Should pensioners expect a one-time payment of 15,000 rubles in September 2020?

This year, due to COVID-19, many citizens of our country have faced financial difficulties. The cost of food and medicines and housing and communal services tariffs have increased significantly. This especially affected pensioners.

In order to provide financial assistance to citizens, the state has prescribed additional payments for some social groups. Citizens of retirement age, both non-working and working, should also fall into this category, according to member of the Public Chamber S. Khamzaev. A one-time payment of 15 thousand rubles was proposed for them.

According to some sources, this payment was supposed to be in August. However, the proposal put forward to additionally pay this amount to pensioners still has the status of an initiative of a representative of the Public Chamber, and no final decision on this matter has been made to date.

What payments and benefits will people be able to receive in August?

Firstly, on August 1 there will be an increase in pensions ( regular cash payments to persons who have reached retirement age, are disabled, have lost a breadwinner, or due to long-term professional activity

) for working pensioners.

Based on the pension points that they received over the last few years of work and which were not taken into account previously.

Let me remind you that at the moment one pension point is equal to 93 rubles.

At the same time, no more than 3 pension points can be added to the maximum. That is, the pension will increase by 279 rubles.

To be honest, it’s such a bonus. I think many people won’t pay attention to this, but they talk a lot about increases for working pensioners.

Secondly, presumably, in August they will once again pay one-time benefits for children in the amount of 10,000 rubles (as in June and July). This news is good, I think this money will come in handy for many at the moment.

Thirdly, pregnant women and military personnel will also receive one-time foreign exchange assistance in the amount of 28,000 rubles.

Fourthly, in August, self-employed elderly people (who have individual entrepreneurs or are registered with the Federal Tax Service as self-employed) will receive a tax bonus in the amount of 12,130 rubles, which they will be able to spend on paying tax arrears or leave them to pay off subsequent taxes (withdraw these funds funds are not allowed).

What pensioners are entitled to due to Covid-19

Until the end of the year, various preferential measures for pensioners will continue to apply, including the cost of housing and communal services, contributions for major repairs, payments of penalties and loans, etc. Working pensioners are given the opportunity to receive paid sick leave for the entire self-isolation period.

Along with this, some regions have approved one-time payments for pensioners, people with disabilities and the poor.

Mishustin's pension reform: Russians under 70 will simply stop paying pensions

Having taken the chair of the head of the Russian government, the former head of the Federal Tax Service, Mikhail Mishustin, immediately started personnel changes in ministries and departments. In particular, he made Maxim Topilin , who previously headed the Ministry of Labor and Social Protection of the Russian Federation, head of the Pension Fund of Russia (PFR).

Former head of the Pension Fund Anton Drozdov , the same one who could not find several hundred billion rubles in the country's surplus budget to index pensions for working pensioners, did not sit without work for a long time and, with the light hand of the new prime minister, moved to the Ministry of Finance, taking work on a new one under his wing pension reform, the creation of non-state pension funds (NPF), the development of a guaranteed pension plan (GPP), as well as currency control.

Will the September elections affect payments to pensioners?

A few months ago, information appeared in the media about an additional one-time payment to pensioners in the amount of an average monthly pension, i.e. 15 thousand rubles. Some timed this to coincide with the regional elections on September 13, 2020.

On this day, 18 governors will be elected, several State Duma deputies in single-mandate constituencies, elections to regional parliaments of 11 constituent entities of the Russian Federation, as well as elections to municipalities will be held.

Hence, they say, the concern for the main electorate - pensioners.

Although there is no officially confirmed information on this issue, there is a possibility for pensioners to receive such an increase from the state in early September.

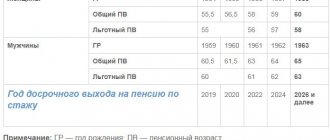

Early retirement in Russia

Early preferential pension is available subject to several mandatory conditions. The first and most important of them is classifying production as harmful or unsafe for the life and health of workers.

There are 2 categories of harmfulness

, assigned to two different lists:

- List I – production with hazardous and harmful labor conditions.

- List II – production with difficult working conditions.

List I includes

the following productions (

in economics, the process of creating a product

) and industries:

- Mining enterprises.

- Processing of special products from mining enterprises.

- Ferrous and non-ferrous metallurgy.

- Chemical and coke production

- Metalworking enterprises

- Electrical engineering branch.

- Oil and gas industry.

- Coal and oil shale processing.

- Glass industry enterprises.

- Pulp and paper industry.

- Industries associated with working with radioactive and toxic substances, including nuclear energy.

- Production of building materials.

- Creation of explosives and ammunition.

- Pharmaceutical industry.

- Transport branch.

- Printing.

List II includes

professions and industries with complex and very difficult working conditions.

- Professions related to mining, ore and coal processing, not included in List I.

- Professions in the metallurgical industry (ferrous and non-ferrous) not included in List I.

- Other professions in industries listed in List I, but not considered unsafe for health.

- Building sector.

- Connection.

- Agricultural sectors associated with the introduction of pesticides.

- Electric power engineering.

In addition to representatives of the above professions, the right to an early preferential pension is

:

- Workers of medical institutions and educational institutions. These preferences are established by Government Resolution No. 555.

- Persons who became disabled as a result of hostilities.

- Earlier than other citizens retire ( regular cash payments to persons who have reached retirement age, have a disability, have lost a breadwinner or due to long-term professional activity

), employed visually impaired people with group I, as well as disabled people suffering from impaired functioning of the pituitary gland - midgets and dwarfs. - Mothers with many children who have raised at least five children can count on early retirement.

- Representatives of small nations, and persons working in the northern regions, as well as in areas equivalent to such. Nationalities and nationalities, whose representatives are included in the preferential group, are prescribed in Federal Law No. 166. Today there are 39 such peoples, living mainly in the north and Far Eastern regions.

There are retirement benefits for employees of law enforcement agencies and the military, but for them everything is not so clear and the calculation is different from civilians.

Lists of preferential industries do not confirm early retirement; there is such a nuance as certification of jobs and contributions from the employer. For example: not all welders receive the second list, since employers do not want to pay additional contributions for their employees and many surprises await their retirement.

Tags

Retirement pensions Russia

Will everyone receive an additional payment for the Day of the Elderly?

Perhaps the only thing that can be said for certain today regarding additional payments to pensioners in September of this year is a one-time payment of 700 rubles. for the International Day of Older Persons.

But here, too, not everything is smooth – due to the lack of federal funding, the accrual of “holiday” payments will be made at the discretion of regional authorities and only if there are available funds in the budget. Several regions have already paid this amount back in July of this year. The rest of the payments must be made to pensioners by September 30.

News

In some cases, pension and work are incompatible. Without knowing this, pensioners may find themselves in an unpleasant situation when the Pension Fund has the right to demand the return of an illegally received pension.

The Pension Fund of Dagestan reminds that this category includes:

1) Social old-age pensions . These pensions are assigned to men upon reaching 65 years of age, and to women at 60 years of age, unless their right to an insurance pension is confirmed (there is no required length of service or “pension points”). If a citizen gets a paid job while receiving a social pension, the payment of the pension will be suspended.

Who will be denied a pension and why?

2) Insurance pension in the event of the loss of a breadwinner - when the recipients are the spouse, parent, grandfather, grandmother of the deceased breadwinner, or an adult brother, sister or child who care for children, brothers, sisters or grandchildren of the deceased under 14 years of age. In this case, the law also states that such recipients must be unemployed.

3) State pensions for long service . State civil and military employees, law enforcement officers equivalent to them, as well as cosmonauts receive a long-service pension only upon dismissal from service. Upon reinstatement in service, pension payments to such categories of pensioners are automatically terminated. At the same time, engaging in other types of paid work is not prohibited.

4) Social supplement to pension (federal or regional). These payments are assigned in cases where the total amount of social security received by the pensioner does not reach the minimum subsistence level approved for the corresponding region of residence of the pensioner. The absence of any type of income for a pensioner is a prerequisite for receiving social supplements.

Social supplement to pension: to whom, when and how much. Table with amounts for all regions

5) Compensation payment for caring for a disabled person . Monthly compensation payments are assigned to able-bodied persons who care for an elderly person (over 80 years old) or a disabled person of group 1. While receiving such payments, the caregiver is prohibited from engaging in paid work.

Recipients of any of these pension payments need to remember that the Pension Fund of the Russian Federation carefully monitors the receipt of insurance contributions to the personal accounts of these categories of pensioners. As soon as it becomes known about the transfer of insurance premiums, the overpayment of the illegally obtained pension is subject to recalculation and a claim for damages is made. At the same time, it does not matter what contract the pensioner worked under - labor or civil servants.

According to Article 25 of Federal Law No. 173, if false data is provided to the Pension Fund, which subsequently leads to overspending of cash payments, the citizen must compensate the state for the damage caused in full, the Pension Fund recalled.

Illegally obtained pensions and benefits will have to be returned

Discount for age

This right is given to them by the law signed by President Vladimir Putin “On Amendments to Article 10 of the Federal Law “On Non-State Pension Funds” on the Issues of Assigning Non-State Pensions.”

Now participants in non-state funds will be able to receive a non-state pension starting from the age of 55 (for women) and from 60 years (for men).

“In addition to the 5 million people who are participants in funds within the framework of non-state pension provision and have not yet received a pension, this law will also affect a much larger number of citizens who will become participants in non-state pension funds in the future,” explained Konstantin Ugryumov, president of the self-regulatory organization National Association of Pension Funds . — The adopted amendments eliminate the legal conflict that arose in connection with the adoption of the law on raising the age for state pension. The new law finally fixes the right of participants in non-state pension funds to enter a non-state pension and begin receiving pension payments upon reaching 55 or 60 years of age - that is, 5 years earlier than when entering a state pension.”

The requirement for insurance coverage, which is important for self-employed pensions, has been removed from the law.

In addition, the updated law, from which the requirement for insurance experience is excluded, will make it possible to attract the self-employed, foreigners, as well as those who have dependents or want to ensure a prosperous old age for their employees to accumulate future pensions in non-state pension funds.

The right to early receipt of a non-state pension is separately guaranteed for those who have the right to receive an early pension under state pension insurance: disabled people, people working in the Far North, etc.

“These changes are aimed at improving the financial situation of citizens of pre-retirement age,” summarized Konstantin Ugryumov.

The new version of the law preserves the right of a person to postpone entry into a non-state pension, but not later than the age of acquisition of the right to a state old-age insurance pension. Another innovation makes it possible to establish additional pension grounds for NPF participants, for example, the length of service with a specific employer-contributor. This will allow companies to have a more flexible personnel policy and additionally reward those who have been working in one place for many years.