Conditions for receiving a Moscow pension

The size of payments and the conditions for receiving them change frequently. Currently, the following are eligible to receive a pension:

- women who have reached the age of 55, and men who have celebrated their 60th birthday.

- having a minimum work experience (9 years). This includes not only periods of actual employment, but also time of military service, child care, etc.

- those who have a pension coefficient of 13.8 points.

How many years do you need to be registered to receive a Moscow pension?

Not all pensioners who actually live here can apply for a pension with a Moscow supplement. The law determines how many years you need to live in Moscow to receive financial payments. The minimum period is 10 years . There is no continuity condition. confirmation is permanent registration. When living under temporary registration, the pension is calculated according to the tariffs of the region of permanent registration of the citizen, but he can submit documents to the Moscow Pension Fund inspection at the place of temporary registration. If a person does not belong to the category of people who are entitled to the Moscow supplement due to a shorter period of residence, he can only count on an additional payment up to the subsistence level. If you do not have the required minimum work experience, you can receive a social pension. Women over 60 years of age and men over 65 can apply for it.

How to apply for a pension in Moscow: what do you need to receive?

To obtain reliable information on how to apply for a pension in Moscow, you should contact the organization directly or look up information on the Internet. To request an old-age payment, you must wait until you reach the legal age, submit an application and a package of documents.

Where to contact?

The pension fund is in charge of processing cash payments. A citizen must contact the Pension Fund office at his place of residence , where he can register for old age. You should come here for the first time 6 months before your birthday. The consultation will help you determine the exact list of documents and the type of their provision. Upon completion of consideration of the application and a positive decision, the person is issued a pension certificate. For questions regarding the registration of surcharges, those residents of Moscow who have the right to receive it should apply here. Unemployed citizens who have lived in the city for at least 10 years can apply for it. Supplements also exist for working pensioners whose monthly income is less than 14,500 rubles.

Documentation

The list of documents required to be provided is most often determined individually. Basic documents.

- Passport. Foreigners are provided with a residence permit.

- SNILS.

- Military ID.

- Completed application for a pension. It has a prescribed form and is issued by an employee on site. It can be found on the official website of the Pension Fund.

- A document with information on the average monthly salary for 60 months of continuous service until 01/01/2002.

- Bank agreement for opening an account. The document is not provided if the applicant wishes to receive a pension at Russian Post (in person or at home) or through another organization for the delivery of relevant payments.

- Papers confirming your place of residence, if it differs from your passport details.

Additional documents.

- Certificate confirming the change of first and/or last name. Issued by the Civil Registry Office.

- Marriage/divorce certificates (if changing surname on this basis).

- Information about disabled relatives.

- Documents confirming the right to early registration of pension payments (for some categories of citizens).

- Papers confirming work experience in the Far North.

When accepting documents, the employee may say that it is necessary to provide additional papers or make changes to the existing ones. If you manage to convey them within 3 months, then the date of application for a pension will be the one when the application was accepted. There is not only an old-age pension; it can also be received on other grounds . You should apply for it at the same place where you need to register and according to age . Based on this, special papers are required confirming these rights.

- To receive a disability pension, you must bring the appropriate certificate issued based on the results of a medical and social examination.

- To receive pension payments based on the loss of a breadwinner, you will need to confirm your relationship with him. This could be a marriage, birth, or adoption certificate.

Basic documents for processing the Moscow allowance.

- Passport.

- SNILS.

- Pensioner's ID.

- Papers proving lack of work activity.

- A certificate proving residence in the capital for at least 10 years.

Deadlines

You can start preparing documents in advance. But they will be accepted no earlier than a month before their birthday. The process may take some time, especially if additional paperwork is required. The applicant can contact the Pension Fund, where they will help you apply for an old-age pension in Moscow after your birthday. It takes 10 days to analyze the application and documents. If some paper is missing, a person has 3 months to provide it. If he does not have time, then the date of acceptance of the application will be considered the day of actual submission of all documents. If the application is refused, the citizen is notified within 5 working days.

Monthly additional payments for certain categories of citizens

According to the law in force in the country, persons belonging to federal beneficiaries have the right to receive a monthly cash payment (MCB). To receive them, a citizen must contact the Pension Fund at his place of registration.

For disabled people

The amount of the monthly supplement depends on the disability group of the individual. Thus, citizens from group 1 receive 3,782.94 rubles, and from group 2 – 2,701 rubles. For persons with the third disability group, an EDV of 2162.67 rubles is provided.

For pensioners of the Ministry of Internal Affairs

To be considered a pensioner of the Ministry of Internal Affairs or receive a military pension, the duration of pure service must be at least 20 years, or mixed service must be at least 25 years. Moreover, a person must devote 12.5 years of them to military service.

For each year that exceeds the specified standards, payments to a pensioner of the Ministry of Internal Affairs will be increased by 3% in the case of pure length of service and by 1% in the case of mixed length of service.

Northerners

The northern regions of the country are considered subjects of the Russian Federation with difficult climatic conditions. Therefore, persons permanently residing in such territorial units, as well as those who have worked in the north for a certain number of years, receive additional allowances.

Persons who have worked in the Far North for more than 15 years with a total experience of 25 and 20 years (for men and women, respectively) receive a fixed payment increased by 50%, the amount of which for 2020 is 5,334 rubles. This payment is calculated regardless of the citizen’s current region of residence.

For pensioners who worked in regions equated to the Far North for 20 years or more, the fixed payment increases by 30%.

After 80 years

Old-age insurance payments are automatically recalculated when the pensioner reaches 80 years of age. The size of the monthly allowance for this category of citizens is 5,344 rubles, which is equal to the amount of the FV. Thus, persons over 80 years of age receive double the old age benefit.

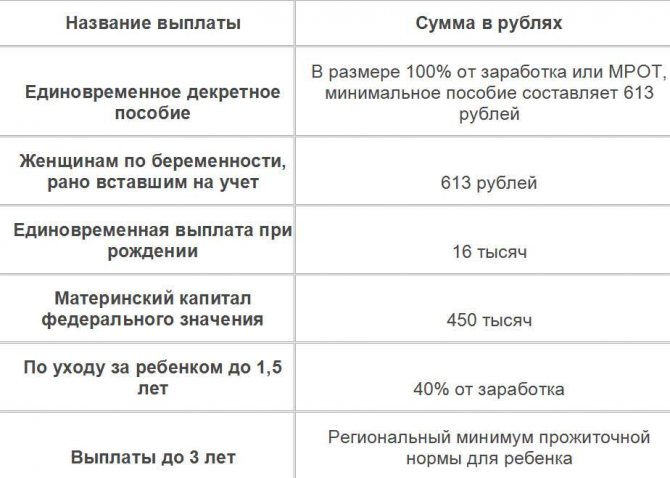

For mothers of many children and for children

Women who raise three or more children are considered to have many children. In this case, children can be either natural or adopted. These women are paid additional benefits for each child.

Payments to mothers

In order to receive additional payments for children, a woman needs to contact the Pension Fund with documents. When recalculating pension points, the period of maternity leave is taken into account:

- for the first - 1.8 points (RUB 157.03);

- for the second – 3.6 points (314.06 rubles);

- for the third - 5.4 points (471.09 rubles).

Civil servants

Persons who have worked in government agencies for more than 16 and a half years receive a civil servant's pension and can count on additional payments. Such additional payments include an increase in average monthly payments by 3% for each year of work in government agencies, which follows the required norm.

For length of service

Persons with a long work history can count on a pension supplement, the amount of which depends on the region of residence of the pensioner, since it is paid by social security authorities. This bonus is given to men with more than 40 years of work experience and women who have worked for more than 35 years. In addition, such citizens have 5 additional pension points, each of which in monetary terms is valued at 87 rubles and 24 kopecks.

For dependents

Pensioners who care for a disabled person receive an additional payment for each dependent.

However, such a payment can be assigned only to 3 dependent persons. EDV for 1 person after indexation will be 1,778 rubles.

Moscow pension in Moscow

I have been receiving a Moscow pension supplement since July 2020. Pension business in Moscow. Currently I have permanent registration in another region. What are my prospects?

I am a pensioner, I have lived in Moscow for 31 years, I receive a Moscow supplement to my pension, but I want to move to another district of Moscow, will I lose my pension supplement when I move? To receive a Moscow pension with allowances up to the city social security. The standard requirement is to live in Moscow for at least 10 years. At the same time, is work experience in Moscow also necessary, or will regional work experience also be suitable? Experience has no legal significance here. You just need to be registered at your place of residence in Moscow for at least 10 years (see Moscow Government Decree of November 17, 2009 N 1268-PP “On regional social supplement to pension”). If you change your place of residence (registration) from Moscow to the Moscow region, you will lose the Moscow supplement (surcharge), if you receive it. The size of the federal pension will not change.

A Moscow pensioner (less than 10 years in Moscow) received a pension of 11,816 before January 2020, but in January 2020 only 10,000. Where did the rest of the amount go?

You need to contact your pension fund department for clarification; unfortunately, only they can answer your question. Best wishes to you! The size of the pension will not change, since it is calculated in a uniform manner according to the norms of the Federal Law “On Insurance Pensions”. But the amount of the supplement to the (regional) pension, of course, will change. And not in the direction of increase. Thus, the total amount of the pension you receive in total and the additional payment to it should decrease. So it goes. I `m a pensioner. I'm going to buy an apartment in Moscow. Will I receive a Moscow pension supplement? You will, but after 10 years of living in Moscow.

The person was registered in Moscow and received a Moscow pension supplement. He had a Muscovite social card. Subsequently, he re-registered in Mos. region and his social card has expired. Question: if he applies to the social service at the place of registration (MO) to receive a social card for a resident of the Moscow region, will the Moscow pension supplement be removed from him?

She was registered in Moscow from 1979 to 1995. Then she lived in the Moscow region, where she retired. Now she is registered in Moscow again. Am I entitled to a Moscow supplement to my pension? It is more profitable for pensioners to live in the capital. Indeed, in the area of payments to these categories of citizens there is much less. In addition, Moscow pensioners can count on large amounts of benefits. Among them are a pension with additional allowances and free metro travel. You can register relatives with you. Experts do not even recommend checking out of an apartment in Moscow if it is sold. To receive some benefits, you must have permanent residence in the city for at least seventy years. The following figures confirm that pension provision is better with registration in Moscow, in many ways: 11,428 rubles - the minimum possible pension size in Moscow. For the Moscow region, the same figure will be only 8,950 rubles. If the answer was useful to you, please rate it. Only if you register with someone you know or relative. To receive a Moscow pension, permanent registration in Moscow is required.

I have a pension near Moscow, will I receive a Moscow pension after registration in Moscow, if I had a Moscow residence permit from 1982 to 1992, when I studied in Moscow, and then until 2020 I worked in Moscow and only recently in the Moscow region. How can I prove my registration if I have changed my passport?

You have the right to receive Moscow allowances; after changing your place of registration in Moscow, apply to the Pension Fund for recalculation of your pension taking into account the allowance. They themselves or you can submit a request to the migration service or the city archive to confirm the fact of residence in Moscow during the period you specified. You can always find a way out of any situation, the main thing is to take steps to achieve it. Contact lawyers with documents related to the case and they will help you in drawing up the documents. Contact numbers and addresses are usually indicated under the lawyer’s response. Good luck to you and all the best in your endeavors. Sincerely, legal, member of the Guild of Human Rights Defenders of Moscow! If you document that you have had a permanent pass in Moscow for 10 years, you will receive a pension with a Moscow supplement, provided, of course, that at the time of retirement you will also be registered in Moscow. I have 2 years until retirement. I lived in Moscow and sold my apartment. We are moving to the Moscow region. Will I lose my Moscow pension? Or should I register in Moscow or not transfer my pension from Moscow to the Moscow region for now? If you are registered in the Moscow region, you will lose the right to the Moscow supplement to your pension. If you have already checked out (9 deregistered) in a Moscow apartment, then you have already lost the right to this additional payment. Question about the right to Moscow pensions. Next year I am moving to Moscow, I will turn 55 years old. Tell me, from what year will I have the right (and will I at all) receive an increased Moscow pension? As far as I know, to receive such a pension you need to live in Moscow for 10 years. From 2012 to 2020, I was registered in New Moscow (Shcherbinka). Persons who have been registered in the capital for at least 10 years have the right to receive a “Moscow pension”; other pensioners have the right to an additional payment up to the subsistence level. Sincerely, Marina Sergeevna. Can I receive a Moscow pension, given that I recently moved to Moscow to live from the Moscow region, but have worked in Moscow for the last 17 years. Can I receive a Moscow pension, given that I recently moved to Moscow to live from the Moscow region, but have worked in Moscow for the last 17 years. There is no such condition as the duration of work in Moscow for calculating a pension as a citizen living in Moscow. The pension amount can be 8,007 rubles. It is impossible to answer how much you are entitled to without documents and calculations. The periods of employment and insurance periods accepted for calculation are in your certificate from the Pension Fund of the Russian Federation. Calculation formula in the Federal Law on insurance pensions. Sit down and count. Nothing complicated. Citizens who have been registered in the capital for at least 10 years have the right to receive a “Moscow pension”; other pensioners have the right to an additional payment up to the subsistence level. Sincerely, Korsun Irina Dmitrievna. No, it will not. He will receive the right to the Moscow social supplement to his pension no earlier than after 10 years of continuous residence and registration in Moscow.

That is, in 2028. This issue is considered in sufficient detail, with the corresponding layouts, for example, at this address: https://pensiaexpert.ru/trudovye/pribavki/pensiya-v-moskve-gorodskaya-nadbavka-v-2016-godu.html Is it possible to receive a Moscow pension if you have been registered in the Moscow Region for 10 years and in Moscow recently. What kind of law regulates this?

Moscow pension supplement of up to 14,500 rubles is provided only to those citizens who have been registered in the capital for at least 10 years. The basis for calculating the allowance for residents of Moscow and the region is Law No. 36/2006-OZ, dated March 23, 2006. I am a pensioner in Mytishchi, Moscow region. Question: where in Moscow do I have benefits as a pensioner: pharmacy, store, museum, theater, cinema, skating rink, etc. At the federal level, there are no benefits for pensioners other than for real estate taxation per property. You have the right to have a 100% benefit, but to do this you need to write an application to the Tax Inspectorate and attach a copy of your pension certificate; all other benefits for pensioners go to the local regional level and are accepted by local According to regional regulations, you can find out about the complete list only in the social protection department at your place of residence. Good evening, dear visitor! This is possible only after 10 years of residence with permanent registration in Moscow or Moscow Region. All the best, I wish you good luck in resolving your issue! To receive an additional payment to your pension, you must have permanent registration in Moscow for at least ten years. Ownership doesn't matter. I heard that in order to receive a “Moscow” pension, you must live in Moscow for at least 10 years. What is 10 years? Total for work activity, or the last ones before retirement? Continuous residence for 10 years, pre-retirement All the best, I wish you good luck in resolving your issue! Since 2013, the Moscow pension supplement of up to 14,500 rubles has been provided only to those citizens who have been registered in the capital for at least 10 years. In this case, all periods for which registration was issued are taken into account, regardless of the breaks between them. Pensioners living in Moscow for a shorter period of time are only entitled to an additional payment up to the pensioner’s subsistence level. In 2020 it is 8540 rubles. Decree of the Moscow Government of August 8, 2012 N 396-PP “On amendments to the Moscow Government Decree of November 17, 2009 N 1268-PP” To receive a regional social supplement to a pension in an increased amount, a pensioner must live in Moscow for more than 10 years. It has been established that an additional payment up to the size of the city social standard is due only to those non-working pensioners who are registered in Moscow at their place of residence for at least 10 years (including the time of residence in the territories annexed to the city). The remaining non-working pensioners (registered in the capital at their place of residence for less than 10 years or registered at their place of stay) are paid extra only up to the pensioner’s subsistence level. Previously, all non-working pensioners registered in Moscow at their place of residence were paid extra up to the city social standard. After 10 years from the date of registration of the pensioner in Moscow at the place of residence, the amount of the additional payment is revised. The changes came into force on January 1, 2013. Upon retirement, you have had permanent registration in Moscow for ten years, then you have the right to the Moscow supplement to your pension and you will apply for your pension in Moscow.

For pensioners who worked in 2019

The indexation procedure applies only to older people who do not work. There is no expectation that the moratorium will be lifted in 2020. But if a pensioner quits, he is entitled to additional payments that were made earlier, and indexations for the entire time the pensioner worked are also taken into account.

The popular bookmaker has released a mobile application for Android, you can follow the link absolutely free.

If a pensioner quits his job in 2020, his indexation is restored and additional payments are guaranteed. And in January, pensions for non-working elderly people will increase by 7.05% . The right to adjust pension payments from August 2020 also remains, since pensioners worked in 2018 and received wages from which contributions to insurance funds were made. For pensioners who earned the maximum possible annual number of pension points (three) in 2020, the additional payment to pension payments from August 2020 will be 261.72 rubles .

Not all pensioners will receive a 1,000 ruble increase in their pension in 2019! Let's understand the reasons

Moscow pension

Will I be entitled to a Moscow pension, and how much will the pension be if over the last 10 years I have temporarily lived and worked in another region, being permanently registered in Moscow? I have been receiving a Moscow pension supplement since July 2018. Pension business in Moscow. Currently I have permanent registration in another region. What are my prospects? I am a pensioner, I have lived in Moscow for 31 years, I receive a Moscow supplement to my pension, but I want to move to another district of Moscow, will I lose my pension supplement when I move? in the city of Moscow (regardless of the type of pension received and the body to which it is paid) and registered in the city of Moscow at the place of residence or place of stay. If a person has Moscow registration, receives a Moscow pension supplement, but lives permanently in another country for 20 years, having a residence permit there, is this not illegal? I am a reserve captain, I moved from the Moscow region to the Perm region in May 2020. I received a pension with the regional coefficient only in February 2020. Is the military registration and enlistment office of the Perm region obliged to recalculate and pay the regional coefficient from May 2020 to January 2020? did you receive this pension only in February 2020? Apparently it’s their own fault, maybe the application was written late, maybe not all the documents were submitted to the pension, maybe the registration was completed later. We don’t know for sure.. I wish you good luck and all the best! The size of the pension will not change, since it is calculated according to the uniform standards of the Federal Law “On Insurance Pensions”. But the amount of the pension supplement varies depending on the region. Accordingly, the final amount of pension funds may indeed change. Military pensioner, 35 years old, pension 25 thousand rubles, registered in the Moscow region. Do I have the right to free or discounted travel with a social card on trains and buses in the Moscow region? 2. Are there any benefits on Moscow transport? Thank you. Dear site visitor! You have discounted fares on trains. And then everything depends on age, if you are 60 years old, then there are discounted travel on buses and transport in Moscow, if you have not reached this age, then there are no benefits.

Additional payment for pensioners with extensive work experience, Perm region

Legislative Assembly of the Perm Territory on December 10. The procedure for acquiring a social travel document and its cost are established by a regulatory legal act of the Government of the Perm Territory. According to the standard, the amount of payment for individual segments of the population is different depending on their social status.

Additional payment for pensioners with extensive work experience, Perm region

This material will discuss what benefits are available to labor veterans in the Perm Territory. When receiving a pension from non-state pension funds, citizens must provide a certificate of the amount of the pension. When receiving a pension from the Pension Fund of the Russian Federation, information on the amount of the pension is provided by the territorial administration of the Pension Fund.

- an increase in pension if its amount is less than the subsistence minimum;

- an annual payment of 6 thousand 270 rubles for veterans whose income is less than twice the subsistence level;

- utility benefits in the form of a 50% reduction in payments for housing and communal services;

- discounts for traveling by public transport (with the exception of private carriers, for example, taxis);

- discounts on medical care, but only in public clinics, hospitals, hospitals;

- 50% discount on the purchase of medicines at social pharmacies;

- assistance in paying for dental prosthetics services;

- extraordinary paid leave for working veterans;

- abolition of the tax levy on land owned by a veteran (if the area of the plot is not more than 600 sq. m);

- 50% discount on transport tax;

- 50% discount on travel on electric trains within the region of residence;

- compensation for vouchers to health institutions.

- supplement to pension, if it is less than the subsistence minimum;

- full compensation for capital repairs for citizens over 80 years of age and in the amount of 50% of the amount for persons over 70 years of age;

- abolition of property taxes if it belongs to a pensioner and he does not use it for commercial purposes;

- exemption from land fees;

- discount on transport tax in the amount of 50% (only for one vehicle);

- assistance in kind (food, hygiene products, clothing), if the pensioner is recognized as low-income;

- out-of-turn service in medical organizations, social and government institutions;

- issuance of special travel cards, which will pay for tickets for any type of transport with a 50% discount;

- discounts on utility bills;

- payment for medicines with a 50% discount;

- the right to additional vacation days if the pensioner continues his professional activity;

- no state duty if a pensioner files a claim with the courts.

We recommend reading: Relocation of communal apartments in St. Petersburg 2020 list of houses

Privileges for labor veterans

- monthly payment in the amount of 1 thousand 851 rubles;

- the possibility of replacing a number of social services with cash payments, while monthly financial assistance will increase to 2 thousand 972 rubles;

- receiving housing or a subsidy for its purchase if the citizen needs to improve living conditions (applies only to the veteran, but not to his family);

- compensation for expenses for living quarters – 50%;

- tax deduction in the amount of 500 rubles, and in the presence of disability - 3 thousand rubles;

- removal of the obligation to pay land tax (if the size of the land is no more than 6 acres);

- exemption from property tax, but only for one object from each category (for example, if there are 2 apartments, the tax will be canceled for only one);

- priority right to purchase vegetable or garden land;

- receiving medical care in clinics and hospitals to which the beneficiary was assigned during the period of service;

- extraordinary provision of medical care;

- benefits for the purchase of medicines;

- provision of prosthetic and orthopedic structures, including free dentures;

- use of vacation at any convenient time, as well as provision of vacation days (unpaid) in the amount of 35 at the request of the beneficiary;

- advantage in using the services of sports and cultural institutions;

- extraordinary purchase of tickets for any type of transport;

- professional training and additional education at the expense of the employer.

Let us immediately note that we are not talking about some kind of independent payment! The increase in the pension for children is obtained as a result of recalculation due to the fact that according to the new law, from January 1, 2020, the rules for calculating the labor pension (assigned both for old age upon reaching retirement age and for disability) have changed, and now its amount in addition to periods of work “non-insurance periods” are also affected - in particular, the care of each child by one of the parents (usually the mother) until the age of 1.5 years (Article 12 of Federal Law No. 400-FZ of December 28, 2020).

I have 47 years of experience, a labor veteran since 1989. I am not against our state supporting citizens of retirement age who have never worked anywhere for various reasons. But why don’t they appreciate us, who abandoned our children for the sake of production, spent strength, nerves and our health to accomplish labor feats and paid taxes to the state? Why were we equated with the slackers who didn’t want to work, as they said, for “the uncle,” and now the “uncle” is not embarrassed to receive a pension from this, taking it away from those who worked conscientiously all their lives?

What benefits are provided to labor veterans of the Perm Territory in 2020

As a reward for long service upon retirement, a person receives not only a basic cash benefit, but also a certain set of additional payments that allow the state to emphasize the significance of the status. However, a labor veteran has the opportunity to qualify for additional payments only if the amount of the basic pension and payments required by law does not reach the subsistence level in the region.

- priority and free provision of telephone lines and radio points;

- financial compensation for time spent in camps and forced treatment: 75 rubles/day, but not more than 10,000;

- 50 percent discount on rent;

- free travel on municipal transport;

- preferential prices for purchasing tickets for water and air transport;

- registration in boarding homes for the elderly out of turn.

We recommend reading: Presidential Payments for 3 Children Rostov Region

Those who have worked for 45 years or more can claim an additional 3 points, and for pensioners who have worked for over 50 years, a fixed bonus of 1 thousand 63 rubles is offered, among other things. Now it remains to find out who is entitled to a pension supplement for 40 years of service in 2020 , where to apply for a pensioner, and whether the fact of current employment affects this.

Benefits for pensioners in the Perm region in 2020

If all three conditions are met, the pensioner can count on receiving premium bonus payments and additional pension points. These measures are being taken to give pensioners an incentive to continue working instead of retiring.

Elderly citizens are a vulnerable group of the population, especially financially. Benefits for pensioners in 2020 in the Perm Territory are issued on the basis of the Federal Law and local regulations. In most cases, regional decrees regulate the amount of monetary assistance in accordance with the financial capabilities of the local budget and the actual pricing policy.

Period of residence in Moscow for MOSKVICH status

What is the period of “settlement” (permanent residence) in the mountains? Moscow to obtain the status of MOSKVICH with all the accompanying social services. benefits? Should this period be continuous or can it be cumulative? Specify for what moment you need this “period of residence”, but as a rule it is calculated by registration, which must total 10 years and which you can prove with documents. A period established by law, other legal acts, a transaction, or appointed by a court is determined by a calendar date or the expiration of a period of time, which is calculated in years, months, weeks, days or hours. There is no such status as “Moskvich”. A number of social measures specified in the Moscow Law of November 3, 2004 N 70 are implemented through the production of plastic cards. Such cards provide citizens with the right to benefits. These are some categories of persons who have Moscow registration without any period of residence, for example, Persons who have reached retirement age, citizens who have received disability of groups 1, 2, and 3 in accordance with the established procedure, WWII veterans, persons who are participants in hostilities, home front workers, veterans labor, low-income citizens, some categories of students. According to the Decree of the Moscow Government No. 396-PP dated August 8, 2012, if you have been registered in the city of Moscow at your place of residence for at least 10 years in total (including the time of residence in the territory annexed to the city of Moscow), a regional social supplement is established if the total amount of them material support does not reach the city social standard. In 2020, the amount of this standard is 14,500 rubles, that is, those pensioners whose pension is less than this amount receive an additional payment so that their income level is not lower than this amount. But to receive this kind of additional payment, there is a residency requirement - ten years of residence in the capital. Thus, in order to receive a Moscow pension, nonresident pensioners must live in the capital for at least ten years from the moment of moving or document that they previously had a capital residence permit. Registration in the capital does not lead to automatic payment of a pension according to Moscow standards. At the same time, even pensioners who have recently become Muscovites have the right to all the benefits that this category of residents of the capital has. Eg.

Non-working pensioners aged 80

From January 2020, pension payments will be indexed by 7.05% . The amount of fixed payments will be 5334.19 rubles . The price of a pension point is set at 87.24 rubles . The basis for increasing the fixed payment will also be significant social circumstances, that is, “northern” experience or the presence of dependents or a disability group.

With the beginning of the New Year, additional compensation for rural experience will be restored (from 01/01/2019). The largest increase of 100% of the fixed part of payments will be for people over the age of 80 and with group I disability. For 2020, the additional payment on these grounds will be 5,334.19 rubles , excluding the general increase in pension payments and their indexation.