Therefore, those people who participated in hostilities in the period 1941-1945, or have the honorary badge of a resident of besieged Leningrad, can count on certain types of benefits and special conditions for their provision. Definitions of concepts To understand the pension provision of WWII veterans, you should understand the meaning of some terms in force in the field. This will help to more clearly understand what and to what extent people with the status of combat veterans are entitled. Concept Meaning WWII Veteran A person who participated in the hostilities of the period 1941-1945 on the territory of the USSR and other countries due to the war with Germany has evidence of this and can provide it.

What kind of pension will veterans of the Great Patriotic War receive in 2020?

Attention

According to the same document, they are divided into the following categories:

- participants of the Patriotic War, residents and workers of Leningrad during its siege;

- participants in military conflicts on the territory of the Russian Federation and other states (Afghanistan, Chechnya);

- labor veterans;

- persons awarded orders for worthy service;

- veterans of military service.

For these people, certain legislative support is provided at the state level. It includes not only pension provision, but also additional “bonuses” in the form of privileges for housing and everyday life, use of government transport, medical care, etc. Types of pensions for WWII veterans But since the majority of veterans have reached retirement age, it is necessary to provide appropriate The state pays special attention to payments to this category of citizens.

What is the pension for WWII (Great Patriotic War) veterans in Russia in 2020

Another type of social payments is DEMO. As a rule, federal beneficiaries receive it. These include: 1. Participants of the Second World War - 1000 rubles. 2. Siege survivors – 500 rubles. It is possible to receive DEMO only according to one of the provided points. To receive this type of payment, you must submit documents according to the list to the Pension Fund. The costs associated with accruing additional payments to the pension of the widow of a WWII veteran are financed from the Federal budget. The right to additional payment is lost if the subject enters into a new marriage. Indexation and assignment of payments The Russian government annually carries out indexation of pension payments. As a rule, it is done twice a year. The coefficient by which the current payment amount is multiplied is determined by the cost of living for the previous year and is established by the Government.

Supplement to pension after 80 years for military pensioners

If they have 15 years of work experience in the northern regions, citizens are entitled to a bonus of 50% of the FV. When working in areas with a similar status for more than 20 years, the bonus is 30% of the FV.

An additional condition is the presence of an insurance period of at least 25 years for men and 20 years for women.

This amount of additional payment is due regardless of the citizen’s place of residence. Citizens who worked in the space industry, upon reaching 80 years of age, are entitled to an additional payment of 200% of social security.

The social pension is fixed and amounts to 5240.65 rubles.

Its value is subject to annual indexation according to changes in the cost of living in the country.

Additional payment People over 80 may require additional care. In such cases, the state provides an additional payment. When the pensioner turns 80 years old, the amount of the additional payment will be calculated automatically.

What pension should the widow of a WWII participant receive?

Info

Participants of the Second World War - 3596.37 rubles. If a citizen has reasons to receive several social monthly payments from the above, the choice is made in favor of one, the largest. A set of social services is support for pensioners, which is provided to those who receive EDV. These are services such as free rail travel, as well as additional medical care.

If necessary, a pensioner can be provided with a trip to a sanatorium for the purpose of spa treatment. Those who are eligible to receive NSO may agree to monetary compensation. Replacement of services with money can be partial or complete.

Important

Applications are submitted to the Pension Fund before the first of October. The full range of social services amounts to 995.23 rubles in cash equivalent. A person accompanying a disabled person also has the right to a voucher and travel to the sanatorium.

How to get a ticket to a sanatorium for a combat veteran

In order to improve informing military personnel, military pensioners and members of their families, and civilian personnel of the Armed Forces of the Russian Federation about the availability of vouchers in military sanatoriums and rest homes of the Russian Ministry of Defense, the number 8-800 is being established (calls within Russia are free), which is already operating in military sanatoriums " Zvenigorodsky" (tel. 8-800-200-9487), "Pyatigorsky" (tel. 8-800-200-0044), "Essentuki" (tel. 8-800-200-14-04), "Kislovodsky" ( tel. 8-800-200-9707), “Sochi” (tel. 8-800-200-0182). A complete list of sanatoriums, houses and recreation centers, as well as their telephone numbers, is provided on the website of the Russian Ministry of Defense.

We recommend reading: Is it possible to get a tax deduction for a husband and wife for treatment?

Why does the attending physician refuse to refer me to receive a voucher to a sanatorium, citing the fact that I receive a one-time cash benefit as a combat veteran established by the Government of the Russian Federation?

Get compensation and benefits

Benefit A certain relaxation intended for a certain category of citizens, guaranteeing them a reduction in taxes or utility bills, the provision of material benefits in a simplified manner, or other state guarantees of a normal life Types of payments In Russia, there are three types of pensions: For compulsory pension insurance Thus, compulsory insurance is divided into insurance and funded pension, and the first type is a pension for old age, disability or loss of breadwinners According to state provision State provision is provided for length of service, old age, disability, loss of a breadwinner and on a social basis For non-state provision But pensions for non-state provision are provided according to special agreements concluded between a citizen and a pension fund of non-state ownership.

The right to receive benefits of a deceased (deceased) DB veteran

- Parents of a deceased (deceased) combat veteran - regardless of their ability to work, being a dependent, receiving a pension or salary.

- Minor children of a combat veteran - regardless of their ability to work or being dependent.

- Children under 23 years of age studying full-time (full-time) in educational institutions - regardless of their working capacity, being a dependent, or receiving a scholarship.

- Disabled children.

- Spouse (husband) of a deceased (deceased) combat veteran - regardless of the state of work, being a dependent, receiving a pension or salary, provided that the spouse (husband): has not remarried and lives: alone or with a minor child (children), or with a child (children) over the age of 18 who became disabled (disabled) before he (they) reached the age of 18, or with a child (children) under the age of 23 and studying in educational institutions for full-time study.

- Other disabled persons who were dependent on the combat veteran at the time of his death.

We recommend reading: Poor Chelyabinsk Region 2019

Our online portal provides free initial legal consultations on social and legal issues. We will help you protect violated rights, apply for benefits and allowances, and consider complex cases in any area of law.

Pension of WWII veterans in Russia

Includes social payments. Participants in the Great Patriotic War, as well as residents of besieged Leningrad, can count on additional payments from the state. Pensions for WWII participants and blockade survivors The above categories of citizens have the opportunity to receive a disability pension under state pension programs, as well as the insurance part of the pension upon reaching a certain age. In addition, various additional payments are provided for them not only from the state, but also from the local regional budget.

In some constituent entities of the Russian Federation, the budget includes additional payments and services for WWII veterans. The law suggests that a disabled veteran does not have to choose, like everyone else, one type of pension, and he can receive both types of payments by default.

What is required to receive government support?

A widow of a WWII participant can count on payments if she receives a special certificate. This document gives her the right to provide benefits from the state and local authorities. To take advantage of a certain privilege, it is enough to present an ID.

A certificate for the widow of a WWII participant is obtained by following a special procedure. To do this, she will need to contact the social security authority with the following documents:

- personal passport;

- application for benefits that are due to widows (written according to the form);

- a document confirming the death of the front-line husband (certificate);

- marriage certificate;

- photo 30*40 mm;

- certificate of war participant, and in the absence, a certificate is issued from the military registration and enlistment office confirming the husband’s service during the war years.

Like

And regarding some pensioners applying for pension payments, there is Law 4468-1 “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and criminal authorities - the executive system, the Federal Service of the National Guard Troops of the Russian Federation, and their families.” It indicates not only the length of service required for retirement, but also states which benefits are transferred to the families of such pensioners, which makes it possible for their immediate family to enjoy the status of a person relatives Important aspects To understand what kind of pension veterans are entitled to, you need to familiarize yourself with the current rates for pension payments and calculate them taking into account all the standards of the Russian Federation.

Benefits for combatants

We can say for sure that route and regular private taxis do not provide any travel benefits. This rule applies throughout Russia. Therefore, you should not expect that you will be able to travel for free using the specified transport if you have the status of a war participant.

Transport tax benefits are provided for combatants. The fact is that often they are simply released from it. Or citizens pay transport tax with a large discount - up to 90%. Sometimes even more. It all depends on the region of residence.

We recommend reading: Is it possible to apply for a tax deduction for dental treatment at the MFC?

Pensions and benefits for WWII veterans in 2020

So, for a fixed payment you should take the figure of 4558 rubles, while 1 pension point costs 74.27 rubles. Thus, it is necessary to multiply the number of points by 74.27 and add 4,558 rubles to obtain the amount of payments due to the veteran. For disability, the Social Disability Pension is almost 5,000 rubles, and the specific amount is 4,959 rubles. But WWII participants are entitled to an increase in disability payments depending on the disability group, and in all cases they increase at least twice. Disability group Percentage (final amount) 1,250% (12,399 rubles) 2,200% (9,919 rubles) 3,150% (7,439 rubles) If disabled WWII participants have financially dependent persons with disabled status, then the social pension increases by another 1,653 rubles for each dependent, but you can add no more than three.

What supplement to military pension is due to pensioners after 80 years of age?

The size of the social pension today is the amount indicated above.

rubles monthly. The payment is due to the wife of a deceased military contractor, officer, midshipman, or warrant officer.

A compensation payment for care in the amount of 1,200 rubles must be issued to a non-working able-bodied person who has reached the age of 16, is not a pensioner, an entrepreneur and is not registered with the employment authorities as unemployed. This person, with the necessary documents, contacts the military registration and enlistment office that pays you your pension and formalizes this payment.

Only then will it be paid to you along with your pension. Without registration it will not be paid.

Is there a bonus for 80-year-old military pensioners? It is important to remember that doubling the pension base is carried out for two reasons:

- presence of disability of the first group.

- reaching 80 years of age;

Therefore, for citizens for whom recalculation was made earlier (due to disability of the first group), the amount of payments remains the same.

The average pension for WWII veterans is 21-30 thousand rubles.

If a veteran of the Great Patriotic War died during military service or died after the end of the war, the widow has the right to receive a survivor's pension, provided that the military wife has lost her main source of income. Even if the deceased did not provide for the spouse financially, she can receive this pension. You can apply for a pension benefit at any time, without any restrictions on the period of application. When the widow of a WWII veteran reaches retirement age, she will be assigned an old-age insurance pension, which will replace survivor benefits - it is impossible to receive both benefits. In addition to pensions, the Government of the Russian Federation has approved another measure of financial support for widows of the Second World War - monetary compensation, which is paid once (one-time, timed to coincide with special events) and monthly (additional monthly financial support - DEMO).

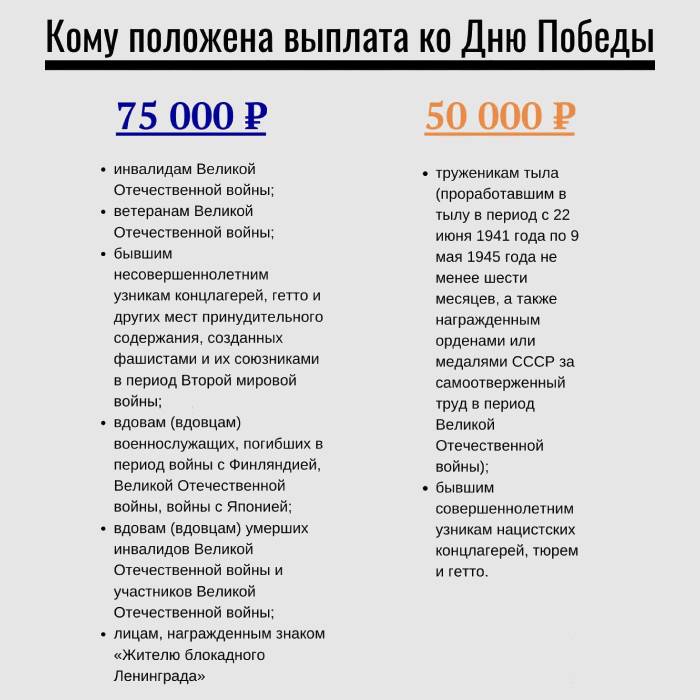

Who is entitled to an additional payment for Victory Day?

The President of Russia issued decree No. 100 of 02/07/20. The document stipulates the list of persons who are entitled to a lump sum payment on the seventy-fifth anniversary of the Victory. For the first time, citizens of the Russian Federation who live in Lithuania, Latvia, and Estonia will receive the reward.

For Victory Day, payments are made to WWII veterans, as well as:

- To minors and adult prisoners of Nazi concentration camps.

- Widowers and widows of military personnel who died during the war with Finland, Japan, and World War II.

- Home front workers.

- Widows, widowers of deceased participants, disabled war veterans.

Payments in 2020

This is an anniversary year, so the Government and the President of the Russian Federation decided that the amount of material rewards will be increased. Veterans and persons equated to them will receive 75 thousand rubles for the holiday. Home front workers and adult concentration camp prisoners are entitled to a one-time payment of 50 thousand rubles.

Local authorities will also congratulate the veterans on their anniversary. The amount of the benefit depends on the subject of the federation. Payments to pensioners will be made by social protection authorities of regions and republics of the Russian Federation.

- Protein-fat diet

- How to format a hard drive via BIOS

- Popular myths about coronavirus