Receipt of a preferential pension due to harmfulness from 2020

» In order to apply for early retirement under the new law from 2020 in connection with work in difficult and hazardous working conditions (the so-called preferential pension for hazardous work), several conditions must be met. We will tell you what these conditions are in this article. For Russian citizens working in difficult and hazardous working conditions, in underground work or in hot shops (the so-called list No. 1, list No. 2 and “small lists” of hazardous professions in the Russian Federation), legislation provides for the possibility early retirement if there is a specified amount of special experience. The retirement age for these categories of workers is established according to a special grid, depending on the type of labor activity performed, as well as on the number of years of accumulated “harmful” experience. In connection with the pension reform in Russia, from 2020 there are no changes to the conditions for issuing an early pension

Harmful experience 1 net

If you still work according to List No. 2 for 10 years, you can retire at 45. 2. I applied for a pension in 2012 according to the northern work experience and under the harmful network, served in Afghanistan for 2 years, studied at a civil aviation school, is 1 year included in the total length of service and how does it disappear? 2.1. 1. Military service in the ranks of the Soviet Army is calculated “year by year” and is included in the total length of service.

2. Studying at the State Pedagogical Technical University is included in the total work experience, subject to the employer’s direction to study.

3. I have 19 years of experience until 1999, of which 5 years, 7 months, 22 days on the harmful grid 1.

Total experience: 21 years, 4 months, I’m retired, I’m 60. I left at 54. As of today, I receive a low pension.

The Pension Fund says there is no experience. I DO NOT AGREE WITH THEM. What should I do? 3.1. Get your pension calculation from them and go to court. 4. Retirement. Hello, my name is Andrey. Me 09.11. Born in 1971, at what age will I retire, if I have a harmful work experience of 7 years and 3 months (1 grid), I am currently working in metallurgical production, but without any harmful work.

Legal Aid Center We provide free legal assistance to the population

The “second grid” includes drivers of various vehicles, workers in the fishing industry, etc.

We recommend reading: Do I need to register a garage?

The peculiarity of summing up the length of service in the first and second lists is that when calculating the length of service in the first grid, the period of work in list No. 2 or any others is not added to it. And when calculating the length of service according to list No. 2, the incomplete experience of the first grid is taken into account.

An application for accrual of harmfulness benefits can be made either directly or through an authorized representative. According to the regulated procedure, the following documents are submitted to the regional office:

- Completed application form;

- Passport or other registration document;

- Additional documents that the Pension Fund may require.

- A document justifying the right to receive benefits;

- A document confirming compulsory pension insurance;

It is possible to submit documents electronically.

Special assessment of working conditions: Law 426 Federal Law

The issues of calculating pension payments, especially when it comes to early retirement, are very relevant. And they especially cause concern for those employers whose enterprises have dangerous or harmful working conditions.

In order to resolve all the issues and difficulties that arise in relation to the early assignment of pensions for certain categories of workers, it is necessary that a special assessment of working conditions be carried out.

It is this procedure that in the future will play the role of the most important factor on the basis of which early retirement will take place. The main difficulty in understanding the mechanism and rules for assigning early pensions is due to the fact that from January 1, 2014, certification of workplaces was canceled and a special assessment of working conditions was introduced. We will tell you how such serious changes affected the establishment of preferential pensions for persons working in conditions deviating from normal ones.

Do employees whose SAS indicate hazard classes 3.1 and 3.2 have the right to a preferential pension if there is no such benefit in the SAS itself?

Answer to the question: No, they do not.

In general, a citizen has the opportunity to receive a preferential pension if the following conditions are simultaneously met:

- reaching a certain age;

- presence of installed;

- availability of the necessary experience in the relevant types of work.

- presence of a value of at least 30;

This follows from the provisions of the Law of December 28, 2013 No. 400-FZ. Read about even more at the link. The insurance pension can be assigned ahead of schedule:

- (regardless of their profession and types of work performed), for example, women who gave birth to five or more children and raised them until they reached the age of eight ().

- citizens, for example women, who have worked for at least 20 years in the textile industry in work with increased intensity and severity ();

At the same time, the employee’s working time according to the considered

List No. 2 of harmful professions for early retirement

The assessment of labor hazard indicators in the company is carried out under the guidance of the employer and a special commission. Whether a position belongs to the list of 2 professions for early retirement is determined by employees of the labor department and labor protection specialists.

- chemical - cause harm to humans through the respiratory tract or when interacting with the skin. Most often present as vapors in the air and liquids synthesized in the workplace;

- physical - vibration, noise, influence of electromagnetic fields or radiation. These factors are typical for any type of hazardous profession and have a cumulative detrimental effect on a person;

- biological - caused by contact with poisons of biological origin, harmful plants, sick animals. These factors are least pronounced among the professions on the second list. Most often found among doctors, veterinarians or members of research expeditions;

- psychological - are the result of overwork, emergency situations, stress and prolonged physical activity. Experts note disastrous changes in the psyche of employees who are forced to spend their working hours underground or are regularly in confined spaces.

This is interesting: What will happen if at the time of entering into an inheritance the heir does not have money to pay the Notary and the state fee?

Harmful working conditions class 3.1 and 3.2 in Russia in 2020

The production cycle of some enterprises is directly related to factors that in one way or another affect the human body.

We recommend reading: Fees for sewerage in an apartment building

To prevent them, a department dealing with labor protection is created. Its main functional responsibility is to minimize the likelihood of damage to the body of workers or the onset of diseases of varying severity, without reducing maximum labor productivity. Legal regulation of labor protection at domestic enterprises is carried out in accordance with the requirements of Article 37 of the Constitution of the Russian Federation.

It emphasizes that every able-bodied citizen has the right to work.

It must be carried out under conditions that meet safety and sanitary requirements. Production factors are divided into 4 classes, which include physical, chemical, biological and psychophysiological.

Disability pension

Contents Workers in fields of activity belonging to Lists No. 1 and No. 2 or to the “small lists” will, if desired, be able to receive a pension earlier than their peers.

All of them have certain impacts during work activities, as a result of which irreparable damage is caused to the human body.

To apply for early retirement, an employee must meet three conditions:

- be an employee of a hazardous enterprise for a specified number of years;

- obtain the required IPC points (pension coefficients).

- reach the specified age (it differs for each category);

October 3, 2020

The age for receiving a pension for them is determined by a table containing a number of positions and the required number of years worked for each of them.

Law No. 350-FZ was signed, affecting the rights of some citizens planning to receive pension payments in the near future. According to previous legislation, teachers

What obligations does an employer have in relation to an employee if his workplace, based on the results of a special assessment, is assigned a hazard subclass of 3.1?

Question: The organization conducted a special assessment of working conditions.

The reform affected employees in the fields of education, medicine, art and residents of the Far North (FN).

What compensation is provided to an employee if his workplace, based on the results of a special assessment, is assigned a hazard subclass of 3.1, and what responsibilities are provided for the employer? Are insurance premiums charged at additional rates for payments in favor of such an employee? Answer: An employee whose workplace, based on the results of a special assessment of working conditions, has been determined to have the first degree of hazard (subclass 3.1) is given an increase in wages of at least 4% of the tariff rate (salary).

In addition, in the presence of specific harmful production factors, the employee is provided with medical examinations at the expense of the employer.

Insurance premiums at an additional rate of 2% for payments made in favor of this employee are charged only if he is employed in the types of work specified in paragraph.

P.

Which periods are now not taken into account?

In 2020, the periods indicated in Part 1, Art. 12 Federal Law No. 400, if before or after them there was no labor activity that was the reason for contributions to the Pension Fund. In this case, the period of working activity is not important, the main thing is its presence.

These periods are related to:

- service in the army or non-departmental structures;

- caring for a child up to 1.5 years old, but in total no more than 6 years;

- temporary disability;

- caring for a disabled person of group 1 or a disabled child, a senior citizen over 80 years of age;

- receiving unemployment benefits;

- the period of settling in the process of moving to another region for the purpose of working.

Important: the period of full-time study is excluded due to the lack of contributions for the citizen to the Pension Fund.

Until 2025, the minimum level of work experience will increase by 1 year until it reaches 15 years, and pension points will increase by 2.4 until it reaches 30:

Depending on the category of experience

The exclusion of a period or its inclusion may be influenced by the length of service that became the basis for termination of employment.

Length of service for pension

When counting this type, the following may be excluded:

- serving in the army if there was no work before or after it;

- a period of temporary disability can only be counted if there were payments from the social fund at that time;

- if the mother was not fired during the periods of child care, that is, she had a job, this time will not be taken into account, and the period of care will be more beneficial for the amount of the pension;

- periods of unemployment, public work and relocation must be confirmed by a certificate from the State Social Protection Service;

- periods of detention or care for disabled and elderly citizens must be confirmed by certificates from relevant institutions or guardians of the disabled person;

- For military wives serving on the territory of the country, certificates are needed not only from military units, but also from employment centers; stay abroad, both with a military husband and a diplomat, is confirmed by a certificate from the organization of his work.

Important: if there are no conditions specified by the standards, the periods will not be taken into account.

Main types of experience.

Experience for early retirement

Such length of service occurs when a citizen works in harmful and dangerous conditions. For them to be recorded there must be:

- entries in the work book about appointment to a position that falls under a similar category;

- the enterprise must have permits to conduct such activities;

- the employer must also make additional insurance contributions.

Important: if all the conditions for confirming special length of service are missing, the pensioner is included in the category of ordinary pensioners, and the preferential length of service expires.

Experience for reduction by 2 years

This length of service is provided for citizens who have worked for over 37 years for women and 42 years for men. If you have the required number of years of work, you can retire 2 years earlier, but only at the age of 55/60.

Non-working periods can reduce the number of years if there were no contributions to the Pension Fund as a result of the lack of work activity before and after such periods.

Harm class

- What is the hazard class of a flaw detector and harmful factors.

- Is the hazard considered to be hazard class 3.1 and higher?

- How many hours should a working week be for a hazard class of 3.2?

- Is there an additional requirement? paid leave if the boiler room is hazard class 2.

- What is the hazard class of an internal combustion engine driver and what benefits does he have? Thank you.

- What is the hazard class of the driver of a ZIL fire truck?

- What is the danger, or the class of a gas-electric welder working in a mine in a workshop.

If you find it difficult to formulate a question, call, a lawyer will help you: Free from mobile and landline Free multi-channel telephone If you find it difficult to formulate a question, call a free multi-channel telephone, a lawyer will help you 1.

What is the hazard class of a flaw detector and harmful factors.

Benefits for employees working in hazardous working conditions

Every citizen of the Russian Federation, in accordance with the Constitution, has the right to work, as well as the creation of employment conditions that meet safety standards and sanitary and hygienic standards. That is why, at the legislative level, a number of benefits are provided for workers who perform their duties in conditions that deviate from normal due to the presence of hazardous factors, which allows them to maintain high performance and prevent occupational morbidity.

We recommend reading: Office of the Federal Register for the Leningrad Region, Tosno Department

According to the norms enshrined in Article 210 of the Labor Code of the Russian Federation, the priority of state policy is to preserve the life and health of workers by introducing a number of measures aimed at improving working conditions, ensuring safety, and also compensating for employment conditions that deviate from the norm. Also, in order to prevent the development of occupational diseases and increased injuries, a number of obligations are provided at the federal level for employers designed to improve the production process and reduce the impact of harmful factors on the health of workers.

Class of working conditions 3.1, 3.2 and 3.3 according to SOUT

Harmfulness class 3 is common because it takes into account factors that are present in most companies. These are the facts:

- dustiness;

- work at high temperatures;

- vibration.

- carrying out gas welding work;

Class 3 is divided into subclasses that take into account negative effects.

Classes of working conditions 3.1, 3.2, 3.3 will be discussed in detail in this material. Benefits are provided to compensate for negative consequences. The hazard class is determined based on the results of a special study.

assessments. "" is described in the material "SOUT".

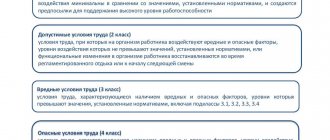

Description of the "SOUT" procedure in the article "". Working conditions are divided into classes according to the level of negative effects, according to hygienic standards. Harmful working conditions: class 3.1, 3.2 and 3.3 - classified according to harmful factors.

Negative conditions of the third class are conditions under which the effect of negative factors is higher than the norm:

- class of working conditions 3.3 - adverse events lead to illness (with the expected loss of ability to work).

- class of working conditions 3.2 - negative phenomena that lead to early stages of occupational diseases;

- what does class 3.1 working conditions mean - this is the presence of factors whose effect on the employee increases the risk of harm to health;

Preferential pension due to harmfulness

/ / / / Harmfulness pension For Russian citizens working in difficult and hazardous working conditions, in underground work or in hot shops (the so-called hazardous professions of the Russian Federation), legislation provides for the possibility of early retirement if there is a specified amount.

The retirement age for these categories of workers is established according to a special grid, depending on the type of work activity performed, as well as the number of years of accumulated “harmful” work experience. In connection with the pension reform in Russia, starting from 2020, no changes will be made to the conditions for issuing an early pension for hazardous work. will not be. According to the new law, all requirements for special length of service, general insurance experience, as well as retirement age standards for the provided preferential lists will remain the same. Thus, in order to apply for an early old-age pension under the new law

Harmfulness premium: procedure for establishing and paying

According to Art. 147 of the Labor Code of the Russian Federation, the salary of employees involved in work in harmful/dangerous conditions is calculated taking into account an increase of at least 4% of the salary. We emphasize that the specified amount of the bonus is the minimum and the employer has the right to set employees a higher additional payment for harmful/dangerous work.

How an employer can approve the amount of a hazard bonus, how to calculate and pay an employee’s salary taking into account the bonus - in the step-by-step instructions below.

Step 1. We approve a local regulatory act on the premium for harmfulness

At the first stage, the employer needs to approve the procedure for assigning and calculating the hazard bonus in a local regulatory act. As a rule, the terms of remuneration for “harmful workers” are drawn up in the form of a separate section of the Regulations on remuneration.

In the text of the local act, the employer indicates:

- list of structural units, positions with dangerous/harmful working conditions (based on the SOUTH act);

- percentage of salary increase (at least 4%);

- procedure for paying bonuses.

In general, the bonus for harmfulness is paid along with the salary within the time limits established by the Regulations on remuneration, in accordance with the norms of the Labor Code.

A sample regulation can be downloaded here ⇒ Sample Regulation on compensation for harmful working conditions.

Step #2. We make changes to the employment contract with the employee

If an employee is hired to work under harmful/dangerous conditions, then this fact must be indicated in the employment contract.

A sample contract can be downloaded here ⇒ Employment contract (harmful working conditions).

If an employee is transferred to a hazardous/harmful job, the procedure for completing this transfer is as follows:

- the employer sends the employee a written notice of significant changes to the terms of the contract (transfer to a position with harmful/dangerous working conditions);

- the employee gives written consent to the transfer by concluding an additional agreement to the employment contract.

If the employee does not agree to the transfer, the employer is obliged to offer him other vacancies at the enterprise, in accordance with the employee’s experience and professional qualifications. If the employee refuses, the employment contract is terminated on the basis of clause 7 of section 1 of Art. 77 Labor Code of the Russian Federation..

Step #3. We calculate the employee’s salary taking into account the bonus

The calculation of wages taking into account the bonus for harmfulness is carried out according to the formula:

Salary with bonus for harmfulness = Salary + (Salary + Coefficient of bonus for harmfulness),

where Salary is a fixed part of the employee’s monthly monetary remuneration (tariff rate per working day/hour, monthly salary, etc.); Harmfulness surcharge – a hazard surcharge coefficient in the amount established by the company’s local regulations, but not less than 0.04 (4%).

Old age insurance: who is entitled to a preferential pension

The state compensates for harmful occupational hazards in the form of premature retirement. Preferential pension, who can receive it.

What you need to consider for proper design. Contents

Preferential pension: for whom and for what Registration of a preferential pension earlier than usual is called a pension “due to harmfulness”. This is the key definition. That is, people who were employed in hazardous industries or worked in conditions with possible damage to health can receive an early pension. There is a list of professions that fall into these categories.

They are enshrined in the Federal Law (On Insurance Pensions) and resolutions of the Council of Ministers. Let us dwell on the conditions equated to severe or health threatening.

Harmful working conditions class 3 1 and 3 2 benefits

ContentsQuestion: The organization carried out a special assessment of working conditions.

What compensation is provided to an employee if his workplace, based on the results of a special assessment, is assigned a hazard subclass of 3.1, and what responsibilities are provided for the employer? Are insurance premiums charged at additional rates for payments in favor of such an employee? Answer: An employee in whose workplace, based on the results of a special assessment of working conditions, the first degree of harm (subclass 3.1) is determined, is set to have an increased tariff rate (salary) of at least 4% salary.

Harmful professions: list 1 and 2

What requirements can a worker employed in the described industries face when reaching retirement age? First of all, you need to pay attention to the name of his profession. This is rather the employer's task. In his staffing table, in the employment contract and other documents in which the title of the position appears, this wording should sound so that it corresponds to the list of professions included in the list of 1 and 2.

The procedure for assigning a pension itself involves collecting and submitting a large number of papers to the pension fund. Actually, such a bureaucratic approach is unlikely to surprise anyone. It is clear that employment in jobs that are included in the pension list of 1 and 2 hazardous professions and the need to confirm “harmful work experience” does not simplify the situation.

10 Jun 2020 lawurist7 202

Share this post

- Related Posts

- Housing and communal services benefits for labor veterans Kursk

- When the Bailiffs Come Debt 20,000

- What is the deadline for non-payment of utilities?

- Which beneficiaries receive a discount on garbage removal Reiondes Saransk