Yellow die, help me survive among this mortal love!

Please:

- In Russia, in addition to everything, there is a simple social pension and a cool old-age insurance pension. Insurance is greater and comes earlier.

- To qualify for an old-age insurance pension, you need to accumulate at least a minimum of work experience and pension points throughout your life.

- Some people do not have time to accumulate them. Then you can purchase additional points and experience. In this case, you do not need to have an employment contract or be an individual entrepreneur.

- Previously, a year of experience was more expensive. From 2020 it is two times cheaper. But they will give you half as many points for this amount.

- To purchase additional experience and points, you need to submit an application and pay insurance premiums before December 31.

- You can buy experience for yourself or anyone, for example, parents. This is convenient if a parent lacks one or two years of experience to retire by age.

- Don't want to sponsor the Russian Pension Fund? Become self-employed in 2020 and save for your own retirement.

Questions and answers

1. Do you negotiate with someone at the Pension Fund to register your unemployed work experience?

There is no need to negotiate with anyone; the instructions describe a completely legal way to obtain work experience without official employment. You yourself go to your Pension Fund Office and demand that the accrual of length of service be formalized in the same wording as described in my method. The most important thing is the wording of what you require from the Pension Fund. It is these “magic words” that are indicated in my instructions.

2. How much experience can I earn according to your instructions?

As much as you want, but as long as you meet the conditions specified above in the section “Conditions for obtaining experience without official work.” You can start at the age of 14 and legally gain experience without working until retirement.

3. I do not live in Moscow, can I get work experience according to your instructions?

The instruction is valid throughout the Russian Federation. Regardless of where you live, the actions according to my instructions will be exactly the same for both a resident of a large city and a resident of the smallest village. My instructions are of particular importance for residents of small towns and villages, where the problem of employment is acute, and finding official work is often simply impossible, where the majority of able-bodied citizens work unofficially or do not work at all. Actions according to my instructions are completely legal, nothing illegal, no “gray” schemes.

4. Has anyone already completed the registration of retirement without work according to your instructions?

According to my calculations, more than 60 people from different regions of Russia used my instructions. No one had any problems registering with the Pension Fund. I myself receive experience for a pension without work in exactly the same way as described in my instructions. Actually, this is where my instructions began. I wanted to share my experience with my relatives and friends and wrote these instructions so as not to retell the same thing over and over again, and so that they would not miss important points when decorating. Only among my family and friends, 9 people took advantage of the instructions and have been receiving experience for the fifth year, and 4 people retired in 2013-2015, taking into account the experience received.

5. Is it possible to obtain work experience according to your instructions in 2020 and beyond?

The procedure for obtaining work experience without official work has not changed in 2020. In addition to the length of service, starting from 2020 you will also be awarded pension points. In the appendix to the instructions I provide links to articles of laws adopted in connection with the new pension reform.

6. How can I confirm my length of service for a pension if I work unofficially, without a work book?

There is no way you can do it in the past time. You need to complete the documents as soon as possible as described in my method, and only after that you will be accrued seniority for a pension, even if you are unofficially employed. Otherwise, you may lose your right to an old-age pension.

7. Question about pensions for those working unofficially: there is no official work in our village, I can’t leave, how can I get work experience in the village?

If retirement age has not yet approached, you can apply according to my instructions at the Pension Fund of the Russian Federation to obtain pensionable service without official work. Then, when you reach retirement age, you will have length of service and will be able to receive an old-age pension.

8. After college, I worked for 1 year and got married. My husband doesn't want me to work. But where can you get work experience in order to later receive a labor pension rather than a social pension?

It's a shame you didn't think about this sooner. After all, you could have been earning seniority for a long time without working. But all is not lost; you can start getting pensionable service using my method right from this month.

9. I am 15 years old, I study at school, I have a passport as a citizen of the Russian Federation. Can I earn experience using your method?

Sure you can! And you could start at the age of 14, as soon as you received a passport. If all other points of the conditions for obtaining experience without work, described above in the section “Conditions for obtaining experience without official work,” are met, you can continue to study at school and college and at the same time receive experience for your future pension. By the time you graduate from university and officially find a job, you will already have a significant amount of experience for retirement and accumulated pension points.

10. Why buy your method for getting experience without work if you can just buy experience?

Do you mean to buy a work book with experience or a certificate of experience? There are plenty of offers on the Internet, veiledly called restoration or correction of entries in the work book, and such services cost from 4,500 rubles. You must understand that in this case you are breaking the law. Besides, such a purchase makes no sense. Since January 1, 2002, length of service is taken into account in the personal (personalized) accounting system in the Pension Fund only if there are contributions to the Pension Fund. No deductions - no experience. It turns out that with such fictitious employment, you need the company to pay insurance contributions to the Pension Fund on your behalf every month, and, of course, no one will do this.

I am offering you a legal way to obtain experience for calculating an old-age insurance pension without work. This is a special case of legally obtaining work experience; you just need to know how it is formalized. Immediately after completing the documents, your length of service will be taken into account in your personal account with the Pension Fund.

If you have any questions about the method of obtaining work experience and pension without work, contact me.

Transfer of additional insurance premiums

The law allows a person to make insurance contributions independently if, for some reason, such contributions are not transferred to the Pension Fund. Such reasons may include unofficial work, work outside the Russian Federation, study, etc.

In order for a year of insurance experience to be counted, you must make monthly insurance contributions within one calendar year in an amount of at least 26 percent of double the minimum wage. But, perhaps, in the near future, the minimum amount of contributions will be reduced to 26 percent of one minimum wage, since this change is on the agenda in the State Duma, and, quite possibly, will soon be adopted.

Materiel about old-age pensions

To qualify for an old-age insurance pension, the following conditions must be met:

- The retirement age required by law has arrived.

- Minimum work experience has been accumulated. In 2020 it is 9 years, and in 2024 - 15.

- There is a minimum number of points on your personal account. In 2018, to qualify for a pension you need to earn 13.8 points, and in 2024 - at least 28.2 points.

If at least one condition is not met, there is no right to an old-age pension. That is, even a man of retirement age who has worked in a position with a good salary for the last five years and has accumulated points will not be given a pension if he only has 7 years of official work experience: because there is not enough experience.

And vice versa: you can have 20 years of experience, but receive a dull salary and accumulate too few points by retirement age. You will have to continue working or wait for a social pension.

But there is another option: buy the missing experience and points along with it. And receive not a social pension, but a labor pension.

Why is it important?

To qualify for an old-age insurance pension, a person must meet several criteria

:

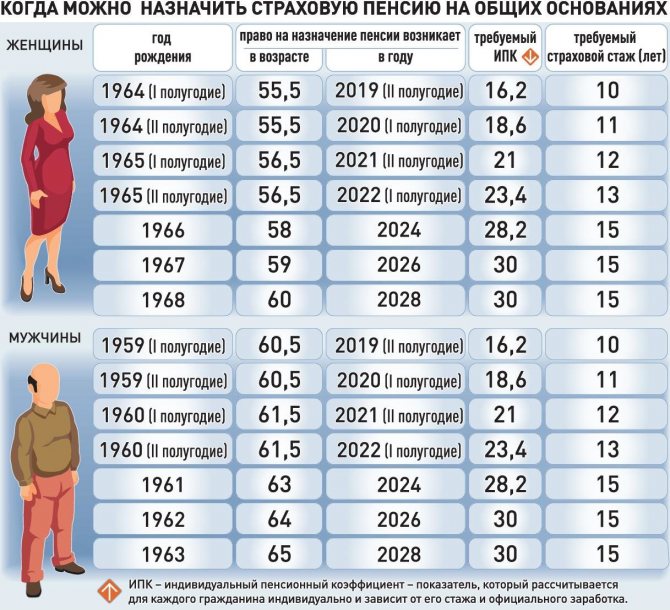

- reach retirement age (this year – 55.5 and 60.5 years for women and men, respectively);

- have the minimum required insurance experience – 10 years;

- have the minimum required number of pension points – 16.2.

If everything is clear with age (hardly anyone will go to the Pension Fund ahead of time), then with experience and points it’s not so much. The insurance period includes periods of work, temporary disability, and some non-insurance periods (army, caring for an elderly person, study - under some conditions).

Pension points are calculated according to an even more complex scheme: before 2002, salary matters, and after that - the amounts transferred to pension insurance.

And since not everyone knows exactly how much experience and pension points they have, about 3% of applicants are denied a pension due to their lack.

The most offensive thing is when you lack just a little experience

for retirement. And there is a way out.

Read also: They want to give “Veteran of Labor” without awards - for work experience of 40 or 45 years. But the government is against 1

What needs to be done to register care for a pensioner over 80 years of age?

When caring for a disabled person, such a period will also be included in the insurance period. Care can be provided for a disabled person of group 1, a disabled child, or a person who has reached the age of 80 years. At the same time, the person providing care must be able to work and not work.

For one year of such care, 1.8 points are awarded. Registration must take place officially, by submitting the appropriate application, so that documents are drawn up in the Pension Fund, the payment that is due for such departure is assigned, and there are documents on file confirming the departure. This is necessary to confirm additional experience.

There are situations when such care is carried out unofficially. In this case, to confirm additional insurance experience, you need to provide the relevant documents:

- a statement from the person being cared for, which confirms the period during which the care was provided;

- certificate of disability, etc.

Additional experience can be obtained during military service, caring for a child until the age of one and a half years, as well as for cooperation with law enforcement agencies.

The very first thing to do is to find a person who is suitable to receive a subsidy. When a pensioner, over the age of 80, is found and agrees to register his care, and he does not need anything more than 1,200 rubles per month, then you can begin to prepare the necessary documents.

How to get insurance while unemployed

In 2020, to qualify for old-age insurance benefits, the required length of service must be at least eight years. What to do if it is missing? Buy more, and there is no crime in it. Starting from January 1, 2020, periods of voluntary payment of insurance premiums for certain categories of citizens can be counted into the insurance period, Elena Bibikova, a member of the Federation Council Committee on Social Policy, told Parliamentary Newspaper.

The insurance period itself is the duration of periods of labor and other activities (including “non-labor” periods), which are taken into account when establishing an insurance pension and during which the employer paid contributions to the Russian Pension Fund. “Not everyone knows about this provision of the law, but since 2020, the time of voluntary payment of payments to the pension system is counted towards the length of the insurance pension,” Bibikova explained. — At the same time, there are a number of restrictions. The first category of persons who can take advantage of this provision of the law are citizens of the Russian Federation living abroad and not officially employed in our country. If they pay their own insurance contribution to the pension system, their length of service benefits them.”

Secondly, officially unemployed compatriots can voluntarily enter into legal relations under compulsory pension insurance. According to various estimates, there are from 15 to 18 million of them in Russia, and these are citizens of working age. “That is, there are no contributions to the pension system for them,” the senator noted. “Such a person can also make voluntary payments to the pension system and his insurance period will be counted.”

Finally, you can “buy” insurance experience for another person who is not registered in the compulsory social insurance system. “For example, if a wife does not work anywhere, she is a housewife, the husband can make a voluntary payment to the pension system, which will be counted towards his length of service. This option is allowed. To be clear, the same can be done by a brother or any other person,” says the parliamentarian.

These categories of persons can buy insurance experience under a number of conditions: they must be registered with the Pension Fund of Russia (by submitting an application to the territorial body of the Pension Fund) and not officially work, so that insurance premiums are not paid for them. “In addition, the law stipulates that the insurance contribution should be made in the amount of 26 percent of two minimum monthly wages (minimum wages),” said Elena Bibikova.

Finally, in this way a citizen can “purchase” no more than half of the required length of service—it cannot be purchased entirely. “This year, to retire, you need eight years of total service, which means that you can only buy four years with additional contributions,” the parliamentarian concluded.

What is the new law about?

The amendments concern voluntary pension insurance. And here’s a little more hardware explaining what it all is.

Voluntary insurance. There is also voluntary pension insurance. This is when a person does not have an employer and is not an individual entrepreneur, but also wants to receive a pension someday. Then he can buy his own experience for money.

For example, a woman takes care of children and does not want to work. The state will not pay her a pension just for the fact of motherhood. But if the husband or she herself voluntarily pays insurance premiums, this paid period will be counted as length of service and will then be taken into account when assigning a pension.

Or the driver worked for himself all his life without registration. And now retirement age is approaching. My health is no longer the same, I have no savings, but I also don’t have the right to an insurance pension at age 66 due to a lack of experience—maybe one year is missing. Then the driver will buy himself this year of experience and receive the right to a pension. Most likely, the expenses for the internship will cost him in a few months. Otherwise, we would have to wait another five years until the social pension.

Is it possible to complete the length of service that is missing for retirement? Eight questions and answers about pensions

Situations with the assignment of pensions and calculation of length of service raise many questions among Sluch residents. Is it possible to receive a pension for a deceased military husband? How to prove work experience if your work record is lost? How many years are counted as experience if you worked in different places?

These and other questions were answered by specialists Elena Orlovskaya , head of the Slutsk regional department of the Minsk Regional Fund of Social Protection Fund, and Marina Gurbo , head of the pensions department of the department for labor, employment and social protection of the Slutsk regional executive committee.

I'm a pensioner. I receive a social pension because I didn’t have enough work experience for a year and a half. Can I get a job and then apply for recalculation of my pension?

The missing length of service can be completed, but during this time it is necessary to give up the social pension. It should be taken into account that now to assign a pension you need an insurance period (with payment of contributions) of at least 16 years 6 months.

Every year, the length of service required to grant a pension increases by six months until it reaches 20 years.

I worked in the 2000s for a private owner without obtaining a work book. Will this work experience count towards my pension?

The former employer must issue a certificate stating that mandatory insurance contributions were paid for you (from July 1, 1998 to January 1, 2003), and the amount of wages from which these contributions were paid.

Work experience after January 1, 2003 is confirmed by information from the Federal Social Security Service.

Without paying contributions, your length of service is not taken into account.

My husband was a military man and received a good pension. I am now receiving a social pension because I did not have enough experience. Can I receive my husband's pension after his death?

Since your husband was a recipient of a pension from the Ministry of Defense, you need to contact the military registration and enlistment office to receive a survivor's pension.

I am an individual entrepreneur, engaged in transportation. The employer enters into a contract with me for the transportation of goods. Should he pay contributions to the Social Security Fund for me under such an agreement?

If you have an employment contract as a driver, then your employer is obliged to pay you a salary and pay contributions to the Social Security Fund. From the day you are hired, you, as an individual entrepreneur, can pay contributions to the Social Security Fund on a voluntary basis.

If the agreement is concluded between business entities (one of them is you as an individual entrepreneur), then you must pay contributions to the Social Security Fund yourself.

I have 35 years of work experience, two years left until retirement. Can I apply for a pension early? What is needed for this?

If you cannot get a job, you need to register as unemployed with the employment service.

For unemployed people entitled to unemployment benefits for 52 calendar weeks, the employment service, if there are no vacancies, may offer an early retirement pension instead of unemployment benefits. But not earlier than one year before the established age.

For people dismissed due to the liquidation of an enterprise, if it is impossible to find a job, the employment service can offer early retirement no earlier than two years before the age established by law.

How to confirm your work experience if your work book is lost?

The main document confirming periods of work is the work book. If it is not there or inaccurate or incorrect information is entered into it, there are no records about individual periods of work, then to confirm the periods of work, certificates issued on the basis of orders, personal accounts, payroll statements are accepted; written employment contracts and agreements with notes on their implementation; labor, track record and registration lists; membership books of cooperative members and other documents containing information about periods of work.

At the same time, periods of work from July 1, 1998 to January 1, 2003 are confirmed by a certificate of payment of insurance contributions to the Social Security Fund.

Is the work experience in Russia (15 years) included in the requirement for a pension and what is needed to confirm it?

When determining the right to a pension in the Republic of Belarus, insurance (work) experience acquired under the legislation of the Russian Federation may be taken into account, provided that it does not coincide in whole or in part in time with the experience taken into account under the legislation of the Republic of Belarus.

When applying for a pension, the department considers each case individually and, if necessary, makes a request to the pension fund of the Russian Federation.

Consultations can be obtained from the Slutsk Federal Social Security Service by phone (8 1 795) 5 26 41.

I receive a Russian pension, but I live and work in Belarus officially, paying all insurance contributions. How will these contributions affect my pension when I retire? Or do you need to apply separately for a pension in the Republic of Belarus during this period?

Periods of work that occurred after the appointment of an old-age pension or a long-service pension are counted towards the length of service if the pensioner does not receive a pension during the period of work. This rule also applies to pension recipients outside the Republic of Belarus.

Periods of public activity until 1992

Until 1992, the length of service required to retire included the period of public activity. For example, if a person held elected positions in party organizations, worked as a collective farm chairman or deputy, subject to direction from the party, the period of work in mine rescue teams, etc. is also counted.

Thus, if in Soviet times a citizen was engaged in public activities, then this period can also be counted towards the insurance period. The main problem here may be the fact that such a period cannot always be established. If there is evidence, this fact can be established in court.

As it was before?

To become a participant in the voluntary pension insurance system, you need to pay contributions. But not any amount, but the one established by the state. The state says: if you want to buy one year of insurance experience, pay this much money. And we give you experience and a certain number of points.

Minimum wage × 2 × 26% × 12

The minimum wage is taken at the beginning of the year for which contributions are paid. From January 1, 2020, the minimum wage is 11,280 rubles. That is, one year of experience in 2019 would cost: 11,280 R × 2 × 26% × 12 = 70,387 R.

How does it feel to “buy” experience?

Only those who have worked for at least 15 years can apply for the right to purchase experience. If they are not recruited, even this opportunity is absent - it is apparently believed that the person is not yet so tired as to demand a well-deserved rest.

Of course, everyone from whom they are not recruited due to salaries received in an envelope after 2004, all freelancers and officially unemployed, as well as those for whom the employer, for some reason, did not pay contributions, and at the same time did not even exceed this cherished threshold, pensions are deprived, in principle.

Of course, on the one hand, the budget can be understood - why on earth should those who work in the future pay for those who did not work at the moment, and accordingly, in turn, did not pay for the old age of today’s pensioners?

It is true, of course, that in many life situations, without the normal policy of non-state pension funds and other useful things that increase personal freedom, it will often be difficult for modern able-bodied individuals to subsequently get out of it in order to still qualify for at least some kind of pension.

Everyone else who has earned a “tag”, but does not want to wait until 25 or more years have passed since the first entry into the labor force, as well as everyone who wants to earn more, should think about purchasing a one-time experience.

Why do this at all? But here everything is very simple: those who have worked for 35 years by the age of 65 will easily qualify for 40% of the minimum wage (the figure will be greater than or equal to the pension minimum subsistence level), but if the length of service turns out to be less, the amount of monthly payments is formed proportionally production based on the subsistence level.

For example, with 25 years of experience, you will receive only 71.43% of the cost of living instead of the full one. Anyone interested should find out individually about the specifics of the purchase, the procedure for this matter and the specific current amounts of the unified social contribution transfer for each year of service on the website of our Pension Fund.

Preferential experience

Preferential length of service is counted if the employee works in harmful conditions, difficult conditions, works with increased psycho-emotional stress, etc. In this case, the insurance period is credited on a preferential basis, for example, 1 year for 1.5 years, etc.

However, it is worth checking that the employer has indicated everything correctly in the information that is transferred to the Pension Fund. If the employer does not do this, for example, does not enter a special code for preferential employment in the reporting, then the Pension Fund of the Russian Federation may not count part of the length of service, and it will have to be proven in court.

Thank you for your attention.

How to get a pension

Take yours from the state!

We tell you how to receive deductions, benefits and allowances in our newsletter twice a week.

The insurance period is the number of years that the employer has paid insurance contributions to the pension fund for the employee. Pension points are the amount of insurance premiums paid, proportional to salary. That is, the higher the salary, the faster pension points accumulate.

For example, with a salary of 20 thousand rubles per month, the employer transfers 4,400 rubles in insurance contributions for you. If your salary was 200 thousand, the employer would transfer 31,500 rubles, not 44 thousand.

Let's calculate how many pension points you will receive for the next year if your salary does not change.

For the year, 4,400 R × 12 = 52,800 R in insurance premiums will be paid for you.

The maximum possible amount of insurance premiums in 2020 will be 12,130 RUR × 12 × 8 × 22% = 256,185.6 RUR.

That is, next year you will earn 52,800 R / 256,185.6 R × 10 = 2.06 pension points.

What is included in the pension period?

The Law “On Insurance Pensions” stipulates that throughout the life of the citizen himself or his employer are obliged to pay contributions to the Pension Fund of Russia. The size of the employee’s future pension is determined from these. The citizen himself pays taxes only if he is an individual entrepreneur or self-employed. The mere fact of working without making contributions to the Fund does not give the right to receive a pension.

Also, in order to receive pension payments, you must be employed in the Russian Federation. Pensions for work in another state may be provided if:

- the citizen makes contributions to the Russian Pension Fund on his own behalf;

- The Russian Federation and a foreign state have an agreement among themselves to pay pensions to their employees on their territory.

What about the points? Are they awarded when purchasing experience?

Yes, when purchasing experience, so-called pension points are also awarded. To assign a pension, you need to accumulate a minimum amount of them, otherwise there will be no pension. The number of points accumulated affects the size of the pension. Each point has a value and it changes every year. How many points have you accumulated towards retirement? The state will pay you for so many points in addition to the fixed payment. In 2020, one point will cost 87 rubles, and the fixed payment will be 5334 rubles.

The amount of points depends on the contributions actually paid for the year and the maximum amount of contributions set by the state. In 2018, you can score a maximum of 8.7 points per year, from 2021 there will be 10.

In 2020, for 70 thousand rubles you can buy more points than for 30 thousand. Therefore, experience under the new formula can be purchased cheaper, but this amount of contributions will have less impact on the size of the pension.

If you want to buy more points, you will have to spend more money. For example, if a year of experience or one point is not enough to assign a pension, you can spend 30 thousand and become entitled to an old-age insurance pension.

What pensions are there in Russia?

Now in Russia there are several types of pensions. The simplest and smallest is social . It is received by disabled people, orphans, and children who have lost their breadwinner. A social pension is also provided for old age - for men from 70 years old, for women from 65. As they say in the Pension Fund of the Russian Federation, “the fact of paid labor activity does not affect the payment of a social pension.”

The amount of the old-age social pension is RUB 5,606.15. per month.

You may not work officially all your life or be self-employed, but you will still receive such a pension.

- There is also an insurance pension , which applies only to pension insurance participants. Although it is also called old-age pension

- just without the word “social”. It is usually larger and comes earlier. To receive it, you need to meet several conditions:

- Reach a certain age. Currently it is 65 years for men and 60 for women.

- Accumulate minimum work experience.

- Earn the required number of pension points. Points depend on salary, are awarded for length of service, caring for a child or disabled citizen, military service - the entire list is listed in Art. 12 of the Federal Law of December 28, 2013 No. 400-FZ.

Now the norm for retirement is a minimum of 15 years of experience and 30 points.

Here is a list of exceptions - those who may retire early and accumulate fewer points.

The size of the insurance pension depends on the number of points and length of service and is calculated for each individual person, but it will definitely be larger than the social pension. You can find out how much experience and points you have using the State Services portal.

A self-employed person will not be given an insurance pension just like that.

Can I buy experience as a gift?

An application for additional contributions can also be sent through the employer or the MFC.

Experience and points can be awarded even if you don’t pay anything at all and don’t work anywhere.

Yes, you can pay fees not only for yourself, but also for anyone. For example, you can buy additional work experience for your parents, spouse or valuable employee.

But in addition to length of service, other conditions are needed to grant a pension: the number of points and age.

Russians were offered to buy pension experience

MOSCOW, February 12, FederalPress. Those planning to retire were offered the option of obtaining the required minimum length of service and points for retirement.

The insurance period and the required amount of points for retirement can now be simply purchased. So, for example, in 2020, 11 years and 18.6 pension points are required to retire, and soon 15 years of experience and 30 points will be required. In addition to the option to finalize what is required, there is a second way out of the situation - to purchase the missing length of service and pension points.

To do this, you should contact the Pension Fund with an application for voluntary entry into legal relations under compulsory pension insurance. The law allows voluntary payment of pension insurance contributions to those for whom the employer does not pay them. The situation also applies to those who work outside of Russia or live in the country, but are not officially employed or are considered self-employed.

You also need to take a receipt from the Pension Fund and pay insurance premiums for the current year through a bank or electronic service. At the same time, there are a number of nuances that the fund’s specialists will explain to you in detail. For example, voluntary contributions are only counted in the year in which they are paid. Or it is impossible to purchase through voluntary contributions more than half of the length of service required to receive a pension.

To receive length of service and pension points this year, the minimum contribution is 32,023 rubles 20 kopecks - this will add 1,740 pension points. It should be remembered that for 2020 a maximum of 9.57 points can be counted towards the pension. Federal legislation allows the payer to choose the desired amount of voluntary contributions within a certain minimum and maximum.

FederalPress recalls that earlier the State Duma of the Russian Federation rejected a moratorium on raising the retirement age in Russia. The bill, proposed for consideration by a number of deputies, was supposed to be an alternative to the pension reform bill, which increased the retirement age.

Photo: FederalPress / Evgeniy Potorochin

More on the topic:

1. For Russians, they decided to lower the age for receiving pensions

2. Russians are asking to be allowed to spend future pensions on paying off mortgages

3. Guardians' pensions will be indexed. The relevant State Duma committee approved the bill

Expert opinion:

1. Oleg Bogdanov: “If the birth rate does not increase, raising the retirement age cannot be avoided.” Demographic Trends Analyst