Legislative aspect

Due to the fact that some categories have certain services to the fatherland due to the special specifics of employment or other aspects, a special procedure for financial support in their declining years has been established for them.

Thus, a separate category includes combatants for whom a pension can be issued in a general manner according to several legislative acts, but taking into account their merits, namely:

- Federal Law of December 28, 2013 N 400-FZ;

- Federal Law of December 15, 2001 N 166-FZ;

- Law of the Russian Federation of February 12, 1993 N 4468-1.

At the same time, for participants in the database who have received the status of veterans, already within the framework of Federal Law No. 5 a number of guarantees and benefits of federal rank are provided. By the way, at the regional level, that is, in the constituent entities of the federation, this category is also marked with the right to receive certain preferences.

Who is entitled to it?

During their military service, many military personnel faced emergency situations and found themselves in hot spots, given that the specificity of the service lies precisely in preserving the integrity of the state and maintaining peace.

Who belongs to this category

The basic legislative act defining the right to the honorary title of veteran of the military service is the Federal Law of January 12, 1995 N 5-FZ “On Veterans”. The stipulated norm also approved the conditions for conferring an honorary title and lists of periods of combat operations with the participation of Russian military personnel, which is the basis for obtaining preferential status.

Within the framework of Article 3 of Federal Law No. 5, combat veterans include:

- career military personnel who serve or served under contract during the period of hostilities;

- conscripts performing international duty, for example, in Afghanistan;

- employees of the internal affairs department, national guard, state security, penal system, who were sent to hot spots as part of their duties;

- civilians sent to combat areas for official reasons or staying as technical personnel.

At the same time, taking into account that the Russian Federation was the legal successor of the former USSR, the above-mentioned persons who fought in hot spots not only as military personnel of the Russian Federation, but also of the Soviet Union from 1960 to the present are recognized as combat veterans.

Places of duty

One of the directions of Russian foreign policy is friendly relations and assistance to neighboring states not only economically, but also militarily.

Thus, within the framework of mutual assistance, Russian military personnel participated in many armed conflicts:

- in Algeria;

- in Egypt (Suez Canal zone);

- in the Arab Republic;

- in Vietnam;

- in Angola;

- in Mozambique;

- in Ethiopia;

- in Afghanistan;

- in Cambodia;

- in Laos;

- in Lebanon;

- in Chechnya;

- in Syria.

And since the military personnel of the USSR and the Russian Federation were sent to the above regions as part of the performance of official and international duty, and to participate in hostilities, and not ordinary exercises, their merits were noted normatively, by defining a number of benefits and preferences.

Age

Combat veterans, by virtue of current legislation, receive the right to pension benefits in the general manner.

However, a feature of assigning a pension to this category is the fact that they can apply for benefits under several federal acts, which of course is reflected in age:

- If a veteran participated in hostilities, for example, in Chechnya as a career military man and then continued military service on the territory of the Russian Federation, he will be able to apply for a pension after reaching the age limit of 50 years under Article 49 of Federal Law No. 53 of March 28, 1998 -FZ. Naturally, his benefit will be established on the basis of the norms of Law of the Russian Federation No. 4468-1, that is, like a military pension.

- If a veteran transferred to the reserve, that is, retired from military service , and his further work activity took place at civilian enterprises, he will have the right to a pension in the general manner after reaching the age of 60 years in accordance with the norms of Article 8 of Federal Law No. 400.

- If a BD veteran, after service, takes a position in government bodies , for example, as a state or municipal employee already within the framework of the norms of Federal Law No. 166, he has the right to a long-service pension, which can be issued upon reaching 61 years of age, if he has at least 16 years of service , in which military service will be included.

Here is the text of the bill itself:

Here, by the way, is the text of the very bill that did not pass because “it was not provided with funds in the budget”:

Well, what can we say about this? All that remains to be said is that the state represented by the current government that does not value its combat veterans, that is, those of its defenders, is short-sighted. who risked their lives and health in carrying out their assigned tasks!

This is important to know: How to obtain guardianship of a child with living parents

-They can only raise their own salaries in the State Duma and forgive debts to African countries.

-How to send to war, then “come on guys,” but how to pay off those guys, there is no money. There is money, but it’s not about our honor.

I myself went through two wars. I served honestly, but I won’t send my children to the army: the state is playing with marked cards. Or rather, not the state, but those who now rule us.

-Inflation of 3% is simply compensation for the prices that increased last year...... And if you add up everything that has increased? Will this 3% cover expenses? Mockery!

-And so that there is no inflation at all in the country, soon all payments will simply be removed, and the problem will be solved. No inflation, no increases. The authorities care about their people, incl. and veterans.

- Funny people in the government - probably 89 rubles is a huge amount for them. This can't even be called a handout. However, by their actions, they themselves shake the chair on which they sit.

-To fight and die for the Motherland is the honorable duty of your children, comrade workers and peasants, but to eat well, have a good walk, state feeder and monetary positions with rich benefits - this is all for the children of officials. For the “golden” youth, for whom the words “army”, “sacred duty”, “military service” cause hysterical laughter and laughter.

-And what the authorities are giving to combat veterans now is generally ridiculous: installing a home telephone out of turn is a fuck-up, we’re in the mid-twentieth century, utilities for water and electricity, heat is not paid for as it should be, 50 percent of the compensation, a set of cheap services is required and three thousand. Housing is provided with a new residential complex of the Russian Federation, that is, no matter how those who stood in the residential complex of the RSFSR will receive compensation for 18 sq.m., they generally try not to remember.

- Guys, it’s time to create your own UBI society, independent of the state. Which would unite Afghans, Chechens and Syrians and would do business and not pretend to be vigorous activity.

After all, there are examples of such organizations, in St. Petersburg there is an Afghan Society, in Yekaterinburg there is a society of Afghans (watch the film about them on YouTube “Afghan. The man did not return from the war.”

After all, when we unite, we are capable of much. Well, the state would rather forgive everyone’s debts than spend this money on us, everything is more important than a former soldier.

Expert opinion

Kostenko Tamara Pavlovna

Lawyer with 10 years of experience. Author of numerous articles, teacher of Law

It’s not for nothing that they said that if you don’t feed your army, you will feed someone else’s, the current wars will look at how they treat us, I think they will no longer have the desire to serve as we served.

-In 15 years they raised it by 2000, and now it’s doubled...

- I fully support raising it to the full minimum in the near future. People like Klintsevich took away 5 years of combat service from us with their pension reform.

I think that it’s time for veterans - Afghans, and “Chechens” too, to unite across the country, before it’s too late, and together try to solve the problem, and not wait until the gentlemen officers from the leadership of veteran organizations, who have good pension coverage, deign to pay attention to the problem of exit for the retirement of privates and sergeants from the VBD environment.

-They could include VBD in the list of retirement from the age of 60, because in this war many lost their health, as it turns out, now, in vain... I AM ADDRESSING YOU, Mr. Klintsevich, because you are the one who protects the interests of veterans...

-Why should they consider the UBI law, they’d rather abolish taxes for themselves. WBD will wait. They were sent to war quickly, and the law could be considered later. Some day.

-I would like all the benefits of the USSR to be returned. It was much more profitable! And pennies will remain pennies.

-Sherin is great, God bless him, but we are needed only when the cockerel is pecking at them from behind, but in the meantime, the positive decisions of our guarantor are very much in doubt...

-Officials and deputies do not forget about themselves and feel good about themselves.

What does it consist of?

Combat veterans are one of the few categories that can enjoy the benefits defined by Federal Law No. 5 immediately after receiving a certificate, unlike the same labor veterans. But veterans can only apply for a pension in accordance with the general procedure.

At the same time, the type of benefits that they can apply for directly depends on what activities the veterans carried out after returning from hot spots, as well as other mandatory conditions determined by federal legislation.

Social

Within the framework of Federal Law No. 166, DB veterans can apply for several types of pensions:

- by length of service as a civil servant by virtue of Article 7, with a government experience of at least 16 years as of 2020;

- by length of service as a representative of the flight test crew in accordance with Article 7.2 with 25 years of experience.

At the same time, these categories have the right to a part of the insurance pension already within the framework of the norms of Federal Law No. 400, simultaneously with the above, which implies double pension provision.

Insurance

Not all DB participants remained among the military personnel after returning from hot spots. Many of them retired to the reserves and realized themselves as civilians who, by virtue of the provisions of Federal Law No. 400, have the right to apply for insurance benefits upon reaching retirement age.

Thus, within the framework of Article 8 of Federal Law No. 400, this category has the right to an insurance pension upon reaching the age of 60 years and having a total length of service of 15 years, as well as an IPC, that is, a pension coefficient of 30 points.

By old age

The type and size of the pension directly depends on the length of service.

So, if a military veteran, after returning from hot spots, was unable to continue his career and does not have sufficient length of service to qualify for an insurance pension, he is entitled to an old-age social benefit under the conditions specified in Article 11 of Federal Law No. 166.

In particular, the following have the right to this type of pension:

- representatives of indigenous peoples of the North over 55 years of age;

- citizens of the Russian Federation who have reached the age of 65 years, but do not have a long work history.

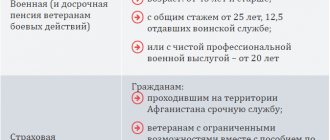

Military

A military pension for combat veterans within the framework of the provisions of Law of the Russian Federation No. 4468-1 is provided if:

- They move on to a well-deserved retirement from military service, being career military personnel in the army.

- DB participants are employees of the internal affairs department, the national guard or the criminal-executive service.

Thus, Article 13 of Law No. 4468-1 states that military personnel can apply for a pension benefit upon reaching the age limit and having at least 20 years of military service.

At the same time, it is possible to go into a well-deserved retirement at the age of 45, provided that the veteran has 25 years of total service, of which at least half were given to military service.

You will find information about pensions of the Ministry of Internal Affairs in our article.

Are there plans to abolish pensions for civil servants? Find out here.

By disability

For this category, it is possible to obtain a disability pension within the framework of several legislative acts:

- If a military veteran has lost his ability to work while being a military serviceman or a certified police officer, the benefit is established within the framework of RF Law No. 4468-1.

- If the disability occurred after, that is, during the period of work in a civilian position, the pension is assigned based on the norms of Federal Law No. 400.

Benefits and allowances

The assignment of a pension is not the only guarantee that is determined for a combat veteran.

Thus, in view of the merits of this category of Federal Law No. 5, a number of additional benefits are also provided, specified in Article 16 of Federal Law No. 5:

- improvement of living conditions;

- 50% compensation of expenses when paying for housing and communal services;

- pre-emptive right when joining housing, garden, country, garage cooperatives or other non-profit associations;

- preferential medical care, including orthopedic prosthetics;

- receiving annual paid leave at a convenient time if the veteran continued military or civilian activities after returning;

- administrative leave of up to 35 days per year at a convenient time;

- extraordinary purchase of transport tickets;

- obtaining education at the expense of the employer;

- monthly cash payment;

- funeral services.

Pension amount

If, according to preliminary data, a citizen has the right to receive a pension for UBI, it is worth knowing how much the veteran can expect. It is worth noting to begin with that the provision (additional payments) to this category of persons is of an individual nature.

For example, there is such a thing as length of service. If a citizen has the right to a pension according to this indicator, then its size may look like this:

- with 20 years of service, a veteran can receive 50% of the salary calculated. The plus to it is 3% for each year beyond those same 20.

Attention! It is worth considering that 85% is the maximum in the total amount of additional payments.

- mixed experience requires 25 years of experience. In this case, there are the same 50% and in addition only 1% for the subsequent year worked, etc.

It is important! VBD, who were civilians during various military operations, receive their funds through the Pension Fund.

You also need to know about the monthly cash payment (MCB), the amount of which depends on the category of the veteran.

This is important to know: Claim letter for debt repayment: sample 2020

For example, in 2020, participants in the Great Patriotic War with disabilities received 5,403.22 rubles monthly as daily allowance. And the UBI is only 2972.82 rubles.

Pension for military veterans in 2020

Considering that they belong to a preferential category, many do not know how combat veterans retire, considering the procedure to be quite complicated. Meanwhile, for current and former military personnel there is a uniform procedure established for all pensioners.

Registration procedure

In order to exercise their rights, a citizen must apply for their provision to institutions vested with certain powers and follow the procedure established by federal legislation.

Who pays and where to go?

The application procedure, as well as the registration procedure, depends on what type of pension benefit the DB veteran will apply for:

- If a citizen retires from a civilian position, he should contact the territorial office of the pension fund at his place of residence.

- If we are talking about a military pension, there will be a visit to the military registration and enlistment office, where the serviceman will register at his place of residence after dismissal.

Civil and military specifics have some distinctive features not only in the procedure for obtaining a pension, but also in the order of financing:

- An insurance or social pension within the framework of Federal Law No. 400 and Federal Law No. 166 is paid from the Pension Fund account to which the citizen previously transferred insurance contributions.

- The military pension is determined through the Ministry of Defense, which actually deals with the issue of financing all benefits for current and former military personnel.

Package of documents

Any type of pension implies an application procedure with the mandatory submission of an application, as well as a package of documents approved by law.

Registration of a civil pension on the basis of the norms of Federal Law No. 400 and Federal Law No. 166 provides for the provision of:

- ID cards;

- military ID;

- certificates of place of registration;

- work book;

- salary certificates from the last place of work;

- metrics or other documents identifying dependents;

- diploma of education;

- social insurance certificates.

If you are applying for a military pension, you should attach the following to the above data package:

- order of dismissal from a military unit;

- monetary certificate;

- private bussiness;

- a certificate from the Pension Fund confirming the absence of an insurance pension.

Find out how to retire early in Russia. How much is a disabled person's old-age pension? Find out here.

I co-financed my pension. Is it possible to withdraw this money? The procedure for receiving funds is described here.

Application and payment terms

Within the framework of Article 22 of Federal Law No. 400, a pension for a veteran of the BD is assigned from the date of filing the application, but not before the right to pension provision arises.

That is, as soon as a veteran reaches the calendar age determined by law, he has every right to visit the Pension Fund to determine the monthly benefit. A similar rule is provided for military pensions.

Then, as soon as all the documents are accepted and examined for accuracy, PF workers will calculate the amount of benefits based on the available IPC, as well as their cost, and after 10 days they will determine the date of payment, which will be delivered to the DB veteran in the manner that he chooses.

At the same time, the old-age pension is paid for life in accordance with Part 10 of Article 22 of Federal Law No. 400, and the disability benefit will be extended on the basis of the next examination until reaching the general retirement age and switching to old-age benefits.

What number is charged?

By virtue of the norms of Article 26 of Federal Law No. 400, pension benefits are assigned for the current month, but are delivered not on the same day, but according to a schedule approved at the regional level.

Thus, according to clause 107 of Order of the Ministry of Labor of the Russian Federation dated November 17, 2014 N 885N, payment of pensions starts on the third day and continues throughout the month.

In this case, the schedule itself is developed taking into account the following factors:

- the total number of pensioners in the service area;

- specifics of the area;

- financing.

That is, a combat veteran can receive a fixed pension both in the first ten days of the current month, and in the second or third, depending on the date determined by the schedule.

Exit order

The procedure for registering pensions for combat veterans is standard and does not differ significantly from citizens of other categories.

Thus, a veteran, upon reaching the age specified by law and having length of service, has the right to apply to the territorial administration of the Pension Fund or the military registration and enlistment office at the place of residence with the above package of documents. After 10 days, the benefit will be calculated and payment will be scheduled from the date of application, followed by monthly transfers.

At the same time, taking into account that BD veterans belong to the preferential category, the amount of the benefit will be calculated in a special manner, taking into account the norms of Article 45 of the Law of the Russian Federation No. 4468-1 and Article 1 of the Federal Law No. 21, which provide for an additional payment as a percentage of the assigned benefit, but again based on the categories of database participants.

Size

As mentioned above, combat veterans can apply for several types of pensions depending on their social status after returning from hot spots:

- So, if a veteran retired from military service, the amount of the pension will be calculated in the standard manner on the basis of Federal Law No. 400 based on the existing length of service. At the same time, a pension supplement for combat veterans who have transferred to the civilian population category will be established within the framework of Federal Law No. 5 as an EDV.

- If the veteran continued his service and transferred to a well-deserved retirement from a military position within the framework of the norms of clause G, Article 45 of Law of the Russian Federation No. 4468-1, an additional payment in the amount of 32% of the social pension, determined in accordance with Article 18 of Federal Law No. 166, will be added to the military pension. . At the same time, within the framework of the norms of Article 1 of Federal Law No. 21, veterans who are already classified as civilians will be able to apply for this type of allowance if they have been awarded certain ranks or received state awards.

The following can count on additional payment:

- heroes of the USSR and the Russian Federation - 415% social. pensions;

- citizens awarded the Order “For Merit to the Fatherland” I – IV degrees, the Order “For Service to the Motherland” three degrees from 415% to 330% of the social pension.

How is the calculation made?

Considering that combat veterans can apply for pension benefits under 3 federal acts, the calculation of this payment is made in different ways, directly depending on the characteristics of their employment.

The insurance pension is calculated on the basis of the norms of Article 15 of Federal Law No. 400, which establishes the main parameters, namely:

- number of pension points;

- cost of points.

At the same time, by virtue of the provisions of Article 16 of Federal Law No. 400, a fixed payment in the amount of 4982.90 rubles is added to the specified payment, which can be increased if the veteran has dependents or northern experience.

In turn, the social pension within the framework of Federal Law No. 166 is calculated in a fixed amount in direct dependence on membership in a particular category. And the military pension is calculated in proportion to the previously available salary based on the salary for the position, rank and established allowances as a percentage.

Formula

When calculating the insurance pension in the manner prescribed by the norms of Federal Law No. 400, the following formula is used:

IPK X SPK = SP st,

Where

- SP st – pension amount;

- IPC – individual pension coefficient;

- SPK – point value.

Is alimony paid?

Section 5 of the RF IC defines the conditions for the collection of alimony, as well as the categories of persons who are obliged to pay them under certain circumstances.

At the same time, taking into account that each individual alimony recipient’s income is generated from various sources, the law also approved a list of income from which alimony payments can be collected. On the basis of clause a part 2 of the Decree of the Government of the Russian Federation of July 18, 1996 N 841, alimony is collected from all types of pensions, including veterans' supplements.

Do they pay extra to the cost of living?

In most cases, insurance and military pensions are rarely set below the subsistence level, given that salaries for military positions are acceptable, and the insurance benefit consists of two parts. Therefore, cases of assigning a small pension to the main one refer to a social benefit fixed in a fixed amount.

And since, by virtue of Article 12.1 of Federal Law No. 178, the pension benefit cannot be lower than the subsistence level, recipients of social pensions have the right to count on an additional payment in the amount that is the difference between their existing income and the minimum amount.

Well, for example, the benefit amount is 5034.25 rubles, the cost of living for a pensioner is 8726 rubles. Thus, the pensioner will receive the following additional payment: 8726-5034.25 = 3691.75 rubles.

Find out what the pension increase for labor veterans is. Are Chernobyl victims entitled to insurance payments? See here.

Is the social pension expected to increase?

- Initially, the budget included funds for recalculation, which will be enough to increase by 2.4%;

- On February 22, it was published that deductions would increase by 2%.

Insurance payments for group 3

For disabled children, payments will amount to 2804.28 rubles. Preferential categories receive NSOs, which are calculated in monetary terms if the applicant has submitted an application to the local branch of the social protection department. The amount of additional payments will be: 1121.42*1.038 = 1164.03.

We recommend reading: Payment for Travel on Personal Vehicles for Military Personnel 2020

The amount that is withheld by the Pension Fund for social services can be received by the citizen in cash equivalent. To do this, he needs to contact the territorial office of the Pension Fund with a package of documents to draw up the appropriate application.

The amount of the monthly cash payment is subject to regular indexation - this is noted in Federal Law No. 5-FZ. In this case, the cost of living per capita will be taken into account. It is established based on the results of an analysis of the cost of the consumer basket, which is carried out by the Statistical Committee of the Russian Federation. Today the size of the EDV is:

Taxation

According to the promise of the Russian government, by 2020 the amount of payments for veterans should increase slightly - in 2020, funds were allocated to the federal budget for this event. In addition, pensions will increase annually by 4% taking into account the level of inflation in the country. This statement was made on the basis of the norms provided for by the bill “On the federal budget for 2020 and for the planning period of 2020 and 2020.”

The rest apply to the military district commission or the military commissariat at the place of military registration with an application and documents. Those who are serving a sentence in places of deprivation of liberty apply to the military commissariat in a correctional institution.

However, in reality the percentage should be higher. The fact is that the EDV is indexed to the actual consumer price index in the country for the previous year. Even according to Rosstat, consumer prices increased by more than 4%. The CPI was around 4.4%-4.5%.

How to receive a monthly cash payment

Participants in military operations in Chechnya are also exempt from paying state fees when appealing to the Supreme Court, but only for claims under the legislation on veterans. In regions, transport tax benefits may be provided.

- 863 rubles are now allocated for the provision of medicines;

- 124 rubles are based on free travel using railway transport (suburban transport and intercity travel are taken into account when traveling to the place of treatment);

- 133 rubles for treatment in sanatoriums and resorts, if a person has indications for it.

Questions

Is it inherited?

By virtue of the norms defined by Article 1112 of the Civil Code of the Russian Federation, only property that belongs to the testator at the time of his death, as well as some obligations, for example, the same debts, are included in the inheritance mass.

A pension refers to rights that are inextricably linked with the personality of the deceased, which is why it is not mentioned in the order of inheritance. However, relatives of a deceased combat veteran have the right to receive an already accrued pension, which he did not manage to receive this month, as well as apply for a survivor’s pension if the veteran has minor children or elderly parents or a disabled spouse.

Is it paid early?

In some cases, life circumstances may prevent you from receiving a stable income just a few years before you become eligible for a pension. Naturally, such situations are provided for by law; moreover, as an exception, if a number of conditions are met, a pension can be issued early.

In particular:

- when reduced within 24 months to 60 years within the framework of Article 32 of Law of the Russian Federation No. 1032-1;

- if you have northern experience by virtue of the norms of Article 32 of Federal Law No. 400;

- if you have 25 years of civil service service and have held a position for the last 7 years in accordance with the norms of Article 7 of Federal Law No. 166;

- upon dismissal from military service under general military service at the age of 45 with a total length of service of at least 25 years.

Last news

Will they raise it and when will it be indexed?

Currently, the law provides for two types of additional payments to the pensions of combat veterans, namely:

- EDV within the framework of Article 23.1 of Federal Law No. 5;

- 32% towards military pension.

At the same time, the agreed allowances amount to a very modest amount, which is why many are interested in whether they are planned to increase them in 2020?

Naturally, legislators are aware of the current situation and a bill is being developed that proposes to increase additional payments to 5,000 thousand rubles.

However, due to the fact that such a procedure will require additional expenses of over 37 billion rubles, the bill is unlikely to be approved. But indexation of the EDV will still be carried out in accordance with Part 5 of Article 23.1 from February 1, 2020.