Home > Pension insurance subjects > For future pensioners > Formation of funded pension > Non-State Pension Fund > How to choose?

- Collapse

- Expand

Article navigation

- How is a funded pension formed?

- NPF or Pension Fund - what to choose?

- Which non-state pension fund is better to choose? Main criteria when choosing a non-state pension fund

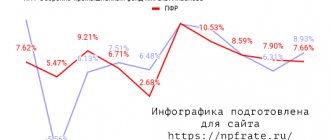

- Ratings of profitability and reliability of NPFs Best NPF in 2020 based on performance results

3 371

In order to choose a suitable fund, you should initially understand how a funded pension is formed and what it consists of. After all, pension savings are not only part of insurance premiums, but can also include funds paid independently by the citizen, co-financed by the state, and directed maternity capital, as well as income from investing all contributions.

In terms of where to store pension savings, a comparison of NPFs and Pension Funds, as well as an analysis of the distribution of contributions in these funds, will help, since in NPFs there is a risk of loss from investment, and in the Pension Fund the level of profitability is stable, but not particularly dynamic.

There are several criteria for choosing the right fund, ratings and statistics. If a more profitable fund is discovered, you can transfer pension savings to it, but it is better to take such a step no more than once every five years .

How is the pension determined?

Our working state currently has a distributive and accumulative nature; active senior citizens acquire finances that were received from the manager throughout their lives, and which were accumulated from personalized capital.

The largest share of payments will be transferred by the director and will go towards creating the insurance share of benefits. Accounting for the submitted finances is carried out on the individual’s individual account, but they will be fully spent on the current needs of the Pension Fund, because of this they will represent more conditional obligations of the state than true funds.

Only 6% of payments will be allocated to savings. The presented finances will be invested in order to make a profit. This ensures an increase in your pension capital.

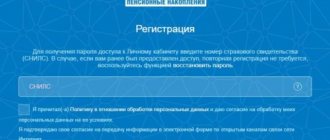

In order to manage such a part, you can stay with either the best Pension Fund or Non-State Pension Fund. The selection of a non-state fund is carried out independently by a person who is insured under the compulsory insurance system. In a different situation, its accumulations will be managed by Vnesheconombank.

What to take care of in advance

Starting from 2020, taking into account the increase in the retirement age, there will be no fundamental changes in the legislation on the payment of pension savings.

They will continue to pay women and men who have reached the ages of 55 and 60, respectively, even if they are not yet pensioners. Citizens of pre-retirement age must decide in advance where they intend to apply for and receive a funded pension. If pension savings are formed in a non-state fund, then you will need to send a package of documents to assign payment from pension savings to this non-state pension fund.

Changes in savings

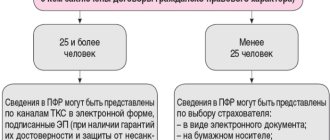

At the moment, the rules for creating a funded and insurance share of benefits are such that employers’ transfers to the Pension Fund for hired employees are equal to 16% of the accrued employee salary fund. Citizens are also given a special right to choose independently where to transfer their own pension payments:

- 0% benefit accumulation and 16% insurance;

- 6% share of accumulation of deductions and 10% insurance.

The choice is made based on the application of the interested citizen. For individuals who did not submit a written request in 2013-2013, transfers go in full to the insurance share of benefits. That is, the “silent ones” who did not choose where they are trying to send their own payments are automatically transferred to the scheme - 16% of the insurance share of payments.

The right to choose is determined by Federal Law No. 351-FZ dated December 4, 2013. The Pension Fund of the Russian Federation says that it is not worth transferring contributions thoughtlessly, as you could actually lose a significant share of them. In 2020, transferring pension funds at no cost is beneficial only to those people who wrote applications that were positively considered by the Fund. When the decision to change the insurer is made before the designated period, the share of investment income will be lost.

Payments

You can receive funds in the form of a lump sum payment from pension savings no more than once every 5 years. This rule has been in effect since 2020. Therefore, if the first time a pensioner was assigned a lump sum payment before 2020, he can apply again without waiting for the expiration of 5 years. If after 2020, then re-payment is made after the expiration of 5 years.