The official policy of the state considers the social security of persons risking their lives for the sake of peace on Earth to be one of the main tasks. For this reason, legislation in the field of providing measures of state support to military personnel who took part in armed conflicts is constantly updated. Benefits for combat veterans in 2020 will mostly remain the same after the innovations that came into force in January 2020, but some types of benefits are planned to change.

Categories of persons who are entitled to benefits as veterans of painful actions

Article 3 of the Federal Law of the Russian Federation “On Veterans” contains a list of persons who belong to combat veterans, these include:

- Military personnel, those liable for military service, employees of the Ministry of Defense, sent to other countries by government authorities and who took part in hostilities, demining and performing special tasks in connection with their official duties.

- Military personnel, law enforcement officers, including security agencies, who took part, in accordance with the decision of the federal authorities, in hostilities on the territory of the Russian Federation.

A complete list of countries, cities and periods of hostilities is contained in the appendix to the above-mentioned federal law.

What benefits are available to combat veterans in Russia: list of benefits

Article 16 of the Federal Law “On Veterans” lists measures of social assistance to combat veterans, including:

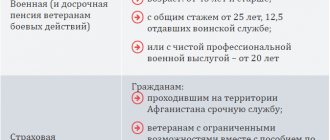

- pension benefits in accordance with Article 45 of the Federal Law “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, troops of the National Guard of the Russian Federation, and their families";

- providing housing to veterans in need of improved housing conditions at the expense of the federal budget;

- compensation payments for expenses related to housing and communal services;

- priority telephone installation;

- preferential rights when obtaining land plots, joining housing and garage cooperatives;

- the opportunity to receive medical and sanitary services in specialized departmental medical institutions;

- provision of prosthetics at the expense of the federal budget in accordance with Article 11 of the Federal Law “On social protection of disabled people in the Russian Federation”;

- extended vacation period up to 35 days, with the possibility of free choice of vacation time;

- priority right to use cultural, sports, transport and communication services;

- obtaining additional professional education and advanced training at the expense of the employer.

In addition to the benefits determined by federal law, combat veterans have the right, depending on their place of residence, to take advantage of the benefits provided by regional laws. For example, in Moscow, a combat veteran has the right to free use of public (except taxis) transport.

Combatant and veteran

At the legislative level, the concepts of combatant and veteran are not defined. People fall into this category:

- having a veteran's certificate who served in the air or motor forces during military conflicts;

- were in Afghanistan for work from 1979 to 1989;

- located in Syria since September 30, 2020;

- those who participated in demining the territory of the Soviet Union after the end of the Great Patriotic War (from 1945 to 1951);

- who carried out missions during the war on the territory of the USSR, the Russian Federation and states.

Benefits for Afghans

Tax benefits for military veterans in 2020

In addition to social support measures, tax benefits are also provided for combat veterans. In accordance with Article 407 of the Tax Code of the Russian Federation. Such benefits include:

| Type of tax benefit | Features of receiving |

| Tax deduction | Art. 218 of the Tax Code of the Russian Federation allows a veteran to return 13% of the tax paid in the amount of 500 rubles monthly. If such a person has a registered disability, then a deduction can be made from the tax amount of 3,000 rubles. |

| Land tax | A combat veteran in accordance with Art. 391 of the Tax Code of the Russian Federation is exempt from paying land tax on a plot of 6 acres. Owned by him. |

| Property tax | Article 407 of the Tax Code of the Russian Federation gives military veterans the right not to pay property tax on one of the real estate objects, except for a land plot, that is in their ownership. |

In addition, according to the norms of regional legislation in some constituent entities of the Russian Federation, combat veterans are exempt from transport tax on vehicles they own. More information about current regional benefits can be found on the official website of the Federal Tax Service.

Who is eligible for the benefit?

Combat veterans are a separate category of citizens who have an impressive list of benefits and preferences, as well as members of their families, in the event of the death of the only breadwinner who is assigned the corresponding status.

Rostov region

- exemption from transport tax for 1 car with an engine power of up to 150 hp. s., motorcycle - up to 35 l. s., boat - up to 20 l. With.;

- utility discounts and compensation for the purchase of solid household fuel for heating a private home in the amount of 50%.

- the right to a preferential purchase of a single social travel ticket.

This is interesting: Lives in Kursk on January 1, 2020

This benefit provides military veterans with certificates with which they can purchase residential property. But the legislation that regulates this benefit clearly states that the size of the room must be 18 square meters. This benefit can only be used by veterans; it does not apply to families.

To obtain a certificate and rank, you must contact the military registration and enlistment office at your place of residence. Through the military registration and enlistment office, documents are sent to the military district commission, which makes a decision on assigning status and issuing a certificate. When applying, you only need to provide a passport; all other documents indicating military service on the territory of the Chechen Republic are available at the military registration and enlistment office at your place of residence.

What payments and benefits are due to participants of military operations in Chechnya?

- military personnel, employees of the internal affairs department and state security agencies who took part in demining the territories of the USSR in the post-war years;

- the composition of automobile battalions for the delivery of goods to Afghanistan during the military conflict;

- USSR flight personnel who participated in combat operations in Afghanistan;

- citizens serving military units of Russia and the USSR on the territories of foreign states who received wounds and concussions in the performance of their duties or were awarded medals and orders;

- civilians who worked in Afghanistan from 12/01/1979 to 12/01/1989;

- persons sent to Syria to perform official tasks starting from September 30, 2015.

- reduction of income tax by 500 rubles for veterans and up to 3 thousand for veterans with disabilities;

- benefits for calculating land tax;

- exemption from paying mandatory court fees.

Features of paying utility bills for combatants in 2020

The peculiarity of compensation for payment of housing and communal services is that benefits are provided at both the federal and regional levels. So Art. 16 of the Federal Law “On Veterans” regulates the right of a combat veteran to receive compensation in the amount of 50% for funds already paid:

- for renting a dwelling and (or) services and work related to the maintenance of housing in apartment buildings, and it does not matter what type of housing stock it belongs to;

- for major repairs carried out, based on the standards approved by law.

After registration of the benefit, compensation is transferred to the account of the combat veteran specified in the application.

Compensation payments for utility services, such as electricity, water supply, and gas supply, are additionally introduced in some constituent entities of the federation, depending on their economic capabilities, at the expense of regional budgets and are not provided for at the federal level.

What benefits are offered by UBI at the federal level?

The veteran will receive social and financial support after receiving a certificate officially confirming his status. Benefits for this category of citizens are provided at the federal and regional levels. Preferences valid throughout Russia are mandatory. Federal and regional benefits are:

- social;

- housing and communal services;

- transport;

- tax;

- labor

- Cardio slim trainer

- Why is coronavirus called that?

- D-panthenol cream

Pension provision

The supplement to basic UBI payments is 32% by law. In some regions there are separate increasing factors. Pensions for long service, disability, and loss of a breadwinner are subject to increase. Military veterans can receive two types of subsidies at once: for old age and for disabled status. Pension benefits include:

- Increased pension amount. It is calculated separately for each veteran. The commission takes into account the length of service, the territory of combat operations, the presence of serious injuries during service, and disability.

- One-time cash payment (LCP). Its size, if the set of social services (NSS) is maintained, will be 1850.26 rubles, and if it is refused - 2850.26 rubles.

Tax benefits

UBDs are partially exempt from regular contributions to the budget.

A special taxation scheme applies to beneficiaries in this category. Benefits for combat veterans in terms of transport tax and other types of mandatory contributions are formalized at the Federal Tax Service Inspectorate. Preferences available for UBI:

| Tax name | Types of benefits |

| Personal income tax (NDFL) | Monthly tax deduction 500 rub. |

| Property tax | UBD are completely exempt from it if the value of the property does not exceed 300 million rubles. |

| Land tax | Calculated based on the cadastral value of the land, reduced by 10,000 rubles. It does not matter whether the site is a summer cottage or for residential construction. |

| Transport tax | Regional benefit. VBD is completely exempt from contributions for 1 car or receives a 50% discount on tax payments. If there are several vehicles, the citizen must choose one for preferential taxation. The power of a passenger car should not exceed 150 hp. s., and the motorcycle’s power is 50 hp. With. |

| Payment of state duty | If the amount of the lawsuit is no more than 1 million rubles, then there is no need to pay state duty. |

Payment for housing and communal services and rental housing under a social tenancy agreement

At the federal level, a refund of 50% of the rent is provided when living in a rented or own apartment.

A similar rule applies to paying for major repairs. To apply for these benefits, the veteran must contact the Social Protection Authorities (OSZN) with the following documents:

- passport;

- statement;

- social rental agreement;

- bank account number;

- veteran's certificate.

The application review period is 15-30 days. After this time, the applicant is awarded compensation or sent a refusal. After approval, compensation for renting housing will be returned to the individual’s account monthly. The applicant can challenge the refusal of the OSZN in court. To do this, you must submit documents confirming the illegality of the decision of the social security authority.

- How to treat toenail fungus

- Trichomoniasis symptoms in women

- 3 rules for successfully obtaining a loan

Obtaining a certificate for the purchase of residential premises

Many citizens mistakenly believe that the state is obligated to provide the VBD family with a full-fledged apartment, but this is not the case. According to the law, a combat veteran is entitled to residential real estate with an area of 18 m2. The state owes nothing to members of the WBD family. The cost of the certificate depends on the price of 1 m2 of housing. To receive benefits, you must contact the administration of the municipal district or district at your place of residence with the following documents:

- passport;

- veteran's certificate;

- statement;

- a certificate from Rosreestr confirming the absence of residential premises in the property.

The application review period is 30 days. In some constituent entities of the Russian Federation, additional documents may be required from a citizen. The certificate is not issued to the applicant. The amount is immediately transferred to the account of the real estate seller. It is allowed to purchase housing on the primary or secondary market. The veteran pays the remaining amount on his own.

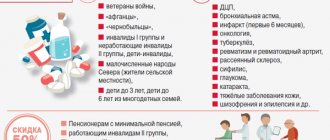

Medical care and prosthetics

The citizen retains the right to go to the clinic to which he was assigned during his service. The hospital will not be able to refuse him. According to the law, an individual with a VBD ID must be allowed out of line.

Prosthetics and prosthetic and orthopedic products for a veteran are paid for from the federal budget.

If a citizen bought them on his own, then their cost will be compensated to him. In some regions, beneficiaries can:

- Purchase medications with a 10-50% discount. When paying with a social card, a citizen can reduce the price of medicines or get back part of the money spent at the end of the month.

- Receive a free voucher for sanatorium treatment if you have medical indications.

Labor and social preferences

Veterans are required to install a home telephone out of turn. VBDs can receive their annual leave at any time convenient for them. The law adds 35 additional days to the standard duration of rest. Combatants can receive a free second education or participate in advanced training courses for free. Veterans are provided with:

- the opportunity to buy tickets for all types of transport without waiting in line;

- free travel on trains;

- exemption from travel fees if the attending physician refers for treatment to another constituent entity of the Russian Federation.

Specifics in obtaining benefits for veterans of military operations in Chechnya and the North Caucasus

The specificity in receiving benefits for persons who took part in connection with official necessity in the armed conflict and anti-terrorist operation in Chechnya and the North Caucasus is the time frame established by the annex to the federal law “On Veterans”. So, to obtain the status of a combat veteran, a person:

- Had to perform official tasks and, in connection with this, take part in the armed conflict in Chechnya and adjacent areas from December 1994 to December 1996.

- Performs a mission in the anti-terrorist operation in the North Caucasus from August 1999 to the present.

Veteran status can be assigned not only to citizens of the Russian Federation, but also to persons with foreign citizenship and stateless persons permanently residing in the territory of the Russian Federation.

How to apply for benefits for military veterans in Moscow

Benefits for combat veterans are issued depending on the type of social support. So, to get:

- the opportunity to use the right to improve housing conditions and obtain a certificate, you must contact the housing department at your place of residence or local government authorities of the locality;

- compensation for rental housing and housing and communal services must be addressed to the social protection department at the place of registration of the veteran;

- tax deductions and benefits require registration at local branches of the Federal Tax Service;

- For a one-time cash payment, you need to contact the branch of the Pension Fund of the Russian Federation.

To obtain benefits, a mandatory condition is the presence of a certificate of a combat veteran.

![Alfa-Bank Credit cards [CPS] RU](https://7daystodie.ru/wp-content/uploads/alfa-bank-kreditnye-karty-cps-ru-330x140.jpg)