About the Pension Fund

The Pension Fund of Russia is a state off-budget fund. This is the Federal system that provides government social security services. The organization's responsibilities are wide:

- it establishes and pays insurance pensions;

- takes into account the rights of citizens subject to pension insurance or social security;

- provides a social supplement so that the pension is not less than the subsistence level;

- provides social benefits to all categories of citizens who are entitled to it;

- forms, invests and pays out pension savings;

- issues a state certificate for family (maternity) capital;

- co-finances social programs.

The pension fund is the country's key social institution. To effectively interact with citizens, the organization has a support service.

PFR maternity capital, what to spend it on

One of the types of government financial programs that the Russian Pension Fund can provide is maternity capital. It is used only for specific purposes specified by the legislation of the Russian Federation. In this article we will give some of the most common examples of maternity capital investments. There will also be an explanation of how to carry out these procedures and what documents may be needed for this.

IMPORTANT! It is strictly prohibited to buy plots of land using maternity capital benefits - in this case you will have to purchase the land with your own money.

- Purchasing a new apartment or house is the most popular investment method according to statistics. The issued amount can be used not only for a one-time purchase, but also for rent.

- Renovating an old or building a new house/apartment, improving living conditions. For the construction process, money is issued in 2 stages. Initially, 50% of the funds from the requested amount are transferred, then, after 6 months, the second part arrives. During this period, the foundation must be completely laid, as well as the walls and roof erected. Reconstruction involves truly changing the characteristics of a living space in technical terms to improve its functionality and efficiency.

- Loans, credit, or mortgage. To invest money to pay off a mortgage, a child must be 3 years old. To receive a positive answer, borrowers must have a positive income on a regular basis, a stable job and a good credit history.

- Payment for services in the field of education. This paragraph refers to the use of money to pay for a contract at a university, or for other training and development purposes.

- Transfer of funds to the pension fund.

This is interesting: How Bailiffs Evaluate Equipment

IMPORTANT! When selling an apartment, some banking institutions require a certificate of non-use of maternity capital.

Hotline number

The Pension Fund Call Center, open 24 hours a day, will answer many questions regarding pensions and social security if you call. Their number:

8(800)51-05-555

The call is free and can be made any day of the week. It is not always possible to get an answer - there are many people who want advice. How to contact the pension fund? It will be easier to do this if you follow the following recommendations:

- contact the Pension Fund hotline at night - there are fewer operators on duty, but there are fewer calls;

- early in the morning people get ready for work, so the lines are not very busy;

- there are not too many calls to the Russian Pension Fund phone in the afternoon, since people are still at work.

What information can you get:

- on pension indexation;

- questions about obtaining SNILS, including replacing a lost one;

- all information about obtaining maternity capital and its use;

- consultations on registration of pensions or social supplements;

- on the creation of a personal account and its operation;

- about pension fund departments in the regions;

- about the work of the official website.

Employees will not provide information only about personal data. Such information is provided only upon personal visit to the branch. Other phones

Each regional center has its own hotline number. In order to find out, you need to go to the Pension Fund website. The table shows the numbers of some regions.

| Region | Number |

| Moscow and region | 8 |

| St. Petersburg and Leningrad region | 8 |

| Stavropol region | 8 |

| Nizhny Novgorod Region | 8 |

| Krasnoyarsk region | 8 |

| Novosibirsk region | 8 |

| Primorsky Krai | 8 |

In all regions, persons who call the Russian Pension Fund hotline will receive qualified assistance.

Maternity capital lawyer

The package of documents is sent to the Pension Fund of the Russian Federation at the place of residence, after being accepted by employees for registration, the review lasts 1 month. Having received the certificate, parents independently choose the way to use public funds. In case of loss of a personal document, upon application, a duplicate is issued with similar legal significance.

This is interesting: How to Find out the Amount of Mat Capital via the Internet

You can receive funds and issue a certificate at any time that suits your parents. Sometimes a significant period of time passes from the moment of birth to applying for a document. This may be due to some difficulties, and not to a lack of parental interest. Online legal advice will help resolve problems, without payment or representation.

Other ways to contact the Pension Fund

You can contact the Russian Pension Fund in person by writing a regular letter or sending a message by email, leaving a request on the website or in groups on social networks.

Website

The PFR website is informative. Here is the information necessary for pensioners, current or future and policyholders:

- personal account of the citizen and the policyholder;

- electronic work book;

- a calculator that clearly explains how the pension is calculated;

- consultation center;

- regional contacts.

You can use all this if you click on the address: https://www.pfrf.ru/.

Social Networks

The Pension Fund maintains official pages on social networks:

- on Facebook - https://www.facebook.com/PensionFondRF/;

- in a group on Odnoklassniki - https://ok.ru/pensionfond/;

- VKontakte - https://vk.com/pension_fond.

He has a Twitter account - https://twitter.com/pension_fond.

Emailing the Pension Fund of Russia is a convenient and accessible form of feedback. To do this, you need to go to the official website, register in your Personal Account and send a letter by going to the “Appeals from Citizens” section (https://es.pfrf.ru/appeal/). After filling out the required information, select a territorial unit, enter the text and send.

Another communication option is to contact the online reception desk of the Russian Pension Fund. It is also easy to find on the website in the “Consultation Center” section.

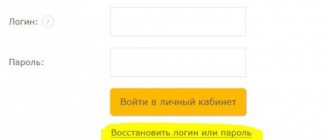

Personal Area

The Pension Fund's personal account, located on the official website, provides information that will not be given over the phone:

- about length of service and insurance premiums;

- about personal account;

- pension coefficients.

You can also make an appointment at the regional office, order a certificate of the amount of your pension or other payments through your personal account.

Frequency of preparation of accounting (financial) statements

Interim accounting (financial) statements consist of a balance sheet and a statement of financial results, unless otherwise established by law, contracts, constituent documents or decisions of the owner of an economic entity (clause 3 of article 14 of the Federal Law of December 6, 2011 N 402-FZ; p. 49 PBU 4/99).

The composition of the annual accounting (financial) statements depends on the category of the economic entity:

- Individual entrepreneurs, as well as branches, representative offices or other structural divisions of an organization established in accordance with the legislation of a foreign state located on the territory of the Russian Federation - if, in accordance with the tax legislation of the Russian Federation, they keep records of income and expenses and (or) other objects of taxation in in the manner established by the specified legislation - they may not prepare accounting (financial) statements (clause 2 of article 6 of the Federal Law of December 6, 2011 N 402-FZ);

- small businesses, non-profit organizations, organizations that have received the status of participants in a project for the implementation of research, development and commercialization of their results in accordance with the Federal Law of September 28, 2010 N 244-FZ “On Innovation (except for the organizations listed below) - may constitute simplified accounting (financial) statements (clause 4 of article 6 of Federal Law dated December 6, 2011 N 402-FZ);

- other organizations, including organizations whose accounting (financial) statements are subject to mandatory audit, housing cooperatives, credit consumer cooperatives, microfinance organizations, public sector organizations, political parties, their regional branches or other structural divisions, bar associations, law bureaus, legal consultations, law firms chambers, notary chambers, non-profit organizations included in the register of non-profit organizations performing the functions of a foreign agent provided for in paragraph 10 of Article 13.1 of the Federal Law of January 12, 1996 N 7-FZ “On Non-Profit Organizations” - must prepare accounting (financial) statements in the general manner (Clause 5, Article 6 of the Federal Law of December 6, 2011 N 402-FZ).

More on the topic Free pension lawyer on pension issues

Simplified annual accounting (financial) statements consist of (clause 6 of Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n):

- balance sheet;

- financial results report;

- report on the intended use of funds (only for non-profit organizations);

- appendices to the balance sheet, statement of financial results, report on the intended use of funds, which provide only the most important information, without knowledge of which it is impossible to assess the financial position of the organization or the financial results of its activities.

The general procedure provides for the preparation as part of the annual accounting (financial) statements (clauses 1 and 2 of Article 14 of the Federal Law of December 6, 2011 N 402-FZ; clauses 28 – 31 PBU 4/99):

- balance sheet;

- financial results report;

- report on the intended use of funds (only for non-profit organizations);

- statement of changes in capital;

- cash flow statement;

- appendices to the balance sheet, statement of financial results, report on the intended use of funds, which provide information without knowledge of which it is impossible to assess the financial position of the organization or the financial results of its activities.

Why can’t they reach me? Reasons and solutions

The rules for making corrections to financial statements are established by PBU 22/2010.

Features of preparation and presentation of accounting (financial) statements

Accounting (financial) statements are considered prepared after signing a copy of it on paper by the head of an economic entity (Clause 8, Article 13 of the Federal Law of December 6, 2011 N 402-FZ).

Interim accounting (financial) statements are approved in the manner established by law, contracts, constituent documents or decisions of the owner of an economic entity (clause 3 of article 14 of the Federal Law of December 6, 2011 N 402-FZ; clause 49 of PBU 4/99).

In most cases, annual accounting (financial) statements are subject to approval by the highest management body of the company, and in some cases - mandatory publication (clause 9, article 13 of the Federal Law of December 6, 2011 N 402-FZ; clause 6, clause 2, art. 33 of the Law “On LLC”; paragraph 11, paragraph 1, article 48 of the Law “On JSC”, etc.).

A trade secret regime cannot be established in relation to accounting (financial) statements (Clause 11, Article 13 of Federal Law No. 402-FZ of December 6, 2011).

Features of the preparation and presentation of accounting (financial) statements:

- when reorganizing a legal entity - Art. 16 Federal Law dated December 6, 2011 N 402-FZ;

- upon liquidation of a legal entity - Art. 17 Federal Law of December 6, 2011 N 402-FZ;

- the composition, features of the preparation and presentation of accounting (financial) statements of public sector organizations are established by the Budget Code, Order of the Ministry of Finance of Russia dated December 28, 2010 N 191n (clause 4 of Article 14 of the Federal Law dated December 6, 2011 N 402-FZ);

- The composition, features of the preparation and presentation of the accounting (financial) statements of the Central Bank are established by the Federal Law of July 10, 2002 N 86-FZ (Clause 5 of Article 14 of the Federal Law of December 6, 2011 N 402-FZ).