Compensation for spa treatment

Former internal affairs employees have the right to improve their own health in sanatoriums and rest homes, which are run by the ministry. This can be done once per calendar year. In order to purchase a voucher, you must write an application, after which the citizen will be put on a waiting list. When the required voucher becomes available, the person will be informed at least two weeks before the start of arrival (deadline).

The cost of a voucher to a sanatorium for 21 days is 12,000 rubles, rehabilitation and restorative medicine centers - 7-9 thousand. Pensioners of the Ministry of Internal Affairs pay only 25% of the voucher price, and their spouses and children can use sanatorium-resort treatment for half the cost. Travel to the place of rest and back (by bus or train) for an elderly person will be free, and the accompanying family member will not have to pay for travel to the place of treatment.

Benefits for pensioners of the Ministry of Internal Affairs

- one-time payment at the time of dismissal from service;

- socio-material preferences;

- tax relief;

- provision of vouchers to a sanatorium-resort area for health improvement;

- preferential treatment and provision of medicines;

- free travel on public municipal transport;

- a number of benefits in the housing and communal services sector.

By length of service

- 2 salaries if you have work experience in the Ministry of Internal Affairs for up to 20 years;

- 7 DS salaries if you have more than 20 years of work experience in law enforcement or security forces.

When determining the amount of payment, the amount of salary at the time of dismissal is taken into account. In addition, the list of benefits for long-service pensioners includes pension supplements, which are calculated taking into account:

- age;

- the amount of accruals during the service period;

- status;

- marital status of the pensioner.

With mixed experience

It often happens that a citizen is employed in a civilian job for a certain period of his life, and after or before that he worked most of the time in the Ministry of Internal Affairs, which in total amounted to 25 years of experience. In this case, the law allows you to receive military pension benefits.

If the length of work experience in a civilian job predominates, then the person is assigned a standard pension.

Veterans of Labor

Examples of regional benefits are:

- the right to free travel in municipal and suburban transport, with the exception of shuttle buses and taxis;

- increased pension;

- discount on payment for housing and communal services in the amount of 50%.

Disabled people

The legislation provides for the following types of benefits and preferences for people with disabilities:

- free services in public health care institutions;

- free medication provision;

- the right to free dental treatment and dentures;

- obtaining vouchers to the sanitary resort zone for health improvement.

Widows

Widows of employees of the Ministry of Internal Affairs receive an almost complete list of benefits, provided that they were supported by the deceased or died due to loss of ability to work.

Important! If death occurs after termination of service in the ranks of the Ministry of Internal Affairs, then widows are not provided with full benefits. For example, the possibility of receiving increased pension benefits or tax benefits is excluded.

Features of granting benefits at the regional level

Due to the fact that many issues regarding the provision of benefits to veterans of the Ministry of Internal Affairs are under the jurisdiction of the constituent entities of the Federation, a situation has arisen where in this issue there is a significant difference in the scope of benefits and their quantity. This is explained by the economic situation and the load on the regional budget in different regions and territories of Russia.

Thus, cities of federal significance, Moscow and St. Petersburg additionally provide benefits for pensioners of the Ministry of Internal Affairs:

- in Moscow there is a law on compensation of fees for the use of telephone landline devices;

- monthly pensioners of the Ministry of Internal Affairs receive a pension supplement in the amount of 1000 rubles;

- In both cities mentioned, city transport tickets are available at a reduced cost.

Residents of those regions where there are additional preferences for pensioners of the Ministry of Internal Affairs must apply for its registration to the city administration.

List and rules for receiving benefits for pensioners of the Ministry of Internal Affairs

The insurance pension is paid to them if they continue to work in “civilian” professions.

According to Art. 8 of the Federal Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ, departmental pensioners can exercise their right to assign an insurance pension while maintaining the pension of the Ministry of Internal Affairs, subject to the following conditions:

- reaching the age of 60 years for men and 55 years for women;

- the value of the individual pension coefficient in 2020 is not less than 11.4 points (Part 3 of Article 35 of the Federal Law “On Insurance Pensions”);

- the duration of the insurance period is at least 8 years in 2020 (Parts 1, 2, Article 35 of the Federal Law “On Insurance Pensions”).

According to the transitional provisions set out in Art. 35 of the Federal Law “On Insurance Pensions”, the value of the IPC required to acquire the right to an old-age insurance pension is subject to an annual increase of 2.4 units until it reaches 30 points in 2025. The insurance period also required to assign this type of pension will increase in each subsequent year by 1 year to 15 years in 2024.

For pensioners of internal affairs bodies, an insurance pension, if they have rights to it, is assigned without taking into account the fixed payment.

Calculation of old-age insurance pension for a pensioner of the Ministry of Internal Affairs in accordance with Art. 15 of the Federal Law “On Insurance Pensions” is made according to the following formula SP = IPK × SPK, where:

SP - old-age insurance pension;

IPC - the value of the individual pension coefficient;

SPK is the cost of one PC on the day the pension is assigned.

Indexation of insurance pensions should be carried out annually on February 1 to the inflation rate and on April 1, based on the capabilities of the Pension Fund.

Payment of a one-time compensation will be of a non-declaration nature, that is, you do not need to apply anywhere and provide additional documents. Compensation will be calculated according to a special delivery schedule, that is, in some cases the payment will coincide with the pension, and in others it will be made as a separate payment.

Payment of pension benefits assigned to employees of the Ministry of Internal Affairs in accordance with Article 57 of the Federal Law of the Russian Federation dated February 12, 1993 No. 4468-1 (as amended on May 1, 2017) “On pension benefits for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control over the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, the Federal Service of the National Guard of the Russian Federation, and their families,” is issued to their recipients, regardless of the work activity of pensioners.

If a pensioner of the internal affairs bodies, receiving two pensions, continues to work, then pension payments, both through the Ministry of Internal Affairs and the insurance pension, continue to be made in full, but in accordance with Art. 26.1 Federal Law “On the suspension of certain provisions of legislative acts of the Russian Federation, amendments to certain legislative acts of the Russian Federation and the specifics of increasing the insurance pension, fixed payment to the insurance pension and social pensions” dated December 29, 2015 No. 385-FZ, indexation of payments through the Pension Fund will be suspended for the period of the pension recipient's labor activity.

Samples of the statements of claim and documents you need, as well as background information, can be found here: Home page.

*"When using site materials, a link to the source is required" Copyright iskoved.com 2017

In Russia, almost all citizens upon retirement receive additional assistance in the form of social services, benefits and compensation. The amount of assistance provided to pensioners depends on many factors, but first of all, on which department pays the pension.

It is no secret that military personnel and former employees of the Ministry of Internal Affairs occupy a priority position when providing them with additional social assistance. We have already talked about the privileges granted to military pensioners, so today we will talk about benefits for pensioners of the Ministry of Internal Affairs.

Citizens who previously served in the Ministry of Internal Affairs and were dismissed from this service due to reaching a certain length of service, for health reasons, age or due to staff reduction, receive a state pension through the Ministry of Internal Affairs (RF Law No. 4468-1 of December 12, 1993) , If:

- service life in the Ministry of Internal Affairs was 20 years or more, regardless of age;

- The length of service in the Ministry of Internal Affairs was 12.5 years, the total work experience was 25 years, and the age reached a maximum of 45 years.

In all other cases, former employees of the Ministry of Internal Affairs receive a pension on the same basis as ordinary Russians and do not have the right to additional assistance through the Ministry of Internal Affairs.

Chelyabinsk region - benefits for pensioners 2020

In the Chelyabinsk region, a pensioner who is not employed anywhere has the right to targeted social assistance in the form of partial reimbursement of the funds he incurred to carry out work on gasification of his own home. The property must belong to the pensioner according to home ownership rights, and he is obliged to personally live in this house.

- stay in the Chelyabinsk region for the last 5 or more years;

- registration in the apartment of a house in which major repairs are being carried out;

- confirmed ownership of the property where major repairs are being carried out and the pensioner is registered;

- disabled pensioners who have no other source of income other than a social or insurance pension;

- there is no debt to pay for major home repairs or the pensioner has entered into an installment agreement to repay the debt;

- other reasons not specified in the law, but having grounds for awarding compensation, are considered on an individual basis.

We recommend reading: Registration of a built country house after March 1, 2020

Other benefits provided to pensioners of the Ministry of Internal Affairs

Despite dismissal from the authorities, former employees retain the opportunity to use medical care in institutions under the authority of the Ministry of Internal Affairs. In addition, he retains the right to purchase vouchers to sanatorium-resort institutions, again through the Ministry of Internal Affairs, for a quarter of the total amount.

If a former employee needs continued treatment, then he is given the right to do this free of charge, with payment from the state for travel to the place of treatment and back. If the voucher is purchased to places not included in the Ministry of Internal Affairs, then the payment is made by the former employee himself, including travel.

Persons who acquired a disability in the service of the Ministry of Internal Affairs have the right to compensation for purchased medicines and drugs. The same applies to dentist services providing prosthetics.

Benefits for public transport are provided differently in different regions of Russia - it all depends on the decision of the regional authorities. For example, in the capital, travel on public transport is provided free of charge for former employees of the Ministry of Internal Affairs who have retired. In the northern capital, on the contrary, only travel tickets are provided to pensioners of the Ministry of Internal Affairs at discounted prices.

Almost no consideration is given to utilities. Only relatives of a person who died as a result of an injury received during service or an illness that led to premature death are entitled to compensation.

As for benefits for immediate relatives, here is their list:

- immediate relatives have the right to receive assistance in medical institutions under the authority of the Ministry of Internal Affairs;

- purchase of vouchers to sanatoriums operated by the Ministry of Internal Affairs is carried out with a 50% discount;

- it is possible to provide payment for travel to the place of treatment for one of the relatives;

- upon the death of a former employee (due to injury or illness acquired in service) who retired, monthly payments for the maintenance of children are implied;

- receiving a one-time cash benefit in the event of the death of a former employee of the Ministry of Internal Affairs due to a disease acquired in the service.

What benefits does a disabled person of group 2 enjoy? A pensioner of the Ministry of Internal Affairs

3.

Transport benefits for disabled people consist of a 50% tax discount when purchasing a car through social security authorities (power up to 100 hp) and complete tax exemption in case of owning a car that has been specially converted for a person with disabilities.

In addition, disabled people due to military injury or other damage to health received in connection with the performance of official duties in internal affairs bodies, resulting in permanent loss of ability to work, have the right to receive monthly monetary compensation in the amount of lost monetary allowance as of the day of dismissal from service in police minus the amount of the assigned disability pension.

What monetary benefits are available for pensioners of the Ministry of Internal Affairs in 2018?

Part of the payments for former employees of the authorities is provided at the expense of the federal budget, the rest falls under the competence of the regions. Benefits for pensioners of the Ministry of Internal Affairs in 2020 are established depending on the length of service the person has, how many ranks he was awarded and how long he has been in service in the authorities. They can receive a pension based on length of service or disability acquired during service. If you continue to work, you have the opportunity to earn yourself an additional insurance pension. In addition to this, citizens who served in the Ministry of Internal Affairs are entitled to:

- one-time cash payment upon dismissal from the authorities;

- tax benefits;

- preferential medical care;

- social bonuses;

- sanatorium-resort holidays;

- free (preferential) travel on suburban, city and intercity transport;

- priority solution to the housing issue.

Preferential pension

The main benefit for employees of the Ministry of Internal Affairs in 2020 is the opportunity to retire early. Citizens are assigned one of the state pensions:

- by length of service;

- on disability.

There are certain conditions for assigning allowances:

- Serve in the authorities for at least 20 years, and a person can retire at any time, regardless of age.

- If you have a mixed experience (civil + service) of at least 25 years, and at least half of this period must be devoted to work in the Ministry of Internal Affairs. An additional condition is that the dismissal must occur for health reasons or due to organizational and staffing measures.

To calculate the pension, the salary by rank and the official salary are taken, which are multiplied by a reduction factor. For 2020, its value is 71.23%, but this value is constantly revised. Additionally, the service life is taken into account for calculation. With a net 20 years of service, 50% plus 3% is added for each additional year beyond this period. With mixed experience, such an addition will be only 1%.

A disability pension is awarded if a person has suffered injuries, wounds, or serious illnesses that prevent him from continuing to serve. You can count on a subsidy if your health condition worsens after retirement, but no later than three months later. The amount of the benefit depends on the assigned category of disability, which is established by a special commission after passing a medical and sociological examination:

- severe illness or disability – 75%;

- loss of ability to work – 85%;

- family in the event of the death of the breadwinner (not due to hostilities) - 30% of the salary.

One-time payment

All those leaving the reserve are entitled to a lump sum payment. Its value depends on the number of years spent serving in the internal affairs bodies:

- up to 20 – two salaries;

- more than 20 – seven salaries in cash.

ODS - the amount of official and salary based on the allowance that was established for the citizen at the time of his dismissal. According to the latest changes, an employee who takes a well-deserved retirement due to health reasons or an injury received during service is additionally rewarded with 2 million Russian rubles. Additionally, a person may qualify for compensation for annual leave if it was not chosen.

All employees who were awarded any state awards at the time, and not only the time of service for the benefit of Russia, but also the USSR is taken into account, are entitled to an additional payment in the amount of one salary. In case of dismissal due to disciplinary action or other similar reasons, no payments are provided.

By length of service

For former employees of the Ministry of Internal Affairs, pensions are supplemented. They depend on the size of the accrual, age, status and marital status of the citizen:

- disabled people of group 1 to provide care for them - 100% of the pension;

- for pensioners over 80 years old - 100% for their care;

- non-working pensioners who are dependent on non-working family members (provided that they do not receive an insurance or social pension): if there is one, 32%; two – 64; three or more – 100%;

- Heroes of the Soviet Union, Russian Federation - 100%;

- Heroes of Socialist Labor and Labor Heroes of the Russian Federation - 50%;

- champions of the Olympic, Paralympic and Deaflympic Games - 50%;

- awarded the Order of Labor Glory of three degrees - 15%;

- awarded the Order “For Service to the Motherland in the Armed Forces of the USSR” - 15%.

Transport tax benefits for pensioners

In 2020, it is planned to abolish the transport tax.

The Tax Code of Russia does not distinguish pensioners as a separate preferential category of citizens in relation to transport tax - the authorities of the constituent entities of the federation are responsible for determining the size of tax rates, preferential categories of citizens and the amount of discounts provided. Therefore, the Tax Code of the Russian Federation contains provisions only on provided federal benefits, which apply not specifically to pensioners, but to all citizens of the Russian Federation.

Federal benefits provide exemption from payment of tax payments on transport in the following cases:

- if the vehicle does not belong to taxable types of vehicles (for example, agricultural machinery) in accordance with Art. 358 Tax Code of the Russian Federation

- if the vehicle has a permissible maximum weight of more than 12 tons and is registered in the vehicle register of the toll collection system (Platon) in accordance with Art. 361.1 of the Tax Code of the Russian Federation (from January 1, 2020, this paragraph loses force).

Regional benefits are regulated by the laws of the constituent entities of the Russian Federation. Their provision for certain categories of citizens can be carried out in the form of full or partial exemption from taxation.

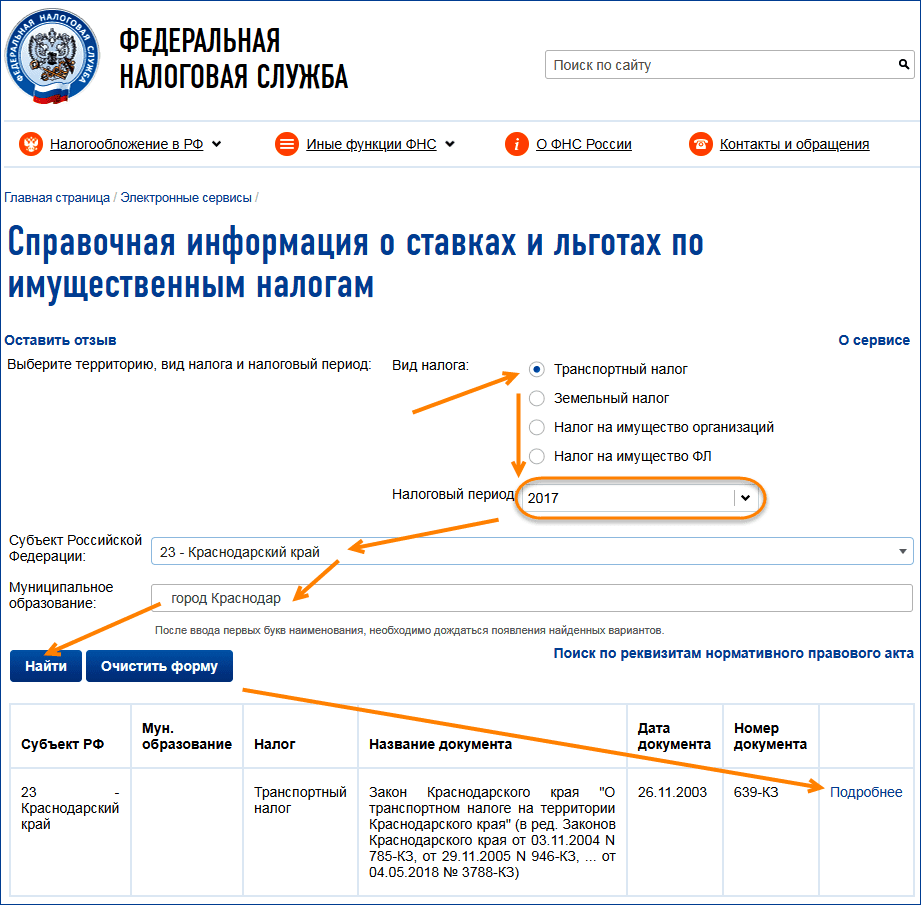

You can find out whether a pensioner belongs to the preferential category of citizens for tax payments on vehicles in a particular region at the Federal Tax Service office or using the electronic service “Reference information on rates and benefits for property taxes” on the official website of the Federal Tax Service. To do this, you need to indicate the type of tax “transport”, the tax period and select a subject of the Russian Federation.

It is worth noting that in different tax periods the list of preferential categories, as well as the amount of benefits provided, may differ. Therefore, the benefits provided in 2020 may differ from those previously provided - this information also needs to be clarified with the Federal Tax Service.

Benefits for pensioners on transport tax in 2020

In different regions of the Russian Federation, transport tax benefits for pensioners differ. In some regions, if you have pensioner status, they are not provided, but other grounds for receiving them are provided, which can be used by all citizens, including pensioners.

For comparison, here are several regions providing transport tax benefits in 2019:

- In Moscow, pensioners are not identified as a preferential category of citizens, but you can avoid paying tax on one vehicle with a power of up to 200 hp if the citizen belongs to the following categories:

- veterans and disabled people of the Great Patriotic War;

- Heroes of the Soviet Union, Russian Federation, persons awarded the Order of Glory of three degrees;

- veterans and disabled combat veterans;

- disabled people of groups I and II;

- citizens who own cars with power up to 70 hp.

- In St. Petersburg, there is a benefit in the form of cancellation of payments to pensioners for one car manufactured in the USSR or the Russian Federation with an engine power of up to 150 hp.

- In the Krasnodar Territory, pensioners have the right to a 50% discount on one vehicle:

- for passenger cars up to 150 hp;

- motor boats up to 20 hp;

- motorcycles and scooters up to 35 hp

- In the Tula region, pensioners are given a benefit in the form of a 50% discount on one passenger car up to 150 hp. and one motorcycle or scooter up to 20 hp.

How to apply for a benefit?

If a pensioner belongs to the categories to which the constituent entities of the Russian Federation provide transport tax benefits, then he can receive it by submitting an application in the established form to the tax authority in any convenient way:

- by post;

- as a result of a personal appeal to the Federal Tax Service;

- through the MFC, which refuses the relevant services;

- through your personal account on the official website of the Federal Tax Service.

The application will need to be accompanied by documents confirming the pensioner’s right to receive benefits (for example, a pension certificate, a certificate of a Hero of the Russian Federation or the Soviet Union, a certificate of disability, etc.).

If the application indicates that the benefit will be used for a limited period of time, then to re-assign it after the end of this period it will be necessary to re-apply to the Federal Tax Service. If the reasons for receiving the benefit remain the same, then re-submission of supporting documents will not be required.

Benefits for pensioners of the Ministry of Internal Affairs

Preferences (also called benefits) for pensioners of the Ministry of Internal Affairs apply to many areas of life: social security, taxation, medical care, housing and communal services, and additional cash payments and some others.

All these benefits are designed to compensate former employees of the Ministry of Internal Affairs for the hardships that they endured during its passage. These include long working hours, increased danger to life and health, and being in “hot” spots while on duty. That is, according to their purpose, benefits for pensioners of the Ministry of Internal Affairs play the role of compensation for previously caused negative consequences of service.

Thus, the state is strengthening law enforcement agencies, which include the Ministry of Internal Affairs, and is doing everything to ensure that personnel turnover in the department does not interfere with the implementation of law enforcement functions.

Let's look at specific types of benefits.

Tax

This type of benefit is of interest to everyone who is preparing to become a pensioner of the Ministry of Internal Affairs, first of all, since a person pays tax deductions and fees independently from the income received or for the possession (use) of one or another object of civil law.

Depending on the level of taxation (federal or regional), options for specific benefits are possible:

- at the federal level, exemption from personal income tax on pensions and other compensation payments is guaranteed; property tax may not be paid for one object;

- at the regional or local level, a decision is made to establish relaxations in the payment of land and transport taxes, and here everything depends on the welfare of the specific region of residence of the pensioner.

Benefits also apply to land tax; in particular, the amount already paid will be returned.

Housing and social support measures

A single social payment can be issued to family members of a deceased Interior Ministry employee within a year. The monetary amount of the payment is influenced by such factors as the price per square meter in the region of residence, the composition and size of the family, length of service in the “authorities,” the presence of state and ministerial awards and titles. This benefit is provided to those who have served in the authorities for more than 10 years, do not own housing, or have one, but it does not meet sanitary standards.

District police officers who do not own housing are rented apartments under a rental agreement at the expense of the ministry. Each case is considered separately, but this possibility is provided for by law.

If an apartment is purchased with a mortgage, the state can help with loan repayment in the amount of up to 50% of the total debt.

If a person joined the queue for improved housing conditions before March 1, 2003 (16 years ago), then he can become the owner of free living space. True, it will not be his property. And under a social tenancy agreement. The exception is disabled people of groups 1 and 2.

If a pensioner of the Ministry of Internal Affairs has children who, due to their age, need kindergarten, they get there out of turn.

Medical and sanitary-resort services

Both during and after service, police officers have the right to free medical care. Unlike the civilian population, employees of the Ministry of Internal Affairs have the right to receive it not only in regular clinics, but also in ministerial institutions and hospitals. There, we must pay tribute, the range of services provided, material support and the personnel situation are better than in civilian ones.

In addition, vacations in sanatoriums owned by the department cost former police officers 75% less, and this is the percentage that the ministry reimburses. And if being there is considered to be further treatment of the consequences of old wounds or diseases, then 100% is compensated.

Travel compensation

If, while serving in the internal affairs bodies, employees have the right to free travel on municipal transport, then after retirement this benefit is regulated at the regional level.

That is, it all depends on the specific place of residence.

Additional payment to pensions for pensioners of the Ministry of Internal Affairs

In most cases, the principle of receiving preferences is declarative, so the pensioner needs to take care of everything on his own: Where to apply The process for granting preferences may vary.

Tax benefits for pensioners per year: Unlike military personnel, banks do not provide benefits to pensioners of the Ministry of Internal Affairs per year. You can build or buy your own home in any locality by resorting to standard offers from different banks. Many lenders have special terms for older people, and if a pensioner is able to provide security, the terms will be more attractive. In order to take advantage of the offer, you must have a certain amount of money for the down payment, and for this you can use maternity capital or a one-time social payment. To reduce the interest rate, it is worth considering products developed by banking structures together with developers.

Full list of privileges for pensioners of the Ministry of Internal Affairs in 2020

The main social preferences for pensioners of the Ministry of Internal Affairs are enshrined in federal legislation. This list includes the following benefits:

- tax;

- medical;

- discounted spa treatment;

- housing;

- additional free services for the disabled.

Subjects of the Russian Federation can accept expanded lists of benefits. They usually relate to travel on public transport and trains or payment of local taxes. At the same time, federal preferences cannot be canceled by regional laws. Let's look at the list of all-Russian benefits in more detail.

Tax exemption

Retired employees of the Ministry of Internal Affairs are exempt from paying property tax. This benefit applies to 3 types of real estate:

- apartments or rooms;

- residential buildings;

- garages.

Tax benefits for pensioners of the Ministry of Internal Affairs apply to a single object of each type: 1 apartment, 1 house and 1 garage. For example, if a person has 2 apartments, only one of them can receive a deduction.

Preferential tariffs for transport and land taxes can only be adopted at the level of a constituent entity of the Russian Federation. Retired employees of the Ministry of Internal Affairs are not entitled to a deduction for the cadastral value of 6 acres of land, provided for old-age pensioners.

Figure 1. Houses are exempt from taxes, but you will have to pay for the plot annually.

Medical service

In regular hospitals and clinics, pensioners of the Ministry of Internal Affairs receive medical care on a general basis. Benefits apply only to departmental hospitals, which you can contact for:

- free medical care;

- discounted medications with a doctor's prescription.

Treatment in a sanatorium

Retired employees have the right to discounted visits to sanatorium-resort institutions affiliated with the Ministry of Internal Affairs. This privilege is provided once a year. Payment for the trip occurs according to the following scheme:

- The pensioner pays 25% of the cost of the trip for himself;

- 50% will have to be paid for vouchers for immediate relatives - spouse and children.

The Ministry fully reimburses the cost of travel to the holiday destination by rail. The length of stay in the sanatorium is usually 14–21 days, but can be increased by decision of the medical commission.

Figure 2. Treatment in departmental institutions can be done for free or at a big discount.

Obtaining housing and discounts on housing and communal services

Benefits for housing and communal services and major repairs can only be provided on the basis of regional laws. In practice, the constituent entities of the Russian Federation do not use this opportunity.

The situation is different when it comes to improving living conditions. If a pensioner of the Ministry of Internal Affairs did not exercise the right to receive housing during his service, he can do so after retirement. In this case, we are talking about the federal program of one-time social payments (USB) provided for the purchase of housing. ESV is assigned if:

- housing owned by a pensioner does not meet sanitary requirements;

- the person lives in a communal apartment or dormitory;

- 2 or more families live in the apartment, while the family is considered to be spouses and their children, but not mother/father or other relatives.

An important addition: according to the law, ESV is assigned only to those employees who needed improved living conditions while still serving in the internal authorities. If the pensioner was not on the list of those in need, he will not be able to receive the payment.

Additional preferences for disability

Beneficiaries who have registered a disability have the right to additional preferences when receiving medical care:

- free medicines and medical products with a doctor’s prescription;

- free dental prosthetics.

Important: the preferential list does not include dentures made of precious metals, metal-ceramics and similar expensive materials. A separate group includes disabled people who lost their health while performing official duties.

In this case, they undergo rehabilitation on preferential terms. The agency fully pays for the entire restoration process according to the following scheme

A separate group includes disabled people who lost their health while performing their official duties. In this case, they undergo rehabilitation on preferential terms. The department fully pays for the entire restoration process according to the following scheme.

- Treatment in the hospital of the Ministry of Internal Affairs of the Russian Federation. If the institution is unable to provide the necessary assistance, the patient is transferred free of charge to a state or municipal hospital where the necessary equipment and specialists are available.

- A medical examination that will determine the need for sanatorium-resort treatment.

- Obtaining a voucher to a sanatorium on a preferential basis: 25% of the cost is paid, the journey is free.

Are pensioners of the Ministry of Internal Affairs exempt from real estate tax and transport tax?

Margarita, good evening. The first thing that should be noted is that, according to the explanation of the Russian Ministry of Finance, pensioners of the Ministry of Internal Affairs do not receive benefits for utilities and telephones. Former employees of the internal affairs bodies of the Russian Federation who receive a long-service pension are exempt from: Payment of tax on one of the personal real estate objects (if you are the owner of several apartments, then this privilege applies to only one of them).

The same applies to houses, cottages, garages. However, if you are the owner of several objects belonging to different types of real estate, then the benefit can be obtained for each of these objects, be it a dacha, house, apartment or garage. Income tax on pensions. Land tax compensation. Benefits for payment of transport tax (in some areas, which need to be clarified with the tax authorities). Pensioners who have these benefits should independently submit the entire package of necessary documents to the tax service.

Veteran of the Ministry of Internal Affairs of Russia: how to obtain the title “Veteran of the Ministry of Internal Affairs” according to new requirements

According to the amendments to Federal Law No., the right to determine who is a veteran of the Ministry of Internal Affairs and assigning this status to him is retained by the Russian Government. in certain situations, this responsibility is assigned to government agencies at the federal level.

Important! Information about the need to assign the status of “Veteran” to a pensioner is transmitted by the organization’s management to the Government of the Russian Federation

Legislative regulation

Various types of benefits and ways to obtain them are discussed in legislative documents. Information on the receipt and volume of state support is contained in the following federal laws:

- Federal Law No. (contains a description of the rights and benefits for employees serving in the Ministry of Internal Affairs);

- Federal Law No. (on social guarantees provided by the state);

- Federal Law No. (considers issues of service in internal affairs bodies);

- Federal Law No. 4468-I (the text of the law describes benefits for citizens who retired after completing work in internal bodies).

The possibility of obtaining state support is also considered in the article of the Tax Code, in the resolution of the Supreme Court of the Russian Federation No. 4202–1.

Important! When receiving benefits, it is necessary to take into account the regulations of the region in which the labor veteran lives. Download for viewing and printing:

Calculation of pension benefits of the Ministry of Internal Affairs of the Russian Federation:

What parameters are taken into account?

When determining the size of the pension, the following parameters of the pensioner must be taken into account:

- Total length of service (the amount of the bonus depends on it);

- The total amount of length of service (there is only experience in the authorities, or there is also civil service);

- The rank from which the employee retired;

- The position from which he retired;

- Cool classification.

In addition, additional payments may be established for the pensioner depending on the state of health and the order of service:

- Participants in combat operations receive a 32% bonus;

- If the pensioner has reached the age of 80 - 64%;

- If a pensioner is 80 years old and has 1 disability group - 100%;

- If a non-working pensioner has dependents, the increase is 32% for one, 64% for two, 100% for three.

Calculation formula

In the general situation, the pension of an employee of the Ministry of Internal Affairs will be calculated according to the following formula:

| Pension of the Ministry of Internal Affairs | = | (Salary according to position + salary based on rank + bonus for length of service) | X | 50%+3% for each year of service over 20 years (but not more than 85%) | X | Reduction factor |

In the case where a pensioner of the Ministry of Internal Affairs served in the territory of a subject where a regional coefficient is in effect, then after a general calculation of the amount of the pension, it is necessary to increase the result by this coefficient.

Help! The size of the reduction factor is determined on the basis of government regulations. At the moment and until October 1, 2020, it is necessary to use a coefficient value of 0.7223. It means that the pensioner receives a pension in the amount of 72.23% of the corresponding salary of an employee of the Ministry of Internal Affairs.

It was planned that the coefficient would be frozen until 2020 and would not rise. However, by order of the President, it will increase by 2%. Thanks to this, there will be an increase in the length of service pension for employees of the Ministry of Internal Affairs in 2020.

Calculation example

We will calculate the pension for a former employee of the Ministry of Internal Affairs.

The salary according to position is 15,000 rubles, the salary according to rank is 11,500 rubles.

The bonus for length of service is 20%, which is 5,300 rubles.

27 years of service, which is 71% of the payment.

Let's make the calculation:

Pension = (15000+11500+5300) x 0.71 x 0.7223 = 16308 rubles.

Average pension of the Ministry of Internal Affairs in Russia

According to statistics, the pension of former employees of the Ministry of Internal Affairs is approximately 1.7 times greater than the old-age pension of ordinary citizens.

Thus, the minimum pension is about 15 thousand rubles, the average pension for a police major is 20 thousand rubles, and for a colonel - 30 thousand rubles.

Do Pensioners of the Ministry of Internal Affairs Pay Transport Tax Irkutsk Region

Anton Logashov recalled that a regional law was adopted in the region in 2007, which provides for a property tax benefit for those enterprises that incurred costs for fixed assets: more than 10 million rubles - 25%, more than 50 million rubles - 50%, more 100 million rubles - the benefit can extend for a year, two or more. The measure is of a declarative nature. The deputy chairman also noted that the region risks receiving less income tax from organizations affected by international sanctions. According to him, two enterprises have already declared such tax withdrawals of 642 and 450 million rubles. “Therefore, in October, together with the new composition of deputies of the Legislative Assembly, we will begin by sequestering budget expenditures,” Logashov said.

Anyone who has any vehicle registered in their name is required to pay the appropriate tax on it. Since it is classified by law as a regional tax, its benefits are established by the laws of the constituent entities of the Russian Federation.

We recommend reading: Tax on Non-Residential Premises and Parking Space in 2019 for Legal Entities

Registration of benefits and concessions

Since all such discounts for tax exemption for various types of taxation are purely applicant’s, you will have to fill out all the paperwork yourself. This means that no one will hand you anything on a platter, once you retire, this will not happen. You need to collect a complete package of documentation and go with them to the tax office, only in this way can you get what is required by law.

List of documents

- Passport of a citizen of the Russian Federation, as well as copies of all significant pages. Instead of a passport, another identification document may be accepted.

- Certificate of a pensioner of the Ministry of Internal Affairs, as well as a copy of it.

- Taxpayer INN.

- Documentation of ownership for which you want to receive a tax discount.

Submission procedure

When all the documentation has been collected, you need to somehow submit it for review to the nearest branch of the Tax Service at the place of your registration (registration) or actual place of residence, which is quite acceptable. Today, in order to receive any benefits, apply for a pension or social benefits, you do not even have to be a citizen of Russia. This can be done using a variety of methods, depending on what you like best and what seems easier:

- Go to the tax office yourself, which will give you the opportunity to find out on the spot whether you have enough certificates and even correct errors, if any.

- Contact the MFC nearby, if there is one in your city, where it will also be easy and convenient to submit all the papers.

- Send copies of documents and certificates by mail, but the letter must be recommended and have a list of attachments.

- Register on the official website of the National Assembly of the Russian Federation, create a personal account, for which you still have to go there and write an application, and upload scans of documents directly to the service server.

After all the papers are finally accepted, you will have to wait a little. Within about ten days, you can already apply for an official answer whether they gave you a discount or relief or not. If you were refused, but you are completely confident that you are right, it makes sense to contact higher authorities; most importantly, document all such letters, complaints and appeals and store them for at least three years.

Health improvement

Once a year, a former employee of the Ministry of Internal Affairs is given a free voucher to a health institution (if this institution is part of the system of the Ministry of Internal Affairs). Also free roundtrip transportation to this location.

At the same time, relatives are given small discounts, namely, they can buy a health package at a reduced price. In this case, the discount system depends entirely on the length of service, length of service and job assignment.

Children of pensioners also receive benefits - compensation for expenses for health improvement after the necessary papers and certificates are provided.

It is recalled that the Law “On the Police” is currently in force, according to which law enforcement officers receive their benefits. Moreover, each city has its own preferential system with additions.

Relatives of this category of people also have advantages:

- They are served free of charge in medical institutions of the Ministry of Internal Affairs.

- Purchasing a voucher at a reduced cost, and for children free of charge with certificates.

- Free travel to the treatment center for one visit.

- If the father or mother, who worked in the authorities and retired, dies from an illness that was acquired during work, his close relatives are given a one-time monetary compensation, a monthly payment for the upbringing and provision of minors, and other discounts and benefits according to the law.

How to pay toll

As soon as a vehicle is registered with the traffic police, its owner becomes obligated to pay tax. This must be done once a year, at a certain time - no later than December 1 of the current year.

A corresponding receipt will be sent to the taxpayer (as a rule, it arrives by registered mail approximately 30 days before the due date). It will indicate the amount that needs to be deposited, information about the object of taxation, as well as details for transferring money.

If suddenly the tax notice is not received on time, the Federal Tax Service recommends not to wait, but to contact the department to receive it. Figuring out who is to blame in this case—the tax service, which “forgot” about you, or the post office, which “lost” the receipt—is a waste of time that will lead nowhere: the letter will be considered delivered after 6 days, and the car owner will not the person who paid the bill will still be charged a penalty. The same should be done if the document sent contains inaccuracies or there was an overpayment and a refund must be made. However, new technologies allow you to solve all these issues without leaving your home - upon registration. Here, using your TIN number, you can find out all the information about your tax debts.

You can pay the bill itself either in person at a bank branch or using the online services of banking institutions. The same service is available on the Federal Tax Service website. To do this, go to the “Pay taxes” section and enter the taxpayer’s data (full name, address, tax identification number, type of tax and amount).

If for some reason a citizen does not pay the transport tax on time, then he will be charged a penalty for each day of delay (in accordance with paragraph 2 of Article 57 of the Tax Code of the Russian Federation). The interest rate of fines is equal to 1/300 of the current refinancing rate of the Central Bank of Russia

Even if the amount is small, you shouldn’t accumulate debts and once again attract the attention of the Federal Tax Service as a defaulter.

To summarize, we note that the reduction in the amount of transport tax is essentially influenced by only two factors - the technical characteristics of the car and the place of residence of its owner. The payment of tax by pensioners (whether it will be canceled or its amount will be reduced) remains the responsibility of local authorities. You can learn about benefits, documents for their registration and the most convenient ways to pay transport tax at the regional Office of the Federal Tax Service.

Features for persons with disabilities

The reform of law enforcement agencies, which has been actively underway since January 2012, has resulted in a reduction in benefits and the abolition of preferences. For now, disabled people from the Ministry of Internal Affairs are holding out. It is difficult to say what awaits retirees in the long term, but now their support from the state is more significant than for ordinary pensioners in uniform.

Free aftercare and sanatorium stay

Let's start with the fact that a disabled pensioner who has lost his health in the service can undergo free rehabilitation in sanatoriums.

The algorithm is as follows:

- The pensioner is undergoing inpatient treatment for the main disease in an institution of the Ministry of Internal Affairs. If the department does not have the necessary equipment and specialists, assistance is provided in state and municipal clinics;

- immediately after hospitalization, it is necessary to be examined at the place of treatment by a medical commission to determine the need for sanatorium-resort rehabilitation;

- then the medical institution sends a request for information about the patient’s need for further treatment to the Medical and Sanitary Unit of the internal affairs department of the subject. All necessary medical documentation for the disabled person is attached.

The allocated voucher with a personal appointment is sent by the medical unit to the department’s sanatorium, which provides specialized treatment.

The applicant for restoration is required to arrive for free rehabilitation by the specified date. If you are late, the tour will be extended at existing prices out of your own pocket. And only if there are free places.

In standard situations, pensioners with disabilities need to pay a quarter of the cost for a trip. The road is free.

Reimbursement for dental prosthetics and other “gifts” from medicine

A pensioner of the Ministry of Internal Affairs who has officially registered a loss of ability to work has the right to preferential provision of medicines and medical products. appointments.

But only when it is confirmed by medical prescriptions from a departmental hospital.

A retiree has the opportunity to install or repair dentures, however, if he does not claim to use the latest generation materials.

What benefits can former employees of the Ministry of Internal Affairs take advantage of in the medical field?

There are three areas for providing preferences:

- provision of free prescription drugs in specialized pharmacies. At the same time, the provision of free medications is possible only for the former employees themselves. Members of their families have no right to count on this type of social guarantees;

- If, on the orders of a doctor, a former law enforcement officer requires treatment in a sanatorium or resort, then he has the right to count on it being provided by paying a quarter of the cost of the voucher. The same benefit will apply to a dependent of a pensioner, for example, a grandchild, if guardianship or trusteeship has been issued for him. But here 50% of the ticket price is paid. The preference is provided only once a year. The network is one subtlety. Rest and treatment will be free if they are carried out in a sanatorium that is part of the system of the Ministry of Internal Affairs of the Russian Federation. As a rule, the duration of treatment in such a sanatorium should not exceed 21 days;

- Both current employees and those retired due to length of service or disability resulting from service have the right to undergo free treatment in hospitals of the Ministry of Internal Affairs. If there is no specified hospital in the area where a pensioner of the Ministry of Internal Affairs lives, then he has the right to be treated in a state or municipal medical institution, also free of charge.

Cash payments to pensioners of the Ministry of Internal Affairs

When calculating pensions for former employees of the Ministry of Internal Affairs, the official salary, regional coefficient, and long-service payments from 10% to 40% are taken into account. For disabled people and pensioners with dependents, monthly allowances are provided:

- 32% — additional payment for a WWII participant;

- 100% - supplement for disabled people of group 1 or pensioners over 80 years of age;

- 32% - additional payment if there is 1 dependent;

- 64% - for 2 dependents;

- 100% - for 3 or more dependents. No additional supplement is paid if dependents are already receiving a pension.

Retiring employees of the Ministry of Internal Affairs are given a one-time payment taking into account length of service and awards. If they have more than 20 years of experience, they receive 7 salaries, less than 20 years - 2 salaries, for an award or honorary title - 1 additional salary.

According to Federal Law No. 166, former employees of the Ministry of Internal Affairs must receive a pension of no less than the established amount. The pension payment is indexed according to general rules. In addition, pensioners of the Ministry of Internal Affairs who have reached retirement age are entitled to a one-time payment of 5,000 rubles.

Additional payment to pensions in Moscow for non-working pensioners in 2020 for employees of the Ministry of Internal Affairs

For information: pension payments to security forces will be indexed from January 1, 2020 with a coefficient of 1.041. As for civil accruals (second benefit), it is constantly increasing for non-working citizens. So, indexing will take place as planned on 02/01/18.

The pensions of victims of political repression and those who worked on the home front during the war will increase. Additional measures have been taken to provide for long-lived pensioners: citizens over the age of 101 will receive a one-time payment of 15,000 rubles. Married couples who have lived together for more than 50 years will receive 20,000 rubles. The amount increases with the number of years spent together:

List and rules for receiving benefits for pensioners of the Ministry of Internal Affairs

Hello Tatyana, in accordance with clause 10 of Art. 11 Federal Law dated July 19, 2011 No. 247-FZ “On social guarantees for employees of internal affairs bodies of the Russian Federation” to a citizen of the Russian Federation who has been dismissed from service in internal affairs bodies and has 20 years or more of service in internal affairs bodies (including preferential calculation) and one of his family members is paid monetary compensation for expenses associated with paying for travel to a sanatorium and resort organization of the federal executive body in the field of internal affairs or an authorized body in the field of national guard troops and back (once a year).

Hello Angelina, in accordance with the Rules for the provision of a one-time social payment for the purchase or construction of residential premises to employees of the internal affairs bodies of the Russian Federation, approved by Decree of the Government of the Russian Federation of December 30, 2011 No. 1223, the registration of an employee for receiving a one-time payment is carried out on the basis of an application from the employee addressed to the head of the federal executive body, a body that states that previously, in all places of public service, he was not provided with lump-sum payments (subsidies) for the purpose of purchasing (constructing) residential premises.

You might be interested

- Rules and procedure for paying child support on a child account

- Certificate of income

- Compensation and payments for injuries at work

- Vacation in advance for the next year according to the Labor Code of the Russian Federation

Additional payment to pensions for pensioners of the Ministry of Internal Affairs for a minor child

But, I believe, it is unlikely that it will be possible to receive funds for previous years, since all payments are made from the date of application with the necessary package of documents. Unfortunately, officials, including the department’s software department, are not required to notify a citizen about what rights he or she has. And it is impossible to prove that they did not notify.

We recommend reading: A Disabled Person Due to a Chaos Accident Is Right to What Pensions?

Employees of internal affairs bodies who are dismissed from service with the right to a pension are paid one-time payments, and in case of dismissal without the right to a pension, payments are made in the amounts determined by the Government of the Russian Federation.