- Yana Semeleva

- 5 612

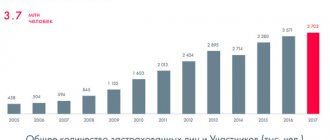

Most people in Russia have small pensions. And by old age, many manage to save a decent amount. People try to put money in the bank, and deposits for pensioners in Rosselkhozbank are considered the right choice today. The institution is among the TOP 10 banks by the number of deposits attracted from the population. The reason for the popularity of a banking organization among older people is the reliability of the company, backed by extensive experience and 100% state support. Numerous branches have been opened throughout the country, as a result, individual deposits for pensioners in Rosselkhozbank are becoming even more accessible to citizens of the Russian Federation.

The essence of the “Pension Plus” deposit

People of the old school are accustomed to not trusting banks and keeping money at home “under the mattress.” But inflation does not stand still and money lying at home reduces its value .

So that you do not lose your savings, but, on the contrary, exaggerate them, Rosselkhozbank has created deposits for pensioners.

In essence, such a contribution is no different from any other. You, like other clients, can choose the period for which savings can be deposited, the type of deposit and the method of interest payment .

“Pension Plus” from Rosselkhozbank is very beneficial for pensioners because it has advantages over regular deposits:

- For pensioners, the minimum amount is very low .

- Such a deposit has a higher interest rate .

- After the expiration of the term, the contract is renewed automatically.

- There is no need to make a regular contribution.

Terms of deposit in Rosselkhozbank

If you want to make an investment in Rosselkhozbank, then find out the conditions for the “Pension Plus” deposit:

- Bring your passport if you are a woman and you are already 55 years old or if you are a man, then you must be 60 years old . If there are two months left before your birthday, then you can also use the deposit service.

- If you have not reached retirement age, but are already a pensioner, you will simply need to present a pension certificate .

- The minimum down payment amount is not large - only 500 rubles .

- You can withdraw money during the validity period , but the minimum amount of RUB 500 must always remain in the account.

- Partially withdraw money, possibly without losing the accumulated interest.

- You can deposit money from a minimum of 1 ruble .

- If you terminate the contract before the end of its term, you will only receive the “On Demand” rate, which is 0.01% .

- The contract is renewed automatically , maintaining the conditions under which the deposit was originally opened.

- You can top it up throughout the validity period.

- The deposit can be opened for a period of one or two years.

- The maximum deposit amount cannot exceed 10,000,000 rubles.

- You can draw up an agreement in the name of a minor child .

Article on the topic: Conditions and interest rates on the “Investment” deposit in Rosselkhozbank

Conditions for deposits

RSHB deposits are provided to the population under certain conditions. Before opening a deposit account (d/s), you need to study information about the bank’s available offers. The investor needs to pay attention to:

- annual return;

- period of the program;

- minimum down payment;

- maximum size limitation;

- currency d/s;

- possibility of withdrawing funds;

- additional services and bonuses (for example, preferential termination of the contract, free card as a gift, etc.).

For convenience, you can use the online calculator located on the official website of the Russian Agricultural Bank and calculate the expected investment according to certain parameters. There is another option - a personal visit to a bank branch. In this case, the RSHB employee will talk about available banking instruments and prepare the necessary calculation schemes so that you can make the most useful investment.

- Address by phone number

- Salad Ladies whim

- Why is it better for pensioners to refuse if they receive a call and are offered free medical care? examination

Requirements for depositors

Retired investors are subject to certain requirements. They may be:

- Any individuals (even a minor child) with a pension certificate, a form from the Pension Fund of the Russian Federation establishing an insurance pension, or a court document assigning monthly lifelong maintenance.

- Women over 55 years old and men over 60 years old. In this case, you do not need to present your pension certificate.

Amount and term of deposit

Deposits in Rosselkhozbank for pensioners can be made for a period from 31 to 1460 days. The bank also opens a “On demand” account. Some financial investments can be rolled over. You can open a d/s with an amount starting from 500 rubles. (“On demand” - from 10 rubles). Investments under programs for pensioners are limited to a maximum of 1-2 million rubles. Other types of investments available to all individuals are limited to 10,000,000 rubles. On some accounts you can place savings without limiting the number of savings at all.

- 3 stages of Alzheimer's disease development

- How to avoid getting infected with coronavirus on a long-distance train

- How to avoid getting infected with coronavirus through food

Interest rates

Interest rates at Rosselkhozbank for pensioners vary. Yield on demand account is fixed - 0.01%. Specialized pension programs (“Pension Income” and “Pension Plus”) have some of the highest rates compared to similar offers from competing banks - 5.9%. The yield on other deposits is from 0.5% to 7.3%. The bank has the right to unilaterally change the interest rate.

Interest rates on the Pension Plus deposit in 2020

You can find out at Rosselkhozbank what percentage “Pension Plus” has by contacting the manager at a bank branch or on the bank’s website.

Interest accrued on a deposit can be capitalized, that is, interest will also be accrued on interest already accrued .

Since Rosselkhozbank cares about pensioners, the rates on deposits with the bank are very attractive :

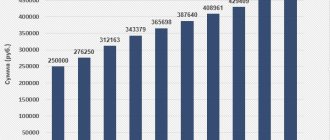

- For a deposit opened for 365 days, 7.80% is accrued for an amount of 500 rubles or more.

- A deposit opened for 730 days will be accrued a higher percentage - 8.00% , for a minimum of 500 rubles.

“Pension Plus” is a very promising investment for clients - pensioners. Rosselkhozbank is constantly growing and developing, and always tries to provide its clients with the most favorable and high interest rates for funds.

Deposits for pensioners in Rosselkhozbank today - in 2020

In this review, correspondents from the 10Banks website will talk about the conditions and interest rates of special deposits for individuals, which are currently offered by Rosselkhozbank for pensioners. Each of you can easily compare them to choose the most profitable one.

Rosselkhozbank deposit “Profitable Pension”

This is a modification of the “Profitable” deposit, but on more favorable terms. If in the original deposit the rate depends on the amount, then the RSHB has made a discount for pensioners. By investing just 500 rubles, you can get a decent percentage. But, of course, opening a deposit for 500 rubles is pointless. Because you can’t replenish it later. To get maximum income, you need to invest more.

Interest rates

| Duration, days | % monthly | % at the end of the term |

| 91 | 4,65% | 4,70% |

| 180 | 4,75% | 5,05% |

| 270 | 5,10% | 5,20% |

| 395 | 5,20% | 5,40% |

| 455 | 5,20% | 5,40% |

| 540 | 5,25% | 5,50% |

| 730 | 5,25% | 5,60% |

| 910 | 5,25% | 5,60% |

| 1095 | 4,90% | 5,20% |

| 1460 | 4,90% | 5,20% |

Conditions

- Amount: from 500 rub.;

- Duration: 91 – 1460 days;

- Replenishment: no;

- Expense transactions: no;

- Capitalization: no;

- Interest payment: at the end of the term or monthly.

Advantages and disadvantages

High interest for a minimum amount.

There are no deposits or partial withdrawals without loss of interest.

Calculate possible income using a deposit calculator

Rosselkhozbank contribution “Pension income”

One of the advantages of the “Pension Income” deposit is that the client is given the choice of interest payment method: monthly capitalization or transfer of interest to another account at the Russian Agricultural Bank.

Another advantage is the possibility of replenishment, and the minimum additional contribution is only 1 ruble. But the disadvantage can be considered the inability to partially withdraw money without loss of profitability.

When you open a Rosselkhozbank deposit “Pension Income” in the amount of 50,000 rubles or more, you can receive a free debit card of the “Amur Tiger - card to deposit” tariff plan. Additional income is accrued monthly on the balance on this debit card.

Interest rates

| 395 days | 540 days | 730 days |

| 4,8% | 4,9% | 5,00% |

Conditions

- Duration: 395, 540 and 730 days.

- Amount: from 500 to 2 million rubles.

- Replenishment: yes.

- Expense transactions: no.

- Interest payment: monthly to the account or capitalization.

Advantages and disadvantages

There is the possibility of replenishment, choice of interest payment method.

There is no possibility of partial withdrawal of money without losing interest.

See also a review of deposits for pensioners in reliable banks

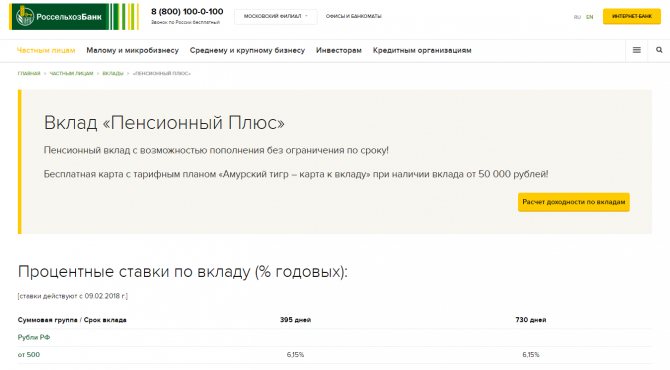

Rosselkhozbank deposit "Pension Plus"

This deposit is also provided only for pensioners. But its conditions are more flexible compared to the previous contribution. The account can be replenished, as well as partially withdraw money without losing interest, if you suddenly need it. It is only important to leave money on deposit in the amount of the minimum balance. Today it is 500 rubles.

If you have a deposit of 50,000 rubles or more, you will be issued a free card with the tariff plan “Amur Tiger - card for deposit”.

Interest rates

| 395 days | 730 days | 1095 days |

| 4,6% | 4,7% | 4,9% |

Conditions

- Duration: 395, 730, 1095 days.

- Amount: from 500 Russian rubles.

- Replenishment: yes;

- Maximum amount: 10 million rubles.

- Expense transactions: allowed subject to maintaining a minimum balance of 500 rubles.

- Interest payment: monthly capitalization.

Advantages and disadvantages

Possibility of replenishment and partial withdrawal of money without loss of interest.

Low interest rate.

See what interest rates on deposits for pensioners are offered by Sberbank today

Amount and benefits of the deposit

Rosselkhozbank has established the most convenient and profitable amounts for the minimum and maximum contributions. The minimum you need to initially deposit is 500 rubles, the maximum you can deposit is 10,000,000 rubles .

You don’t need to collect large sums to deposit them later; you can deposit 1 ruble.

Article on the topic: Review of the “Classic” deposit in Rosselkhozbank in [y] year

Very favorable interest rates on deposits. These rates are among the best for similar deposits in other banks.

The advantage of opening a Pension Plus deposit at Rosselkhozbank will be:

- Rosselkhozbank is a state bank, which speaks of its reliability and stability. Such a bank will not suddenly leave, taking your savings with it .

- There is no need to collect and carry a huge package of documents with you. All you need is a passport or pension certificate .

- There is no required monthly contribution amount , deposit funds whenever you want and as much as you want.

- If you urgently need to withdraw money, then you can do it easily and painlessly. You only need to have 500 rubles left in your account.

- To extend the term of the contract after its expiration, it is not necessary to come to the bank. The system will do this for you automatically.

- If you are afraid that something will happen to you and the bank will take your money, then you can safely open a deposit in the name of a minor child .

Recommended video for viewing:

Let's sum it up

Depositing money into the Pension Plus deposit at Rosselkhozbank is much more profitable than keeping it at home.

You keep the principal amount of your funds, plus you can spend the accrued interest. Many pensioners are afraid that they will die and the bank will take their money. No need to worry, because you can simply draw up a notarized will, providing which your heirs will calmly take your savings.

Rosselkhozbank necessarily insures all contributions brought by depositors . Be sure that your funds are reliably protected from adverse circumstances and you will not suffer any losses.

Come to a branch of Rosselkhozbank - specialists will advise you on the terms of “Pension Plus” and answer all your questions. With this bank, your money will be in safe hands.

Rosselkhozbank: deposits for pensioners

In the current year 2020, many of our fellow citizens have become concerned about finding a profitable deposit to save their savings, and the older generation is no exception. In this article you will find a description of the current Rosselkhozbank programs for pensioners, their main conditions and interest.

general information

This banking organization is very popular among the population of our country, especially among older people. The reason for this is the reliability of the company, which is supported by extensive experience and government support (all 100% of the shares belong to the state).

The bank is relatively young, it was formed in 2000 to provide financial services to the agricultural industry and rural areas, and since then it has annually been among the largest and most stable companies in Russia in terms of assets and capital.

An important advantage is also the fact that the bank participates in the deposit insurance system, which means that your savings in the amount of up to 1.4 million rubles will be reliably protected and guaranteed by the state. How exactly the DIA works is described in detail in this article.

“Pension Plus” deposit in Rosselkhozbank Pension deposit with the possibility of replenishment without restrictions on the period and amount. It is possible to perform expense transactions within the minimum balance.