Home NPF

The non-state pension fund "Blagosostoyanie" was founded back in 1996. Initially, its goal was to accumulate funds from employees of Russian Railways with subsequent pension provision. But later, other citizens of the Russian Federation received the right to open personal accounts in this fund. Today it is one of the largest non-state pension funds in the country, with a high rating. In order to make control over their own pension funds more convenient, clients were offered a personal account of the NPF Blagosostoyanie.

npfb.ru - official website of NPF Blagostostoyanie

Features of your personal account

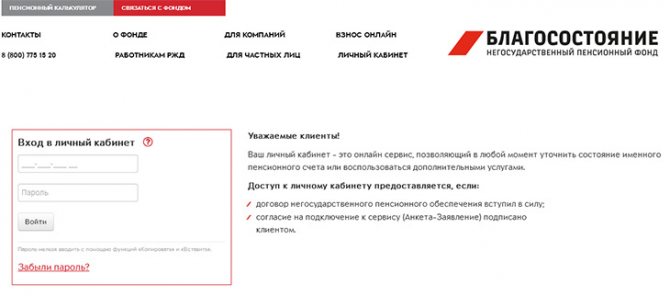

The developers of the personal account on the official portal https://npfb.ru took into account that its users will be elderly people, many of whom do not have high computer literacy. Therefore, the service interface is made extremely simple and understandable, all the elements are quite large, and their purpose is easy to guess.

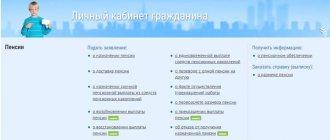

The personal account provides the user with a number of useful functions:

- receiving advice on pension issues;

- obtaining information about the current balance of a personal account;

- familiarization with company news, new opportunities and services;

- notification of all changes;

- sending requests for various documents, certificates, downloading forms.

“welfare” is a non-state pension fund. how to withdraw money? reviews

- This is the best answer Hello. There is simply no single model. Non-state pension provision for employees of JSCo "Russian Railways" is carried out in accordance with the Regulations on non-state pension provision for employees of JSCo "Russian Railways", approved by the order of JSCo "Russian Railways" dated December 28, 2006 No. 2580 r Between JSCo "Russian Railways" and the Non-profit organization "Non-state pension fund "BLAGOSOSTOYANIE" ", a Non-State Pension Agreement has been concluded, according to which the procedure for the withdrawal of the Participant-Contributor (an employee of JSC Russian Railways) from the NPO Agreement is carried out by submitting to the personnel service at the place of work of the Participant-Contributor "Notification of withdrawal from the Non-State Pension Agreement with payment of the redemption amount (transfer to another non-state pension fund) form No. 213.

Creating a personal account

To get a personal account on the website of NPF Blagosostoyanie, you must fulfill 2 conditions. First of all, the client should sign an agreement with the fund, which must come into force. This means that at least 1 payment will be made to the personal account.

You also need to submit an application to the pension fund to provide remote access to your personal account. It is on the basis of this document that the client is provided with a personal account. You can submit your application in one of three possible ways:

- application on the official website of the fund, fill it out, print it and send it by mail to NPF Blagosostoyanie.

- Visit a branch or branch of NPF Blagosostoy to submit an application. You need to have an identification document (for example, a passport) and SNILS with you.

- Current and former employees of Russian Railways can go to the human resources department at their place of work to submit an application.

NPF Blagosostoyanie: registration form

Online registration of a personal account on the company’s website is not provided. Based on the received application, fund employees will provide the client with a password for their personal account. If the client visits the fund branch in person, the password will be issued to him immediately. If the application is sent by mail or submitted to the personnel department, you will need to wait until NPF Blagosostoy receives it. The password will be sent by email, the address of which the client must indicate in the application. Therefore, when entering it, you need to be extremely careful. SNILS will be used as a login to enter your personal account.

NPF Blastostoyanie

Contents of the article In addition to the state institution, about a hundred non-governmental organizations carry out pension provision activities for the citizens of our country.

Among them, established by Russian Railways more than two decades ago and invariably occupying a leading position in the pension services market for a number of indicators.

The non-profit organization was registered in 1996. The most important element of its activities is the implementation of social policies aimed at workers in the railway industry. Along with corporate offers, which can only be used by employees of the Russian Railways holding company, the fund offers individual pension programs (IPPs).

is the largest fund in our country. It consists of 1.2 million people.

The number of participants who receive additional pensions exceeds 354 thousand. The fund's pension reserves amount to 346 billion rubles.

Login to your personal account

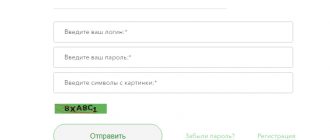

To log in to your personal account, you need to follow the appropriate link, which is available on the main page of the official website. In the form that opens you need to enter:

- login, that is, SNILS of the user;

- password provided by the foundation. It is best to immediately change it to something more user-friendly.

Login to your personal account of NPF Blagosostoyanie

Access to the email indicated in the application must be maintained, since only with its help will it be possible to obtain a new password if the old one is lost. In the authorization form there is a link “Forgot your password?”, clicking on which you need to enter SNILS and email address. An email will be sent to you with instructions on how to set a new password.

Pension co-financing programs: differences

Pension co-financing is part of compulsory insurance for pensioners, present and future.

Thanks to this program, citizens themselves can influence the amount of future pension contributions.

- By transferring savings from state pension funds to non-state ones. This helps to increase investment returns.

- Participation in government co-financing programs.

Joining a non-state pension fund allows citizens to independently shape their future pension provision. By law, any member of this organization can terminate the contract, taking with him the so-called redemption amount.

The following rules must be taken into account.

- When using the state co-financing program, 1 thousand from the state is added to every thousand rubles paid by a citizen.

- But the state can pay citizens no more than 12 thousand per year.

- When participating in independent funds, the size of investments can be changed, but you should not count on additional payments.

In this case, the insurance pension can be transferred to the heirs in the event of the death of the pensioner. But this happens only if certain conditions are met:

- If before this moment the compensation of payments, the amounts and recalculations were determined and carried out in practice.

- In case of urgent payments.

- If a one-time deduction has been established, but in practice it has not yet occurred.

If the funded portion is assigned to a pensioner for payment indefinitely, then the funds are not issued even to legal successors.

Non-state pension funds often become more profitable solutions for citizens if we consider them from the point of view of the profitability of investments. After all, with government co-financing, the possibilities are somewhat limited. At the same time, a citizen can combine several options for forming a pension at once, if funds allow.

Checking pension savings

The personal account allows each user to find out the status of their own pension savings in the NPF Blagosostoy at any time. But fund clients have other ways to obtain such information:

- go to the nearest branch of the fund. Here you will receive an account statement upon presentation of your passport;

- send a postal request to NPF Blagosostoyanie using the services of Russian Post. At the same time, in the request it is important to note the fact that the client’s residential address does not coincide with the address specified in the contract (if such a discrepancy exists).

Non-state pension fund "welfare"

The frequency of payment of contributions along with their amounts is determined by the citizen himself. The main thing is that the first payment is at least 10 thousand rubles. Subsequent contributions can be made for any amount. In this case, an open-ended contract is concluded. The participant can terminate it at any time when the following conditions are met:

- More than a year has passed since the conclusion. Then the entire amount of investment is returned, as well as the income received on its basis.

- If less than 12 months from the date of conclusion, then the investment will be returned along with income at a guaranteed rate of up to 4 percent.

No more than two months must pass from the date of early termination before the money is returned. Conclusion of contracts If we are talking about a Russian Railways employee, then the first step is to contact representatives of the personnel service. The sooner this is done, the better, then the amounts will be maximum.

- When using the state co-financing program, 1 thousand from the state is added to every thousand rubles paid by a citizen.

- But the state can pay citizens no more than 12 thousand per year.

- When participating in independent funds, the size of investments can be changed, but you should not count on additional payments.

- In this case, the insurance pension can be transferred to the heirs in the event of the death of the pensioner. But this happens only if certain conditions are met:

- If before this moment the compensation of payments, the amounts and recalculations were determined and carried out in practice.

- In case of urgent payments.

- If a one-time deduction has been established, but in practice it has not yet occurred.

Deactivation of your personal account

Your personal account remains active until:

- the contract will not be terminated;

- obligations under the contract will not be fulfilled in full.

The user cannot close his account on his own. If he wants to close his personal account on his own initiative, he can contact the company with a corresponding request. Current legislation allows you to do this. The client can write a letter to NPF Blagosostyanie, in which he demands that all his personal data be deleted from the system. However, if cooperation with the fund is still ongoing and the obligations have not yet been fully fulfilled, closing the account is not recommended.

Exit from welfare money back terms

Russian Railways employees were able to leave the non-state pension fund only with the help of the transport prosecutor's office Russian Railways employees were able to leave the non-state pension fund only with the help of the transport prosecutor's office It has been established that the applicants are participants-contributors to the non-state pension fund "Blagosostoyanie" on the basis of an agreement concluded between the said fund and JSC Russian Railways. In connection with the decision to withdraw from the fund, depot employees turned to management with relevant applications, which, contrary to the requirements of the law, were not considered. "Blagosostoyanie" is a non-state pension fund. How to withdraw money? Reviews Activities Why? NPF "Future" ("Welfare") is a non-state pension fund. It was renamed into NPF Future in June 2020. He is engaged in collecting, preserving and increasing your money.

Personal account security

To prevent attackers from gaining access to the user’s personal account, you need to keep your authorization data secret. And if it is not so difficult to obtain the SNILS number of any person, then stealing the password, if it is securely stored, will become a difficult task. Still, scammers can hack into email and steal personal information. If a client suspects that unauthorized persons have accessed his account, he must immediately change his password using the “Forgot your password?” link. from the authorization form. It is also useful to change your email password.

How long does it take to return money from the welfare fund?

Of course, during this period you will not receive any additional accruals in any fund. An unpleasant moment that no one warns about. Refusals The most interesting thing is that “Welfare” is busy with all its might and tries not to let its clients go. Here, as the participants assure, a very interesting and simple scheme is used: you are simply refused to terminate the contract for one reason or another. Either the application was written incorrectly, or the conditions for transferring to another pension fund were not met. In general, some people get tired of this situation, and they remain in the “Welfare” organization.

If you really intend to leave the fund, you will have to prepare to do so with a fight. Several complaints, repeated applications and a long wait for the transfer of funds - and you will achieve your goal.

Just keep in mind: in the year in which you leave the corporation, you will receive almost no profit.

That is, by joining a non-state pension fund, you voluntarily invest money into your personal pension account, or more precisely, into your future non-state pension provision. By law, you have the right to withdraw from the contract (terminate the contract) with the NPF, and at the same time take the “redemption amount” (all invested funds).

With state co-financing of pensions, 1 thousand rubles are added to each pension paid by a citizen. (minimum contribution 168 rubles per month) state 1 thousand rubles is added. But the state pays no more than 12 thousand rubles per year.

When accumulating NGOs, the amount of contributions can be changed at your discretion, but the state will not pay anything extra. The most obvious difference between pension programs is the right of inheritance, which occurs under NPO, regardless of any conditions.

Each citizen, when participating in programs from the NPF “Blagosostoyanie,” retains the right to receive a tax refund in the amount of 13 percent for serious expenses for the purchase of real estate, treatment, training, and so on. The pension is retained even upon dismissal, if the insurance period is at least five years.

And after dismissal, individuals have the right to increase their security. It’s just that contributions become individual rather than corporate.

NPF Blagostostoyanie is a reliable fund to which more than a million people have already entrusted their savings. They adhere to an integrated approach to investing funds.

This ensures a high level of profitability for any investment. At the same time, the risks remain minimal. The average industry pension for Russian Railways employees reaches 90 thousand rubles.

Taking care of your pension long before you reach the appropriate age is the most sensible approach. It is worth deciding in advance which organization in this area a citizen is willing to trust.

NPF Blagosostoyanie is one of the most reliable players on the market. But the need to terminate the contract may arise even when collaborating with such a company. How to withdraw money from the non-state pension fund Blagosostoy?

Customer support

The user’s personal account allows him to contact the fund’s support service and get answers to questions that arise during the work process. There is also a free hotline at number 8 . Its specialists will be happy to advise clients of the fund or those who are just planning to become one.

You can contact support directly from the main page of the official website. At the top there is a “Contact the Fund” button. It allows you to read answers to frequently asked questions, order a call back from the fund, or write a letter to the support service.

Official site:

https://npfb.ru

Personal Area:

https://online.npfb.ru

Hotline phone number:

What programs does Blastostoyaniya operate?

In total, there are two areas that have become the main ones for the company’s activities:

- Pension programs designed specifically for Russian Railways employees.

- Individual offers for people who do not work for Russian Railways.

About the program for railway workers

The bottom line is that the employer and employee of the company participate in equal shares in the formation of savings. The terms of a specific contract depend on which service option the client chooses.

According to standard schemes, several solutions are proposed:

- The ability to choose inheritance: it is either absent or applies to personal or state savings.

- Contribution amount: minimum, maximum, optimal.

- Limitation on the number of heirs. Or the absence of such conditions.

A non-state pension is paid in the following circumstances:

- Upon dismissal from Russian Railways.

- With participation in the program for at least 5 years.

- Reaching the generally established retirement age.

Individual programs for employees of other companies

Any citizen, not only Russian Railways employees, can be a party to such agreements. Personal savings are involved in the formation of a pension.

The frequency of payment of contributions along with their amounts is determined by the citizen himself. The main thing is that the first payment is at least 10 thousand rubles. Subsequent contributions can be made for any amount.

In this case, an open-ended contract is concluded. The participant can terminate it at any time when the following conditions are met:

- More than a year has passed since the conclusion. Then the entire amount of investment is returned, as well as the income received on its basis.

- If less than 12 months from the date of conclusion, then the investment will be returned along with income at a guaranteed rate of up to 4 percent.

No more than two months must pass from the date of early termination before the money is returned.

Who owns the largest non-state pension funds in Russia?

Info

Moreover, the asset itself is considered attractive, but with many reservations. However, in this case, the merchants’ saying that “for every cow there is a buyer” worked.

In a nutshell, the situation is as follows: the Central Bank is sanitizing Promsvyazbank, which should become a support for the needs of the military-industrial complex. At the same time, the regulator takes away from the Ananyevs (Orthodox bankers are haunted by their sins with illegal transactions on securities) Revival, for the ownership of shares of which applicants have recently appeared. From the very beginning, the purchase of Absolut was accompanied by scandals. February brought “good news” to the bank: it became known that it could be purchased by the Blagosostoyanie fund. We have already written about the unique ability of the railway NPF to invest in risky assets.

About customer reviews

Most opinions on this organization remain positive. Among the main advantages, citizens note:

- High ranking positions.

- Excellent level of profitability.

- Fund stability.

Separately, they note the high level of service, even for specific branches located in small towns. There is only one drawback - forced entry into this fund for those who work for Russian Railways.

But everyone has the opportunity to choose individual terms of service. Deposit amounts and profitability depend on gender, as well as age at the time of conclusion of the agreements. In addition, the so-called compensation social package is added to the funded part. You can choose either the complete set or its individual parts.

Each citizen, when participating in programs from the NPF “Blagosostoyanie,” retains the right to receive a tax refund in the amount of 13 percent for serious expenses for the purchase of real estate, treatment, training, and so on. The pension is retained even upon dismissal, if the insurance period is at least five years. And after dismissal, individuals have the right to increase their security. It’s just that contributions become individual rather than corporate.

NPF Blagostostoyanie is a reliable fund to which more than a million people have already entrusted their savings. They adhere to an integrated approach to investing funds. This ensures a high level of profitability for any investment. At the same time, the risks remain minimal. The average industry pension for Russian Railways employees reaches 90 thousand rubles.

If there is a need to terminate the contract, this can be done in a matter of minutes. Funds and savings are returned to the depositor or transferred to representatives of another organization. The employer's contribution remains in the company's accounts. The money can be withdrawn when the citizen reaches retirement age. You just need to competently assess your capabilities and understand how profitable this or that solution is.

About the Merger of NPF StalFond and NPF Blagosostyanie in the following video:

Noticed a mistake? Select it and press Ctrl+Enter to let us know.

Fund collectors: who owns the largest non-state pension funds

Important

Includes: European Pension Fund NPF (JSC); SAFMAR NPF JSC (formerly Raiffeisen NPF); Trust NPF CJSC; REGIONFOND NPF CJSC; Education and science NPF JSC. The BIN Group initiated the merger of four of its NPFs under the name SAFMAR NPF JSC: it will include REGIONFOND NPF CJSC; Education and science NPF JSC and European Pension Fund NPF (JSC).

Attention

The group's market share is 6.26%. The BIN Group (Moscow) is a large Russian financial and industrial group controlled by the Gutseriev family, whose main activities are finance, oil production and refining, development, real estate management, and trade. Main activities: Oil production and refining, development, real estate management, trade, finance. Financial holdings and companies within the group: OJSC Binbank (holding company (part of the Binbank group).

How to find out your wealth savings

Source: npfb.ru, cbr.ru Guided by the principles of safety, profitability and information transparency, the fund invests client funds in various profitable areas of activity. Rice. 3. Investments of NPF “VOZROZhDENIE”. Source: official website npfb.ru Funds are invested in:

- financial market;

- road maintenance;

- railway industry;

- real estate market;

- energy;

- social infrastructure.

This approach made it possible to ensure:

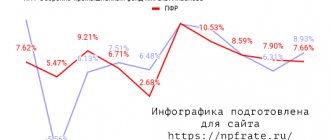

- 9% average return for the period 2003-2016;

- 10% yield, based on the results of 2020, 2020;

- 229.7% accumulated return for 2003-2016.

Schedule. 3. Cumulative return for 2003–2016. Source: npfb.ru Awards and ratings The Fund has repeatedly received and confirmed high positions in the ratings of national agencies.