrect entry requires the preparation of a new document. Once submitted, damaged forms must be written off six months after the audit.

In case of loss or damage to the pension certificate, you must:

- Contact the issuing department with an application.

- State the circumstances of the loss.

- Get the document. After the conclusion is issued, a duplicate is issued with the appropriate stamp affixed. The legal force of the new document is similar to the lost one.

General's pension in Russia

- when working in the structures of the penal system;

- while serving in National Guard units.

- To receive maintenance from military units, one of the following conditions must be met:

Then Vadim Sayushev was appointed deputy chairman of the State Committee for Vocational Education. Three years later he was made first deputy. Sayushev told me that when Shelepin was transferred to the committee, Suslov called the chairman, Alexander Alexandrovich Bulgakov, and frankly explained:

Pension of a retired colonel

161 lawyers are now on the site 3592 consultations in 24 hours

My husband is a retired colonel. His pension is higher than 41 thousand rubles. I am a pensioner. My pension is 15 thousand rubles. We have two adult children. He doesn't live with a family. He left to live with his mistress 6 years ago. Doesn't help the family. I bought a car. Question: can I apply for alimony for my maintenance in the amount of 13 thousand rubles? (average value of our pensions) can I apply for car division? And yet, he helped buy his mistress a 2-room apartment. Apartment for 7 million rubles. How can I protect my family's rights?

Good afternoon, the answer to your question depends on whether you are in a registered marriage. Of course, you can apply for alimony, but your pension is above the subsistence level, and there are no dependents, you are not disabled and are fully capable, so it is unlikely that you will be awarded 13 thousand rubles, they will probably refuse or set a lower amount.

Hello. If the court determines that you are disabled (this has been established - you are retired) and in need, then the court will be able to collect alimony from him. But your pension is higher than the subsistence level, so it is unlikely that you will collect alimony in the required amount. You can go to court with a claim for division of jointly acquired property. If the apartment is registered to his mistress, then you will not prove anything.

The machine is indivisible, it cannot be divided; You can charge him 1/2 of the cost of the car. Further. Your pension is above the subsistence level, the court does not find you in need and you will be denied alimony. Further. 7 million - whose money is this, from your family budget? You would like to clarify this issue.

I am the widow of a pensioner of the Ministry of Internal Affairs. The husband was a colonel. Now I’m 55, I want to take my husband’s pension because I didn’t work. Where to apply and what will be the pension? Thank you!

You need to contact the Pension Fund directly with this question, and the size of the pension can only be found out there, since you need to raise the pension case.

The widow of a retired military man (colonel) retires in a year. She works in a kindergarten. Is she entitled to receive the pension of her deceased spouse in exchange for her pension? What documents are required for this? From what period can she receive the pension of her deceased spouse?

Hello. She is not entitled to the pension of her deceased husband. But for a survivor's pension - maybe. When contacting the Pension Fund, submit an application to calculate a survivor’s pension to choose the best option. All the best. Thank you for choosing our site.

Has the right to a survivor's pension if he provides documents to the VC confirming cohabitation and dependency. If VK refuses, appeal in court.

A pensioner of the Federal Penitentiary Service, due to his length of service, was deprived by a court verdict of the special rank of Colonel, Ext. Does the pension payment stop?

A pensioner of the Federal Penitentiary Service, due to his length of service, was deprived by a court verdict of the special rank of Colonel, Ext. Does the pension payment stop? No, the pension payment does not stop in this case.

My husband died, a pensioner of the RF Ministry of Defense (colonel), I work and receive a pension (pension 11 thousand, salary 14 thousand). Do I have the right to transfer to his pension? There are many chronic diseases that require ongoing treatment. My next steps, what should I do? Thank you.

Hello Irina, what does it mean to switch to his pension? Why on earth? You can apply for a survivor's pension, but it is not a fact that it will be greater than your old-age pension.

At the end of 2020, my husband, a pensioner, a customs service veteran with the rank of colonel, died. His pension for 2020 is 27,019 rubles, my labor pension is 10,746 rubles. Could I count on something? Another question: he died on December 28, 2015, but his January pension had already arrived in his savings book at the end of December. Can I take it off? (I have a power of attorney).

Hello. Article 1112 of the Civil Code of the Russian Federation

Hello. My retired military husband (Colonel), who worked after his retirement in the same military unit, died. Should the military pay me a funeral benefit or should the military registration and enlistment office do this? .

Funeral benefits for military pensioners are paid from the funds of the Federal executive authorities in which the deceased (deceased) served in military service. The amount of funeral benefits is constantly increasing and is associated with revisions and updates of the 1994 Decree of the Government of the Russian Federation No. 460. The exact amount of benefits in each specific case must be clarified with the social security agency with which the deceased was registered.

I am a pensioner, my husband, a military pensioner colonel, died, I want to switch to his pension according to the law, my husband’s pension is greater than mine for his length of service, but the FSB pension department requires me to provide a certificate stating that at the time of my husband’s death I was a dependent or they say go to court. Is this legal on their part, because I have the right to choose.

Get a written refusal and contact the prosecutor's office.

My husband retired with the rank of colonel; we got married while we were pensioners. My husband died, can I transfer to his pension since my pension is small?

No, you can't go

I am a pensioner of the Ministry of Internal Affairs. Rank: Police Colonel. Retired for 8 years. Age 59 years. I have a military ID as a reserve officer of the USSR Ministry of Defense, the rank of captain. Until when should I be registered with the military registration and enlistment office?

Senior officers, for example, are in the reserve until the age of 60, and after reaching this age they retire

In 2011, my retired husband, a former colonel of the Ministry of Internal Affairs and then the Ministry of Emergency Situations of Ukraine, died. He received a pension of 4500 UAH. I switched to his pension and was assigned a ridiculous pension of 1354 UAH. Now it is 1828 UAH. My husband’s former colleagues all say that my pension was calculated incorrectly. As the widow of a serviceman, I should receive much more. Where should I go to find out?

Valentina Nikolaevna, she will contact the Pension Fund, and a lawyer who specializes in this area can check the calculation of the pension, and then she will have to file a claim in court.

I have this question. My husband is a retired military colonel; since November 2010, in retirement, he has given his entire life to the Armed Forces, 35 years of service. Participant in hostilities in the DRA and Chechnya (New Year 1994). According to the age limit, he was supposed to retire in the summer of 2009, but since we have a service apartment in a closed military camp, they did not fire him, they said that a service apartment is, one might say, homeless. But after a year and a half, he was quickly fired, without even warning (we realized this when a small amount of money arrived on the card), they simply told him to come for documents, it turned out that he was fired 10 days ago. They didn’t give me a permanent apartment; we still live in a service apartment. We have been living together for 35 years, the children have grown up and moved away. But the whole catch is that my parents died in 2008 and my brother and I inherited an apartment. My brother and I sold it and with the proceeds I bought an apartment (75 sq.m.), I am not registered in it, she I just own it. I am registered in a service apartment with my husband. Based on reviews on the Internet, I realized that my husband might not be given an apartment because... my wife actually says that these meters should be subtracted and allocated for the two of us (18*2+25=61 sq.m). It turns out that my husband and I not only won’t get an apartment from the Moscow Region, but we also have to pay them the difference in meters, i.e. the difference is 14 sq.m., what kind of absurdity is this? We would like to move out, at the moment we have a four-room apartment, we got it for 5 people (me, my husband and three children). A two-room apartment would be enough for us. During our entire service, we did not have a permanent apartment (either the desert, then educational buildings, or rented apartments). Here’s my question: what are the chances for my husband and I to get the apartment we deserve with our blood and sweat? If it's not difficult, please answer. Is it possible to get an apartment?

Unfortunately, the Ministry of Defense employees are formally right, since you own an apartment, they believe that your family is provided with housing. You need to act differently; you need to contact a practicing lawyer in this area of law.

You bought an apartment while married. ? Then this is your common property; you and your husband have housing and you are provided with it, according to established standards. What arithmetic with meters?” Subtract, pay” You will simply be denied housing.

Was your apartment purchased during marriage????What does this have to do with your parents? if you BOUGHT an apartment after inheritance?

Military pensioner, receiving a pension from the Ministry of Defense of the Russian Federation for length of service, retired colonel. Disabled due to war injury. Current age is 56 years old, insurance experience (non-military work, after leaving the army) is more than 10 years. The branch of the Pension Fund of the Russian Federation at the place of residence and the regional body of the Pension Fund of the Russian Federation rejected my application for the appointment of the insurance part of the old-age labor pension - ahead of schedule, as someone who had reached 55 years of age and was disabled due to a military injury. I was asked to give up my long-service pension through the Russian Ministry of Defense and switch to a disability pension, which does not suit me, since the military pension is expected to increase in 2012. In the responses of PFR officials, the grounds for refusal cite excerpts from individual laws, and not their totality, which gives the right to a positive decision on accruing the insurance part of my pension. My request in electronic form to the Pension Fund of the Russian Federation remained completely unanswered. QUESTION: Do I have the right to simultaneously receive the two specified pensions: -Military, based on length of service, which I continue to receive, -The insurance part of the old-age labor pension - ahead of schedule, as someone who has reached 55 years of age and is disabled due to a military injury.

Law of the Russian Federation of February 12, 1993 N 4468-I “On pension provision for persons who served in military service………………………” Article 7. The right to choose a pension………………………………….. The persons specified in Article 1 of this Law, IF THERE ARE CONDITIONS for the appointment of an old-age labor pension, have the right to simultaneously receive a long-service pension or a disability pension provided for by this Law, and an old-age labor pension (with the exception of the fixed basic amount of the insurance part old-age labor pension), established in accordance with the Federal Law “On Labor Pensions in the Russian Federation”. Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation” Article 28. Retention of the right to early assignment of a labor pension to certain categories of citizens 3) disabled people due to military trauma: men upon reaching the age of 55 and women upon reaching aged 50 years, if they have an insurance period of at least 25 and 20 years, respectively; You have 10 years of service after the army. This means “conditions”, i.e. 25 years, for the application of paragraph 3 of Article 28 no. PF should have written exactly the same.

A pensioner of the Ministry of Internal Affairs, a retired colonel, worked in the governor’s office as a chief specialist for the last three years before retirement. Can he convert his pension to a civil servant's pension? Work experience in authorities for more than 35 years. Retired for 10 years. Lives in another region. (Not where he worked and retired).

Hello, Ekaterina. If you have reached the age of 55, then you can renew your pension upon reaching age, i.e. social, in which your pension (Ministry of Internal Affairs pension) will be increased along with other civil pensioners. However, you cannot switch to a civil servant’s pension, that is, re-register a pension based on the salary you already received as a long-service pension in the Ministry of Internal Affairs.

Please, how is a pension issued to the widow of a Soviet Army pensioner (retired colonel), a citizen of Ukraine, when she moves to Russia for permanent residence and from what moment does this pension begin to accrue?

Dear Lola! In accordance with the Law of the Russian Federation dated 12.02.93 N 4468-1 “On pension provision for persons who served in military service, service in internal affairs bodies, institutions and bodies of the penal system, and their families” (as amended on December 6, 2000) To assign a pension in the event of the loss of a breadwinner (a colonel of the RF Ministry of Defense, who received a pension through the RF Ministry of Defense), the spouse, who is a CITIZEN of the Russian Federation, applies to the pension department of the regional military registration and enlistment office, which calculated the pension for the spouse and provides all the necessary documents. The day of application is the day the entire set of documents is provided, and the pension can be paid for the previous period, but not more than 12 months. At the same time, I find that, based on Art. 1 of the above-mentioned Law, pension authorities will give a positive answer and accrue pensions from the date of receipt of Russian citizenship.

The size of the pension of a retired colonel of the Ministry of Internal Affairs

If there is a reduction in staff or numbers, the employer has the right to retain the average earnings for the previous job in the amount of the cost of training. Thus, additional payments are paid to the entire balance of payments to them. To calculate average earnings, it is determined by Article 16 of the Federal Law on Labor Pensions in the Russian Federation and in part two of Art. 20 of the Federal Law of December 17, 2001 173-FZ. With respect, lawyer Neklyaeva Elena Valentinovna! ..

Hello. File a complaint with the prosecutor's office. In accordance with the Federal Law of January 17, 1992 2202-1 "On the Prosecutor's Office of the Russian Federation": Article 10. Consideration and resolution of applications, complaints and other requests in the prosecutor's office 1. Statements, complaints and other requests are resolved in the prosecutor's office in accordance with their powers appeals containing information about violations of laws. The decision made by the prosecutor does not prevent a person from going to court to protect his rights. A decision on an appeal against a sentence, decision, determination and order of the court can only be appealed to a higher prosecutor. 2. Applications, complaints and other appeals received by the prosecutor's office are considered in the manner and within the time limits established by federal legislation. 3. The response to an application, complaint or other appeal must be motivated. If the application or complaint is refused, the applicant must be explained the procedure for appealing the decision, as well as the right to go to court, if provided by law. 4. The prosecutor, in accordance with the procedure established by law, takes measures to bring to justice persons who have committed offenses. 5. It is prohibited to forward a complaint to the body or official whose decisions or actions are being appealed.

Interesting: Is there a benefit for labor veterans when paying for garbage?

Pension for military pensioners in 2020

According to the Decree of the President of the Russian Federation, payments to the military must be indexed annually by 2% without taking into account adjustments due to inflation. For 2020, the adjustment rate is expected to be 5-7%.

The last indexation was carried out in 2020 and amounted to 7.5%. According to the law, all pensions must be indexed this year to the level of inflation. At the end of last year, the inflation rate was 12.9%. Thus, indexation should occur at the same level, which raises serious doubts in connection with the crisis. Thus, pension increases for retired military pensioners are not yet expected until the economic situation improves. Today's payments to retired military personnel exceed the pensions of civilians by almost 1.5 times.

Attention: What kind of pensions do military pensioners have? So, let's take an ordinary shooter with the first tariff category and having the military rank of private. How much do military personnel earn in Russia? Let's take a look at the minimum monthly salary of officers in the Russian army:

- Lieutenant – RUB58500

- Major General – RUB116508

- Captain – RUB66000

- Colonel – RUB94700

- Lieutenant General – RUB137417

- Lieutenant Colonel – RUB78600

As we can see, the salaries of the generals and officers of the Russian army are more than impressive. The official salary of a Moscow general is 27,000 rubles, how much do the military receive? Payment for conscripts until 2012 caused only ridicule - about 500 rubles per month.

After the law came into force in 2012, recruits began to receive 2,000 rubles per month. A major, battalion commander, will receive a military pension in the amount of 16,513 rubles. A colonel, brigade commander, who has served for 20 years, will be entitled to a monthly pension in the amount of 19,110 rubles, and if his service is 25 years, then he will receive 26,754 ruble. An army general who held the position of commander of the district troops, who served in the Armed Forces for thirty years, will receive 52,528 rubles monthly. How much money does a military pensioner receive? What does the latest news say about military pensions in 2020. To implement the provisions of subparagraph “d” of paragraph 1 of the Decree President of the Russian Federation dated May 7, 2012 No. 604 “On further improvement of military service in the Russian Federation”, providing for an annual increase in pensions for citizens discharged from military service by no less than 2% above the inflation rate, budget allocations in the amount of 79.09 billion rubles.

Amount of pension for a retired lieutenant colonel

And in the blogosphere, people are already discussing this. Against the backdrop of Rostelecom’s multi-million dollar “golden parachutes”. And they are threatening to turn off landline phones en masse. But there’s no point in whetting other people’s appetites. Yes, their appetites will not disappear, but ordinary signalmen may be left without work. That's why we're in no hurry. Well, the “colonels” are doing better now. A second pension is in sight for them. But for the rest, such a symbolic increase still does not lead to bright thoughts. Here is the link we found in Runet “A number of events and changes will occur in the Russian pension system in 2013 that will affect future and current pensioners, as well as Russian employers. Labor pensions of Russian pensioners will be increased twice in 2013 . The first indexation will take place on February 1 - labor pensions will increase by the inflation rate in the Russian Federation for 2012 (approximately 6.5-7%), the second time - on April 1 - by more than 3% (according to the level of growth in Pension Fund income in 2012 in per pensioner). In August, the traditional recalculation of labor pensions of working pensioners will take place. State security pensions, including social pensions, will increase by 5.1% from April 1. At the same time, on April 1, the size of the EDV (monthly cash payments that federal beneficiaries receive along with their pension) will be indexed by 5.5%. As a result, the average old-age labor pension in 2013 will be 10,313 rubles, and the social pension will be 6,169 rubles.” This data is already partly outdated. In February, labor pensions increased by a compromise 6.6% , but they still can’t calculate the April figure “for Pension Fund income” or what? “Hey, are you up there?”…Answer us. The local branch of the Pension Fund told us that they are ready to accrue as soon as they announce the official decision. People will soon receive pensions, but in two days it’s still an intrigue! Has fashion gone like this? It would be good in politics. And it even spread to social media. Why wait? We won't get very rich anyway. Copyright Murom.ru with comments on the topic

How well the “average” Russian pensioners understand the irony of this character. And how difficult it is for them to understand the selfish words of the former wife of Valery Zolotukhin, who left us long, long ago (annoyingly early for a sought-after creative and talented actor), a pensioner with extensive experience, Nina Shatskaya, the widow of Leonid Filatov, that now her son Denis, a priest, and his wife and eight children with his income of 25 thousand rubles, it is difficult without the help of his father (Zolotukhin drove a huge family cart and for 10 years helped the family of his eldest son after Filatov’s death - how could he not overstrain himself!). “Even if Deniska had 50 thousand. . This is not enough for me alone. “,” said the ex-beauty, who herself had not communicated with Valery Sergeevich for 20 years. And not a word about how morally difficult it will be for eight-year-old Vanechka, the son of Irina Lindt, the actor’s common-law wife, what it will be like for his second official wife Tamara, whose son voluntarily passed away at the age of 26 (the duet of “thickets” with “thickets”, as he defined in the words of Lyubimov in a recording on the Kultura TV channel. Amazing dependency reigns in this world. Everyone is owed to them, even by those whom they abandoned for the sake of great love for another, but to the people on whose shoulders Russia still rests - no one!

Interesting: Is it possible to sell a house bought for capital without guardianship authorities

What determines the amount of cash benefits?

The military pension is a monthly payment received by former army personnel. Such payments are financial support and are provided by special government bodies. The amount of the pension depends on many factors that largely shape the material security of not only the person who has served, but also his family. In this case, the amount of cash benefit is calculated based on:

- length of service;

- military rank;

- positions.

It is possible to receive an average military pension at a fairly young age - at 40 years old and even earlier. In this case, the total experience of the employee must be at least 20 years. Participation in hot spots, military operations, special and counter-terrorism operations is of no small importance when calculating a pension. Some government agencies are also subject to the above conditions:

- fire protection structures;

- Defense Department;

- prison services;

- police structures;

- some federal departments for special purposes.

Cases of disability and death of a serviceman while performing his direct duties are considered separately. The victim or his family members can count on cash benefits from the state.

Comparing the pensions of military, police and FSB employees

Information on the pension provision of prosecutors and employees of the Investigative Committee is not provided in the report, but, as the website for pensioners “My Years” (moi-goda.ru) already wrote, the average pension of a former district-level investigator in 2020 was 20 – 22 thousand rubles . A retired district attorney makes about the same amount.

If military pensions are a topic of widespread discussion, then you have not heard about pensions for employees of the Federal Security Service in 2020 and will not hear in 2020. And the point here is not the secrecy that exists in relation to this information, but the fact that the recipients of such pensions themselves are literally more than 100 times smaller than former military personnel who were assigned a military pension.

Interesting read: Bailiffs for alimony after trial

What is the formula for calculating military pension?

First of all, the amount of financial support is influenced by the military rank and position held. Also, the average pension for a military retiree depends on economic factors. Thus, the accounting department forms the final amount, taking into account inflation rates and other important parameters. The specific number is obtained by the formula: base × (50% + 3% for each year of service after 20 years of service, but not more than 85%) × reduction factor.

The base is the sum of salaries by position and rank, taking into account additional allowances for length of service. Correction factors depend on the soldier’s place of service. How to calculate a military pension using a specific example?

If a person liable for military service decides to retire from the position of platoon commander (salary 20 thousand rubles), he will receive a cash benefit in the amount of 15,571.9 rubles. In this case, the rank of captain was taken into account (11 thousand rubles), the bonus for length of service (for example, service life of 22 years) is 30%. Thus, the size of the premium is determined: (20000+11000) × 30% = 9300 rubles. As a result, the base amount is 40,300 rubles. (20000+11000+9300).

The received military pension amount is adjusted by a coefficient depending on length of service. 20 years - 50% allowance, additional years - 3%. If the example shows 22 years, that means 56% of the salary. Since military pensions are considered to have a reduction factor (60% - depending on the economic situation in the country), the amount will change significantly: 403,008 × 56% × 60% = 13,540.8 rubles. At the end, indicators of the regional coefficient are used, which depends on the place of military service (for example, Karelia). In this case, 13,540.8 × 1.15 = 15,571.9 rubles.

The country annually indexes cash payments. This means that a presidential decree must regulate all social benefits. They are revised by financiers and increased by 2%. What a military pension should be will also be determined by inflationary processes. For example, their indicators can fluctuate between 5-7%. However, even experts do not undertake to predict a drop in consumer demand. Material payments to army personnel are subject to indexation in early January and October. This makes it possible to compare real indicators with statistical data.

Retired major's pension in 2020

This figure is approximate, since in each case the calculation will be individual depending on the conditions of service. Prospects for increasing pensions for the military In 2020, it was planned to increase military pensions by 20 - 22%, but taking into account the current circumstances in the economy, the hopes of military pensioners did not come true.

In 2020, the monthly cash payment (MCP) to combat veterans is RUB 2,780.74. From February 1, 2020, the amount of the monthly cash payment (MCV) to combat veterans from among the specified persons is 2850.26 rubles.

Average salary allowance for a military pensioner

The average pension for military personnel in Russia is up to 20 thousand rubles. Government agencies are constantly working to improve the material well-being of army personnel. Sometimes a former employee can count on a second pension. We are talking about reaching retirement age. However, anyone wishing to receive this type of assistance must acquire at least 6 years of civil service. It is impossible to receive this material support before the specified period.

Any veteran knows how much the pension of former military personnel was during the Soviet era. A person who defended the Motherland was entitled to 75% of the salary after 25 years of service. After 1992, pension payments decreased by 25%. Now the pension salary is calculated using innovative methods that take into account the military man’s personal contribution to the common cause and his right to a decent life. Modern approaches to solving such important problems are aimed at recent retirees, not at veterans of yesteryear.

Reforming the pension system will not be possible without new indexation. It must comply with the requirements of the consumer basket law. According to experts, in this way, the cash benefit of military pensioners should increase and amount to 170% of average civilian payments. It is possible to achieve such indicators by gradually increasing salaries. At the initial stage, it is planned to increase pensions by 10-15%.

The procedure for obtaining a pension for the widow of a military pensioner and its amount in 2020

- husband's military documents confirming his rank and position;

- own passport;

- certificate of death of a serviceman;

- medical reports on the cause of death and documents confirming illness or injury during military service;

- papers confirming the official marriage between the applicant and the serviceman;

- documents on disability;

- the child's birth certificate;

- work book;

- any other documentary evidence of entitlement to receive this payment.

Officers' wives can be classified as an unprotected category of citizens, because often the husband's career develops in such a way that he is forced to constantly change service cities. In addition, service in small towns does not allow a woman to build a full-fledged career and find a job. Therefore, when they lose their husband, many wives are left without their own pensions, since they have not earned the necessary work experience.

Interesting: How much does the bank take from Matkapttal when buying an apartment?

Amount of allowance for a general

For military personnel who have retired with the rank of general, certain benefits have been established.

The general's pension in Russia, the amount of which is calculated using a special formula, depends on the following indicators:

- salary amount;

- additional payments for length of service;

- bonuses for rank.

The formula looks like this: P = (O+D+N) *50%

To obtain the payment amount, you will need to multiply all components by 50%. When a citizen has served for more than 20 years, 3% is added to each additional year. If indexation is carried out, the benefit amount is multiplied by 2%.

In 2020, the reduction coefficient was fixed, its value is 54%. The resulting amount is multiplied by it. If a general serves in a northern type area, then the coefficient established in the area must be added to the resulting value.

Types of benefits and average payments

A general's pension may be assigned due to disability. Applicable coefficients in this situation vary depending on the disability group.

The additional payment depends on the disability group:

- if a person is recognized as a disabled person of the first group, then the premium is 280%;

- for the second – 230%;

- and for the third – 170%.

The average value of the payments under consideration for a military man ranges from 40,000 to 60,000 rubles.

The calculation is approximate, since in each case it is individual. The last time the amount of benefits for generals was indexed was in 2020. At that time, the indexation percentage was 7.5%. There are no plans to increase pensions for army commanders in the near future.

Military pensions from January 1, 2020

The latest news from the pro-government offices that reached society turned out to be not very pleasant. It was decided to freeze the increase in pensions for retired defenders of the Motherland until the end of this year. Even the Defense Committee of the State Duma could not influence the situation. The government voiced its intentions in firm terms, explaining this move by the complicated economic situation due to additional sanctions. Whether military pensions will rise from January 1, 2020 is also still in question. Officials ask not to ask about this at least until mid-summer, when the economic results of the six months will be summed up.

But State Duma deputies have a salary of 380 thousand. Feast in Time of Plague. Only “talkers” and “promisers” gathered in power. You yourself should live on 12 thousand re a month, and not travel around the world at state expense, build villas for your old age and provide for your snickering children. You were elected by the people, but you work and do everything against them! Don’t forget that a moment may come when everyone will take up pitchforks, since there will really be nothing to lose.

30 Jun 2020 hiurist 248

Share this post

- Related Posts

- Where to apply for a gubernatorial allowance in Kursk for a second child 2000 rubles

- The distance between the house and the fence is 3 meters since what year

- Preferential benefits for mothers of many children Dagestan

- Is it possible to get a permanent job within the Russian Federation without registration?

What kind of pension can a general receive?

Federal Law No. 4468-1 of 1993 “On pensions for military personnel” contains rules regarding the conditions and procedure for assigning payments.

Legal acts developed by this department provide for what payment can be received by a military man in this rank:

- benefits accrued based on length of service;

- upon receipt of disability.

The calculation of this benefit for generals is not carried out by the Pension Fund of Russia; this area is under the control of the country's Ministry of Defense.

By length of service

Article 5 of Federal Law No. 4468-1 of 19993 indicates that persons with a certain amount of length of service are entitled to receive long-service benefits.

Payments are made from funds allocated by the Ministry of Defense. Length of service applies not only to the military sphere, but also to other areas of activity equivalent to it. For example, these are employees of the Ministry of Internal Affairs.

The amount of a general's pension in Russia depends on the number of years of service.

When calculating this benefit, two conditions that the military must meet are taken into account:

- having more than 20 years of service;

- work experience must be at least 25 years.

The average amount of long-service benefits ranges from 60,000 to 80,000 rubles.

The specified number of years of experience must necessarily include length of service in the amount of half of this value. If a citizen wants to go into service for the second time and then leave it, then he must understand that the determination of length of service is carried out at the time of the last dismissal. Similar rules apply to establish total length of service.

General's disability pension

How much a general’s pension will be in the event of loss of ability to work depends on what disability group he was assigned during the examination.

Article 19 of Federal Law No. 4468-1 of 1993 specifies the conditions for receiving the type of payment in question:

- loss of ability to work must occur while the citizen is performing military service or within a three-month period after dismissal;

- a person may be recognized as disabled later than the specified period, but the reason for this is an illness acquired in the service.

There are two groups of generals recognized as disabled who receive these payments.

Their sizes vary:

- persons who, during their service, received the status of a disabled person, but the disease that became the cause is not associated with official duties;

- receipt of disability is associated with participation in hostilities or other operations where a person took part due to the performance of official duties.

Benefits are provided not only for the retired general, but also for his family. You can take advantage of these benefits after the death of a military personnel.

Minimum amount of disability benefits for a general

Minimum values of payments due to citizens who retired with the rank of general have been established.

Military personnel of such high rank receive the following amounts:

- if the disability occurs as a result of an injury received during service, then the amount ranges from 175 to 300% of the salary (the amount will be from 57,700 to 99,000 thousand rubles, this is influenced by the disability group);

- if the cause of disability is a disease acquired in the service, then the value will be from 150 to 250% (from 49,500 to 82,500 rubles).

In the latter case, the size is influenced by the established disability group. It is determined in accordance with the ITU resolution.

By old age

If a citizen who received the rank of general during military service decides to go to civilian work, then he retains the right to receive insurance benefits upon reaching a certain age. The average pension specifically depends on the number of years of service (insurance period).

If a person has held a commanding position in a military unit for thirty years, then the amount of payments will be 52,500 rubles.

To receive insurance benefits, a person must meet the following conditions:

- be in the age category of 60 or 65 years;

- compulsory insurance in the pension system;

- availability of insurance experience;

- assignment of payments through the Ministry of Defense;

- accumulated points.

The age criterion depends on the gender of the officer. For males this is 65 years old, for females - 60.

Military pensioners for Russia and its armed forces

The period for indexing pensions for working pensioners after dismissal has been reduced from 3 to 1 month. Indexation of pensions for this category is frozen until 2020.

In what cases is the amount of payments increased? For persons who have retired from service, the law provides for additional allowances when calculating payments.

It is impossible to say specifically what size of pension a retired lieutenant colonel will have in 2020, because for each individual case the rate will also be different. But we cannot fail to mention that a high rank has a positive effect on its size.

- conducting combat operations in hot spots;

- participation in special or anti-terrorist operations;

- serving in fire and police structures;

- experience in special authorities;

- service in the Ministry of Defense.

In this case, promotions that were awarded for special conditions of service are not taken into account. The resulting amount is multiplied by 69.45%.

According to the planned changes to the Law of the Russian Federation “On pension provision for persons who served in military service...” from January 1, 2012, not the entire specified pension base will be taken into account, but only 54% of this amount.

Dmitry Aleksandrovich Egorov has been performing official duties in the Ministry of Internal Affairs for 25 years. This entitles him to receive military payments. After passing this bar, the serviceman decides on further military service, taking into account the fact that he has already earned a pension, and it will be paid to him for life.

Length of service in the FSB for pension 2020

No matter how strange the ideas discussed at NIFI may seem, they are worth listening to.

After all, as indicated on the website of the Ministry of Finance, among the tasks and functions of this institute is the development of the theory and methodology of financial management, forecasting, planning, preparation and execution of the federal budget, the preparation of proposals and recommendations for improving budget legislation. In other words, the developments of NIFI in the form of a bill may go to the table of the head of the Ministry of Finance, Anton Siluanov.

We are talking about monetary allowances for military personnel, private and commanding officers of internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, and persons serving in institutions and bodies of the penal system. According to the norm, the effect of which is suspended, the specified monetary allowance is taken into account when calculating the pension from January 1, 2012 in the amount of 54 percent and, starting from January 1, 2013, increases annually by 2 percent until it reaches 100 percent of its amount. The adoption of the law was due to the fact that the total amount of expenses provided for by the law on the budget for 2020 - 2020 is insufficient to financially support the spending obligations of the Russian Federation established by law. Inflation indexation from October 1, 2020 is promised to be 4.66% (Total 66.78%)! Included in the calculator.

Military pensions from 2020 - calculation of pensions for military pensioners

The salary depends on the position, and the final amount of payment is calculated from it, taking into account inflation factors, length of service and other things.

where the Base is the sum of official salaries and salaries according to a specific rank, as well as bonuses for length of service. Next, an adjustment takes place taking into account regional coefficients, depending on the place of service.

A retired soldier retires from the position of platoon commander, with a salary of 20 thousand.

“On amendments to certain legislative acts of the Russian Federation”

persons specified in Article 4 of this Law who served in military service, service in internal affairs bodies, bodies for control over the circulation of narcotic drugs and psychotropic substances and institutions and bodies of the penal system in other states, and the families of these persons - provided that treaties (agreements) on social security concluded by the Russian Federation or the former USSR with these states provide for the implementation of their pension provision in accordance with the legislation of the state in whose territory they live; b) for persons who performed military service as officers, warrant officers and midshipmen or military service under contract as soldiers, sailors, sergeants and foremen in the Armed Forces, the Federal Border Service and border service bodies of the Russian Federation, internal and railway troops, federal bodies government communications and information, civil defense forces, federal security service (counterintelligence) and border troops, foreign intelligence agencies, other military formations of the Russian Federation and the former USSR and in institutions and bodies of the penal system created in accordance with legislation, in United Armed Forces of the Commonwealth of Independent States, on private and commanding personnel who served in the internal affairs bodies of the Russian Federation and the former USSR, agencies for control of the circulation of narcotic drugs and psychotropic substances, in the State Fire Service and in institutions and bodies of the criminal executive system, and the families of these persons who live in states - former republics of the USSR, which are not members of the Commonwealth of Independent States, if the legislation of these states does not provide for the provision of their pensions on the grounds established for persons who served in military service, service in internal affairs bodies, and their families.

per year, if we are talking not only about military personnel, but also employees of law enforcement agencies and the penal system, security and foreign intelligence services, fire departments, investigators, prosecutors, and so on. Currently, a military pension is assigned to persons who, on the day of dismissal, have had at least 20 years of service in the law enforcement agencies.

In addition, those dismissed upon reaching the age limit, health conditions or in connection with reorganization and who have reached the age of 45 on the day of dismissal, having a total work experience of more than 25 years, of which at least 12 years and 6 months are service in law enforcement agencies.

In an interview with Nezavisimaya Gazeta, experts were skeptical about such proposals from the Ministry of Finance.

We've finally sorted out military pensions! »

Silence No. 2. Chairman of the State Duma Committee on Defense United Russia Viktor Zavarzin: “Currently, the state is paying the MOST CAREFUL ATTENTION to the issues of social development of the army.

Benefits for FSB pensioners based on length of service

Employees of the Federal Employment Service retire under different conditions from most citizens. In this case we are talking about state pension provision.

Retired colonel's pension

The amount of allowance depends not only on the rank, but also on the position. Interest is added to the amount for special conditions of service, complexity and tension, etc. Additional payments are provided for the availability of awards.

Promotion in 2020

Since January 2020, the increase in pensions of FSB military personnel has amounted to 4%. The same growth is expected in the next two years. The federal budget has already allocated funds for the implementation of the program. On average, lieutenants receive 2-3 thousand more than last year.

Thus, for the Federal Security Service, as representatives of the law enforcement bloc, special rules for processing pension payments have been established. Their calculation procedure depends on the length of experience or service life, various percentage allowances.

In general, the only limitation - the maximum age for service - can be increased with efficiency, which also helps to increase the future pension.

Length of service in the preferential calculation of the FSB

Source: https://idatenru.ru/pensija/vysluga-let-v-fsb-dlja-pensii-2019-god