Pensioners are reliable clients for banks; their income is guaranteed by the state. They have preferential rates. The most favorable offers on loans and deposits can be obtained where the pension card is opened.

What is attractive about Rosselkhozbank? How to quickly and without commission receive cash using his card? How convenient is it to save money with it?

Offer for pensioners

Recipients of pensions and social benefits can order a free debit card from Rosselkhozbank. Interest is charged on the remaining balance. For non-cash payments, customers accumulate points that can be spent on goods from the bank’s catalog.

Rosselkhozbank terms and conditions

To receive plastic, you need to confirm your right to social benefits: pension, allowance.

On the same day of application, you can receive non-registered MIR plastic for instant issuance. Those who wish can order a personalized MIR card. Both products are free.

Tariff plan "Pension"

6 types of Rosselkhozbank plastics are serviced on preferential terms. Three of them work in the MIR system and can be issued at the discretion of the pensioner.

Until 2020, beneficiaries could order international MasterCards. They are covered by the pension plan until the end of the term.

Re-issue is not possible; instead of MasterCard you can get MIR.

Pension card MIR

With the introduction of economic sanctions in 2014, holders of international Visa and MasterCard cards cannot use them in Crimea. There is a risk of problems arising throughout Russia.

In order for pensions and other regular payments from the budget to reach citizens without hindrance, the government has obligated by law to deliver them without the use of foreign instruments.

The Russian payment system MIR allows you to receive money and use it in the usual way through a card.

Characteristic

Applicants choose from three types of MIR Rosselkhozbank pension cards:

- instant release;

- classic;

- jointly with UnionPay.

With their help you can:

- pay non-cash for purchases;

- receive and send money transfers;

- manage accounts in Rosselkhozbank via the Internet;

- enjoy bank privileges for pensioners.

Classical WORLD

Plastic works in Russia, Armenia, Turkey. The management of the payment system is negotiating with other countries.

The card is similar in appearance to Visa and MasterCard, it contains the following information:

- holder name;

- card number;

- validity period, which is 3 years;

- Three-digit code required when paying online.

Instant map MIR

Pre-issued cards are stored in the offices of Rosselkhozbank. They have the same data as the classic, with the exception of the holder's name. The validity period upon issue is 3 years, as it is stored in the department it decreases, but upon issue it cannot be less than 2 years.

When registering, a bank account is opened for the client, and a plastic number is attached to it. Issue occurs on the day of application. When it is required to indicate the name of the holder, for example, when paying via the Internet, it must be written in Latin letters.

If you are in doubt about how to do this correctly, you can:

- look at the writing on another card;

- Check with the bank in person or by calling support number 88001000100.

The functionality is similar to the classic one. The difference is a reduced daily limit for cash withdrawal from an ATM.

Co-branding WORLD

The card is issued in conjunction with the UnionPay payment system. In countries where Russian plastic is accepted, it works like a classic MIR. When entering foreign countries where MIR does not operate, the card is recognized as UnionPay. You can pay her by bank transfer.

Is it possible to receive via Visa or Mastercard?

It is no longer possible to issue international cards to receive a pension from mid-2020. Those who wish can register them of their choice, replenish them, and use them. A pensioner can freely transfer a pension from a MIR card or any other account to Visa, MasterCard.

Cost of issue and maintenance

The main pension card is issued and serviced free of charge. Additional service fee is 200 rubles per year.

If there are no transactions on the card for a year or more, and the balance is less than 3,000 rubles, a monthly account maintenance fee of 100 rubles is provided.

SMS notifications for all transactions 59 rubles per month. Replenishment notifications can be activated for free.

Cash deposits and withdrawals

Rosselkhozbank does not charge a fee for replenishment through its ATMs, cash desks using a card or account number.

You can receive money without commission through:

- Rosselkhoz ATMs;

- its cash register;

- at ATMs of partners - Alfa-Bank, Promsvyazbank, Raiffeisenbank, Rosbank.

The cost of issuance at third-party ATMs and cash desks is 1% of the transaction, minimum 100 rubles.

Limits and restrictions

Maximum amounts for transactions:

| MIR classic, co-branded | Instant | |

| Cash withdrawal from RSHB ATMs per day, rub. | 150 thousand | 75 thousand |

| Cash withdrawal at RSHB issuing points, through third-party banks, rub. | 300 thousand | |

| Receipt of cash per month, rub. | 1 million | |

| Transfers from card to card, by account number | 100 thousand/day 1 million/month | |

Information about legal entities and individual entrepreneurs

Basic information Accounting report Extract from the Unified State Legal Entity Reviews Fines, taxes

General Finance Details Founders Registrar OKVED Codes Register History Management Relations

| abbreviated name | CJSC NPF "TEMP" |

| Full name | CLOSED JOINT STOCK COMPANY RESEARCH AND PRODUCTION |

| Status | Current |

| Managers | Lekarev Valery Gennadievich INN: 400900144101 |

| OGRN | 1024000669142 from 06/24/1997 |

| INN/KPP | 4009002553 / 400901001 |

| Kind of activity | (26.51) Manufacture of instruments and instruments for measurement, testing and navigation |

| Tax type | OSN |

| Employees | 1 |

| Region of the Russian Federation | Kaluga Region |

| Legal address | 249711, Kozelsky District, Lomonosova Street, 19, A Kaluga Region, Sosensky City |

| Actual address | 249711, Kozelsky District, st. Lomonosova, 19, A region. Kaluzhskaya, Sosensky |

| Reviews and opinions | Not found Add your review |

| Reviews and opinions of employees | Not found Add your employee review |

| Email address | Not found |

| Manager's phone number | 4144* |

| Website address | Not found |

| Brief information | The organization 'ZAKRYTOE AKTSIONERNOE OBSCHESTVO NAUCHNO-PRIZVODSTVENNAYA' was registered on June 24, 1997 at the address 249711, Kozelsky District, Lomonosova Street, 19, A Kaluzhskaya Region, Sosensky City The company was assigned OGRN 1024000669142 and issued TIN 4009002553. The main activity is the production of tools and devices for measurement, testing and navigation. The company is headed by Lekarev Valerij Gennadevich. In 2018, the company’s profit amounted to 184,000 rubles. Complete information from official sources: contacts, founders, management, details and other data. Detailed information is available in the extract from the Unified State Register of Legal Entities and in the history section. |

Online services Tax for checking the legal purity and reliability of legal entities

Checking the company during a transaction

The service will check the company's legal status. cleanliness, presence of collateral, encumbrances. The company has ownership rights and debts.

Check company online

Checking your financial well-being

Online verification of the site company by INN, OGRN, director for collateral, arrest, information about the owner.

Check tax reporting

Checking company details

Check the company using any data online.

Check details

Similar organizations

- LLC "ZTK"

- SNT "BUILDER"

- BRANCH FOR THE ULYANOVSK DISTRICT OF THE FECA FOR THE KALUGA REGION

- ARFA LLC

- MUP "SPK I O" SGO

- PEASANT (FARMER) FARM "MRIYA-3" RUMYANTSEVA ELENA ALEXANDROVNA

- MKU "ARCHIVE OF SVETLOGORSK CITY DISTRICT"

Interest accrual

Let's give a simplified example. Then we will describe the basic rules of how interest is calculated on the Rosselkhozbank pension card.

Let's assume:

- on the morning of May 1, the balance on the card was 10,000;

- May 5 pension crediting 15,000;

- 5,000 spent on May 11;

- On May 28, 600,000 was credited to the account from the sale of the dacha;

- On June 5, the pension was credited and immediately cashed out;

- Until the end of June the card was no longer used.

Calculation of interest on balance:

| Period | Amount of days | Remainder | Accrued % |

| 1.05-5.05 | 5 | 10000 | 5.48 rub. (RUB 10,000 x 4% / 365 days x 5 days) |

| 6.05-11.05 | 6 | 25000 (10000+15000) | 16.44 rub. (25000 x 4% / 365 x 6) |

| 12.05-28.05 | 17 | 20000 (25000-5000) | RUB 37.26 (20000 x 4% / 365 x 17) |

| 29.05-31.05 | 3 | 620000 (20000+600000) | RUR 203.84 (620000 x 4% / 365 x 3) |

| Total for May | RUB 263.02 (5.48+16.44+37.26+203.84) | ||

| 1.06-30.06 | 30 | 620,000 (at the beginning of the day did not change throughout the entire month, the pension was received and withdrawn in one day) | RUB 3,057.53 (620000 x 6%/ 365 x 30) |

Conditions

The bank records the balance in the pension card account at the beginning of each day. If it is more than 100 rubles, 4% per annum is charged.

In months in which amounts over 50 thousand are stored on the account, the client receives an additional percentage:

| Balance, rub. | Surcharge to the rate |

| 0-50000 | 0% |

| 50000-100000 | 0,5% |

| 100000-500000 | 1% |

| More than 500,000 | 2% |

How are they calculated?

Base charges at an annual rate of 4% are calculated daily. They do not burn when the remainder changes. The total amount is credited to the account on the last day of the month.

The client receives additional interest on the minimum balance amount per month. Therefore, in our example, in May there was no additional accrual after the receipt of 600 thousand.

Restrictions

- Crediting money to your account sometimes occurs with a delay of up to 3 business days. When calculating interest, the actual account balance is taken into account. Additional interest is charged on the minimum amount that was recorded for the month.

Hence:

- if you expect to receive increased income from savings, they should be deposited at least 3 working days before the start of the month;

- If you spend the money and deposit it on the same day, the next day your account balance may be reduced because the bank does not have time to process the transaction.

- 4%, 0.5%, 1%, 2% – annual rates. 4% from 1000 rub. is 40 rubles. This amount will be credited if 1000 remains on the account for a year. To calculate daily income 40 rubles. divide by 365 days, we get 11 kopecks.

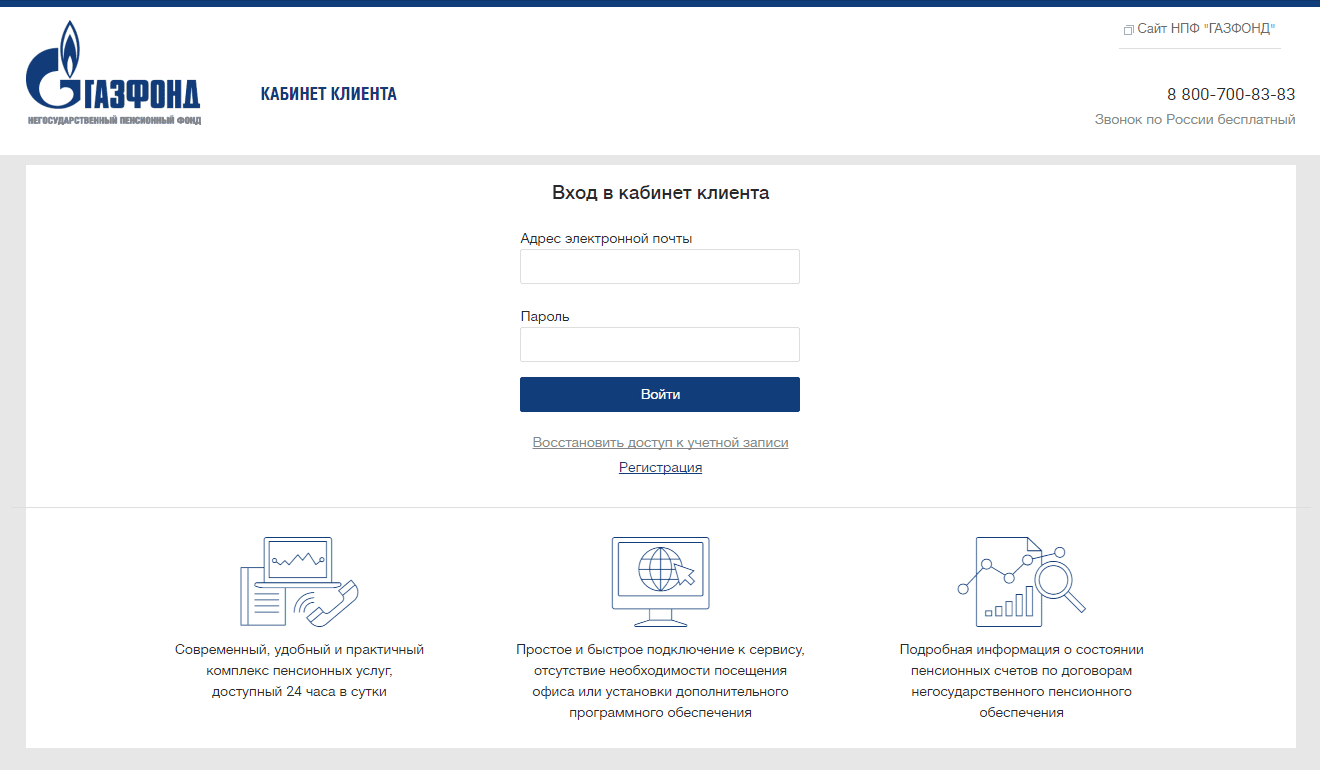

Registration and login to your personal account

Clients who have an active pension account with the Fund and are registered in the system through the official website of NPF Gazfond have access to the “Client Account” from the section of the website of the same name. It is enough to enter your email and password on the main page of the section, and you will be logged into the client’s account.

Individuals who have entered into an agreement with the Fund independently or through an employing organization have the right to register in the Internet service “Client Account” after transferring the first pension contribution to the Fund’s current account. Registration for access is carried out on the website according to the following scheme:

- The client goes to the Gazfond personal account page using the “Client Account” link from the menu of the official website, activates the “Registration” link, finds himself on the page with the Terms of Service, reads them carefully and, having checked the box indicating his agreement with them, clicks on the “ Further".

- On the following tabs of the registration page, the client indicates a valid email address that needs to be confirmed, and his data - last name, first name, date of birth and details of one of the documents from the list: Russian passport, foreign passport, residence permit, birth certificate, identity card , asylum certificate, temporary residence permit in the Russian Federation, temporary certificate.

- The operator checks the information received from the user online and sends a confirmation code to the mobile phone number included in the contract.

- The client enters the received SMS code into the form on the website, after which he gets the opportunity to set, in addition to his login (email address), a password and a security question with an answer.

- The operator updates the user's information in the client's account and activates the account.

You can always recover the password to the client’s account via email, which was used to register in the service.

- Official website: https://gazfond.ru

- Personal account: https://client.gazfond.ru

- Hotline phone number: 8 800 700-83-83

How to receive a pension on a Rosselkhozbank card?

Step-by-step instruction:

- with a passport and a document confirming the right to payment, contact the RSHB office;

- together with a bank employee, fill out an application for transfer of funds at Rosselkhozbank;

- submit the application to the Pension Fund or other body that pays you money;

- If your pension was transferred to you through another bank, you should contact them to close the account. Often, if there are no operations for several months, preferential conditions cease to apply, and a service fee may be charged.

Requirements

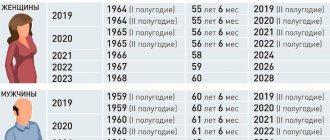

The applicant must be a resident of the Russian Federation. Minimum age 18 years. You need to confirm your right to receive a pension or social benefits. If retirement age has been reached or there are no more than 2 months left before it, it is enough to present a passport. Otherwise, a certificate is required from the body paying the pension, for example, the Pension Fund.

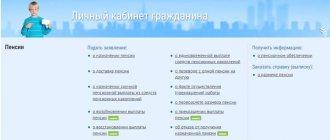

How to withdraw pension savings from Gazfond.

To assign payment of pension savings, you must submit the appropriate application and the documents necessary for the assignment of payment to JSC NPF GAZFOND Pension Savings.

The application can be submitted: in person;

through a legal representative (guardian, trustee);

through a trusted person.

The application must be accompanied by originals or notarized copies (in accordance with Decree of the Government of the Russian Federation No. 1048 of December 21, 2009):

documents proving the identity, age and place of residence of the insured person (place of stay);

documents proving the identity and place of residence of the legal representative (place of stay) or authorized representative, as well as documents confirming their powers;

insurance certificate of compulsory pension insurance of the insured person;

a certificate from the territorial body of the Pension Fund of the Russian Federation confirming the receipt (right to receive) by the insured person of an old-age insurance pension, indicating the date of assignment (the emergence of the right) and the amount of the pension. This certificate must be obtained from the territorial office of the Pension Fund.

The application must also be accompanied by a printout of bank details indicating the personal account number of the insured person for the transfer of pension savings.

Types of payments from pension savings

On July 1, 2012, Federal Law No. 360-FZ of November 30, 2011 “On the procedure for financing payments from pension savings” came into force, which provides for the following types of payments from pension savings:

One-time payment;

Urgent pension payment;

Funded pension;

Payment to successors.

One-time payment

A lump sum payment is a one-time payment of all pension savings of the insured person recorded in the pension savings account.

The following are entitled to receive a lump sum payment:

1. Persons receiving an insurance pension for disability or loss of a breadwinner, or receiving a pension under the state pension provision, who, upon reaching the generally established retirement age (men - 60 years old, women - 55 years old) have not acquired the right to an old-age insurance pension due to lack of required insurance experience or number of pension points; ATTENTION! Insured persons who have exercised the right to receive pension savings in the form of a lump sum payment have the right to apply again for a lump sum payment no earlier than 5 years from the date of the previous application for payment of pension savings in the form of a lump sum payment. A one-time payment is not made to persons who previously received a funded pension.

2. Persons who, when the right to establish an old-age insurance pension arises (including early), the amount of the funded pension is 5% or less in relation to the amount of the old-age insurance pension, taking into account the fixed payment to the old-age insurance pension and the size of the funded pension. The amount of the funded pension is calculated on the date of its assignment.

Urgent pension payment

A fixed-term pension payment is a monthly payment of a pension for a period specified by the insured person, which cannot be less than 10 years, when the right to establish an old-age insurance pension arises (including early).

Persons who form a funded pension through:

1) participation in the State Pension Co-financing Program, namely:

— additional insurance premiums transferred by the insured person personally;

— additional employer contributions paid by him in favor of the insured person;

— state contributions to co-finance the formation of pension savings;

— income from investing all of the above funds;

2) directing funds (part of the funds) of maternity capital for the formation of a funded pension, including income from their investment.

A person who forms a funded pension in the above manner, if he has the right to assign an old-age insurance pension, can, at his choice, receive the above funds of pension savings:

- in the form of an urgent pension payment. The insured person determines the payment period independently, but not less than 10 years.

OR

— in the form of lifelong pension payments as part of a funded pension.

For insured persons who have exercised the right to receive an urgent pension payment, a special procedure is provided for the payment of pension savings to legal successors. In the event of the death of the insured person after the appointment of an urgent payment, the legal successors have the right to receive the balance of funds in the pension account, with the exception of maternity capital funds aimed at forming a funded pension, which is payable to the child’s father (adoptive parent) or minor children (if there is no father), if the children are minors or full-time university students under the age of 23 inclusive.

How and where to apply?

Contact a bank branch in person or order plastic through the bank’s website. A link to remote registration is on the card description page.

You will report:

- your region;

- FULL NAME.;

- contacts;

- date of birth;

- bank branch, convenient for circulation.

An employee will contact you to agree on delivery details.

Get a card

Wait for a notification from the bank that the card is ready for issue, and receive it at the selected branch. Present your passport and other documents agreed upon during registration. For example, a pension certificate.

How to open a deposit?

In addition to the usual method of opening a deposit by contacting a bank branch, there are several other options for registering a deposit. You can use terminals and ATMs. Despite the fact that this option appeared relatively recently, the client simultaneously receives several advantages:

- A complete absence of queues, a high level of service, as well as an ideal territorial location. The office is not always located nearby, so the solution with an ATM is optimal.

- Simplicity and intuitive clarity of choosing the main indicators for the deposit, as well as submitting documents.

You can use the Internet office payment system, that is, remote access to your personal account. To use this method, you must have access to the Internet and register in the remote access system. This design technique has special advantages.

The most important of them is the absence of the need to waste time visiting a bank office. In just a few simple steps, you can calculate the profitability of the “Pension Income” deposit from Rosselkhozbank using a calculator and, after choosing the optimal option, register the deposit.

Comparison with pension cards of Sberbank and VTB

Let's compare the conditions:

| Rosselkhozbank | Sberbank | VTB | |

| Possible service fees | 100 rub. for maintaining an account in the absence of credits, write-offs (except commissions) for more than a year | None | 249 rub./month. in the absence of pension credits for 2 months |

| Additional card | 200 rub./year | Not provided | Up to 5 pieces. Registration is free, service on conditions similar to the main card. |

| SMS notifications | 59 rub./month. | 30 rub./month. | For free |

| Daily cash withdrawal limit without commission, ATM + cash desk | Up to 300 thousand | Up to 100 thousand | Up to 350 thousand |

| Accrual of interest on a pension card | 4% basic + up to 2% additional | 3,5% | To generate income, a savings account is opened. It has 4% base charges + up to 4.5% additionally. |

| Basic cashback | 1.5% points, can be spent in the bank catalog | 0.5% points, accepted by bank partner outlets | 1% in cash |

Review analysis

According to reviews, the Rosselkhozbank pension card has an average rating. Users almost unanimously note the benefits of savings.

Among the minuses, clients write about:

- incomprehensible conditions for cashback - for our part, we will comment that its calculation is quite simple, 1.5% for purchases, discomfort is caused by the limited opportunities to spend it - only through the bank catalogue, the benefits are comparable to a souvenir shop;

- the need to spend time in queues;

- a small number of RSHB ATMs - we assume that users are often not familiar with the opportunity to withdraw funds for free from partner terminals - Rosbank, Raiffeisen, Alfa, Promsvyazbank.

A client from Voronezh writes that he was unable to issue an additional co-branding card.

RSHB buys NPF

According to the Interfax agency, Rosselkhozbank at the end of 2015 ranked sixth in assets with 2.5 trillion rubles. In fact, it remains the only large state-owned bank that does not own or whose group does not include a non-state pension fund.

RSHB announced its intention to develop its own pension business three years ago. Then the bank intended to create its own non-state pension fund, specializing in servicing the population of rural areas, small and medium-sized cities. Market participants then indicated that a more logical step for the state bank would be to purchase an existing player - in this case, it would immediately be able to work under compulsory pension insurance. As a result, things did not go further than declarations about the creation of a non-state pension fund.