About the fund

In 2002, the Basic Element group of companies was the founder of 4 non-state pension funds:

- Society (Moscow);

- GAZ (Nizhny Novgorod);

- Krasnoyarsk HPP-Penfo (Krasnoyarsk);

- Energy (Irkutsk).

Later, these NPFs were united under a single brand - NPF Socium.

The conclusion of OPS agreements began in 2004, when NPF received a license to carry out the corresponding type of activity.

The fund has two shareholders:

- NPF Ingosstrakh-Pension;

- Investment Policy.

In February 2020, the Society became a participant in the rights guarantee system in accordance with 422-FZ of December 28. 2013 “On guarantees...”.

Some facts about the fund:

- 17 billion rubles of own assets;

- customer base totals 380,000 people;

- Since its founding in 1994, more than 36,000 clients have received pensions.

Rating of the non-state pension fund Sotsium

On October 20, 2020, the rating agency Expert RA assigned this fund a rating of ruAA-. This rating is “4th from the top” - only ruAA, ruAA+ and ruAAA are higher.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The rating outlook is stable, which means that it is unlikely to change for the better or for the worse in the near future.

Junior Director for Insurance and Investment Ratings RA Expert Ekaterina Zuikova noted that NPF Sotsium is characterized by:

- high sufficiency of own assets to carry out operational work;

- high level of organization of risk management and strategic support.

The foundation is hindered from “breaking into the big leagues” by:

| low dimensional performance criteria | low average client account for NPO - 12,800 rubles, for OPS - 58,500 rubles, small volume of fund assets - 17.3 billion rubles. |

| net outflow of funds according to OPS | according to the results of the 1st half of 2020, the volume of pence. liabilities decreased by 493 million rubles |

Other ratings (according to the Central Bank of the Russian Federation, relevance as of June 30, 2020):

| 24th place | by volume of assets |

| 13th place | according to the amount of obligations for compulsory pension. insurance |

| 29th place | by the amount of obligations for NGOs |

| 13th place | by number of insured persons |

Duration of the procedure

To avoid problems, open an inheritance and enter into rights, it is necessary to submit all documentation to the notary no later than 6 months after the death of the citizen. According to the law, this is the time necessary to verify the degree of relationship and other information. After this, a certificate of right to inheritance is issued.

Sometimes a citizen is deprived of property automatically if the statute of limitations for the procedure has expired. In order for the right to be restored, you need to write an application. It must indicate a valid reason why the document was not completed on time.

More on the topic Top 3 best NPFs in Russia in terms of profitability and reliability, list

How to apply

Citizens who, before December 31, 2020, chose to form both an insurance and funded pension, as well as “silent people” who have never chosen a management company or non-state pension fund, can transfer their savings (in the second category - if they have any) to NPF Society.

Based on Art. 36.4. Federal Law No. 75 of May 7, 1998 “On non-state...”, the transfer of funds from another fund or from the Pension Fund of the Russian Federation is carried out after the conclusion of an OPS agreement between the client and NPF Sotsium.

The requirements for the contract are specified in Art. 36.3. of this Federal Law.

The client will need only 2 documents:

- passport;

- and insurance certificate OPS.

Methods for concluding an agreement:

- personal appeal to one of the territorial representative offices of the fund;

- or filling out the OPS agreement yourself in 3 copies, sending it to the postal address of the territorial division of the fund and waiting for the return of the agreement signed by the fund.

You can also order a consultation with a specialist who will answer all your questions, or write by email.

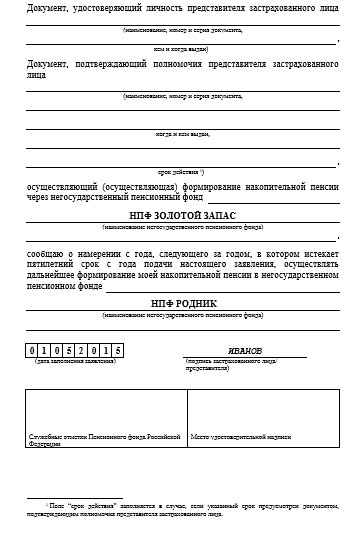

Regardless of the method of concluding the contract, the applicant must personally visit the local Pension Fund office and fill out one of the applications:

- or to transfer from the Pension Fund to the fund;

- or to transfer from fund to fund.

savings from another fund or Pension Fund. The Pension Fund or another fund must transfer funds by March 31 of the year following the year of filing the application. Please note that in case of early transfer of funds (if 5 years have not passed since the previous transfer), the client loses investment income. Therefore, it is recommended to change the fund no more than once every 5 years.

In addition to savings under compulsory pension insurance, NPF Sotsium operates in the area of non-state pension provision (NPO).

As part of this program, any citizen can enter into an NGO agreement and independently choose a pension scheme (that is, frequency, deadlines for paying voluntary contributions and other conditions).

Advice on applying for a non-state pension can be obtained from hotline specialists - 8 (800) 775 - 72 - 35.

Allocation of mandatory shares

This process is regulated by law. The allocation of obligatory shares occurs with the participation of a notary. This is the part of the property that is calculated first. Certain categories of citizens may enter into inheritance rights, regardless of other conditions of the will.

The obligatory share is allocated:

- Minors or disabled children of the testator who cannot work.

- Dependents who lived off the income of the deceased person, regardless of their relationship with him.

- Disabled mothers, fathers or spouses.

Payments

According to 360-FZ dated November 30. 2011 “On the procedure...”, persons who have pension savings can receive:

- One-time payment.

Represents a one-time payment of all the money in the savings account. Carried out if:

- The applicant has reached retirement age and receives fear. a survivor's pension, disability or state pension, but did not acquire the right to fear. old age pension;

- or storage size pensions are less than 5% of the insurance amount. old age pensions + accumulative

- Urgent pension payment.

The applicant can apply for a pension not for life, but for a certain period (at least 10 years).

The right to an urgent pension payment is only available to those who participated in the pension co-financing program or sent funds to mat. capital.

Payments to legal successors

The savings can be received by legal successors whom the insured designates when concluding the contract.

If such persons are not specified, inheritance will occur in the general order (heirs of the 1st stage in equal shares, if there are none - heirs of the 2nd stage, etc.).

Legal successors have the right to receive money if the death of the testator occurs:

- before appointment pensions;

- after the appointment of an urgent pension. payments;

- after appointment at one time. payment, but before receiving it.

Legal successors can apply for payments within 6 months from the date of death of the insured.

Rules for entering into inheritance

All collected information and confidential data are necessary for NPF Sotsium to operate and provide the stated services. Without the prior consent of the user, they are not transferred to third parties, except in situations described by law. For example, at the request of government bodies entitled to do so.

Before death, a person can draw up a will, which indicates who will receive the property and in what shares. If there is no document, you will have to enter into inheritance according to the law.

To avoid problems, all paperwork must be completed no later than 6 months after the person’s death.

Citizens who plan to inherit an inheritance must declare their intention in writing and be sure to have the document certified by a notary.

Required conditions for obtaining this right:

- Compliance with procedure deadlines.

- Availability of documents that confirm the death of a citizen and establish the queue for receiving an inheritance.

- Carrying out the property acceptance procedure.

If the amount left is insignificant, and the deceased had large debts or a loan, the inheritance can be refused. Otherwise, the successor assumes the obligation to repay the debt.

When a person did this with his own hands, it will be impossible to restore the rights of succession.

A citizen may be deprived of an inheritance by a court decision for unworthy behavior:

- evasion of maintenance of the testator;

- the use of violence against him;

- deprivation of parental rights.

First of all, you need to approach the notary with a document containing information about the place of last registration of the deceased. The lawyer will issue a list of papers that need to be collected in order to enter into inheritance rights. After that, contact him again.

The procedure for receiving an inheritance includes 3 stages:

- Write an application requesting a certificate.

- Pay the state fee.

- After 6 months, obtain from a notary a ready-made certificate of the right to inheritance according to the law. If it does not contain a complete list of property, you need to draw up an additional act. If the notary refuses to draw up a document, the heir has the right to go to court.

This concept refers to situations where the successor:

- Owner or manager of property. The heir can live there and rent out the apartment.

- Carries out actions to protect property from external attacks.

- Spends his own money on property maintenance and repairs. This could include utilities and vehicle maintenance.

- Bears the costs of paying off the debts of the deceased person - taxes, loans, and other payments.

Advantages and disadvantages

Advantages:

- Society participates in a system of guaranteeing rights;

- through your personal account on the official website of npfsocium ru you can find out the current status of your savings account;

- Future pension calculations are made directly on the website.

Among the shortcomings, we note the not the highest rating and a not very developed branch network - the company has offices only in 10 cities of the Russian Federation.

So, NPF Socium has been carrying out activities in OPS and NGOs for more than 20 years. To draw up an agreement, the client can visit one of 10 offices located in major cities of the Russian Federation, or send documents by mail. In addition to the contract, the client must also notify the Pension Fund of the transfer.

Registration cost

The legislation of the Russian Federation does not provide for the introduction of an inheritance tax. To enter into inheritance rights, you need to pay for the services of a notary before completing the documentation. The amount differs by region. The size is determined by the notary chamber of the subject.

When preparing documents, heirs must pay a state fee.

The amount depends on the degree of relationship and the health status of the legal successors. If they lived and continue to live in the same living space as the deceased citizen, then there is no need to pay. Minor heirs receive exemption from state duty.

For other citizens, the amount is a percentage of the value of the property; the heirs pay:

- Spouses, parents, children, brothers and sisters – 0.3%.

- All other citizens – 0.6%.