Citizens of the Russian Federation require a salary certificate at different periods of their lives and for different purposes. This document does not have a rigidly fixed form and is drawn up arbitrarily. Despite this, the certificate contains all the necessary information, taking into account the purposes for which the document is drawn up. Its production period cannot exceed three days. The basis for issuance is a written request from an employee or employee of an organization/institution.

- Purposes and forms of completion

- Help for calculating pensions

Purposes and forms of completion

The purpose of requesting information about the income of an individual - a working or previously working citizen of the Russian Federation - may be different. Thus, a salary certificate is submitted:

- to the bank's credit department to obtain a loan;

- to the employment center when registering unemployed status;

- to calculate a pension for the pension fund inspector at the place of residence;

- to the judiciary for various purposes;

- upon confirmation of financial solvency to obtain a visa.

The form of the document is usually developed by the personnel department of the enterprise. You can look at the sample on specialized Internet resources and develop your own form based on it. The earnings certificate must contain the following information and formal grounds:

- official name of the enterprise or institution;

- date of issue, outgoing number;

- signature of the chief personnel officer, accountant or head of the organization;

- blue seal, without which the document has no legal significance.

The position held and the period of work in this position must be indicated. The form contains exact information about the amount of wages received for a certain period: three months, six months, a year or, in the case of a pension, the entire period of work at the enterprise. Information about the amount of payments is required.

If the form is filled out to obtain a bank loan, then you need to indicate all information about charges, deductions, payments, debts:

- total income, average monthly indicators;

- the amount of monthly accruals and payments made for 12 months. An employee whose employment relationship with the employer lasted less than a year is issued a certificate of actual payments during work;

- the amount of funds allocated and paid to state funds: social, pension, insurance funds, tax inspectorate for one, three months, six months, 12 months;

- the amount of wages owed to the employee, if any.

The chief accountant and the director of the enterprise/institution have the right to certify the completed form.

Issuing PFR reports to employees

The Law on Personalized Accounting states that an employee who has applied to the Pension Fund for a pension must be given copies of the information submitted to the Pension Fund within 10 calendar days from the date of filing the application for retirement. However, employees who apply for a pension apply to the employer with another statement - on the submission of reports to

GROUND 1. Information about the employee has been submitted to the Pension Fund as part of current reporting

As for administrative liability, the employer can be held for violating both the norms of the Labor Code itself and the norms of labor law contained in other legal acts. But can the failure of the policyholder to issue copies of personalized statements to the insured be considered a violation of labor law?

Tatyana Ivanovna, have the changes provided for by the pension reform affected current pensioners? – Changes to the Law, which came into force on October 1, 2011, apply only to people applying for a pension after this date. For those who were assigned a pension before October 1, 2011, non-payment or reduction of the pension amount is not expected.

In order to avoid the question “how to find out whether contributions are being made to the pension fund?”, you can contact the multifunctional center. To request the necessary information, you must have an identification document, SNILS and a corresponding application with you . A sample of such a statement should be provided to you at the center itself.

How to submit information

This document contains information about the amount of income that the employee received throughout the year, as well as the amount of tax contributions to the budget. The employer issues a 2-NDFL certificate upon dismissal only if the employee indicated it in his application (Article 230 of the Tax Code of the Russian Federation).

In current practice, a certificate to the Pension Fund stating that you have worked, according to the model established by the employing company, is provided to process social payments due when there are no other documents confirming work experience, or to resolve disputes in other authorized structures (for example, in the judiciary ). To obtain a certified document, specialists contact the human resources department of the company where they previously worked or are currently employed.

Help for calculating pensions

Sample salary certificate form

A certificate of earnings is required for a pension. To begin the paperwork process upon reaching retirement age, you need:

- passport;

- original work book;

- other documents received from the employing organization that prove the existence of work experience;

- certificate of average salary from the start of employment until January 1, 2002;

- if there are disabled family members and/or dependents - confirmation documents, the form of which is approved by social services;

- documented registration at the place of application to the pension fund;

- a document explaining the name change, if such a fact took place;

- disability certificate.

A certificate of average earnings is ordered from the HR department of the enterprise/institution. Its form is developed by the enterprise independently, although any form of another organization can be used as a basis. The completed form is signed by the head of the personnel department, chief accountant, and director.

information can be found here: .

If the company no longer exists, you should contact the archive that accepted the papers of the liquidated company and make an extract from the accounting documents. This must be a certificate of earnings, containing data on the amount of average monthly payments. The form of such a document is known to the archive staff, who help collect documents for the pension. If an archivist cannot issue a certificate in the approved form, he has the right to independently draw up a document according to the information that is available.

A certificate of earnings for applying for a pension must contain information on the amounts of payments separately for each year; average values, for example, for three months or six months, are unacceptable. Any official remuneration is accepted for calculation: overtime, days off, part-time pay, except for dismissal benefits or compensation payments for unused vacation.

The document must be certified by the manager, have an outgoing number, and a date.

Ask your question below and get a free one-on-one consultation with our expert in 5 minutes!

salary certificates to the pension fund for calculating pensions - where to get, how to apply

His old-age benefit depends on how long a person worked during his life and how much he received for it. Since 2002, with the introduction of personalized accounting, the Pension Fund itself has been accumulating this information. What happened before must be confirmed independently. To take into account earlier periods, you need a salary certificate for a pension.

Preparing documents in advance for granting a pension

The pension is assigned from the day you apply for it with all the necessary documents (but not earlier than from the day the right to a pension arises).

Due to a change of job, region of residence, or profession, it is not always possible to quickly collect the documents needed to assign a pension. In addition, the available documents often contain numerous errors made during registration.

Errors can affect the size of a future pension, and in some cases lead to a refusal to grant a pension.

The Russian Pension Fund provides the opportunity to collect and verify documents confirming pension rights in advance.

In order to improve the quality of work on the assignment of pensions and reduce the time it takes to assign them, the PFR Branch for the Murmansk Region recommends that residents of the region contact the territorial PFR office at their place of residence in advance (preferably no later than 12 months before the right to a pension) for a preliminary assessment having documents on the length of service and earnings of working and non-working citizens. In cases of registration of a special category of pensions (for example: for work in hazardous working conditions, individual entrepreneurs), you should apply for early verification of documents at an earlier date.

If necessary, Pension Fund employees:

— will provide assistance in sending requests to former employers in Russia to provide additional necessary documents confirming insurance experience or work experience with special working conditions;

— check the correctness of the documents, evaluate the completeness and reliability of the information contained in them.

You must have the following documents with you:

Documents confirming experience:

- original work book;

- if available, you can additionally provide written employment contracts drawn up in accordance with labor legislation, certificates issued by employers or relevant state (municipal) bodies, extracts from orders, personal accounts and payroll statements;

- employment service certificates (if available);

- archival certificates (if available);

- military ID (in case of military service);

- documents on training; documents confirming the implementation of entrepreneurial activities (if necessary);

- other legally significant documents (marriage certificate, birth certificate of children, etc.);

Documents confirming earnings:

- if necessary - documents on earnings for any 60 consecutive months until 01/01/2002. (earnings for 2000-2001 are confirmed by individual (personalized) accounting information).

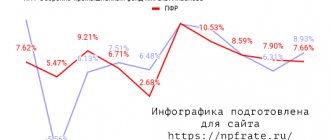

When accepting an application for a pension, the specialist analyzes whether the salary for 2000-2001 allows you to set the maximum earnings ratio - this is 1.4.

That is, the salary at that time should have been at least 2.5 thousand rubles. In this case, you do not need to provide any further certificates.

If the salary for the year 2000-2001 is less, a salary certificate will be required for any five years (60 months) of work in a row until 01/01/2002.

After January 1, 2002, the salary is not directly involved in the calculation of pensions, since the pension is calculated from the amount of insurance contributions accrued by employers for the employee. The amount of insurance premiums, in turn, depends on the amount of wages and length of work experience. [1]

Approach in advance for an appointment at the Office (Department) of the Pension Fund of the Russian Federation at the place of registration. If you live at an address that is not confirmed by registration, then contact the Pension Fund of the Russian Federation at your place of actual residence.

IMPORTANT! As part of the advance work, PFR specialists will assist citizens in obtaining additional necessary documents on experience and earnings.

It should be noted that an application for the purpose of preliminary assessment of documents for the assignment of a pension is not an application for the assignment of an insurance pension.

You can submit an application and documents for the assignment of a pension no earlier than a month before the date on which the right to assign a pension arises. The insurance pension is assigned from the date of application for it, but not earlier than from the date the right to it arises.

How to get a salary certificate for a pension fund

- Instead of a header, an imprint of the enterprise is placed, which reflects all the basic information about it. If there is no such stamp, the data is filled in in writing and a stamp is affixed below;

- Last name, first name, patronymic of the employee, as well as his date of birth.

However, some businesses do not bother to record information about the age of the former employee; - How long does the employee work at the company? In this case, the exact periods and total service life are reflected;

- The amount of the employee's salary reflected by month.

Annual income is also taken into account when drawing up the certificate; - The currency in which the employee is paid. This is a requirement for all financial documents. It is enough just to write the final amount in words.

Important! To calculate income for the period before 2002, the automated system takes the period from 2000 to 2001.

However, if at this time a citizen received a small income, and in other periods his salary was higher, he may request a recalculation. Moreover, the average monthly salary is calculated based on the salary for any five years.

Salary certificate

The salary certificate is drawn up in any form, depending on the requirements placed on it by the organization to which it is submitted. A salary certificate is issued by the employer upon written application from the employee within three working days.

Most often, a salary certificate is issued to an employee to present:

- to a bank to obtain a loan;

- to the employment fund for registration;

- to the pension fund to assign a pension;

- to the embassy to obtain a visa to enter the country;

- to other organizations.

The HR department is responsible for issuing the certificate in the organization. The salary certificate must contain the following details:

- name of the organization that issued the certificate;

- registration number and date of issue of the certificate;

- signature of the manager, head of the human resources department or chief accountant;

- must be certified by the seal of the organization or human resources department.

The certificate is a confirmation of the employee’s place of work, position and salary. If the certificate is not drawn up on the organization’s letterhead, then it must have a stamp with the organization’s details. The salary certificate form must contain the TIN and legal address of the employer organization. A salary certificate is invalid if it is not certified by the seal of the organization or the seal of the HR department.

Certificate of accrued and paid insurance premiums upon dismissal

Each employer makes monthly contributions to the pension fund. The company must provide information about them quarterly. For this purpose, a certificate of accrued and paid insurance premiums is provided. Upon dismissal, the employee must request this document, since it is not required to be issued.

Documents upon request upon dismissal

The employer gives the former employee a work book. If an employee requires other documents, he can make a request in writing. In this case, copies of them (Article 62 of the Labor Code of the Russian Federation) are provided. The organization must submit the documents on the day the employee is dismissed or no later than three days following the filing of the application. Information about transfers may be useful in the future.

Example of a written statement:

To the Director of Tandem LLC

N. V. Utkina

from a general seller

Ya. D. Malyutina

Statement

In connection with my dismissal on December 2, 2017, I ask you to issue a certificate of the transferred contributions for compulsory pension insurance.

number, signature

The application can be written in free form, but it is better to check with the employer: it is possible that the organization has its own form. When issuing certified copies of documents by the human resources department, the former employee must sign to acknowledge their receipt. This can be recorded in the journal of issued certificates, with a receipt or signature on the original documents remaining at the company.

Until 2014, employers issued certificates of the form SZV-6−1 and SZV-6−4, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated July 31, 2006 N 192p. After 2014, calculations are made using the PFR form RSV-1, section 6.

By the day of dismissal, the organization is obliged to provide information for the period worked. If the data has not been provided previously, it is generated and transmitted to the employee.

Help on request:

- about wages;

- on insurance contributions to the Pension Fund;

- 2-NDFL (on income;

- certificate of average earnings for the last 3 months (if you plan to register with the employment center);

- about the period worked in the organization.

A certificate of contributions and 2-personal income tax is issued by the accounting department, and a certificate of the period worked in a given company is issued by the human resources department. If there is no personnel department, then the documents are prepared in the accounting department.

If an employee is refused to issue any document, this leads to administrative liability of the employer and a fine in the amount of: 1000−5000 rubles (individual entrepreneurs and officials), 30000−50000 rubles. (for legal entities).

certificates

The requested document must contain information about the insurance period, employer contributions to the employee's funded pension and other transfers. When calculating, all types of income and compensation are taken into account, except for benefits upon liquidation of an enterprise and reduction of employees.

What information is included in the certificate:

- Name of the organization;

- number of the employer registered with the Pension Fund of Russia;

- taxpayer number and reason code for registration (TIN and KPP);

- date of sending the information to the Pension Fund;

- the period for which information is provided;

- employee's insurance certificate number;

- surname, name, patronymic of the insured;

- the form is indicated (original - if it is submitted for the first time for this individual, corrective - if the information that was submitted earlier has changed, or canceling - cancellation of previously submitted information);

- funds credited and paid for the insurance part of the pension;

- the amount transferred and paid for the funded part of the pension(overpaid amounts are not indicated);

- length of service (including vacation, temporary disability);

- working conditions (full time, part time)

This information is contained in the certificate of insurance premiums. Upon dismissal, a sample of accrued and paid amounts looks the same.

Reinstatement

In the case when a resigned employee decides to return and is hired, calculations are made for all the time he worked in this organization, and the income is summed up. The law is valid if this happened within one year, that is, 12 months have not passed between the date of dismissal and hiring.

If an employee managed to work in another organization before returning to the enterprise, then the income received in another company should have been taken into account by it . For example, after working for three months, A.I. Ivanov quit and returned to Mechta LLC. For the three months he worked, the personnel officers of the Stroymat enterprise were supposed to make transfers.

All documents and certificates are issued to the former employee against signature and free of charge. If the employee did not provide a bypass sheet, did not return work clothes or other property to the company, then papers on labor activity and transfers must still be issued within three days by hand or by registered mail.

Source: https://trud.help/docs/spravka-o-strahovyih-vznosah/

Salary certificate: form, contents and sample filling

For those who have not yet encountered the provision of documents to confirm their income, this material has been developed. Here you will find out to which authorities information on wages is submitted, in what form the documents must be drawn up, and what details must be present on the form. Depending on the place where the certificate is provided, there are many features of its preparation.

The article will be useful both to the employee himself and to the employer’s representative, so as not to miss important details in the process of drawing up the document.

Bodies to which a salary certificate can be submitted

Cases in which a salary certificate is provided:

- Registration with the labor exchange - a document will be needed to calculate benefits for unemployed citizens while looking for a job.

- Obtaining credits and advances by citizens from financial and credit institutions.

- Receiving benefits and subsidies from the budget to pay for utility costs.

- Registration of pensions in the Pension Fund of the Russian Federation.

- Obtaining a visa to travel abroad of Russia.

Help contents

At the top of the document there is a header that states:

- Name of the organization.

- TIN and checkpoint.

- Organization location address.

- Phone number of a contact person who can provide clarification on the certificate.

The certificate form sent to the credit institution may differ from the form prepared for the employment service.

The text of the document contains:

- The position held by the employee.

- Work period.

- The amount of wages an employee receives, minus taxes, for the required period.

The chief accountant and the head of the organization put signatures on the document form, which are certified by a seal.

You can learn how to obtain a salary certificate from your place of work for a visa from the video.

Features of calculating income in a certificate of average salary

Let's take a closer look at the principles of calculating income depending on the place where the document is provided.

If provided to an employment office, or otherwise to an employment center, for the calculation and assignment of unemployment benefits, a period of three months preceding the date of dismissal of the employee is taken. This takes into account the average earnings.

To calculate the average earnings, you need to multiply the number of working days in the required period by the average daily earnings. On the form you must indicate the taxpayer identification number of the enterprise, the date of hire and the date of dismissal.

If the employee has vacation at his own expense or absenteeism, then the periods for such cases are indicated.

If a certificate is submitted to the bank to obtain a loan, the document indicates the amount of the employee’s salary for the last six months of work. The bank asks to indicate the amount of income tax withheld from accrued wages.

In addition to the certificate, the bank often asks to provide a copy of the work record book certified by the head of the enterprise. Some organizations and individual entrepreneurs enter into an agreement with banks on the so-called “Salary Project”.

Its essence is to automate and optimize payroll costs. A list of employees and a payment order for crediting funds to accounts are sent to the bank.

The employee retires. You need a salary certificate for 5 years.

Message from Svetlana SV

An employee collects documents to apply for a pension. The company requires a “Certificate of wages for 5 years when applying for a pension.” Please tell me where I can find the form for this certificate, I just looked on the Pension Fund website and just on the Internet, I couldn’t find anything. I didn’t find such a form on the Clerk

Have you already been told for which 5 years a certificate is required? for the period AFTER 2001 no certificates are needed. The certificate form is brought by pensioners from the pension fund and we fill them out, if we are talking about years BEFORE 2002

We are often asked for these certificates. but they are asking for a specific five years. there the average salary should be no less than the Russian average for those years, we have this form.

Nibbler,

thank you very much, you helped me a lot. The fact is that our director is retiring (or rather, not retiring, but simply starting to apply for it), and you can’t argue with him. They told him that a certificate was needed for 5 years, take it out and put it away. Although, to tell the truth, our enterprise has existed since 2003 and has been operating since 2004, but now I will carry out its task, I will not give up. Although I have already informed him that he needs such a certificate not from us, but from his old places of work. Well, okay, my job is to inform and carry out the task. Otherwise he will immediately decide that I am not good for anything. Thank you very much again.

In Moscow, certificates from the Pension Fund about wages for 5 consecutive years are accepted only until 1997, then everything is available in the Pension Fund based on individual information. If in 2000-2001 the salary was at least 1,800 rubles, then the maximum coefficient of 1.2 is automatically taken to calculate the basic pension and no certificates are needed at all. I understand that he is the director, but you should quietly hint to him that a month before his retirement, he should go to his pension fund and there they will tell him whether he needs to bring something or not.

Tarim

It’s probably the same here in Samara with these certificates. He has six months until retirement, but recently he received a letter from the Pension Fund, which lists the documents that he must take there in advance. Incl. and this certificate is indicated. Who's next? I'm near. Accountant at work. So he instructed me to make such a certificate. And those organizations in which he previously worked either closed or went under. And I'm sitting here. So he won’t run to look for those offices and those who can give him such certificates when I’m nearby. So what if I explained to him that his company annually provided the Pension Fund with individual information (personalized accounting). It doesn't bother him much. It is written on the piece of paper that a certificate from the ent is needed, so in the end I am puzzled. And to rack your brains over something, that’s okay, look for other fools, not my director. So I will give him this certificate, he will take it to the Pension Fund, they will reject it for him there, they will explain what and how, then he will have no more questions for me, he will begin to think for himself where to go.

Message from Svetlana SV

I will warn him so that he first finds out about this matter, and then chooses his years. And so, in our office his salary in 2009 was 20,000 rubles a month. in 2008 - 15,000 rubles. in 2007 for 10,000 rubles. in 2006 for 5,000 rubles. Maybe this will be normal. And if they say that it is better to bring a certificate from the 70s, then he will probably look for those offices. But it won't bother me anymore.

It is better to collect all possible certificates for all the years yourself, and then ask the Pension Fund to choose the most “profitable” one. They don’t know what salaries were there.

Well, let him collect it. He instructed me to issue him such a certificate. I gave it out today. And she told him everything in detail. But, boy, he decided that it was difficult or reluctant for me to give him this certificate, and that I reproached him for this. That, they say, it’s unlikely to be needed anyway. He left inflated, but with a certificate.

Another confirmation that it is better not to argue with directors, but to silently carry out instructions, no matter how absurd they may be.

Last edited by Svetlana SV; 05/19/2010 at 16:32.

The Pension Fund of Russia will take information for the period after 01.01.2002 from the personal account of the insured person, formed from individual information from policyholders. And salary certificates for 5 years, which are later than 01/01/2002, are meaningless for assigning a pension.

The employer did not make contributions to the Pension Fund of the Russian Federation

So, find out, not that no deductions were made, but find out whether the report was submitted based on individual data and not just the fact that it was submitted in general by the employer for his company and the employees working there, because I know that I applied, all employers do, but it is necessary to establish the fact that they did not apply specifically to you, i.e. that you worked in the black.

And here you will need to act in terms of what you want to get. You can contact the tax office and the Pension Fund of the Russian Federation, and point out that the employer has unregistered employees who work in menial jobs and an extract from the Pension Fund of the Russian Federation stating that a report on individual data was not submitted for you, and here from the tax office and the Pension Fund of the Russian Federation there will be very large penalties against the employer.

We recommend reading: How to get one million for young specialists from the governor of the Sverdlovsk region for doctors

How to fill out a certificate of earnings for 5 years to assign a pension: form, sample

A certificate of earnings for 5 years for calculating the pension is submitted for calculating the pension. We have a sample certificate and a certificate form for 5 years.

The current pension legislation provides two options for calculating average monthly earnings to establish a pension: the pension can be calculated from average monthly earnings for 2000-2001 according to personalized records or according to a certificate of earnings for any 5 consecutive years of all work activity. In the second case, the employee may request from the employer a certificate of earnings for 5 years. In this article we will tell you how to fill it out. Subscribe to the most practical magazine about the simplified tax system “Simplified” . and the book “Annual Report on the Simplified Tax System” we will give you as a gift.

In what cases is a certificate of earnings for 5 years needed to assign a pension?

Practice shows that in the case where nothing has changed for a citizen in terms of place of work, profession (position), the best option for earning money over 5 years is earnings in the period from 1976 to 1986.

A certificate for five years is not required if the citizen’s monthly earnings, according to personalized records for 2000-2001, are at least:

Otherwise, you should take care in advance to obtain a certificate for five years of work with higher earnings, if you had one during other periods of work.

It is necessary to confirm your experience and earnings with documents before the period of registration of citizens in the personalized accounting system, i.e. until 1998. From this moment, experience and earnings are confirmed by personalized accounting information. Therefore, it is especially important that the employer promptly and in full transfers insurance contributions to the Pension Fund for its employees. Negative actions by the employer may result in the assignment of the insurance part of the labor pension in a smaller amount.

For people retiring, it is important that individual personalized accounting information for them both for previous years and for the current year is provided by the employer by the time they apply for a pension. To do this, the future pensioner must write a corresponding application to his employer in advance.

salary certificates to the Pension Fund for calculating pensions - where to get, how to apply?

Every year, government programs come into force that allow certain categories of citizens to receive financial assistance.

One of these areas is pensions.

When a citizen approaches retirement age, he needs to prepare documents confirming his earnings and required for calculating monthly payments.

This form is a salary certificate.

Where can I get information about income for calculating pension payments?

Old-age pension for men begins at the age of 60 years, for women - 55 years. But some professions (preferential ones) imply retirement at an earlier age.

A certificate of the employee’s average salary for the purpose of an old-age pension is requested from the organization’s accounting department.

As a rule, an employee of pre-retirement age only asks for a certificate orally. This practice is used in small companies; in large enterprises, a corresponding application is also drawn up.

Each enterprise can develop the salary certificate form for the Pension Fund independently; it is also possible to fill it out using an existing document taken from another organization as a basis.

The completed certificate is signed by the head of the human resources department, chief accountant, and head of the enterprise.

If the organization has been liquidated, it is necessary to send a written request to the archive department that accepted the papers of the deregistered company, and issue an extract from the salary documents.

The form of the certificate for the Pension Fund is known to the archive workers; they help collect the necessary documents for assigning a pension.

It is not always possible for an archive employee to draw up a certificate in the approved form, but he has the right to fill out the document himself according to the information he has.

Additionally, on our website you can download samples of earnings certificates:

Where should the salary form be submitted?

Order No. 884n of the Ministry of Labor and Social Development (dated November 17, 2014) states that citizens, in order to apply for a pension, send their applications to the territorial bodies of the Pension Fund located at their place of registration.

Persons whose registration and place of actual residence are different can submit a set of documents for calculating a pension at their place of residence.

Convicted citizens submit the form to the Pension Fund through the administration of the correctional colony at their location.

The deadline for applying to the Pension Fund for accrual of an old-age pension is not limited by law.

For what period is it compiled for assigning and calculating a pension?

The pension legislation currently in force allows 2 methods of calculating the average monthly salary to determine the size of the future pension:

- based on personalized accounting information, average monthly earnings in 2000-2001 are taken into account;

- in accordance with the submitted salary certificate for 5 consecutive years of work.

As practice shows, with a permanent place of work, it is more profitable for a citizen to take the salary received in the period 1976-1986 for calculation.

A salary certificate for 5 years is not needed in cases where the employee’s monthly earnings in 2000-2001 are equal to:

- 2100 rub. — for regions where wages are multiplied by a regional coefficient of up to 1.5 (for example, 1.5 for the Udmurt Republic);

- 2600 rub. — for areas with an established coefficient in the range from 1.5 to 1.8 (Murmansk region);

- 2900 rub. — for areas with a coefficient over 1.8 (Yakutia).

Otherwise, an employee planning to retire must prepare in advance for the Pension Fund a certificate for 5 years of work with a higher salary, if there were any for a different period of work.

The earnings certificate submitted to the Pension Fund serves as one of the main documents from the entire necessary package for calculating a pension.

The amount of the accrued pension depends on the amount of income. Every citizen is very interested in providing this form.

Filling out for Pension Fund authorities

An employee’s earnings certificate for applying for a pension must include information on the salary amounts paid for each individual year.

Average values (for 3 or 6 months) are not taken into account when calculating pensions.

To accrue and calculate a pension, the Pension Fund accepts any official payment to an employee:

part-time wages, overtime, days off, with the exception of dismissal benefits or compensation for unused vacation, child care benefits.

The certificate for the Pension Fund is drawn up in any form; it must contain the following information:

- company stamp (corner) with the date of issue of the document and its number;

- FULL NAME. (in full) of the employee who applied;

- date of birth of the worker;

- period of work;

- monthly salary amount and calculation of annual income;

- Payroll currency (ruble).

The form in the Pension Fund must also contain information about the organization that issued it:

- full name of the legal entity (in accordance with the constituent documentation);

- address of registration of the enterprise with the tax authority;

- company telephone numbers, tax identification number.

It is necessary to take into account in the certificate the amount of wages actually paid to the employee, and not accrued.

As a note, you should note the periods of sick leave and unpaid leave, and also record the presence of a certificate of incapacity for work before and after the birth of the child.

At the bottom of the form, the fact of deductions of insurance contributions to the Pension Fund of the Russian Federation for all employee accruals at accepted tariffs, as well as the grounds for issuing a salary certificate (personal accounts, payroll statements) must be recorded.

The certificate is signed by the company's responsible persons and the company's seal is affixed.

to the Pension Fund of Russia

Download a free sample of filling out a certificate to the Pension Fund for calculating and assigning a pension – word.

What documents are needed to calculate a pension and important points to pay attention to can be found in this video:

conclusions

When a company is reorganized, a certificate of renaming of the legal entity is issued as a supplement.

Confirmation requires the length of service and earnings of workers before 1998; after this date, citizens were registered in the personalized accounting system and their data on labor activity.

For people approaching retirement age, a very important point is the availability of individual personal accounting information presented not only for previous periods of work, but also for the current year (during the period the employee applied for a pension).

To do this, you should write a statement to your employer in advance.

Source: https://azbukaprav.com/trudovoe-pravo/zarplata/dokumenty-zp/spravka-o-zarplate-v-pfr.html