What taxes do old-age pensioners not pay?

Tax benefits for Russian old-age pensioners are provided at two levels – federal and regional/local. For this reason, the list of persons of retirement age entitled to tax relief will be different, depending on the specific locality and social legislation for a given subject of the federation. Old-age pensioners are exempt from the following fiscal payments:

- transport;

- land;

- property;

- income.

Federal benefits

Current legislation provides federal tax benefits for old-age pensioners in several areas. These include tax breaks:

- Land and transport - federal legislation defines some preferential categories, which are specified at the regional level;

- Property - applies to all pensioners when purchasing real estate and is equal to 13% of the amount of wages received for the last three years of work;

- Income – concerns the exemption of pensions (and some other payments) from personal income tax (NDFL).

Tax exemption for pensioners at the regional level

The two-tier system of benefits for pensioners implies that the basic definition of the categories of persons who are entitled to tax breaks is determined by federal law. And regional authorities, if possible, expand and supplement this list, adding new conditions and categories of tax beneficiaries. The number and size of regional benefits is regulated by two factors:

- The level of well-being of the subject of the federation - in donor regions, social policy is much more developed than in unprofitable regions and republics;

- The attitude of local authorities to social problems - often regional heads do not pay enough attention to social programs, preferring the support of businessmen or promising politicians.

The easiest way to find out tax benefits for old-age pensioners for a specific region is to look at the website of the Federal Tax Service (FTS). If we take the situation as a whole, it concerns two types of payments:

- Transport - according to Article 357 of the Tax Code (TC), each subject of the federation has its own circle of beneficiaries;

- Land - in accordance with Article 387 of the Tax Code of the Russian Federation, preferential categories can be formed for each municipal entity.

Tax benefits for early retirement - how to apply for and receive

A citizen must visit the Federal Tax Service with a package of documents confirming his right to receive preferences. The subsidy cannot be transferred to a third party, i.e. it can only be issued on behalf of the beneficiary. The procedure for applying for any tax benefit for pensioners:

Are there benefits for those who took early retirement?

- disability payments;

- early pension payments;

- insurance state compensation;

- funded pension;

- financial assistance from your last place of work;

- money and things received as gifts;

- vouchers for sanatorium and resort treatment paid for by third parties.

This is interesting: Payments at the birth of a child

The legislation of the Russian Federation defines both types of support measures and categories of citizens who can use certain options. An important factor is a person’s place of residence, since some support measures are regulated at the subject level.

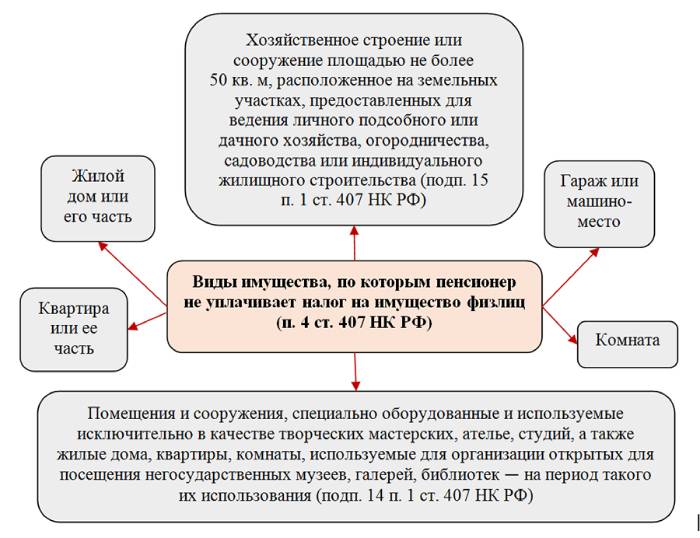

Property tax benefits

The Tax Code establishes that pensioners are exempt from paying taxes on property owned by them (this includes different categories of real estate - apartments, houses, other buildings and structures). It is important that from 2020 the relief applies only to one real estate of each type - a pensioner is allowed to simultaneously apply for a tax break for one apartment, garage and residential building if they are his property. If an elderly person owns, for example, two apartments, the benefit will not apply to the second.

According to the law, the owner of several similar properties must notify the tax office by November 1 which of them the benefit should be directed to. If this does not happen, then the Federal Tax Service chooses the option with the largest tax amount to apply the relief. The legislative limitation on the number of objects that are subject to tax breaks for pensioners is caused by the desire to limit the possibilities for abuse, when apartments and houses were transferred to persons of retirement age in order to take advantage of existing breaks.

Who is entitled to

The categories of recipients of benefits for property tax payments include both working and non-working pensioners. It is mandatory to fulfill each of the following conditions:

- The property was registered in the name of the pension recipient.

- This property was not used for commercial activities.

- The maximum cadastral value of an object is 300 million rubles (if higher, then tax must be paid).

A citizen of retirement age who wants to take advantage of fiscal preferences must have documentary evidence of compliance with these conditions (for example, an extract from the unified real estate register) and present them to tax officials.

Objects of preferential taxation

The Tax Code contains a list of real estate objects to which a pensioner's right to fiscal benefits applies. This list includes:

This is interesting: Additional payment to pensioners for more than 40 years of service

- apartments;

- separate rooms;

- non-residential premises for professional creative activities (for example, studios or exhibitions);

- private houses;

- garages;

- outbuildings for farming (for example, barns or warehouses);

- residential properties under construction.

Tax deduction for the second object

Pensioners often confuse the tax benefit for a second piece of property (to which they are not entitled) and preferences when purchasing real estate (to which they are entitled). A pensioner can receive such a deduction in accordance with Article 220 of the Tax Code of the Russian Federation when purchasing an apartment, room, building a house, etc., but only on the condition that no more than three years have passed since retirement. This opportunity appeared in 2014, but it requires two conditions to be met:

- You can apply for a repeated deduction only once;

- the total amount of the tax base should not exceed 2 million rubles (regardless of the number of square meters).

Property tax for retirees

According to Article 407 of the Tax Code of the Russian Federation, women over the age of 55 and men over 60 should not make property payments. It doesn't matter whether they work or not. Only a person is obliged to come to the tax office himself, show his identification and write an application in order to be exempted from payments - otherwise notifications about their need will continue to appear.

- How to cleanse your body of toxins

- Treatment of pulmonary tuberculosis

- How to lose weight in your face so that cheekbones appear. What to do to make your face thinner

The benefit applies to all types of real estate:

- Houses, apartments, garages, dachas.

- Unfinished architectural objects, utility buildings (no more than 50 m2), places for storing cars.

The main condition: the property must be owned in a single copy. If a pensioner has 2 apartments, he will pay for 1 of them. Until November, a person must submit an application indicating for which property he wants tax exemption. If this is not done, the state itself will decide for what to take interest.

A pensioner who buys real estate (house, apartment, land with a residential building) is also provided with tax benefits if he continues to work. A person submits an application to receive a deduction at a rate of 13% of income for 3 calendar years. The refund amount cannot exceed 2 million rubles for finished housing and 3 million for housing under construction.

Land tax preferences for old-age pensioners

The object of taxation in this situation is the land plot owned by the citizen. Such an allotment happens:

- country house;

- homestead;

- housing;

- agricultural.

In 2020, legislative changes were adopted at the federal level, according to which recipients of old-age pensions entered the preferential category, for which land taxation is carried out at a reduced rate. The amount of the reduction is equal to the cadastral value of 600 square meters of land they own, which means that people of retirement age will not have to pay for plots of 6 acres or less.

Land tax falls under the competence of local authorities, therefore, in different regions of Russia, benefits for persons on well-deserved retirement vary. For example, in St. Petersburg, Tomsk and Rostov-on-Don, the maximum size of a plot exempt from taxation is 25 acres. Pensioners of Novosibirsk, with a plot of more than 6 acres, have a preference of 50% of the amount of accrued payments. But elderly people in Moscow, Ufa and Krasnoyarsk do without additional concessions.

What taxes are pensioners exempt from in 2020 - old age, labor veterans, what payments?

For example, in the Astrakhan region, since 2020, labor veterans have been paid a monthly allowance for the subscription fee for using the telephone in the amount of 182.63 rubles (Resolution of July 3, 2020 N 219-P), and in Moscow the amount of compensation is 230 rubles. per month (clause 4.2.

This is interesting: Okopf 12165 or 12300 for LLC

Benefits for pre-retirees

The main condition for the provision of a subsidy is that the pensioner does not have any debt on payment for housing and utilities, and if such debt does arise, the pensioner will be required to enter into an appropriate agreement on the procedure and timing of its repayment.

According to current legislation, every citizen of the country, if he has an object of taxation, must pay one or another tax. Persons who have retired and no longer work receive incomes that differ greatly from the remuneration under the employment contract. Therefore, the state provides tax benefits for certain categories of pensioners.

Tax benefits for pensioners on transport tax

According to the Tax Code of the Russian Federation, this type of tax belongs to the regional category. It is paid by the owners of vehicles - cars, motorcycles, scooters, boats, snowmobiles, etc. A person of retirement age is exempt from taxation if his car:

- equipped for use by people with disabilities;

- received from the social security authorities and the engine power is no more than 100 horsepower (hp);

- boats with motors up to 5 liters. With.;

- agricultural machinery.

Transport tax is established at the regional level, so the conditions for benefits in the regions of Russia differ. Subjects of the Russian Federation independently decide whether the preference will be applied on their territory. If a tax break is adopted, regional authorities determine the vehicle engine power indicators for which preferential taxation is provided. The table shows the situation with transport tax benefits in some Russian cities:

Conditions for granting transport tax benefits

The rate is 20% of the base rate, with a maximum engine power of 150 horsepower

No benefit provided

Cancellation of taxes on one Russian or Soviet-made car, up to 150 hp.

Peculiarities of calculating personal income tax for old-age pensioners

In accordance with Article 217 of the Tax Code of the Russian Federation, 13 percent personal income tax is not levied on pensions, so old-age pensioners do not pay it. For this reason, they cannot receive a tax deduction if they paid for medical services or sanatorium treatment. But this situation does not apply to working pensioners who pay personal income tax from their salaries and can receive tax benefits.

A non-working person of retirement age may have additional income (for example, from renting out an apartment and other types of indirect commerce). In this case, the non-working pensioner fills out and submits a tax return in Form 3-NDFL to calculate the appropriate tax, and, if necessary, can receive preferences on payments.

What income is not subject to taxation?

For persons on well-deserved retirement, Russian legislation provides benefits when calculating taxes. Not subject to taxation:

- full pensions;

- financial assistance from a former employer in the amount of no more than 4,000 rubles per year;

- subsidies from the place of previous work for medical treatment or payment for sanatorium-resort vouchers.

Tax deduction for personal income tax for working pensioners

In a situation where a person of retirement age is employed and has an official salary, income payments from his earnings are paid by the employer. In this case, when the right to tax benefits arises (for example, when paying for treatment on your own), the pensioner has the opportunity to return the personal income tax paid in part or in full. To do this, according to Article 229 of the Tax Code of the Russian Federation, he must submit a declaration to the tax office at the place of residence or registration.

This is interesting: Law on Children of War

Refund of personal income tax when purchasing real estate

According to the law, preferences for purchasing housing are provided only if you have income. Since pension tax is not withheld, in most cases, non-working persons of retirement age do not have the opportunity to receive a personal income tax refund when purchasing real estate. An exception is the situation of transferring the tax deduction to previous years, and if during the previous 4 years a person paid income tax (for example, this period just preceded retirement), then he can return these amounts.

In 2020, when purchasing real estate, a non-working pensioner can return personal income tax for 2020, 2020, 2020 and 2014 (provided that these payments were made). For officially employed persons, income tax is refunded through their place of work. The amount to be returned is 13% of the cost of the purchased object (but not more than 2 million rubles).

The legislation defines situations in which you can receive a tax deduction when purchasing real estate. These include:

- purchase or construction of housing (apartment, room, cottage, etc.);

- purchasing a plot of land with a residential building standing on it (or for its construction);

- mortgage interest payment;

- expenses for home renovation, if it was not originally finished.

Taxes for pensioners: what you don’t have to pay in 2020

Everyone knows very well that, in comparison with pensioners in most of the country, older Muscovites live more or less decently. Moscow is a wealthy region; it can afford a good minimum pension for those who have lived in the city for more than 10 years, various benefits, and exemption from some taxes.

What taxes a pensioner does not need to pay in 2020

If an elderly Russian owns two apartments, the tax for one of them will need to be paid in full. If there are two garages - the same thing. Moreover, if a pensioner has an apartment and a garage, he will not pay tax on any of such real estate. Taxes are paid only on the “surplus”. In this way, the state at least insures that the pensioner’s children’s apartments, etc., will not be registered.

This is interesting: How long can you buy alcohol in Yekaterinburg?

The provision of tax exemptions for pensioners is established by regulatory documents at the federal, regional and local levels. The benefit allows you to be partially or completely exempt from certain taxes.

The state government provides comprehensive social support to pensioners, who are one of the vulnerable segments of the population.

From income tax

Taxation in all areas is strictly controlled by the Tax Code of the Russian Federation. It is this legislative document that contains information about who a taxpayer is, what types of government fees there are and categories of citizens who have tax breaks.

Other types of real estate are subject to a property tax in accordance with the general procedure. Also, this benefit does not apply to expensive real estate , the cadastral value of which is above 300 million rubles. In order for an object to be exempt from taxation, two conditions must be met:

How to apply for tax benefits

To receive a preference for fiscal payments, a person of retirement age must write an application (a sample can be obtained from the tax office or downloaded from their website). Additionally, a package of documents is provided, which includes:

- applicant's passport;

- pensioner's certificate;

- TIN;

- certificates and certificates on the basis of which the right to a benefit arises (for example, a referral from a local doctor and receipts for payment for treatment).

There are several options for submitting documents to the tax office. If the application is submitted in person, the algorithm of actions is as follows:

- Prepare all the necessary documents and bring them to the Federal Tax Service office at your place of residence or registration.

- Contact the inspector on duty and inform them that you want to receive benefits.

- The tax inspector gets acquainted with the submitted documentation, establishes the identity of the taxpayer and accepts the application or gives a written refusal indicating the reasons.

- As confirmation, a certificate is issued, using the number of which you can later clarify the acceptance of tax benefits.

Another option would be to send documents via mail. This requires:

- Make photocopies of documents and have them certified. For certification, it is not necessary to contact a notary - you can do this yourself by writing “Correct” on each copy, putting the date, signature and your last name with initials.

- Be careful when preparing documents, because if there are errors or incorrect execution, they will not be accepted by the tax office, and revisions will increase the duration of this procedure.

- Send the package of documents by registered mail with notification.

- Wait for confirmation that the mail has been received.

You can also submit documentation using the Internet. To do this, you first need to register with the branch of the Federal Tax Service at your place of residence and receive information to log into your personal account. After this, the applicant must:

- Make scanned samples of the required documents in jpg, png or pdf formats, and the total volume of the package should not exceed 20 megabytes.

- Log in to your personal account using the received login and password. When you log in for the first time, the system will ask you to change your password; 1 month is given for this procedure.

- Study the information on the main page of your personal account. Here is a list of property owned by the citizen, an indication of payment transactions and data on the presence of debt or overpayment of taxes.

- Create a personal digital signature by clicking on the “Profile” button in the upper right corner of the screen. In the page that opens, you must select the “Obtaining an ES verification key certificate” section. Next, the user information is checked and data for a digital signature is issued. The certificate can be stored on the user’s computer or on the secure website of the Federal Tax Service (for individuals, the second option will be more convenient).

- Attach scanned sample documents one at a time, adding a description to each and clicking the “Save” button.

- Enter the password for the received electronic key at the bottom of the page and click the “Sign and send” button on the screen.

- Wait for the online notification that the package of documents has been sent to the Federal Tax Service. Your shipment number will be displayed in the upper right corner of the monitor, and if necessary, you can receive a receipt for documents acceptance. If you want to track the progress of your shipment, you will find information about this in the “Status” window.

Application procedure

The existing procedure for providing benefits implies that a person entitled to benefits informs the tax office about this. To do this, you must prepare an application indicating in it:

- benefits provided;

- details of the pension certificate;

- TIN;

- passport data.

This is interesting: How much does it cost to inherit?

If the application along with the original documents is submitted no later than November 1, next year the pensioner receives a tax exemption or is recalculated taking into account the discount. You can submit your application in person at the tax office, by mail or through your personal account on the Federal Tax Service website.

What taxes are pensioners exempt from?

Elderly people have the right to legally refuse to pay taxes.

Real estate

Pensioners who have retired due to age have the right to refuse to pay full property taxes. This applies to residential properties and car garages.

If there are several outbuildings on private territory and their area is less than 50 square meters, the benefit will also be relevant only for one object. In cases where there is a residential building and 1 business premises on private territory, the benefit may be relevant for both objects.

The pensioner independently determines for which object a tax benefit is required. To do this, you need to contact the tax service within the prescribed period (November 1). Otherwise, tax inspectors will make their own decisions based on the amount of calculated tax.

garden plot

This tax rate is determined only at the local level, so it depends on the region of residence of the pensioner.

- Sometimes senior citizens receive a 100% discount on plots provided for agricultural activities or the construction of individual garages.

- Also at the local level, the area of the site for which a benefit can be provided is determined.

Cars

Transport tax is also regional.

- Typically, tax is not paid on passenger cars if they are equipped specifically for use by disabled people or have engines of minimal power. Typically, such vehicles are provided by social welfare authorities.

- Seniors also pay a minimum tax on motorcycles and scooters if they are equipped with engines up to 36 hp. (the rate is 1 ruble for each horsepower).

The tax rate is relevant only for one vehicle.

![Alfa-Bank Credit cards [CPS] RU](https://7daystodie.ru/wp-content/uploads/alfa-bank-kreditnye-karty-cps-ru-330x140.jpg)