Personal account "Kit Finance"

Free assistance from a Pension Lawyer Legal advice on disputes or conflicts with non-state pension funds, insurance compensation, refusals of payments and other pension issues.

Every day from 9.00 to 21.00 Moscow and Moscow Region St. Petersburg and Leningrad Region Free call within Russia Legal advice Get qualified help right now! Our pension lawyers will advise you on any issues.

Get legal advice

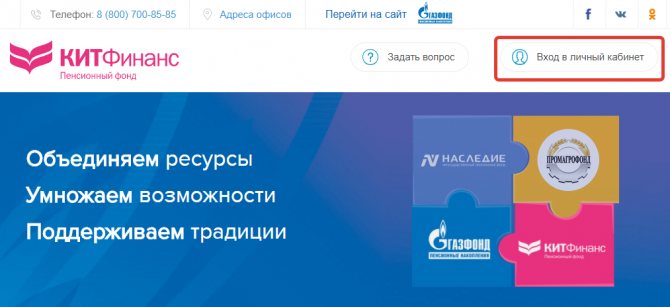

"Kit Finance" is a pension fund, the personal account of which has been moved to the page of the NPF "Gazfond". In 2020, it was reorganized and ceased operations. Instead, Gazfond fulfills its obligations.

Advantages of Kitfinancebank personal account

The fund's service is organized to simplify interaction with registered clients. The personal account of NPF KIT Finance provides the following beneficial opportunities:

- 1) control pension savings online;

- 2) see the return on investment of invested funds;

- 3) make regular contributions using a bank card;

- 4) change personal data if necessary.

A calculator for approximate calculation of future pension and a feedback form are also available on the official website. The necessary information can be obtained by calling the hotline 8-800-700-85-85.

Registration in your personal account and login

Information about the non-state pension fund (NPF) "Kit Finance":

● old official website https://www.kitnpf.ru;

● new: https://gazfond-pn.ru;

● personal account: https://lk.gazfond-pn.ru;

● login: https://lk.gazfond-pn.ru/auth/.

Please note: Keith Finance stopped working in 2020. He joined Gazfond.

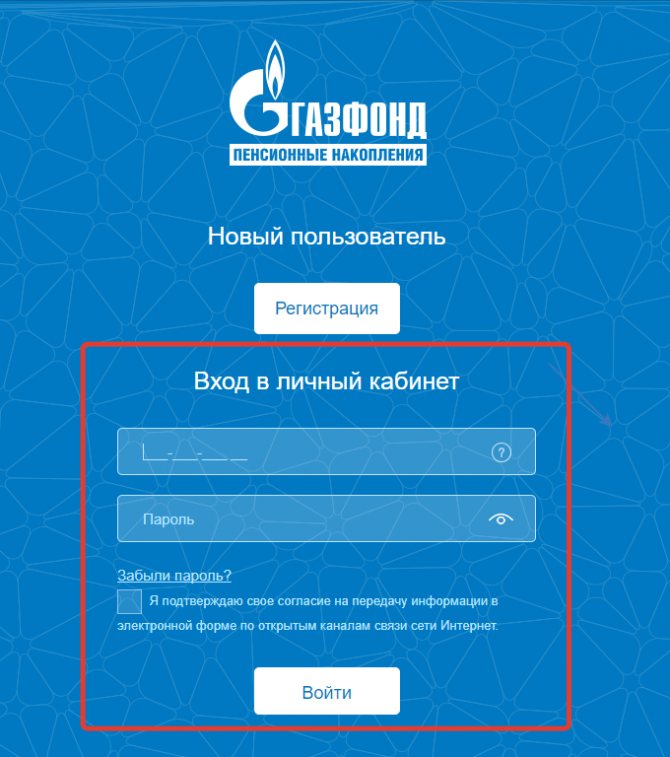

The Kit Finance personal account is now on the Gazfond website. When you navigate, a page opens with buttons “Registration” for new users and “Authorization” for clients.

How to register:

- Enter your SNILS number in the field and read the data processing policy. Please check the box if you agree.

- Click "Next".

- Enter your phone number to gain access to your personal account.

- A password will be sent to it. Change the code after your first login.

Note. Registration is available for clients only. If the entered number is not in the database, a notification will appear asking you to clarify the status of the contract.

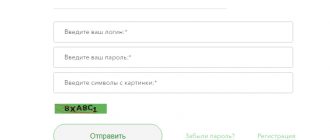

How to enter your personal account:

- Enter your SNILS number and password.

- If you have lost your password, click on “Forgot your password?”.

- Confirm your consent to transmit data over an open channel.

A lost password can also be restored on the registration page using the “Recover Password” link. Enter your SNILS number, read the personal data processing policy and check the box. Click "Next" to continue the procedure.

Official website and personal account

- activities;

- KIT Finance contacts (address and telephone);

- schedule;

- company's news.

There is also a list of necessary documents that must be submitted to KIT Finance (pension fund). You can use your personal account if you wish. Registration in it is not mandatory, but it greatly facilitates mutual understanding between the client and the company’s employees and will help track the amount of accumulated funds.

KIT Finance (non-state pension fund) is a reliable and open organization for its clients that inspires trust among millions of clients.

Advantages of the fund over other market participants:

- The company has the largest number of insurers among similar pension funds.

- Pension savings are constantly in motion, do not depreciate and increase every year.

- The company creates a modern high-tech service thanks to such functions as a personal account, feedback, a pension calculator, and qualified support service.

- Refers to participants in a system that guarantees the protection of the rights of insured persons. Has the highest reliability rating “A” from “Expert RA” and “AAA” from the “National Rating Agency”.

KIT Finance (NPF) provides reliable support in the future and stable additional income.

Long-term savings and profitable investment of pension funds are forcing an increasing number of clients to choose KIT Finance. On November 2, 2020, the company’s rating was confirmed by the rating agency Expert RA (RAEX) and assigned the fund a trust level of “A”. One of the highest. This indicator indicates that it is quite stable and always fulfills its obligations to clients of NPF KIT Finance.

The reliability rating from the National Rating Agency is similar. The fund was assigned the “AAA” level, which indicates the highest degree of reliability.

Few pension funds can boast such high reliability indicators from two leading rating agencies in the country. This is a huge plus for the entire activity of KIT Finance and helps clients make the right choice.

Reliability of NPF "Kit Finance"

Reliability of the fund according to the rating agency "Expert RA":

- 2010, February: B++, transcript: “Acceptable level of reliability.”

- 2010, June: A. The mark is raised to “High level of reliability.”

- 2011, March: A.

- 2011, July: promotion to A+.

- 2012: the assessment remains at the same level. The forecast is “stable” - most likely, the level will not change in the near future.

- 2013-2016: A++. The highest level of reliability with a stable forecast.

2016: The national rating agency gave an “AAA” rating, indicating maximum reliability.

In 2020, the rating was withdrawn from all agencies. The fund was reorganized and became part of the NPF Gazfond.

Customer Reviews

Reviews about Keith Finance are different. Clients noted the presence of a personal account for receiving services via the Internet, a variety of tariff plans, and clear contract terms as positive aspects of the fund.

Among the shortcomings, the most common complaint is about employees going door to door and trying to impose services. Their impudence and assertiveness are noted, but not in all cases. After such conversations, people lost the desire to apply to the fund. Other reviews are related to insufficient profitability, transfer of funds without consent, and a decrease in the company's rating.

Let's sum it up

NPF Kit Finance completed work on pension programs in 2016, becoming part of Gazfond, which now fulfills all obligations to clients of both organizations. The reliability rating has confirmed the effective performance of the fund for many years. The personal account helps users receive services. Customers in their reviews appreciated both the positive and negative aspects of the company.

Attention! Due to recent changes in legislation, the legal information in this article may be out of date! Our lawyer can advise you free of charge - write your question in the form below:

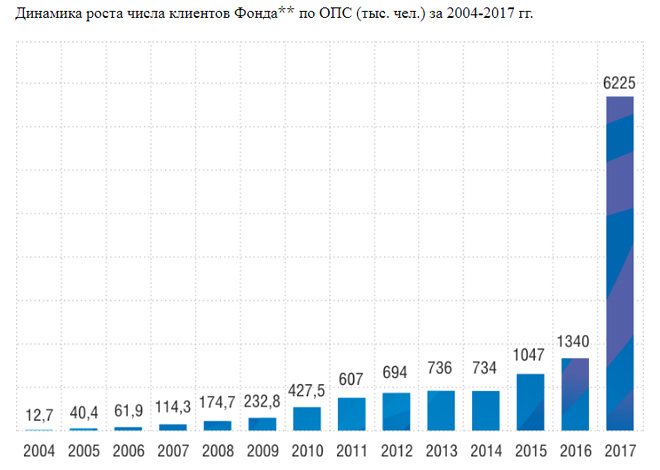

Created in 2002, NPF Soyuz was soon reorganized into Kitfinance (NPF). In 2020, it underwent changes again, becoming part of Gazfond, and was removed from the register of non-state pension funds. The merger of large non-state pension funds increases the levels of profitability and reliability, the volume of pension savings and the client base are increasing.

Pension fund "KIT Finance"

The non-state pension fund "KIT Finance" specializes in paying additional benefits to clients who have reached retirement age. The brand of the same name that represents it consists of banking and brokerage institutions, as a result of which it has high profitability and reliability.

In accordance with this, many citizens are interested in the experience and reviews of those investors who have already chosen NPF “KIT Finance” to accumulate a pension. The owner of the main stake in the KIT Finance pension fund is. This is an actively developing young non-state pension fund, which has been in the TOP-3 since 2010 in terms of the number of insured persons.

According to the same indicator, it ranks second among all Russian non-state pension funds, numbering about 2 million people.

Profitability indicators:

- By the end of 2020, the growth was 7.57% per annum;

- The return over the last 5 years was 9% per annum;

- Insured persons received 63% of the income during the same time.

It is worth noting that NPF is a two-time winner of the joint award “Financial Elite of Russia” and winner of the “Consumer Rights and Quality of Service” award from Rospotrebnadzor. It was a surprise for well-known statistics collection agencies to receive data on the presence of more than a million satisfied customers of this company. Their authoritative opinion once again proves the reliability of the organization and the competence of its specialists. Russian experts from the RA and NRA awarded the company the highest rating - A++ and AAA. All pension contributions are officially protected by the state and insured by the DIA organization. At the moment, many non-state pension funds are losing their license, which is an additional advantage for clients who care about their funds.

Since 2020, many companies have experienced a lot of inconvenience. After the Central Bank’s requirements increased, some firms, along with large banks, ceased to exist, small companies merged to be able to continue to stay afloat.

NPF Kit-Finance, together with clients Norilsk Nickel, transferred to NPF Gazfond in 2016. This means that if you entered into an agreement with Kit-Finance before this time, then now your servicer.

If there is no branch of this fund in your locality, you can always get advice by phone or online.

Basic data:

- For 2020, the profitability of insured persons was 7.31%;

- The average income of insured persons for 2005-2017 is 8.65%;

- Profit from investing pension savings for the same period - 194.16%;

- The amount of pension savings is 457,381 million rubles;

- The number of fund clients is 6,225,306 people;

- The increase in pension reserves is 7.16%.

If you have a desire to become a client of the Kit-Finance fund, leave a request on the official website of the organization at gazfond-pn.ru. Each client will be provided with a Personal Account, with which you can control your own funds.

Official website of NPF "Kitfinance"

Official website: https://www.kitnpf.ru.

The resource includes reporting in the “Information Disclosure” section, frequently asked questions and answers to them, useful information for fund clients on the topics of public benefit organizations and non-governmental organizations. There is also an entrance to your personal account for quick interaction between the parties and obtaining up-to-date information.

You can become a client by contacting the Gazfond office or the online website: https://gazfond-pn.ru.

Information about pension programs for individuals and companies can be found in the relevant sections.

In your personal account you can check your pension savings, pay contributions and keep your personal information up to date.

The investment portfolio of NPF Kitfinance as of December 31, 2016 included:

- 62.8% - corporate bonds;

- 10.5% - government debt securities of the Russian Federation;

- 10.4% - shares;

- 7.9% - government debt securities of constituent entities of the Russian Federation;

- 6.9% - cash;

- 1.1% - mortgage-backed bonds;

- 0.4% - deposits in banks.

New investment portfolio of Gazfond in 2020:

- 42.7% - shares of enterprises and organizations;

- 24.7% - corporate bonds;

- 21.1% - units of mutual investment funds;

- 4.2% - bank deposits and certificates of deposit;

- 3.0% - money in current and brokerage accounts;

- 2.5% - bonds of constituent entities and municipal bonds;

- 1.7% - federal government securities;

- 0.1 — mortgage-backed securities;

- 0.1 - real estate.

Pension reserves of Gazfond:

| Year | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| Volume in million rubles. | 290 021 | 308 866 | 304 016 | 317 391 | 325 428 | 338 810 | 372 203 | 374 379 |

On the Gazfond website you can also find all documents related to reports, rules and licenses.

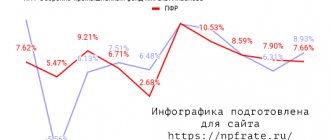

Fund returns by year

84.73% is the fund’s return during operation, 7.64% on average for the year.

| Year | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| Profitability, % | 10,35 | 17,26 | 9,98 | 0 | 6,7 | 6,63 | 2,06 | 11,79 | 12,92 |

In 2020, NPF took 3rd place in profitability.

Taking into account the profitability of the Gas Fund, the following indicators are obtained:

| Year | 2012 | 2013 | 2014 | 2015 | 2016 |

| Profitability, % | 7,73% | 6,39% | 2,72% | 11,07% | 11,41% |

The Gazfond's return over the entire period is 146.9%, and on average 8.46% for the year.

Programs of the Kitfinance Fund

CJSC Kitfinance NPF offers pension programs with flexible settings.

- Increasing the funded part: co-financing programs;

- transfer of maternity capital.

Benefits of the programs:

- The minimum contribution amount is 1,000 rubles;

- minimum investment period - 4 years;

- frequency of contributions - any;

- the ability to specify an heir;

- early refund;

- social deduction 13%.

You can become a client on the official website of Gazfond by filling out an agreement and attaching the necessary documents: passport and SNILS. Another way: leave a request and wait for a call from a specialist.

Free help from a Pension Lawyer Legal advice on deprivation of rights, road accidents, insurance compensation, driving into the oncoming lane and other automotive issues. Every day from 9.00 to 21.00 Moscow and Moscow region ext. 945 St. Petersburg and LO +7 (812) 426-14-07 ext. 644

How to log into the Personal Account of NPF “Kit Finance”

If you, as a client of the Non-State Pension Fund KITFinance, logged into your account through the Fund’s website kitnpf.ru in the “Personal Account” section or followed the link https://lk.kitnpf.ru to the authorization page, then you probably already noticed that the link https://lk.kitnpf.ru/ leads to the site https://lk.gazfond-pn.ru/.

It is necessary to understand why authorization in the system occurs with redirection to another resource and what does the GAZFOND website have to do with it. The fact is that as a result of the reorganization, a merger with OJSC NPF GAZFOND Pension Savings took place and the Closed Joint Stock Company KITFinance Non-State Pension Fund (CJSC KITFinance NPF) ceased its activities in April 2020.

Now new clients cannot register in the Personal Account of NPF KIT Finance, at the same time its clients have been transferred to NPF GAZFOND pension savings and gain access to the Personal Account on the website of this Fund.

Contacts, links to enter your Personal Account, registration, hotline, support

| Official website of NPF KITFinance | https://www.kitnpf.ru/ |

| Official website of NPF GAZFOND | https://gazfond-pn.ru/ |

| Login to your Personal Account | https://lk.gazfond-pn.ru/ |

| Registration of GAZFOND Personal Account | https://lk.gazfond-pn.ru/register/ |

| Hotline number | 8 (Call within the Russian Federation is free) |

| Contact support | https://gazfond-pn.ru/feedback/ |

Advantages and disadvantages

In cooperation with NPF Gazfond, the following advantages can be highlighted:

| versatility | the possibility of independently forming a funded part, which has a positive effect on the financial component and subsequent provision |

| governmental support | you can take advantage of the opportunity to apply for a social tax deduction and return 13% of the amount of pension contributions, but not more than 120 thousand rubles |

| inheritance | accumulated funds can be received by heirs in the event of the death of their owner |

| legal protection | the funded part is not taxed and cannot be reduced due to collection under various judicial acts |

| profitability | based on the results of the past year, a percentage of profitability is accrued on the accumulated part, which is why the funds increase |

| service | The website of NPF Gazfond offers full use and management of your account |

On the website in your Personal Account, you can create various applications and requests to resolve certain issues about which questions have arisen.

Disadvantages include the established period of mandatory cooperation, as well as the inability to track the movement of your own funds. The last factor is intended for all non-state pension funds - clients cannot influence the investment of any assets.

NPF Gazfond has excellent reviews and positive forecasts for the future. Experts talk about reliability and stable growth of equity capital, so cooperation with the fund is safe and profitable.