Login and password

After the merger of the two funds, clients of NPF “European” have the right to use the service under the same conditions. If necessary, you can seek help through the appropriate section of the site.

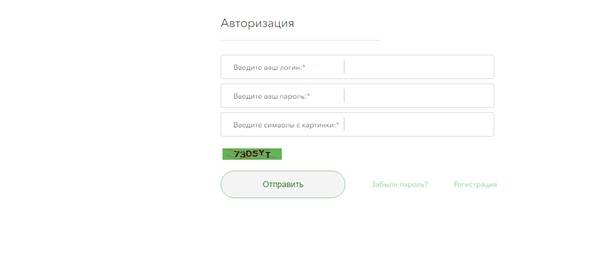

Login to your personal account on the official website of the European pension fund is carried out using your login and password. In addition, you must enter the numbers shown in the picture (anti-spam function).

Important! The personal account of NPF "European" is now available on the SAFMAR website client.npfsafmar.ru.

Download mobile app

A non-state pension fund not long ago released a special application for modern smartphones.

This is one of the very first software that was developed by similar organizations in the Russian Federation. You can install the application from such portals as the Apple Store and Google Play. After downloading this application, as soon as the question of how to enter the personal account of the European pension fund is resolved, you will have a large number of options at your disposal:

- Obtaining information regarding nearby pension funds. In this case, the addressee, mobile number and the operating mode accepted in the organization are indicated;

- Sending numerous questions to the fund's contact centers;

- Checking the general condition of the individual person during the inspection. It is possible to track the movement of funds in the account;

- Changing the official address so that letters from the fund can be sent.

- It is possible to study PF news and current press releases;

According to professionals, a pension bank with a European level of service is rapidly approaching high-quality customer service equal to modern banks. It is for this purpose that a well-thought-out application was proposed, which can also be entered using the contract number or card.

Registration process

Before using the service, you must go through the registration procedure, during which the client of the fund is issued a special plastic card. It is provided at the time of execution of the agreement or later sent by mail.

This is where you can find your password and login to enter your personal account of the European pension fund. The user receives access 3 months from the date of signing the OPS agreement.

Helpful information! The fund informs clients about the possibility of using a personal profile via SMS.

In case of loss of the card or other situations requiring password recovery, you need to click on the active link “Forgot your password?”. Next, enter the email address associated with the profile. A new password will be sent to it. If the NPF client did not indicate an email in their profile, you need to contact technical support by phone and order a new card.

Important! Currently, only OPS clients can register to use the account. The procedure is not yet available for NGOs, but the fund promises to provide such an opportunity later.

Pension Fund "Safmar": login to your personal account after registration

After registering in your personal account of the non-state pension fund "Safmar", you can log in to it.

After entering all the data, all that remains is to click on the “Submit” button. To the right of it there is also a “Forgot Password” button, when clicked, updated data will be sent to the email address specified during registration. If an email address was not specified when registering in the personal account of NPF Safmar, there are several solutions:

- Appear in person directly at the pension fund office in Moscow. You must have your passport and SNILS with you;

- By mail. This method is the least successful, but the most suitable for those who do not have the opportunity to apply in person. The first thing you need to do on the site is a lost password application, fill it out and sign it. Also, copies of your passport with your signature and personal signature must be attached to your application;

- Go to one of the Raiffeisenbank branches with your SNILS and passport.

Important! When visiting an office or one of the bank's branches in person, we strongly recommend that you make an appointment in advance so that there are no unpleasant surprises during your visit.

Also, if you want to change your password to a more memorable one, go to the special section in your personal account.

Using your personal account on the official website of JSC NPF Safmar is absolutely free, but it is impossible to completely disable the account. If you don't need it, you can simply log out and stop using it.

User account functions

In the personal account of the pension fund NPF "European", the user can:

- Familiarize yourself with information about the contract number, the date of its conclusion and the validity period;

- Monitor the level of your savings, profitability as a percentage;

- Make an account statement for the selected period of time;

- Issue a special notice;

- Change personal information by submitting appropriate applications;

- Change password and address;

- Configure notification functions sent to your email inbox.

The personal account is disabled automatically when the contract with the NPF is terminated.

How to enter your personal account of the pension services fund

Standard authorization in the created profile is available only after correct registration. Such an operation does not require the user to spend a lot of time or study the submitted application for a long time. To carry out the registration operation and create your own profile, you will need the following information in a special form:

- Official number of the issued SNILS;

- Work mobile;

- Active email.

After this, the button is pressed to create an account, and you can perform an operation to enter the personal account of the European pension fund using the contract number.

As soon as a person receives an official social insurance agreement, the organization issues and issues a special plastic access card to the personal account of the European pension fund. It will be possible to perform authorization using it. If such a card is not available, entry will be denied. This is a fairly reliable method of protecting your investor. The security of all personal information is confirmed by a special SSL certificate.

After passing authorization, which is available to everyone, the user has the opportunity to familiarize himself with personal information regarding the position and amount of funds in the account.

The portal organizes confidentiality and overall high security of users and their personal information at the highest level. Thanks to the use of a well-thought-out service, the organization is characterized by fairly high information security. Thanks to this, users are provided with complete confidentiality in the provision of services; the main thing is to know how to log into the pension fund account.

Despite the fairly high level of security, users themselves are also required to comply with certain requirements. Here are the most basic and effective of them:

- Cleaning viruses from viruses;

- Using high-quality software;

- When accessing the Internet, you should use a firewall;

- You must purchase programs exclusively from trusted suppliers;

- You should constantly update the installed software, as it is constantly being improved.

If you access the network via a modem, you must check the dialed number. Such rules can significantly enhance the overall level of security when using the personal account of the European Pension Fund for individuals.

Top up your account and control your Home Internet and TV balance

Stay up to date with current promotions and offers

Find out account details

Increase the speed of your home Internet

Order a TV connection or additional set-top boxes to watch TV in other rooms

Fill in your contact information so that we can inform you about the status of your contract

In order to obtain information about the status of a corporate or personal pension account with the European Pension Fund from anywhere in the world, it is enough to have a computer connected to the Internet.

Many special functions are available to clients of the European Pension Fund NPF through their personal account. And although they do not receive them immediately, but only some time after the conclusion of the contract, they completely cover the long wait.

First of all, you can use the following functions of your online account:

- Opportunity to get acquainted with all the details regarding the number and date from the moment of conclusion of the contract on compulsory pension insurance or non-state pension provision.

- The ability to constantly monitor the state of your pension account, savings, and accumulated interest on income.

- Creation of a special statement about the state of a personal pension account for a certain period (for a current year, a contract period or a clearly defined period of time).

- Control and analysis of the effectiveness of all personal data that was specified on the site, as well as the opportunity to leave a special request to change it.

- Issuing a special notice to the current insured person, which must be provided in accordance with the current legislation of the Russian Federation.

- Changing the password for your personal profile, changing your email address or adding it.

- Setting up notifications to your email address (consistency and information content).

What programs does it offer?

Before the reorganization, European offered the following programs:

- compulsory insurance of pension deposits for individuals. Based on the agreement, the funded part of the pension is increased;

- individual programs: for graduates of educational institutions, young professionals who have not previously entered into employment contracts;

- for a young family. You can choose the amount of contributions yourself;

- for families with children. Savings can be made both in your own name and in the name of your children;

- for pensioners. Short-term program. Allows you to increase current or future payments in a short time.

All agreements concluded with the European Fund, after its entry into the Safmar joint-stock company, continue to be valid.

How to transfer pension

In order to transfer your pension to NPF Safmar, you must:

- contact the Pension Fund to transfer funds, in person or by email (by signing with an electronic signature);

- for compulsory insurance of pension deposits, fill out in three copies: for the Pension Fund, NFP and the applicant;

- The NPF inspector will review the application and make a decision; if positive, an account will be created for the insured person, and the data will be transferred to the Pension Fund for changes.

When visiting in person, you must take your passport, SNILS and pension certificate (if received).

About the fund

European is a non-state pension fund (NPF), founded about 25 years ago. At first he served corporate clients, but in 2010 he began to deal with mandatory pension insurance.

The European Pension Fund was one of the most successful non-state funds. The income of his clients for 2009-2016 amounted to 140 percent, while the profit of other non-state pension funds was on average 90%.

Since 2020, the European Fund has merged with the non-state fund Safmar (formerly Raiffeisen), which became a participant in the system of guaranteeing the rights of insured persons. In addition to him, it included the NPF “Education and Science” and “Regionfond”.

The reorganization took place to achieve higher efficiency in managing the funds of pensioners, both current and future.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how to solve your specific problem

— contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week

.

It's fast and FREE

!

All agreements concluded on non-state pension provision, compulsory pension provision, available to the European Union, continued to be valid and remained in force. After all, the reunification took place on the condition that the pension provision for their owners would remain unchanged.

Responsibilities to depositors are now fully fulfilled by JSC NPF Safmar, without renewing contracts.

Advantages and disadvantages

The advantages of NPF include:

- The ability to independently influence the amount of your future pension by determining the amount of contributions.

- Participation in a non-state fund involves receiving a pension from two sources: from the state and from the fund. If there are several funds, the number of sources increases.

- The ability to predict the start and amount of payments.

- The activities of funds are regulated by the state, which affects their reliability.

- Tax Benefits - Funds are not taxed by either the contributing employer or the contributor.

- Transparency. In your personal account you can find out information about the amount deposited, payments received, and investment profit.

- Investing only in reliable sources defined at the legislative level.

- Reducing the possibility of fraud: funds are stored in bank accounts, investments are handled by an asset management company, and the administrator distributes profits. Control over each structure is carried out by government agencies.

- Possibility of transfer of accumulated funds in case of early death by inheritance.

- If problems arise, you can transfer the deposit to another NPF.

But despite a number of advantages, the activities of non-state pension funds are not without disadvantages:

- you have to plan many years in advance, which can be dangerous in an unstable economy. You have to deposit money in advance, and then wait for decades for payments;

- low percentage of return, which does not always cover the inflation rate;

- impossibility of receiving capital from the fund in less than 5 years. Otherwise, all profits accumulated during this period will be withdrawn;

- penalty for late payment;

- estimated income level;

- capital management fee, tax on investment income.

After the freezing of the funded part of pensions, most non-state pension funds ceased to exist. But the European Fund was reorganized and all obligations to its clients are still being fulfilled.