How does the IPC value affect your pension?

Keep in mind that in addition to the IPC, a number of other factors and indicators influence the amount of the insurance pension. The formula looks like this:

SSP = FV x PC1 + IPTot. x RVPB x PC2 + SNP , where:

- SSP – the amount of the insurance pension.

- FV – fixed payment. Its size is reviewed annually on January 1. The base value in 2020 is RUB 5,334.19. For some categories of applicants the figure is different. So, for example, for disabled people of group I or people over 80 years old, the PV doubles (10,668.38 rubles). If the applicant has one parent who has died and receives a survivor's pension, the PV will be only half of the base value (RUB 2,667.10).

- IPKobshch. – the total number of points accumulated by a citizen on an individual personal account (IPA) for the entire period of official employment and non-insurance periods.

- RVPB is the ruble expression of one pension point. The value is set annually on January 1 and is the same for all recipients of insurance pensions. From 2020, 1 PB is equal to 87.24 rubles.

- NPP is the funded part of the pension. It is determined if the future pensioner participated in its formation.

- PC1 and PC2 are increasing coefficients. They apply if the pension was assigned at the personal request of the citizen later than the time established by law. When entering a well-deserved retirement, in accordance with the law, the value is applied equal to 1.

Pension points are used to calculate all types of insurance pensions (age, survivor, disability). They directly affect the final payment amount. The greater their number, the higher the pension size will be.

Anyone can independently increase their own income in old age by forming a funded pension in the pre-retirement period. The employer can do this for him. The money is placed in a state or non-state pension fund at the discretion of the investor. The final amount of payments is affected by the amount of funds accumulated in the personal account.

Minimum number of pension points

The possibility of receiving an insurance pension from the state depends on the minimum number of pension points earned over the years of work. If a person has earned less than the established value in total for his official work activity, he will only be assigned a social old-age pension.

In 2020, the minimum IPC was 6.6. Its importance increases every year. The growth step is 2.4. By 2025, the minimum should reach the final value of 30 points:

- 2019 – 16,2;

- 2020 – 18,6;

- 2021 – 21;

- 2022 – 23,4;

- 2023 – 25,8;

- 2024 – 28,2;

- 2025 – 30.

Maximum pension coefficient

For each year, the maximum annual IPC is determined for calculating the pension. A person will not be able to be awarded more than the maximum value, although salary affects the number of points earned.

The maximum pension ratio in 2020 is 9.13. From 2020 it will increase to 9.57. Starting in 2020, the maximum IPC will be 10 PB. The limit value is also influenced by the fact of formation of the funded part of the pension. If a citizen decides to take this step (there is a moratorium until 2020 - all points are credited to the insurance), the maximum individual coefficient for a calendar year cannot exceed 6.25.

- Funeral benefit: amount of payments

- Adjika recipe for the winter

- Jellied in eggshell - how to cook according to step-by-step recipes with photos

The influence of the IPC on the size of the pension

According to the requirements of the legislator, all Russian citizens engaged in working activities must register in the national system of compulsory pension insurance.

Since 2020, after the implementation of the above-mentioned legislative changes in the field of pension legal relations, the pension has been divided into 2 parts: insurance and funded.

In Article 8 of Law No. 400-FZ, which regulates the procedure for assigning old-age insurance pensions to citizens, the legislator provides conditions for processing this type of pension payments. Thus, a working citizen will have the right to apply for old-age insurance pension payments only when the following 3 conditions are met:

- the achievement by a citizen wishing to receive a pension of a legally defined retirement age (60 years for male citizens and 55 years for women);

- having at least 15 years of work experience;

- having a minimum IPC of 30 points (from 2025).

The legislator provided for the gradual implementation of pension reform, fixing transitional provisions in Article 35 of the above-mentioned law. In the current 2020, pension payments are assigned if a person of retirement age has 9 years of insurance experience and a minimum of 13.8 IPC.

Thus, today the IPC plays a very important role in determining the right to pension transfers, and also directly affects their size. The amount of such pension points that a working citizen can accumulate in a calendar year is determined on the basis of the size of his official salary and the insurance contributions paid by the employer.

Accordingly, the size of future pension payments directly depends on the amount of insurance contributions transferred by the employer for officially employed employees. This means that the higher the size of a citizen’s official (so-called “white”) salary, the higher the size of the insurance premiums paid under compulsory pension insurance, and, consequently, the greater the future insurance pension of this employee.

Each IPC point has a certain value, which is regularly indexed together with other payments. All pre-reform pension rights previously earned by citizens are also subject to conversion into pension points and taken into account when assigning payments to a pensioner.

Increase in pension points

Citizens can increase the number of PBs. This is possible if the individual pension coefficient for calculating the pension is less than the required value. Self-employed citizens can also take advantage of the offer. There are two main ways to increase the IPC value:

- Receive missing points through additional monthly deductions. You can pay contributions for yourself or for another person.

- Provide the Pension Fund with documents on unaccounted length of service and non-insurance periods.

Increasing factor

The value of the bonus coefficient is determined by law. It has different meanings for PV and IPC. Its value is influenced by the time of going on vacation - ahead of schedule or on a general basis. The premium coefficient is applied if two main conditions are met. A citizen needs:

- Go on vacation later than the generally established period (at least 1 year).

- Refuse to grant a pension. They will only pay wages at the place of work.

Depending on how many years a person will continue to work without receiving a pension, the value of the pension coefficient will differ:

Upon retirement on a general basis

- 1 year – 1.07;

- 2 – 1,15;

- 3 – 1,24;

- 4 – 1,34;

- 5 – 1,45;

- 6 – 1,59;

- 7 – 1,74;

- 8 – 1,90;

- 9 – 2,09;

- 10 and more – 2.32.

If you have the right to early retirement

- 1 year – 1.046;

- 2 – 1,10;

- 3 – 1,16;

- 4 – 1,22;

- 5 – 1,29;

- 6 – 1,37;

- 7 – 1,45;

- 8 – 1,52;

- 9 – 1,60;

- 10 and more – 1.68.

How to buy pension points

Citizens who have an insufficient coefficient of pension points have the right to “purchase” additional pension points. The order of registration is as follows:

- Contact the customer service of the territorial branch of the Pension Fund of Russia.

- Find out the missing value of the individual coefficient for calculating pension payments.

- The specialist will calculate the minimum monthly payment amount.

- Read the information. If desired, adjust the number upward.

- Conclude an agreement to independently pay insurance premiums.

The amount to be paid is calculated individually taking into account the missing points. The minimum wage (minimum wage) is used as the calculated value. The citizen independently determines the amount he plans to transfer as insurance premiums. The minimum annual threshold for 2020 is RUB 29,779.20. Funds are transferred monthly until December 31, and they will be displayed on the ILS no earlier than March of the next year.

Calculation of insurance pension

The IPC is directly related to the calculation of the amount of the insurance pension, which today is calculated according to the following formula:

insurance pension = IPC * SIPC + FV

This formula uses the following values:

- IPC is the individual coefficient of pension points earned by a citizen applying for pension payments for the entire period of his working activity;

- SIPC - the cost of one pension point (IPC), taking into account the indexation;

- FV - payment of a fixed amount.

According to Russian pension legislation, the cost of an IPC point, as well as a fixed payment, are subject to annual indexation by the state. Since the beginning of 2020, the SIPC amounted to 81.49 rubles, and the fixed pension payment was 4982.9 rubles.

Accordingly, the amount of insurance pension payments in the current year is established according to the formula:

insurance pension = IPK * 81.49 + 4982.90 (rubles)

In addition, for each year of later initiation by a citizen of the assignment of pension payments to him after his rights to an old-age insurance pension arise, the amount of payments is subject to increase by the corresponding premium coefficients.

How to calculate the individual pension coefficient

There is a method that allows you to independently calculate pension points. Please note that the amount received will be indicative only. Only a PFR specialist can determine the exact number of PBs after studying the information in the citizen’s payment file.

When calculating IPCtot. Different algorithms are used depending on the reporting periods:

- Until 2002

- From 2002 to 2020

- From 2020

- Non-insurance periods.

The pension coefficient for the entire working life can be calculated using the formula:

IPKobshch. = IPK2002 + IPK (2002–2015) + IPK2015 + IPKnon-insurance.

- Find a person by phone number

- How to make zucchini pancakes

- Cucumber and onion salad for the winter

Calculation of IPC until 2002

The number of pension points accrued to a citizen during Soviet times until 2002 is calculated using the formula:

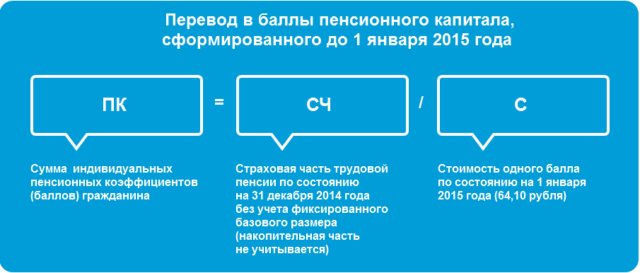

IPK2002 = RPK / SPK2015 , where:

- RPK – estimated pension capital;

- SPK2015 – the cost of one pension point as of January 1, 2020 (64.10 rubles).

To calculate the RPC, you need to know a number of special indicators that directly affect the final amount:

- Determine the experience coefficient (SC). With a total work experience of 25 years for men and 20 years for women, it is 0.55. For each year above the established standard, 0.01 is added. Regardless of the result, the maximum should not exceed 0.75.

- Calculate the average earnings coefficient (AEC). To do this, take the average salary for any 60 consecutive months, or for 2001–2002, after which the value must be divided by the average monthly salary in Russia for the same period of time. The limit value is limited to 1.2. For “northerners” it varies in the range from 1.4 to 1.9.

- Calculate the estimated pension (RP).

SC is 0.55 . For men, the formula is used: RP = (SC x KSZ x 1671 - 450) x (duration of employment in years before 2002 / 25). For women - RP = (SC x KSZ x 1671 - 450) x (length of service in years before 2002 / 20). The minimum value (SC x KSZ x 1671 – 450), regardless of the result, is taken as 210.

SC is greater than 0.55 . RP = SK × KSZ × 1671 – 450. Regardless of the result, the minimum value is 210 rubles.

- Valorization, or the process of one-time increase. 10% is added to the result obtained if the applicant did not work before 1991. If before this year a person was officially employed, for each full year of experience he will receive an additional 1% of the amount.

- Define PKK. The amount obtained from the above calculations is multiplied by 5.6148 - the product of the annual indexation coefficients from 2002 to 2014.

Determination algorithm from 2002 to 2014

The number of PBs for a period is calculated using the formula:

IPC (2002-2015) = PC / 228 / 64.10, where:

- PC – pension capital. It refers to the amount of insurance premiums transferred by the employer for the employee from 2002 to 2020. You can find out by contacting the Pension Fund yourself, by creating a request in your personal account on the fund’s website or on the State Services portal. The ILS extract will contain figures without taking into account indexation. Before adding them up, the amounts must be multiplied by the appropriate coefficient: 2014 – 1.083;

- 2013 – 1,101;

- 2012 – 1,1065;

- 2011 – 1,088;

- 2010 – 1,1427;

- 2009 – 1,269;

- 2008 – 1,204;

- 2007 – 1,16;

- 2006 – 1,127;

- 2005 – 1,114;

- 2004 – 1,177;

- 2003 – 1,307.

Please note that the ILS is data not only on accumulated individual coefficients, but also on length of service, earnings and insurance premiums that have been accumulated at the moment. Each account has its own unique number. It matches the 11-digit SNILS number.

After registration with the Pension Fund, all information about the duration of employment is confirmed by insurance premiums. If they did not enter the Pension Fund, then their length of service is not taken into account when assigning a pension. You can confirm the transfer of funds with a salary certificate, archival and bank statements.

Calculation formula from 2020

After the pension reform in 2020, the system for determining pensions changed. All insurance contributions are immediately converted into points. You can find out their number for the current year on the Pension Fund website. To do this, use an online calculator. The only parameter you need to enter into it is the amount of the average monthly salary before taxes.

Experience has no effect on the size of the individual coefficient. IPC is calculated using the formula:

IPK2015 = SV / NRV x 10

- SV – amount of contributions;

- NRV is the standard amount of contributions to the insurance pension, which is 16% of the maximum contributionable annual salary. Its size is set annually: 2020 – 1,150,000 rubles;

- 2018 – RUB 1,021,000;

- 2017 – RUR 876,000;

- 2016 – RUR 796,000;

- 2015 – 711,000 rub.

Pension points for non-insurance periods

The time when a citizen did not work due to objective circumstances is considered a non-insurance period. For each full year, 1.8 points are awarded on the HUD. These include:

- compulsory military service in the active army;

- caring for a disabled person of group I or a disabled child;

- care for an elderly person who has reached the age of 80;

- detention if the person was subsequently rehabilitated;

- being in the status of unemployed with registration at the labor exchange;

- participation in paid public works;

- moving with a military spouse to an area where it is impossible to find employment in your specialty (maximum 5 years);

- living abroad with a diplomatic spouse (no more than 5 years);

- temporary disability if compulsory social insurance benefits are paid;

Maternity leave to care for a child until he reaches 1.5 years of age is also considered a non-insurance period. The maximum duration is limited to 6 years - caring for 4 children. The number of PBs is influenced by birth order. For each full year you are entitled to:

- 1.8PB – when caring for the first;

- 3.6PB – behind the second;

- 5.2PB – behind the third and fourth.

Pension reform

Since 2001, Russia has been gradually moving to a mixed savings system. When determining the amount of payment, the IPC is used - the individual pension coefficient, the calculation of which will be presented below. The pension itself now consists of the following parts:

— insurance, in the calculation of which the IPC is applied;

— accumulation payment.

Individual rules for calculating pension savings are provided only for persons:

- those who have reached 80 years of age;

- living in the Far North;

- disabled people of group 1.

Under the new scheme, pensioners have to choose between benefits and salary. The reform is designed in such a way that for 12 months of work, a pensioner can increase the amount of payment by 17%. This will encourage future retirees to continue working as long as possible. At the same time, the law establishes some restrictions. It makes no sense to work for more than 10 years, since the additional coefficient will not change.

What is IPC?

The IPC is a special coefficient that is obtained by summing up all the insurance points that a person has earned during the working period. Also, the overall size of the IPC is indirectly affected by length of service, type of work and some other parameters. Some unemployed citizens may also be assigned insurance points:

- Caring for a child up to 1.5 years old.

- Urgent army service.

- Caring for a disabled person.

- A period of stay with a military spouse in places where, due to objective reasons, it is impossible to find work.

- Accompaniment of a diplomat's spouse abroad during his service.

All pension savings that were transferred to the Pension Fund before 2015 were converted into insurance points according to a special formula. After 2020, the size of the IPC is calculated based on the amount of contributions to the Pension Fund using the following formula: IPC = (FKPO/MKPO) x 10. Explanation:

- FKPO - the actual amount of pension contributions. This value represents the entire amount of money that you transferred to the Pension Fund during your work.

- MKPO - maximum number of pension contributions. This value represents the entire amount of money that you could contribute to the Pension Fund if you received the maximum salary. The maximum salary is indexed every year taking into account inflation, and in 2020 it is 1,051,000 rubles, in 2020 - 876,000 rubles.

- 10 is a correction factor that must be multiplied by at the end to get the total number of IPC points.

You should also remember that the total number of insurance points should not exceed a certain limit. The threshold limit is revised every year in accordance with the pension reform plan, and in 2020 a person can earn a maximum of 8.7 pension points. If, after calculation, it turns out that the pension amount is less than the subsistence minimum, then such a person is also entitled to a social supplement.

The concept of IPC

In 2020, after retirement, a new type of calculation of pension accruals was offered to individuals. The central part of such a system is the individual pension coefficient. The concept of IPC is defined at the legislative level. This is the figure used to calculate pension benefits. Its value is determined on the basis of annual coefficients, information about which is obtained from the results of an assessment of the average wage of an insured citizen.

Each pensioner can independently calculate the value of the IPC; for this it is necessary to use a special formula. It is planned that by 2021 this individual indicator will have a maximum score of 10 points. Nobody talks about 50 points, upon reaching which a person can count on pension benefits.

Submission by a pensioner of an application to the Pension Fund of the Russian Federation means the person’s desire to apply for a pension and that he has the necessary work experience, which gives him the right to receive support from the state.

New calculation formula

The modern formula for calculating a long-service pension is a rather impressive combination:

SP = IPC * SIPC * K + FV * K

Let's look at what each of the elements means separately.

- IPC – summarized pension points.

- SIPC displays the value of the individual pension coefficient.

- K denotes bonus multipliers set to incentivize a person to work as long as possible.

- FV is an amount fixed by the government (regulated by the Federal Law “On Insurance Pensions”).

At first glance, it often seems to many that calculating a pension based on points is extremely difficult and incomprehensible. But if you study each of the above-mentioned concepts separately, it becomes obvious what is calculated and how. Therefore, in order to know how to calculate the indicator and how the means are calculated, let’s get acquainted with each element of the formula in more detail.

Pension coefficient (PC) and its meaning

The pension coefficient is a specially established value that for each pensioner depends on his contributions paid for him by official employers. It is the use of this kind of coefficient when calculating pensions that is considered an innovation proposed by modern innovations. As a result, many are now interested in the question of their number of pension points, how and where they can look it up.

We will now tell you how to calculate the individual pension coefficient, but first, please note that the accruals of interest can be divided into 2 halves:

- insurance;

- cumulative.

The first is considered mandatory for everyone; it consists of funds accrued by employers. When calculating pension payments, the worker’s age is taken into account. Thus, it can be obtained only after reaching the age requirements required by the standards (55 for females and 60 for males). To calculate a pension based on length of service, you must have at least 10 years of work experience. activities behind you. But every year the time period under consideration will increase by another year.

The second half is created according to the will of the person, by reducing payments to the Pension Fund of the Russian Federation. Such money is accumulated in non-state funds, and when and how to spend it is determined by the payer himself.

To account for the accrual of pension points for persons over 14 years of age, a special personal account (SNILS) is created.

The calculation of the pension accrual coefficient is carried out annually. When a person resigns, all the data they have is added up. At the federal level, maximum limits are defined that cannot be exceeded. So, there are the following coefficients by year:

- 2015 – 7,39;

- 2016 – 7,83;

- 2017 – 8,26;

- 2018 – 8,70;

- 2019 – 9,13;

- 2020 – 9,57;

- 2021 – 10.

10 is the largest multiplier that will continue to function in the future. For those who are interested in how to find out pension points and their number, you should note that for the calculations, a salary is taken that does not exceed 80% of the national average. Therefore, if income exceeds this indicator, they are not taken into account when the question arises of how to calculate the specific number of pension points available to an individual person.

IPK. What is it and what are its features

What is an IPC for calculating a pension - we have decided. It refers to the points that a person has accumulated over all his years of working life. Now let’s look at how to calculate such points for a pension.

IPC value

It is quite possible to determine the value of the individual pension coefficient using the following formula:

IPC = SV / SVmax x 10

SV means fear. contributions made by the employer, and CBmax means the highest amounts of such contributions. Every year there is an increase in the limit indicators.

When calculating insurance pensions, it becomes clear to everyone how important it is to have officially registered employment and “white” earnings. After all, the higher the salary, the greater the deductions and, consequently, the amount of further payments. Moreover, it is easier to find out the exact amount of your earnings, and knowing it, it will not be difficult to calculate the points received.

PC cost in 2020

According to the generally accepted rule, the value of the multiplier is indexed. As a rule, this procedure is carried out in early February, taking into account the amount of inflation recorded in the previous year. If there are additional funds, another indexation can be carried out in April.

This year, indexation was carried out earlier – in January. The cost of the coefficient was indexed by 7.05%. Now one coefficient for identifying length of service will be equal to 87.24 rubles. However, it must be taken into account that this kind of indexation did not affect working pensioners. For them, upon reaching retirement age, the IPC is frozen.

How to increase your IPC

The pension coefficient is calculated taking into account the time frame when the person was involuntarily disabled. This includes, for example, maternity leave. Thus, women receive points for four children inclusive. For the first, 1.8 is awarded, for the second and third, 3.6, and for the fourth, 5.4. The time spent in the army is also taken into account. Military service is equivalent to 1.8, as is caring for a sick relative or representative with 1st disability group.

You can increase the number of your points by delaying the end of work. activities. For each subsequent year of work after the moment when the person has already received the right to retire, an increased multiplier is accrued.

How to calculate pension point

When determining how the score is calculated, such influencing factors as the pensioner’s date of birth are taken into account, as well as whether there were breaks in his work activity. The total length of service can consist of three time periods:

- until 2002 (experience and salary for 2001–2002 are taken);

- from 2002 to 2014 (they take insurance savings);

- from 2020 (calculations are made using the above formula).

The total multiplier is determined as the sum of points awarded until 2020, as well as in all subsequent years.

Features of calculating pensions using IPC

When calculating a pension based on points, 3 elements are taken into account:

- personal score;

- unit cost;

- fixed bonus.

The purpose of payments under the IPC may include:

- information until 2020;

- the amount accrued after 2020;

- coefficients of time periods that were not considered insurance.

The final result also becomes greater if the conversation about calculating a pension did not start immediately after such a right arose, and the person continues to work. Points should be calculated taking into account indexation, which is inextricably linked with inflation processes.

Now many residents of the Russian Federation are faced with problems of recording earnings in the 90s. Back then, unaccounted salaries were common, and deductions were not made. Be prepared that if you ask the fund how to check the calculation of pensions by the pension authority, they will tell you that only those periods of a person’s working life that are included in the work book will be taken into account. If such a check shows that there is no evidence base, the state has the right not to take such work into account.

It should also be noted that for the calculation process there is not only a maximum, but also a minimum annual score. If a smaller number is collected than established in the standards, citizens are denied a pension. For calculations, the ratio of a person’s income to the average monthly earnings in the state is found.

Calculation example

Knowing all the components will help in calculating your old-age pension. For better clarity, let’s consider one such example of calculation in practice. Let’s imagine that a person has accumulated 50 points until today, while he has a minimum pension coefficient. Then his allowance this year will be: 50 × 87.24 + 5334.19 = 9696.19 rubles. Bonus coefficients, as well as a guaranteed fixed payment, can also be added to the amount received.

Premium odds

Such indicators are used to encourage people to stay in their jobs longer, since the rule here is: the longer you work, the higher your pension will be in the future. It was previously mentioned that every year it increases up to 10 years of work in case of retirement age.

Fixed payment amount

A fixed payment is a guaranteed amount that is added to the pension by the state. Its indicator is officially determined by standards and also changes every year. It is not affected by the size of a person’s monthly salary, so all pensioners can apply for such an additional payment. In addition, in cases provided by law, this amount may be increased. The reason for this may be:

- the person has disabled dependents;

- confirmation of disability group 1;

- the onset of 80 years;

- 15 years of experience in the Far North;

- retirement later than the standards allow.

How to calculate your old age pension yourself

Let's look at step-by-step instructions on how to carry out the entire procedure in question yourself.

- Initially, you should calculate your pension points based on known income.

- If the work process ends later, the coefficient that is added for a later retirement should be applied.

- The cost of one coefficient should be multiplied by the number of points.

- We add a fixed payment to the resulting figure.

It is worth taking into account that many indicators in the formula are not constant, they change annually, so you need to take into account only current information.

There are also online calculators on the Internet that allow you to independently calculate payments without leaving your home. But to do this you need to know all the required data.

Pension calculator

It was mentioned earlier that there are various calculators on the Internet that can help you calculate your future payments. For this purpose, you will need to fill out special cells in which you should indicate:

- floor;

- date of birth;

- How many children;

- the duration of the non-working period counted towards the length of service;

- How many more years does a person plan to work after receiving the right to retire?

You can find out how to calculate your length of service for a pension on the Pension Fund website here https://www.pfrf.ru/eservices/calc/