In addition to state pensions for old age, disability, and loss of a breadwinner, there is a system of non-state pension provision. It allows a citizen to independently influence his level of income in old age by making voluntary contributions to private funds.

In this article we:

we will tell you what a non-state pension, funded pension and non-state pension fund are;

Let's look at the main differences between NPO and state pension (OPS);

We will help you decide which is better: Pension Fund or Non-State Pension Fund;

we will tell you how to become a member of an NGO and how to choose a reliable private foundation;

Let's talk about the nuances of concluding agreements with private funds.

As a bonus, we have prepared for you a rating of the best non-state pension funds in Russia.

The concept of a non-state pension

Citizens of the Russian Federation can provide themselves with additional income in old age in the form of a non-state pension. The essence of this pension is as follows:

- this is a cash benefit, the amount and frequency of payment of which are stipulated in advance in the contract;

- it will be paid to a person who voluntarily and regularly paid contributions to the non-state pension fund (NPF);

- starting point of payment: reaching 55 years of age for women, 60 years for men.

In other words, relations regarding non-state pension provision are contractual in nature. They resemble long-term deposits with interest. On one side of the agreement is the future pensioner, on the other - the non-state pension fund.

REFERENCE : A non-state fund is a financial organization that has a license to carry out activities related to pension insurance and provision. There is no need to doubt such organizations (they are reliable), because they are under the close control of the Bank of Russia, and there is serious competition between the funds themselves.

Advantages of entering into an agreement with a private fund:

- you can discuss the conditions for the formation and accrual of benefits with the fund in advance;

- receiving a pension begins upon reaching the age of 55/60 for women and men, respectively, while the old-age insurance pension is assigned from the age of 60/65 (changes related to the pension reform 2019);

- in the event of the death of a party to a non-state pension agreement, the funds will not be lost, this money will be inherited by legal successors (they can also be designated in the agreement);

- a citizen can himself influence the amount of benefits he will receive in old age - this depends on the amount of contributions to the fund;

- you can withdraw funds from your account early (not in all companies);

- in some funds you can form a pension not only for yourself, but also for other persons;

- funds insure savings;

- transparency of information about the status of the future pensioner’s account (as a rule, access to the personal account through the fund’s website);

- money is deposited into the fund at interest, that is, if it is properly managed by fund specialists, the amount of savings can be increased, and, accordingly, the future pension benefit;

- the ability to choose between different private funds;

- the opportunity to move from one organization to another.

A non-state pension is a tool that will help a pensioner maintain their usual standard of living (to avoid a situation where, after retirement, a person loses a significant part of his usual income).

Legal regulation

Legal regulation of relations arising from non-state pension provision (NPO) is mainly carried out by three regulations.

- Federal Law No. 75 “On Non-State Pension Funds” of 1998, which regulates the creation and activities of private funds, in particular, the procedure for the implementation of NPOs.

- Federal Law No. 424 “On funded pensions” of 2013, which establishes the grounds and procedure for citizens to exercise the right to receive pensions from a non-state pension fund under a compulsory pension insurance agreement.

REFERENCE: From 2002 to 2014, contributions from employers (22%) went towards the formation of not only an insurance pension in the Pension Fund, but also a funded pension: 16% for insurance, 6% for funded. At the same time, citizens themselves decided whether they needed the funded part - it was permissible to send all 22% to the insurance pension. Now, until 2022, there is a moratorium on the formation of a funded pension, but what has managed to accumulate “remains in force.” The funded pension can be disposed of by sending it to a private fund.

- Tax Code of the Russian Federation (Article 213.1), which regulates the specifics of taxation under NPO agreements.

How does non-state pension provision work in Russia?

The operating principle of NPFs is approximately the same as that of the Russian Pension Fund (PFR). The only difference is that contributions to a private fund are a voluntary decision of a citizen, while contributions to the Pension Fund are mandatory.

After a certain amount of funds accumulates in a citizen’s account, the NPF invests them in any direction that:

- brings profit to the investor in the form of a larger pension in the future;

- protects the citizen's funds from inflation.

REFERENCE: Information about a citizen’s investment portfolio is confidential. However, in some cases, employees may provide such information to their client.

The relationship between the investor and the fund is regulated on the basis of an agreement. It must indicate the amount of indexation, possible adjustments, and stipulate a schedule for future benefit payments.

- A person writes an application to the NPF according to the sample provided by an employee of the organization. Attaches the required documents.

- Fund employees study the information provided and select the most suitable NGO programs for the citizen, which will help increase his retirement income in the future.

- The applicant chooses the option he likes.

- The citizen and the NPF sign an agreement.

- Next, the citizen, according to the terms of the agreement, makes periodic contributions to the formation of his future non-state pension.

- Upon reaching the term/retirement age specified in the contract, the citizen begins to receive a non-state pension benefit in the amount specified in the contract (or higher if it was possible to receive income from investments).

Important innovations for 2020

Surely everyone has heard about the sensational pension reform of 2019. Its essence lies in the gradual increase in the retirement age of citizens from 55 to 60 years (women), from 60 to 65 years (men). Initially, these changes affected all types of pensions in the Russian Federation: both insurance pensions and non-state pensions.

Previously, Article 10 of the Federal Law No. 75 “On Non-State Pension Funds” of 1998, which regulates the grounds for assigning a pension from a private fund, read: “the grounds in pension agreements are the pension grounds established at the time of conclusion of these agreements by the legislation of the Russian Federation.” That is, the NGO unwittingly fell under the reform of the state pension system.

Deputies of the State Duma corrected this misunderstanding and introduced amendments to Article 10 of Federal Law No. 75, which actually removed NGOs from the scope of the reform. The changes came into force in March 2020 on the basis of Federal Law No. 61-FZ dated March 18, 2020. Now, as before, the right to a pension from a private fund arises for females from the age of 55, and for males from the age of 60. NGO participants will receive the right to early retirement according to the law on insurance pensions, which was in force as of December 31, 2018 (before the reform ).

Non-state pension provision (insurance) in Russia

Reading time: 4 minutes(s) Currently, 7 million people are participants in the non-state pension system, and their number is only increasing every day. Today we will talk about what non-state pension provision is, as well as what features of the formation of a future pension you should know.

NGOs in the Russian Federation

What is non-state pension insurance?

Non-state pension provision is an additional payment of funds established to the main pension, and is formed from the personal contributions of a citizen.

The procedure for the formation and payment of non-state pensions is regulated by Federal Law No. 75 “On State Pension Funds”. The same document regulates the relationship between participants in this type of pension provision.

What an NGO is is described in detail in the following video:

What is the difference from the state one?

Experts believe that the distinctive features of this type of pension provision are:

- it is not necessary to have insurance experience;

- the ability to independently determine the amount and frequency of payment of contributions;

- the right to terminate the contract and return all funds paid.

In addition, the state pension is paid at the expense of the Pension Fund, while NPFs are responsible for the payment of non-state pensions.

With whom is the non-state pension agreement concluded?

The main condition for participation in the non-state pension system is the conclusion of an appropriate agreement with the selected fund. In this case, the parties to the contract are:

- NPF operating on the basis of a received license;

- depositor making payments;

- a participant who has already been paid or will be paid a non-state pension.

According to the law, investors can be both individuals and legal entities.

In the first case, citizens personally pay contributions and at the same time are also parties to the agreement. In the second case, contributions are paid by organizations in favor of employees.

How to become a member of an NGO: what to do and where to go?

When signing an agreement with a non-state pension fund, a citizen must choose one of the schemes offered to him by the fund.

A pension scheme is a list of conditions that determine the procedure for paying contributions and paying a non-state pension.

With regard to the payment of pension contributions, the following schemes can be distinguished:

- by the number of investors: with a single person or parity (with the participation of employees and employers;

- by type of account being opened: individual (with the transfer of funds to a personal account) and joint (payment of contributions in favor of a predetermined circle of persons).

As for the payment of non-state pensions, the schemes can be fixed-term (payments are made during the period specified in the contract) and perpetual (if there are funds in the account, the pensioner is supported by the NPF for life).

It should be noted that the depositor determines the amount of contributions, duration and frequency of their payment independently.

Most often, payments are transferred at the following frequency: once a month, once a quarter, once every six months, once a year. A one-time deposit of funds is used quite rarely.

Payment of contributions is made in the manner prescribed by the concluded agreement. At the same time, there are several ways to transfer funds, including through mail (transfer), banking institutions (non-cash transfer) and the employer’s accounting department (through deduction from wages).

Thus, to receive an additional pension in the future, you must adhere to the following sequence of actions:

- select NPF;

- conclude an agreement and approve a payment plan;

- make contributions according to the agreement.

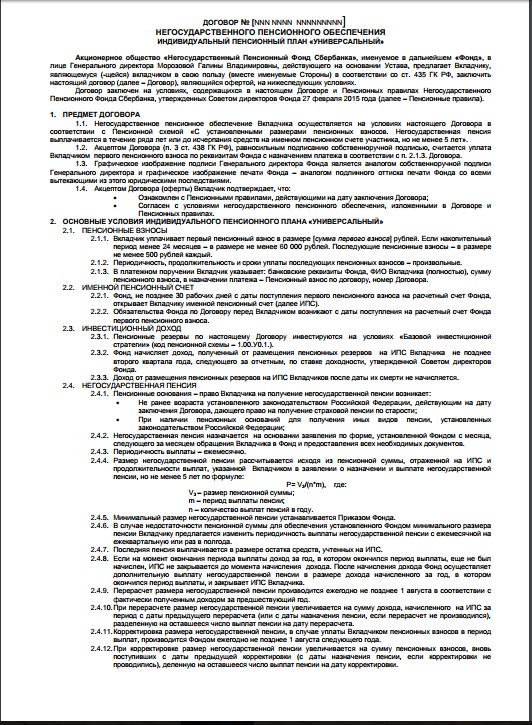

Sample contract for non-state pension provision of Sberbank

In a non-state pension agreement, the parties reflect not only the rights and obligations of the participants, but also the principles of their interaction. In this regard, before drawing up an agreement, the NPF client needs to determine for himself:

- the desired amount of future pension;

- acceptable pension payment period;

- Convenient payment schedule.

In essence, such an agreement is an agreement between the pension fund and the investor, concluded in favor of the party to the agreement.

The requirements for the content of the agreement are determined by Article 12 of Federal Law No. 75 of 05/07/1998.

The agreement is drawn up in two copies, having equal legal force for each of the parties. The validity period of this document is equal to the period of fulfillment by the parties of the agreed obligations.

Such an agreement usually looks like this:

At the request of the investor, the contract with the NPF can be terminated at any convenient time. Also, the basis for severing contractual relations is the death of a participant, but in this case, the citizen’s pension savings can be inherited by his legal successors.

We offer agreements on participation in Sberbank NPO here: https://yadi.sk/i/WLHVoqST3RNXZB

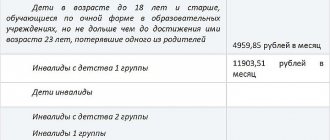

How is non-state support paid and its size?

To establish non-state pension provision, a participant in the non-state pension system must contact the appropriate fund with an application for the assignment of payments and a package of documents, the list of which depends on the rules of a particular institution.

The default date of assignment of a non-state pension is the date the applicant applies for its assignment. However, this payment cannot be assigned before the corresponding right arises.

The deadline for transferring funds is usually 30 calendar days from the date of submission of the application.

The size of future payments depends on parameters such as:

- rules of the selected pension fund;

- pension scheme specified in the contract;

- the amount of savings at the time of payment.

It should be noted that the amount of non-state support may be increased in connection with the receipt of income from investing funds at the end of the calendar year.

After establishing pension payments, the fund sends a notification to the applicant about the assignment of a pension, indicating the accrued amount and the period during which the funds will be paid.

There are several ways for a participant in the system under consideration to receive a pension: to a bank account, to a card or by postal transfer. In this case, the pensioner chooses the method of delivery of funds independently.

Is early non-state pension possible?

According to the law, a non-state pension can be assigned earlier than the generally established age, and therefore paid ahead of schedule. The reason for this may be the employment of the contract participant in certain types of work, defined by paragraph 1 of Article 30 of Federal Law No. 400 “On Insurance Pensions”.

It is important to take into account that in order to recognize working conditions in such work as dangerous and harmful, a special assessment must be carried out. At the moment, it is a replacement for the previously existing certification of workplaces in connection with the adoption of Law No. 426 “On special assessment of working conditions.” Based on the results of this assessment, the working conditions are assigned the appropriate hazard class.

If we are talking about the third or fourth class of danger (harmful and dangerous working conditions), then the employer will have to pay insurance contributions to the state pension fund at a special additional rate corresponding to the working conditions, or make additional payments to a non-state pension institution.

The employee’s consent is required to join the early non-state pension system under the second option. In this case, the pension program is chosen by the employer himself.

The requirements for an early NPO agreement are determined at the legislative level and are regulated by Article 36.33 of Federal Law No. 75 of 05/07/1998.

It should be noted that the lower limit of monthly contributions for early NPO is determined as follows:

- not less than 2 percent of the income of an employee working in hazardous conditions;

- not less than 4 percent of all payments to an employee employed at a workplace in hazardous working conditions.

In addition, the employer's pension program may include the opportunity for the employee to participate in the formation of an additional pension. In this case, part of the contributions will be deducted from the employee’s salary.

Did this article help you? We would be grateful for your rating:

0 1

How to become a member of a non-state pension fund - possible options

In addition to the previously described option for a citizen to independently enter into an agreement with a non-state pension fund (when the citizen himself pays and receives a non-state pension), there is the option of inclusion in the NGO program through an employer. For this there must be official employment.

In this case, the agreement with the fund will include:

- NPF;

- depositor – the person who will transfer contributions (employer);

- participant - a person who will receive a pension.

The obligations of the fund to the parties to the agreement will be determined by the internal rules of the organization, which are approved by the board of directors. They contain information about the pension schemes used, the grounds for making payments, etc.

REFERENCE: A pension scheme is how contributions to the fund will be made (amount, frequency and method) and subsequent payments (amount, frequency and method).

What determines the size of a non-state pension in 2020?

One of the guarantees provided by the state to its citizens is the payment of pension benefits upon reaching retirement age - 55 years for women and 60 years for men.

However, the country's budget does not allow providing elderly people with such a pension so that people can live out their days with dignity, without needing the most necessary things. Therefore, more and more future retirees are voluntarily making monetary contributions to non-state pension funds.

Let's find out how this scheme works, what you can count on, what is the size of the non-state pension, and what are the pros and cons of this approach to the formation of future benefits.

What is non-state pension provision

A non-state pension is understood as a benefit that will be paid to a citizen who has reached the age of 55 or 60 years (for women and men, respectively) from the budget of a non-state private pension fund to which the person voluntarily contributed money on a regular basis. The amount of the future pension is known in advance and agreed upon in an agreement with a private financial company. The size and frequency of payment of contributions are also regulated by the agreement.

The difference between NPO and state pension (OPS)

| Comparison criteria | OPS (compulsory pension insurance) | NGO (non-state pension provision) |

| Regulation | The amount, procedure and grounds for payments, contributions, etc. are strictly regulated by law. | All conditions of the NGO are governed by an agreement between the citizen and the NPF. |

| How is it formed | Mandatory employer contributions to the Pension Fund. | Voluntary contributions of citizens to non-state pension funds under an agreement. |

| What does the size depend on? | From the citizen’s official work experience, IPK and accumulated points. | On the size and frequency of a citizen’s independent deductions, as well as on the investment portfolio. |

| Conditions of retirement | Tightened in connection with the pension reform: the general retirement age and requirements for individuals entitled to early retirement have been increased. | The pension reform was not affected; the withdrawal conditions apply as of December 31, 2018 (before the reform). |

| Investment Strategies | At least 90% are invested in instruments with minimal risk, so the returns are low. | You can choose investment instruments and independently regulate the ratio of risk-income categories. |

| Possibility of inheritance | – | + |

| Possibility to withdraw your entire pension at once | – | + |

| Opportunity to receive pension earlier | – You can get it later if you don’t have time to accumulate experience, points, and IPK. | + |

| Guarantees | All money is insured by the state. | If the fund goes bankrupt, there is no guarantee of getting your money back. |

Non-state pension agreement - what is it, with whom is it concluded?

The main condition for participation in the non-state pension system is the conclusion of an appropriate agreement with the selected fund. Its parties are:

- Non-state pension fund operating on the basis of an obtained license;

- The depositor making payments;

- A person who has already been paid or will be paid a non-state pension.

According to the law, investors can be both individuals and legal entities. In the first case, citizens personally pay contributions and at the same time are parties to the agreement. In the second case, contributions are paid by organizations in favor of employees.

Which is better: NPF or Pension Fund?

We have already mentioned that from 2002 to 2014, within the framework of the compulsory pension system, a pension was formed, consisting of two parts: insurance and funded. Despite the fact that there is now a moratorium on the formation of funded pensions, what they managed to accumulate before 2014 has not gone away. Citizens strive to properly manage their savings portion, so they are interested in the question of who to entrust the management of this money to the Pension Fund or Non-State Pension Fund?

REFERENCE: Citizens have the right to choose where to keep and form a funded pension in a non-state pension fund or Pension Fund.

| Advantages | Flaws | |

| Pension Fund |

| The investment policy is aimed at minimizing risk, so you should not expect to receive a high income by saving funds in the Pension Fund. |

| NPF |

|

|

Thus, when choosing between the Pension Fund and the Non-State Pension Fund, a citizen chooses between reliability and stability and the opportunity to receive a high income. The Pension Fund guarantees the safety of funds and protection from inflation, but you should not expect a significant increase in the funded pension by choosing the Pension Fund.

A private foundation, with proper management of the client’s funds, will be able to significantly increase them. However, profits can be lost if the NPF goes bankrupt, loses its license or pursues an illiterate financial policy. Therefore, when giving preference to non-state pension funds, you should carefully choose the organization to which you entrust your money.

Tax deduction for non-state pension provision

The legal basis for this preference is specified in disposition 219 of the Tax Code of the Russian Federation. In accordance with its provisions, the maximum possible amount from which the described deduction will be calculated should not exceed 120 thousand rubles. This means that the provided 13% will be calculated from the indicated amount. All payments that exceed the specified amount will not be directly taken into account when providing a deduction.

How to choose a good NPF - selection criteria

We already know that with the help of non-state pension funds you can receive a non-state pension in addition to the insurance one, as well as transfer a funded pension there (if you have one). Private foundations will help you “earn extra money,” but you should be very careful and scrupulous in choosing an organization. Let's consider the main criteria that will help you make the right decision.

Find out the creation date

The earlier an organization is created, the more experience it has in managing pension savings of citizens. Companies that were created in the 90s are especially trustworthy. This means that the fund has experience in overcoming difficulties in conditions of severe economic crisis.

The date of establishment of the organization can be found out by receiving an extract from the Unified State Register of Legal Entities. It is enough to enter the name of the NPF and indicate the region. The service is provided by the tax service free of charge.

Pay attention to the founders

The extract from the Unified State Register of Legal Entities also contains information about the founders of the fund. It is worth paying special attention to this information. Preference should be given to those organizations whose founders are other large companies.

REFERENCE: If a large financial or resource company with billions of dollars in assets is indicated as the parent organization, then there is no need to be afraid of the bankruptcy of the NPF or its liquidation.

Determine profitability

The main reason why people transfer their funded pension to a non-state pension fund is investment income. Therefore, you need to check the fund’s profitability indicator before entrusting your money to it. You can obtain information about the fund’s income on the Bank of Russia website. Be careful, if an organization operates in both the OPS system and the NPO system, then income indicators for these two areas are published separately.

IMPORTANT: A good rate of return is 10% or more. But it is worth noting that good performance in the past is a guarantee of similar success in the future. It is better to analyze the fund's activities over the past few years.

It would also be useful to study the investment declaration of the NPF - how the fund is going to manage your money (however, the company is not obliged to disclose this information, but can do so).

Assess reliability

Any investment activity is risky. The activities of non-state pension funds also have risks. The risk of the pension recipient is associated with the fact that he will not receive income from the investment and will lose a certain amount of money as a result of inflation, as well as the fact that the fund may go bankrupt, lose its license, etc.

Assess the reliability of non-state pension funds based on information analysis:

- about the period of existence;

- about the founders;

- availability of a valid license (can be viewed on the Bank of Russia website);

- about debts, legal disputes of the organization.

REFERENCE: Services that will help you find out debts, legal disputes and the presence of enforcement proceedings: the website of the Federal Bailiff Service, the Transparent Business service on the website of the Federal Tax Service, a file of arbitration cases, a register of information on bankruptcy (EFRS).

Also, the reliability of the fund is assessed by independent agencies that conduct research and compile ratings.

Analyze your place in the ranking

Special rating agencies analyze various performance indicators of private funds and compile ratings. For example, these could be ratings for:

- number of clients;

- reliability;

- level of capitalization;

- volumes of payments, etc.

We will talk about this in more detail later in the article.

Check the activities of NPFs over the last year

NPFs are obliged to follow the principle of transparency in their activities. This means that they are required to publish all information about their current activities on their official website.

HELP: Information for those who are already in a contractual relationship with a private fund or on the way to it. Many NPFs have the opportunity to create a personal account and track all the information on their savings in it.

Non-state pension provision - advantages

- ensuring a decent level of payments upon reaching a disabled age;

- accumulated funds are inherited;

- formation of a complete social package of the organization;

- increasing work motivation;

- confidence in the employer;

- a wide selection of pension products for various fields of activity and age categories of workers.

When choosing a pension fund, pay attention to the annual fund ratings published on the Internet. An indicator of reliability and stability is the fund’s high rating, open access to viewing pension programs, as well as sample contracts.

Do not chase the promised high profitability; first of all, we look at the criterion of reliability and stability. Also, many non-state pension funds offer registration of pension payments without leaving home (through your personal account on the official website, email, etc.), which will allow you to save time for other matters.

Rating of non-state pension funds in Russia

So, we have already said that ratings of independent organizations can help you choose a specific non-state pension fund. Only the best, reliable funds are included there. Ratings are compiled according to various objective criteria:

- reliability;

- level of capitalization;

- number of clients;

- volumes of payments, etc.

Bank of Russia rating in 2020

The main controller of all financial organizations, the Bank of Russia (formerly the Central Bank), ranks all non-state pension funds, focusing on the profitability of investing pension savings, the size of the funds’ own assets and the participation of non-state pension funds in the deposit insurance system.

TOP 10 NPFs according to the Bank of Russia for the 3rd quarter of 2019:

| № | Fund name | Profitability |

| 1 | "Surgutneftegaz" | 13.10 % |

| 2 | "Hephaestus" | 12.88 % |

| 3 | "Opening" | 11.97 % |

| 4 | "Khanty-Mansiysk" | 11.89 % |

| 5 | "Evolution" | 11.66 % |

| 6 | "First Industrial Alliance" | 11.61 % |

| 7 | "Volga-Capital" | 11.37 % |

| 8 | "Stroykompleks" | 11.36 % |

| 9 | "Agreement" | 11.31 % |

| 10 | "Big" | 10.91 % |

NPF rating in 2020 according to Expert RA

One of the largest Russian credit rating agencies, Expert Ra, also offers its list of reliable private funds:

| № | Fund name | According to the financial reliability scale* |

| 1 | "Surgutneftegaz" | ruAA |

| 2 | "Evolution" | ruAAA |

| 3 | "Alliance" | ruAA |

| 4 | "Gazfond pension savings" | ruAAA |

| 5 | "Diamond Autumn" | ruAA |

| 6 | "VTB Pension Fund" | ruAAA |

| 7 | "Gazfond" | ruAAA |

| 8 | "Big" | ruAA |

| 9 | NPF Sberbank | ruAAA |

| 10 | "Renaissance of pensions" | ruAA |

*Financial reliability scale

TOP 5 most popular NPFs

The same NPFs are found in the top positions of the ratings of the agency and the Bank of Russia. We invite you to learn more about the 5 top Russian private funds.

JSC NPF Surgutneftegas

The Surgutneftegaz Foundation was created in 1995 to meet the needs of employees of Surgutneftegaz OJSC. In 2020, he entered into a partnership agreement with JSC BANK "SNGB", which expanded the geography of its services to all cities of Russia where there are branches of the partner bank.

- NPF has assets of more than 26 billion rubles.

- Serves more than 85 thousand people.

- It is one of the largest and oldest NGO companies.

NPF Sberbank

The founder of this NPF is Sberbank of Russia. The fund has existed since 1995 and during this time has managed to accumulate 480 billion rubles and serve more than 10 million clients. You can become a client of this organization from anywhere in Russia:

- There are 6,500 offline branches across Russia;

- There is online service.

The fund's activities are based on the principle of transparency. It openly publishes its investment policy.

"Alliance"

The Alliance Foundation has existed since 2004. The main block of shares belongs to PJSC Rostelecom (95%), the state share in which is more than 50%. This indicates the reliability of the NPF. The fund's profitability indicators in the 2nd quarter of 2020 (taking into account the COVID-2019 pandemic) are also quite good:

- 9.7% – for NGOs;

- 9.68% – for compulsory pension insurance.

JSC MNPF "Bolshoi"

The Bolshoi private foundation was created in 1995. It is among the TOP 10 funds by the number of insured persons: 410 thousand people from 24 cities of Russia. The fund positions itself as the largest association of employers, including Renova Group of Companies, Integra Group of Companies, and Pipe Metallurgical Company. The volume of pension funds of the fund is about 40 billion rubles.

JSC NPF "Evolution"

"Evolution" (formerly "NEFTEGARANT") has existed in the pension services market for more than 20 years. One of the largest clients of PNF is PJSC NK Rosneft. Over the period of its existence, the fund has served 1.4 million clients, 89 thousand of whom receive pensions today.

Step-by-step instructions for transferring money from the Pension Fund to the NPF

Let us remind you that those citizens who have a funded part of their pension can keep it in the Pension Fund or transfer it to any NPF.

ATTENTION: Determining the fate of the funded part of the pension is the legal right of a citizen. He can transfer these funds from one fund to another: from private to state, from state to private, from one NPF to another NPF. You can change the fund no more than once a year.

Procedure for transferring from the Pension Fund to the Non-State Pension Fund:

- Select the NPF you want to transfer to. We outlined the selection criteria in detail earlier in this article.

- Conclude an agreement with the selected NPF.

- Fill out an application for transfer of funds from the Pension Fund to the selected private fund.

- Send an application to the Pension Fund:

- in person at the Pension Fund;

- through the MFC (multifunctional center);

- through the Gosuslugi portal (if the account is verified, it is confirmed).

REFERENCE : The application is sent no later than December 1 of the year preceding the transfer of funds to a private fund.

Algorithm for transferring to a non-state pension fund from the Pension Fund through “State Services”:

- Log in to the portal https://www.gosuslugi.ru/.

- Enter “NPF” into the search bar.

- Select the box for early transfer from the Pension Fund to a private fund.

- Click “Get service”.

- Fill out the form: indicate information about yourself, about the current fund, about the new fund, about the Pension Fund of the Russian Federation to which the application is being submitted.

- Click on “Proceed to sign the form.”

Is it possible to change a non-state pension fund?

As we have already said, an agreement with a private pension fund is not a lifetime contract. A person may want to change the NPF if he has lost faith in its investment policy or reliability. The fund responsible for the funded part of the compulsory pension pension can be changed at least every year. The algorithm is the same as when transferring from the Pension Fund to the Non-State Pension Fund (see previous paragraph).

The transition from one NPF to another within the framework of a voluntary NGO is regulated by an agreement between the organization and the citizen. The conditions of such a transition (termination of the contract) must be spelled out in detail in it.

According to the terms of the agreement, it may turn out that during the transition a person will be left without investment income for some time or for the entire period, and sometimes even go into losses (receive less than he contributed). This is explained by the fact that contracts with non-state pension funds are designed for the long term - the funds invest citizens’ funds in long-term projects with high returns. By withdrawing funds from the NPF before the end of the contract, the fund incurs losses. Therefore, the person’s money will be returned, but it’s not a fact that everything will be returned.

Pension capital was returned to the Central Bank

The results of the current transition campaign, according to Mr. Sidorov, will be comparable to last year’s, with a correction of 10-12%. At the same time, the general director of NPF LUKOIL-Garant, Denis Rudomanenko, expects an increase in the transition of “silent people” to NPFs by 25% compared to last year. Against the backdrop of actively informing NPF clients about the loss of investment income during early (more than once every five years) transfer of savings, the number of transfers between funds will decrease by 10-15% from last year’s campaign, expects General Director of NPF Soglasie Alexander Vyunitsky. According to the managing director for corporate ratings of Expert RA, Pavel Mitrofanov, in the 2020 campaign, NPFs will spend 12-13 billion rubles on attracting citizens’ savings, while the influx of funds from “silent people” into the funds will amount to 230-250 billion rubles.

The Ministry of Finance and the Central Bank first announced the reform of the pension system in the fall of 2020 (see Kommersant on September 24). At the same time, the key principle of mass participation was announced - auto-subscription of citizens (with a gradual increase in contributions to the IPC from 1% to 6% of the salary and the opportunity to take payment holidays). The concept of the law on IPC was sent to the government in mid-May with significant adjustments - auto subscription was fixed in it, but rather nominally - as a mandatory addition to the employment contracts of citizens and employers (see Kommersant on May 24). However, even in this truncated form, auto-subscription did not receive approval from the government’s social bloc.

Interesting read: Is it possible to get a veteran of labor based on length of service without awards in Moscow in 2020

Is it possible to return from a non-state pension fund to the Pension Fund?

If you moved from the Pension Fund to a private foundation, but were not satisfied with its work, you can return to the state organization. Moreover, such transitions can be made repeatedly.

ATTENTION: It is better to avoid frequent transfers (more than once every 5 years), otherwise you may lose your income received from the investment portfolio.

3 options to choose from:

| Contact the Pension Fund | Contact your NPF | Fill out the form for “State Services” |

| Fill out the application (the form is posted on the Pension Fund website). Take it to the Pension Fund office. You need to take your passport and SNILS with you. You can also submit an application through the MFC or the offices of large banks: Sberbank, Alfa Bank, Rosselkhozbank and other partners of the fund. | You need to come to the NPF and terminate the OPS agreement. Company employees should provide you with all the information about your savings and help you fill out an application for transfer to the Pension Fund. | You must log into the portal https://www.gosuslugi.ru/. Enter “NPF” into the search bar. Select the column about the transition from NPF to Pension Fund. Click “Get service”. Fill out the form: indicate information about yourself, about the current fund, about the new fund, about the Pension Fund of the Russian Federation to which the application is being submitted. Click on “Proceed to sign the form.” |

If a non-state pension fund goes bankrupt - possible consequences for investors

The most obvious disadvantage of cooperation with a non-state pension fund is the risk of losing your contributions and investment income if the organization is declared insolvent (bankrupt) and, as a result, liquidated. The second unfavorable scenario is liquidation due to license revocation:

- If the fund participated in the compulsory pension insurance system (responsible for funded pensions), the Deposit Insurance Agency will liquidate the organization.

- If the NPF was engaged only in voluntary NGOs, its founders will liquidate it.

- If a company is liquidated as a result of being declared bankrupt, the procedure is carried out by an arbitration manager.

The liquidation procedure in each case will necessarily include an assessment of the organization’s assets: property, real estate, investments, accounts receivable, etc. and their sale.

When it comes to NGOs, the proceeds from the sale are distributed in strict order:

| First, the money will be received by NPF clients who have already acquired the right to a pension and should receive it for life. | The deposit insurance agency or the founders of the NPF must hold a competition and select another fund that will offer the best conditions for clients of the bankrupt NPF. The funds will be transferred to this NPF and the person will continue to receive it, however, possibly in a smaller amount. |

| Then clients who have already acquired the right to a pension and must receive it within a certain period. | Payment of the remaining pension will be in the form of a one-time payment (all or part of the remaining amount at once). |

| Then - investors who are still accumulating pensions, in proportion to the funds remaining in the NPF accounts | Payment of the remaining pension will be in the form of a one-time payment (all or part of the remaining amount at once). |

| The companies that paid contributions for their employees will be the last to receive the money. |

ATTENTION : If the NPF’s money is not enough to pay off depositors’ claims in full, it will not be possible to get your money back in full.

Corporate pension: concept, features, conditions of formation and appointment

The social orientation of the policy of the Russian Federation guarantees each citizen the payment of certain amounts in connection with retirement for one reason or another.

But to increase the size of these payments, a system of non-state pension provision operating in parallel with compulsory pension provision is provided. Within the framework of this system, a person can independently take care of increasing his income upon retirement. One of these ways to take care of your well-being while receiving a pension is to apply for a corporate pension.

Concept of corporate pension

A corporate pension is a part of non-state pension provision, which aims to increase the level of well-being of citizens of retirement age through the formation of additional payments to the basic pension, with some features.

The employer, as a rule, one of the large companies, taking care of the well-being of his employee after retirement, makes contributions to a special account. Different accounts are opened for each such employee, and at the same time the employer tracks and takes into account the funds deposited.

This social support is designed to reduce staff rotation and motivate them to work productively in exchange for additional pension benefits. The formation of a corporate pension is implemented in three alternative ways:

- Solidarity. Contributions transferred by the employer are subject to income tax;

- Individually. Contributions transferred independently by the employer are not subject to taxation;

- Parity. Funds are credited to the employee’s account not only by the employer, but also by the employee himself.

The corporate pension system in Russia originated in the post-Soviet period according to the Decree of the President of the Russian Federation of September 16, 1992 No. 1077 “On non-state pension funds”.

Important nuances of the contract - what should you pay attention to?

So, speaking about an agreement with a non-state pension fund, we can talk about two different agreements:

- Or it is a compulsory pension agreement related to the transfer of a funded pension to the management of a non-state pension fund.

- Or these are agreements within NGOs on the formation of a voluntary pension.

The content of the OPS agreement is regulated by Art. 36.3–36.5 Federal Law “On Non-State Pension Funds”. The law states that it is concluded according to the standard form of the Bank of Russia. This agreement must necessarily indicate:

- information about the parties, their details;

- subject of the agreement - relations under the joint security agreement;

- rights and obligations of the parties to the contract;

- grounds, conditions, procedure for pension payment;

- liability of the parties;

- general provisions on the procedure for terminating a contract and resolving conflicts between the parties.

There should be no problems with this agreement, because it is clearly regulated by legislation and acts of the Bank of Russia.

But the agreement regarding the formation of a voluntary pension is worth paying attention to. It is regulated by Art. 12 Federal Law “On Non-State Pension Funds”. It must contain the following information:

- data and details of the parties;

- description of the subject of the agreement - implementation of NGOs;

- the rights and obligations of each party;

- the procedure for forming a pension;

- payment procedure and conditions;

- indication of the selected pension scheme;

- liability of the parties;

- duration of the agreement;

- dispute resolution procedure, etc.

The document is drawn up in two copies of equal force and signed by the parties.

Be sure to pay attention to the part of the agreement concerning the conditions for terminating the contract with a non-state pension fund and transferring to another non-state pension fund. Otherwise, you may lose a significant portion of your investment earnings or even a portion of your contributions. For example, the contract may contain a condition that no income is accrued for the year in which the contract is terminated, that the person is obliged to compensate the NPF for losses associated with early termination, etc.

Tax deduction – who can get it and how?

According to tax legislation (Article 213), the amount of investment income received as a result of concluding an agreement with a non-state pension fund is subject to personal income tax (personal income tax).

However, from Art. 219 of the Tax Code of the Russian Federation it follows that the taxpayer has the right to a social tax deduction equal to the amount of contributions paid under the NPO agreement during the tax period, but not more than 120,000 rubles. This means that up to the amount covered by the deduction, you do not have to pay tax.

To receive a deduction, the taxpayer must:

- fill out a declaration in form 3-NDFL and submit it to the tax authority at your place of residence;

- Attach to the declaration a copy of the agreement with the NPF, copies of documents confirming contributions to the NPF (checks, payment orders, etc.).

IMPORTANT: If contributions to a private fund for an employee are made by the employer, then you need to write a deduction application to the employer. The employer will independently decide the issue of social tax deduction from the Federal Tax Service as a tax agent.

Non-state pension provision in 2020

How to get involved?

Any citizen of Russia who wishes to receive additional income can join the system.

There are two ways to join the pension insurance system:

- get a job at an enterprise that pays contributions to the accounts of its employees centrally;

- independently contact the NPF to conclude an agreement with a passport and identification number.

The law does not establish any restrictions on joining the pension savings program for all citizens of the Russian Federation.

Agreement

Russian legislation in the field of private pension provision defines an agreement as an agreement between a non-state pension fund and a contributor (participant) of the system.

According to it, the fund undertakes to issue pension payments to a person when certain conditions are created, and the investor guarantees regular payment of pension contributions.

This document takes the form of a clearly defined document that defines the rights and obligations of the parties, as well as the procedure for interaction between the parties in the cooperation process.

Example of a contract with a non-state pension fund:

Non-state pension agreement

Termination of an agreement

Please note that the procedure for severing relations between the investor and the NPF is prescribed in each agreement.

Basically, termination is carried out by agreement of the parties. According to general rules, one of the parties that does not want to further fulfill the terms of the contract must warn the other about the need to terminate it.

Breaking a contract can also be motivated by violations on one side or the other.

In addition, the agreement may lose legal force as a result of a court decision on the claim of the parties or in the event of liquidation of a non-state pension fund.

Procedure for making contributions

The rules for replenishing a pension account are always clearly stated in the contract. All payments must be made in the national currency - Russian rubles. Funds must be transferred to the Fund's current account.

The contribution amount is determined individually by each person wishing to become a pension fund contributor. The additional agreement establishes the terms for making payments. Usually this date is set in agreement with the donor of funds.

The pension agreement gives the fund's client the opportunity to make additional contributions not provided for by the terms of the agreement in any amount.

There are several ways to fund your retirement account:

- payment through a bank cash desk using a current account;

- depositing funds via Internet banking from a card.

Payment rules

A non-state pension begins to be paid only when the beneficiary reaches the level provided for in the traditional pension system.

The first action of a potential pension recipient is to send a notification to the fund about the need to begin pension payments.

In this letter, the Investor sets out his basic requirements:

- payment period;

- date of receipt of pension;

- pension amount (it cannot be lower than the minimum established by law).

Russian Post and Sberbank of Russia are partners of a huge number of non-state pension funds that operate in the Russian Federation. That is why most payments of non-state pensions are made through these structures.

There are several schemes for paying pensions from non-state sources.

Scheme No. 1 includes the following steps:

- a person transfers money to the fund for the entire remaining period of his life;

- the amount of future payments is determined by the fund;

- All conditions for the assignment and payment of funds are specified in detail in the contract.

There is also a second scheme:

- the person decides when to transfer funds, how often and for how long to do it;

- The rules for making payments are determined by the contract.

In practice, these schemes are often used in combination with each other. Each of them has its own nuances, so each point must be spelled out in the contract. This will allow the pensioner to avoid unpleasant surprises in the future.

You can find out about the types of pensions existing in the Russian Federation on our website. Who is entitled to the state long service pension? See here.

How long must a teacher have to retire? Information is here.

Tax deduction

Payment of non-state pensions in the Russian Federation is subject to income tax.

In addition, Article 219 of the Tax Code of the Russian Federation states that citizens can receive a social tax deduction in the amount of the amount of pension payments made, but only upon concluding a special agreement.

You can only apply for compensation for the previous year.

Let’s say that throughout 2020 a person received a non-state pension, from which income tax was taken. The pension recipient will be able to return this money only in 2020.

conclusions

So, we tried to cover as broadly as possible the topic of relations that arise within the framework of cooperation with non-state pension funds.

- Since 2002, the labor pension has been formed from two parts: insurance and funded. Not only the Pension Fund of Russia, but also the Non-State Pension Fund may be responsible for the growth and preservation of the latter. The citizen himself must choose who will manage (invest and receive income) his funded pension.

- Pension Fund is a more reliable, but less profitable option. NPF – invests more “aggressively”, so it can promise a good income (more than 10%), but also greater risks.

- When giving preference to a non-state pension fund, you should make sure of its reliability and rationality of investment policy: look at data on the founders, profitability, ratings, etc.

- Funds can be changed once a year at the request of a citizen. But it is better not to do this more often than once every 5 years. Otherwise, you may lose your investment income.

- In addition to the funded pension, a citizen has the right to enter into an agreement with a private fund within the framework of a voluntary NGO: make contributions to the fund and in old age receive, in addition to the insurance pension, a benefit from the NPF.

- The age for receiving a voluntary non-state pension is 55 years for women, 60 years for men.

Relationships with non-state pension funds are a great way to increase your income in old age. The main thing is to carefully choose the company you will entrust your money to.

Payment procedure and amount of non-state pension provision

The amount of payments that will be accrued to a citizen in the future depends on the following factors:

Specific features of a particular non-state pension fund;- Pension program described in the contract;

- The amount of contributions at the time the client enters retirement age.

It should be noted that the size of the non-state pension can be increased in connection with the receipt of income from investing funds at the end of the calendar year.

After establishing pension payments, the fund sends a notification to the applicant about the assignment of a pension, indicating the accrued amount and the period during which the funds will be paid.

There are several ways for a participant in the system under consideration to receive a pension: to a bank account, to a card or by postal transfer. At the same time, the pensioner chooses the method of delivery of funds independently.