NPF "Future": login to your personal account

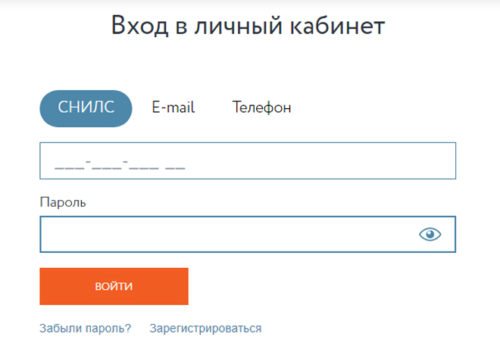

The authorization process involves manually entering the password and login from your personal account. The first identifier is sent by email, and as the second you can use:

- SNILS number;

- personal email;

- Mobile phone number.

Although the identifier options listed above are equivalent, it is recommended to select and use one login for authorization. The personal data entered when entering the account must match those specified when creating the account: you cannot, for example, use an e-mail that belongs to the client, but is not registered in the private pension fund database.

Personal Account Features

The official website of “Future” has integrated the depositor’s personal account, which is a remote service service and allows clients online:

- Monitor the profitability of the deposit. Using the personal account, the client can find out how much money was transferred from the NPF to the savings account for any time period. Information is displayed in the form of charts.

- Make changes to the form with personal data. The function will be useful to those investors who, for example, received a new passport. The system also allows you to change your contact phone number.

- Get more information about your own savings account. In your personal account, you can order details of account replenishments, as well as familiarize yourself with the characteristics of the tariff according to which the client receives interest.

- Order an electronic version of the contract. It is worth noting that thanks to a digital signature, an electronic contract has the same legal force as its paper version. If desired, the investor can order an additional copy of the paper contract, which will be delivered by Russian Post.

Your personal account has a simple and intuitive interface.

Registration in the personal account of NPF "Future"

To create an account in Personal Account, an existing client of “Future” will need to open the official website of the fund, click on the link to “Personal Account” located in the “header” of the initial page of the resource and go to the “Registration” section. On the page that appears you will need to enter:

- SNILS number;

- series and number of the passport of a citizen of the Russian Federation;

- last name, first name and patronymic;

- Mobile phone number;

- E-mail address.

To register an account in the system, you can use not only the passport of a citizen of the Russian Federation, but also any other document confirming the identity of the depositor. Also, before creating an account, you will need to accept the privacy policy and enter the symbols located on the anti-spam picture. The password for your personal account will be sent to the email address specified in the registration form. If desired, the user can subscribe to the newsletter from a private pension fund and activate e-mail notifications.

Personal account and website

The Future Pension Fund, like all NPFs, has a personal account and a functioning website. In your personal account you can:

- Find out your pension savings.

- Calculate your approximate pension using existing figures using a convenient calculator.

- Arrange for insurance services.

- Manage assets and invest in existing projects to increase your future pension.

Registration and login

- To register, the client must already transfer the savings portion to the fund. Upon registration, the client is given a temporary password.

- If he lost it, then he can register. To do this, go to the page – https://futurenpf.ru/personal/registration/. We carefully enter: Last name, First name, Patronymic, Series and passport number, SNILS, Email, phone number. Enter the verification code from the picture and click register.

- To log in, go to – https://futurenpf.ru/personal/. You can use SNILS, Phone or E-mail as a login.

- Now the client will be able to use all the features of his personal account.

Mobile app

On the official website of a private pension fund you can find a special section that contains ready-made answers to popular questions about pension provision and the company’s activities. You can also contact customer support by:

- call the hotline of your local Future branch;

- write an email to the company's main office;

- use the chat form provided on the official website.

Contact information is presented in the section with the appropriate name (link in the upper right corner of the main page of the site).

Contacts and telephone

Official website: https://futurenpf.ru Login to your personal account: https://client.futurenpf.ru Hotline phone number: 8

[Total: 0 Average: 0/5] Consultation with a pension lawyer by phone In Moscow and the Moscow region +7 (499) 110-25-80 St. Petersburg and region +7 (812) 407-18-13 NPF card

| Profitability: | -5,97 % |

| Assets: | 308933312.23102 thousand rubles. |

| Reliability: | A |

| Official site: | futurenpf.ru |

| Personal Area: | |

| Telephone: | 8 |

Information is current as of 12/18/2018.

NPF "Future" is one of the largest companies in the pension market, with a client base of over 4.5 million people. In addition to the non-state funds “Welfare OPS” and “StalFond”, the organization at the end of 2020 was replenished with two more large enterprises - NPF Uralsib and NPF Our Future.

Thus, the combined group took third position among the leading players. The nuances of the organization’s activities and its achievements will be discussed below.

reference Information

Table 1. General information about the fund

| Name | Requisites |

| Full title | Joint Stock Company "Non-state pension fund "FUTURE" |

| Registration date | 30.04.14 |

| License | 431, unlimited |

| Location | 127051, Russia, Moscow, Tsvetnoy Boulevard, 2 |

| Assets, million rubles | 296 364 |

| Place in the NPF ranking | 3 |

| Yield according to the Central Bank as of September 30, 2017 | 4,9 |

| Official site | https://futurenpf.ru |

| Telephone | 8 |

NPF "FUTURE" received its name in June 2020 as a result of the rebranding of NPF "BLAGOSOSTOYANIE OPS".

As a separate structure, the Blagosostoyanie OPS fund began operating in February 2014 after the reorganization of the NPF Blagosostoyanie and the transfer of all rights and obligations for compulsory pension insurance to the non-profit part.

In December 2014, the organization was sold to the investment company O1 Group, which already owned large pension funds: StalFond and Telecom-Soyuz.

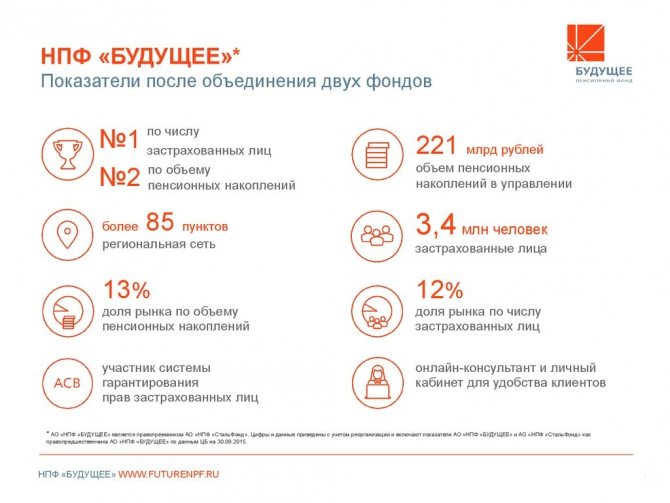

Rice. 1. Together into the future - the advertising slogan of the new fund

Under the new name of JSC NPF FUTURE, in March 2016, the assets and pension savings of the Blagosostoyanie OPS fund were combined with the assets of the NPF StalFond, which was one of the 10 largest funds in terms of pension savings under management, which made it possible to expand the scope of activities organization and withdraw it:

- in the TOP-3 non-state pension funds of the Russian Federation;

- in the RBC rating of “500 largest companies in Russia”.

By the end of 2020, the following were also added:

- NPF "Uralsib";

- NPF "Our Future".

NPF "FUTURE" in order to improve service and guarantee the safety of deposits became one of the first participants:

- Deposit insurance systems from 01/01/2015 – register number 5.

- National Association of Non-State Pension Funds.

NPF is part of the Future financial group, which is its sole owner.

The final beneficiary is Boris Iosifovich Mints - he indirectly owns 25% of the fund's shares.

Note! According to Forbes magazine, in March 2018, negotiations began on the sale of assets of the NPF FUTURE to the non-state fund Sberbank.

The organization's activities are aimed at providing services:

- Mandatory pension insurance in terms of funded pension.

- Providing non-state pension provision in the context of individual plans and corporate programs.

To implement its main mission: “Caring for the future is our job” and improve the quality of service, the organization is expanding its remote service channels and branch network.

New service formats with interaction with various banking structures are constantly being tested. NPF partners are reputable banks and financial organizations.

Rice. 2. Partners of NPF “FUTURE”

To find the nearest fund office or branch of a partner bank, you can use the search service on the official website in the “Office Addresses” tab.

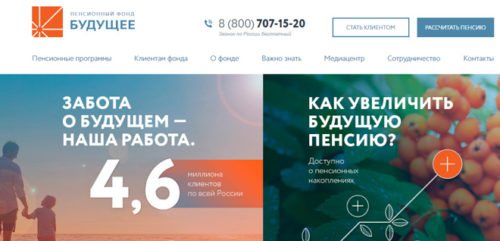

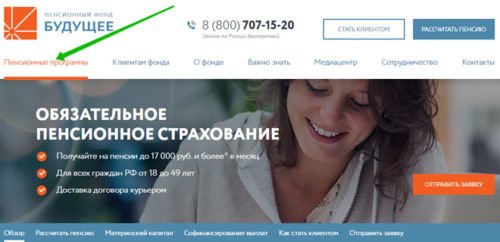

Official website of NPF "Future"

The company’s Internet resource is located at https://futurenpf.ru/. The site has good functionality; the main menu offers all the sections necessary for interaction with the fund - from pension programs to contacts. At the very top of the page there is a button to go to your personal account, as well as a search engine for site materials.

The approximate size of the future pension and the amount of savings helps to calculate the pension calculator, which opens when you click on the “Calculate pension” button.

The result obtained does not guarantee income, and before transferring your funds to the management of the fund, you must study the charter and insurance rules in detail. All necessary information is available on the official website.

Anyone can become a client of the joint stock company NPF "Future". To do this, you should go to the nearest office with your passport and SNILS or leave an application online. Next, you will need to conclude an agreement, after which you can evaluate the possibilities of online and offline interaction with the fund.

Existing clients can receive a free consultation by calling the hotline, leave a request with a question directly on the website, and receive the necessary information in their personal account. In the “Media Center” section you can follow the latest news from the fund.

NPF "Future" transferred to itself the pension savings of a resident of Udora without his knowledge

The Udora District Prosecutor's Office conducted an investigation at the request of a local resident regarding the legality of the transfer of his pension savings from the Pension Fund of the Russian Federation to NPF Future JSC, the Komi Prosecutor's Office reports.

During the inspection, it was established that on November 30, 2020, an unidentified person on behalf of the applicant, without his knowledge, entered into an agreement on compulsory pension insurance with the non-state pension fund JSC NPF Future. According to the agreement, the citizen’s pension savings from the Russian Pension Fund were transferred to a non-state pension fund. At the same time, the applicant insisted that he did not write an application for the transfer from the Pension Fund of the Russian Federation to NPF Future JSC, did not enter into an agreement on compulsory pension insurance with a non-state pension fund, and does not consider the signatures in the application and agreement to be his own.

The prosecutor of the Udora district, in the interests of the insured person, sent a statement of claim to the court to recognize the concluded agreement as invalid and to impose on NPF Future JSC the obligation to transfer the citizen’s pension savings to the Pension Fund of Russia. The court decision satisfied the demands of the prosecutor's office.

***Pension legislation provides for the possibility of transferring the funded part of a pension from the Pension Fund of Russia to a non-state pension fund.

Within the meaning of Art. 36.7 of the Federal Law of 05/07/1998 No. 75-FZ “On Non-State Pension Funds”, the transfer of a person insured in the pension fund of the Russian Federation to a non-state pension fund is of a declarative (voluntary) nature.

However, recently there have been increasing cases of transferring funds to a non-state pension fund of citizens without the knowledge of the insured person.

According to paragraph 2 of Art. 36.5 of Federal Law No. 75-FZ, the contract on compulsory pension insurance is terminated if the court recognizes the contract on compulsory pension insurance as invalid.

You can find out information about the transfer of pension savings from the Pension Fund to a NPF or from one NPF to another NPF at the Pension Fund branch at your place of residence or place of actual stay, as well as in your personal account on the Pension Fund website.

In case of transfer of such funds without the knowledge of citizens, it is necessary to contact the NPF to which the pension savings were transferred and which is obliged to inform on the basis of which the pension savings were transferred to this NPF.

In the future, citizens have the right to independently challenge the transfer of pension savings in court or apply to the prosecutor’s office for protection of violated rights.

Pension programs of the Future Fund

Similar to its competitors, the NPF in question offers three main products:

- a program aimed at forming the funded part of the pension;

- corporate security option;

- compulsory pension insurance program.

OPS and the individual option allow future clients to transfer funds already available in the Pension Fund (or other NPF) to the Future Fund.

Thanks to investing funds, each client has a real opportunity to increase the size of their future pension.

A corporate program developed for a specific business makes it possible to retain the necessary specialists in the team and attract new personnel. As an element of the social package, such a fund product allows companies to have tax benefits.

About the fund

Since the company is not a newcomer to the pension services market, it can already “boast” of success in its business. At the beginning of 2020, more than 3.2 million people became clients of the combined fund from the merger of two significant structures in the field of pension insurance. In total, the pension giant JSC NPF Future owns more than 12% of the market.

Initially, the company had a direct relationship with Russian Railways and was their corporate partner. Subsequently, the expansion of client flow and the loss of the status of a highly specialized non-state pension fund allowed agents to differentiate insured persons and attract billions of rubles for pension provision. Currently, the cash cushion in the NPF Blagosostoyanie and NPF Stalfond, which are the unified Future Fund, amounts to 210 billion rubles.

How to find out your savings

You can obtain information on savings in several ways:

- at the nearest branch of the fund;

- on the organization’s website using the “Personal Account” service;

- in the department cooperating with NPF "Future".

In terms of saving time, the most convenient way is to use the “Personal Account” service. You will first need to register. This can be done on the authorization page, where you should click the “Register” button.

In the form that opens, enter personal data - full name, series and passport number, SNILS, email address and telephone number. You should receive an SMS with a confirmation code on your phone.

When filling out the form, you must check the box indicating your consent to the processing of personal data. You can also agree to receive messages by phone or email.

Registered users are authorized by entering their SNILS and password. The service provides access to a personal account, which can be controlled at any convenient time. The profitability provided by the company's investment policy is also visible here. The work of your personal account is constantly being improved.

How to withdraw the funded part of a pension from a non-state pension fund and receive it in a lump sum

In terms of saving time, the most convenient way is to use the “Personal Account” service. You will first need to register. This can be done on the authorization page, where you should click the “Register” button.

Acquaintance with JSC NPF "Future" usually begins with the history of its creation. Until 2014, the organization was called NPF “BLAGOSOSTOYANIE OPS” and attracted employees of the Russian Railways holding company for services. After changes in pension legislation, 100% of the fund’s shares were acquired by the O1 Group holding.

The pensioner will receive a one-time payment of pension savings in the amount of 200,000 rubles.

Make changes to the form with personal data. The function will be useful to those investors who, for example, received a new passport.

A funded pension is a monthly cash payment to insured persons entitled to an old-age insurance pension. The size of the funded pension is calculated based on the amount of pension savings of the insured person as of the day the funded pension was assigned.

I didn’t pull this out of thin air, but from the vastness of the Internet. From various sources. I already know that it is impossible to withdraw. You can close the topic.

If pension savings are formed in a non-state fund, then a package of documents to assign payment from pension savings funds must be sent to this non-state pension fund.

Well, look - everything that was thrown in there before the moratorium + dividends on this amount, in theory, can be collected from them, in the sense of the maximum, and so, a lot of pebbles can be added to the agreement.

Obviously, with such results there is no need to talk about any significant positions in the profitability ranking.

Earn more points - your pension will be higher. The number of points depends on length of service and employer contributions.

Unscrupulous NPF agents can take advantage of your trust, your password to the Government Services Portal, or your inattention and transfer your pension savings. It must be remembered that transferring funds to a non-state pension fund or management company is a right, not an obligation! Do not give in to the persuasion of NPF agents that your pension savings in the Pension Fund may disappear.

Do not confuse these two abbreviations: in this article I use the abbreviation IPC only in the meaning of the individual pension coefficient.

Employees of the Russian Pension Fund never go door to door and do not offer to process any documents or applications. We draw the attention of citizens to the fact that employees of credit institutions, insurance or recruitment agencies, and mobile phone stores can act as NPF agents.

The law on funded pensions provides for the possibility of receiving NPP only after retirement. Until this time, you cannot withdraw your savings.

How to receive the funded part of a pension from NPF “Future”?

Payments may be assigned upon reaching retirement age (or earlier, subject to certain conditions). The procedure starts after submitting an application and a package of necessary documents. The latter, as a rule, is identical to the package of documents for the appointment of an insurance pension.

If a lump sum payment is expected, the processing time for the application may be a month. If we are talking about an indefinite or urgent option - 10 working days.

The urgent option involves individual determination of the duration of monthly payments, but it cannot be less than 10 years. Perpetual benefits are based on life expectancy determined annually.

Last year the period was 20 years. The monthly payment amount is calculated by dividing the entire accumulated amount by 234 months.

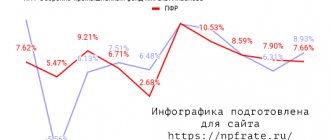

Profitability of NPF "Future" by year

Investing citizens' pension savings allows the fund to receive a certain income, which increases the amount of funds in each client's account. In 2014, the percentage of profitability of NPF “Future” was small - only 1.47%. Compared to the profitability of the Pension Fund of Russia, the indicator was lower by 1.21%.

In 2020, the yield was already 5.58%, in 2016 it decreased again - 3.87%, in 2017 - the figure stopped at 1.85%. This picture may indicate the futility of investments. However, this is not entirely true, since the annual profitability figures could potentially change significantly, and therefore grow.

NPF cannot achieve profit for clients for the second year in a row

The problematic non-state pension fund (NPF) “Future” is bringing losses to its clients for the second year in a row. Last year they set a record: NPF posted a negative result of 12.6%. The fund needs to replace more than a quarter of its assets soon, and the actuary has identified a shortfall. However, the NPF still plans to show “positive profitability” this year.

One of the largest Russian private funds, NPF Future, suffered record losses in the accounts of its 4.5 million clients in 2018: the pension savings of citizens forming their future pensions in this NPF decreased by 12.6%, according to the fund’s reporting data on industry accounting standards (OSBU). This is the second year in a row that Future has reduced its obligations under compulsory pension insurance (OPI) to clients. In 2020, he posted a 4% loss on the accounts of insured persons.

NPF "Future" at the beginning of this year was the fourth largest Russian fund in terms of obligations to citizens under mandatory pension insurance. Last year, the financial group of the same name (FG), which included a non-state pension fund, transferred debts from Boris Mints’ O1 Group to the Cypriot offshore Riverstretch Trading & Investments (RT&I, see “Kommersant” dated November 20, 2018), which at the end of last year sold 49 % of the shares of the flagship fund invest, owned by the Cyprus offshore WHPA of the group's majority shareholder Sergei Sudarikov (see Kommersant-Online dated December 30, 2020). At the beginning of this year, through an additional share issue, IC increased its share to just over 50% of the authorized capital of the NPF.

NPF Future encountered financial problems in the second half of 2020 after the Central Bank reorganized the bank FC Otkritie (BKFO) in August of the same year. The fund was both a shareholder of BKFO (see “Kommersant” dated November 7, 2020) and a holder of bonds of the bank’s former main owner, Otkritie Holding. The NPF was also seen investing in the same assets with other pension funds that were part of financial groups concentrated around a number of banks (see Kommersant on April 1). In addition, “Future” actively invested funds from future retirees in projects associated with its owner (see “Kommersant” dated April 12, 2018). Most of these investments turned out to be unsuccessful. In the financial year itself, which owned the NPF, based on the results of the first half of last year, they indicated that negative results from investment activities, in particular, were caused by “investments in a number of assets related to projects of the O1 Group company,” including defaulted bonds of Prime Finance" and "Risland".

As a result, FG “Future”, which accounted for 88.4% of the assets of the group of funds, indicated in its reporting that assets amounted to 27.7 billion rubles. at the end of the second quarter did not meet current requirements. In addition, its NPF needed to get rid of assets worth another 40.7 billion rubles by mid-2020. The reports of the NPF Future published yesterday recorded that at the beginning of this year, assets worth 21.2 billion rubles. (7.9% of total assets), there was a violation of the rules for investing pension savings; the fund must get rid of another 55.5 billion assets (20.7%) by July 1. The actuary also recorded a deficit of 30.6 billion rubles. Against the background of financial problems, NPF “Future” has already faced outflows of its client base. Following the results of the transition campaign last year, 170 thousand people decided to leave the fund (see Kommersant on March 6).

However, as stated in the reports, the management of the NPF hopes that the new majority shareholder will continue to “further support the fund to ensure” its obligations. Also about NPFs is the achievement of “a positive return as early as 2020.” Earlier, a Kommersant source close to Future also expressed hope that the fund would end this year with a positive result.

Ilya Usov

On termination of the contract with NPF "Future"

The procedure for terminating the contract is quite simple. Nuances can be specified in the relevant paragraphs of the document. If there are none, you simply need to notify the fund of your intention to terminate cooperation.

Important! Russian legislation prohibits changing funds more than once a year.

If termination occurs for the first time this year, then a written application from the client will be required to implement the procedure. It must contain information about what to do with the amount of funds accumulated in the account.

It can be withdrawn to a bank account (card) or transferred to another NPF. Within three months after submitting the application, savings are transferred to another fund or to the account specified in the application.

It is worth remembering that termination of the contract entails certain consequences:

- loss of income from investing savings;

- taxation of withdrawn funds;

- payment of a commission for transferring the amount to the account.

Operating principle of NPF "Future"

To implement the task of accumulating clients’ pension funds and investing them to obtain the required level of income, the NPF uses a package of individual pension programs (IPP).

Participation in them is subject to the following conditions:

- The minimum contribution (monthly) must be at least 1000 rubles.

- In order for pension payments not to be subject to income tax for individuals (providing tax deductions) in the amount of 13% (personal income tax), the maximum amount of contributions should not exceed 120,000 rubles. in year.

- The period at which the payment of pension savings from received contributions and income begins is at least 5 years.

- The frequency of pension payments from the fund is no more than 1 time per month.

- Payment of contributions by the client must be made for at least 3 years continuously.

- There is an option in which the initial payments by the client’s pension fund can be 40% of the total amount of savings over a 3-year period.

- There is the possibility of early termination of the contract while preserving the accumulated part of the savings and the corresponding income for the past period.

Savings can be deposited through bank accounts and electronic payment systems such as Yandex. money or WebMoney.

Pension payments can be received only when the client reaches the retirement age specified by law (taking into account the availability of a preferential category).

The main difference of the program is that savings can be inherited automatically or when this fact is indicated in the will.

Hotline number of NPF "Future"

By calling the hotline number 8-800-707-15-20 you can find out all the necessary information on pension issues. Moreover, this applies not only to clients who have entered into an agreement directly with NPF Future, but also to those who have an agreement with organizations that are part of it. Calls within Russia are free of charge.

The success of an organization can be indirectly or directly judged by numbers. The volume of pension savings of the company under consideration is 283 billion rubles, which allows it to close the top three leaders in the pension market. And the volume of payments to clients and legal successors, which almost reached 6 billion rubles, indicates a high degree of reliability.

Attention! Due to recent changes in legislation, the legal information in this article may be out of date! Our lawyer can advise you free of charge - write a question in the form below:

As the experience of many people shows, the key to a good pension is investing in a non-state pension fund. Among the large number of funds, NPF “Future” deserves special attention. The activities of the foundation and its employees are official. Each department has all the necessary conclusions from the relevant services.

The fund began operating only in 2014, but has already gained several million Clients and received a high rating of reliability from government representatives. If you want to invest your finances reliably and be confident in the timely payment of your pensions, then this NPF is what you need. To do this, you will need to discuss all possible subtleties with the agent and draw up an appropriate application.

In order for you to get maximum information and track the entire history of your contributions, you will need to register and enter your personal account of NPF Future.

This does not require additional effort, just go to the “Personal Account” tab and follow the instructions.

Expert opinion Inna LoyalnayaEditor. Internet expert. More than 5 years of experience in IT. If you have any questions, PFR consultants will be happy to help you. You can contact them at the official phone number of NPF Future – 8.

disLike24.ru

I will also share my modest experience of dealing with this NOT a pension fund... That is, a sharashka office.

Registration and login to your personal account

In order to register, you will need to click the “Register” button and enter your personal data, namely:

- Full name

- Series and passport number

- SNILS number

- Phone number

- The verification code that will be indicated

Your login password will be sent to the specified email address. Therefore, enter only the current mailbox.

Access can be achieved in 3 different ways:

- By SNILS number

- By email address

- By phone number

If your password has been lost, you can restore it by pressing a special button. Here you need to enter your SNILS number, after which the new password will be sent to the email address specified earlier.

Functional

Thanks to your account, you can track any savings online. This service will be available not only from a computer, but also from any device with Internet access. Personal account functions allow you to:

- View detailed information about your pension investments

- Track all data on the results of investing your funds

- View the accumulative part and how it is calculated

- Receive advice from specialists, as well as send technical requests about any errors or failures

- Independently make changes to the current plan under which you are collaborating

Your personal account allows you to minimize the cost of your time and view in detail information about absolutely all operations and manage the agreement with NPF Future.