Moscow, 02.09.2020, 15:34:28, editorial office of FTimes.ru, author Tatyana Orlonskaya.

Subsidies for Russian pensioners have been preserved in 2020. All Muscovite pensioners who cannot cope with housing and communal services payments can apply for a support benefit.

Utilities are now expensive, and even residents of smaller apartments feel this. In addition, tariffs increase with enviable regularity, sometimes outpacing the growth of wages and pensions. In such conditions, even citizens with more or less decent incomes are thinking about saving. What can we say about those who have difficulty making ends meet? The Russian authorities, and in particular the Moscow authorities, are trying to somehow alleviate the financial burden on the family budget of retired Muscovites by providing subsidies that partially cover utility costs. In 2020, this type of assistance is still available to citizens.

What are the benefits for pensioners in paying utility bills?

Benefits for paying utility bills for military pensioners and other elderly people, as a rule, mean good discounts.

Often, federal beneficiaries are entitled to discounts of 50%. In some situations, older people are completely exempt from paying utility bills. Which one exactly?

Retirees with high incomes, as practice shows, may not count on additional support. To qualify for benefits on utility bills, bills must be more than 22% of total family income. In fact, a person will have to recognize his status as a needy person.

Who can count on receiving a subsidy

Subsidies are designed for those pensioners who spend more than 22 percent of their monthly income on housing and communal services. Therefore, to find out whether you are entitled to assistance from the state, you just need to divide the amount of relevant costs by the amount of pension payments.

What about beneficiaries? Do they have the right to use subsidies? Yes, they do. But the amount of assistance will be adjusted to the cost of utilities for a particular citizen, divided in half (if preferential discounts are 50 percent).

What benefits for paying for housing and communal services are provided for military pensioners?

- original and copy of all completed pages of the passport;

- a certificate of family composition (who lives in the same living space as the military pensioner);

- any documents that can confirm the degree of relationship with a military pensioner (required for those family members who live with him);

- documents capable of confirming ownership of a residential property. If the apartment is rented, a rental agreement is required;

- certificate of income for the last six months;

- a document confirming the right to receive discounts on housing and communal services (military pensioner certificate);

- a certificate from the housing office confirming the absence of debt for utility services.

- Article 5 of Federal Law No. 5 on obtaining the title of military pensioner;

- Article 1 of Law No. 4468 - 1, which regulates the provision of social benefits, including discounts on utility bills. It is worth noting that the law regulates the possibility of receiving state assistance when paying for used housing and communal services for widows of military pensioners.

Documentation and application

To apply for a rent benefit, a pensioner must provide the following documentation:

- passport;

- payment receipts for previous months;

- certificate of the owner of the living space;

- certificate of apartment size;

- details of the bank account to which the money will be sent;

- paper confirming citizenship status;

- income certificate for the last three months.

The application required to receive funds is completed quite simply and quickly.

It contains all the basic information about the applicant’s family:

- Full name of each member;

- number of an open bank account (it is in the documentation issued by the banking organization);

- name of the bank where the account is opened;

- the applicant's place of residence;

- type of living space (privatized, rented, purchased, etc.);

- housing size;

- contact phone numbers.

Although the amount of information that needs to be indicated in the application is not so large, it must be filled out with the utmost responsibility and seriousness, because even the slightest miscalculation and error can lead to a refusal to issue a subsidy.

Benefits for pensioners for housing and communal services in Moscow ✅

- Financial assistance is provided for 1 premises where the applicant lives.

- The payment period is 6 months. The document collection procedure is repeated every six months.

- The law gives 10 working days to employees of the authorized body for:

- study of supporting documentation;

- checking the accuracy of information;

- calculation of the subsidy amount (recalculation);

- issuing a decision to the applicant.

When applying for exemptions regarding major repairs, discounts on housing and communal services that do not depend on income, a pensioner needs to submit an application only when a privileged right arises for the first time. Further, concessions will apply automatically, since the information is stored in information databases.

Can pensioners be exempted from paying housing and communal services? Benefits for housing and communal services for pensioners

- a copy of the pensioner’s passport , if he is single, or copies of passports and SNILS of all members of his family;

- pension certificate of the applicant and other pensioners living with him;

- a copy of the certificate recording the ownership of housing, or a contractual agreement for social tenancy;

- a certificate of family composition (if more than one person lives) and copies of documents on family ties (for example, a marriage certificate);

- information on the size of living space from the BTI;

- a document stating the absence of debt for utility payments (it can be obtained from the unified settlement information center or housing office);

- documentary evidence of benefits for this type of payment;

- background information on the income of all residents of the same living space for the last 6 months.

We recommend reading: Order number where grandchildren can use the benefits of the liquidator of the nuclear power plant for admission to kindergarten

- Writes an application requesting a subsidy, which specifies the method of transferring money (to a bank card, through post offices).

- An employee of the social security agency registers the submitted application and documents accompanying it.

- Familiarization with the decision to receive a subsidy or refusal, made by the territorial department of social protection, takes place within ten days.

So, can pensioners be exempt from paying for housing and communal services? A 100% exemption from payments for pensioners predicts complications in the activities of public utilities, which may not receive the funding necessary for uninterrupted operation. There is a proposal not to cancel pensioners’ payments for housing and communal services, but to introduce monetization of this benefit.

How to make payments

A pensioner needs to open an account in a bank with which state or municipal authorities work.

Next, to apply for a subsidy, the pensioner needs to contact the management or department of social protection.

The following documents are most often requested (may vary in different regions):

- copies of passports of all persons registered in the apartment,

— a document confirming the ownership of housing/social tenancy agreement,

- certificate of family composition,

- certificate from the BTI on the size of the living space,

- a certificate confirming the absence of debt for utilities (it can be obtained from the HOA, housing maintenance office or at the unified information and settlement center),

- if benefits are provided, a supporting certificate is needed,

- SNILS of everyone registered in the apartment,

- pension certificates of the owner and other pensioners living in the apartment,

- certificates confirming the relationship of people living under the same roof (marriage certificate),

- application for a subsidy,

- a document from the bank indicating the exact bank details for transferring funds to the pensioner’s account,

- certificate of income for six months of all people registered in the apartment. The income certificate is an important document in this list. The pensioner receives it from the pension fund, working people receive it at their place of business, and the unemployed receive it from the employment center. Unemployed people may be required to provide a copy of their work record. If a person is not registered with the Employment Center, then the social security authorities will take into account his hypothetical income in the calculation in the amount of the official average salary in the Russian Federation as a whole or specifically in a particular region for the reporting period.

After registering with the social security department, the pensioner must be notified within 10 days of a positive decision/refusal.

If the decision is positive, the subsidy may be assigned from the month in which the documents were submitted, if the pensioner managed to do this before the 15th. If the documents were brought in the second half of the month, then the subsidy will be assigned only from the next month.

You can submit documents not only directly through the social security department, but also at the multifunctional center.

Benefits for military pensioners on utility bills

If in the region the procedure for obtaining a privilege is to apply for subsidies, then the military pensioner must write an application to social security, where the amount of the discount is determined individually. In this case, you will first have to pay for water, heating, light according to receipts, and then receive a refund.

there should be no debts when paying utility bills;

Special procedure for calculating subsidies

The legislation also defines certain categories of citizens who are entitled to receive subsidies according to special rules. These include, for example, military pensioners, persons who perform military service on the basis of a contract (both in the Russian Federation and in other countries). In addition, a special procedure for calculating funds for housing and communal services applies to citizens of the country who permanently reside in closed military installations.

On our website you can get advice from a professional lawyer completely free of charge!

Benefits for pensioners on utility bills

- After registration, wait 10 days for a decision. If you make it before the 15th, help may be assigned right from the month of submitting documents. Otherwise, you will receive a discount starting next month.

- The subsidy is valid for one year in Moscow, and six months in other regions. Then the entire procedure and collection of documentation must be repeated.

extract from the BTI on square meters of living space;

Free legal assistance

- If the answer is positive, funds can be issued through a bank or by transfer to your personal account.

- Documents for housing and communal services subsidies in 2020 The mandatory list of documents that are required to apply for a subsidy includes:

- Passports of all adult family members, birth certificates of children.

- Documents that confirm the right to housing;

- A copy of the applicant’s work book or the original work book if the person is unemployed.

- Receipts for payment of utility bills for the last month.

- Certificate of family composition.

- Certificates of income of all family members for the last six months. All types of income are taken into account: wages, pensions, alimony, scholarships, benefits for the unemployed, child benefits.

- application for a subsidy for housing and communal services;

- passports of all adult family members, birth certificates of children;

- documents that certify the right to housing;

- a copy of the applicant’s work book or the original, for unemployed citizens;

- utility bills for the last month;

- certificate of family composition;

- income certificates of all residents for the last six months;

- applicant's account;

- details from the banking organization where the money needs to be transferred.

Payment of housing and communal services by pensioners in Moscow - list of benefits and procedure for their registration

According to the laws of the Russian Federation, each subject of the federation independently sets the limit of expenses for housing and communal services from the total income of a pensioner. The Moscow Municipality has set a threshold of 10%. If a citizen spends more than this standard on utility bills, he is entitled to subsidies. This preference has the following features:

The Housing Code of the Russian Federation stipulates the possibility of receiving compensation when paying housing and communal services bills from the federal or local budget. The legislation defines a list of persons entitled to preferences. Pensioners living in Moscow can receive additional benefits. The mayor's office provides financial support to retired Muscovites.

Compensation for housing and communal services

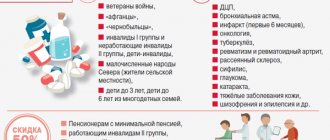

Certain categories of pensioners can receive compensation for actual expenses on utilities:

- disabled people and WWII veterans;

- home front workers;

- military pensioners;

- residents of besieged Leningrad;

- labor veterans;

- family members of deceased combatants.

The listed persons are entitled to a 50% discount, which is provided when paying receipts for utilities, renting a municipal apartment and major repairs.

Additional subsidies for utility bills are provided to certain categories of pensioners from the regional budget in the form of monthly payments or compensation as decided by local authorities. The amount of subsidies can range from 30 to 100 percent of the cost of utilities. In most regions, the following groups of pensioners can count on subsidies:

- disabled people of groups 1 and 2;

- participants in nuclear tests and liquidators of the Chernobyl disaster;

- Heroes of the USSR and Russia.

Pensioners who do not belong to any of the listed categories of beneficiaries, as well as those who have a sufficient level of income, can only count on compensation for payments for major repairs (clause 2.1 of Article 169 of the Housing Code of the Russian Federation).

To receive compensation, a pensioner must satisfy the following conditions:

- have no income other than a pension;

- be over 70 years of age;

- live alone or in a family of pensioners over 70 years of age.

The amount of compensation for the overhaul fee is 50% of the amount of the standard payment for the minimum number of square meters required for citizens to live in (in most regions - 15 sq. m per person).

For example, a family of two pensioners over 70 years old lives in an apartment of 40 square meters. m. They have the right to count on compensation for the fee for 30 sq. m in the amount of 50%, and upon reaching the age of 80 years, compensation for major repairs will be 100%.

It is important to take into account that the availability of compensation for expenses for housing and communal services is taken into account when calculating subsidies paid when a pensioner’s income is low.

What benefits for housing and communal services are available to military pensioners?

As you can see, there is something to think about here, because what are the benefits for military pensioners for paying for housing and communal services and utilities? The same applies to free medical care. In both cases, the amounts that can be saved will be significant.

We recommend reading: Computer Primary Tool Or Not 2020

Well, if a serviceman dies, then his family has the right to a pension. The amount of such benefits is calculated individually, depending on the conditions of death of the family breadwinner and the number of its members who were supported by him. But in most cases, the benefit is several times larger than the standard pension. And this is a lot, even for a wealthy family.

Types of benefits

You need to learn the basic concepts. The Housing Code of the Russian Federation provides benefits to categories of pensioners on rent in the form of:

- benefits for living space;

- compensation for consumer services.

These are completely different types of government support that cannot be identified.

Subsidies are money from the budget given to the population to partially pay the costs of living space. A share of these costs is paid by the state, and the other share by the citizen himself.

Compensation is government reimbursement of the price of consumer services paid by the pensioner.

These types of cash assistance are similar because each of them is allocated from the state budget free of charge.

Their main difference is that a subsidy for housing and communal services can be issued to any person who is a Russian citizen, while compensation is issued only after all bills have been paid.

From this we can conclude that benefits for pensioners help to find the necessary amount of money to pay for housing, and compensation is only a refund of funds already spent.

Based on the law on subsidies, they are provided to Russians who receive an income not exceeding the minimum subsistence level established in the region. If we keep pensioners in mind and use numbers, then rent and utilities equal to 22% of the pension are suitable for this category.

Important! To apply for a discount on rent (rent includes housing and communal services), you must collect all the necessary documentation and submit it to the competent department. It is impossible to independently calculate the amount of money, since department employees are responsible for this. Calculations are carried out individually.

Benefits for pensioners to pay for housing and communal services in 2020

In this case, it is mandatory to confirm the absence of similar benefits for other housing if the citizen’s registration and residence address do not match. The assistance can only be used for one dwelling. This primarily concerns the calculation of benefits for pensioners for paying housing and communal services in Moscow, because it is no secret that older citizens often rent out their apartment to receive additional income, while they themselves live in another place.

The most important housing benefits for pensioners are provided based on a comparison of their income level and the amount of utility bills. So, if the latter is more than 22% of the pension or total family income, a discount on payment is prescribed.

The nuances of providing benefits to a pensioner

When applying for benefits for housing and communal services, you need to know some features:

- Pensioners are entitled to a discount on housing and communal services payments only for one place of residence, regardless of the number of apartments owned.

- When the applicant is not able to apply for benefits for utility bills himself, he can entrust the procedure to an authorized person by power of attorney.

- Compensation is accrued to beneficiaries when paying for utilities until the conditions change: financial situation, family composition, etc.

- Benefits for pensioners to pay for housing and utilities will be accrued for six months and paid every month. Then citizens receiving housing subsidies need to re-register the provision of the service.

- There are other features when calculating rent relief. Let's assume that electricity payments are reimbursed only within 100 kW.

Many citizens of retirement age are interested in how to receive a subsidy. To do this, the main condition must be met - utility payments exceed twenty-two percent of the monthly income of the applicant and all family members living with him.

Pensioners living alone need to collect a package of documentation and submit it to the subsidies department.

Benefits for pensioners to pay for housing and communal services in Moscow and the region

- subsidizing – that is, partial payment for services is carried out from budget funds;

- compensation, when after a certain period of time a refund is made of part of the amount spent by the pensioner on housing and communal services;

- Rent benefits are permanent privileges that consist of special fixed discounts.

Pensioners in Moscow can apply for housing subsidies aimed at partial compensation of housing and communal services costs if their family's expenses for utilities exceed 11% of total income. For other regions, this share may vary between 11-22 percent.

What are the requirements for applicants for government assistance?

Subsidies for payment for housing and communal services are issued for a period of six months. In this case, their recipient must fully comply with the requirements mentioned below:

- have citizenship of Russia or another state with which the Russian Federation has relevant agreements;

- have in hand documents confirming ownership of housing or a lease agreement;

- make timely payments for housing and communal services. The presence of debts is one of the main grounds for refusal to issue funds;

- be able to confirm the fact of residence in the apartment for which assistance is being issued;

- pay for housing and communal services in an amount exceeding 22 percent of monthly income.

If you fully meet these requirements, you can contact protection centers in Moscow or institutions that have full authority to apply for a subsidy. To receive assistance, you will need to prepare a package of relevant papers in advance, which we will discuss in detail below.

Benefits for paying housing and communal services for pensioners

7. The procedure for determining the amount of subsidies and the procedure for their provision, the list of documents attached to the application, the conditions for suspending and terminating the provision of subsidies, the procedure for determining the composition of the family of a subsidy recipient and calculating the total income of such a family, as well as the specifics of providing subsidies to certain categories of citizens are established by the Government of the Russian Federation.

3. Subsidies are provided by the executive body of a constituent entity of the Russian Federation or an institution authorized by it to the citizens specified in Part 2 of this article, on the basis of their applications, taking into account their family members permanently residing with them.

Are all pensioners entitled to payments?

Not only owners of residential premises and members of their families living with them can apply for a subsidy, but also those who live in apartments owned by the state/municipalities on the basis of a social tenancy agreement. Members of housing cooperatives can also receive it.

To be awarded a subsidy, the pensioner must meet the following requirements:

- be a citizen of the Russian Federation,

- registered at the address at which the issue of assigning a subsidy will be considered,

- have no debt on utility bills (if there is still a debt, the pensioner may be required to draw up an agreement on the timing of its repayment, and also issue a subsidy),

— spend more on utilities than is allowed in the region as a whole.

If we are talking about a pensioner’s family, then in order to receive a subsidy, the family must spend more than is allowed by local law, based on total income.

The exact amount is calculated using a formula by employees of the Social Security Administration.

However, the law provides for cases when, even in the event of overspending, a subsidy is not due.

This right is deprived:

- tenants of apartments from private homeowners,

— loan recipients under a free use agreement,

— recipients of life annuity on the basis of a maintenance agreement with dependents.

Benefits for pensioners for housing and communal services in Moscow

Currently, you can submit an application or find out the necessary information online on the state website. services Are retired teachers entitled to any utilities? Read more about this. Special case Most often in rural areas, retired doctors or teachers have the right to receive a 50% or 100% discount.

Therefore, the legislation provides for certain assistance - subsidies and benefits for pensioners to pay for housing and communal services. They are quite varied and are provided upon meeting various criteria. Categories of beneficiaries In order to qualify for assistance from the state to pay utility bills, it is not enough to simply become a pensioner. Such support is provided to especially needy citizens and those who have special merits.

How to calculate the subsidy amount in 2020

If you are completely sure that you have every right to subsidize utilities, you will be interested in the formula for calculating the amount that the state will provide. To do this, you can use a calculator, which can be found on any website dedicated to this topic. In addition, you can independently perform all the required calculations using the following formula:

C (amount of funds provided by the state) = SSZHKU (minimum cost of housing and communal services) – D (income of all family members or the amount of payments of a single pensioner) x 0.22 (threshold for obtaining assistance, which, as we found out earlier, may be different in each region of the country).

In addition, in the calculation process it is necessary to use such a value as the established cost of living. If it is higher than the total income of all family members, an adjustment factor will be required. It is calculated by simply dividing income by the cost of living in a particular region.

![Alfa-Bank Credit cards [CPS] RU](https://7daystodie.ru/wp-content/uploads/alfa-bank-kreditnye-karty-cps-ru-330x140.jpg)