SocLgoty.ru - all about social assistance in Russia

- home

- Social benefits

- Benefits for combat veterans

Persons who took part in combat operations during the military campaign in Chechnya are entitled to benefits in accordance with the Federal Law “On Veterans”. Participants in a military conflict are also considered veterans, so they are entitled to equal preferences.

These are, first of all, cash benefits, a discount on housing costs, advantages in obtaining housing, emergency medical assistance, annual leave and other federal benefits, that is, privileges that do not depend on local authorities. At the regional level, additional preferential conditions are possible, for example, free travel for military veterans and their families in Novgorod and the region, free travel on public transport in other cities, etc.

The wife and children of a serviceman who died while performing a combat mission are also paid cash assistance and provided with a set of benefits. There are also additional payments for disability.

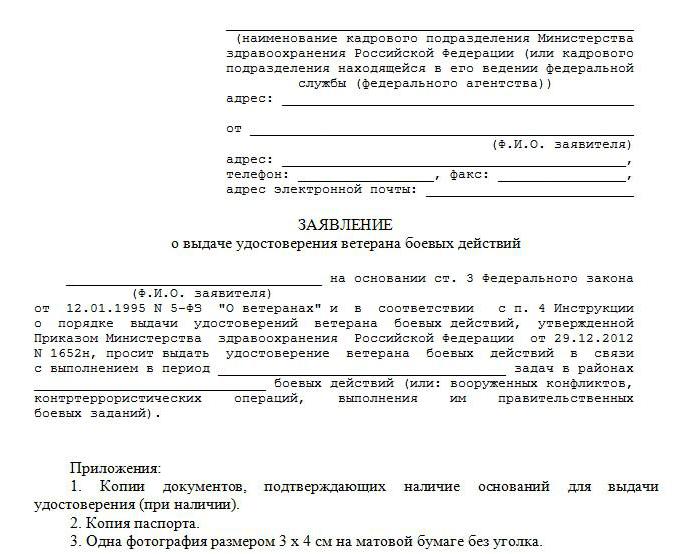

But in order to receive the necessary “crust”, participants in these hostilities need to confirm their status and clearly know which categories of citizens fall under it.

Pension in 2020 for participants in combat operations in Chechnya and Afghanistan

- Tajikistan;

- the Transnistrian Republic, which is currently an unrecognized state;

- Chechen Republic;

- South Ossetia and Abkhazia;

- the former Yugoslavia, which as a result of conflicts broke up into several independent states;

- Afghanistan, into which troops were sent back under the USSR, in 1979;

- North Ossetia and others.

As we have already mentioned, the size of the pension for participants in the Second World War and armed conflicts on the territory of other states depends on a variety of factors. Today it averages from 21.8 to 30 thousand rubles. These amounts were obtained based on the results of indexation carried out in 2020. Every year they, albeit slightly, still increase, thanks to the recalculation carried out by the state. Indexation is mandatory for combatants, since they belong to the priority categories of persons receiving pensions.

Taxes

Let's start with the most interesting, important and exciting moment. We are talking about taxes. They worry the entire population of Russia. Tax benefits for veterans of military operations in Chechnya are offered exactly the same as for everyone else. What exactly are we talking about? What can veterans count on in this case?

The bulk of bonuses from the state are provided at the regional level. Therefore, it is best to check more accurate information about tax benefits in a specific locality. However, veterans are also entitled to federal tax bonuses.

Among them are the following benefits:

- Exemption from property tax. All veterans in Russia do not have to pay tax on property (for example, a house or apartment).

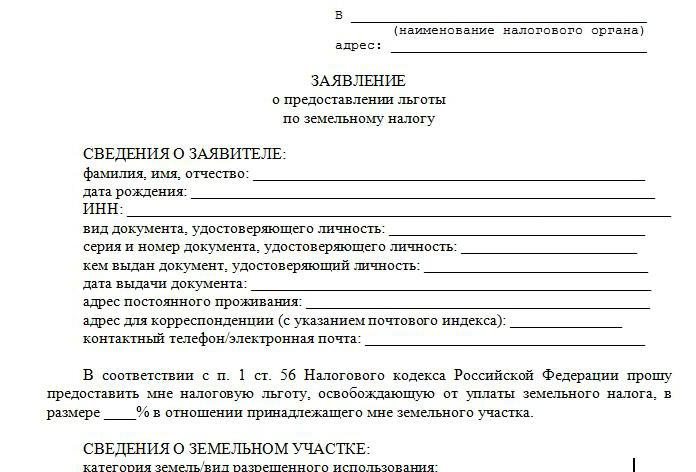

- Reducing the tax base for land taxes. No one in Russia is exempt from this payment. However, federal benefits for combat veterans (in Chechnya and not only) make it possible to reduce the tax base by 10,000 rubles. A similar bonus is prescribed in the Tax Code of the Russian Federation (Article 391, paragraph 5).

- When paying personal income tax, you can receive a standard tax deduction. A veteran is entitled to an additional 500 rubles. If a citizen has a disability, he is entitled to 3,000 rubles.

- Transport benefits. They are usually regulated at the regional level. Most often, the benefits provided to veterans of military operations in Chechnya (and in other regions) imply a complete exemption of the citizen from transport tax.

There is no longer any tax support in Russia for the category of persons under study. How can I apply for these benefits and receive them?

One-time and monthly cash payments to combat veterans

The following types of income of individuals are not subject to taxation (exempt from taxation): state benefits, with the exception of temporary disability benefits (including benefits for caring for a sick child), as well as other payments and compensations paid in accordance with current legislation. At the same time, benefits that are not subject to taxation include unemployment benefits, maternity benefits.

The amount that is withheld by the Pension Fund for social services can be received by the citizen in cash equivalent. To do this, he needs to contact the territorial office of the Pension Fund with a package of documents to draw up the appropriate application.

Benefits for veterans of military operations in Chechnya

This means that hospitals and clinics located in the area where a serviceman is registered do not have the right to refuse to provide assistance to him. This category of persons has the right to receive medical services out of turn. They do not need to make an appointment in advance to see a doctor.

- In the period from August 1999, when anti-terrorist operations were carried out in the Seven Caucasus.

- In the period from 12.1994 to 12.1996, when Russia was drawn into an internal conflict. In addition to Chechnya, the adjacent territories, unwittingly drawn into the war, are also taken into account.

Who is entitled to benefits?

- 1 Who gets benefits?

- 2 Who else can apply for help?

- 3 Privileges of participants in the armed conflict in Chechnya

- 4 Who else does these preferences apply to? 4.1 Other preferences

Veterans of the Chechen armed conflict include persons who have a corresponding entry in their military ID (military personnel, privates and officers of state security and internal affairs bodies) who participated in combat operations:

- during military operations from December 1994 to the end of 1996 in Chechnya and the adjacent territories of the Russian Federation, drawn into the war;

- during the period of anti-terrorist actions since August 1999 in the North Caucasus.

Benefits for veterans of military operations in Chechnya

All combat veterans are entitled to free housing. However, this type of privilege has a number of limitations. For example, those who submitted an application before 2005 receive apartments out of turn. Persons who submitted an application after 2005 are provided with housing on a general basis, just like other citizens of the Russian Federation.

The legislation provides for monthly cash benefits for veterans of military operations in Chechnya. Tips for obtaining it allow you to achieve recognition of a military veteran and assign a monthly allowance in the amount of 2225 rubles. This amount also includes NSS (social services), paid in the amount of 839 rubles.

We recommend reading: Session For Correspondence Students 2020 In Guu When It Starts

What tax benefits are provided by law for military veterans?

Combat veterans should have an idea of the tax benefits that they are entitled to in accordance with the Tax Code and legislative acts of the Russian Federation:

- In accordance with Art. 4 of the Law of the Russian Federation of December 9, 1991 No. 2003-1, combat veterans are exempt from paying property tax.

- Veterans are provided with a reduction in the tax base for land tax by a non-taxable amount, the amount of which is 10,000 rubles. This provision is spelled out in paragraph 5 of Art. 391 Tax Code of the Russian Federation.

- The right to receive a standard tax deduction in the amount of five hundred rubles for each month of the tax period when calculating personal income tax in accordance with paragraphs. 2 clause 1 art. 218 Tax Code of the Russian Federation. If a combat veteran is assigned a disability, the deduction amount will be 3,000 rubles.

- Regional legislation may establish transport tax benefits for combat veterans.

Benefits to participants of military operations in Chechnya from the State

It is known that during their service, many of the military personnel were awarded orders, medals, titles and even the Gold Star of the Hero of Russia. The question arises about how pension benefits are interconnected if individuals have several reasons for them?

- Personal file of a military man;

- Military ID;

- Extract from the order for enrollment into the ranks of employees;

- Awards documents;

- Documents about injuries;

- Flight books;

- Data from archival documents;

- Extracts from orders, depending on where the applicant serves, these may be orders of the Ministry of Internal Affairs, for a military unit, etc.;

- Officer's ID;

- Business trip certificate.

Pensions and benefits

Federal benefits for veterans of military operations in Chechnya include pension provision. This support measure applies both directly to the military man and to his family (in the event of the death of the sole breadwinner).

Veterans' pensions and benefits change every year. Therefore, it is recommended to check with the Pension Fund how much additional a pensioner with a special status can receive. In addition, much depends on the citizen’s earnings and length of service.

Benefits are issued to the Pension Fund. What should a veteran of combat operations in Chechnya bring with him? Benefits for 2020 are issued in the same way as before. The veteran needs to take with him:

- pensioner's ID;

- SNILS;

- passport;

- military ID;

- income certificates;

- veteran's certificate;

- account details for transferring pensions and benefits;

- statement.

But it is more difficult for a veteran’s family to apply for benefits and pensions. To do this, they will need to bring an application in the prescribed form, and with it:

- documents indicating that you are dependent on the deceased;

- certificates confirming relationship (birth/marriage certificate);

- SNILS;

- account details;

- death certificate of a citizen;

- certificates and extracts confirming the veteran status of the deceased.

Nothing difficult or special. The main thing is to know exactly about your rights.

List of benefits provided to participants and veterans of military operations in Chechnya

As mentioned above, combat veterans also have every right to receive monetary compensation for refusing a set of social services in full or in part - a monthly cash payment (MCP). This payment has been indexed since February 1, 2020 and its amount is 2972.82 rubles.

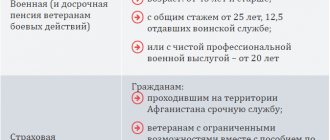

According to the current legislation, in particular Article 45 of the Law “On pension payments for those categories of citizens who served in military service” No. 4468-1 of December 1993, the minimum pension amount for military veterans who took part in the armed conflict in Chechnya is higher by more than 32% of the social pension amount.

Procedure for issuing EDV for combat veterans

Regional branches of the Pension Fund of the Russian Federation are empowered to establish and pay monthly cash transfers to veterans. The most important rules for the provision of services related to the establishment and transfer of cash payments to veterans once a month are prescribed in Order of the Ministry of Labor of the Russian Federation dated October 30, 2012 No. 353n.

Please note that a combat veteran can submit an application for EDV payment either in paper form or in electronic form. An application for a monthly cash payment to the Pension Fund can be submitted by a veteran personally or his representative. When visiting a PF office, a veteran must have with him a complete package of documents confirming his right to receive payment.

Documents are submitted to the Pension Fund office at the veteran’s place of residence. In the absence of permanent registration at the place of residence, the veteran has the right to submit an application at the registration address at the place of residence.

From the moment of submitting the application and the corresponding package of documents, authorized officials will consider this issue within 10 days and make a decision on the appointment of EDV or refusal.

To summarize, we can say that a fairly wide range of social benefits is provided for combat veterans at the legislative level. In addition to benefits, combat veterans have the right to apply for additional monthly cash payments and a certain set of social services.

Benefits for combat veterans in 2020

Issues related to the recalculation of social payments and compensation amounts for this category of Russians remain among the most pressing. Let us remind you that not so long ago veterans received indexation payments twice a year, but since the country began to feel the consequences of the economic crisis, payments have been frozen. In 2020, indexation was not carried out, but veterans received one-time assistance in the amount of 5 thousand rubles. At the same time, the payment itself amounted to 2,780 rubles (including compensation for refusal of benefits).

The category of exceptions included only those who have the title of Hero of the USSR, full holders of the Order of Glory and some other persons. Those veterans who applied before 2004 also remained in the queue. Some territorial authorities have retained this benefit, but you need to find out about it at your place of residence.

About housing opportunities

Now a little about issues related to housing - many citizens pay attention to them. It is already clear what benefits veterans of military operations in Chechnya are entitled to today. But what features of their design will you need to know about?

Firstly, providing housing. Citizen veterans are legally entitled to receive free land or apartments on a first-come, first-served basis. Not everyone has the opportunity to claim such an opportunity. The condition applies only to those who declared their rights before 2004 (inclusive). Other veterans cannot receive free housing. This is what modern laws say.

Secondly, veterans of military operations in Chechnya have benefits regarding utility services. This rule applies to the entire family of a citizen with the status being studied. The benefit is expressed as a discount on utility bills. Today it is 50%.

However, not all members of a veteran’s family have the right to such support. We are talking only about citizens living together with a person who fought in Chechnya.

Benefits for participants of military operations in Chechnya: assistance from the state

The list given in the third article of the law “On Veterans” provides a comprehensive definition of the concept of “a person who participated in hostilities.” It includes military personnel who went through combat while performing direct duties, and those who retired as a “reserve” (option - retired), soldiers who arrived at assembly points.

As a general rule, a person wishing to obtain UBD status is required to provide a certain amount of title documentation. Depending on the characteristics and complexity of the tasks performed by a person at the time of armed conflicts, these may be the following documents:

Benefits for veterans of Chechnya: amount of benefits, how to apply, documents

Until 2004, participants in military operations in Chechnya could count on receiving a plot of land. Since 2005, this law has been repealed. Only those veterans who managed to submit documents before 2005 remained in the federal queue for land.

The conduct of hostilities on the territory of the Chechen Republic became a difficult period for citizens of the Russian Federation. After their completion, a decision was made at the state level to assign the status of veterans to the war participants. This status implies that its owners can receive a number of benefits and compensation in many areas of life.

Peculiarities of paying pensions to participants of military operations in Chechnya

- medical: provision of free medical care in the department of the relevant organization at the place of application;

- extraordinary service (for this you only need to present an identification; an appointment is not necessary);

- assistance with prosthetics (does not apply to the installation of dentures, which are classified as expensive);

- provision of monetary compensation in case of independent purchase of a prosthesis.

- calculation of land tax based on the cadastral value of the plot, reduced by 10,000 rubles;

- provision of ownership of a residential property, or federal budget funds for its acquisition (the size of living space is determined at the rate of 18 m 2 per person, and it is provided only if the citizen is recognized as needy);

- transport tax benefit (its exact amount will vary depending on the region, in some areas the tax has been removed completely regardless of the power of the vehicles used by veterans);

- performed military or permanent service in Chechnya or in adjacent territories (as soldiers and officers);

- were persons sent to carry out certain duties in hot spots;

- were posted employees;

- directly took part in the war on the border with the Republic of Chechnya.

We recommend reading: How much is the Early Pregnancy Registration Benefit?

What benefits are available to veterans of Chechnya?

All benefits available to veterans of battles in Chechnya can be divided into the following groups:

- benefits, payments;

- pension benefits;

- housing;

- tax;

- medical.

Benefits, payments. The state pays participants in military operations in Chechnya a monthly allowance from the budget. In addition to it, social support is provided, which is the allocation in kind of tickets for public transport, vouchers to a sanatorium, free medicines, or the payment of funds as an increase to the monthly benefit if the veteran refuses to receive assistance in kind.

Pension benefits. Participants in battles on the territory of Chechnya are paid an increased social pension - 32% more than the standard amount. At the end of 2020, the amount was 11,220 rubles.

Housing benefits. The group of housing benefits for veterans of Chechnya includes the following discounts and compensations:

- registration of ownership of housing or receiving money for its purchase at the expense of the federal budget (subject to the allocation of 18 sq.m. according to the norm of the Ministry of Construction or the acquisition of housing, partly at one’s own expense and only after being placed in a queue as housing in need of improved housing);

- reduction in utility bills (50% of the amount paid per month on utility bills),

- the possibility of obtaining a loan to improve living conditions or purchase an apartment at a preferential rate (residents of the Samara, Saratov, and Nizhny Novgorod regions have the opportunity);

- registration of ownership of a plot of land (land for the construction of a residential building from the regional land fund can be obtained on a first-come, first-served basis),

- extraordinary connection of a landline telephone.

Tax benefits. Veterans of Chechnya are also entitled to tax benefits for their services. The authorities of some regions have provided veterans with exemption from personal income tax and property tax, but such assistance measures have not been adopted everywhere, so you should check with the regional office of the Federal Tax Service for details. In any case, there will be a discount in relation to the payment of land tax - if a veteran owns a plot of land, a discount of 10,000 rubles from the amount of its cadastral value will be taken into account when calculating the land tax. This amount will not be subject to tax.

Medical benefits. Benefits for veterans in the medical field include medical care at the place of residence in any clinic chosen by the citizen. No medical institution has the right to refuse to provide assistance to a combat participant in the Chechen Republic who applies. Moreover, they are required to accept it without a queue, so there is no need to make an appointment - take your ID with you and present it at the reception.

Those who need prosthetics can also count on government support as part of benefits provided to veterans. If it was necessary to take action urgently, and there was no time to apply for benefits, so he had to pay for a prosthesis or prosthetic-orthopedic product himself, the veteran retains the right to receive compensation for its purchase from the authorities.

If a veteran’s rights are violated, his complaint will be accepted for consideration:

- Chief physician of the hospital,

- Administration of territorial entity,

- Ministry of Health care.

Pension for veterans of military operations in Chechnya in 2020 amount

Thus, military pensioners from among the persons specified in subparagraphs “a” - “g” and “i” of subparagraph 1 of paragraph 1 of Article 2 of the Federal Law “On Veterans,” as well as combat veterans from among the persons specified in subparagraphs 1 — 4 paragraphs 1 of Article 3 of the Federal Law “On Veterans” will receive a military pension from January 1, 2020 with an increase of 1,610 rubles. 96 kopecks

The pension for veterans of military operations in Chechnya includes monthly payments that are not subject to taxation. Currently, such payment on general terms is 2,225 rubles. Social services must be included in this price. Including, almost 93 rubles are given for travel to the place of treatment and back; the share for the purchase of a voucher to a sanatorium is assigned in the amount of 100 rubles, and the funds for providing medicine correspond to the amount of 646 rubles.

List of UBD subsidies

Based on the data in paragraph 1 of Article 16 of the Federal Law of January 12, 1995 No. 5 “On Veterans,” you can find out what benefits veterans of military operations in Chechnya have:

- improving the living conditions of those in need with the help of budget funds if they are placed on the waiting list before January 1, 2005;

- benefits for military veterans to pay for utilities in the amount of a 50% discount for all family members;

- immediate installation of a landline telephone;

- priority provision of medical services in hospitals, clinics and other medical institutions;

- free orthopedic prosthetics;

- if a VBD works, then he has the right to take vacation at any time, including at his own expense in the amount of 35 days per year;

- priority purchase of transport tickets, attendance at sports, recreational and cultural events;

- if a citizen works, then he has the right to retrain and improve his qualifications at the expense of the employer;

- UBDs must be admitted without competition to state universities and technical schools, and also receive a scholarship established by the regulatory legal acts of the Russian Federation;

- income in the amount of 500 rubles is not taxed, which is described in Article 218 of the Federal Law “On Veterans” of January 2, 2000 N 40-FZ. Federal Law of January 2, 2000 N 40-FZ “On Amendments and Additions to the Federal Law “On Veterans”. This amount is considered a monthly payment to veterans of military operations in Chechnya in 2020 on an ongoing basis.

Pension provision for combatants in Chechnya in 2020

Only after the introduction of amendments to Russian legislation, military personnel who participated in the battles in Chechnya from 1994 to 1996 began to be given the status of VBD. This status gives the right to receive an increased pension and an additional payment - EDV, which is not taxed.

According to the Federal Budget Law adopted in 2020, pensions will be indexed. At the same time, the growth volume will be 3.7%. The amount of monthly additional payments also increases by 3.2%. Indexation is carried out annually by decision of the Government of the Russian Federation.

About funeral services

All the previously listed opportunities are also benefits for the families of combat veterans. In Chechnya and beyond. Typically, a citizen’s relatives are entitled to government support if:

- the military man died and was the only breadwinner;

- the family lives with the veteran.

An important issue is the benefits for funeral services. The state takes on part of the costs associated with the funeral.

Funeral services include:

- transportation of the body to the funeral site;

- direct burial (funeral services);

- production of the monument and its installation.

As a rule, the state reimburses all listed expenses. But this is not all that veterans and their families deserve! There are other benefits.

Benefits for veterans of military operations in Chechnya

At the local level, people in this category have the opportunity to enjoy other benefits, one of which is free discounted travel on city public transport. Some regional benefits also apply to travel on commuter trains and buses; in some regions, the state fully pays for travel to places of treatment in the Russian Federation. Also, purchasing tickets for intercity transport is guaranteed without queuing.

In addition, a participant in the armed conflict in the Chechen Republic and adjacent territories, whose services to the Fatherland are confirmed by documentary information from the regional military registration and enlistment office, may receive a “combat veteran” medal. The fact of possessing a state award is also confirmed by an appropriate certificate.

List of benefits

What benefits can veterans of combat operations in Chechnya receive in Russia in 2020? As already mentioned, this feature is regulated by the relevant Federal Law. After studying it, you can answer all the citizen’s questions.

However, it does not always make sense to understand the laws. It’s enough just to remember the list of benefits. For veterans of combat in Chechnya or Afghanistan, this is not so important; Basically, all persons with a similar status have the same rights. And their families too.

Accordingly, almost any veteran is entitled to the following benefits:

- additional pension provision;

- providing a veteran's family with housing;

- utility benefits;

- the right to preferential installation of a home telephone and its connection out of turn;

- medical care in institutions where the veteran was observed;

- out-of-turn service in all medical organizations;

- provision of prosthetics and orthopedic products (except for teeth and implants);

- annual leave (without or with pay) at a time convenient for the veteran;

- the right to purchase tickets for any vehicles out of turn;

- free additional education from the employer (if necessary);

- priority right to use cultural and recreational services, sanatoriums, sports and recreational institutions;

- tax “bonuses”;

- ritual benefits.

These are the opportunities offered to all combat veterans in Russia. As a rule, housing and funeral benefits apply to military family members of the status being studied. Next, we will talk in more detail about the main features of this or that state support.