What documents are needed to assign a pension?

Before applying for an old-age pension, you should find out what documents are required for this procedure. This is a very important point that needs to be approached with maximum responsibility. You should not expect that a passport, work record book and a corresponding application will be enough to apply for a pension. The exact list of documents will depend on the specific circumstances.

To apply for an old-age pension, you will need the following documents:

- Application in the prescribed form;

- Passport of a citizen of the Russian Federation;

- SNILS;

- Military ID (if available);

- Documents on length of service (work book, written employment contracts, extracts from orders, etc.);

- Birth certificates of children (if you were on maternity leave).

Depending on the specific situation, additional documents may be required. Don’t worry if something is missing, the missing documents can be provided. When preparing documents for applying for a pension, special attention should be paid to documents and certificates confirming your earnings in various periods and labor service. The main document confirming periods of work is the work book. If for some reason you do not have it or it does not display complete information about the periods of work, then you can provide other certificates confirming your length of service. We discussed this issue in more detail in a separate article.

- Important

If not all necessary documents are attached to the application, you may be given an explanation about the need to provide them within three months.

Advantages and disadvantages

It probably seems that the process of calculating pensions on the State Services portal has no disadvantages:

- a Russian should not come personally to the Pension Fund;

- State documents are designed for the convenience of filling out and sending applications (acceptance, study of documents, calculation of payments);

- filling out a digital application implies the correctness of the forms;

- in cases where the necessary information is not displayed in the application, the portal will notify the citizen that the fields need to be filled out. This eliminates the possibility of incorrect or incomplete data entry.

The procedure for calculating a pension, issued through an electronic resource, has the following disadvantage - the applicant will ultimately be required to contact the Pension Fund in order to present a passport, work book and other documents.

This disadvantage is inferior to the advantages of the method, and in connection with this, the proportion of citizens choosing this option is increasing.

Conditions for assigning an old-age insurance pension

If you are thinking about how to apply for a pension in 2020, it means that you have reached the generally established retirement age (55 years for women and 60 years for men). However, this is not the only condition that must be met in order to assign an old-age insurance pension. To avoid wasting your time, you should find out in advance whether you can retire or not.

To receive an insurance pension in 2020, the following conditions must be met:

- The generally established retirement age has been reached (55 years for women and 65 years for men);

- Total insurance experience of at least 9 years;

- The minimum number of pension points is 13.8.

Please note that these terms only apply if you retire in 2020. Every year there is an increase in the requirements for length of service and the number of individual pension coefficients (points). By 2024, 15 years of experience and 30 points will be required to assign an insurance pension. If a citizen does not meet at least one of these criteria, then he is denied an insurance pension. In such situations, a social pension is assigned, the average amount of which in 2020 is 9,062 rubles.

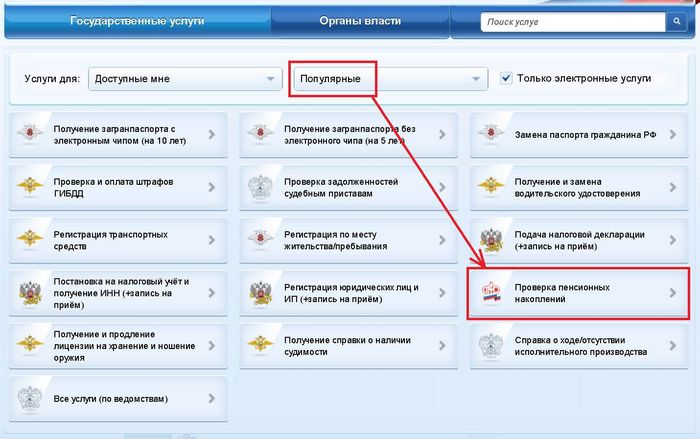

So, to understand whether you are entitled to an insurance pension, you need to have information about your length of service and the number of points. Of course, you can get this data from a pension fund, but there is a more convenient option. Every citizen can find out pension points for government services. A similar opportunity is available on the official website of the Pension Fund. You can also find out your work experience through government services. In principle, this is the same procedure, which involves receiving notification of the status of an individual personal account in the Pension Fund. The service is free and provided in real time.

- Important

In 2020, to receive an old-age insurance pension, you must have a minimum of 9 years of service and at least 13.8 pension points.

Personal account service for pensioners

In your personal account you can order different types of services

The previously described procedure for obtaining a password and registration allows you not only to create an account, but also to create your own Personal Account. Thanks to this, future retirees can realize the following opportunities:

- receive complete information about the current state of your pension savings (number of points, insurance period, as well as the amount of contributions);

- request information about the current status of your personal account (personal account).

In addition, they can independently calculate the amount of the components of their future pension using a software personal calculator.

Using LC services, a pensioner can also manage his funds, namely:

- formalize a refusal to form a funded component in favor of its insurance part;

- submit an application to change the insurer;

- receive notifications from the Pension Fund about replacing the previous insurer.

By using the services of this service, each owner of a personal account gets the opportunity to:

- apply for pension benefits;

- choose one or another delivery method;

- place an order for a certificate about the current status of various accounts and the amount of payments.

Important! For working pensioners, the LC indicates the amount of insurance payments, taking into account indexation corresponding to the amount of pension benefits that a citizen is entitled to upon completion of work.

Where can I apply for a pension?

It is no secret that pension registration is carried out at the Pension Fund branch at the place of residence. Meanwhile, this is far from the only option. If you wish, you can completely eliminate the need to visit the pension fund. Few people know how to apply for a pension via the Internet, meanwhile, in 2020, a similar opportunity is available to all citizens who have an account in the Unified Identification and Authorization for State Services.

You can apply for an old-age pension:

- By personally contacting the Pension Fund;

- Through MFC;

- Through the citizen’s personal account on the Pension Fund website;

- Through a single portal of public services;

- By mail.

As you can see, it is possible to apply for a pension in several ways. You can choose any option convenient for you. The classic option involves applying to the pension fund at your place of residence. You can also contact the MFC. The procedure for applying for a pension will be the same in both cases, so you can choose either option. If you want to avoid queues, you can apply for a pension online. Perhaps it makes sense to consider all these options separately.

Electronic application

Through a personal account on the Internet, a citizen can submit an application for any type of pension. The legal representative of a minor or incompetent person can do the same. To enter the account via the Internet, the registration data of the State Services website is used. When filling out the application, you must correctly select the territorial office of the Pension Fund of the Russian Federation to which the application will be automatically sent.

Personal data

An application written in accordance with all the rules is the key to quick and accurate calculation of pension payments. It is necessary to accurately indicate passport data, date of birth, personal identification number, and citizenship. In addition to this information, you need your residential address, email, and telephone.

Type of pension

The third stage requires indicating the type of pension (insurance, preferential, survivor), the presence of other accruals, whether the applicant is employed at the time of filing the application, whether there is a dependent. In your personal account, you can check the amount of insurance coverage, the number of deducted contributions, and view your pension points.

Delivery method

At the final stage, you are asked to choose a method of receiving pension benefits. Transfer to a bank account requires information about the financial institution, account number and card. When choosing delivery of a pension by Russian Post, the address of the future pensioner is indicated. If you prefer another organization responsible for delivering pension benefits, then information about it is needed. The recipient's address is also entered.

How to apply for a pension through the MFC or Pension Fund

If submitting an electronic application for an insurance pension seems too complicated for you, you can use the classic option. We are talking about a personal appeal from a pension fund or a multifunctional center (MFC). Until recently, at the MFC it was only possible to receive related services upon retirement, while applications and documents were submitted only to the Pension Fund. Now on the official website of the pension fund it is noted that you can also submit an application through the multifunctional center.

So, in order to apply for a pension, you need to decide where the documents will be submitted - to the Pension Fund or the MFC. Next, you need to contact the department of your choice, taking with you the documents provided earlier. A specialist will take the package of documents and help you draw up the application correctly. If you have all the necessary documents with you, the specialist will take the originals and within 10 days you will receive a pension certificate . To avoid queues, you should register with the pension fund online. Registration at the MFC is also available in every region of the country.

- Important

You can submit documents to apply for a pension one month before reaching the generally established age.

How to apply for a pension through government services

To apply for a pension through government services, follow these steps:

- Follow the link gosuslugi.ru and log in;

- Select the “Service Catalog” section;

- Select the category “Pension, benefits and benefits”;

- Go to the section “Establishing a pension”;

- Select ;

- Read the terms of service and click on the “Get service” button.

Now you need to fill out an electronic application. Step-by-step instructions are not required here, since the system itself gives the appropriate hints. As soon as your application is reviewed, you will receive a notification about the need to contact the executive body that you selected when filling out the electronic application to submit original documents. The list of required documents is provided on the government service website. We have also provided relevant information above. If any documents are missing, they can be submitted within three months.

Features of the State Services portal

The State Services website is in great demand among Russians. To obtain information about the amount of a future pension on this portal, a citizen needs to:

- Complete mandatory registration, since any information about pension savings is available only to an authorized user. To create a personal account, you need to fill out all the required lines and send a request to receive an individual activation code via email notification. When a citizen receives a special letter with a secret combination, it must be entered in the activation line. If the manipulation is successful, the person will have wide access to various government services.

- For further authorization, you will need to enter your choice: personal mobile phone number, email address or SNILS. The final step is to enter your password. When the provided data is verified, the main page of the site will appear on the screen. On it you need to find the Pension Fund tab and click on it with the mouse.

- The window that appears will contain a list of various electronic services, among which there is information about the amount of accumulated funds. To see them, you need to click on the link, which will open another page. There will be an option “Get a service”.

- By clicking on the banner, the citizen will send a request to the system. After processing, the information can be saved in your personal account or ordered sent to an email address linked to your account. As a rule, the letter arrives within a minute.

How to find out the balance of maternity capital through State Services

You can also find out the size of your pension online using SNILS on the Sberbank website. To do this, you need to receive your salary on the card of this bank and have a connection to the online banking service. To check the amount of savings you need:

- log in to the banking institution’s website;

- in the window that appears, find the Pension Fund service and click on it;

- Fill in the SNILS line, after which information about existing savings will appear on the monitor.

If desired, you can activate the voluntary top-up service so that after retirement the payment will be larger.